Unbelievable Info About Advance Rent In Balance Sheet

However, the benefits are availed in the future accounting period.

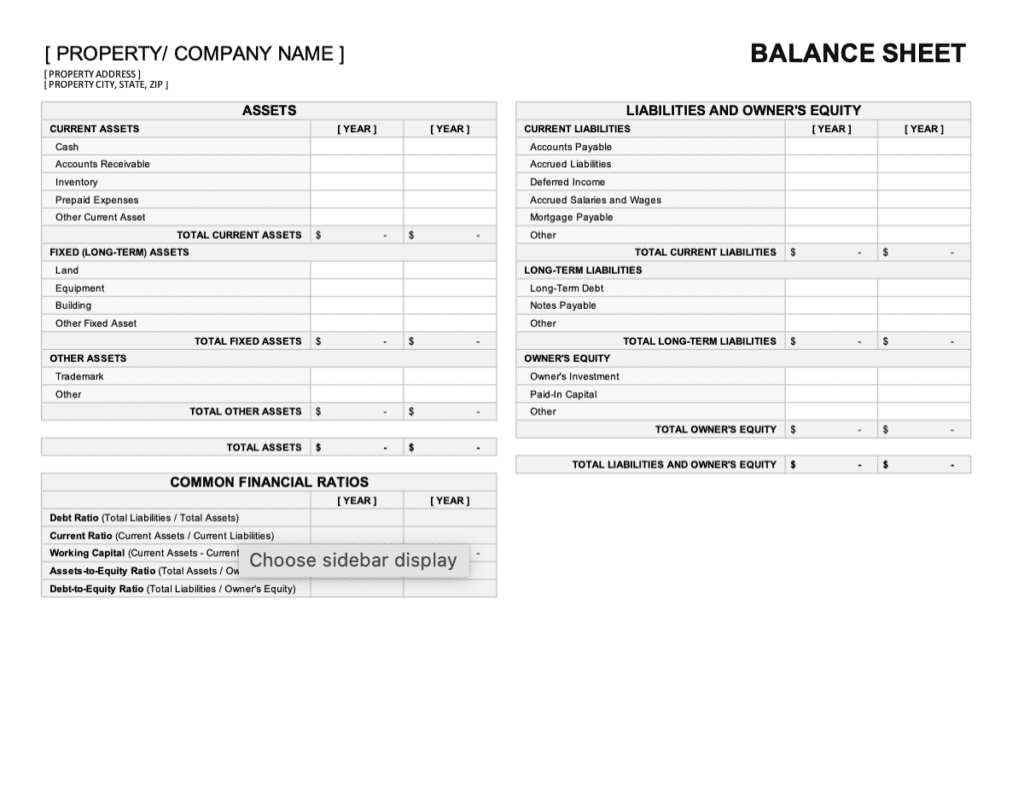

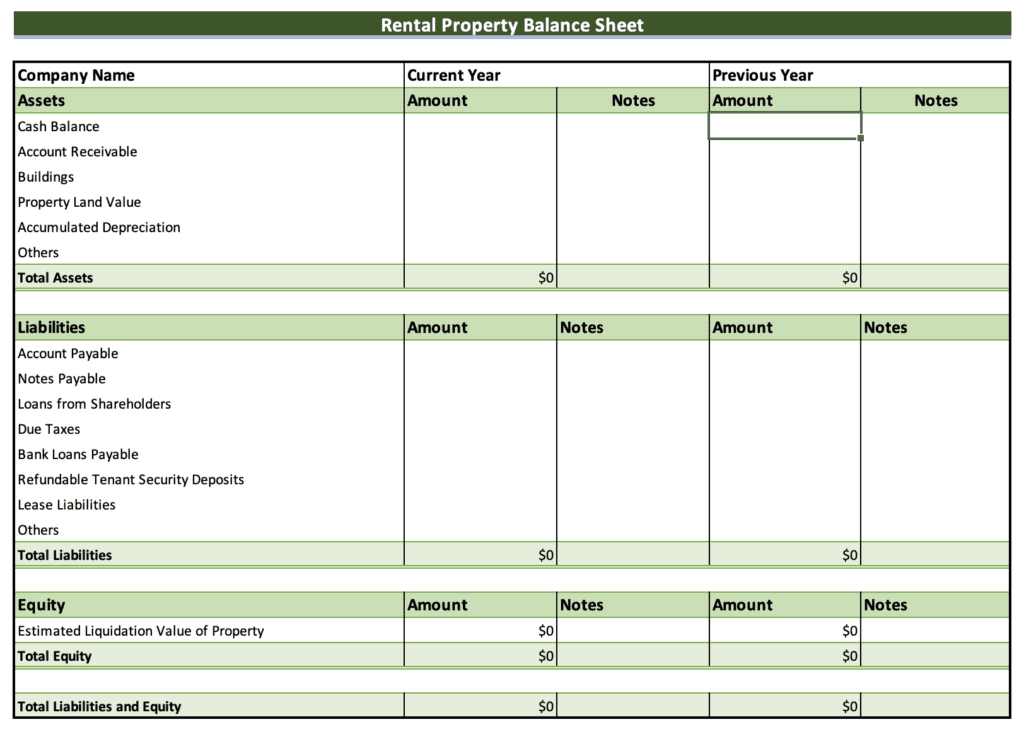

