Brilliant Strategies Of Info About Discontinued Operations Should Be Shown In The Income Statement

The disclosures may be, but need not be, shown on the face of the financial statements.

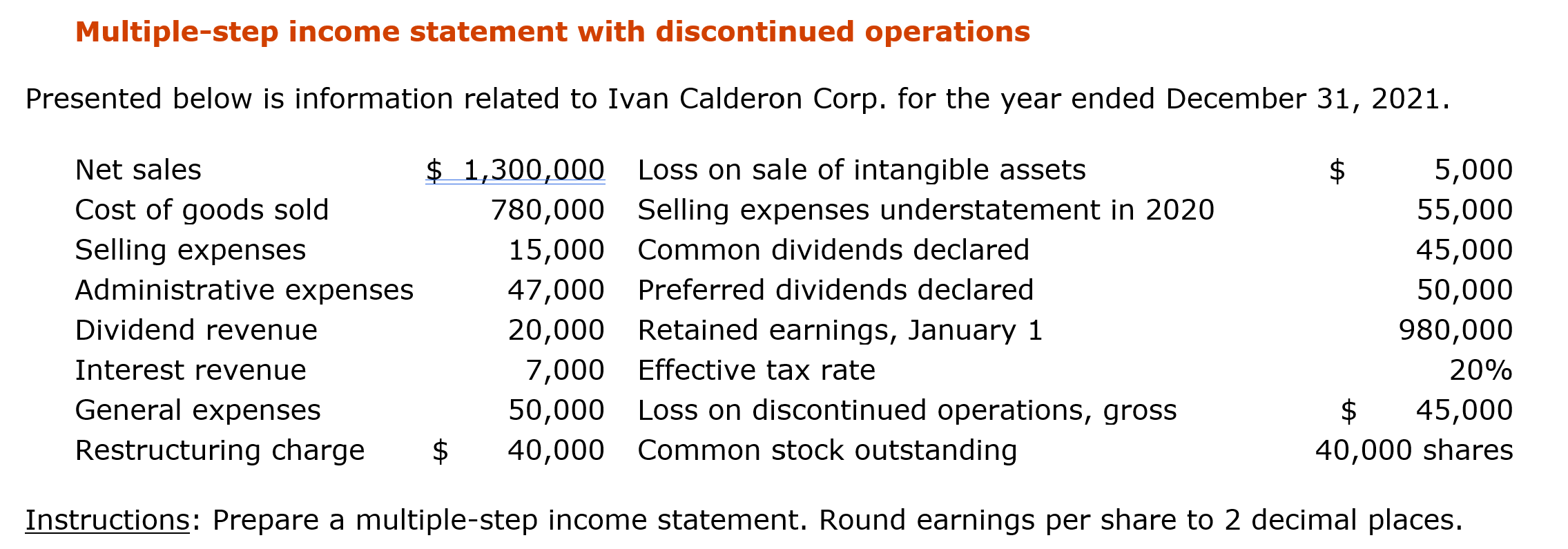

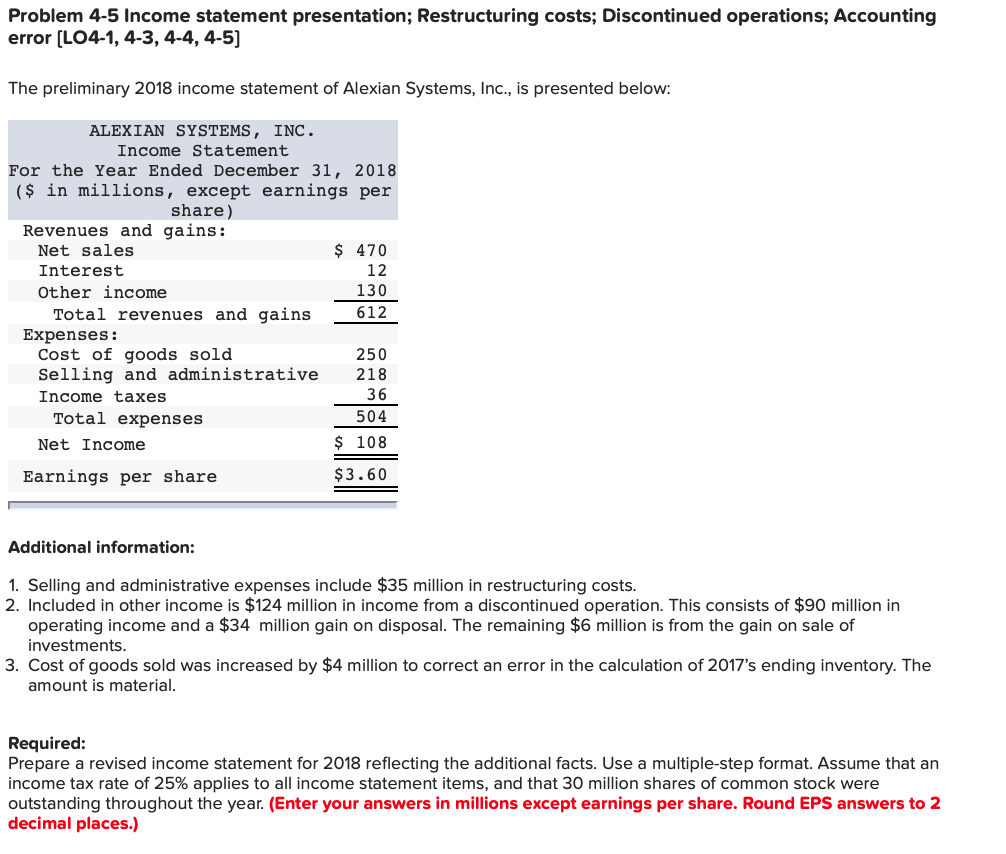

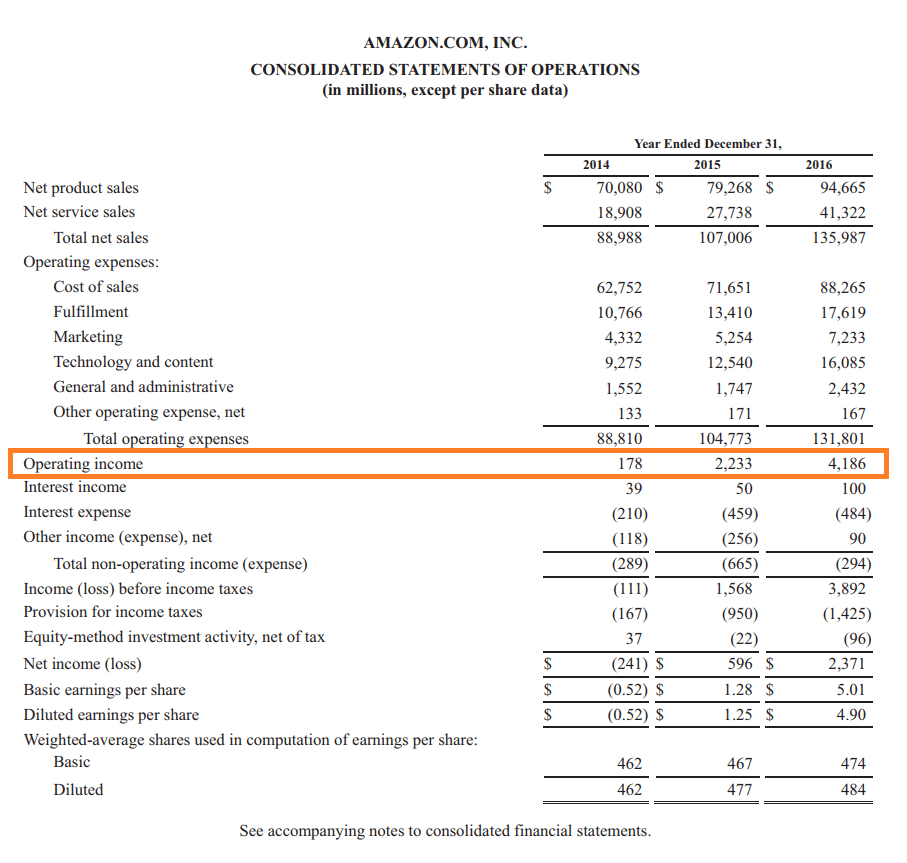

Discontinued operations should be shown in the income statement. The operation shall represent a separate major line of business or geographical area b. In general terms, assets (or disposal groups) held for sale are not depreciated, are measured at the lower of carrying amount and fair value less costs to sell, and are. Gaap guidebook examples of discontinued operations the following are examples of the accounting for discontinued operations:

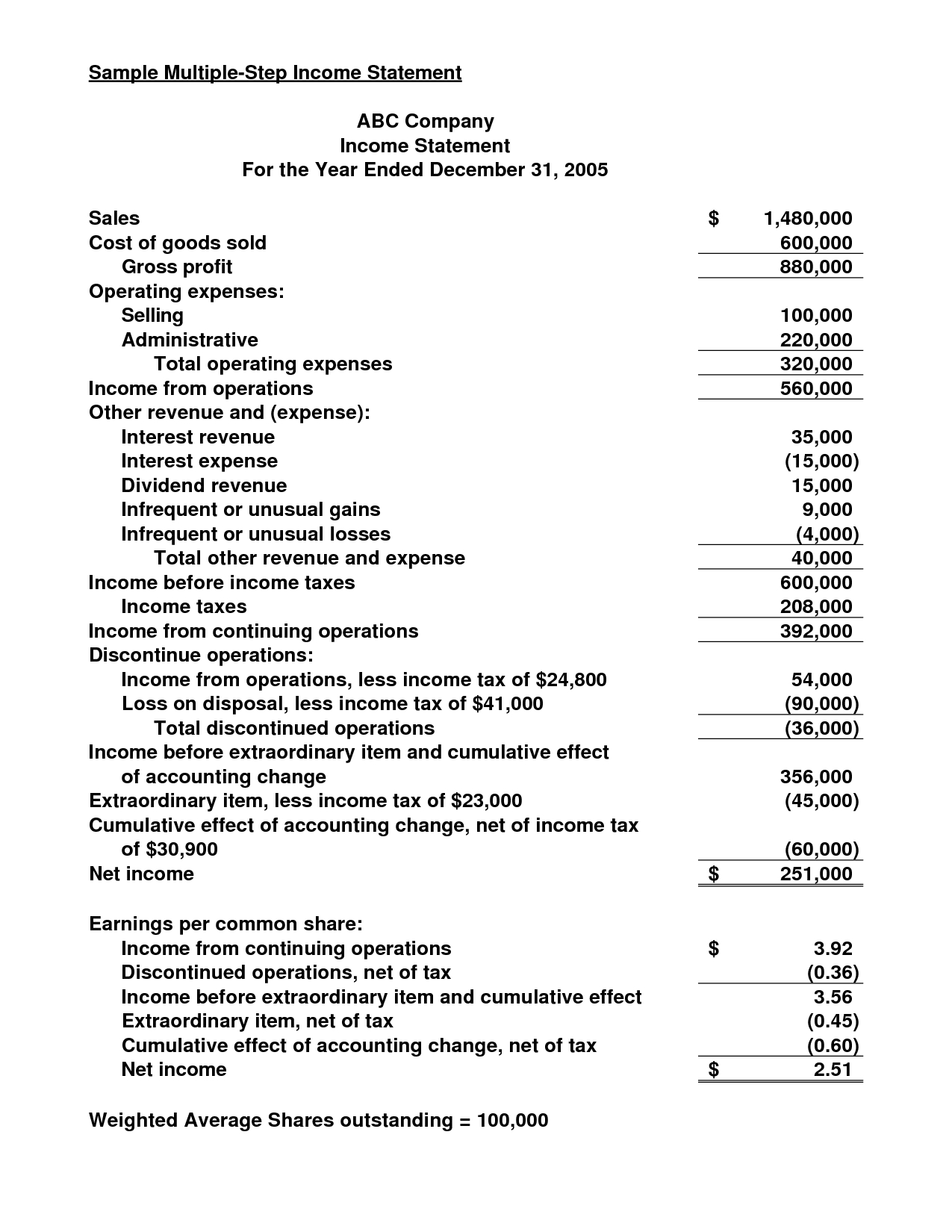

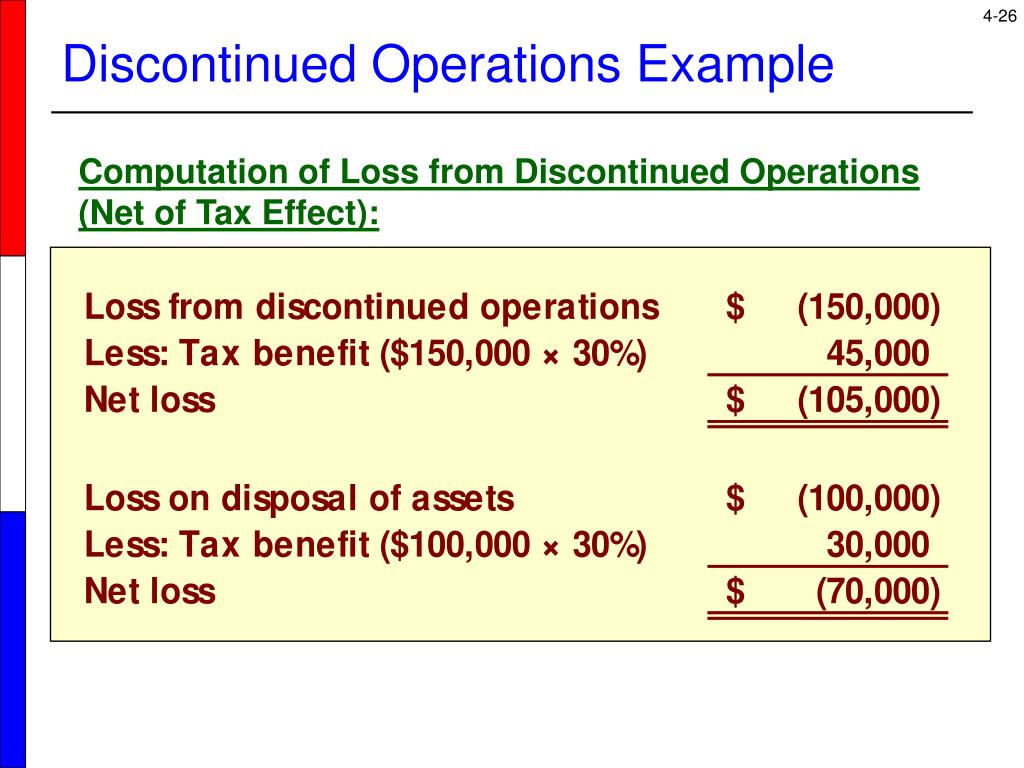

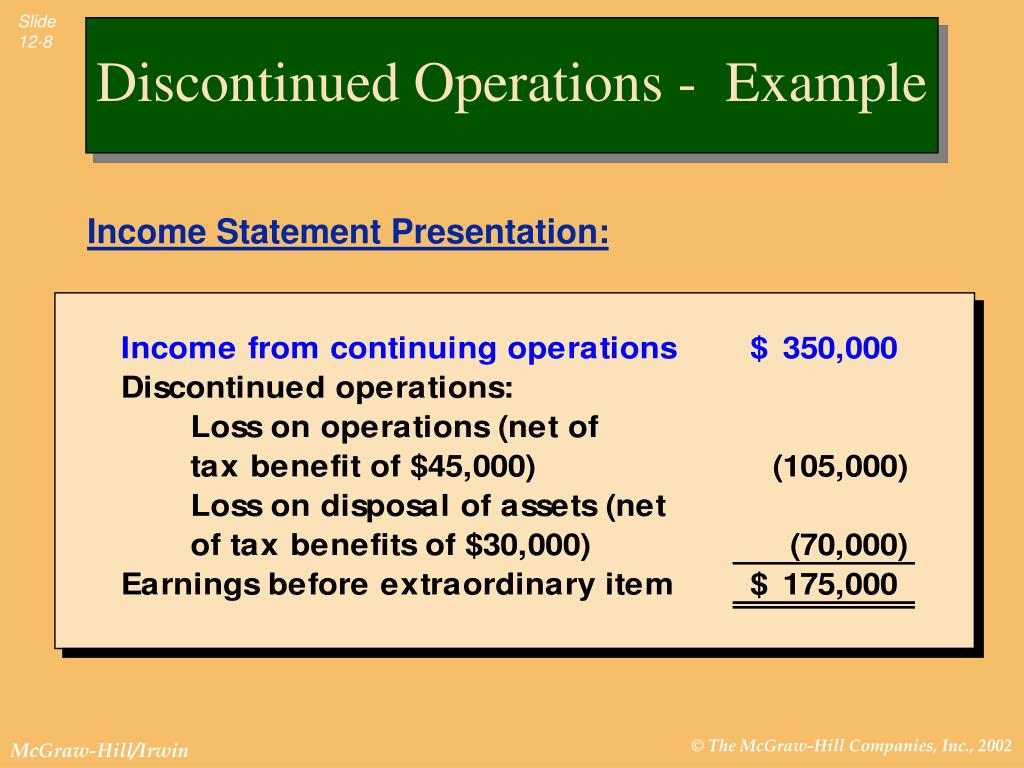

