Neat Tips About Statement Of Comprehensive Income Example

The revaluation represents a hypothetical gain (i.e.

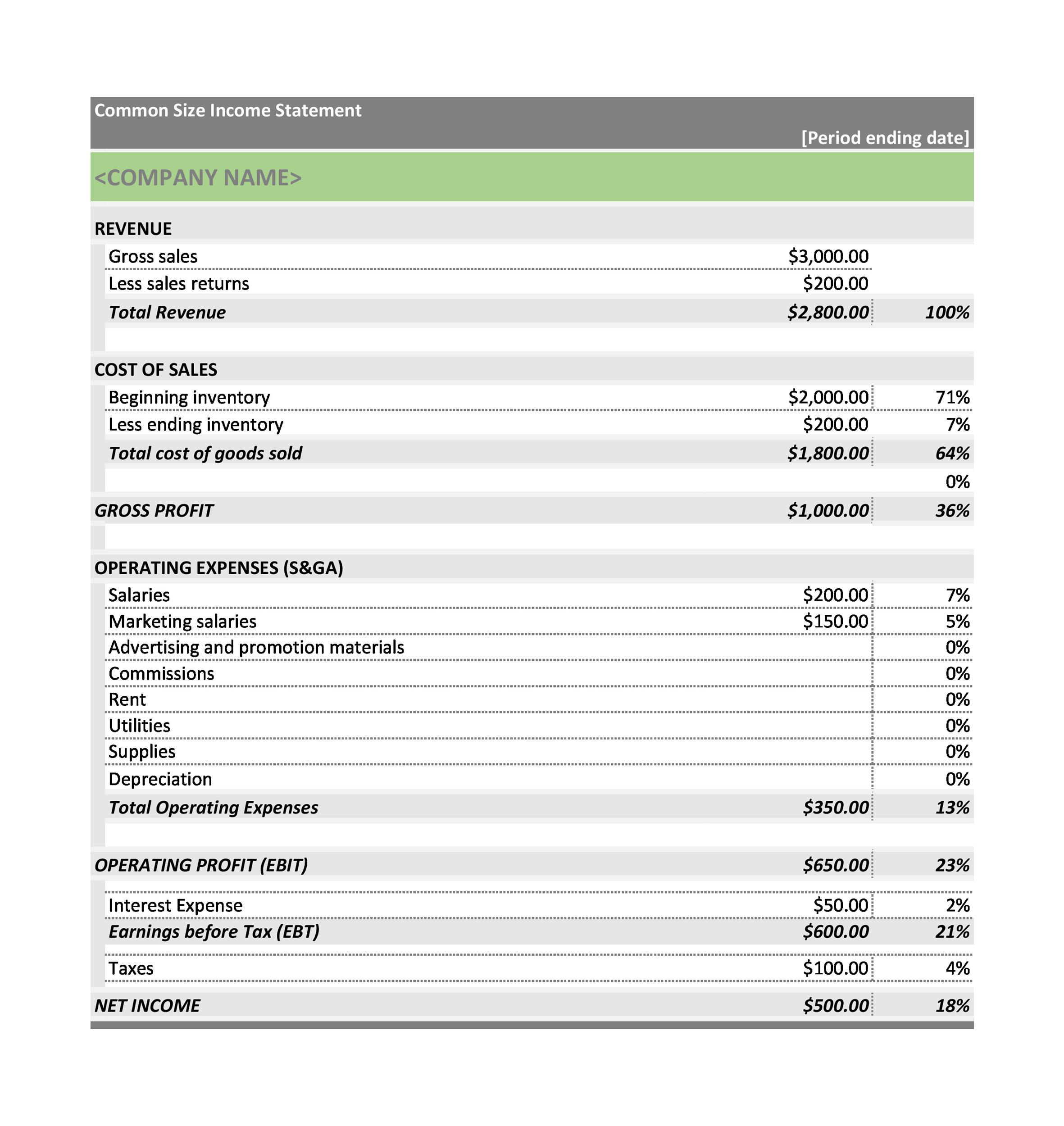

