Ace Info About Finance Cost In Cash Flow

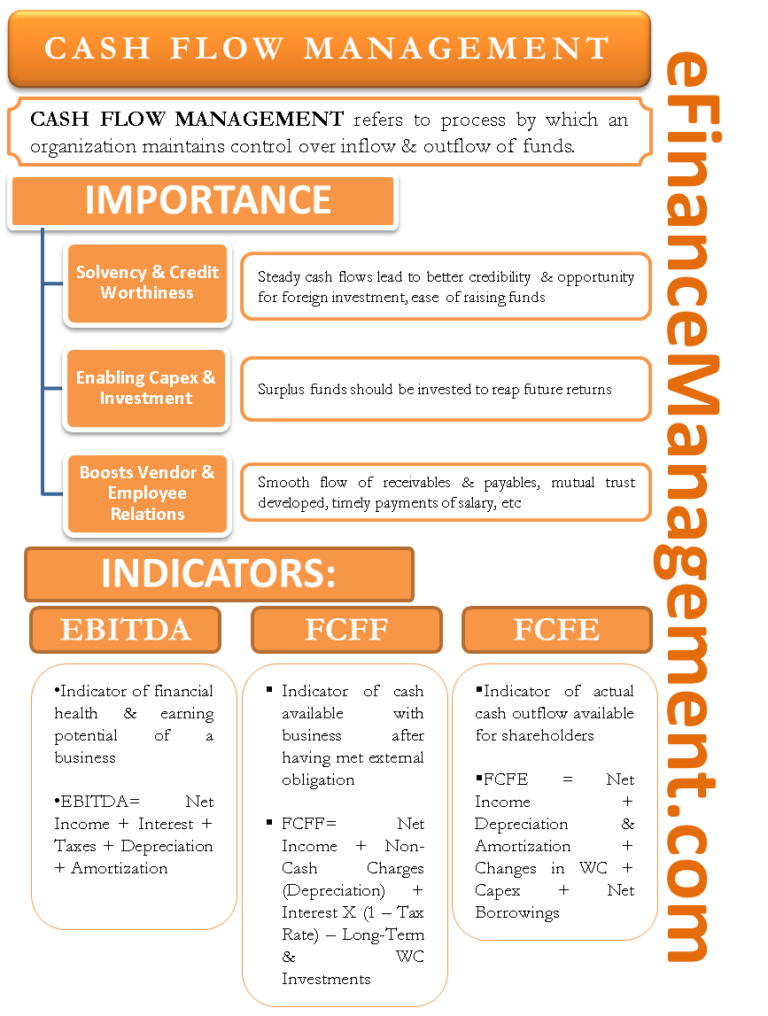

In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period.

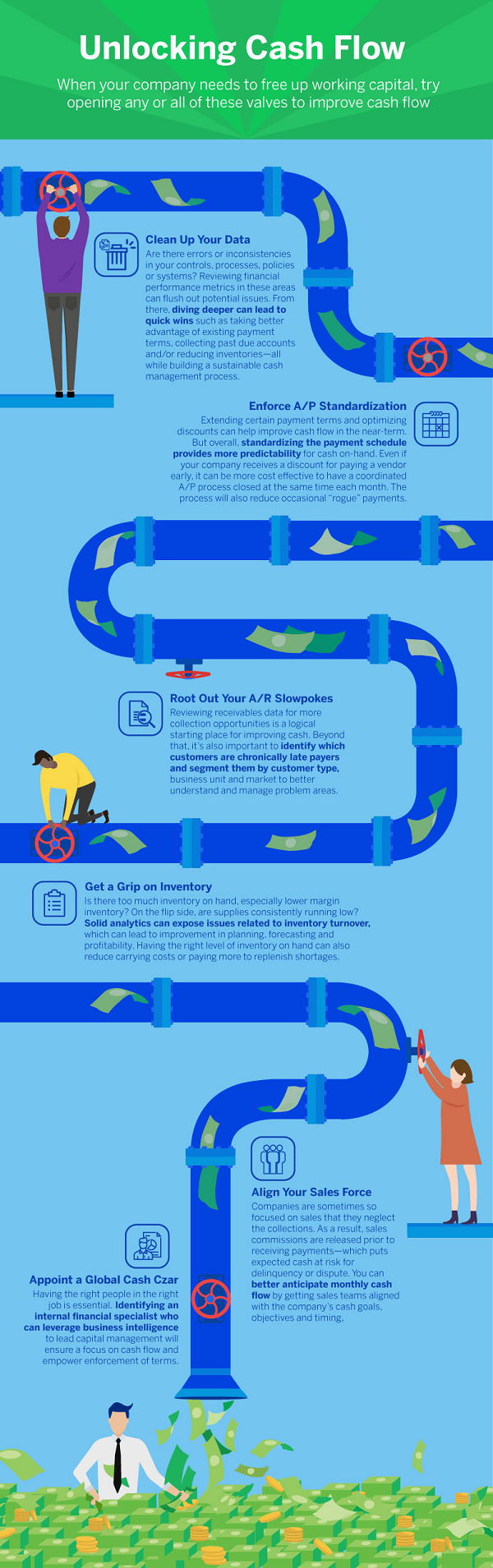

Finance cost in cash flow. Cash flow from financing (cfi): Cash flow is the heartbeat of your small business, reflecting the movement of money in and out. As an example, let's say a company has the following information in the financing activities section of its cash flow statement:

