Supreme Tips About Cash Paid For Equipment Would Be Reported In The Statement

![[Solved] STATEMENT OF CASH FLOWS 1. The following is a balance sheet](https://media.cheggcdn.com/media/02d/02de0eed-7409-47e1-8241-2802017e5d99/phpnDASFP)

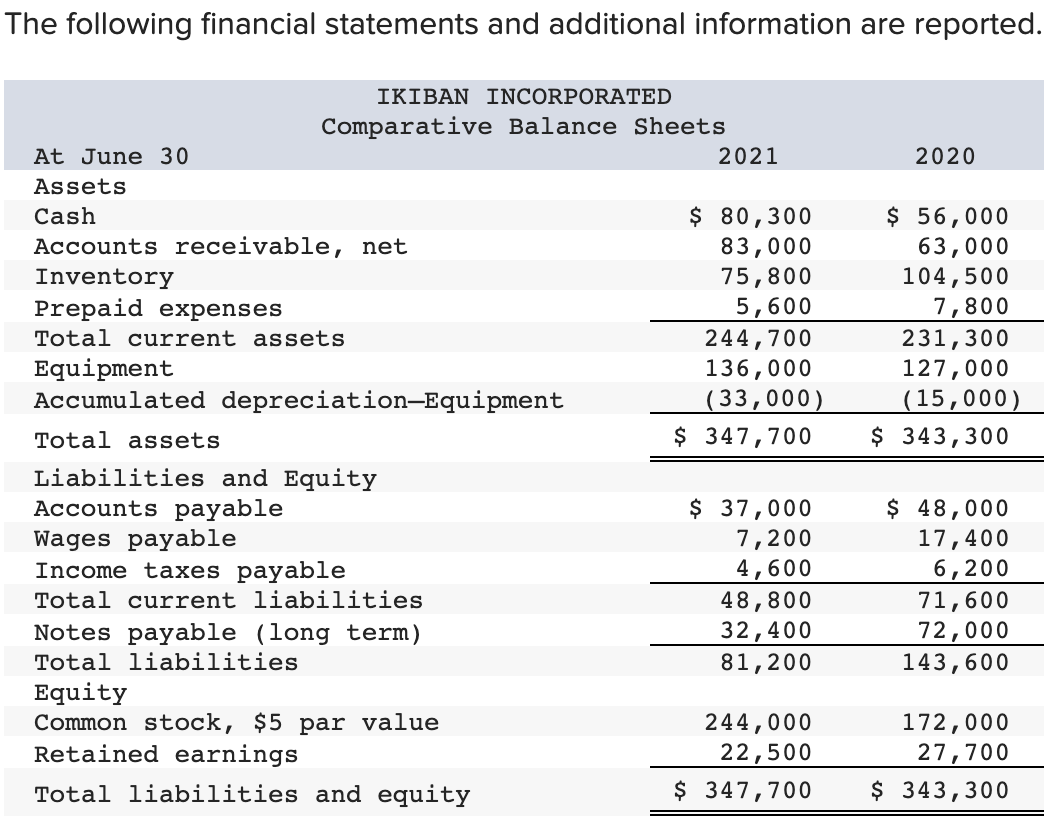

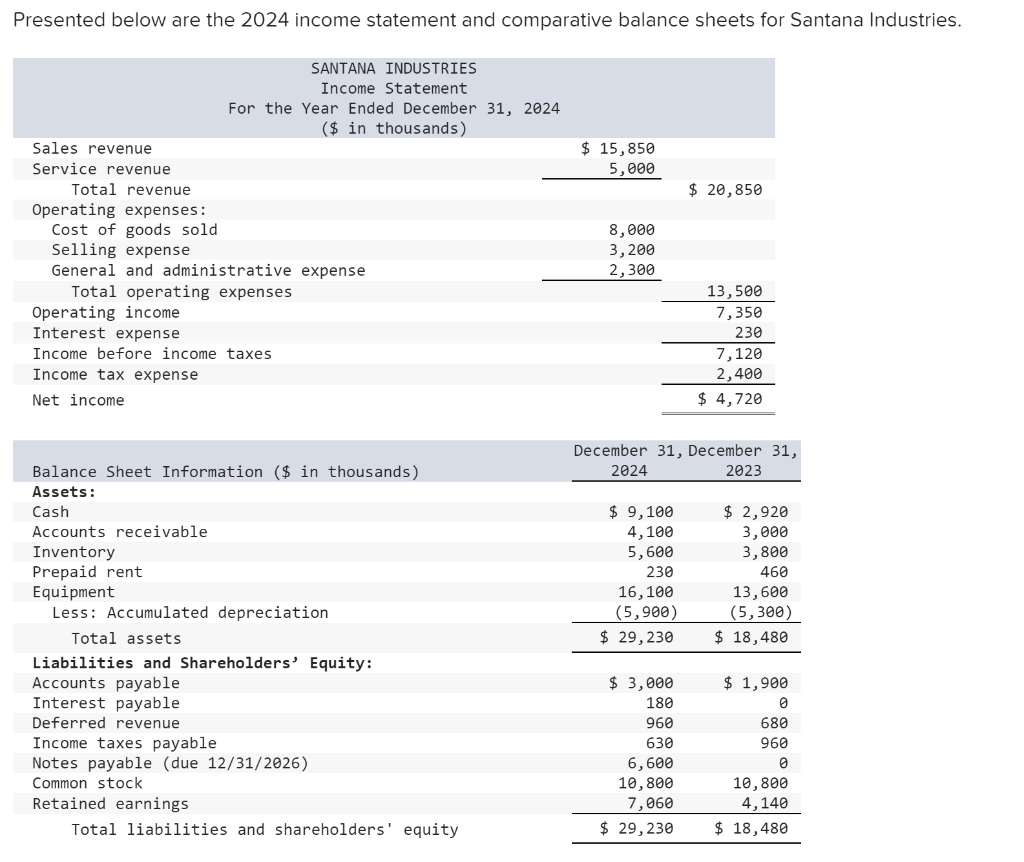