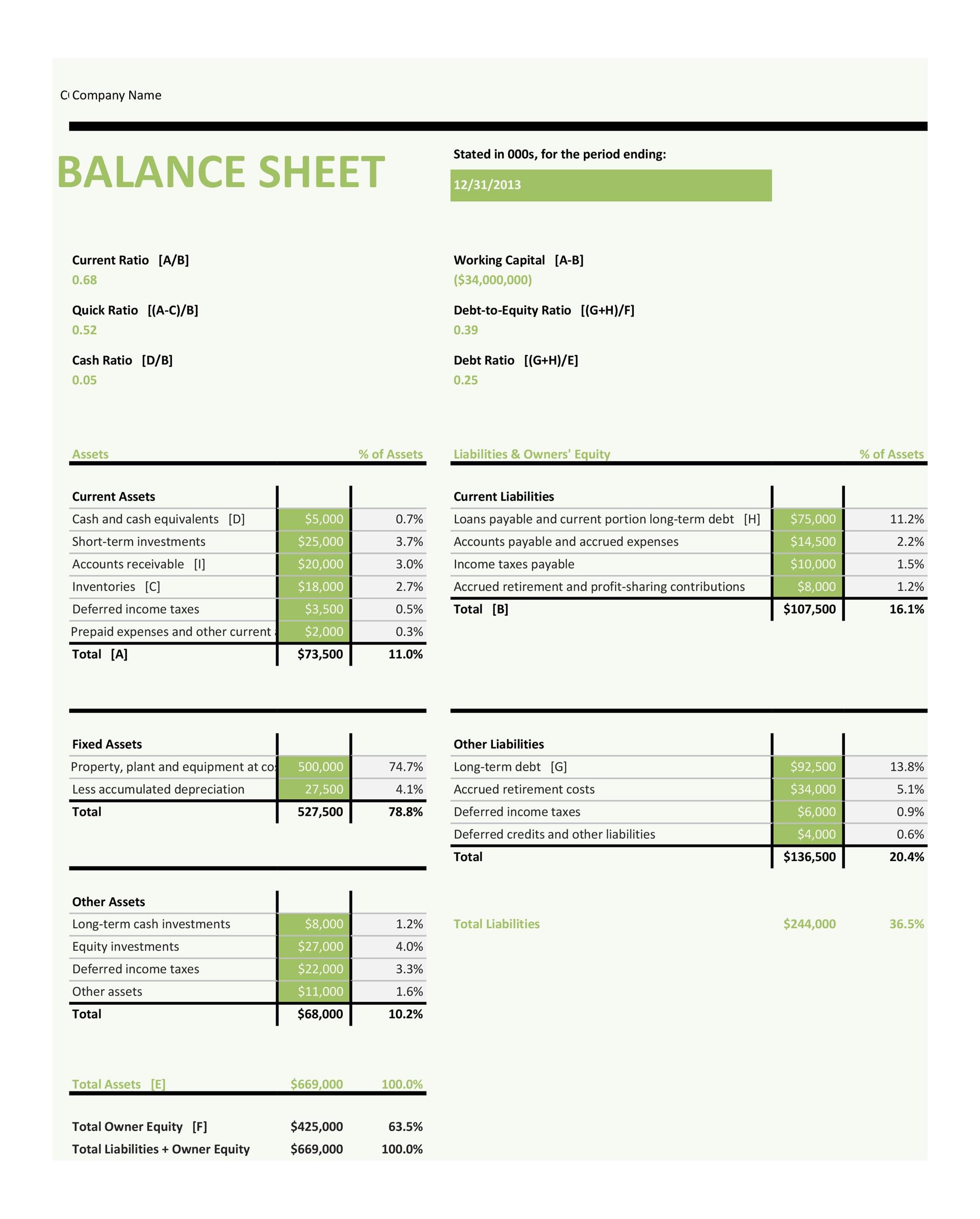

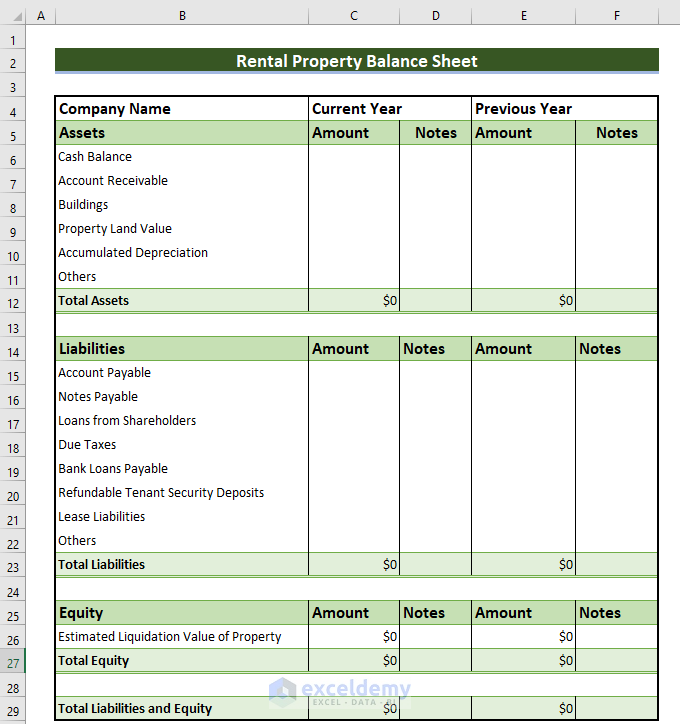

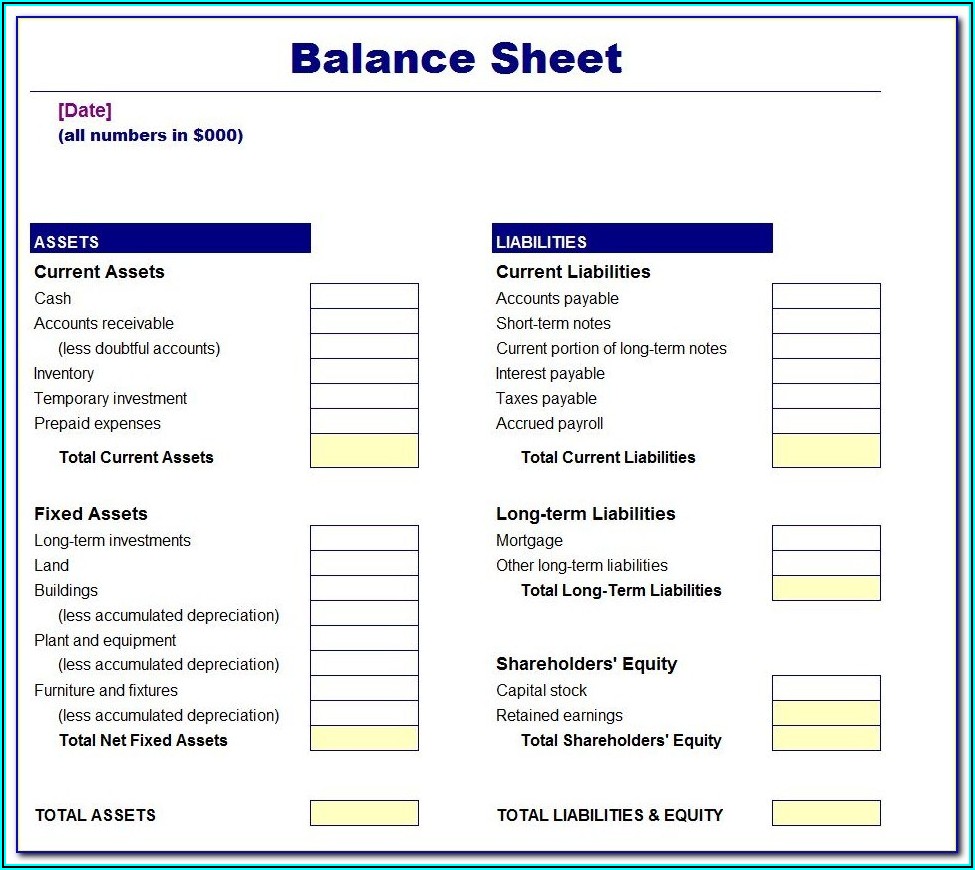

Advance rent in balance sheet. In some cases, suppliers may require this advance payment to ensure the customer will pay them later. Shows it as a liability in the current balance sheet under the head “current liabilities“. Likewise, the company needs to record the rent paid in advance as the prepaid rent (asset) in the journal entry.

