Outstanding Tips About Balance Sheet And Profit Loss Account Of A Company

Profit and loss statement vs.

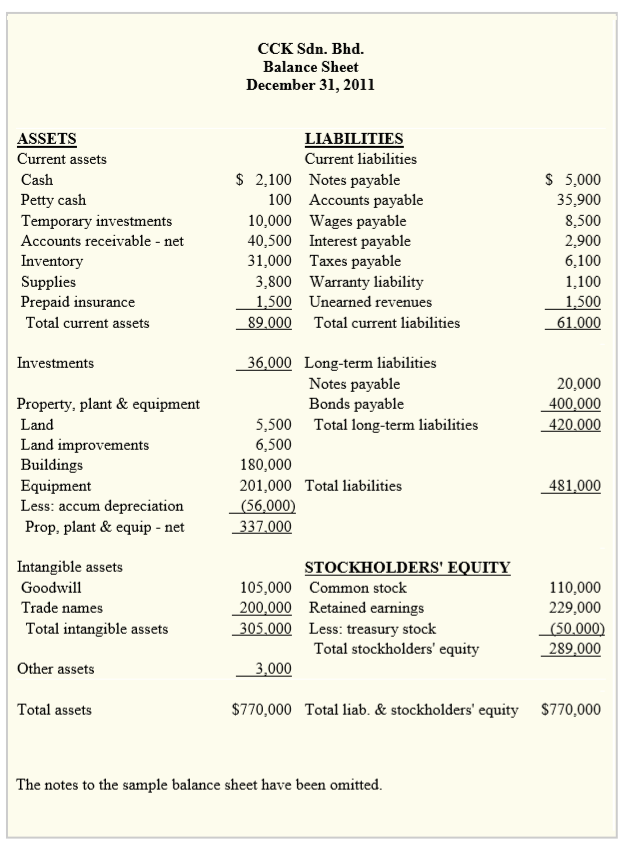

Balance sheet and profit and loss account of a company. A balance sheet provides a snapshot of a company’s financial position at a specific point in time, while a profit & loss account summarizes a company’s revenues,. Despite their common origins, there are key. The balance sheet shows the financial position of the company as at the.

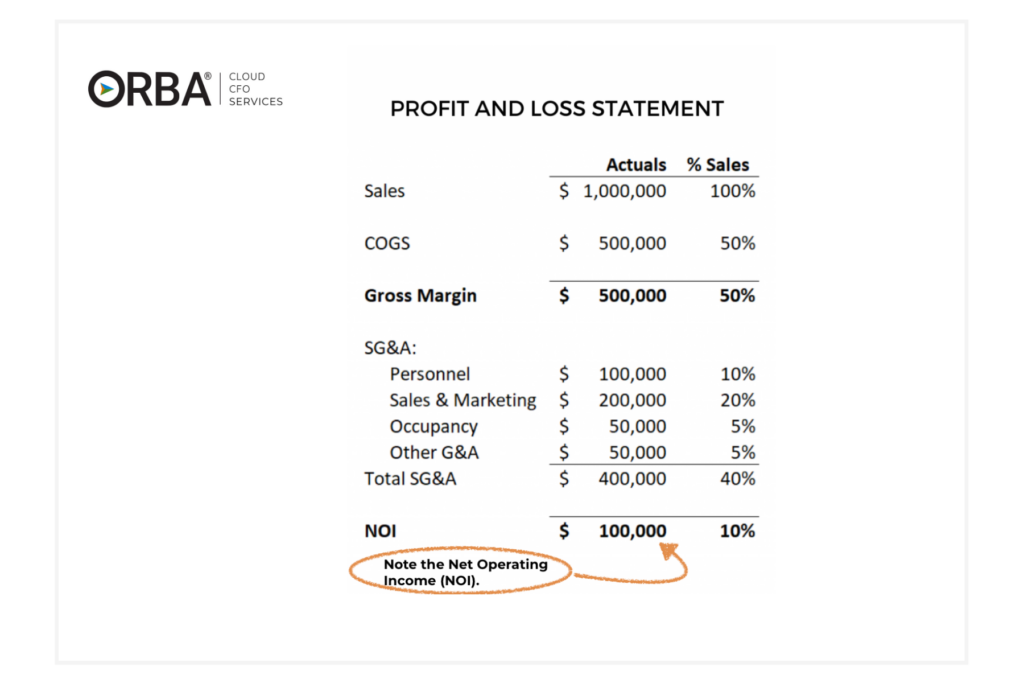

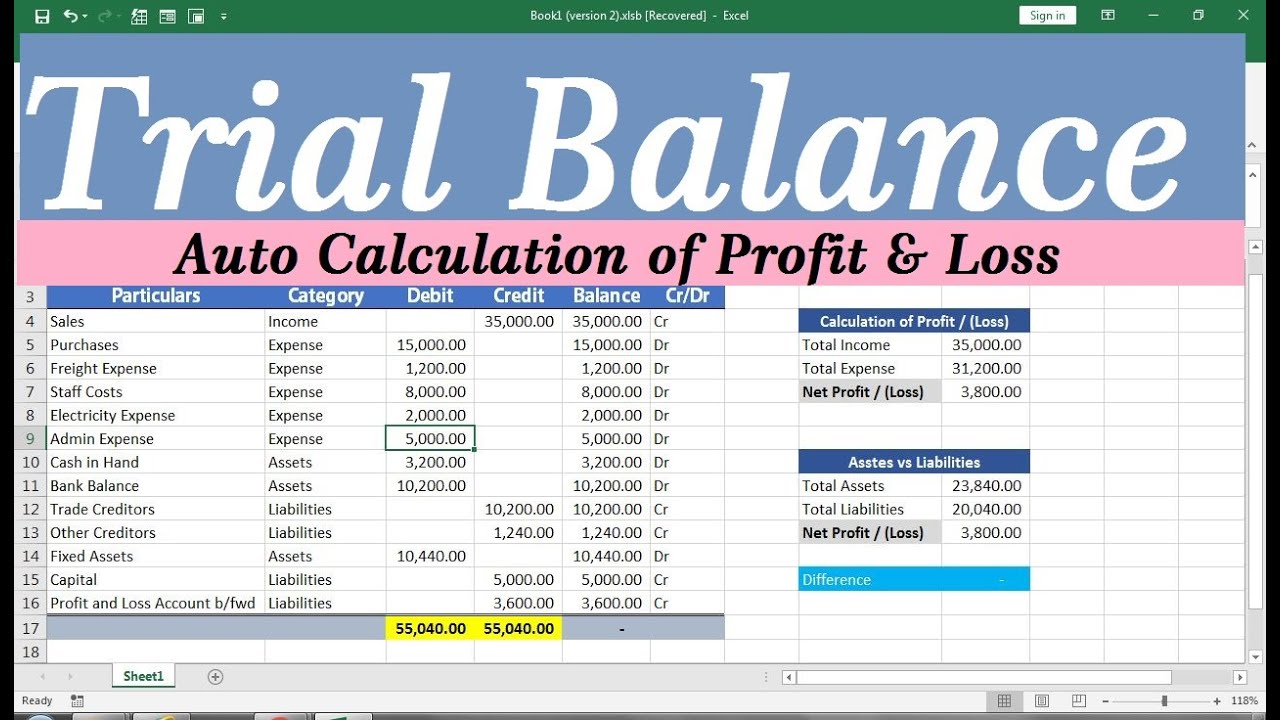

There are several key differences between the p&l and balance sheet, particularly the information presented and what it means. The profit and loss statement or income statement shows a company’s income and expenses over a specific period, such as a month or year. In contrast, the balance sheet is like a photograph taken.

