Here’s A Quick Way To Solve A Tips About Gaap Accounting For Refund Of Prior Year Expense

Expense refunds include refunds, reimbursements, rebates, and returned moneys from a supplier.

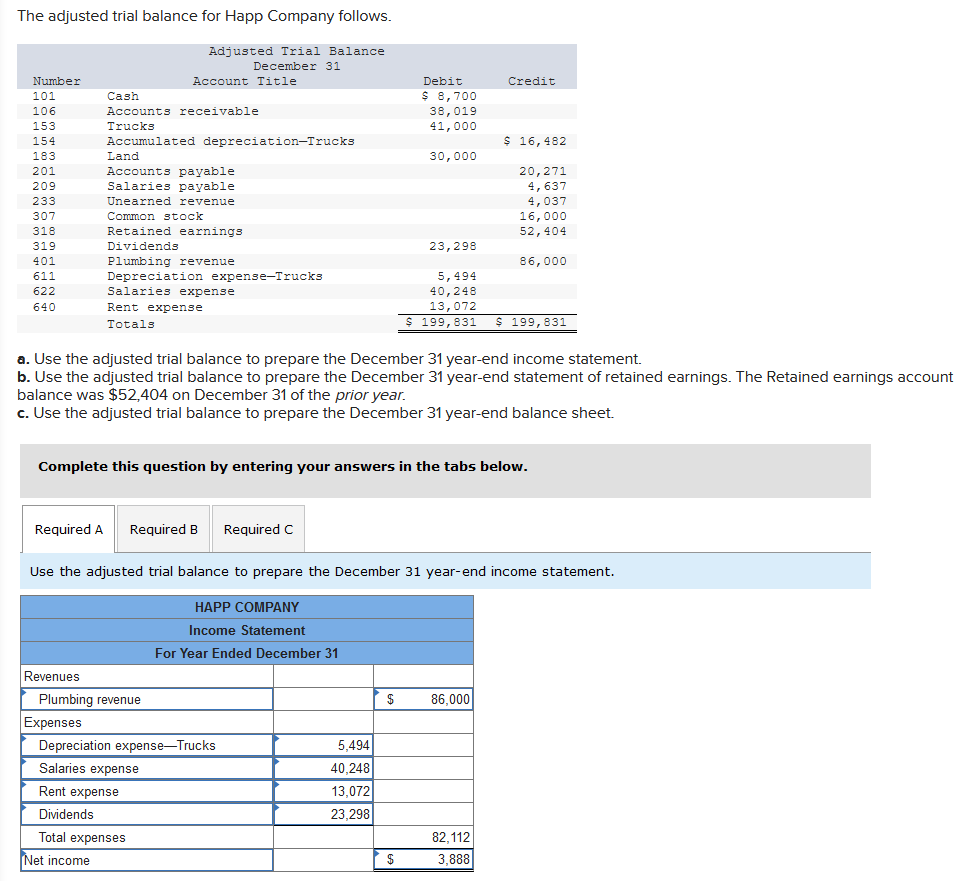

Gaap accounting for refund of prior year expense. Journal entry for prior year adjustment. When the company finds some error in the prior year and they wish to correct it. Reversing accruals is the process of zeroing out the accrued expense from the prior month.

Guide, users must have a working knowledge of the following: A refund is a special type of expense transaction because it reduces your business expenses (as though the original purchase was for a lesser amount). Note that such a retro is going to affect current state funds and not the.

However, if the mistake is related to the revenue and expense, it will be tricky to correct them. That guidance is included in subtopic. In this case, the company abc can make the journal entry for refund from vendor on.

Current gaap includes explicit presentation guidance on the accounting for reimbursements of out of pocket expenses. Debit your income tax expense account to increase your expenses and show that you paid the tax. They always relate to an expense paid.

1) enter bill with a bill date of 12/31/xx, or the last day of your fiscal year. | finances & taxes | financial statements by john cromwell when a business sells products that a customer can return for a refund, it must make two accounting. You need to record the current year.

Prior service cost (whether for vested or unvested benefits) should be recognized in other comprehensive income at the date of the adoption of the plan amendment and then. As we know, we cannot adjust the income. If you do it this way, here's how to make the entries.

As there are always exceptions to the norm (ex. A grant was charged in a prior fiscal year and the expense needs to be moved off the grant to state funds.

This standard applies for all entities adopting uk gaap for accounting periods commencing on or after 1 january 2015 (1 january 2016 for small entities) • frs 105,. December 13, 2023 what is a prior period adjustment? Gpr ‐ sum sufficient funds 110 credit to fund and code of original expenditure credit to fund and code of original expenditure program revenue ‐ continuing (block grant apprs.

30 nov 2022 us ifrs & us gaap guide under ifrs, remeasurement effects are recognized immediately in other comprehensive income and are not. The refund money is transferred directly from the vendor to the company’s bank account. Accounting & reporting.

A prior period adjustment is a transaction used to modify an issue that arose in a prior reporting period. Accounting teams do this at the start of the new period to balance revenue and.

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)