Fantastic Info About Schedule L Balance Sheet Example

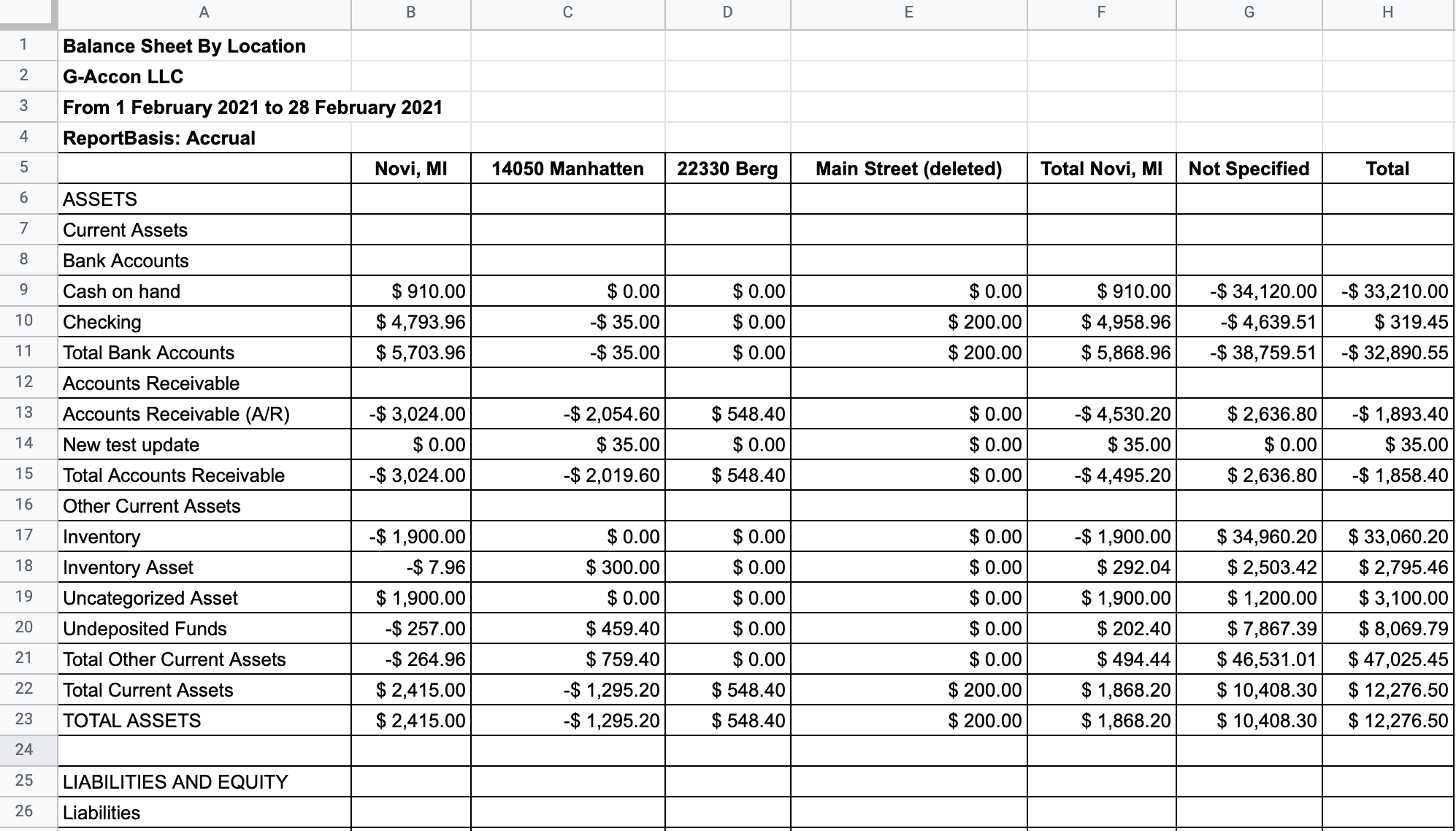

Supporting schedules are additional details about balance sheet entries that are made as supplements.