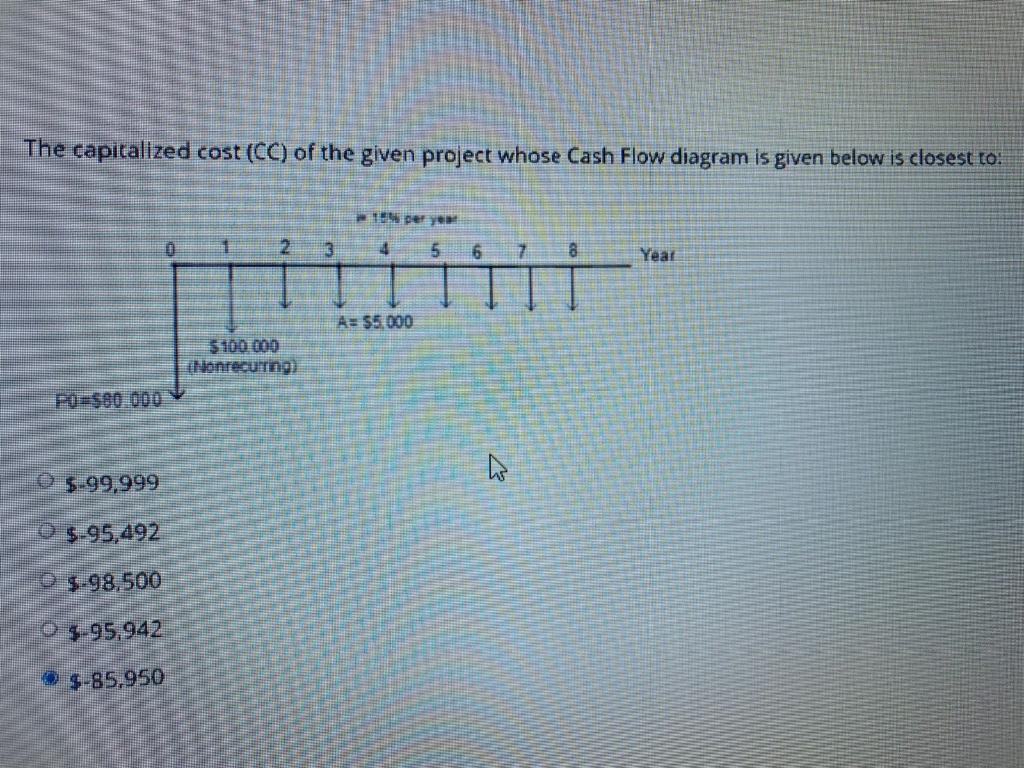

Finance costs are expenses that arise from borrowing funds or financing obligations. From a personal point of view, assume that you have an opportunity to invest $2,000 every year, beginning next year, to save for a down payment on the purchase of your first home seven years from now. It’s essential because it mirrors your financial health and is the lifeblood that sustains your operations.

A crucial component of a cash flow statement. Lyft beat estimates for quarterly profit on tuesday and said it would generate positive free cash flow for the first time in 2024, as it benefits from cost cuts and pushes back against competition from larger rideshare rival uber. Reviewed by dheeraj vaidya, cfa, frm financing costs definition financing costs are defined as the interest and other costs incurred by the company while borrowing funds.

Even though our net income listed at the top of the cash flow statement (and taken from our income statement) was $60,000, we only received $42,500. Cash flow analysis first requires that a company generate cash statements (opens in new tab) about operating cash flow, investing cash flow and financing cash flow. Taking into account the profit and cash generation in 2023, as well.

Key takeaways cash flow is the movement of money in and out of a company. Ias 7 cash flow statements replaced ias 7 statement of changes in financial position (issued in october 1977). These costs include interest payments on loans, bank overdrafts, or other borrowings.

The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. When crafting a cash flow statement, it’s vital to account for these expenses accurately. Corporate finance systems face unprecedented challenges in such crises, including fluctuations in consumer demand, escalating operational costs,.

Docs free cash flow data by ycharts; Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the international accounting standards committee in december 1992. Although the presentation of operating cash flows differs between the two methods,.

The writer is the managing partner of daams, a social enterprise for development of smes and. Finance departments are digging in to “do more with less” this year, amid a rather sudden overall shift in corporate focus. $500,000 (cash outflow) payments of.

Finance activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations. If a cash flow does not meet the definition of an investing activity or a financing activity, the cash flow is classified as an operating activity. Updated april 26, 2021 reviewed by david kindness fact checked by patrice williams the cash flow statement is one of the most important but often overlooked components of a firm’s financial.

A vertical presentation of the numbers lends itself to noting the source of the numbers. The business brought in $53.66 billion through its regular operating activities. At the bottom of our cash flow statement, we see our total cash flow for the month: