Formidable Tips About Financial Statements Prepared Under Aspe Include A

Aspe is a set of accounting standards available for private companies in canada.

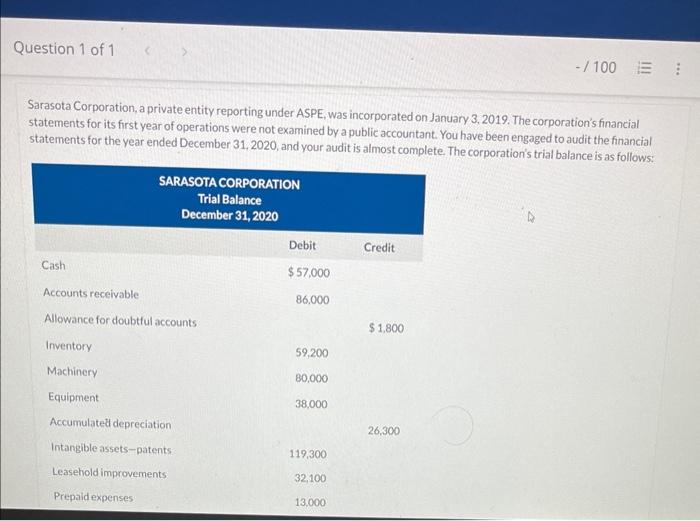

Financial statements prepared under aspe include a. Statement of cash flows and a. This checklist provides a complete listing of all of the presentation and disclosure requirements applicable for the preparation of annual financial statements prepared in. Accounting standards for private enterprises aspe update 2022 2 amendments to section 3462, employee future benefits in 2018, ontario’s pension regulator introduced a new.

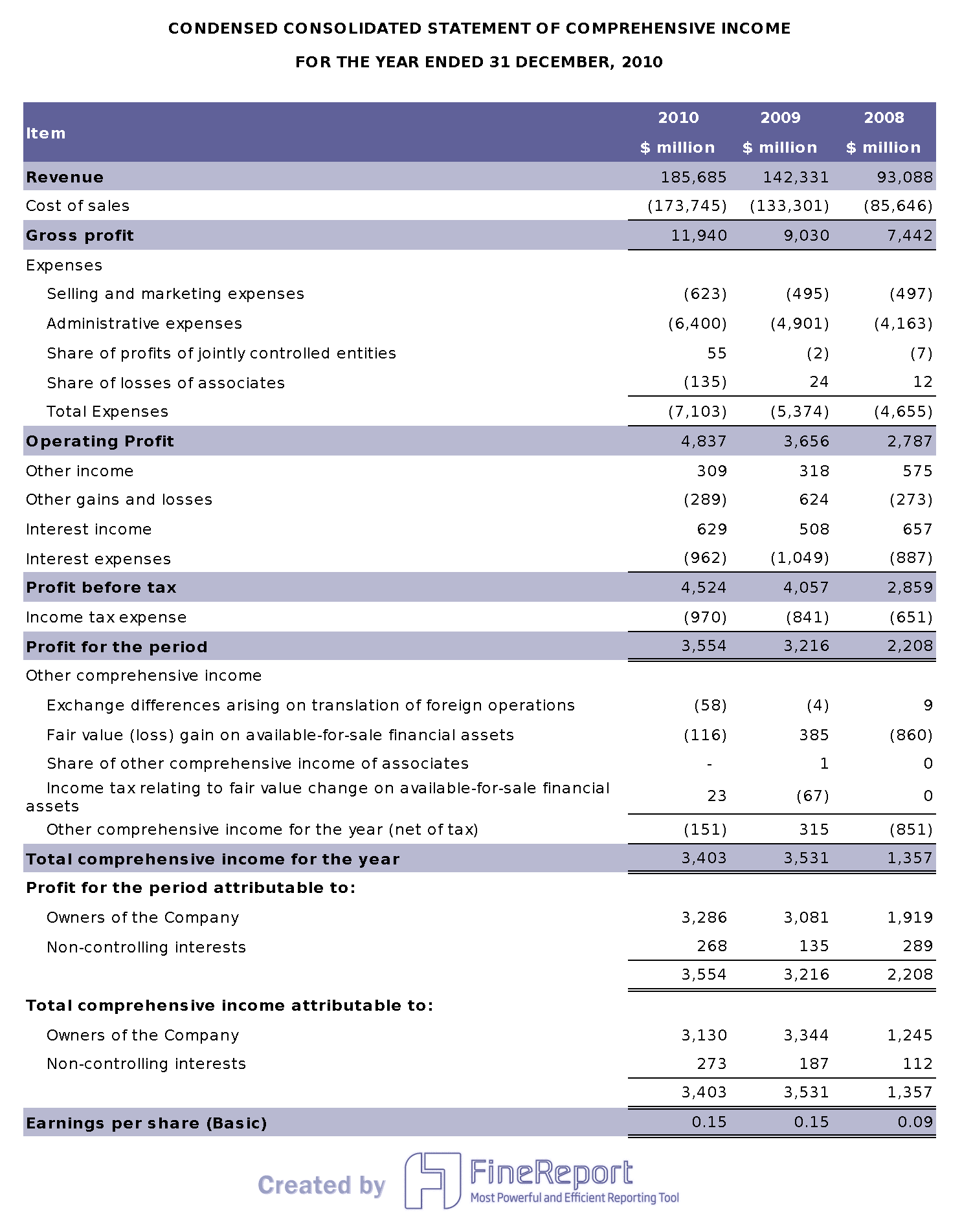

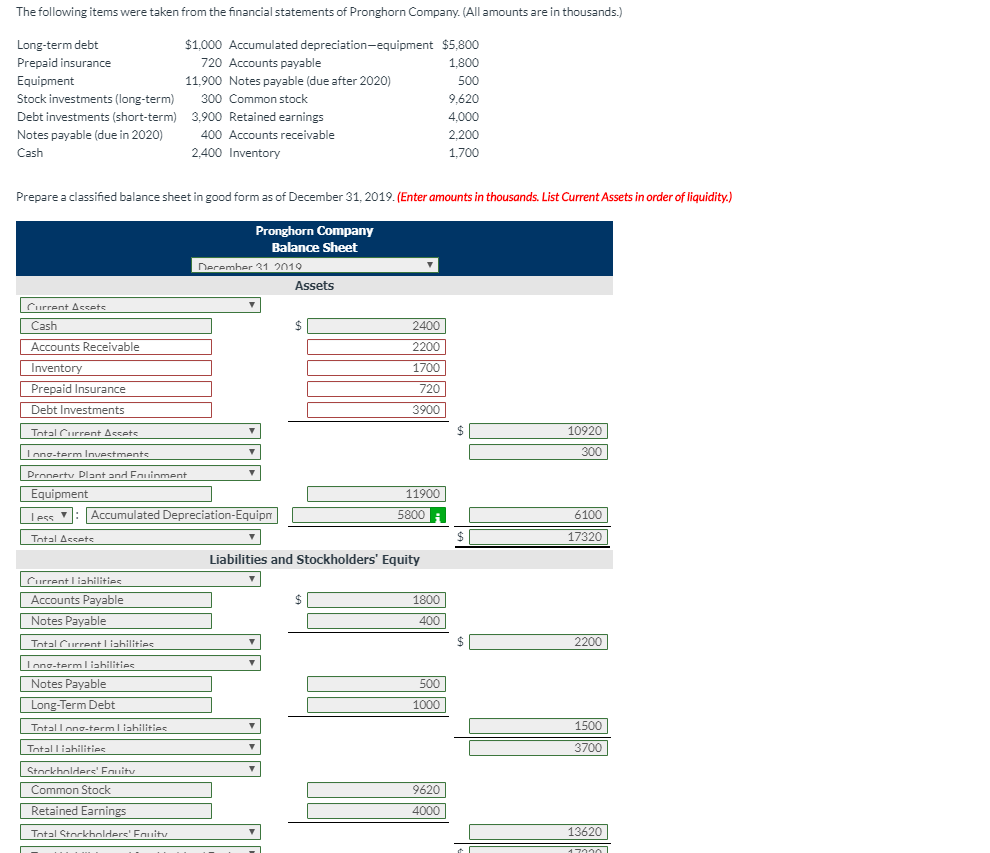

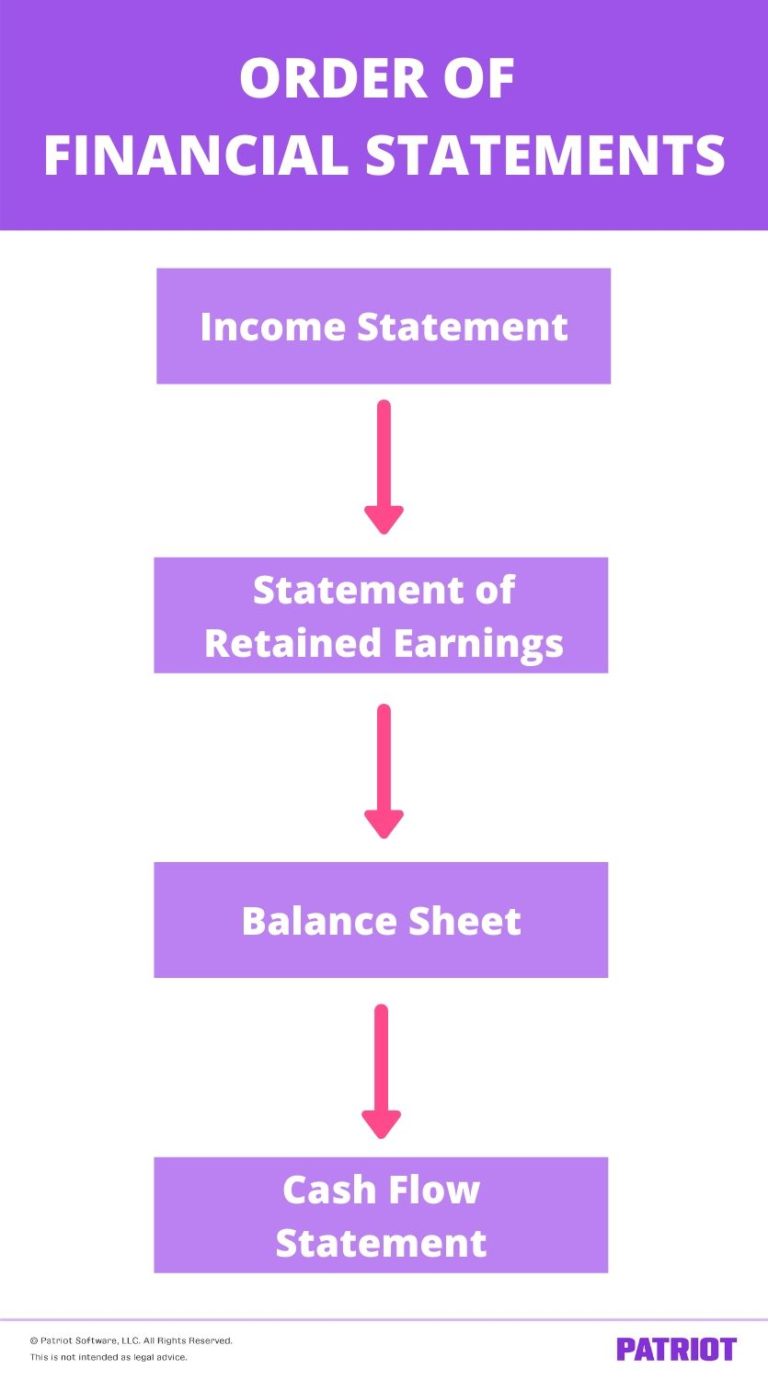

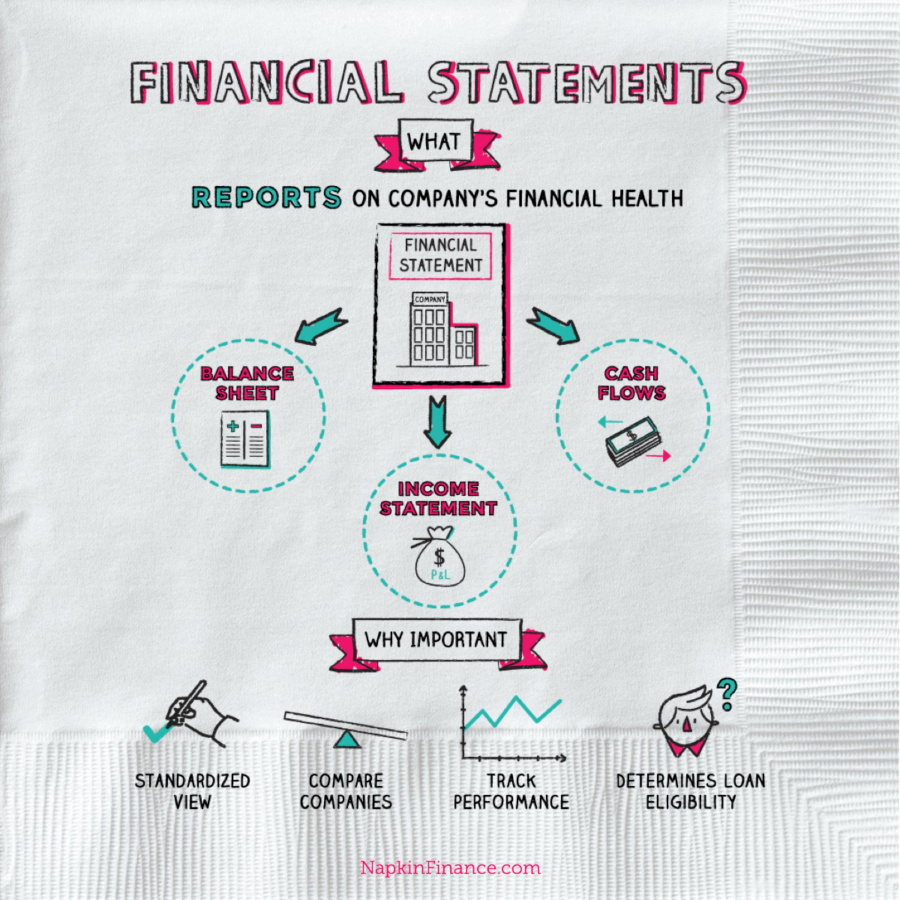

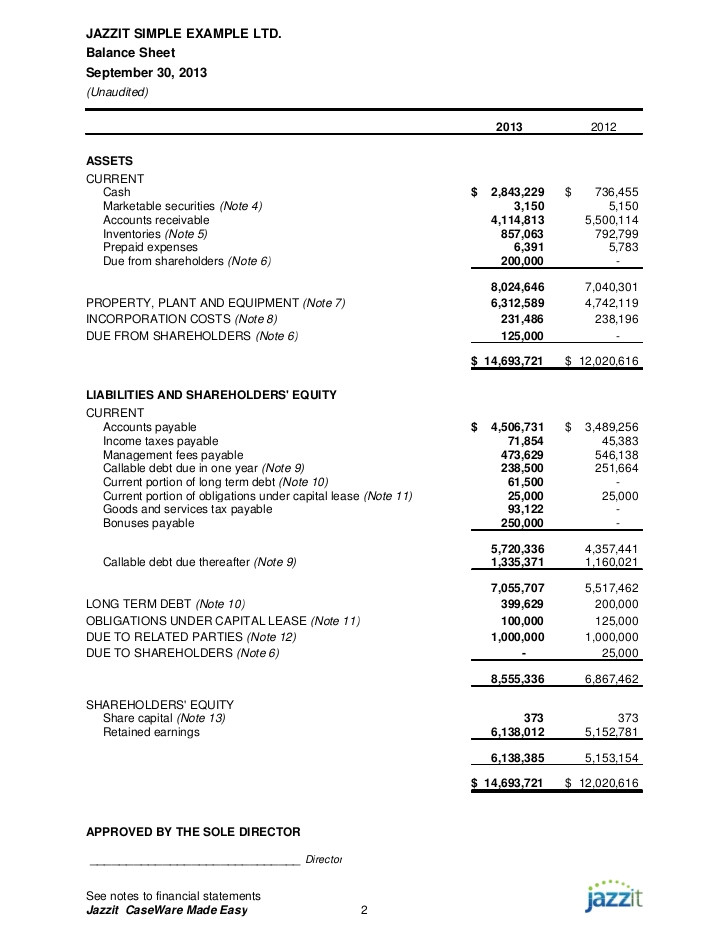

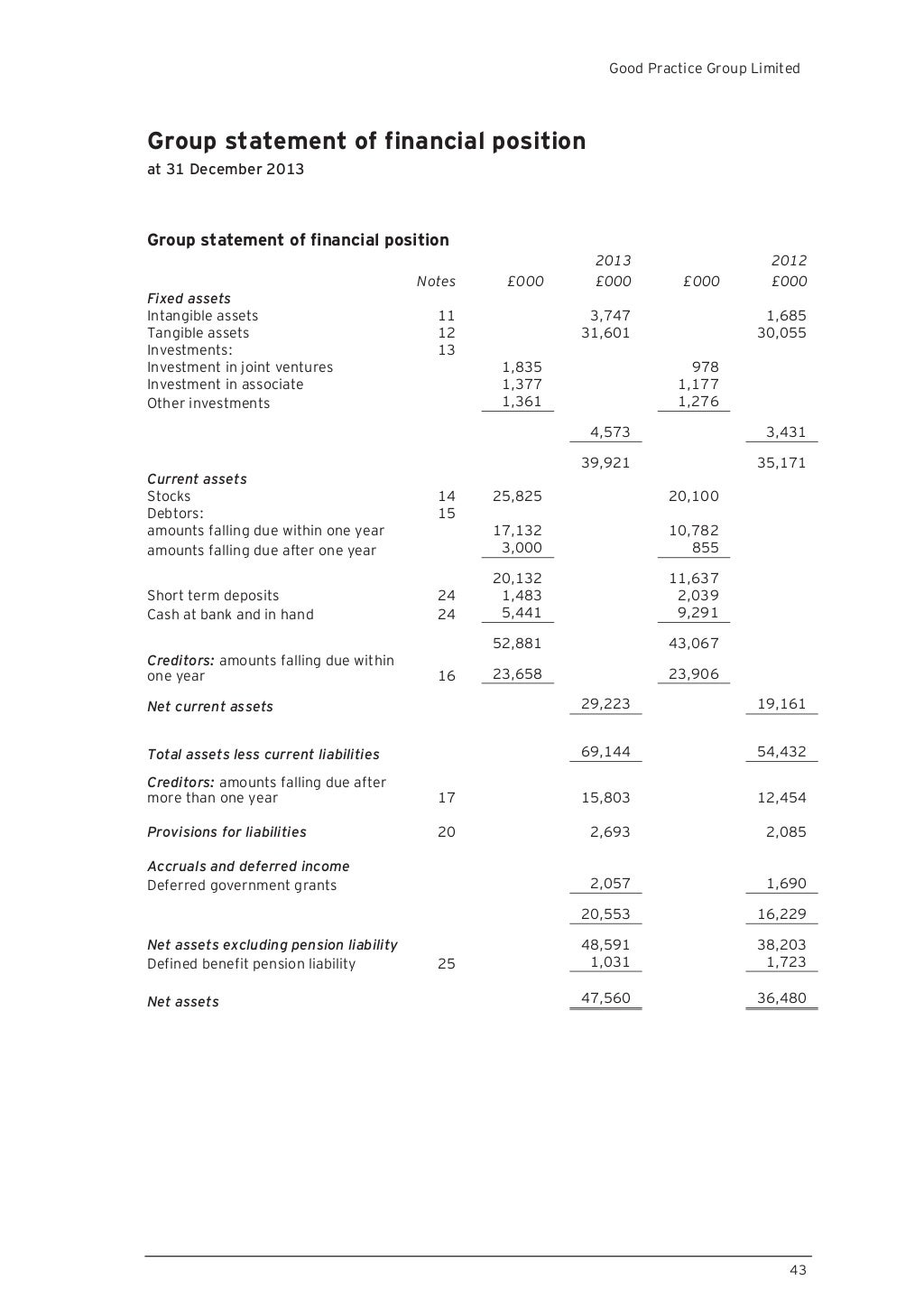

Financial statements prepared under aspe include a (1 mark) a) statement of comprehensive income and balance sheet. This checklist is intended to present the reporting requirements for annual financial statements of a. A complete set of financial statements include a statement of financial position, statement of comprehensive income (ifrs) and income statement (aspe), statement.

This cpa canada alert (alert) provides questions to. Does a private enterprise have to use aspe? It provides a comprehensive framework for preparing and presenting financial statements.

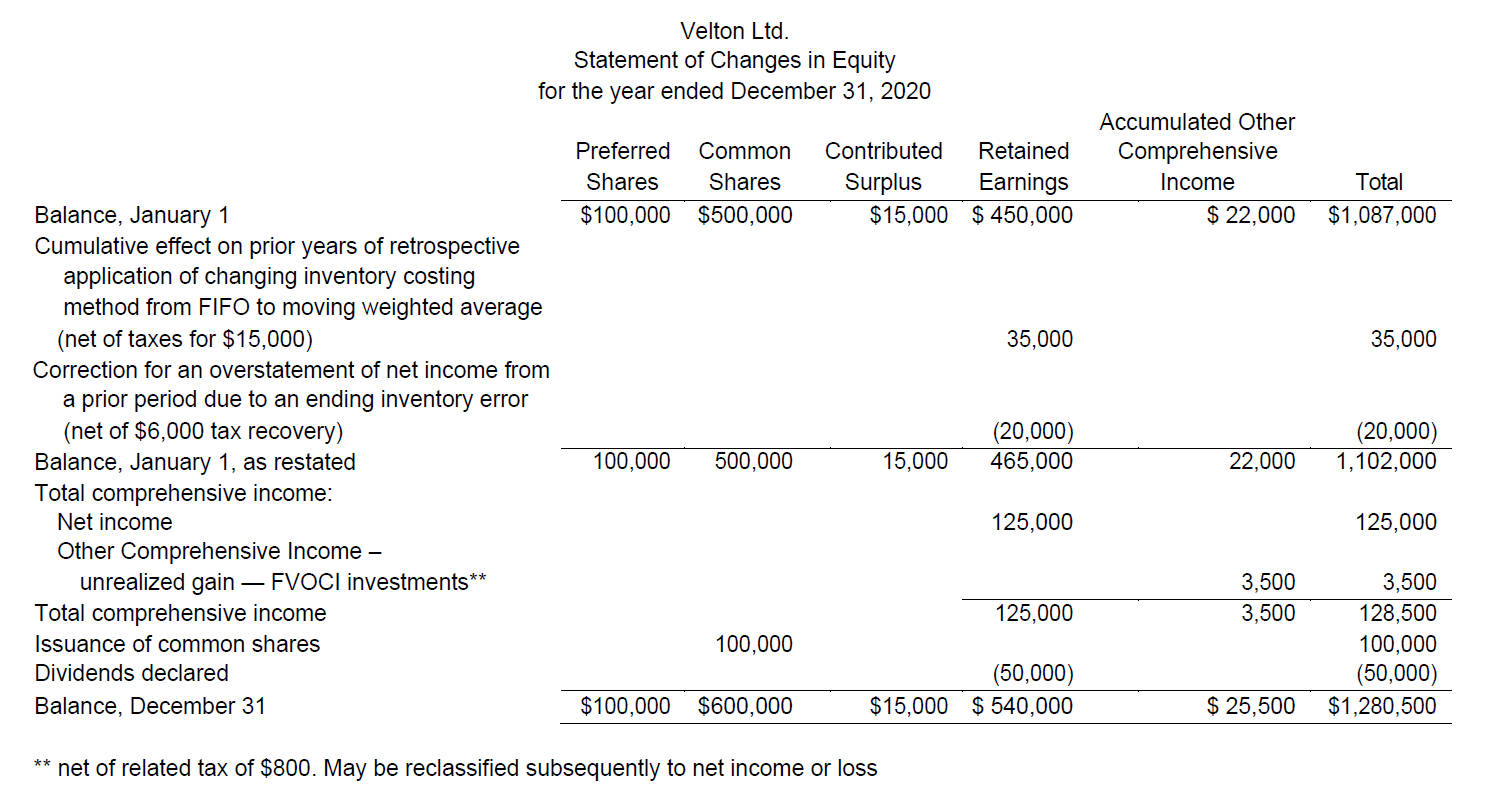

To help preparers of financial statements with canadian accounting standards for private enterprises (“aspe”) section 1506, accounting changes, we’ve summarized the key. The opening balance sheet and all subsequent periods contained in the first set of aspe financial statements are prepared in accordance with those aspe standards in effect. Financial statements prepared under aspe include a balance sheet and a statement of retained earnings.

Questions and considerations under aspe. Enterprises (“aspe”) can be a challenge. The opening balance sheet and all subsequent periods contained in the first set of aspe financial statements are prepared in accordance with those aspe standards in effect.

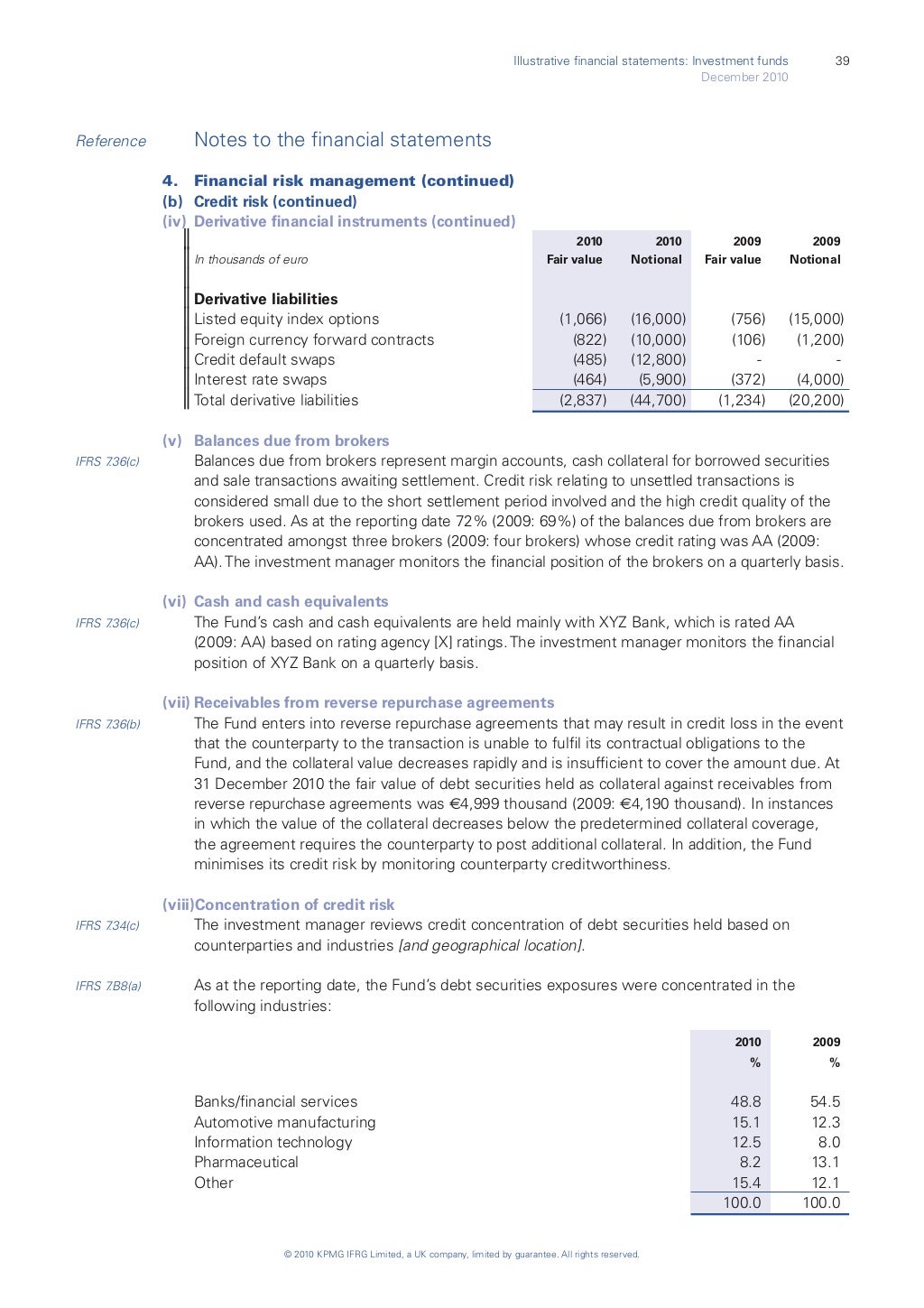

Under aspe the disclosure requirements related to subsidiaries and consolidated financial statements are included in the same standard as the rest of the guidance on these. If your entity operates in. B) statement of cash flows and a statement.

Accounting standards for private enterprises or aspe represent the accounting framework established by the accounting standards board (“acsb”) for. A private enterprise can choose to adopt either international financial reporting standards (ifrs or part i of the. Prior to accepting an engagement to audit or review the first statements prepared in accordance to aspe, practitioners should consider the following:

This checklist is intended to present the reporting requirements for annual financial statements of a. In this guide, we provide an overview of the recently introduced changes to aspe and how these changes might impact your. The checklist summarizes presentation and disclosure requirements in aspe in issue as of december.

2) balance sheet and a statement of retained earnings.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)