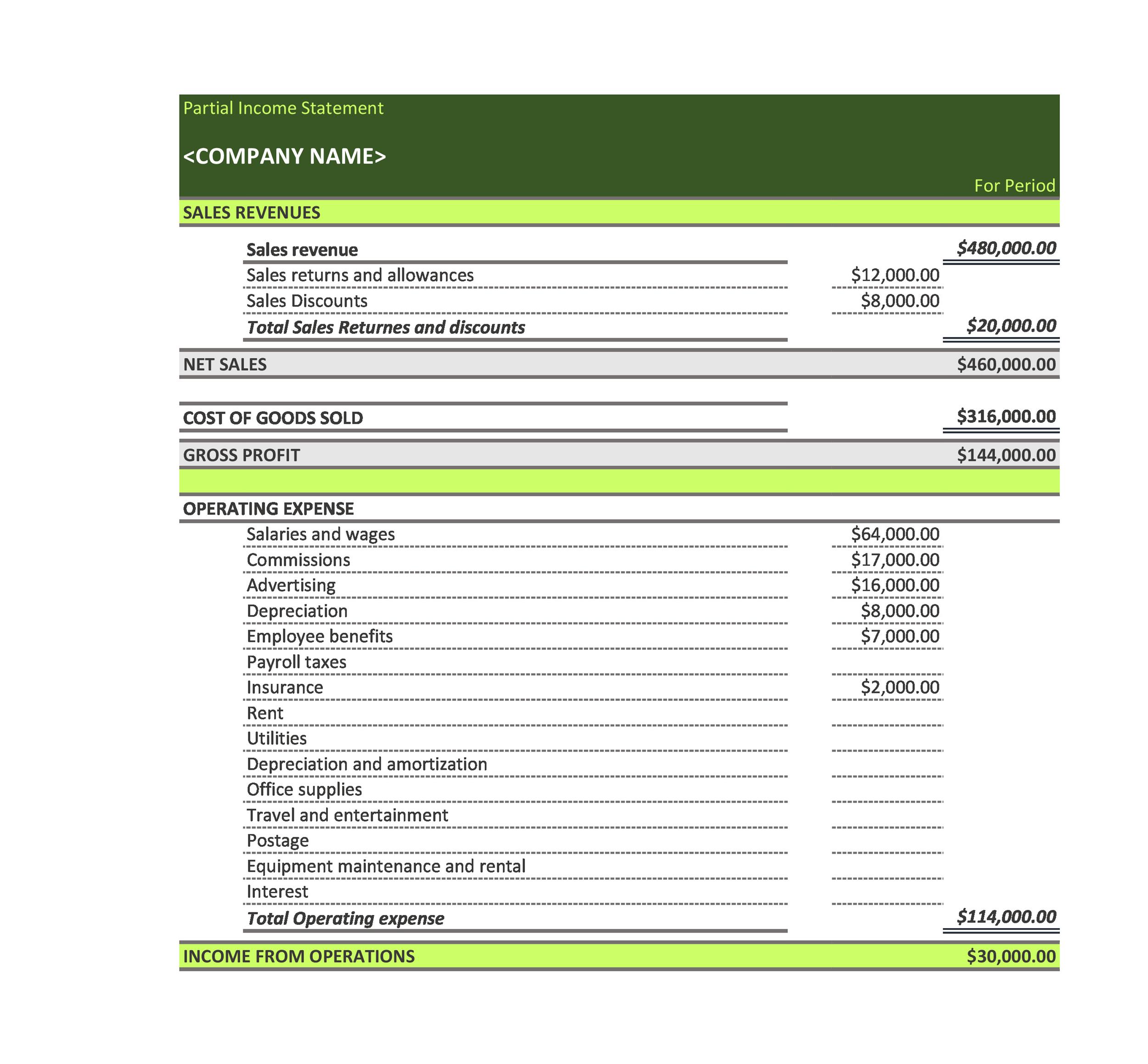

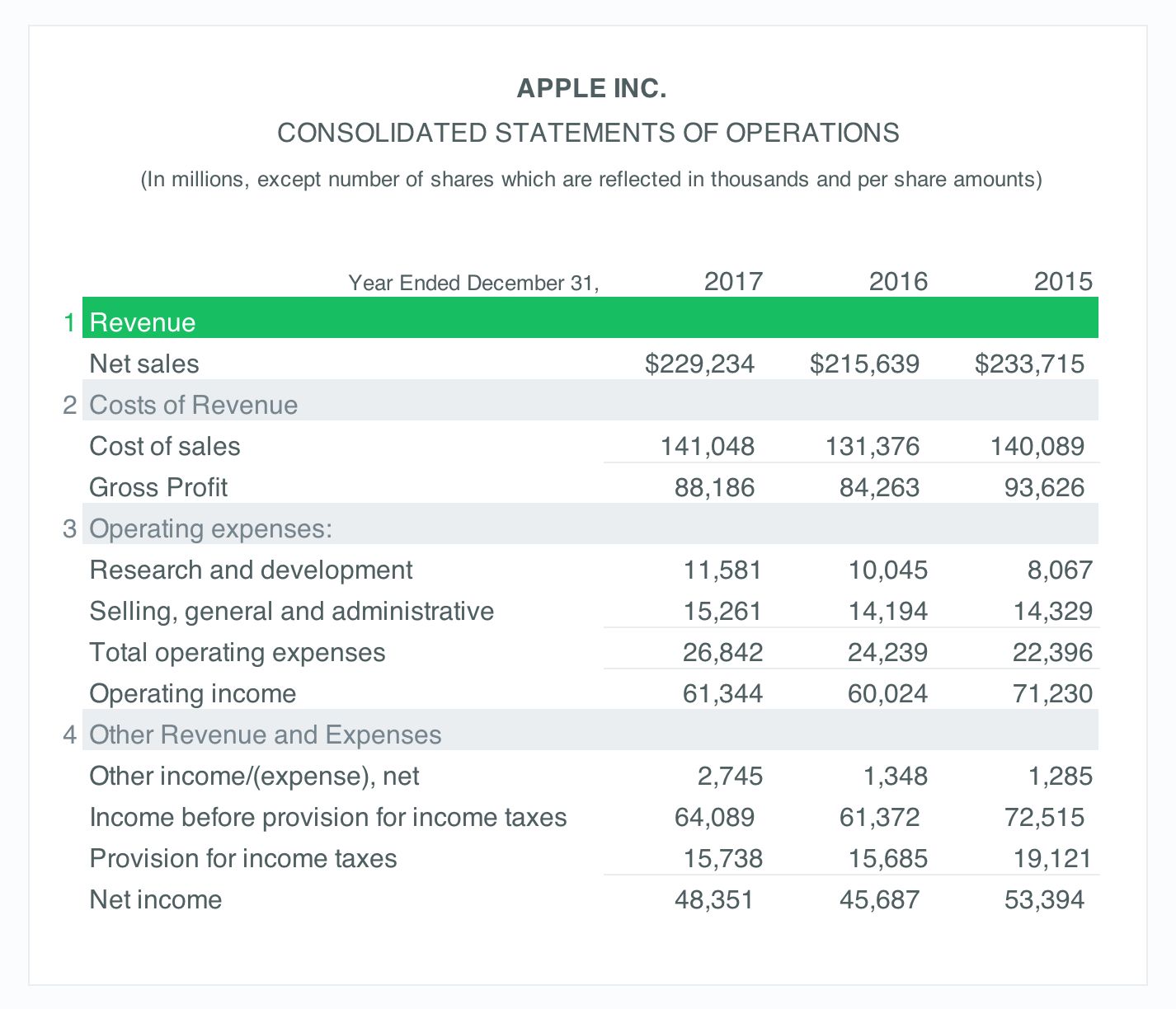

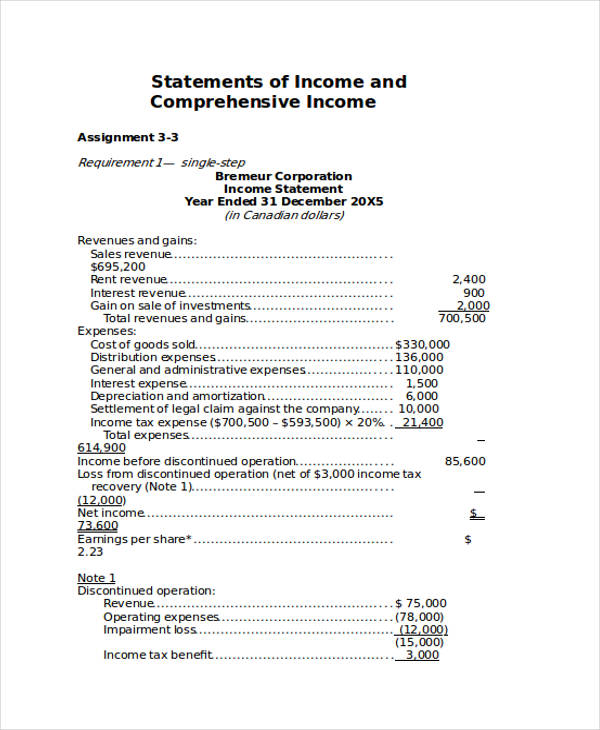

Statement of comprehensive income example. Net income is the profit that remains after all expenses and costs, such as taxes. Comprehensive income includes net income and oci. The following are some examples of unrecognized profits or losses:

