One Of The Best Tips About Financial Projections For Startup Example

As a startup, you have some extra considerations to apply to your financial projections.

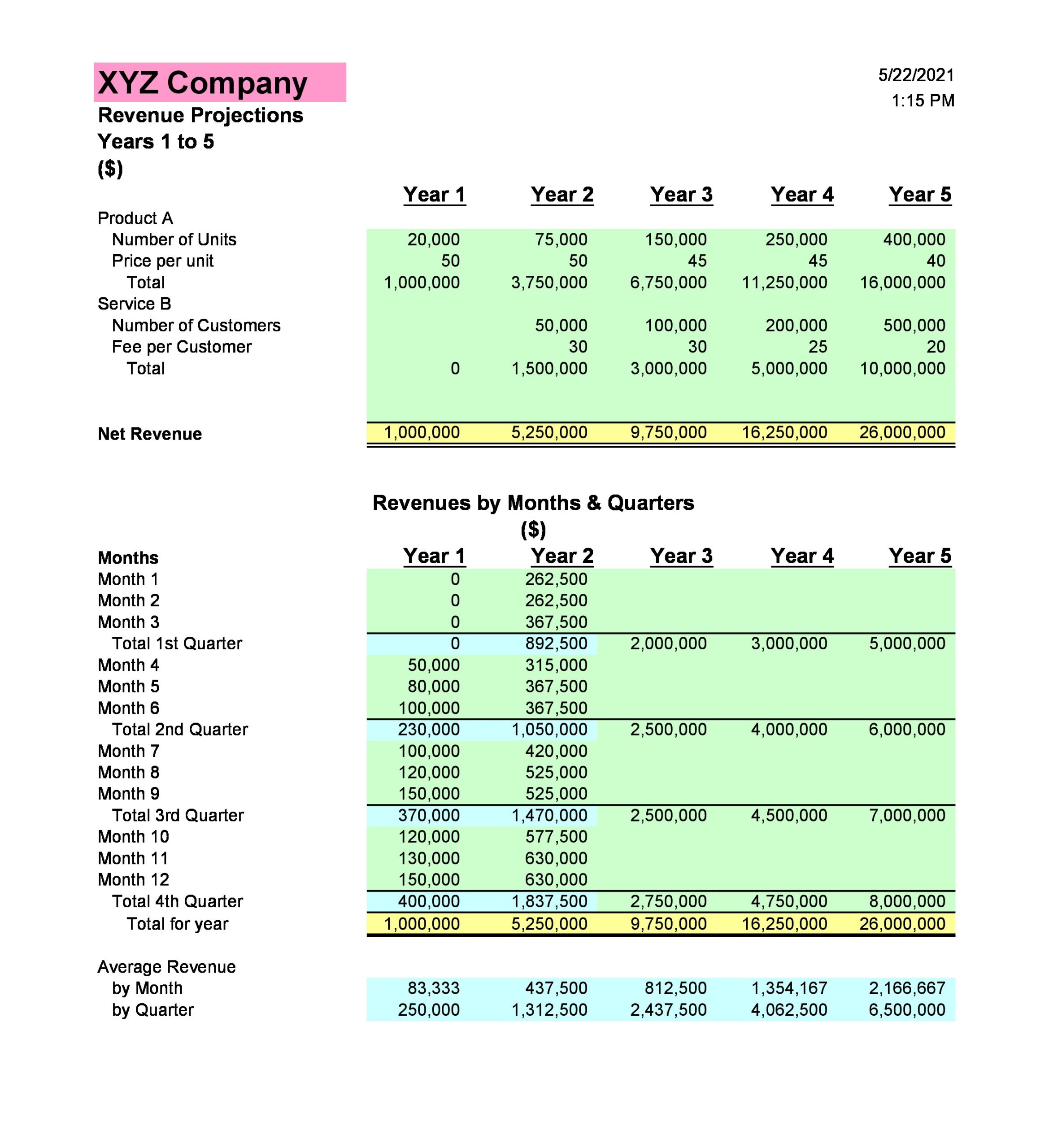

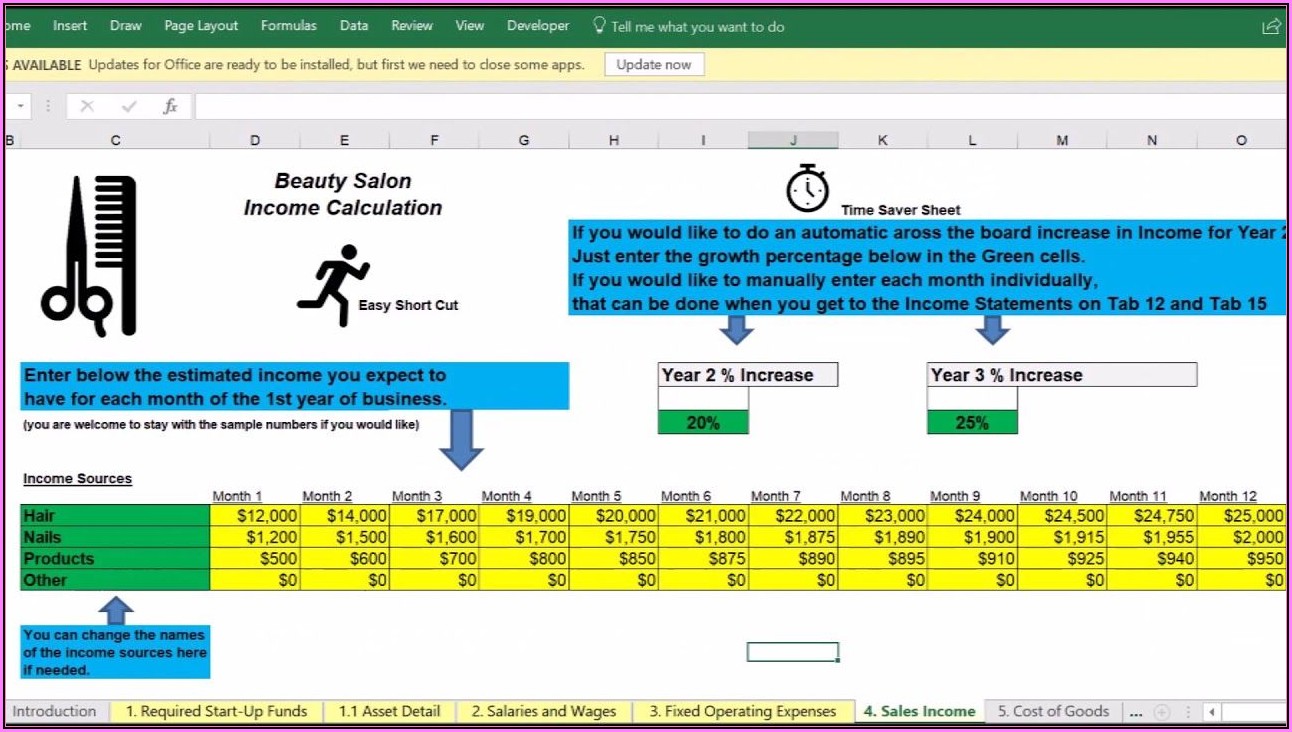

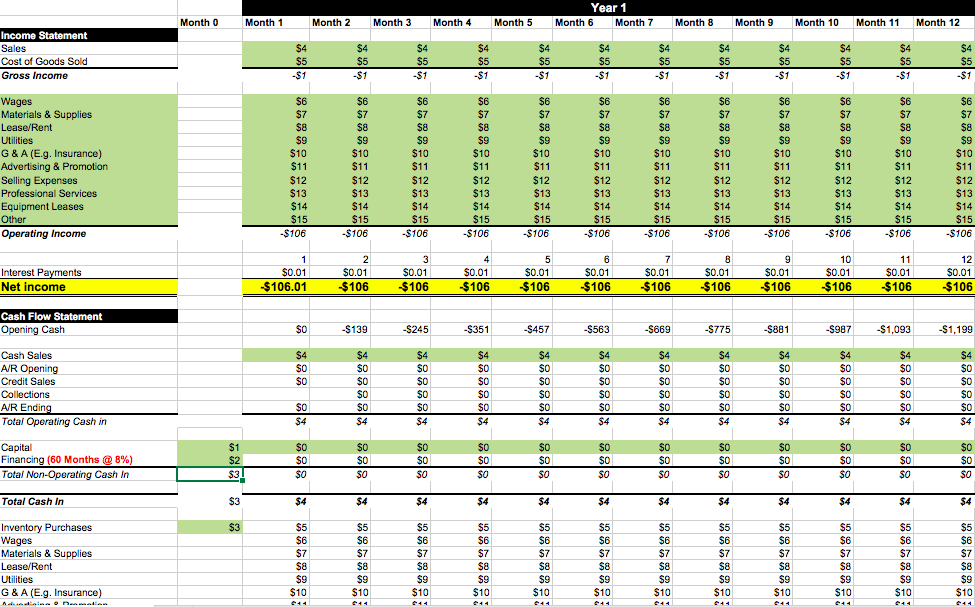

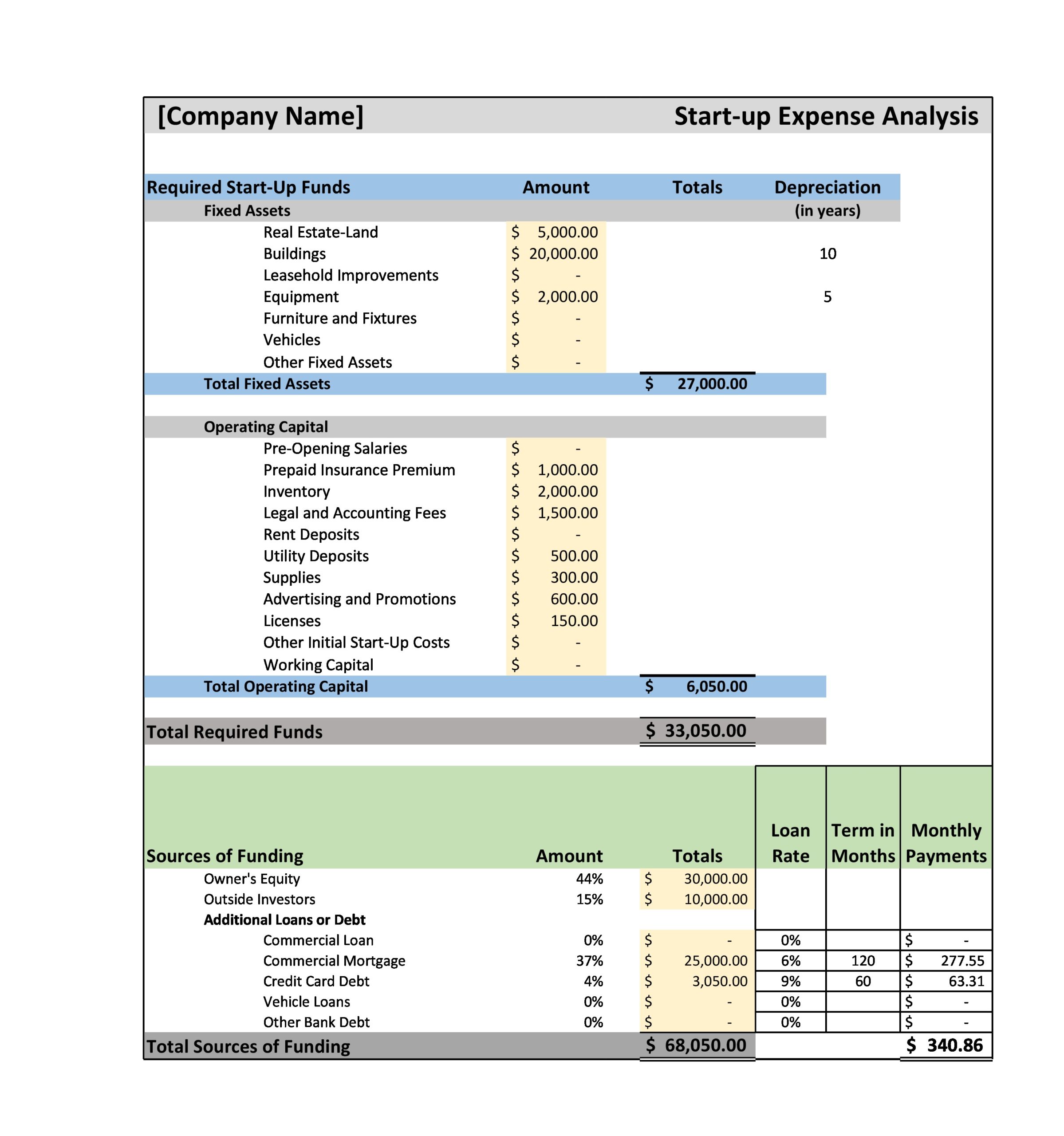