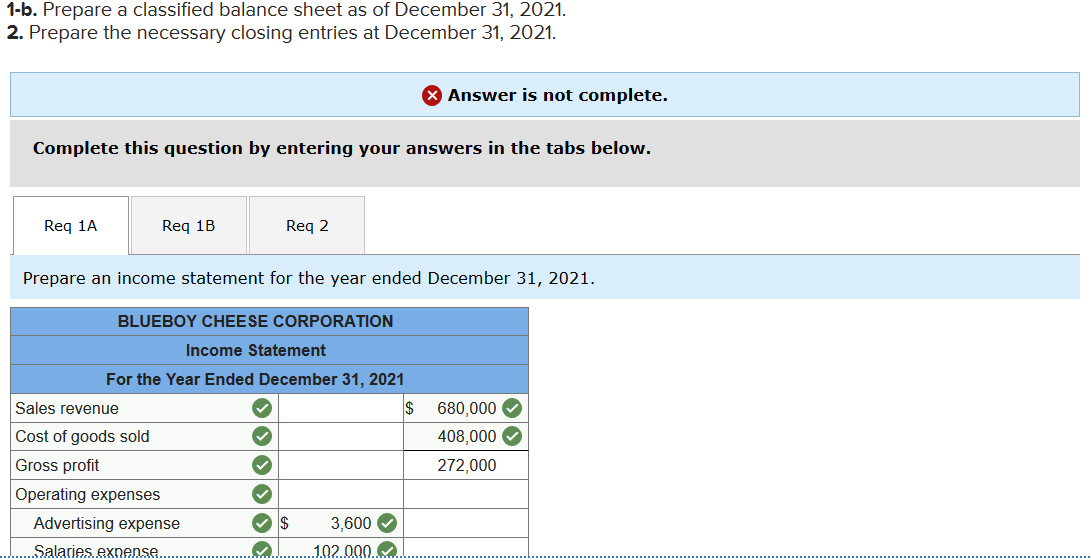

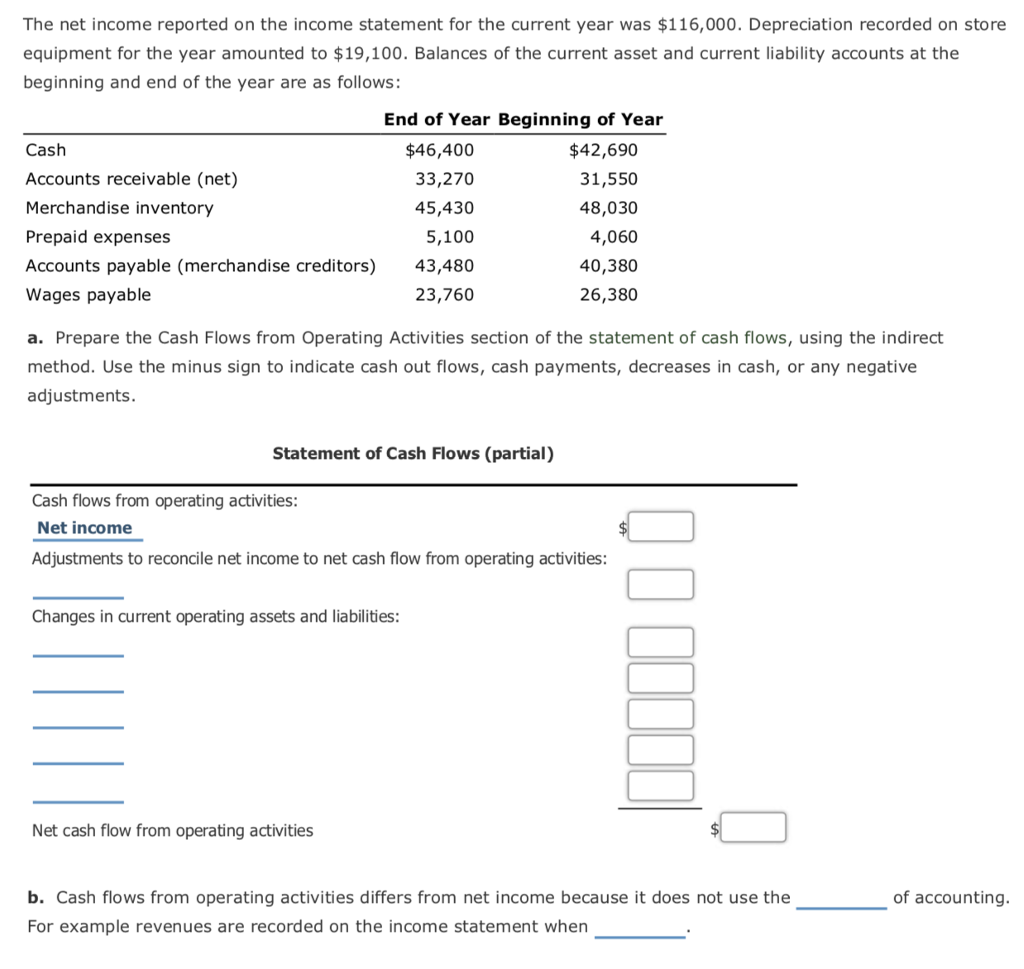

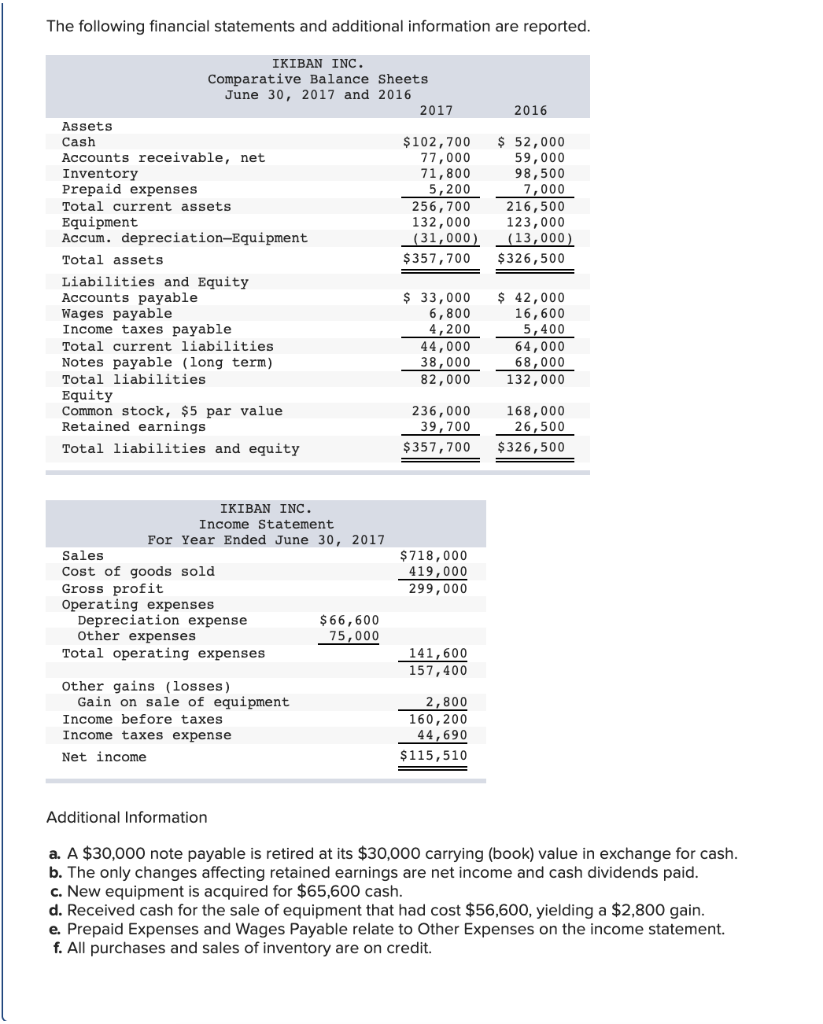

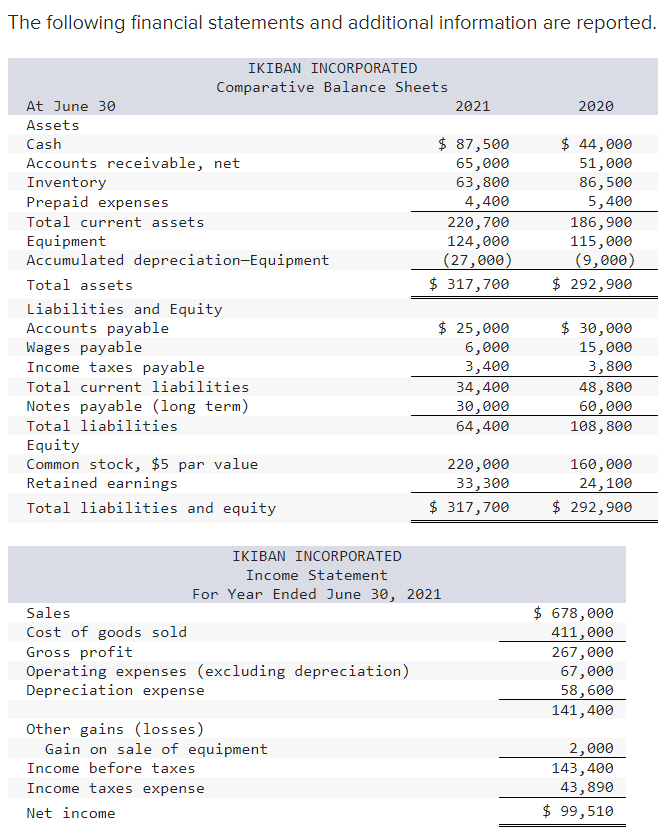