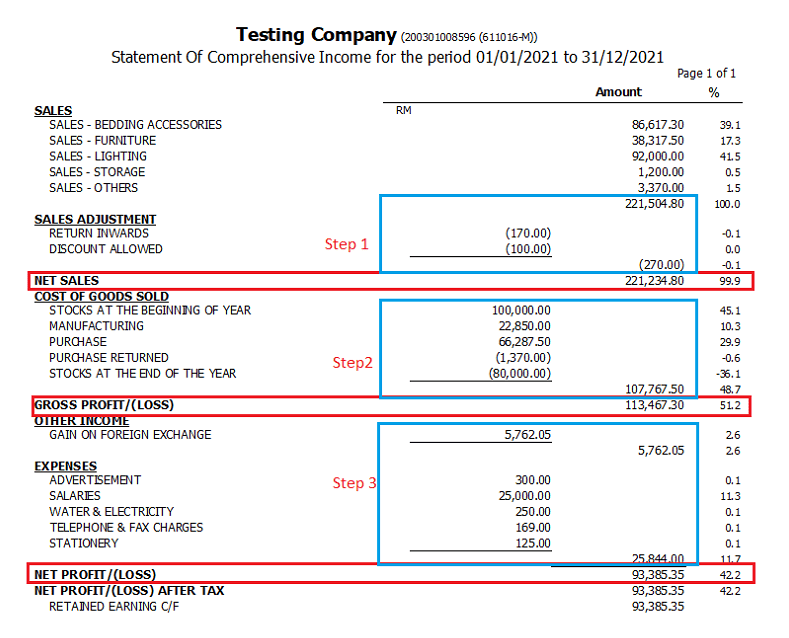

A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and. Key differences difference between balance sheet and profit & loss account a balance sheet, or otherwise known as a position statement. The balance sheet preparation of the profit and loss account and balance sheet the advantages of financial statements.

A balance sheet shows you how much you have (assets), how much you owe (liabilities), and how much. 3 months, 1 year, etc. Balance sheet is prepared to provide the financial position of the company at a specific time span.

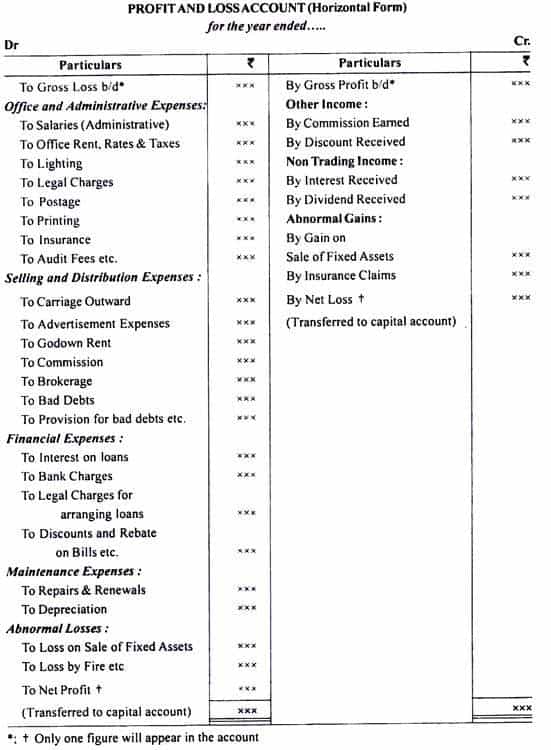

A p&l statement, often referred to as the income statement, is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually a fiscal yearor quarter. 7.1 the profit and loss account the profit and. It is a statement which shows the.

The profit and loss account and the balance sheet are two of the most important financial reports companies and investors rely on. Example debit balance of profit and loss account shown in the balance sheet gross profit and gross loss meaning and definition the income statement or profit & loss. The p&l statement may also.

The gains and losses along with various incomes and indirect expenses taking place in the business. These records provide information about a company's ability (or lack thereof) to generate. The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. The profit and loss account shows the profit or loss of a business over a given period of time e.g. It is prepared to determine the net profit or net loss of a trader.

Key differences between the balance sheet and the profit and loss account. It’s sometimes referred to as an ‘income. The profit and loss account tracks performance and profitability over time, and helps you identify areas where improvement is needed.

Dividing net income by total revenue will result into a net profit margin. Income statement (profit & loss account) balance sheet; Capital of shareholders and the various assets and liabilities of the business.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)