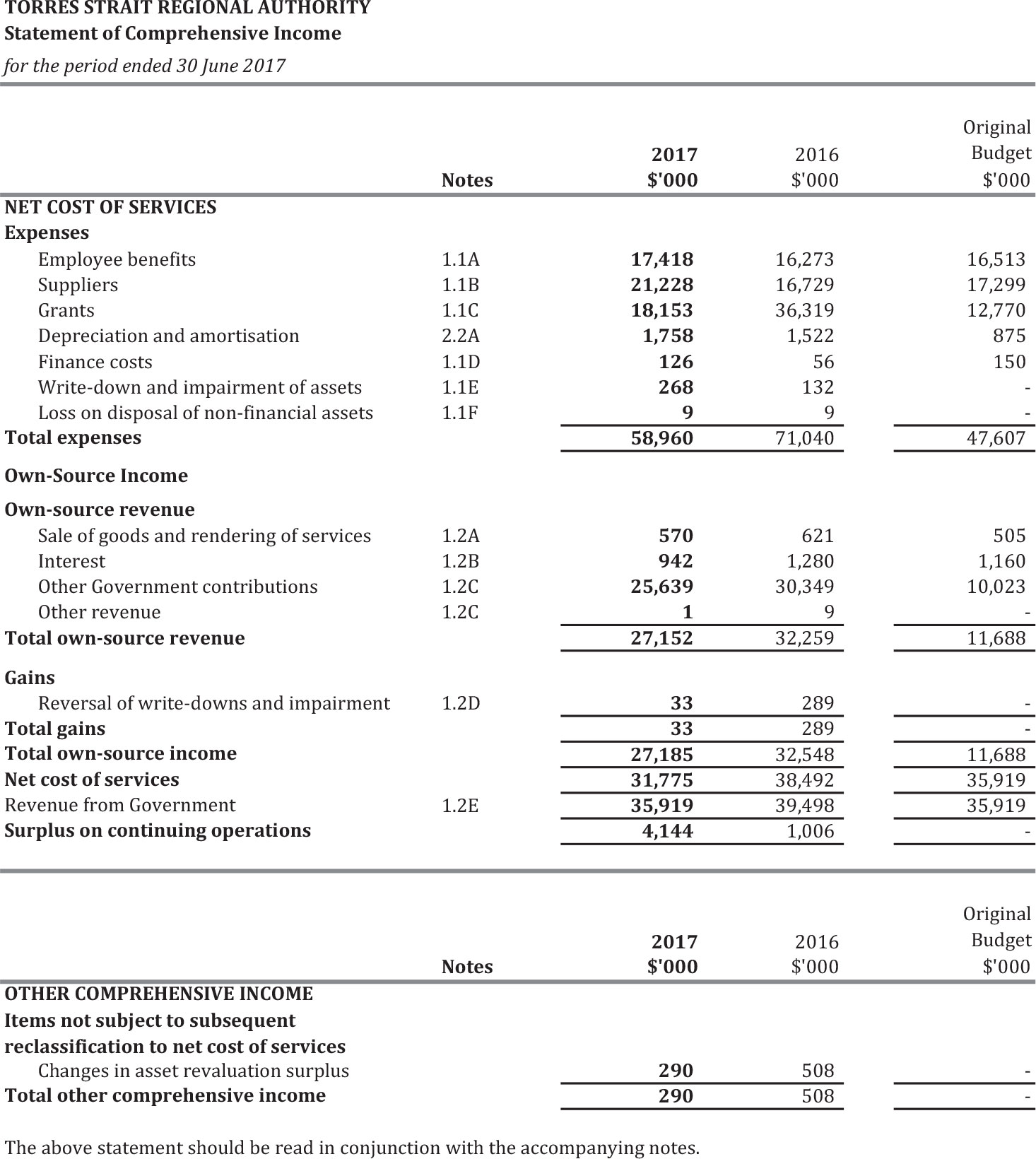

In this accounting lesson, we go through a thorough example of preparing the statement of comprehensive income (income statement). The main example is the revaluation of tangible assets. Items in statement of comprehensive income the items included in the two sections are as follows:

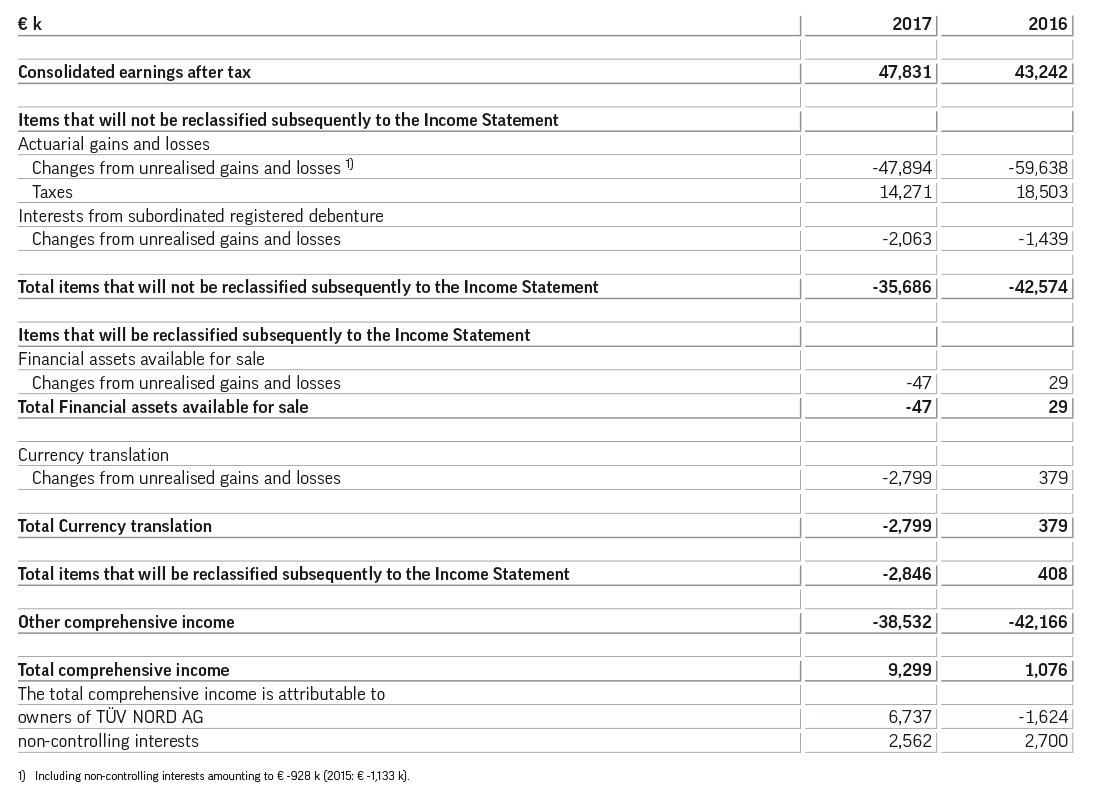

To emphasize these features, the income statement goes into great detail. Comprehensive income changes that by adjusting specific assets to their fair market value and listing the income or loss from these transactions as accumulated other comprehensive income in the equity section of the balance sheet. It includes all changes in equity during a period except those resulting from investments by owners and distributions to owners.

