Formidable Info About P&l Account Items

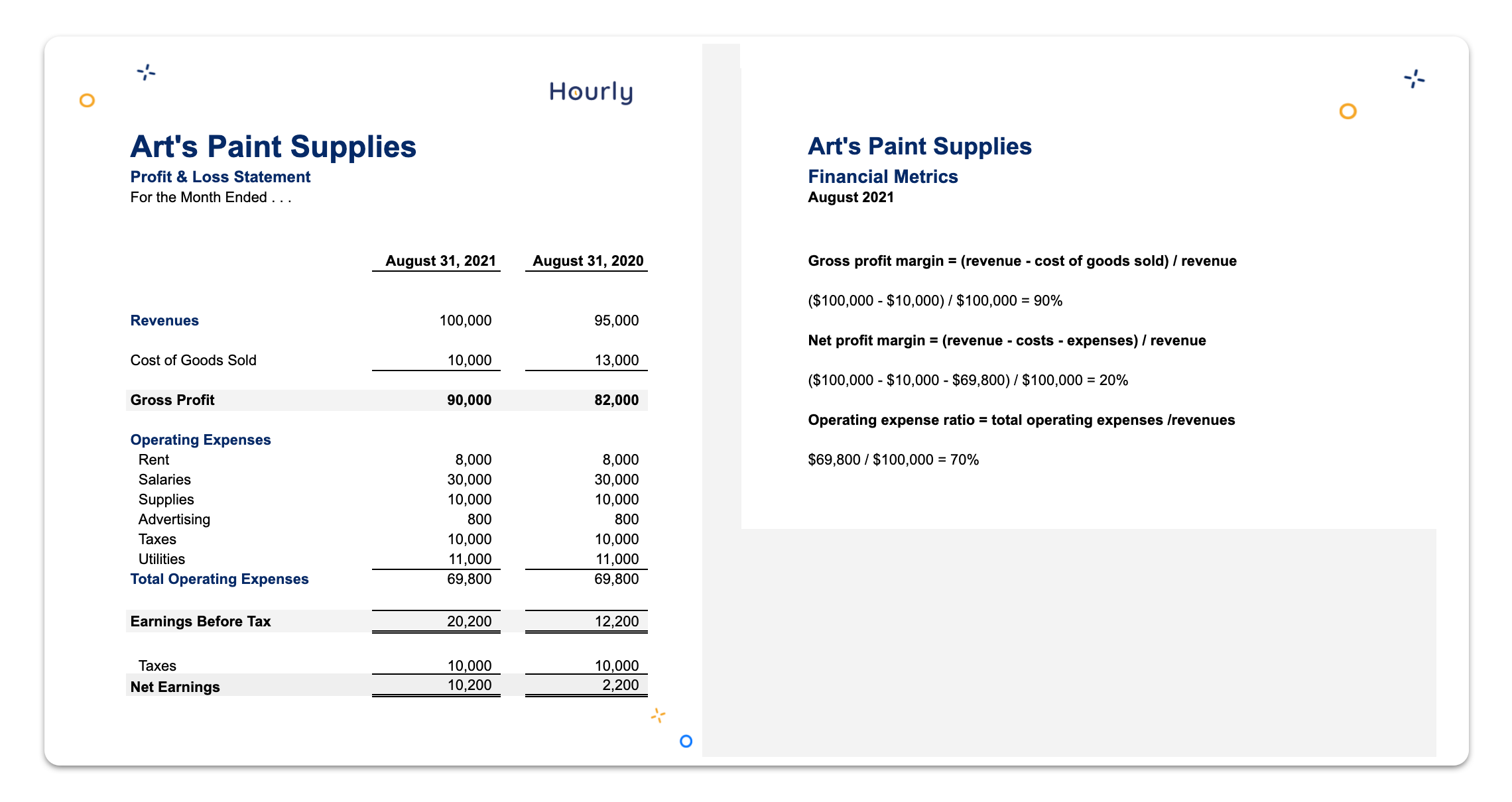

A p&l statement shows a company's revenues and expenses related to running the business, such as rent, cost of goods sold, freight, and payroll.