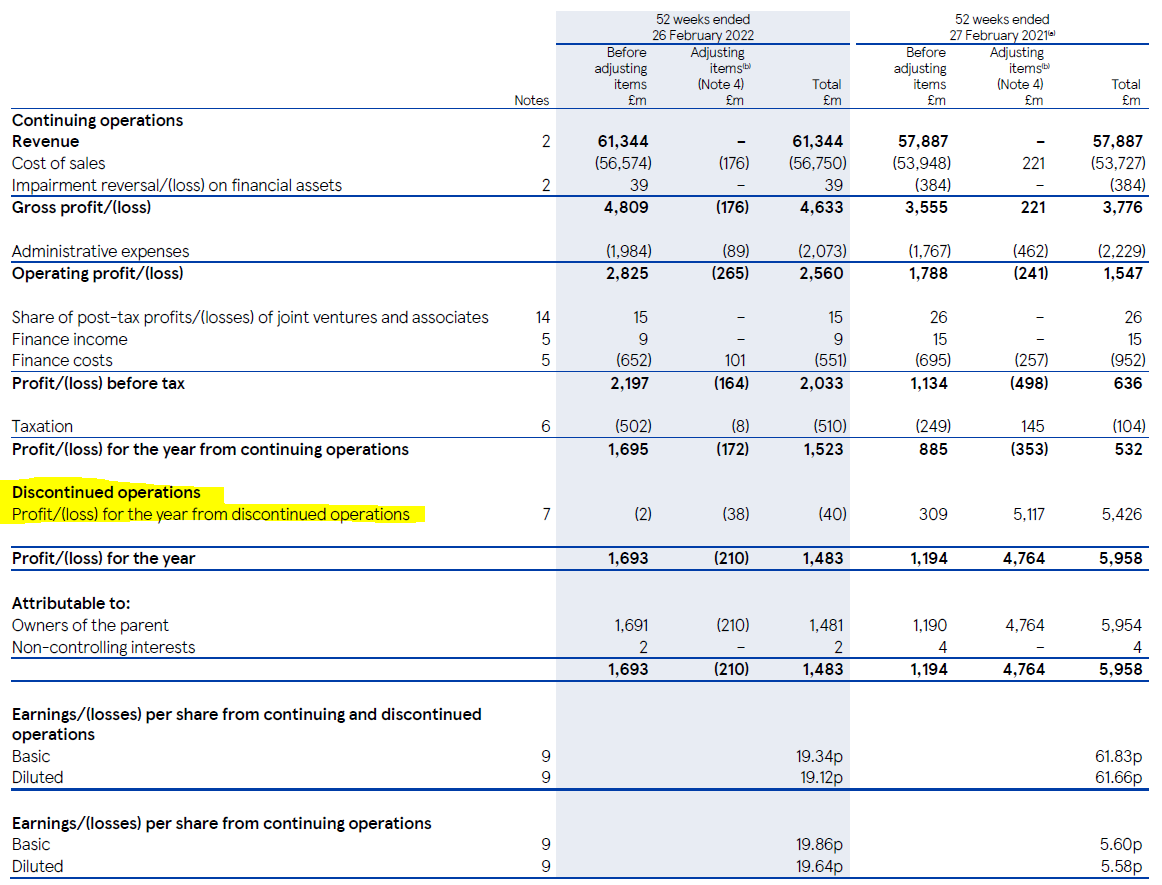

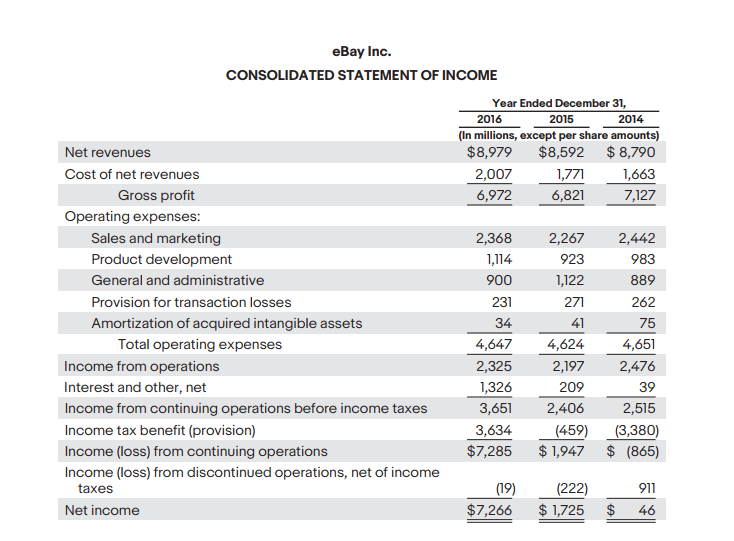

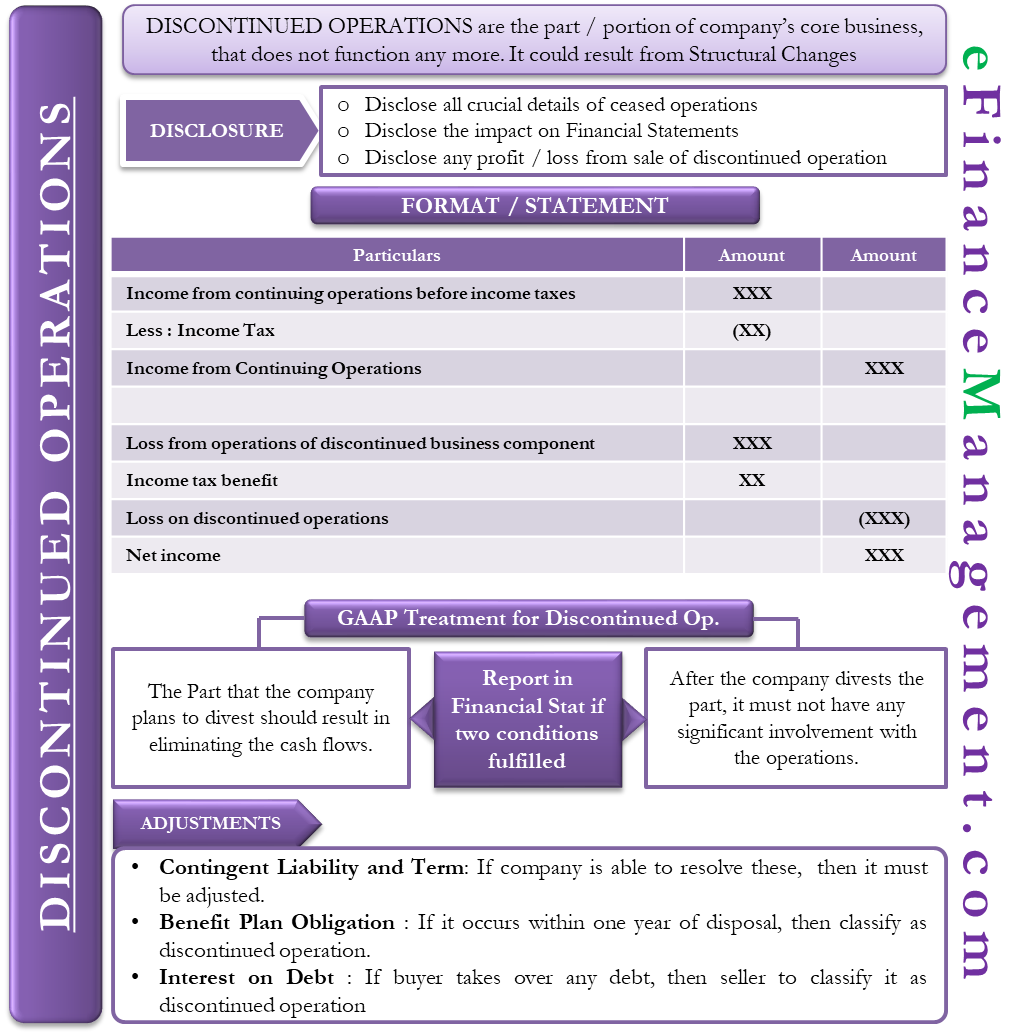

