Have A Tips About Income Statement Revenue And Expenses

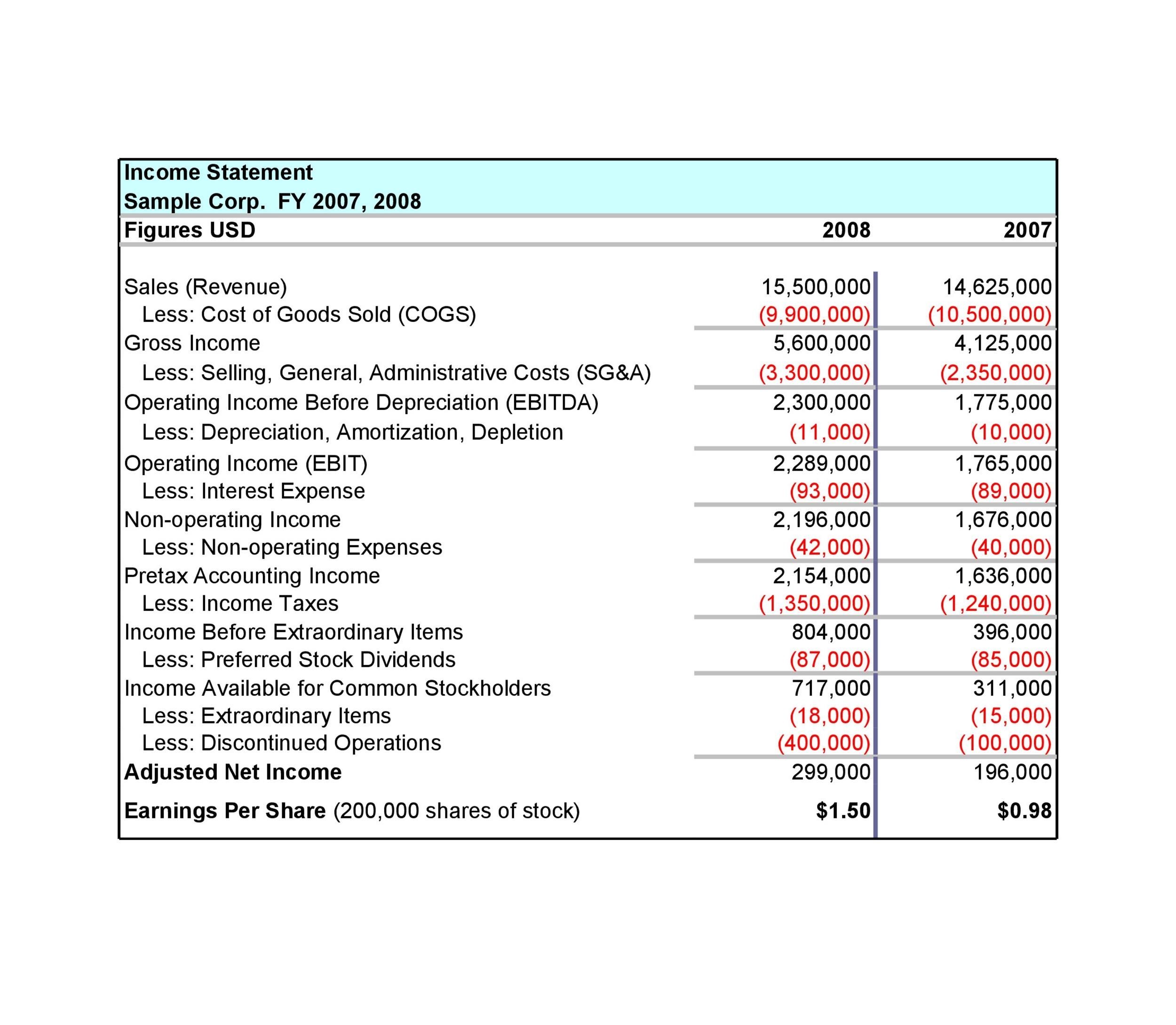

Record adjusted ebitda margin fourth.

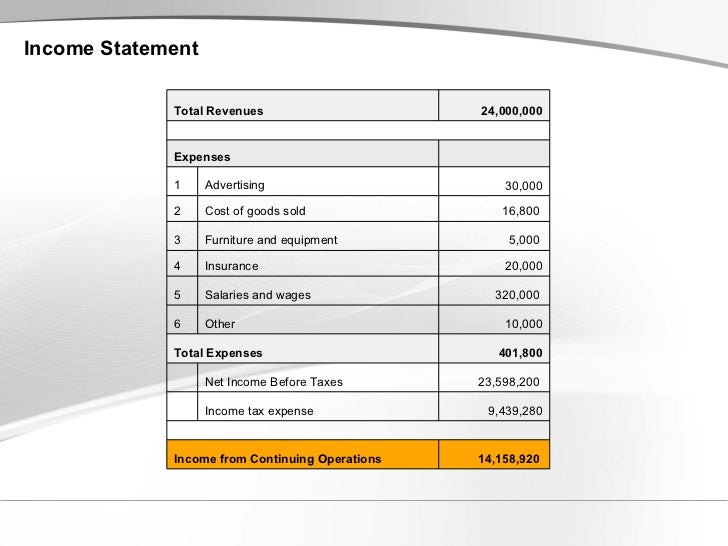

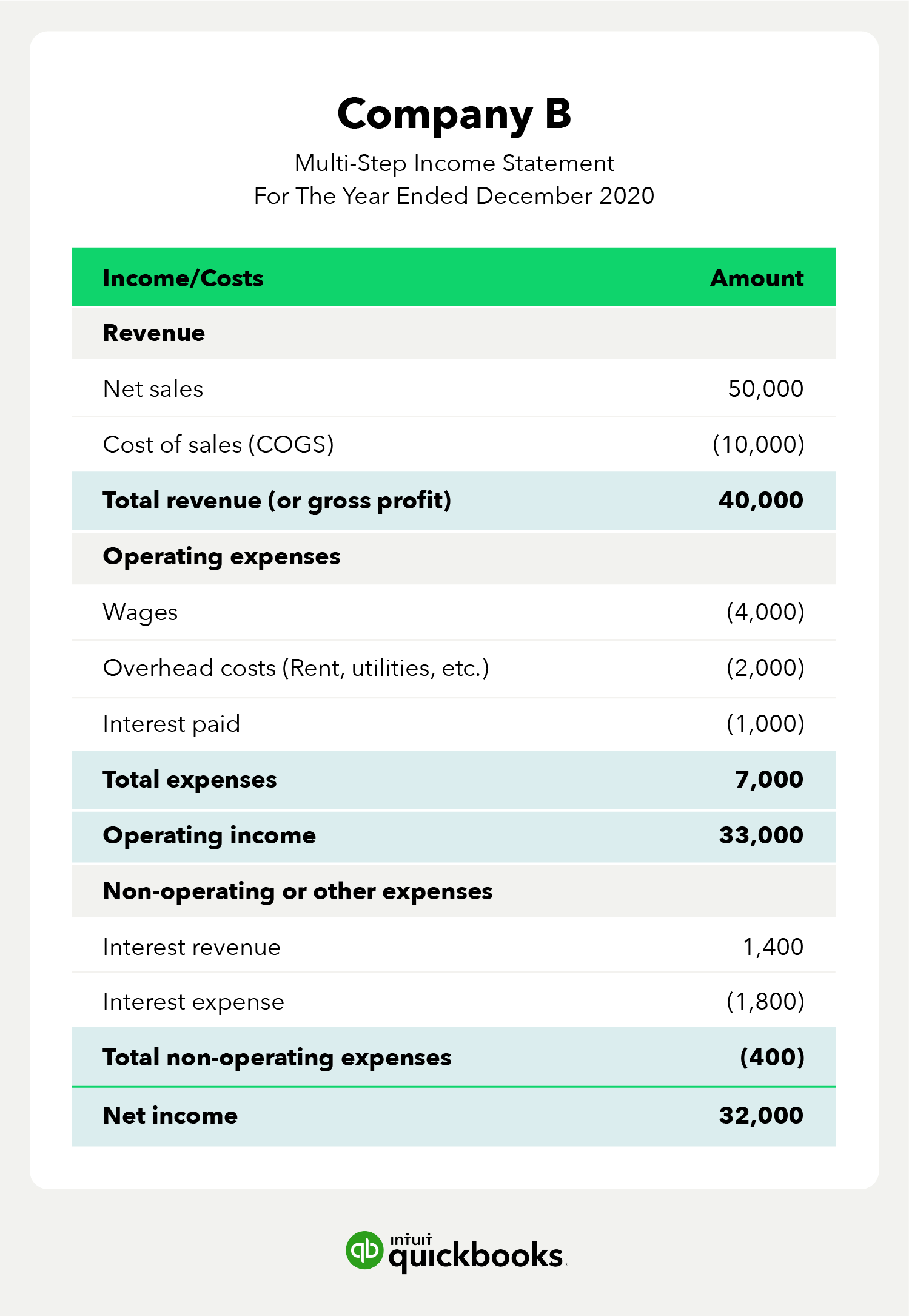

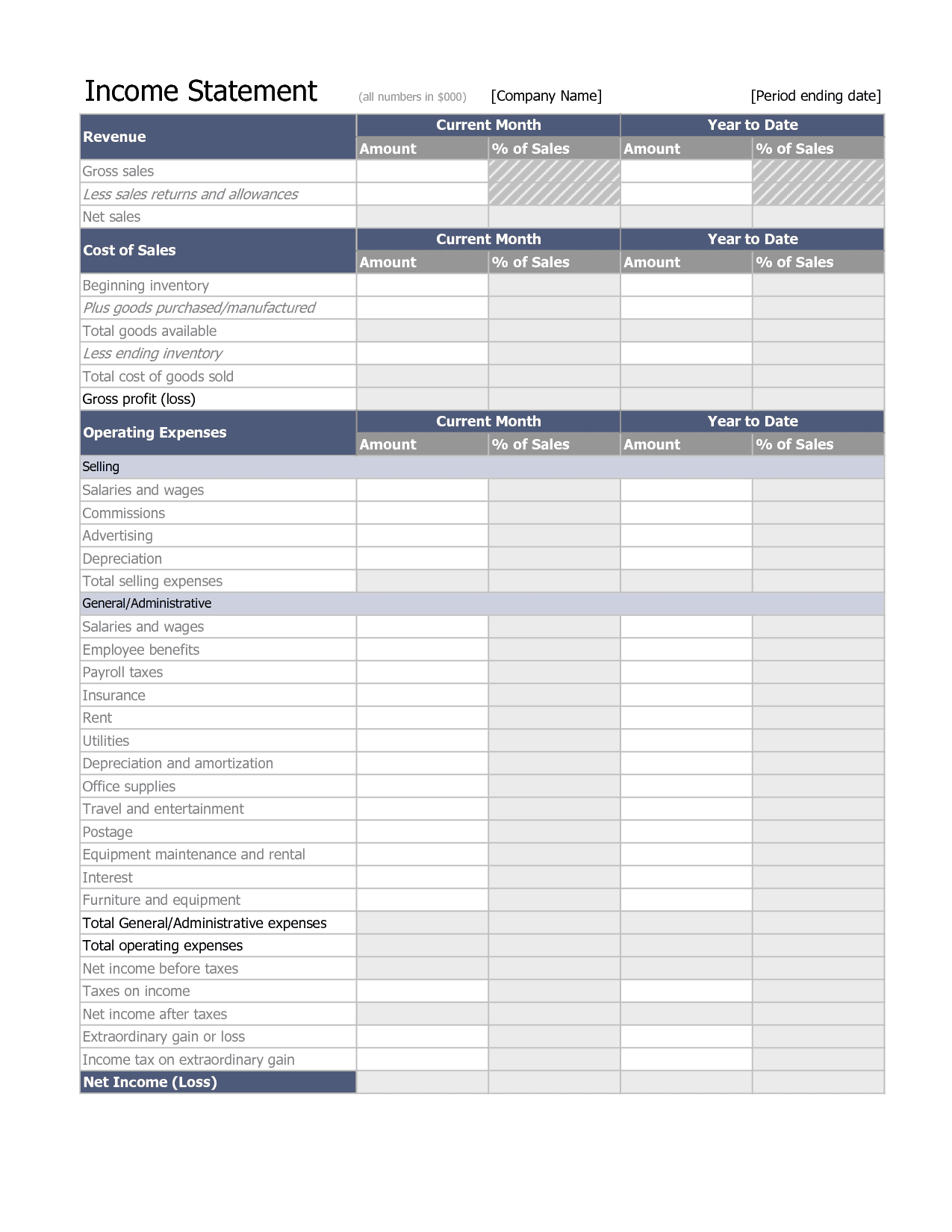

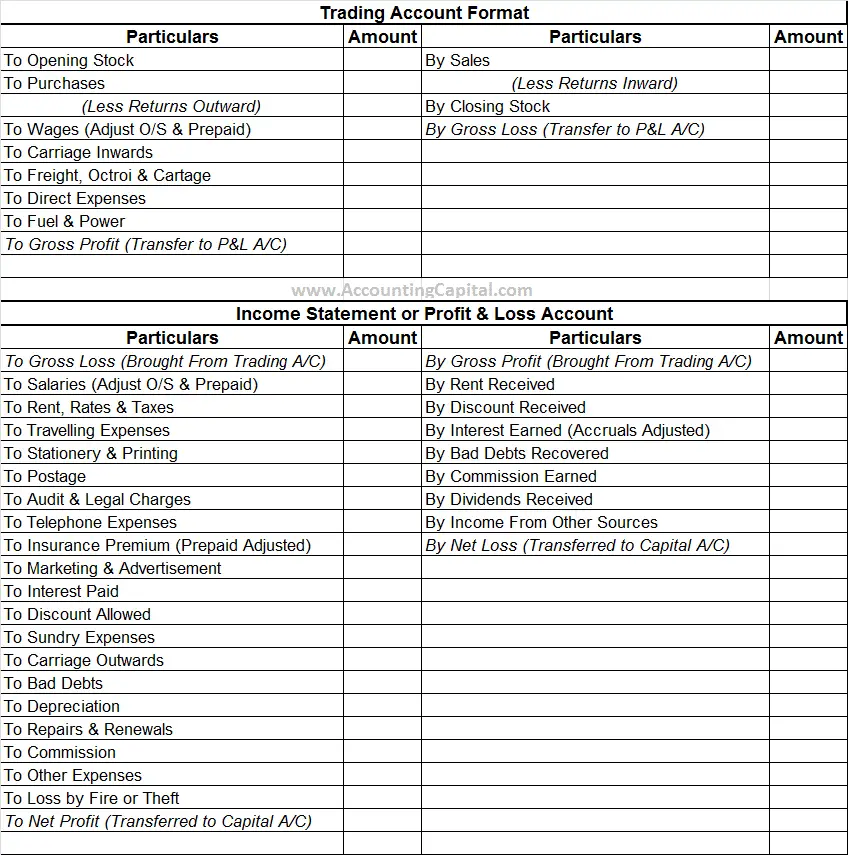

Income statement revenue and expenses. Income statements depict a company’s financial performance over a reporting period. Revenue, expenses, gains, and losses. Financial statements for businesses usually include income statements , balance sheets , statements of retained earnings and cash flows.

Gross profit minus operating expenses and taxes. Revenue minus expenses equals profit or loss. Your net profit margin tells you what portion of each revenue dollar you can take home as net income.

It tells the financial story of a business’s operating activities. In accounting, the income statement (also called the statement of profit and loss) summarizes a company’s revenues, expenses, and net income. This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues.

For companies big and small, accountants use an income statement to keep track of money coming in (revenue) and money going out (expenses). Santa clara, calif., feb. An income statement is a financial statement detailing a company’s revenue, expenses, gains, and losses for a specific period of time that is submitted to the securities and exchange commission (sec).

Revenues and expenses appear on the income statement as shown below: This financial report follows the following formula: Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago.

An income statement is a profitability report. At the most basic level, it. It also shows whether a company is making profit or loss for a given period.

The income statement, also known as the profit and loss (p&l) statement, is the financial statement that depicts the revenues, expenses and net income generated by an organization over a specific. The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. Hopefully, the examples above have.

Revenue expenditures are also known as operating expenses or operational. Key points an income statement is another name for a profit and loss statement (p&l). For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter.

Shareholders, investors, lenders, and competitors use this document for interpreting and comparing financial performance. Net income, which is revenue minus all costs, including cost of goods sold, selling, general and administrative expenses (salaries, rent, energy, marketing, accounting, travel, etc), taxes, depreciation, and any other expenses. An income statement that presents a subtotal for gross profit.

Key points to this reading include the following: This takes into account all your expenses—cogs, general expenses, interest payments, and income tax. The income statement reports income over a certain time period, typically a quarter or a year, and its heading specifies the duration, for example, for the (fiscal) year/quarter ended june 30, 2021, while a balance sheet gives a snapshot of a company's finances as of a specific date.

:max_bytes(150000):strip_icc()/ScreenShot2022-03-05at10.15.17AM-b1c05918ed68413fbbaa818d057eda34.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)