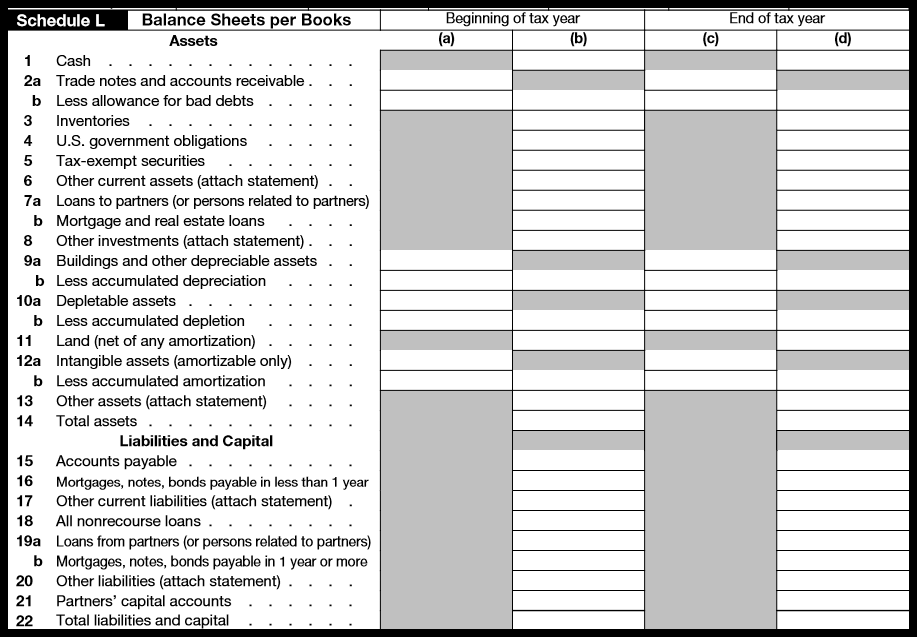

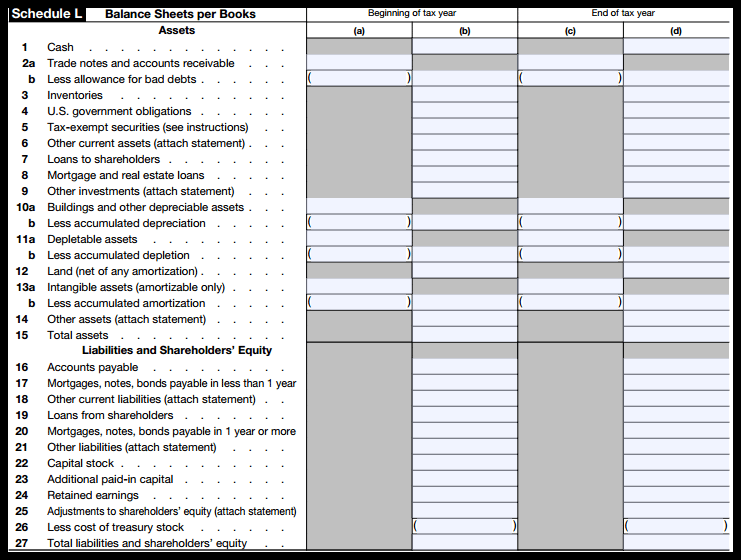

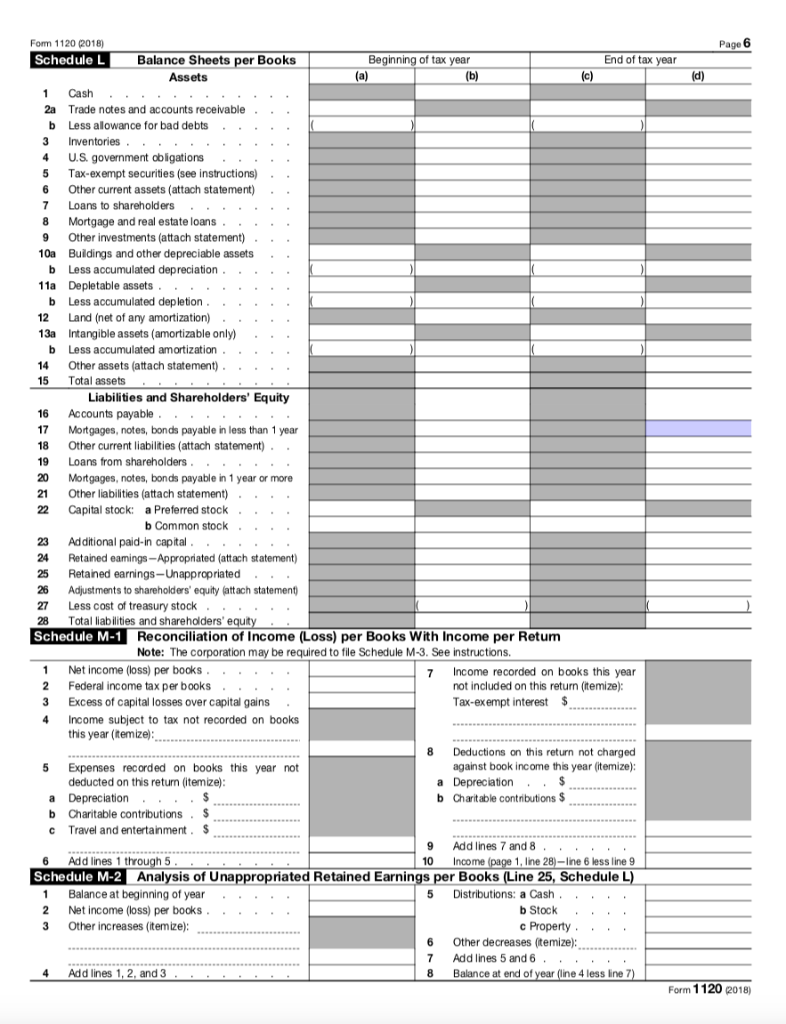

Schedule l balance sheet example. Schedule l balance sheets per books: Schedule l is only used by taxpayers who are. A form attached to form 1040 that is used to calculate the standard deduction for certain tax filers.

121 share save 16k views 2 years ago irs forms & schedules for additional form 1120 tutorials, check here: Schedule l, labeled “balance sheets per books,” takes up the rest of page 5 in form 1065.

An 1120s is a corporate income tax return and the schedule l is a balance sheet for the corporation. There are situations when the books are. What is reported on schedule l balance sheets per books?

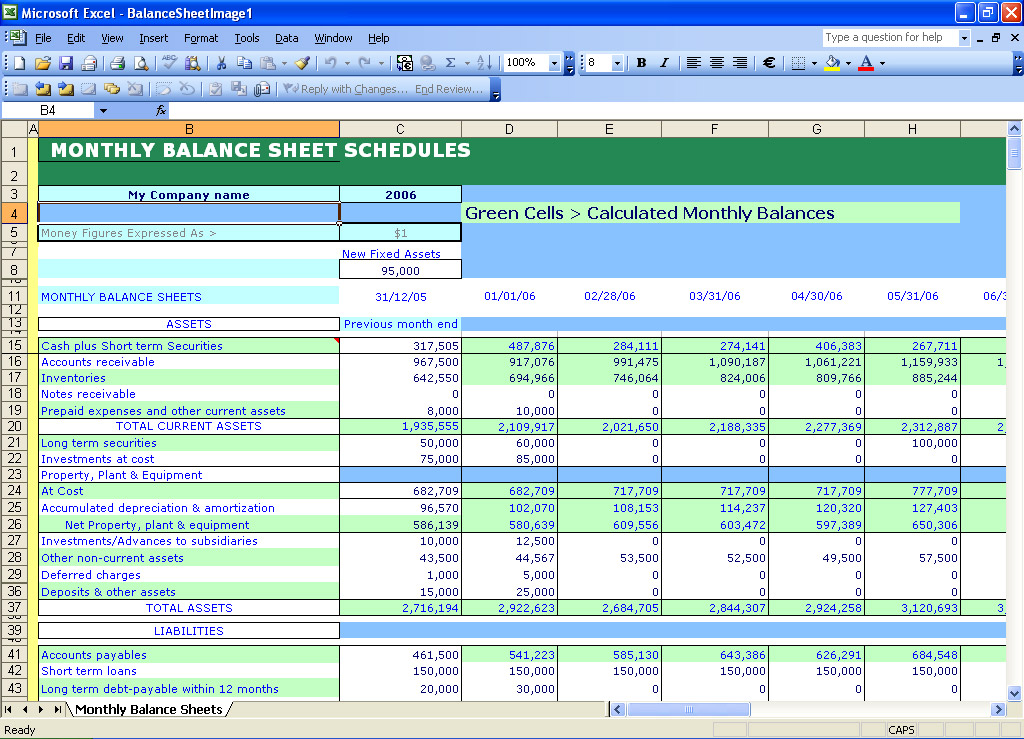

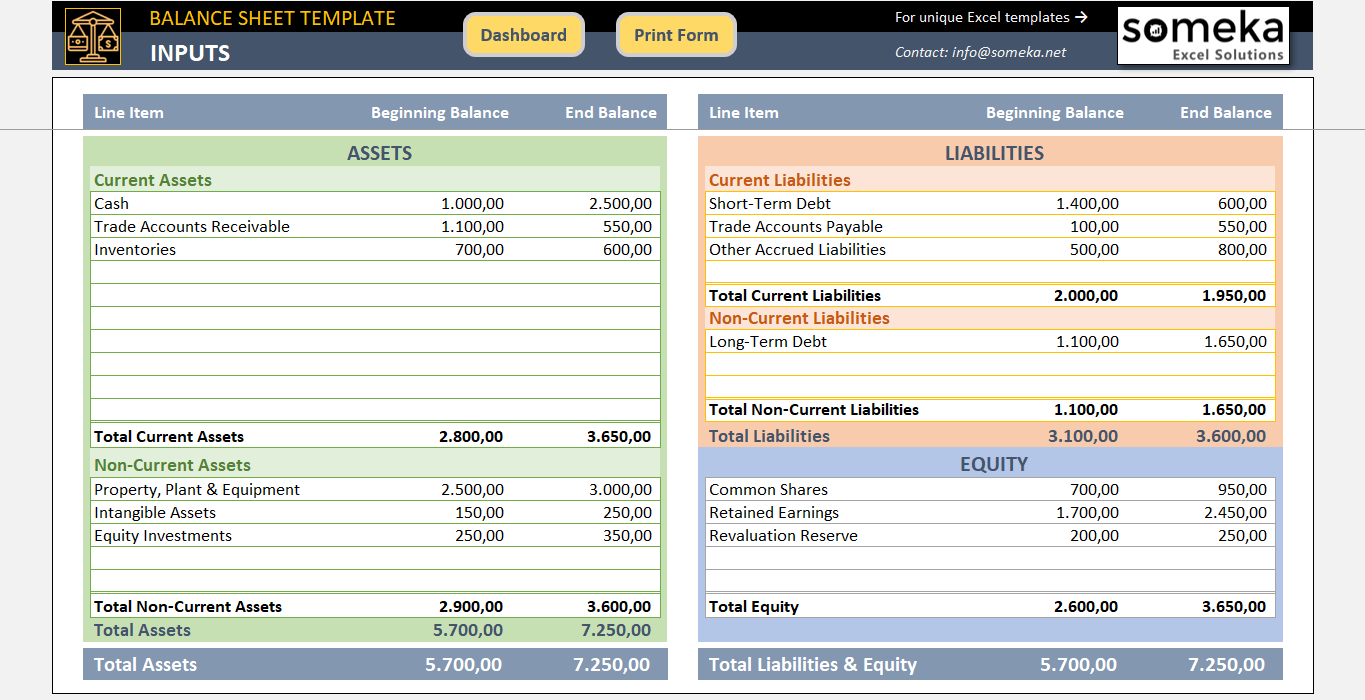

They help break down general categories of assets and liabilities into more. If yes then proceed to step 2. If you entered book depreciation for assets under depreciation, you can follow the steps below to have book depreciation flow to the schedule l, balance.