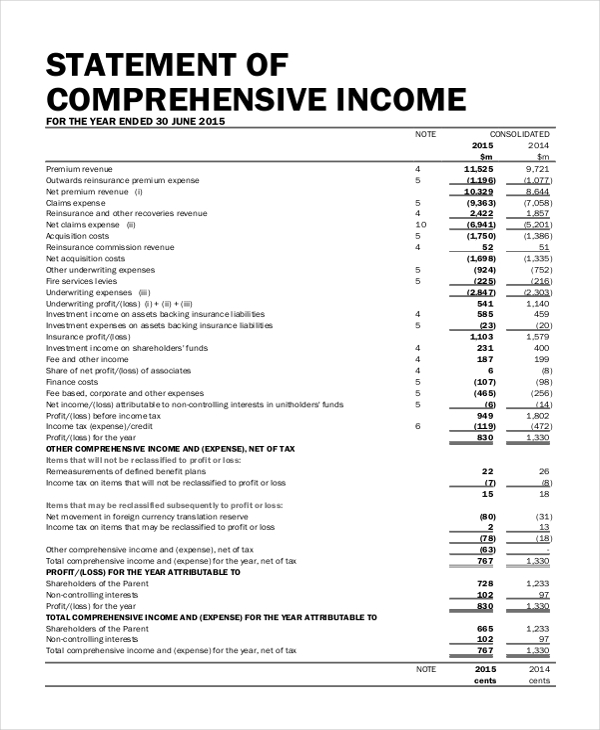

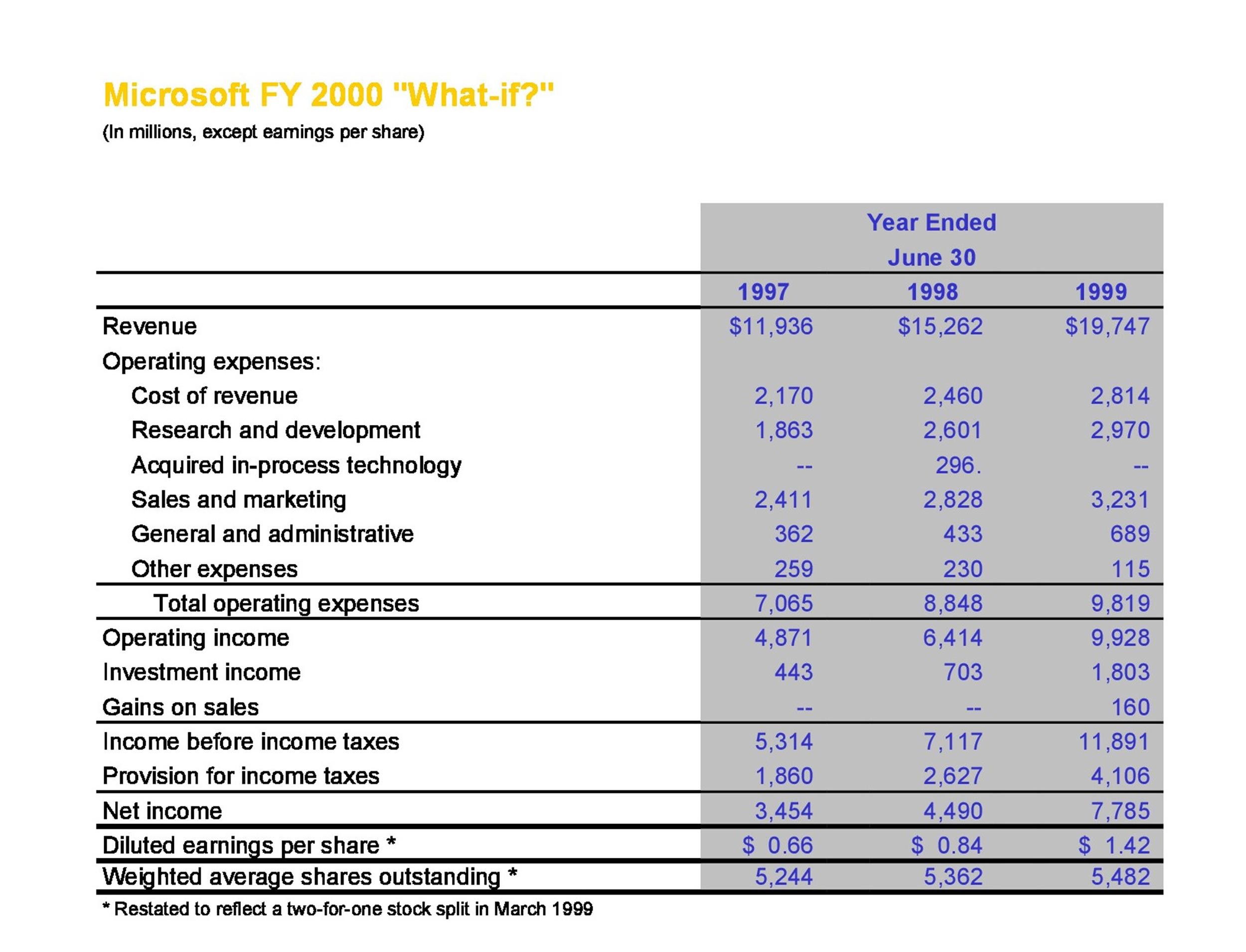

Example the above figure shows an example of a statement of comprehensive income. Organising the statement of profit 106 or loss by function of expenses appendix b: Here are some examples of other comprehensive income that you may find on the comprehensive income statement:

We show how to do the income statement when given the. Profit or losses on debt securities that have not yet been realised 5. The gain is not realised until the asset is sold and converted into cash.

The unrealized gains and losses on securities that a company has for sale gains. Ifrs example consolidated financial statements 1. It gives a more complete picture of the financial.

Access to page content (press enter). Statement of comprehensive income 108 presented in a single statement appendix c: It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements.

Derivative financial instruments commonly considered as advanced investing investments expected to yield returns and retained earnings in the future, such as stocks, bonds, real estate, and gold debt securities that can be bought or sold prior to maturity The advantages of the statement of comprehensive income include the following: The statement of comprehensive income should be presented immediately after the income statement.

As the name suggests, the statement represents the company’s net income. Different examples are mentioned below: Profit and losses from pension and other related retirement programmes 2.

A separate income statement and a statement beginning with profit or loss and displaying components of other comprehensive income. What gain would a company make if the asset was sold). A reporting entity should disclose the income tax effect of each component of oci, including reclassification adjustments, either on the face of the statement in which those components are displayed or in the footnotes.