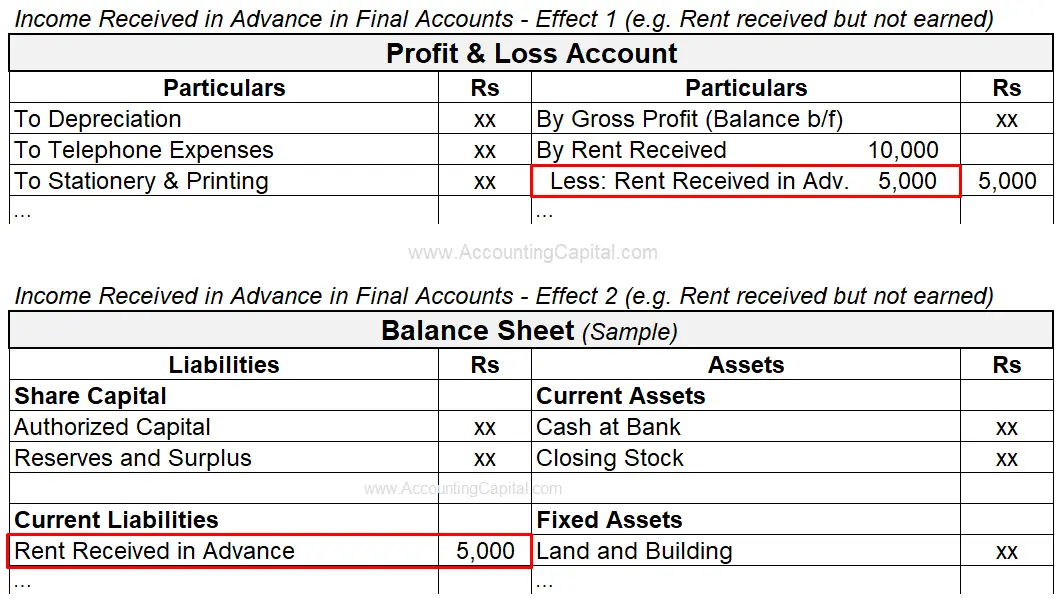

In addition, prepaid rent is recorded on the balance sheet as an asset or liability depending on the nature of the transaction. While preparing the trading and profit and loss a/c we need to deduct the amount of income received in advance from that particular income. The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet.

The adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). Rent, as an expense, is recorded on the income statement and affects the equity section of the balance sheet, but it is not classified as a current liability. Rent received in advance is the amount of rent received before it was actually due, however, the related benefits equivalent to the advance received are yet to be provided to the tenant.

When a company receives money in advance of earning it,. In this case, the accounting equation for the rent received in advance is as below: In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and then charge it to expense.

It has a prepaid rent of 3,000. Amount (cr.) the income received in advance a/c appears on the liabilities side of the balance sheet. Let’s assume that in the month of march 10,000 are received in advance for rent, the rent actually belongs to the month of april.

Furthermore, rent received in advance is deducted from the amount of rent in the income and expenditure account and thereafter the amount received in advance is posted on the liability side of the balance sheet. Yes, prepaid rent is considered an asset in accounting. This prepaid amount is recorded as an asset on the balance sheet.

Refer to the first example of prepaid rent. A concern when recording prepaid rent in this manner is that one might forget to shift the asset into an expense account in the month when rent is. Only two expenses are usually larger than rental expense:

If you receive it in 2023, it is income in 2023. Such an intake of money belongs to the future accounting period. Rent paid in advance means the payment of any rent obligation prior to the rental period in which it is due.

Prepaid rent is an amount for rent which has been paid in advance. It is an example of prepaid expense. Usually, it encompasses the customer’s commitment to initiating a contract.

Presentation in the financial statements it is shown on the debit side of an income statement (profit and loss account) example on the 15th of march, unreal corporation paid a rent of 10,000 (in cash). If they will be earned within one year, they should be listed as a current liability. As in the example above, we can make the accounting equation for rent received in advance on december 28, 2020, as below: