Favorite Tips About Creating Financial Projections

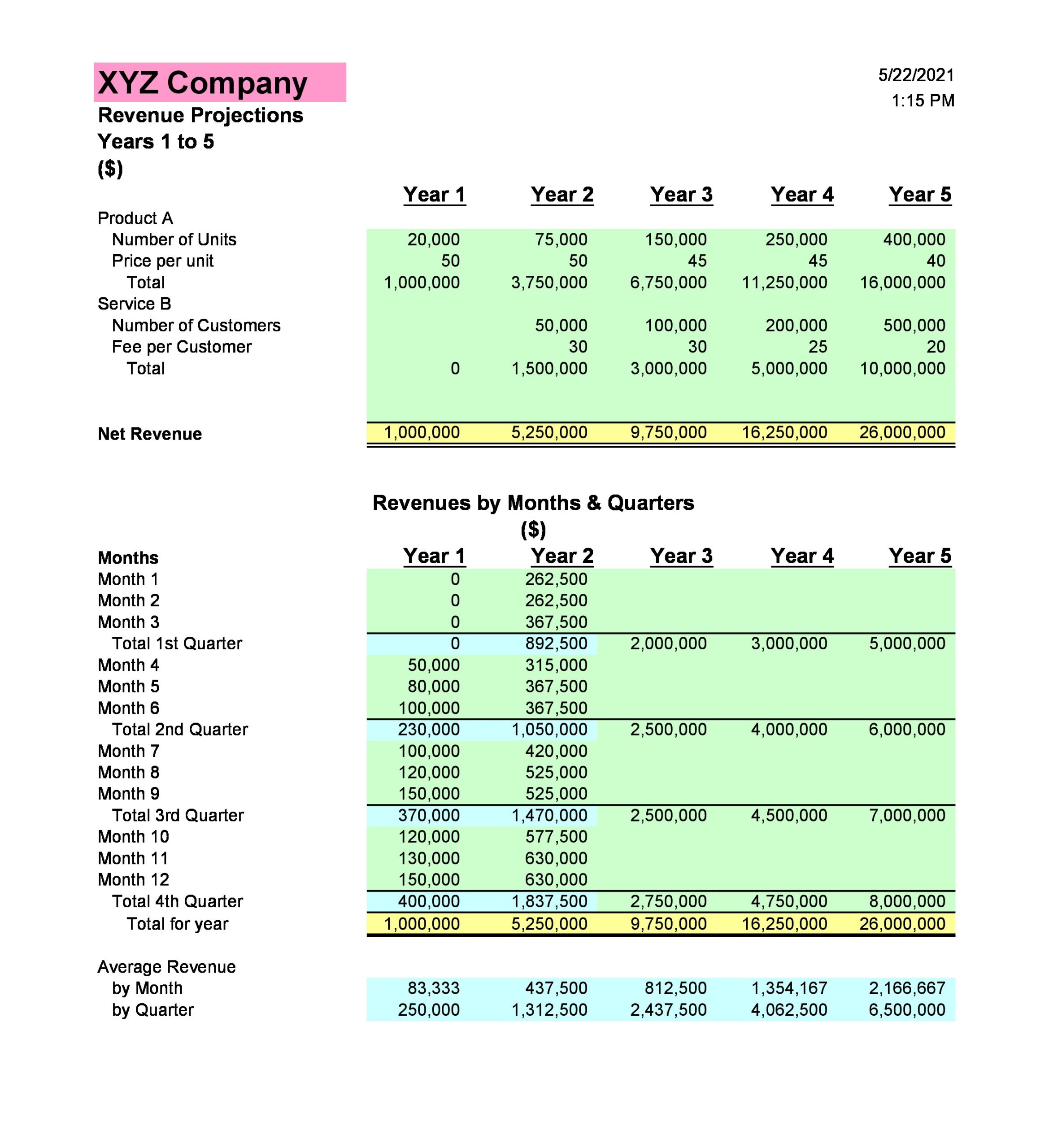

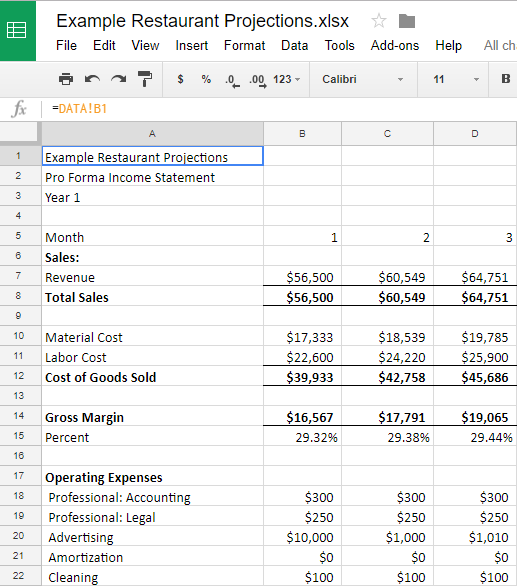

For subsequent years, annual projections will suffice.

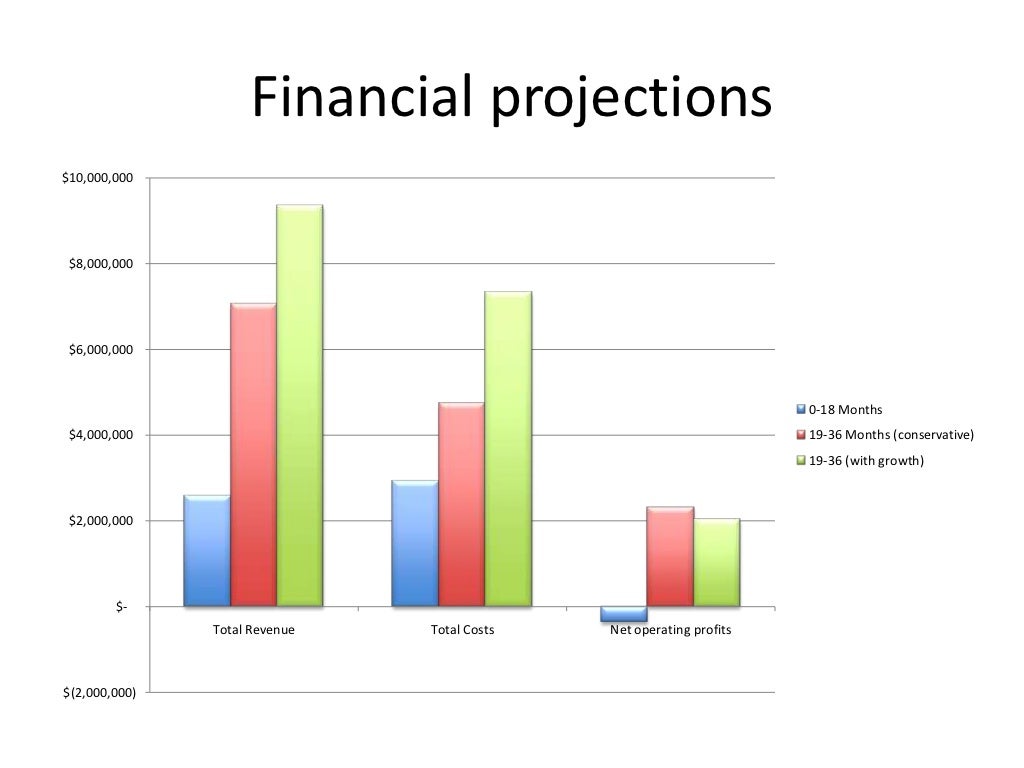

Creating financial projections. The financial projection shows forecasts and predictions on the financial estimates and numbers that range from revenues and expenses pertaining to financial statements and takes external market factors and internal data into account. Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. The critical elements of a financial projection are the income statements, cash flow and balance sheet.

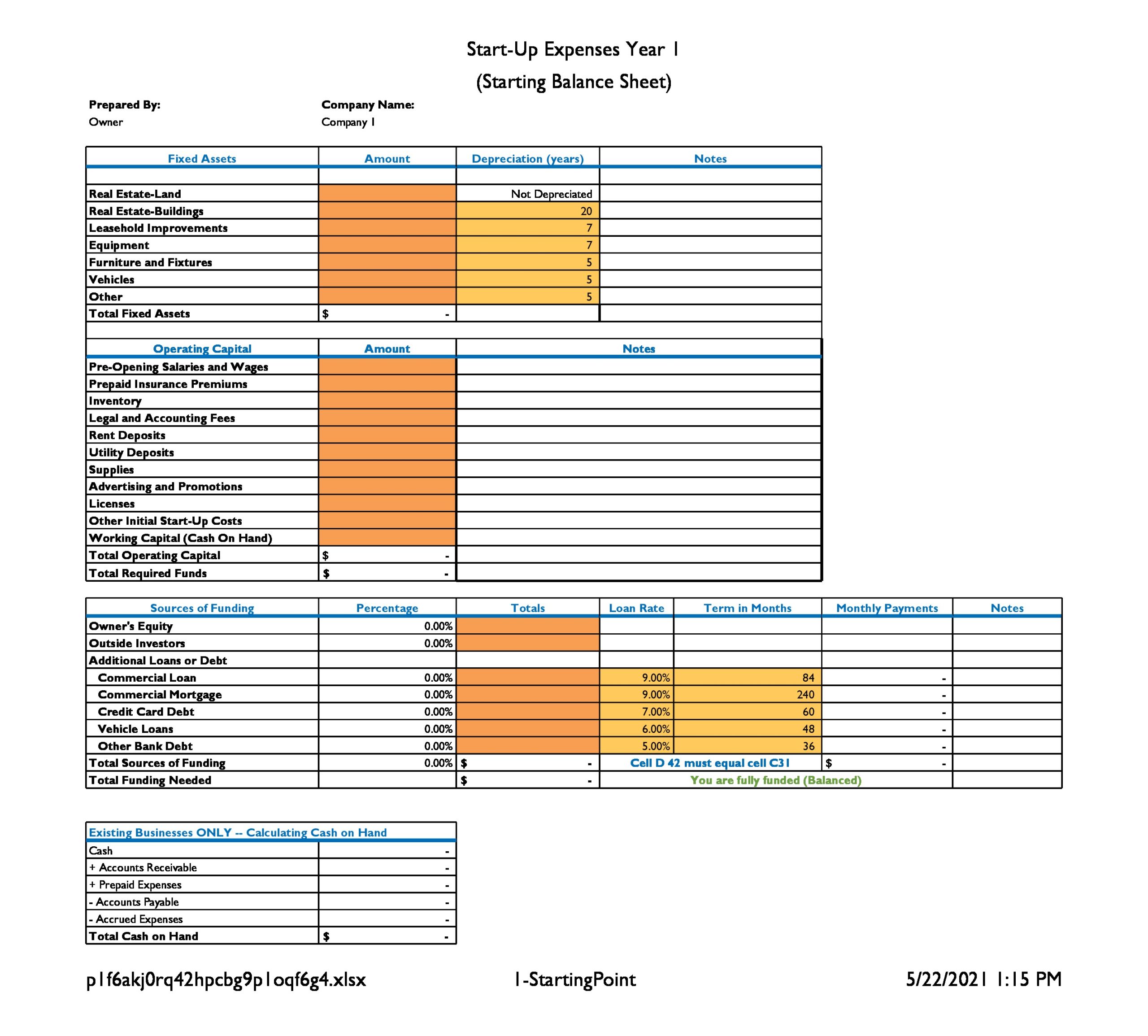

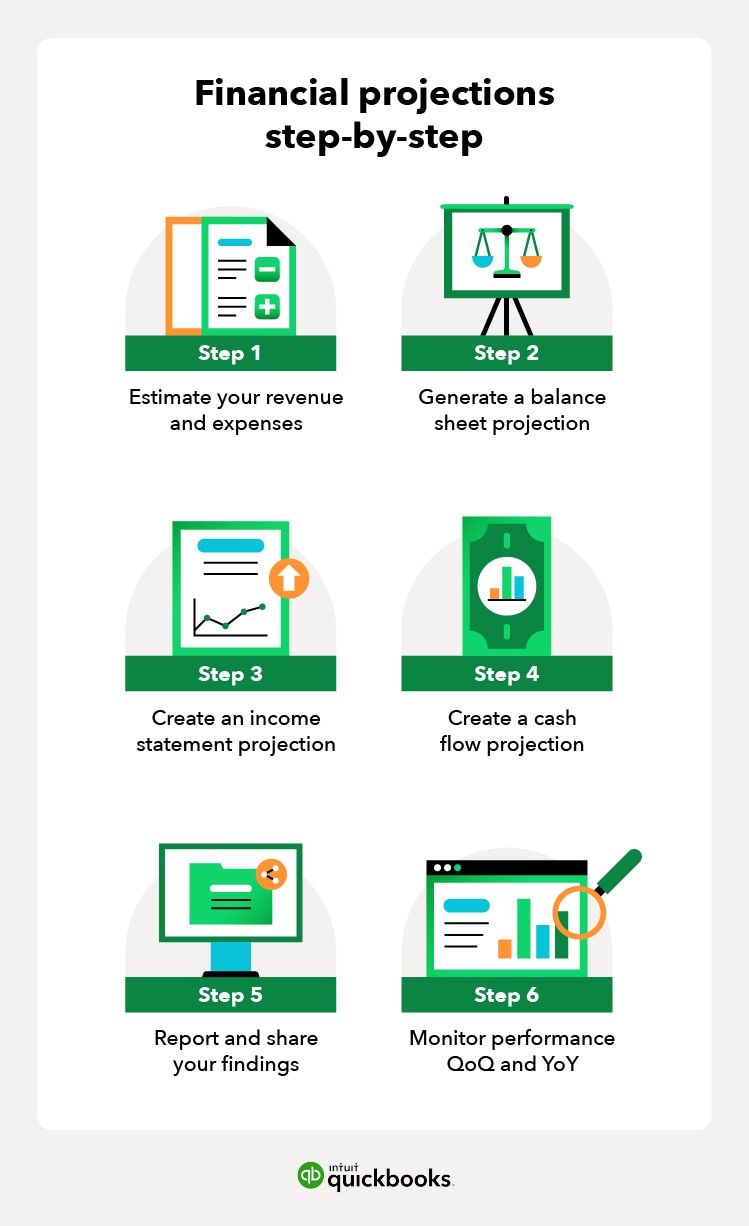

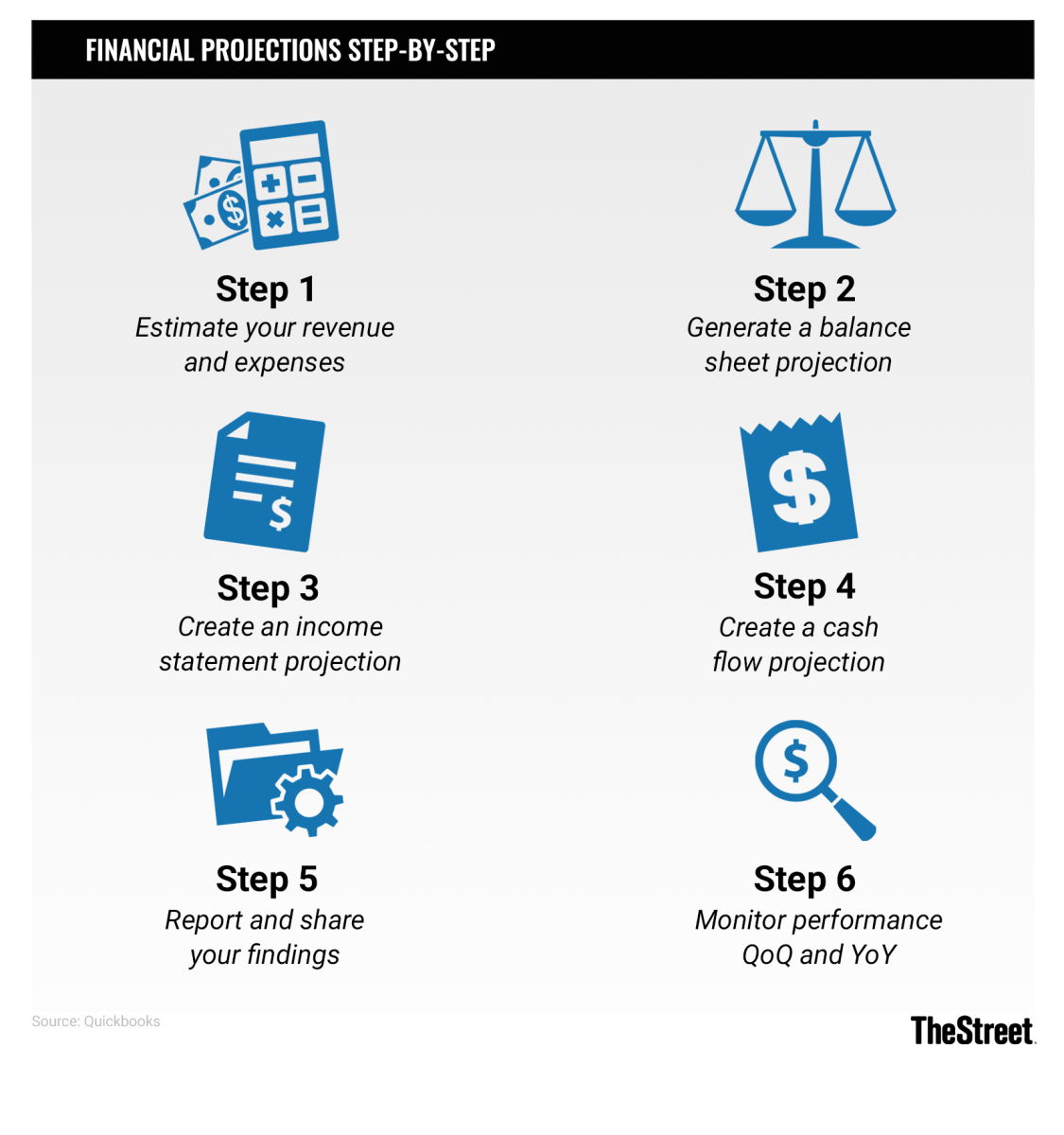

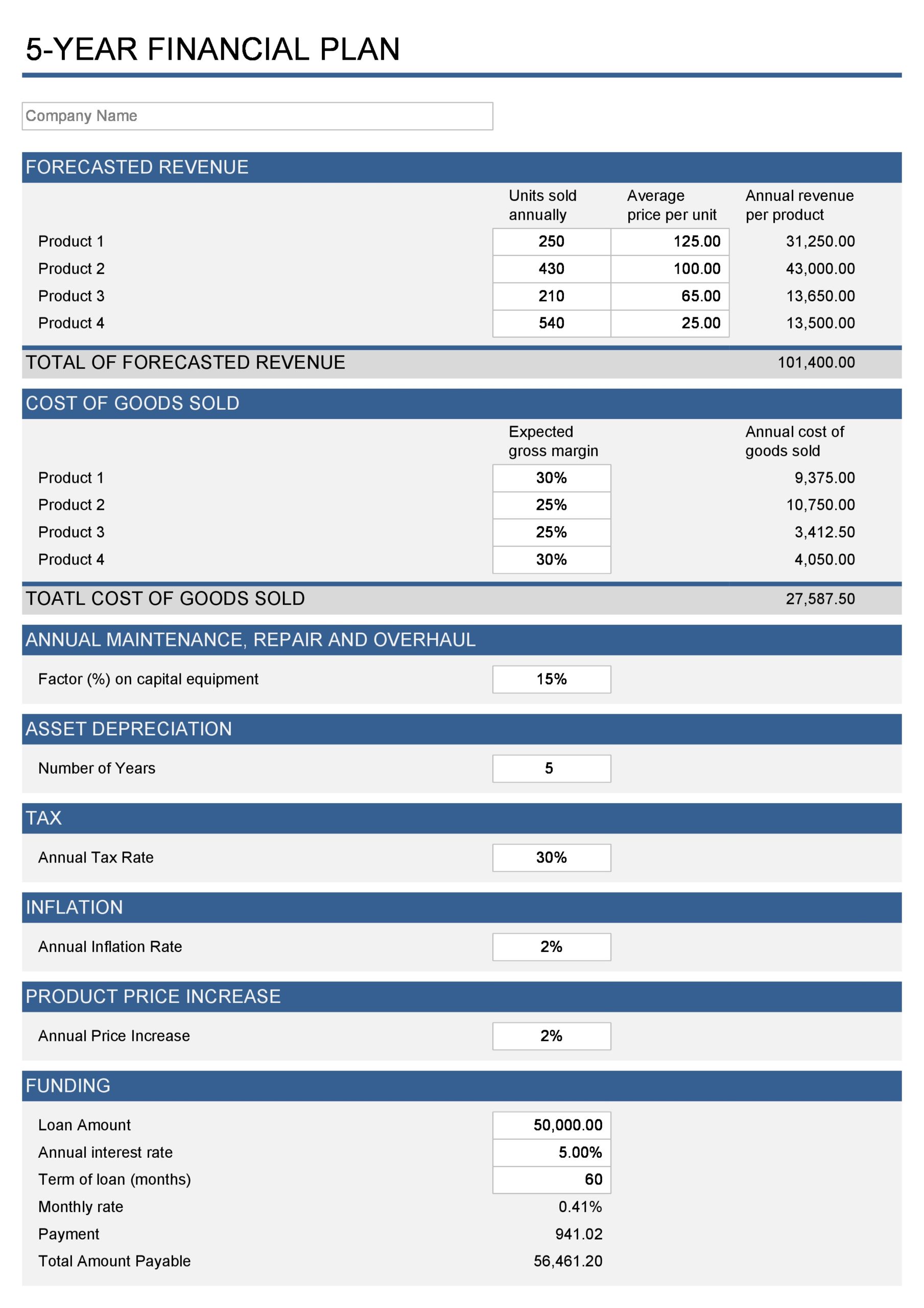

Sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections The first year of your financial projections should be presented on a granular, monthly basis. In this guide, we’ll break down everything you need to know about creating financial projections.

Creating realistic financial projections to make financial projections that hold up to scrutiny, you have to base them on realistic data and assumptions. Be realistic about your expectations for the future so you create projections that have a good chance of being accurate. These should give you a better understanding of what’s included in the three financial statements, and how they relate.

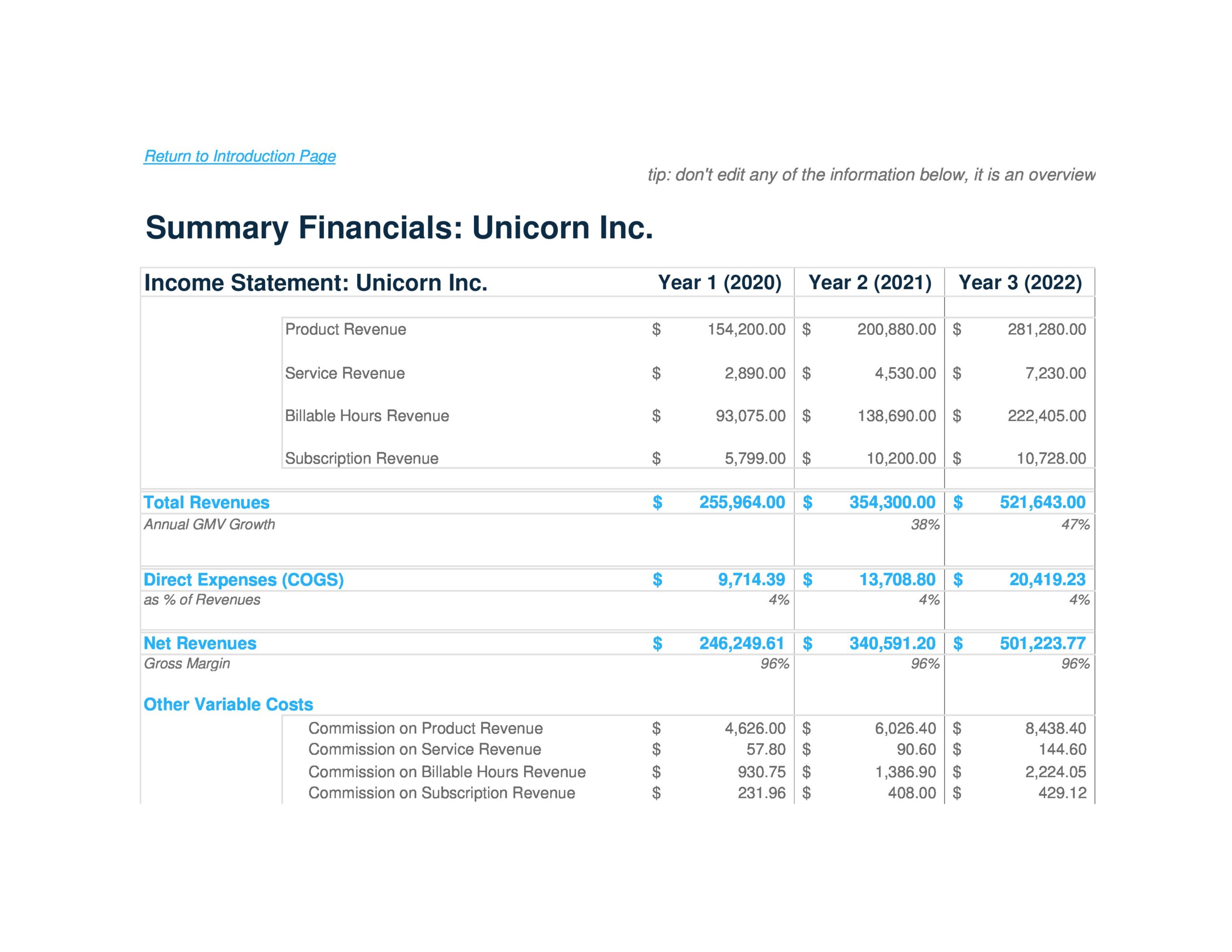

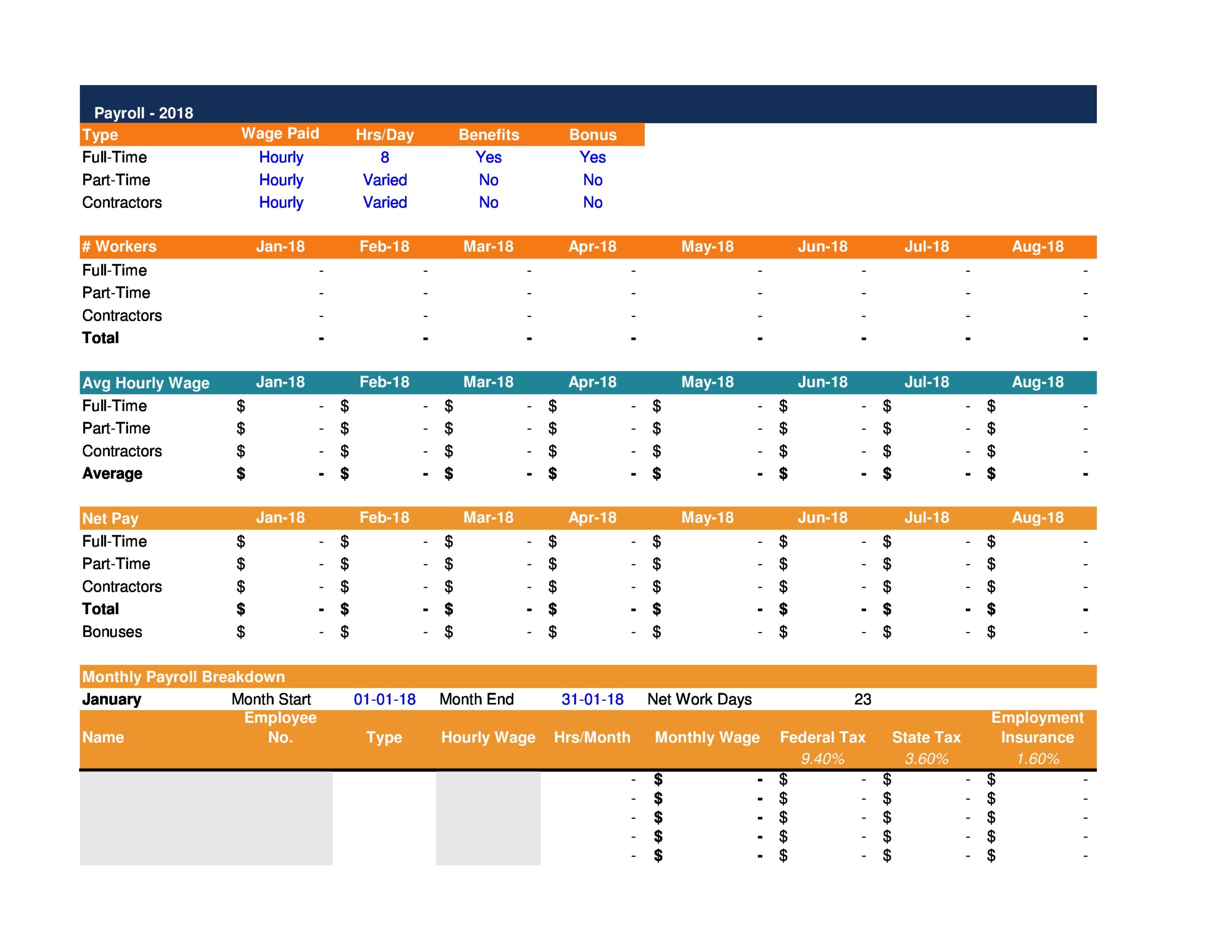

Financial projections will usually have a detailed view in a spreadsheet, as well as a summary of some of the most important information. This involves guesswork and assumptions, as many unforeseen factors can influence business performance. When creating financial projections, it is important to generate projections for multiple years.

From what to include, how to create one, and what steps to take based on your projections. There's an 85% chance the us economy will enter a recession in 2024, the economist david rosenberg says. Here are some tips for creating effective financial projections:

Frequently used as a way to attract future investors, financial. Learn how to create accurate and effective financial projections to guide your business towards growth and success, with practical tips and examples. Introduction a financial projection is a tool used to estimate the financial performance of a company over a certain period of time.

Project your spending and sales. This upward trend is evident, with the. This box gauges the macroeconomic impact of climate change policies aimed at reducing greenhouse gas emissions.

Operating expenses for the first 3 years of business. On our estimates [the stage 3 tax cuts] will be the equivalent to around 50 basis points [half a percentage point] of rate cuts in the 2024/25 financial year, senior economist catherine birch said. It is an essential part of any startup’s business plan as it enables the business owners to make sensible decisions based on comprehensive facts and figures.

5 year income statement, cash flow, and balance sheet pro formas. Use realistic assumptions about the future. Your financial projection hub.

Projecting sales the first step for a financial forecast starts with projecting your business’s sales, which are typically derived from past revenue as well as industry research. You can analyze many factors to help predict the future, including sales trends, demographic information,. To meet the goal of reducing emissions in the european union (eu) by at least 55% in 2030 compared with 1990 levels, governments have started implementing different sets of measures.