Lessons I Learned From Tips About Financial Ratios And Formulas

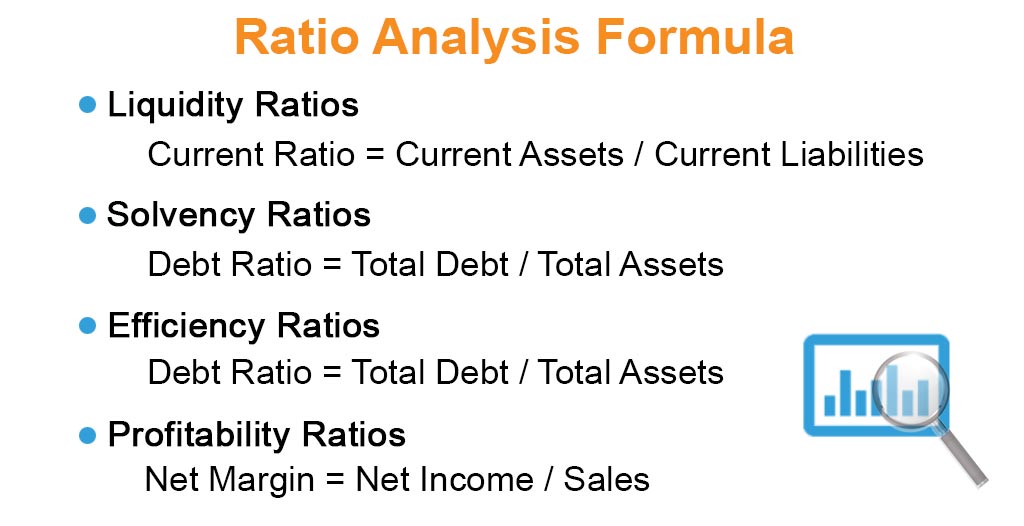

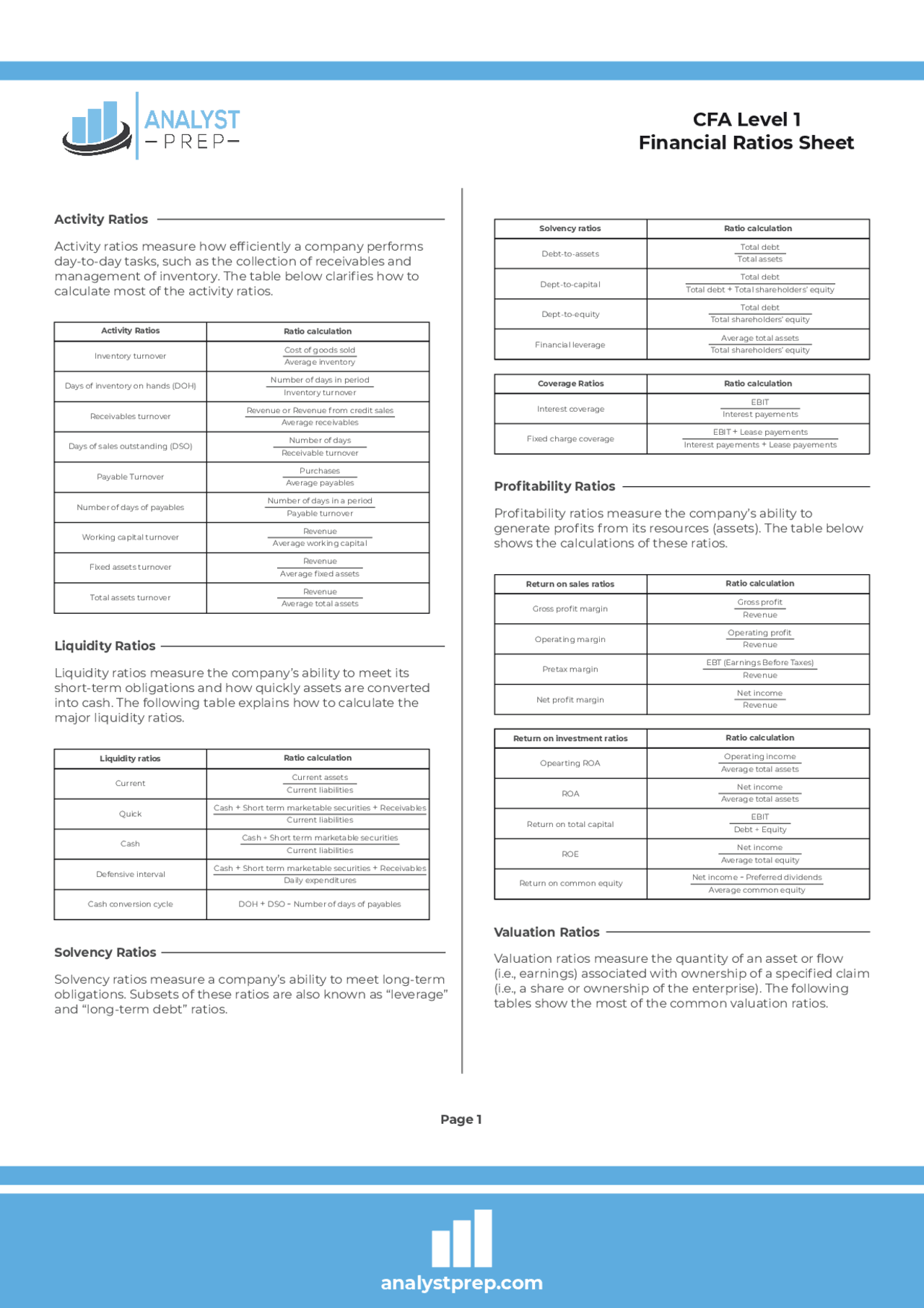

Liquidity, solvency, efficiency, profitability, equity, market prospects, investment leverage, and coverage.