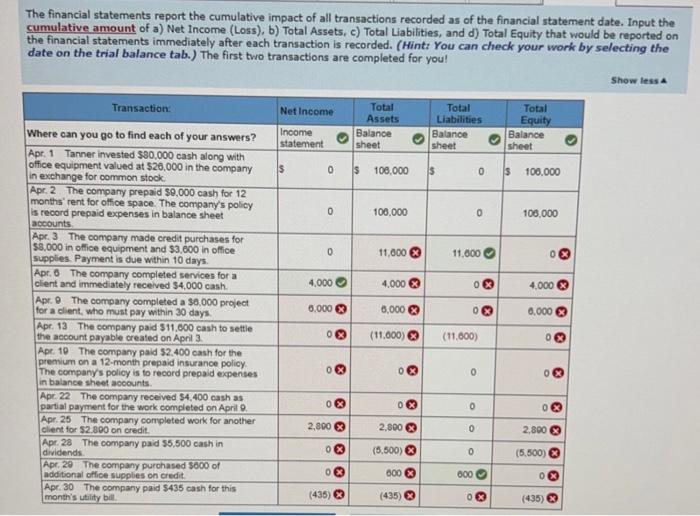

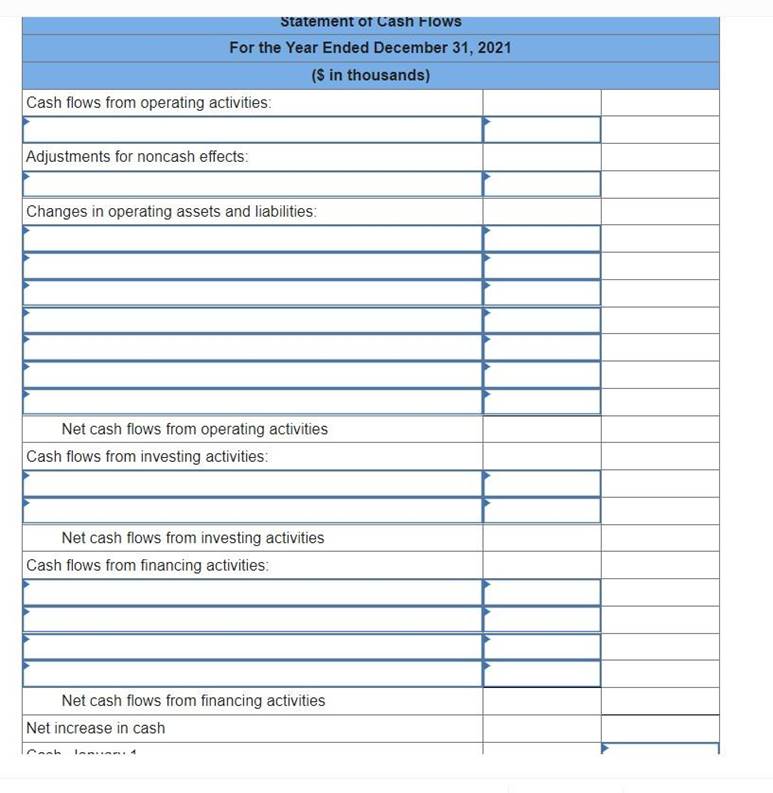

The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive.

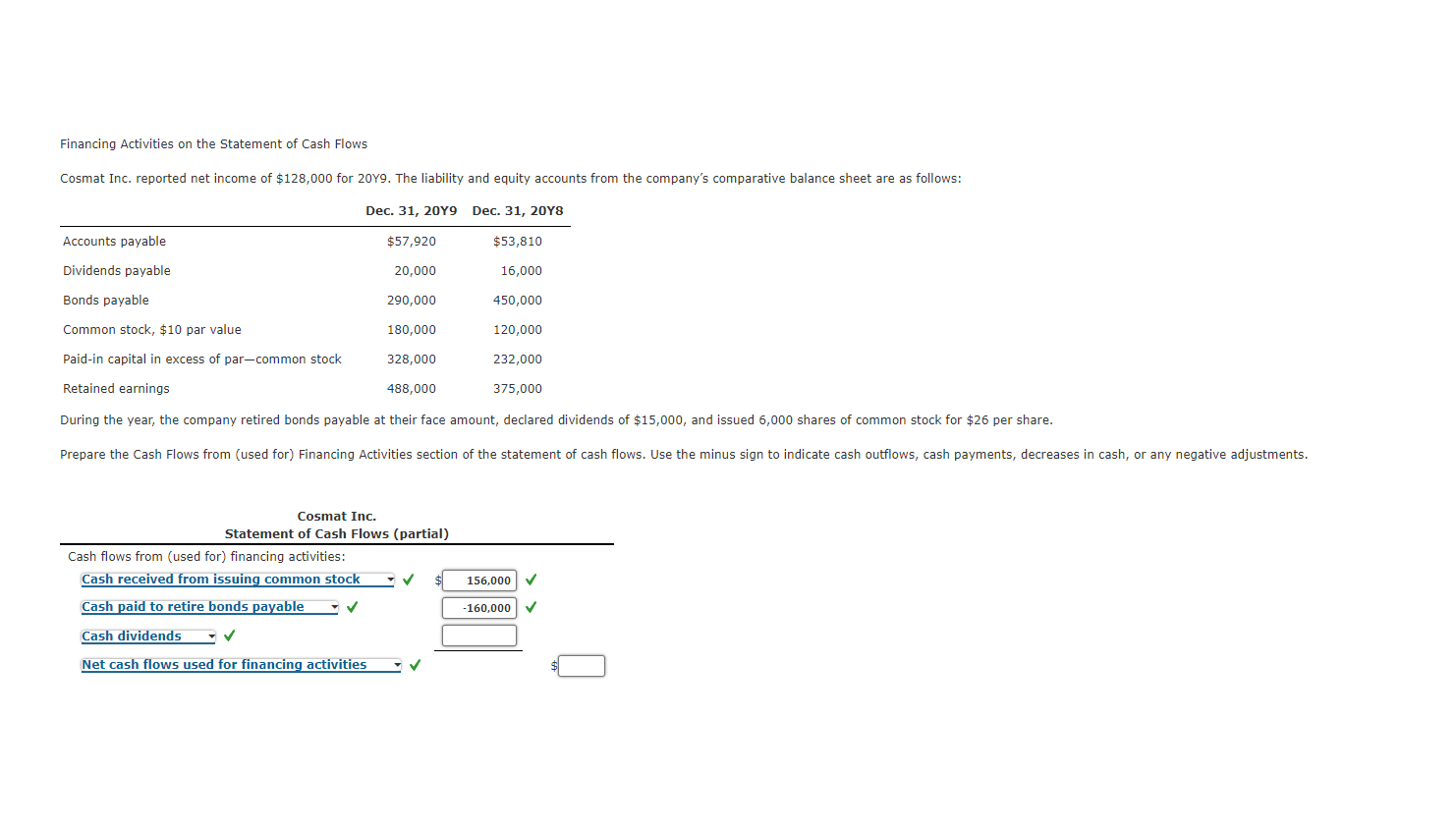

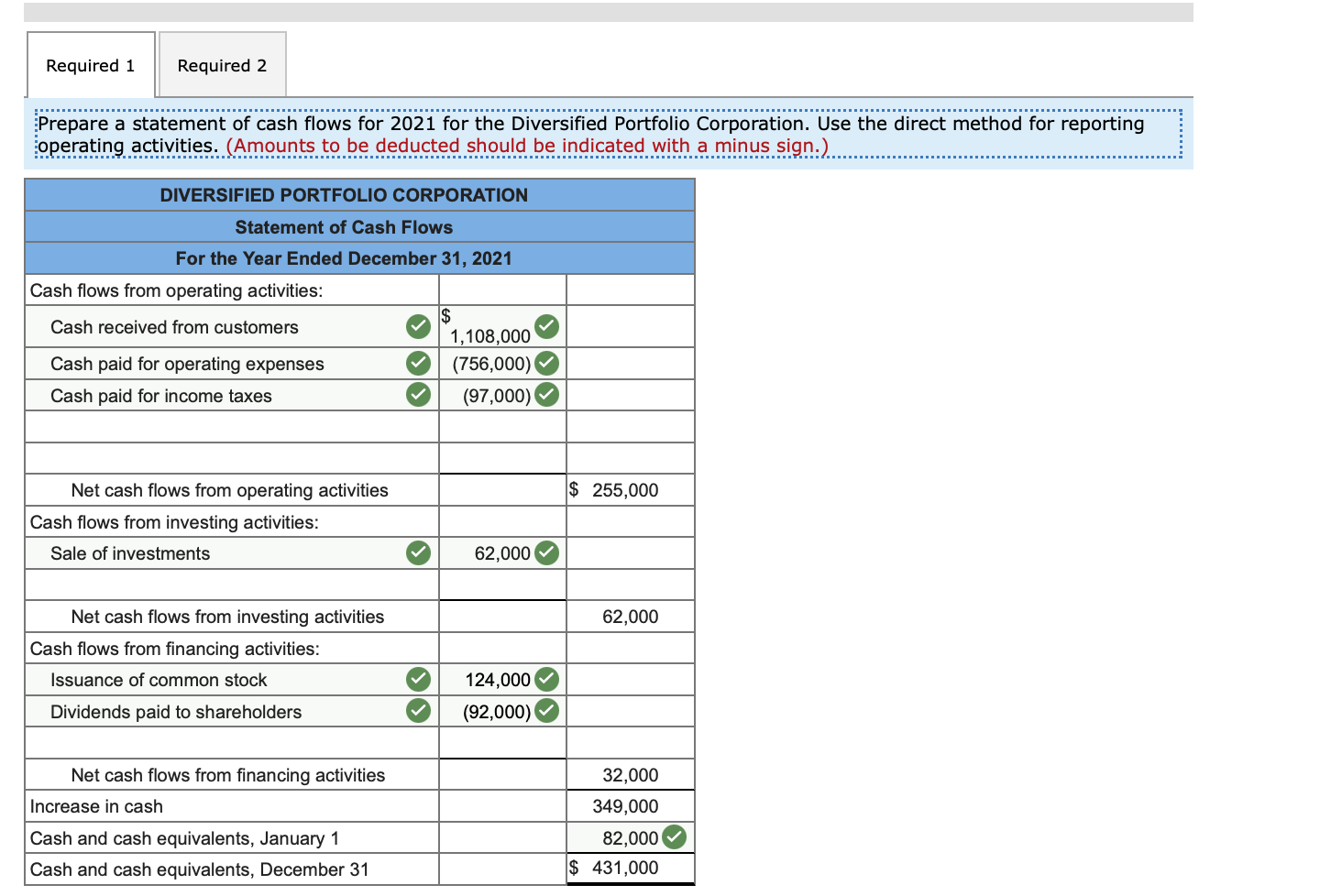

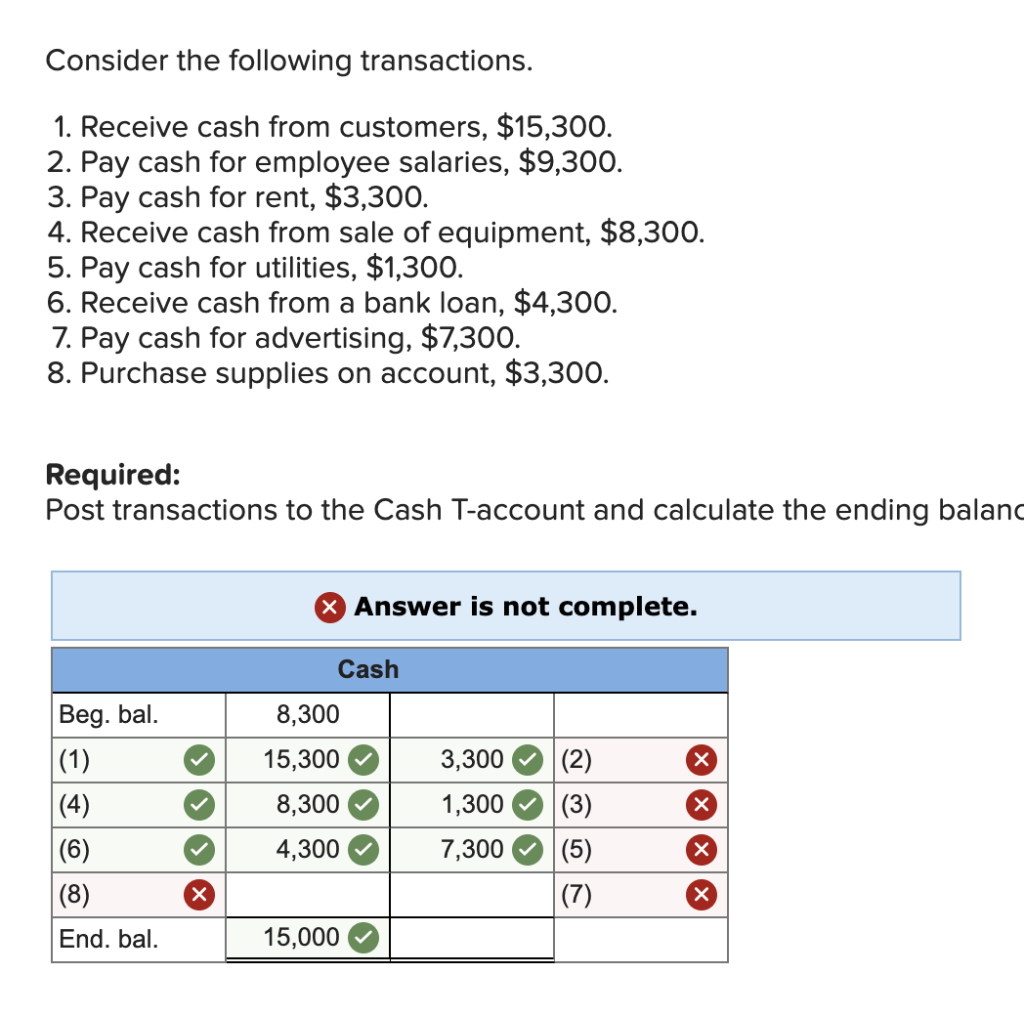

Cash paid for equipment would be reported in the statement. The cash flow statement is reported in a straightforward manner, using cash payments and receipts. The cash paid for the purchase of equipment during the year is $27,000, and the proceeds from the sale of equipment during the year are $16,750 (= $9,500 cost +. The statement of cash flows is prepared by following these steps:

The state ag’s office said that when factoring in pre. New york (ap) — on the witness stand last year, donald trump proclaimed:

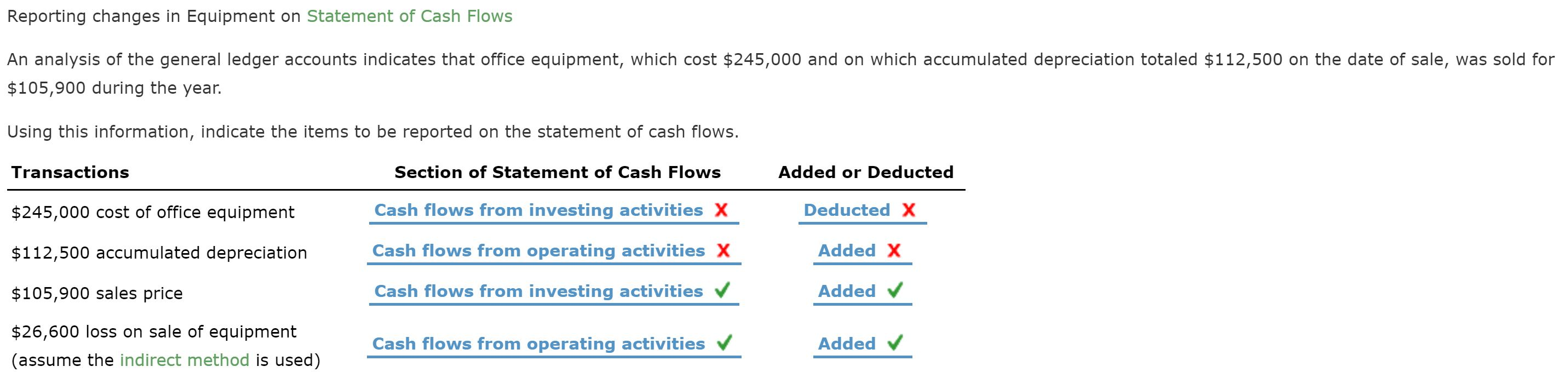

The cash paid for the new equipment exceeded the cash received for the old equipment. First, the purchase of equipment for $67,000 cash is shown as a decrease in cash. The civil fraud ruling on donald trump, annotated.

Using the indirect method , actual cash inflows and. Accounting questions and answers. Using the indirect method, operating net cash.