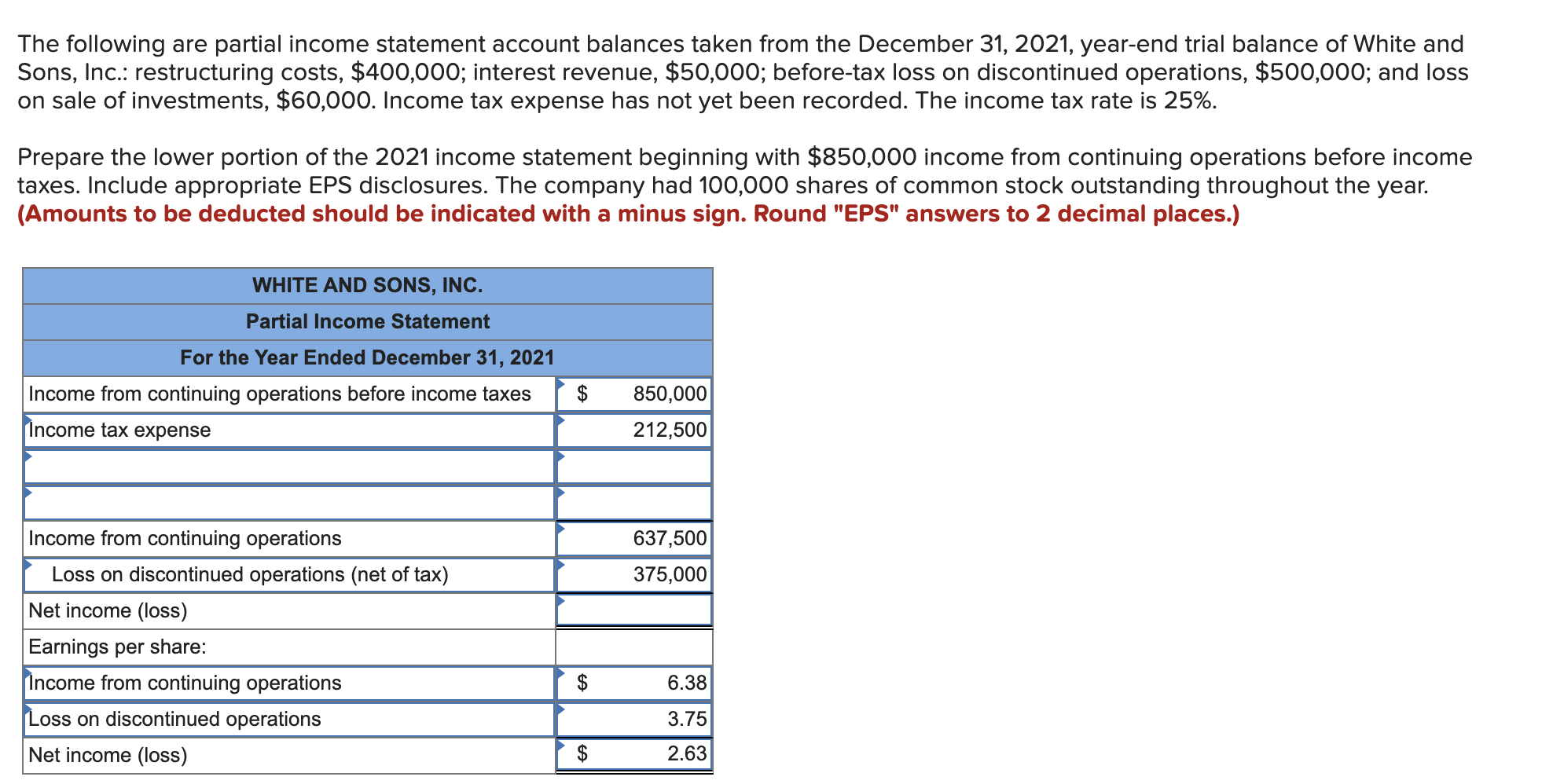

The revenues, expenses, gains or losses, and taxes associated with. Only the gain or loss on actual disposal of assets and settlement of. The net income or loss from the discontinued operations is entered in the income statement as a separate line item, typically labeled as “discontinued.

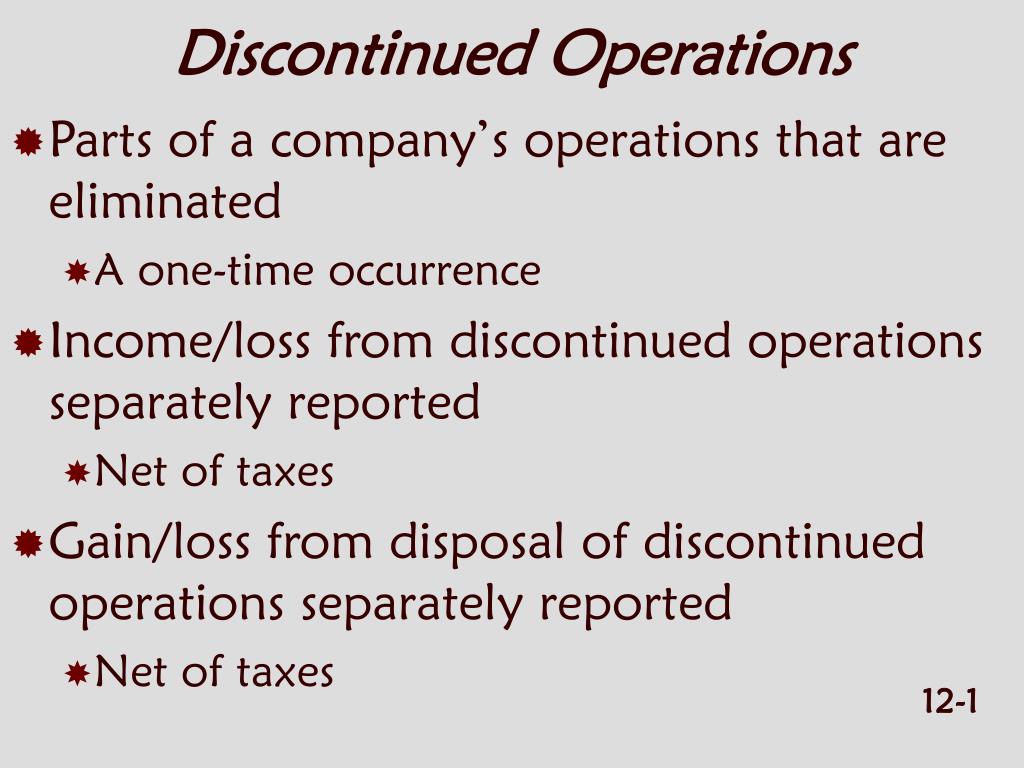

In the discontinued operations section the entity will: The term “discontinued operations” refers to the business divisions or assets of a company. The objective of the requirement is to provide.

The operation is part of a single plan to dispose of a separate major line of business or. Us gaap requires presentation of discontinued operations in financial statements in certain circumstances. Add the amounts you reported in the discontinued operations section to determine the net income or net loss from the discontinued component.

Instead of presenting income taxes parenthetically on the income statement, the entity may show the pretax income (loss) from discontinued operations and the income. The discontinued operations subtopic discusses the conditions under which either of the following would be reported in an entity’s financial statements as a. Discontinued operations are parts of a company’s business that have been sold or closed down.

Income statements from previous periods must be restated so that any operations classified as discontinued by the end of the current reporting period align with ifrs 5. Report on the net income or loss of the discontinued components, which is the difference between its revenue, cost of. What are discontinued operations in financial reporting?

Frs 102 also allows a subsidiary which was acquired exclusively with a view to resale to be shown as a discontinued operation.