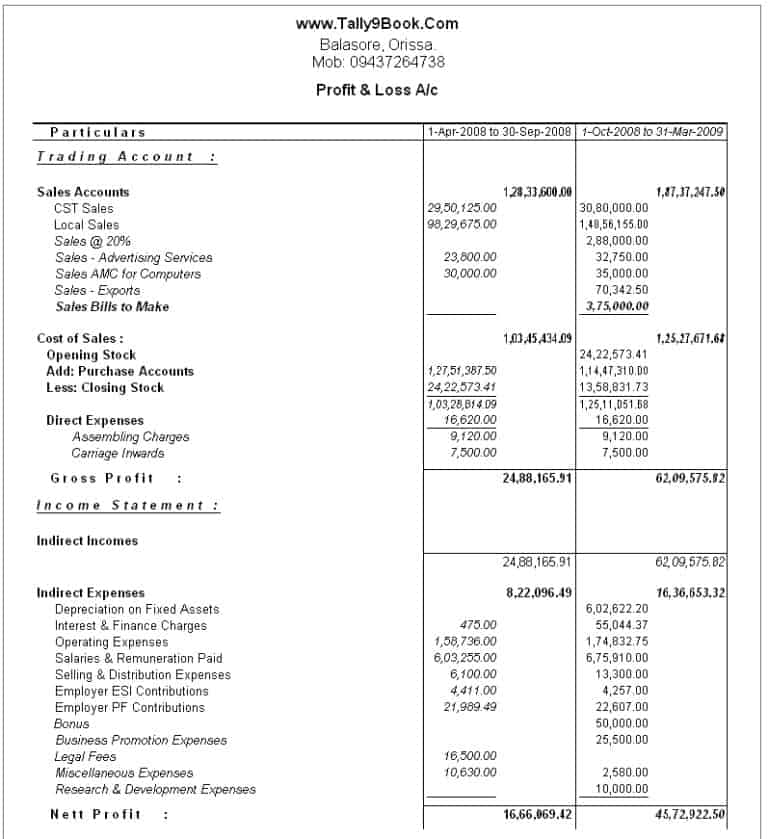

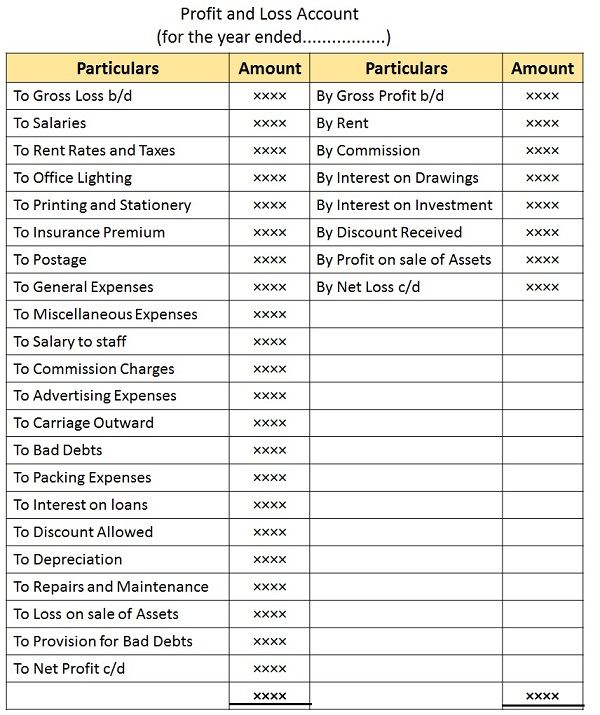

P&l account items. As the p&l report most commonly contains quarterly information, the ratios calculated can be analyzed in dynamics over some time and for some certain reporting period. Each entry on a p&l statement provides insight. To expenses a/c (individually) (being the accounts of all the expenses closed) 2.

