Neat Tips About Best Balance Sheet Ratios

This concludes our discussion of the three financial ratios using the current asset and current liability amounts from the balance sheet.

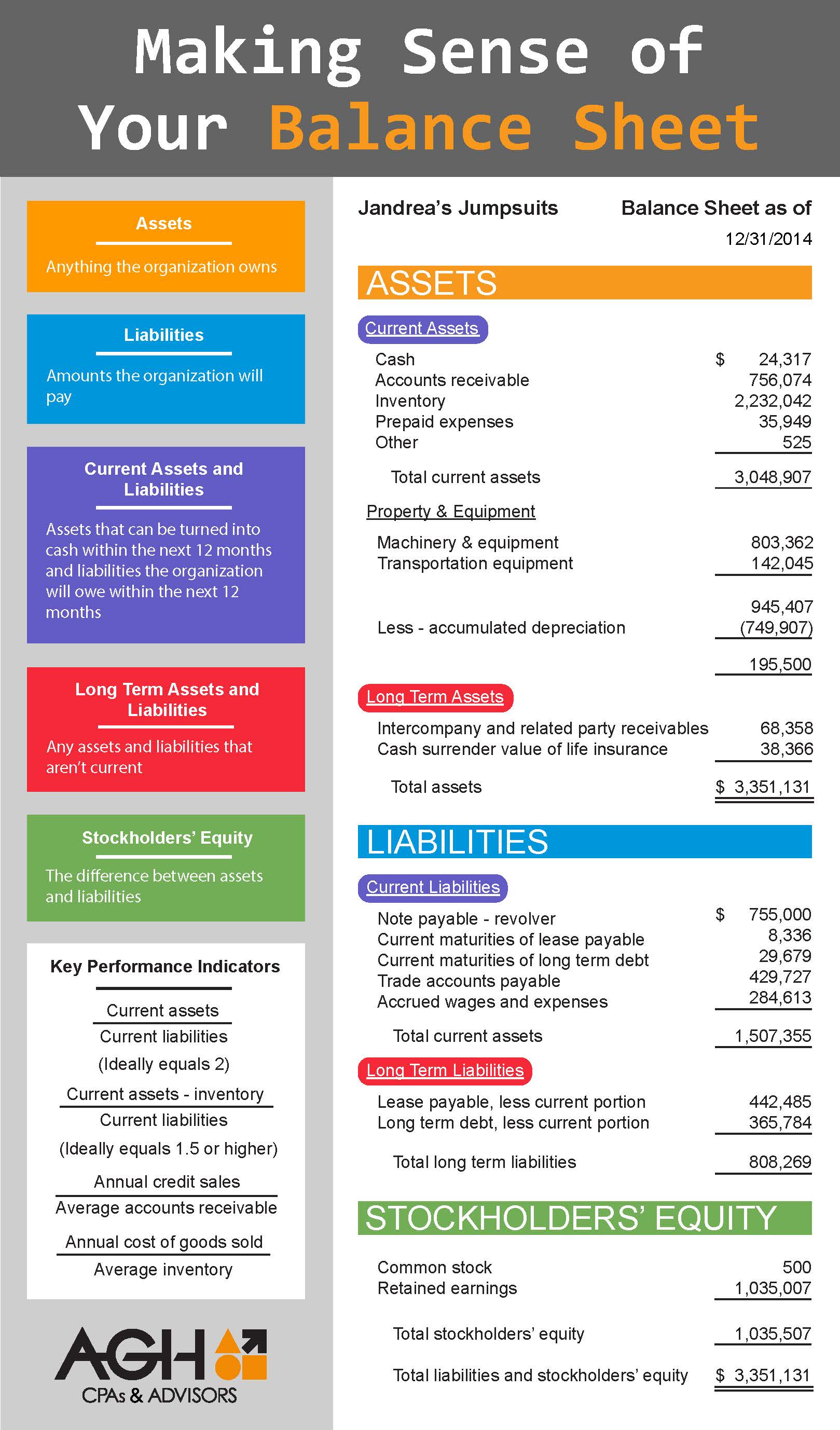

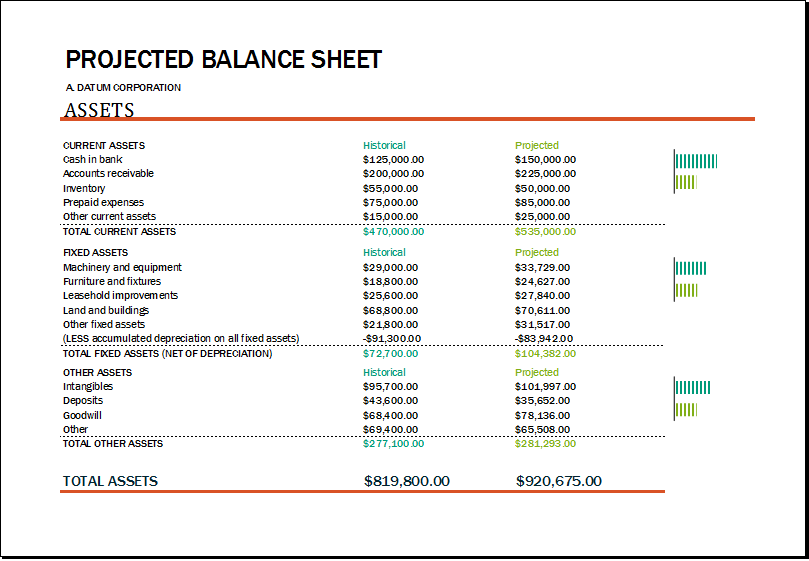

Best balance sheet ratios. Chip stapleton fact checked by jiwon ma for investors, the balance sheet is an important financial statement that should be interpreted when considering an investment in a company. Quick ratio = 1.25 (or 1.25 to 1 or 1.25:1 ) if beta's quick assets are mostly cash and temporary investments, it has a great quick ratio. Although the minimum current ratio is 1:1, you want to aim higher if you want more current assets than liabilities.