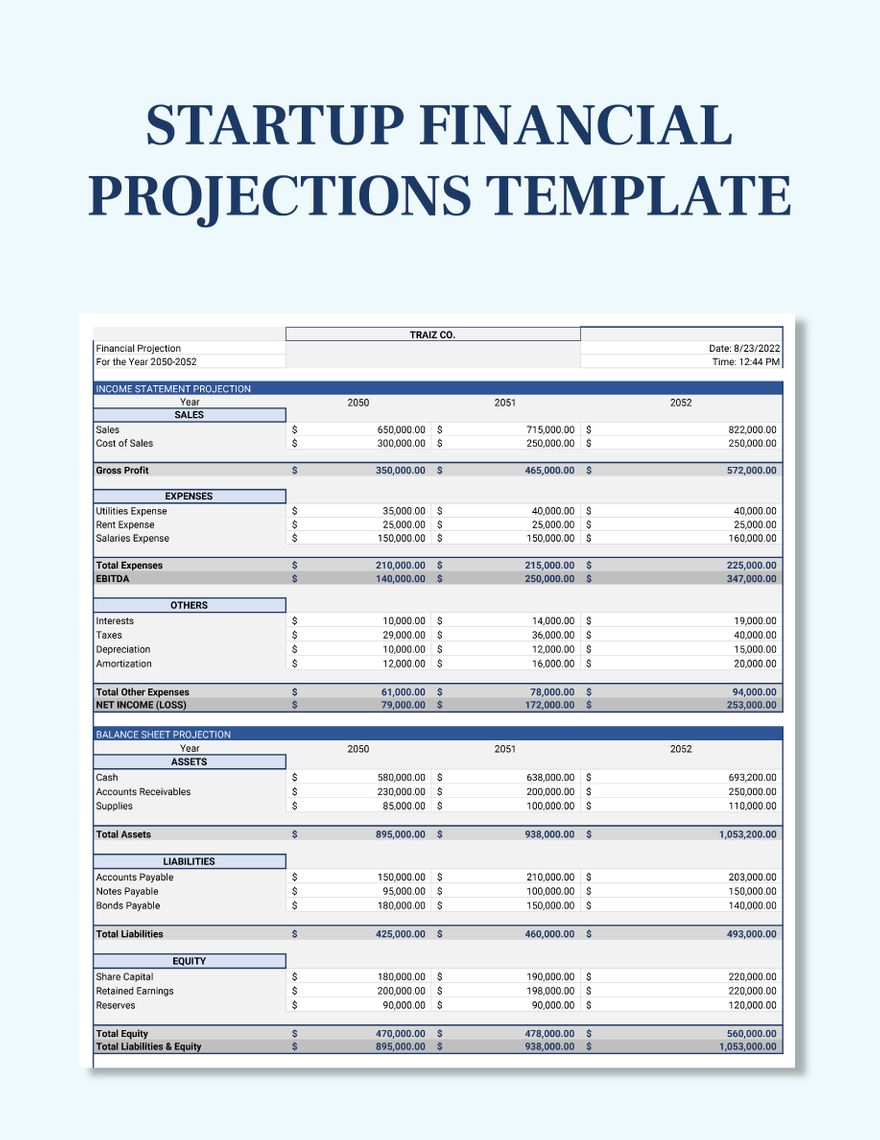

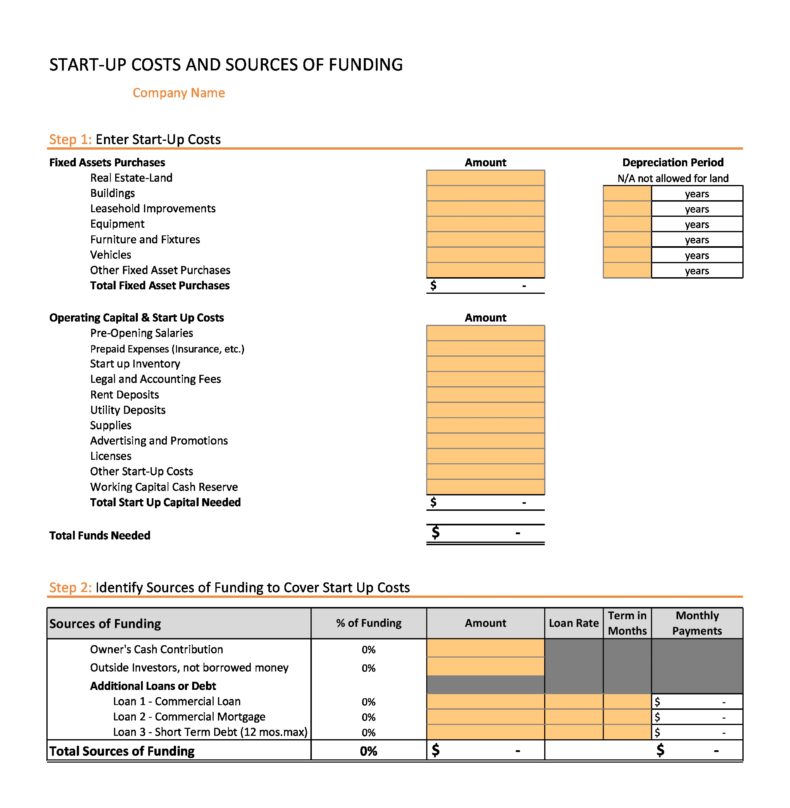

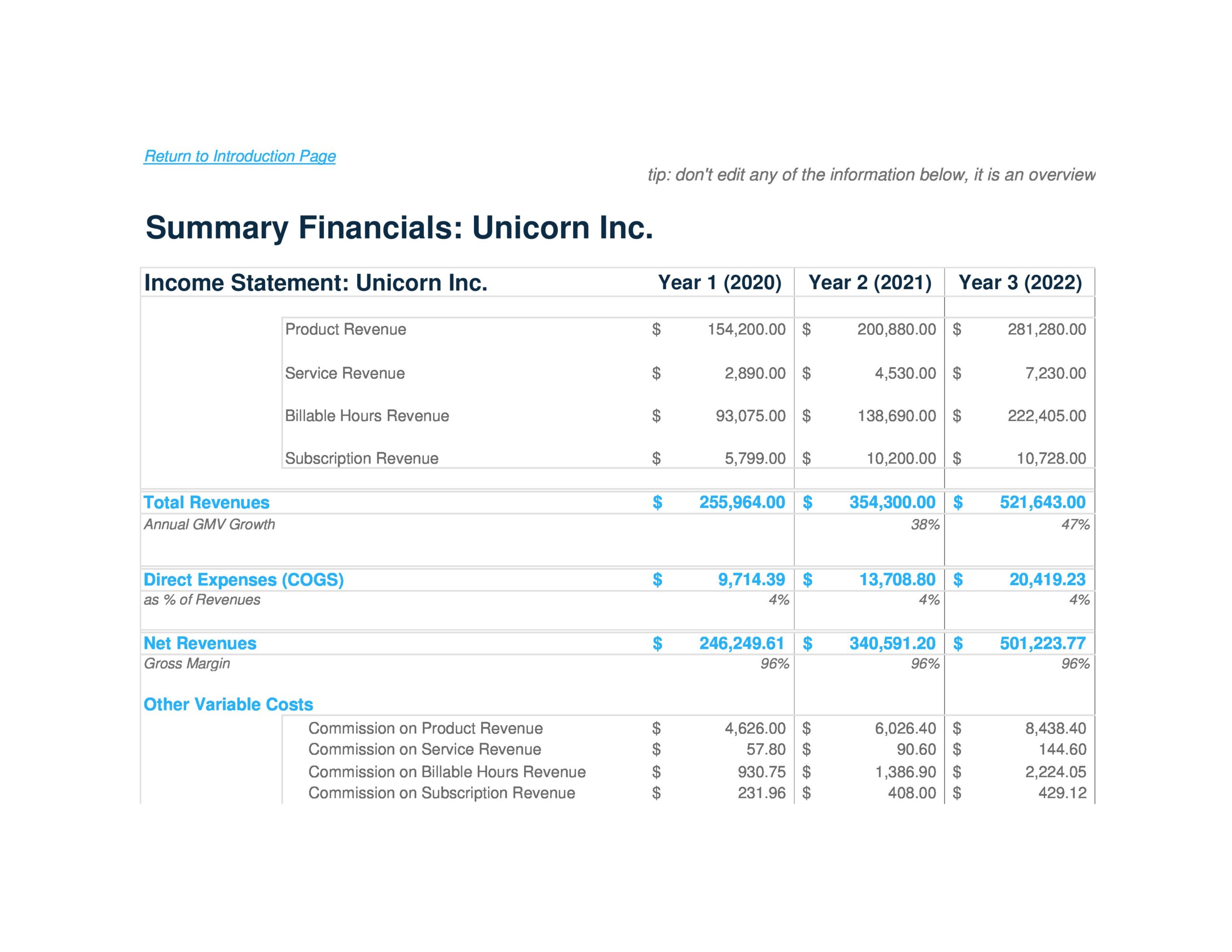

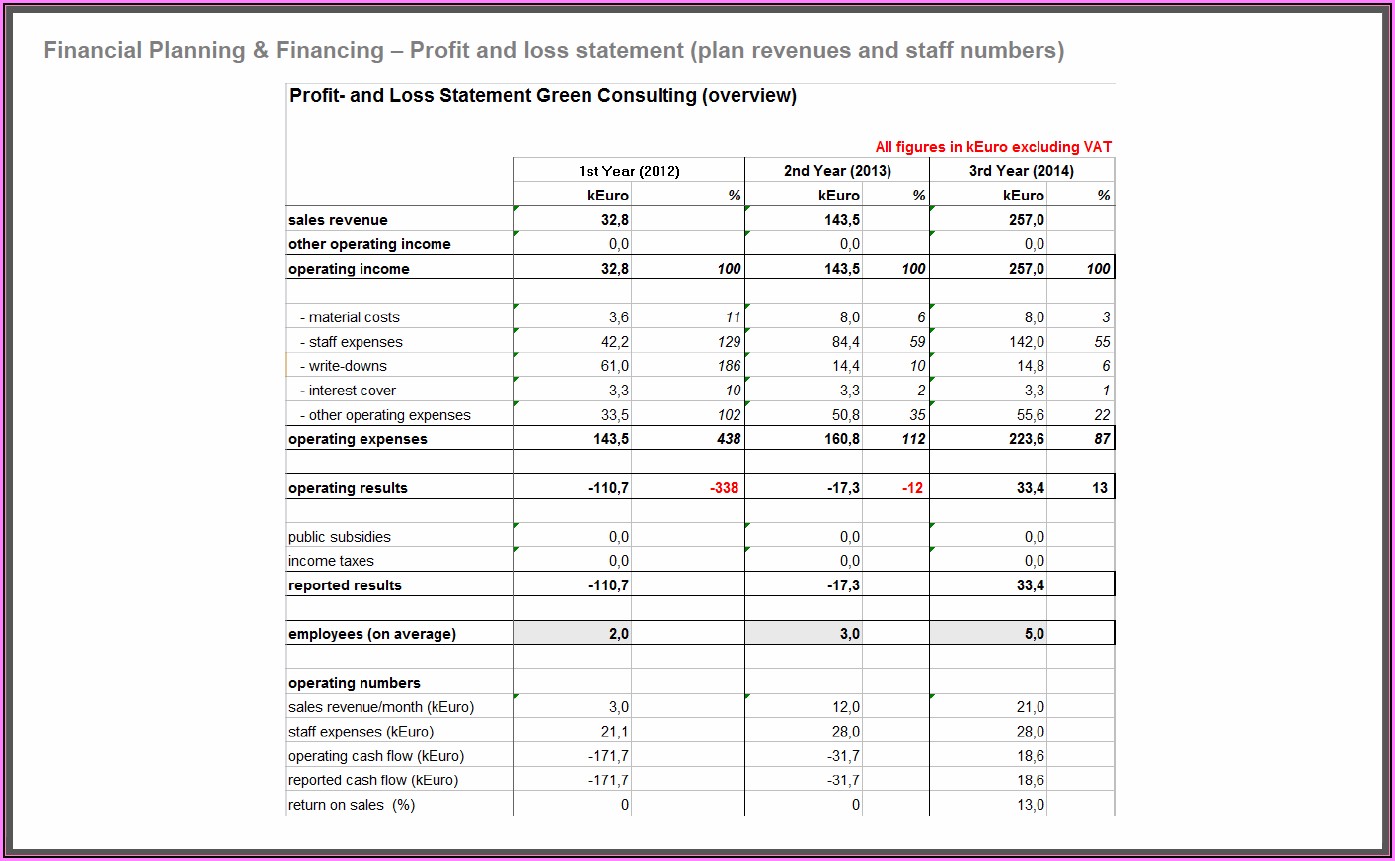

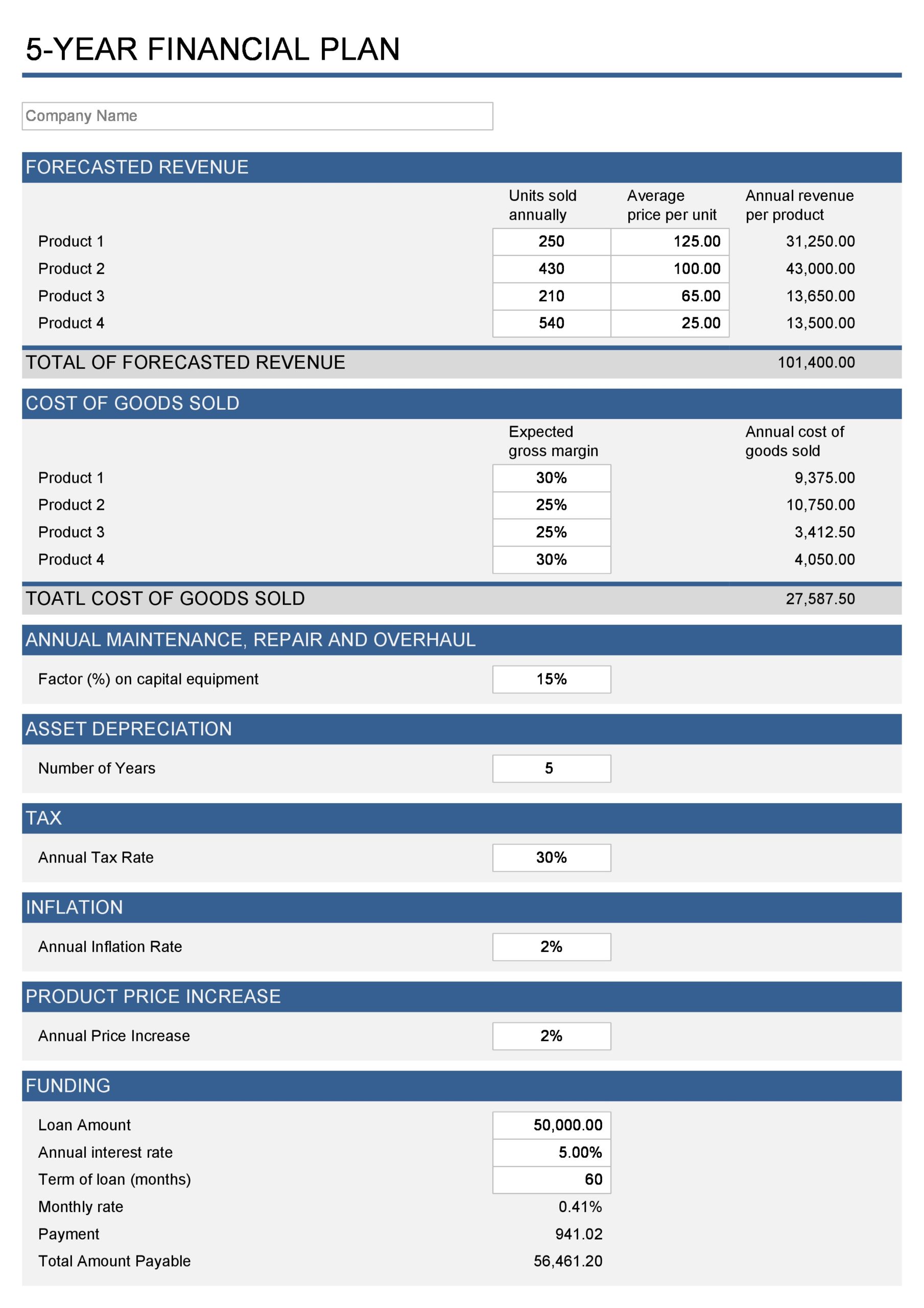

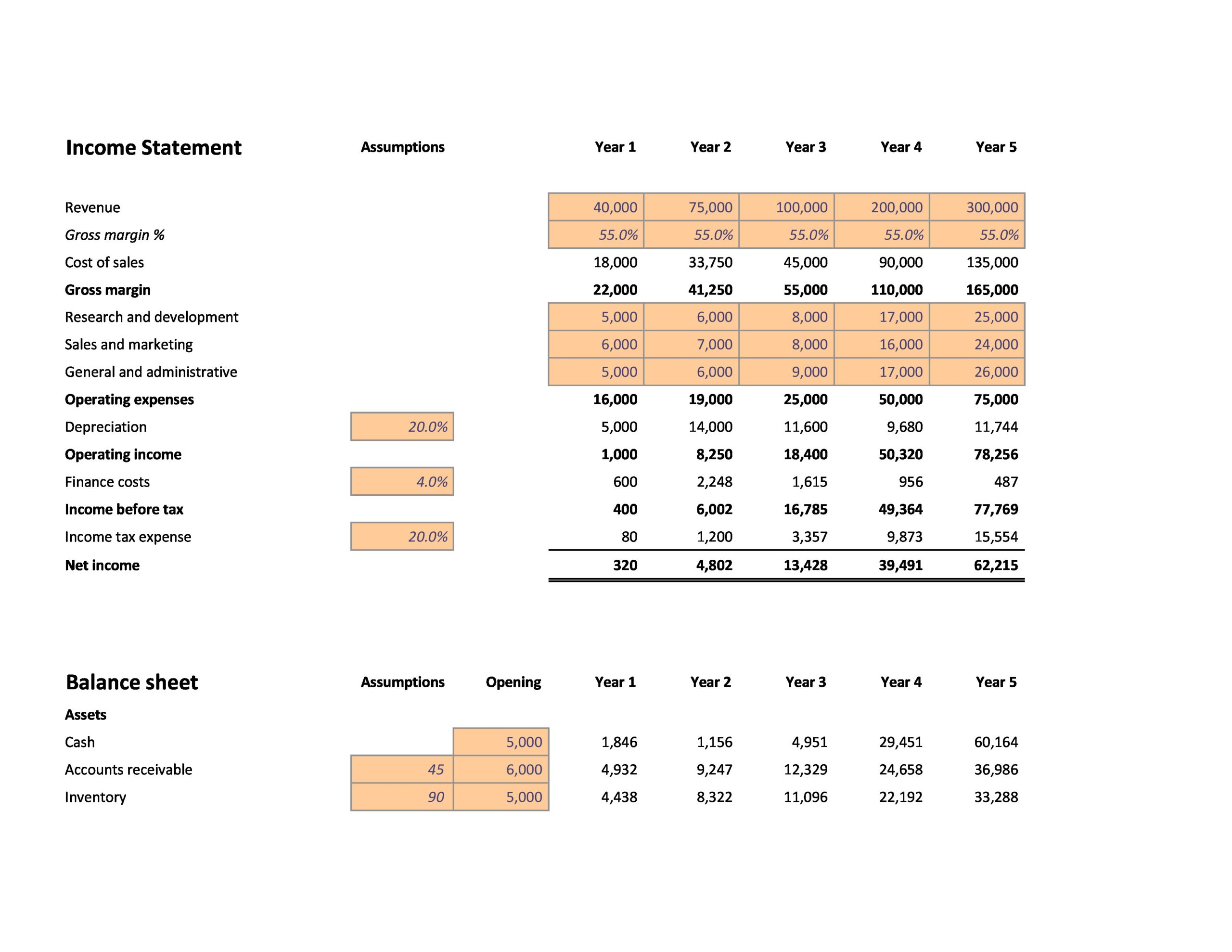

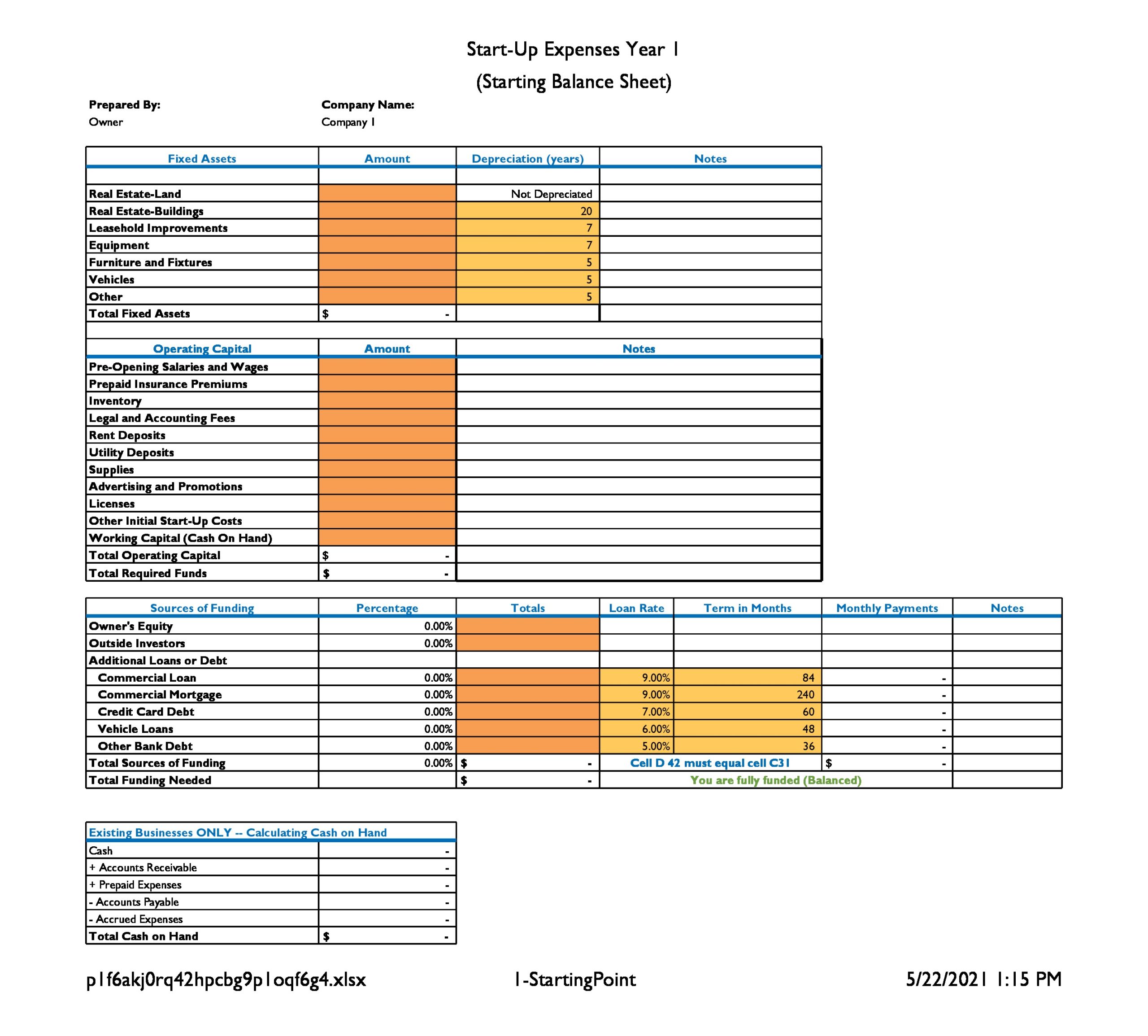

Financial projections for startup example. Financial projections and financial forecasting provide a view into the future financial health of your startup. Examples of financial statements to include in your forecast your forecast will need to include 3 financial statements: Some examples of pro forma financial statements include projected income statements, balance sheets and cash flow statements.

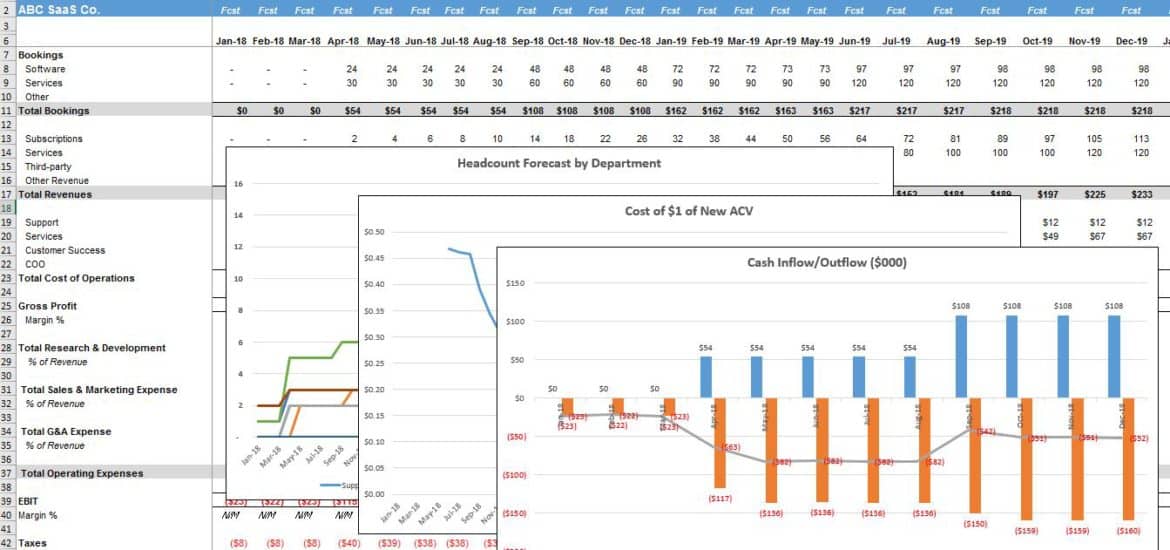

Calculate the net present value of your free cash flows and terminal value by using the discount factor. The customer pays a fee each time they use your service or product. They allow to change a few parameters (user growth, pricing, etc.) and see the impact on your financials.

Think paying suppliers, salaries, and maybe that fancy new espresso machine for the office. Realistic projections help you build a financial plan for your startup business. Great financial projections are flexible.

That too is a fact. Operations/fulfilment expenses divided by the number of orders per month (e.g. Below, we’ll walk you through actionable tips to help you create a reliable and comprehensive model for your startup.

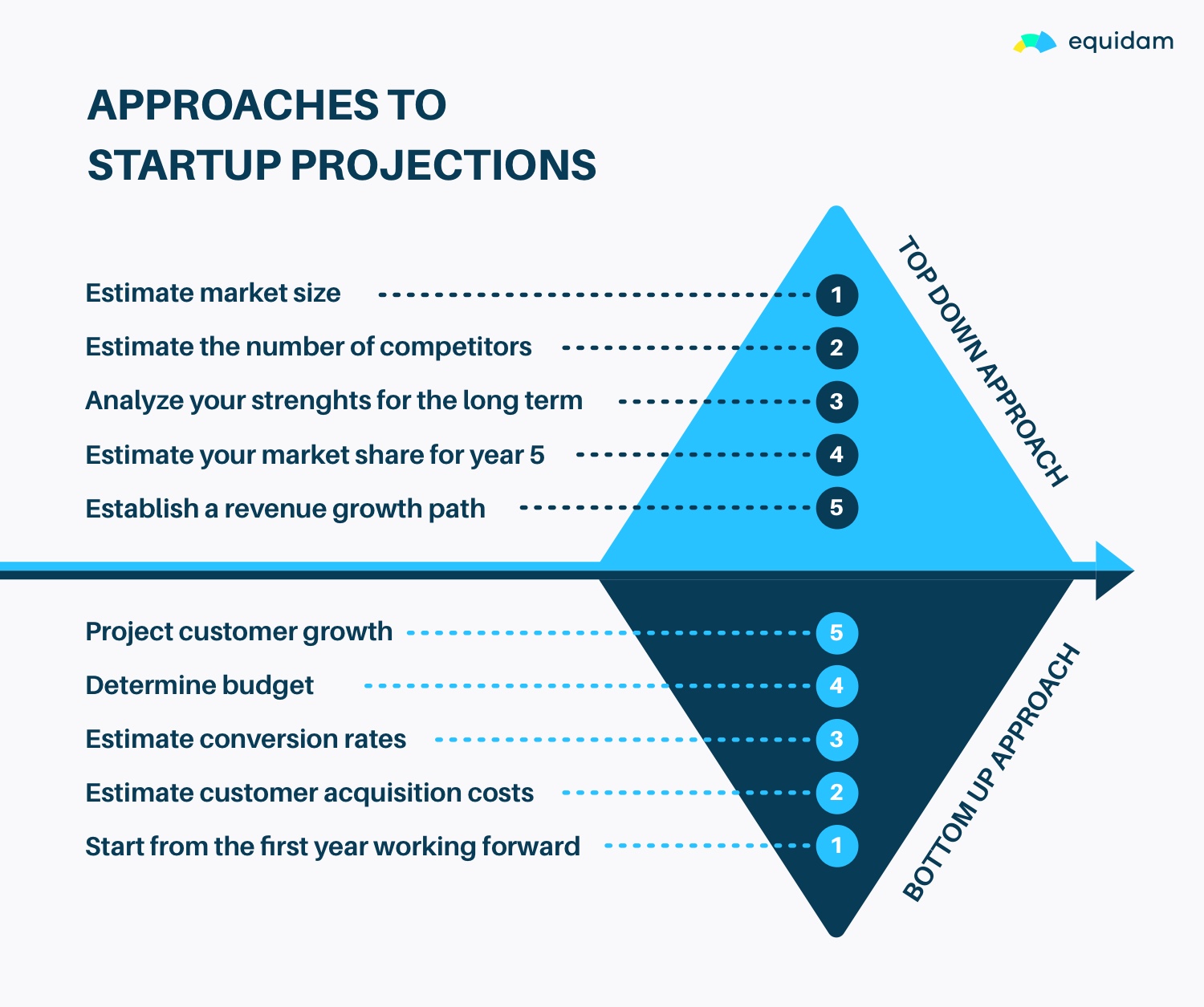

Determine the projected free cash flows. The growth of the company by analyzing the evolution of the turnover over several years; The steps to create startup financial projections.

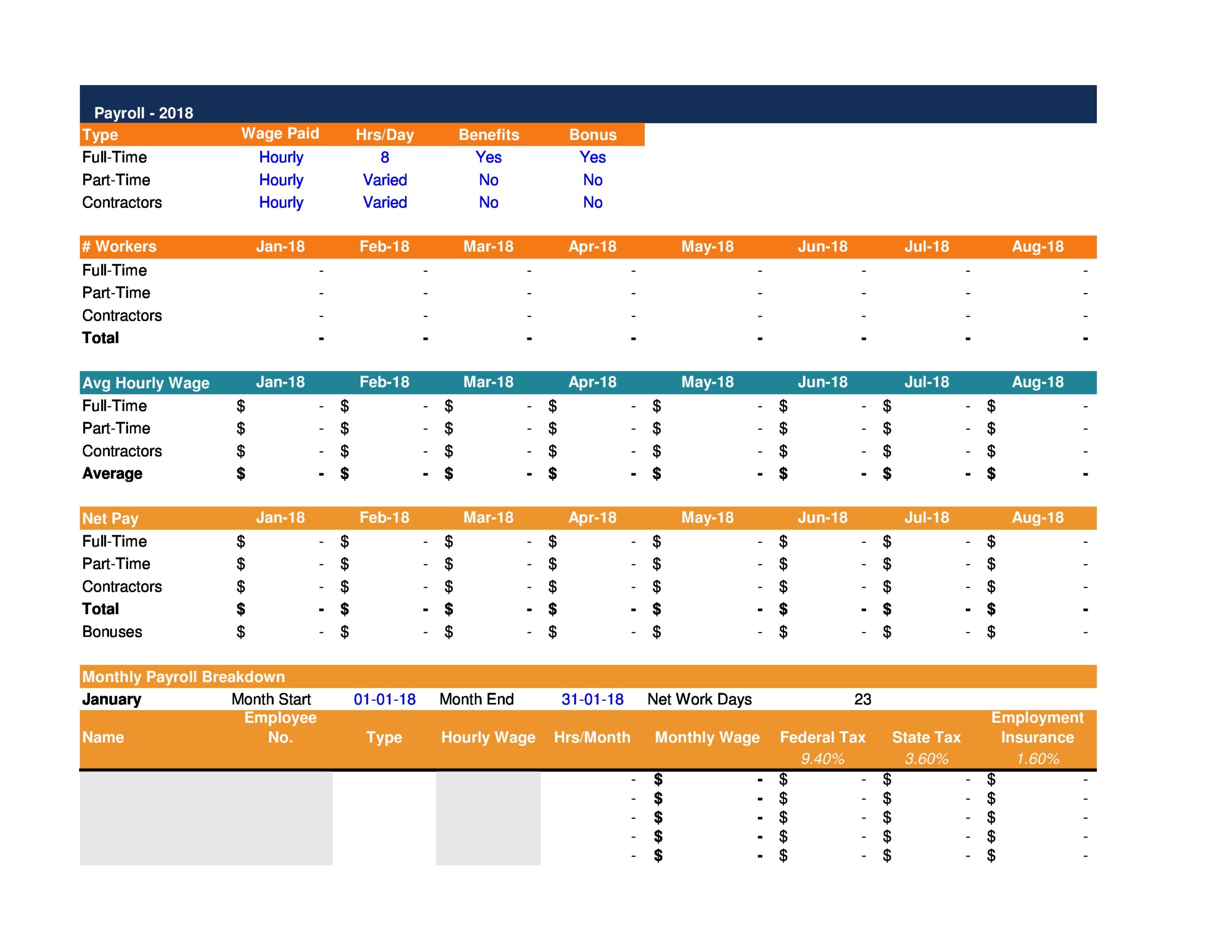

A less favorable projection may cause you to pull back a bit and be more conservative with hiring, marketing costs, and other expenses. It's meant to serve as a handy guide to key conversations that can keep a startup on the right track. You can use this template to create the documents from scratch or pull in information from those you’ve already made.

Robust startup financial models aren’t just about optimistic revenue projections—they’re a holistic approach that captures every financial aspect of your business. Template and example how to create a financial projection for your startup follow these five steps to build a financial projection for your startup: In short, financial projections are a forecast of future revenue and expenses.

Most financial models fall into one of two categories: Review of financial, economic and monetary developments and policy options. Drop your historical financial results into the template, if you have them.

Create financial projections for your firm (tick in the box!). This can ultimately lead to your business running out of cash. The customer pays for every transaction they make with you.

The 3 main types of revenue models are subscription, usage, and transaction. Through the likes of funding circle, mt finance, iwoca and swoop, new businesses are able to access capital much quicker and raise significant amounts, even as much as £500,000 or £1 million. Input estimated monthly revenues and expenses, tracking financial performance over the course of a year.