Build A Tips About Formula For Return On Common Stockholders Equity

In other words, this is the.

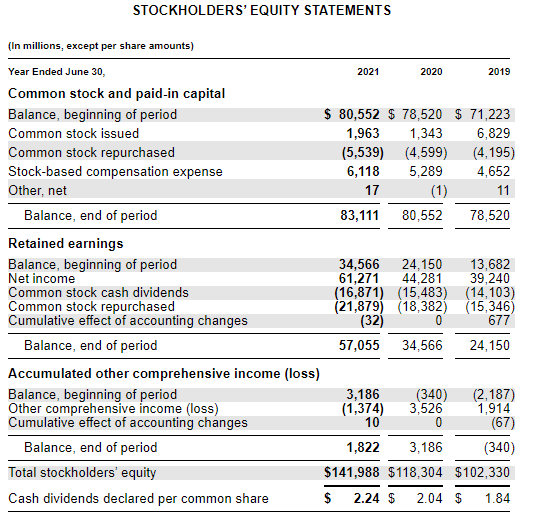

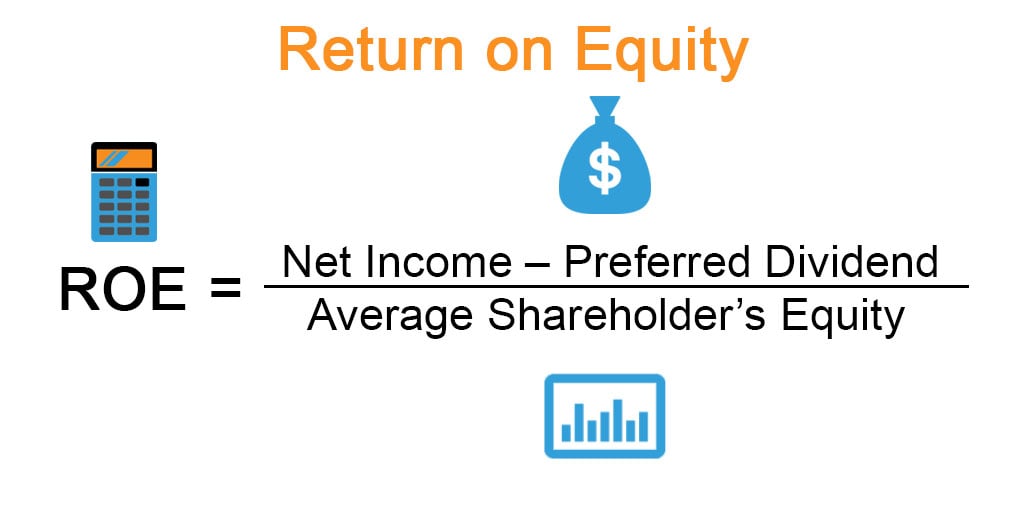

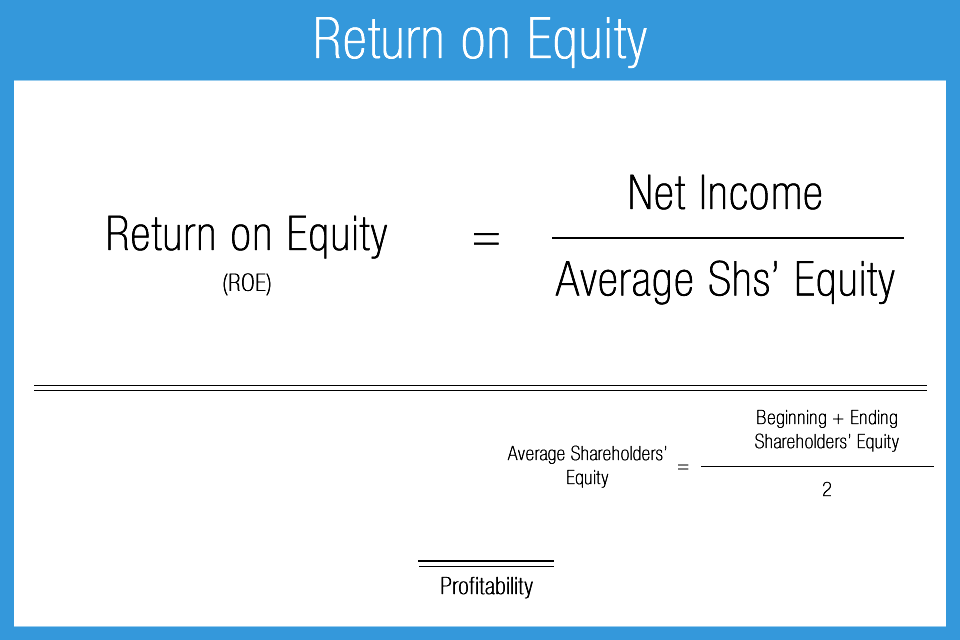

Formula for return on common stockholders equity. Return on common equity (roce) is a profitability ratio for measuring the return to common stockholders on their invested capital. Roe (return on equity) is a ratio of profitability, which shows how much profit the company has managed to make from its equity. Because shareholders’ equity is equal to assets minus.

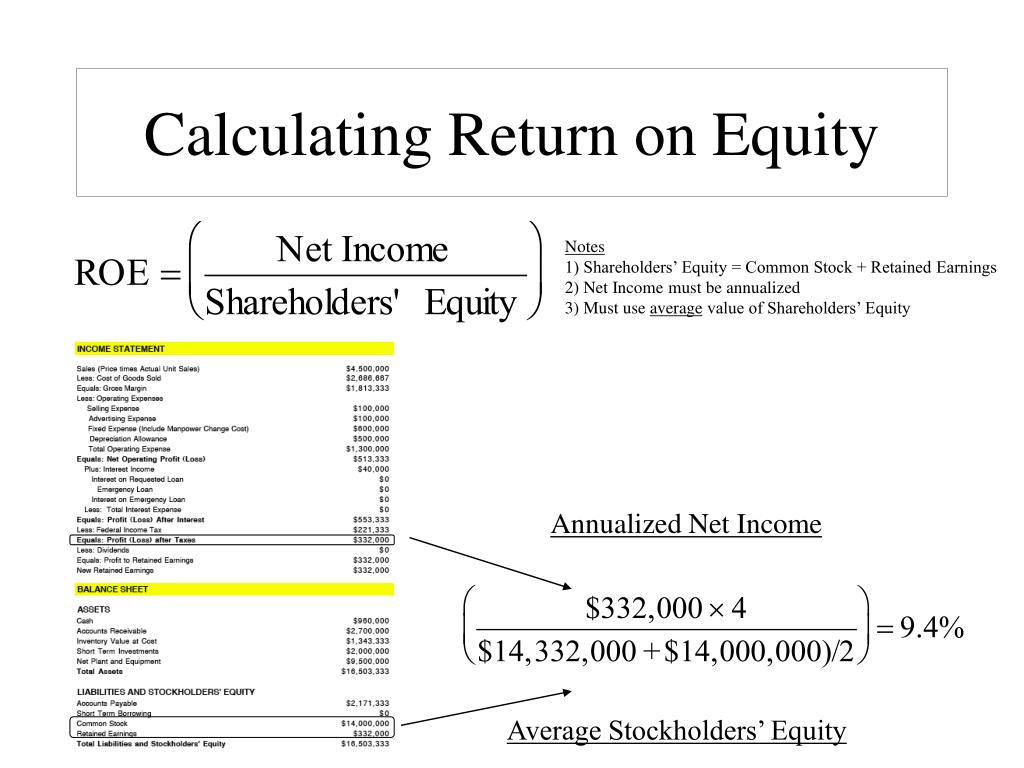

Roe of abc ltd = net income / shareholders’ equity. To calculate roe, analysts simply divide the company’s net income by its average shareholders’ equity. Return on common equity is calculated using information from the income statement and the balance sheet.

Most of the time, roe is computed for common shareholders. Put the formula for return on equity =b2/b3 into cell b4 and enter the formula =c2/c3 into cell c4. For example, if an investor is calculating the return.

You can determine shareholders' equity by calculating the total assets and liabilities using the following formula: = 0.246 or 25% (approx.) abc ltd.'s return on equity is at 25%. Roe= \frac {\text {net income}} {\text {shareholder equity}} roe = shareholder equitynet income where:

To calculate roe, analysts simply divide the company’s net income by its average shareholders’ equity. In the example below, abc co. To calculate the return on common equity, use the following formula:

Return on common equity: When calculating the return on equity, the stockholder's equity should be averaged based on the time being evaluated. The return on equity ratio formula is calculated by dividing net income by shareholder’s equity.

Once that is completed, enter the corresponding values for. Return on common equity = ($19,877 − $2,309) ÷ $185,392 = 9.48%. Return on common equity (roce) can be calculated using the equation below:

Has $20,000 in earnings after taxes. It tells that the return to common shareholders is 9.48% on their investment. This means that for every rupee.

Because shareholders’ equity is equal to assets minus. The basic formula for calculating roe is: Roce = net income ( ni )/ average common shareholder’s equity in order to find the.

Common variations of this metric include return on common stockholders equity (which would treat preferred stock more like debt) and return on invested capital (roic).

:max_bytes(150000):strip_icc()/ScreenShot2021-05-03at11.03.30AM-985f846f70e347c69f0f288359e7beed.png)

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)