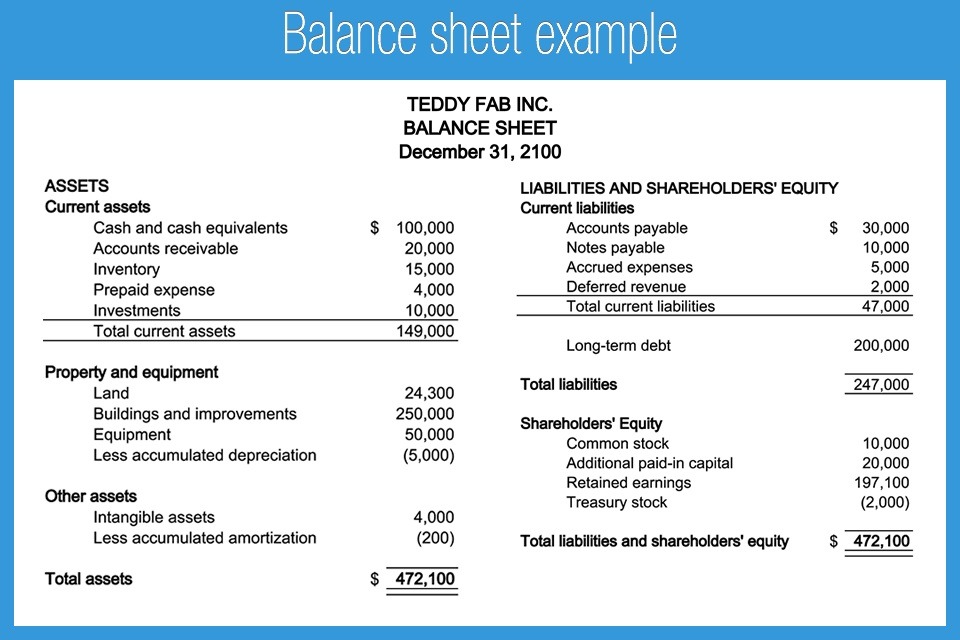

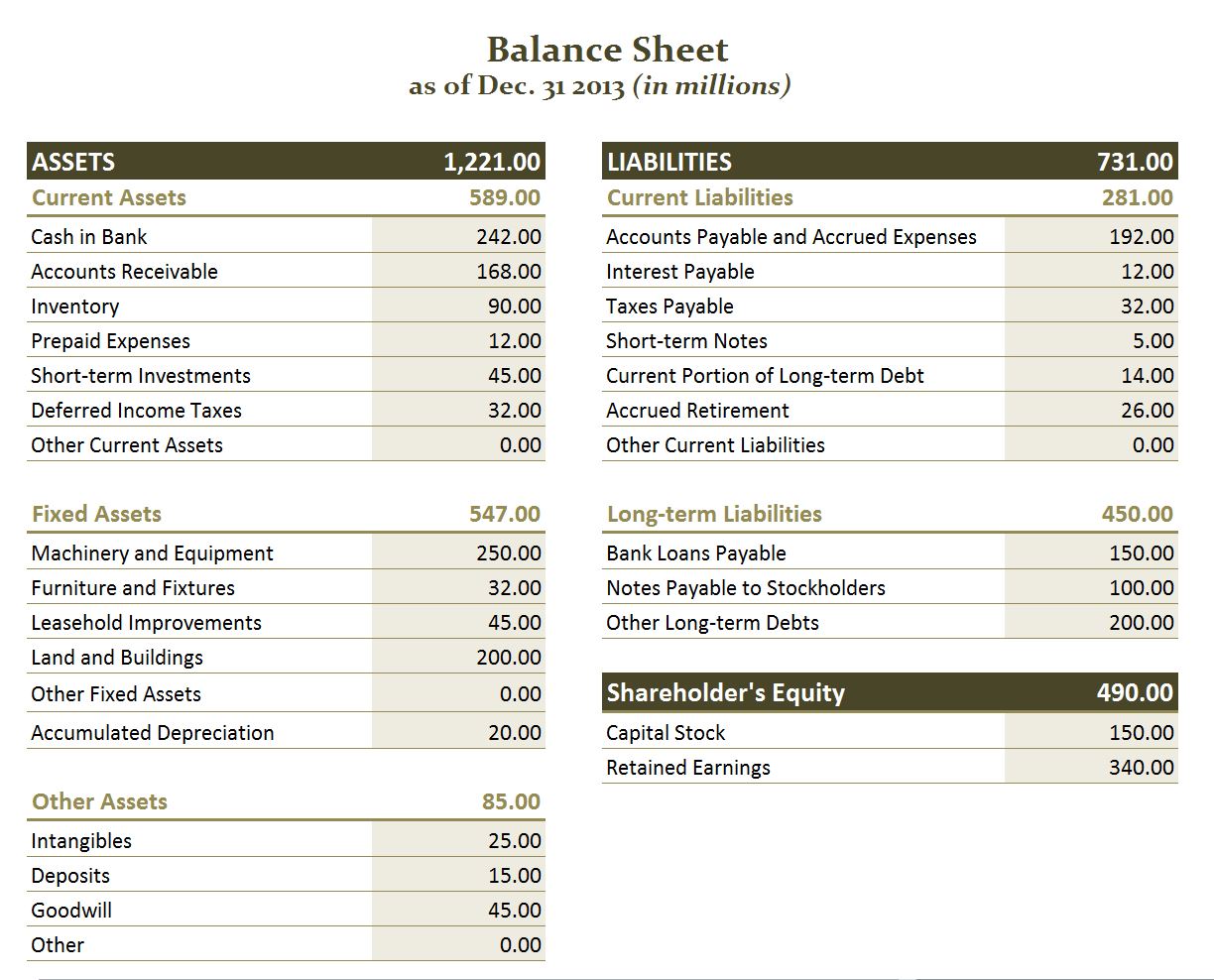

This made the older, lower. Quick ratio = quick assets / current liabilities quick assets = $140,000 + 250,000 + 300,000 = $690,000 current liabilities = $300,000 + 40,000 + 20,000 = $360,000 quick ratio = 690,000 / 360,000 = 1.916 times Example 1 calculate the quick ratio from the balance sheet shown below.

