Ideal Tips About Define The Term Trial Balance

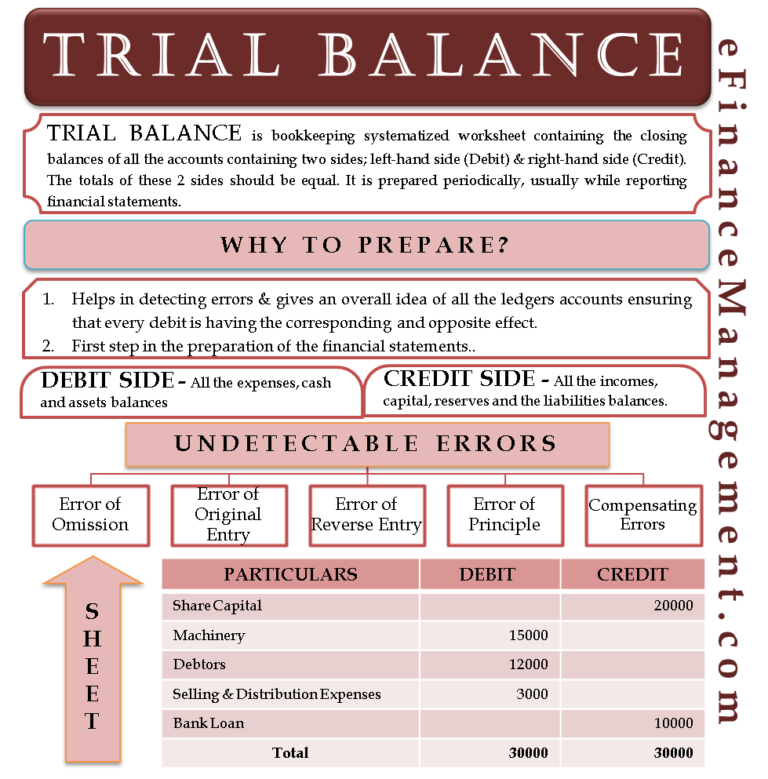

A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a business as at a specific date.

Define the term trial balance. A business will prepare trial balances on a periodic basis. A company prepares a trial balance. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

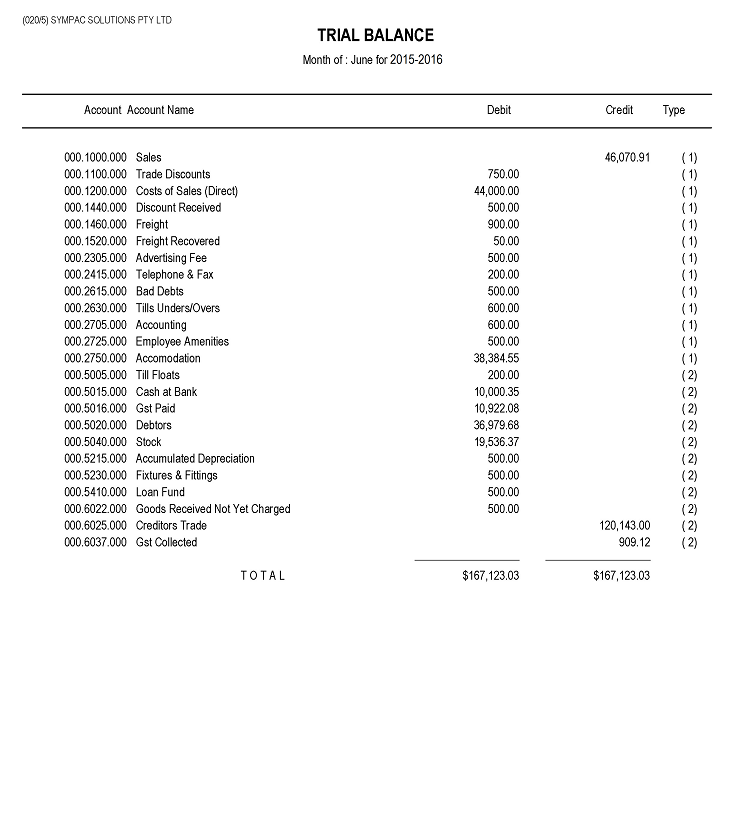

A trial balance is a list of all accounts in the general ledger that have nonzero balances. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Trial balance is prepared at the end of a year and is used to prepare financial statements like profit and loss account or balance sheet.

This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. 5 limitations of trial balance. This statement comprises two columns:

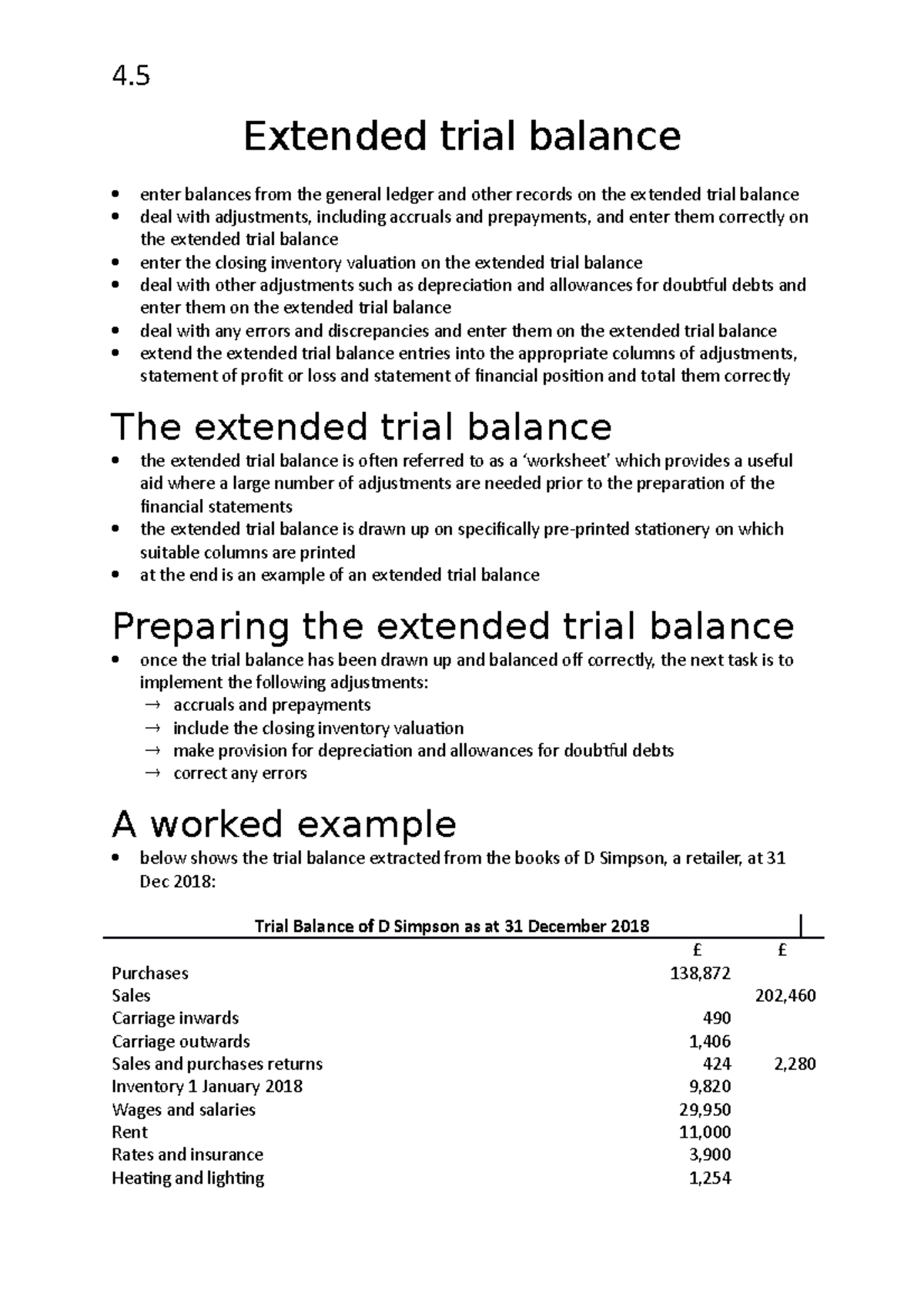

6.5 posting an amount twice in an account. Three different types of trial balance are: Trial balance definition a listing of the accounts in the general ledger along with each account's balance in the appropriate debit or credit column.

Trial balance is a statement summarizing the closing balance of all the ledger accounts, prepared with the view to verify the arithmetical accuracy of ledger posting. (often the accounts with zero balances will not be listed.) the debit balance amounts are. The inventory directory shows what is actually in your company, in addition to the results of your bookkeeping.

Definition of a trial balance a trial balance is a bookkeeping or accounting report that lists the balances in each of an organization's general ledger accounts. 6.2 posting to the wrong side of an account. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

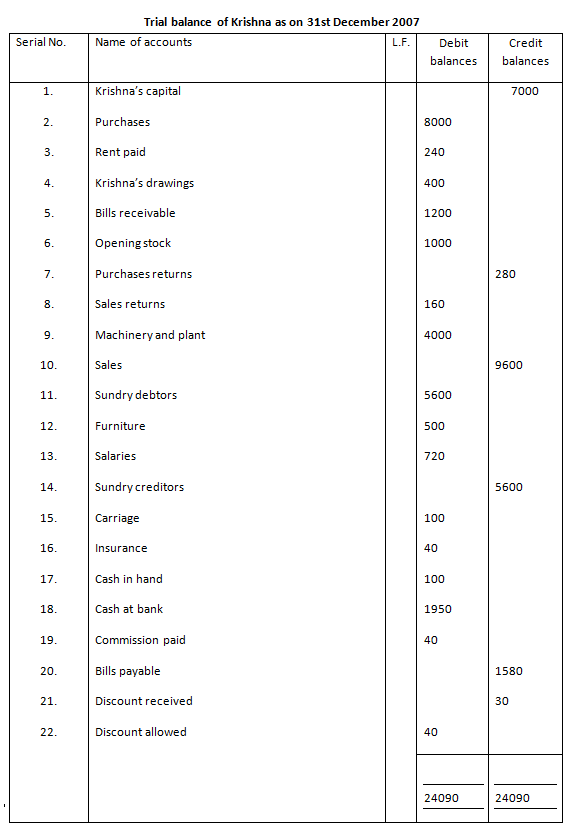

Creating a trial balance is the first step in closing the books at the end of an accounting period. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Example of a trial balance document

Some small businesses less efficiently use google sheets or excel worksheets or templates for preparing their trial balance documents. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. All the ledger accounts (from your chart of accounts) are listed on the left side of the report.

This list will contain the name of each nominal ledger account in the order of liquidity and the value of that nominal ledger balance. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. A trial balance is a statement that keeps a record of the final ledger balance of all accounts in a business.

A glance at the trial balance reveals scarcely a trace of expense, the small undistributed balances only remaining. Accounting software and erp systems often generate trial balance reports. Cyclopedia of commerce, accountancy, business.

:max_bytes(150000):strip_icc()/trial-balance-4187629-1-c243cdac3d7a42979562d59ddd39c77b.jpg)