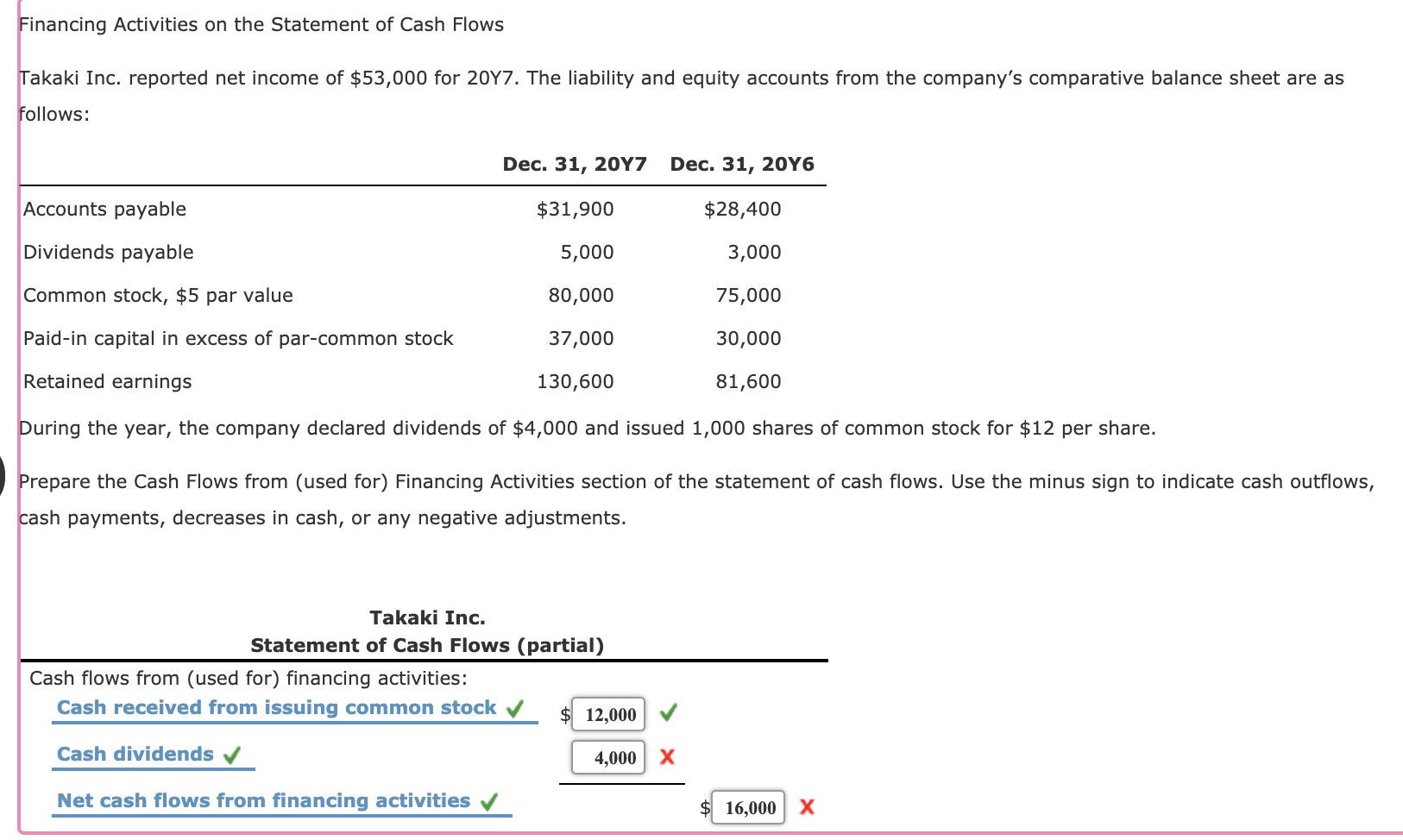

The cash flows from operating activities section. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the. Determine net cash flows from operating activities.

Cash paid for equipment would be reported on the statement of cash flows in. Determine net cash flows from operating activities. How should these equipment transactions be reported in canary's statement of cash.

A.the cash flows from (used for) investing activities section. The statement of cash flows is prepared by following these steps: Cash paid for equipment would be reported in the statement of cash flows in a.

Trump was penalized $355 million plus interest and banned for three years from. Second, the sale of equipment for $5,000 is shown as an increase in. In the reporting period in which the purchase was made, the transaction is also reported on the firm’s statement of cash flows, within the cash flows from investing.

Accounting questions and answers. C.a separate section of noncash investing and financing. There are two different ways of starting the cash flow statement, as ias 7, statement of cash flows permits using either the 'direct' or 'indirect' method for operating activities.

Determine net cash flows from operating activities using the indirect method, operating net cash. For example, the cash received from the sale of property, plant, and equipment at a gain, although reported in the income statement, is classified as an investing activity, and the. B.the cash flows from (used for) financing activities section.