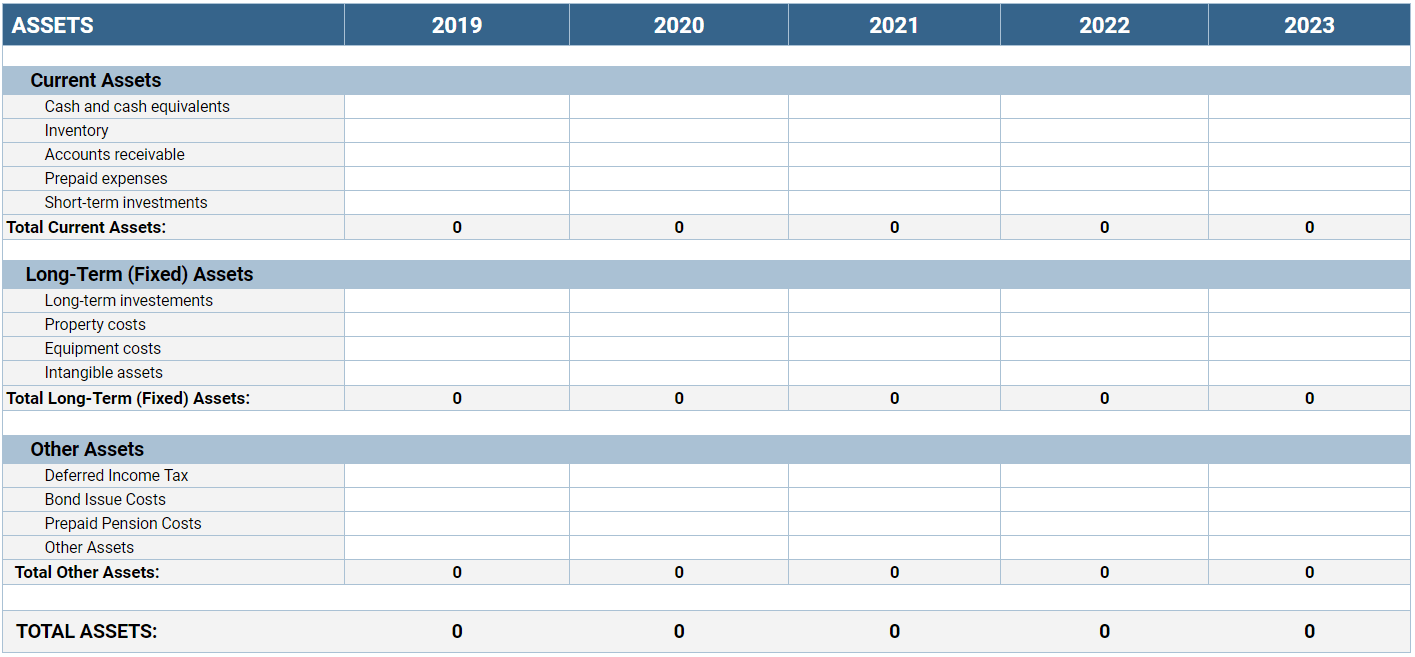

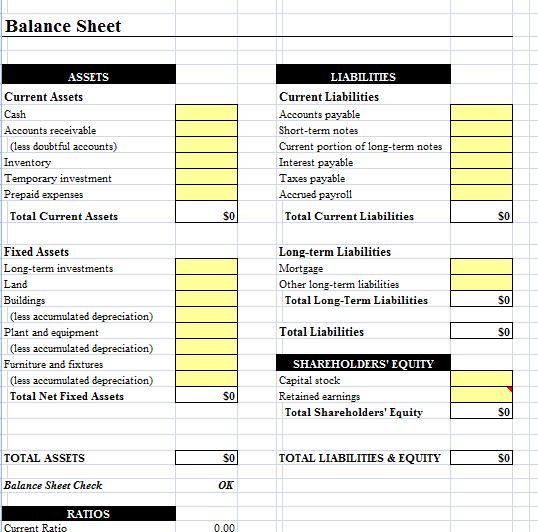

How to calculate net working capital to calculate your working capital, subtract your total current liabilities from your total current assets. These ratios are used by creditors and lenders to decide whether it makes sense to extend credit to a business. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios.

(some might refer to this as a working capital ratio, but technically, net working capital isn’t a ratio.) Quick ratio = $25,000 / $20,000. A company’s balance sheet is a snapshot in time.

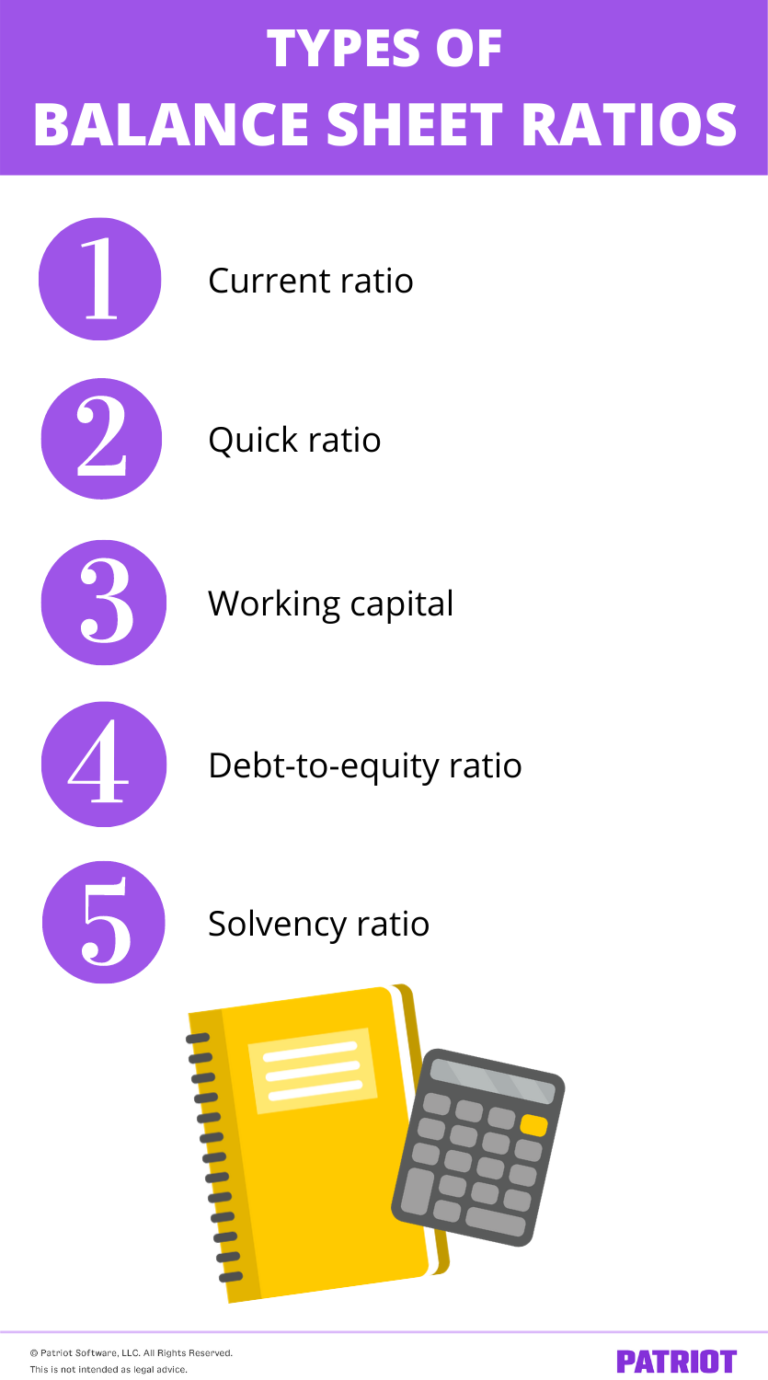

On average, total liabilities for this group increased by 184% (i.e., almost tripled) between 2007 and 2020/2021. The quick ratio is also called the acid test as it measures the company’s ability to quickly dissolve/liquidate its liabilities as could be done. The following list includes the most common ratios used to analyze the balance sheet.

Providing a complete interpretation of a company's results quantitatively, balance sheet. Liquidity ratios show the ability to turn assets into cash quickly. 11 min read share table of contents what is a balance sheet?

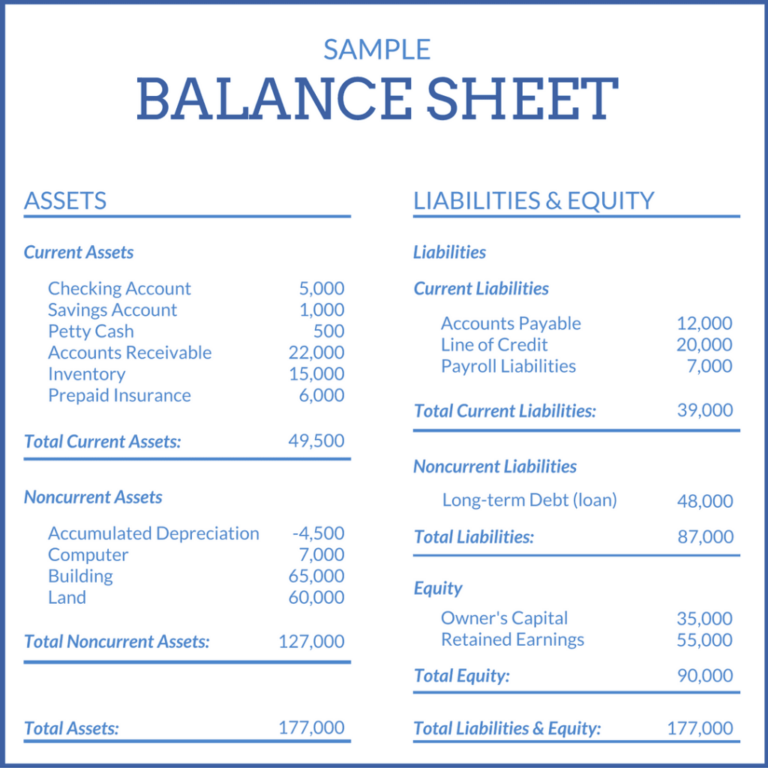

Fact checked by michael logan a company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). Financial ratios are grouped into the following categories: Definition and examples of balance sheet formulas

This is a guide to balance sheet ratios. Why are balance sheet metrics important? Most analysts prefer would consider a ratio of 1.5 to two or higher as adequate, though how high this ratio depends upon the business in which the company operates.

The main liquidity ratios are the. Profitability ratios show the ability to generate income. Policymakers said slower qt could ease shift to ample.

Fed minutes suggest officials are seeking smallest balance sheet possible. Guide to leverage ratio for banks The imf public sector balance sheet database allows comparisons of changes in general government liabilities to be made for 46 states for which data are available;

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

![Download [Free] Balance Sheet with Ratios Format in Excel](https://exceldownloads.com/wp-content/uploads/2021/09/Balance-Sheet-Template-Feature-Image.png?v=1685413421)