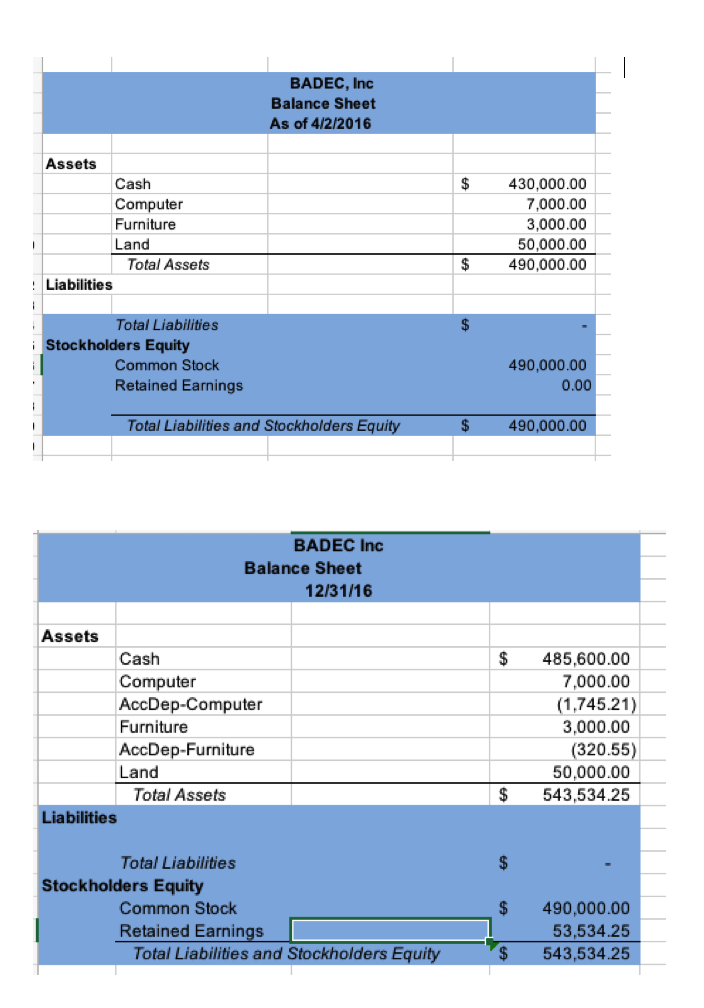

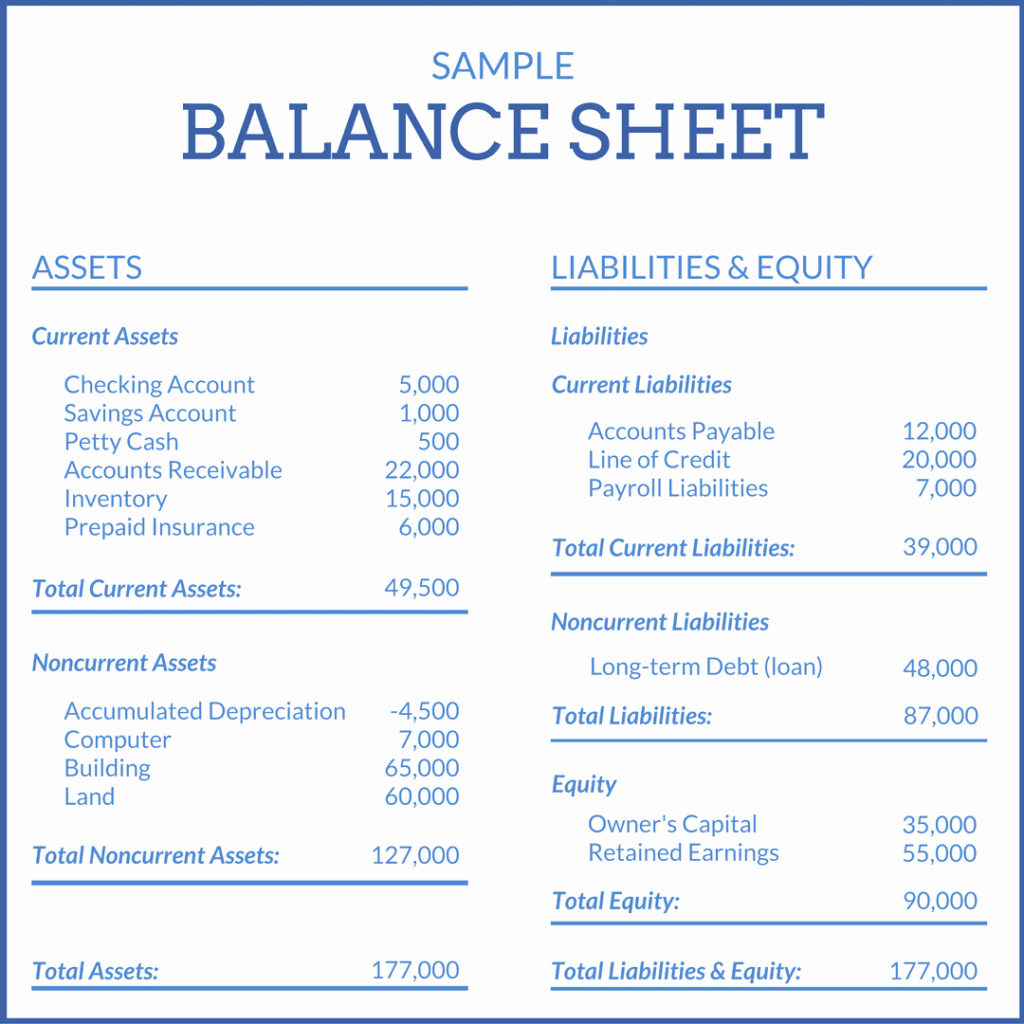

Continue with the interview questions until you reach the screen titled schedule l balance sheet. Near the end of the post, i briefly mentioned schedule l, the balance sheet. Below is an example of amazon’s 2017 balance sheet taken from cfi’s amazon case study course.