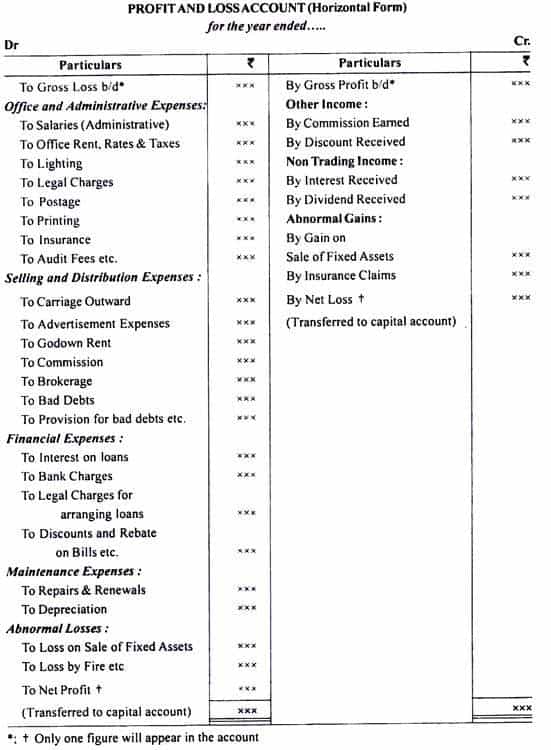

Line items include revenue, cost of goods sold, interest expense, earnings before tax, and net income. To profit and loss account a/c (being the accounts of all the incomes closed 3. The profit & loss account reports the incomes and expenses directly related to an organisation to measure the performance in terms of profit or loss.

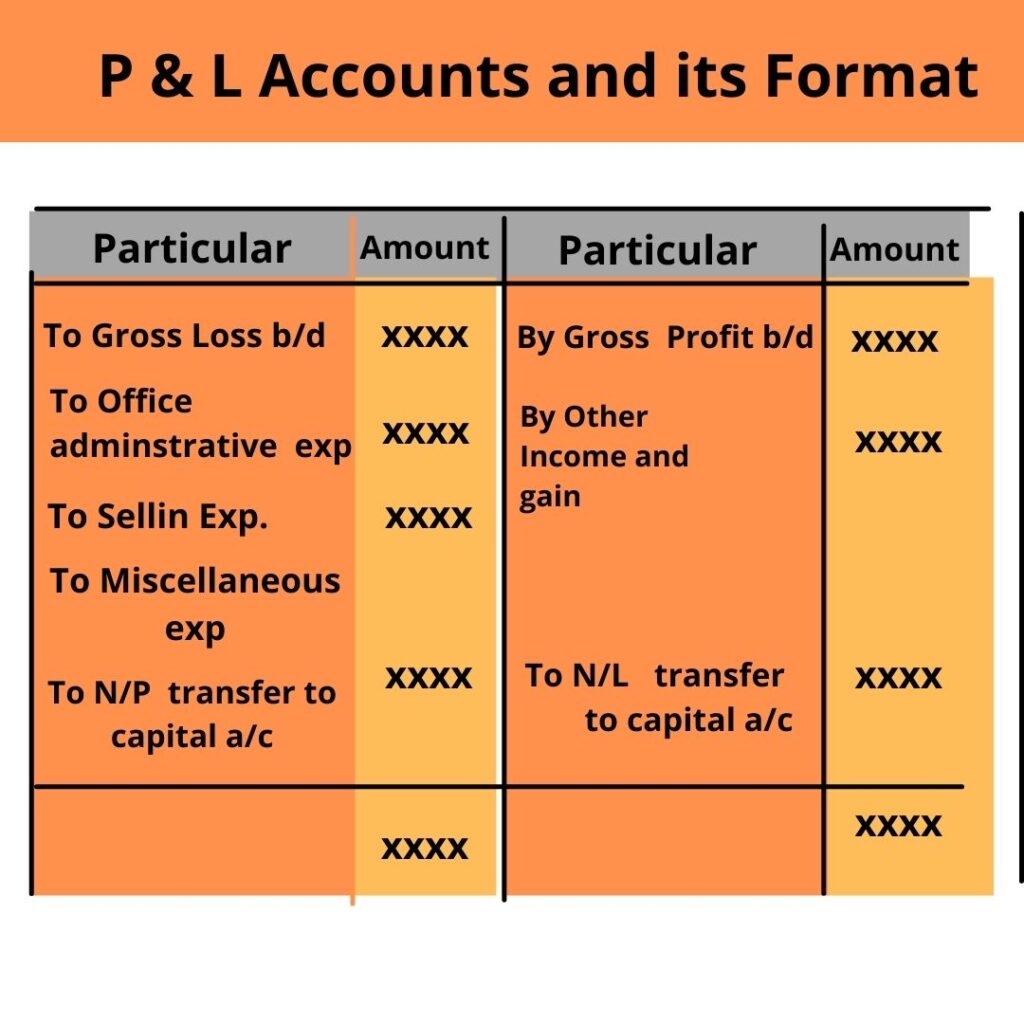

This form of a p&l account allows the progression of profits or losses to be more easily traceable, as each group of items individually contributes towards the final result. A profit and loss account is prepared to determine the net income (performance result) of an enterprise for the year/period. Profit & loss account is also known as p&l a/c, profit & loss statement, income statement or income and expense statement.

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits. There is no particular format for p&l account under gaap gaap gaap (generally accepted accounting principles) are standardized guidelines for accounting and financial reporting. Cash accounting is when the business enters the figures for revenue or expenditure on the transaction date.

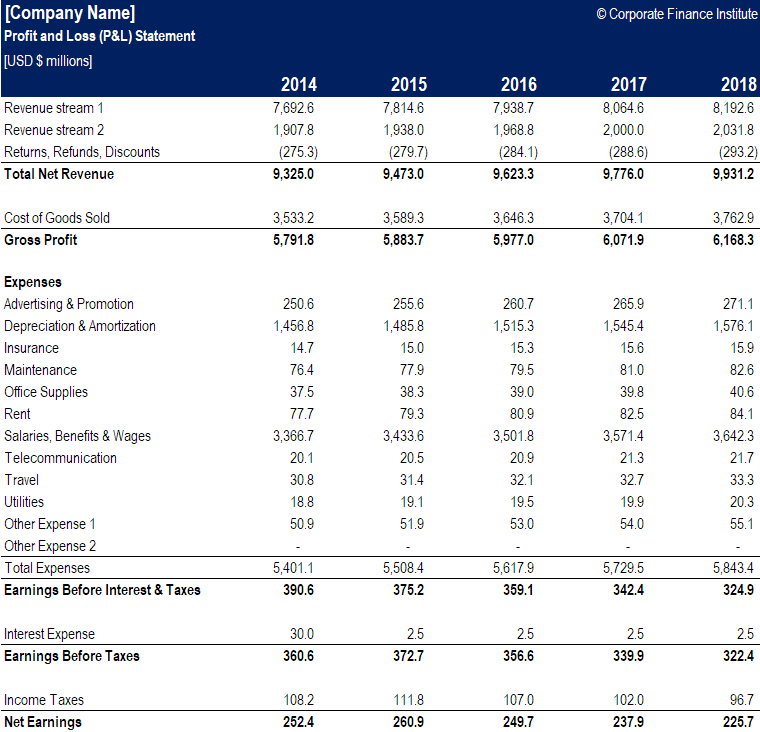

The p&l is made up of two types of transactions: The downloadable excel file includes four templates. The statement is based on the fundamental equation:

Download cfi’s free profit and loss template (p&l template) to easily create your own income statement. Business owners use the p&l to assess the company's profitability—how much money a company makes. #2 annual profit and loss template (p&l template)

Components of a p & l account. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time. A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time.

The profit and loss statement is an apt snapshot of a company's financial health during a specified time. Profit and loss account a/c: Basic elements of the profit and loss report are:

A profit and loss statement (p&l) is an effective tool for managing your business. But, learning how to read one isn’t always intuitive. A p & l account is normally prepared for an annual, quarterly or monthly period.

Knowing how to read a profit and loss statement is key to making informed. Many customized formats are used. A profit and loss (p&l) account shows the annual net profit or net loss of a business.