Financial ratios and formulas. Most ratios are best used in combination with. Net revenue, sales, turnover fixed assets: In general, an roa above 5% is considered good.

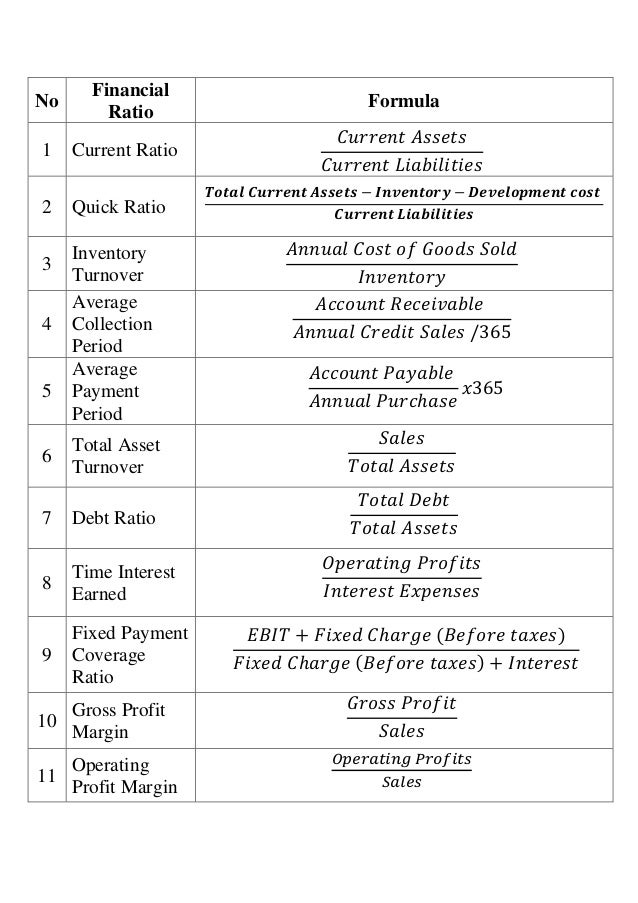

Financial ratios using balance sheet amounts. Michael logan what is ratio analysis? There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories:

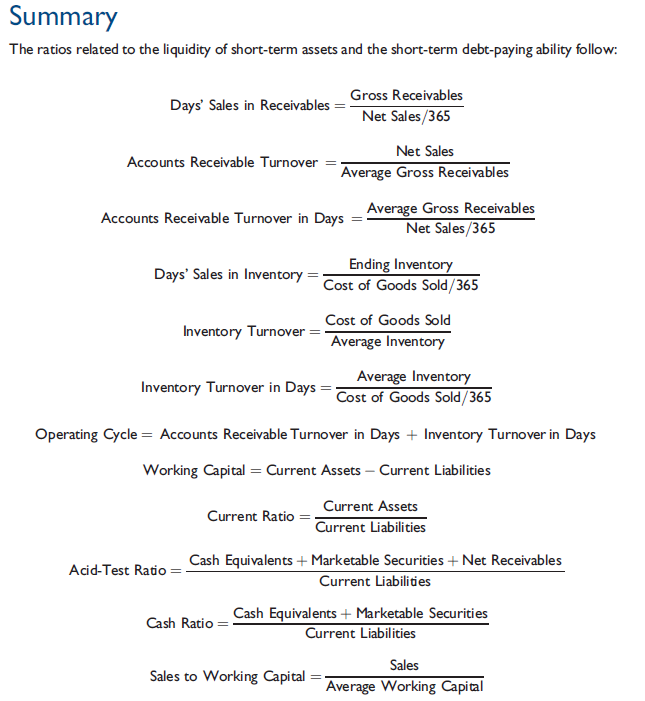

Current ratio = current assets/current liabilities 2. Liquidity ratios measure a company’s ability to. What do financial ratios tell you?

October 11, 2023 what are financial ratios? Financial ratios are grouped into the following categories: Measures a company’s current share price relative to its.

Debt ratio = total liabilities/total assets commonly used liquidity ratios and formulas 1. Key terms dividend payout ratio standard deviation compound annual growth rate (cagr) discounted cash flow (dcf) cost of goods sold (cogs) price elasticity of. List of financial ratios, their formula, and explanation.

Types of financial ratios: By rosemary carlson updated on november 30, 2022 reviewed by khadija khartit fact checked by david rubin in this article view all the balance sheet for financial ratio analysis the income statement for financial ratio analysis analyzing the liquidity ratios the current ratio the quick ratio Financial ratios have the following uses:

Net book value of fixed assets gross profit: Ratio #5 debt to total assets. Corporate finance ratios are quantitative measures that are used to assess businesses.

Financial ratios compare different line items in the financial statements to yield insights into the condition and results of a business. Our explanation will involve the following 15 common financial ratios: In general, there are four categories of ratio analysis:

Profitability, liquidity, solvency, and valuation. Financial statement ratios can be helpful when analyzing stocks. 2) return on equity (roe) return on equity measures a company’s ability to generate earnings in relation to its shareholders’ equity.

Ratio #3 quick (acid test) ratio. Examples, formulas, how to calculate; These ratios are used by financial analysts, equity research analysts, investors, and asset managers to evaluate the overall financial health of businesses, with the end goal of making better investment decisions.