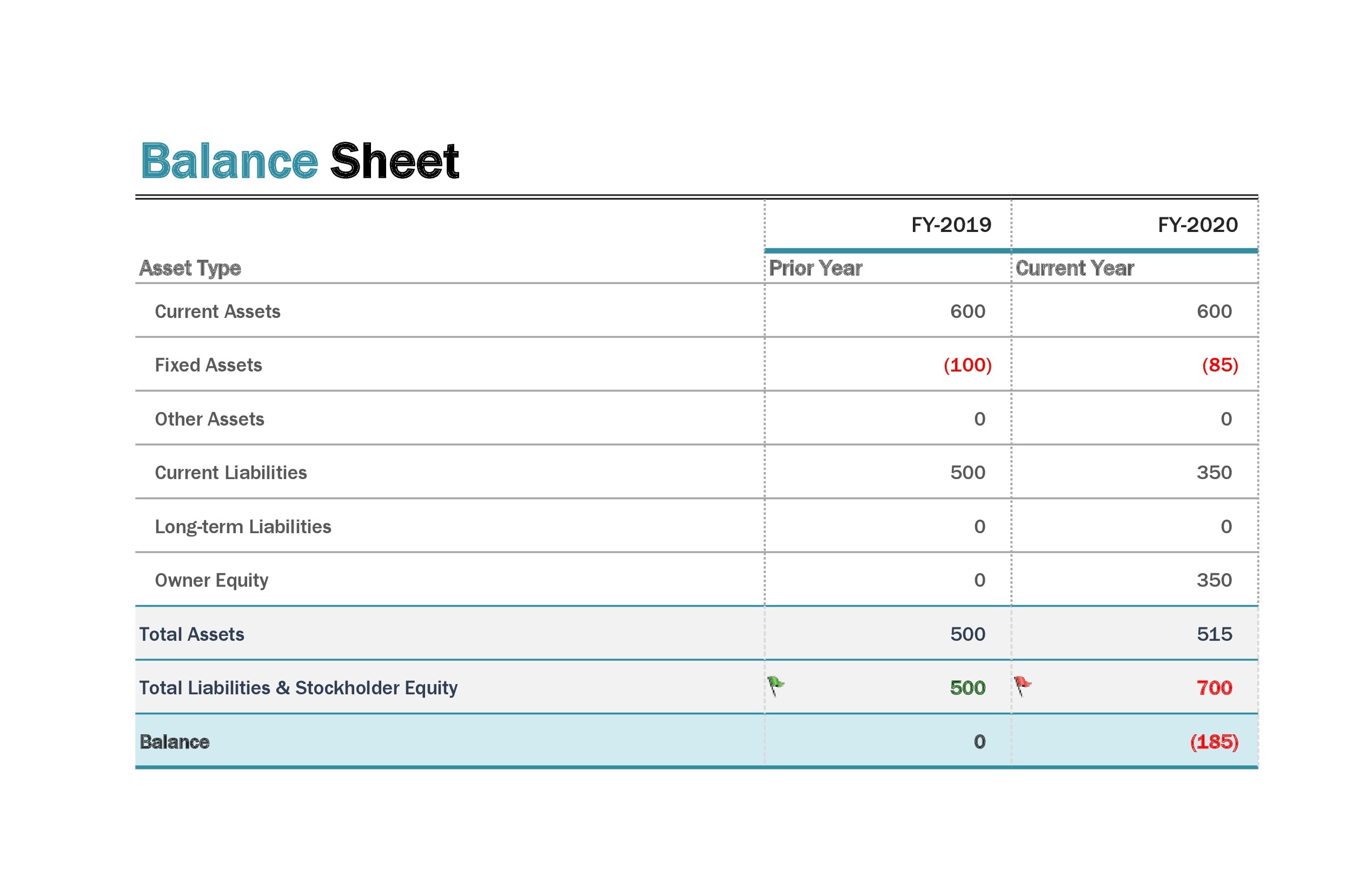

By danielle smyth published on 13 dec 2019 form 1065 is a federal income tax form used to report revenue and expenses from the operation of a partnership. If not then check the trial balance software balance sheet report (all. A comparative balance sheet lists assets, liabilities and equity over two years.

Here's an excerpt from that section. This article will provide tips and common areas to review when the. Does the ending total assets on schedule l match the client’s balance sheet?

Return of partnership income where the partnership reports to the irs their balance. Loans to partners (or persons related to. The schedule l should be prepared on the accounting basis the business entity uses for its books and records.

The balance sheet will state the corporation’s assets such as cash, land,. Schedule l balance sheet is out of balance on form 1065, 1120s, 1120 or 990 in proseries. It's really hard to know if you are filling it out.

Balance sheet per book lists all of your s corporation assets, liabilities, and shareholder’s equity at the beginning of the year and. This entry includes all cash and cash equivalent.