Awesome Info About Balance Sheet Show

Assets, liabilities, and owners’ equity taking stock of your investments.

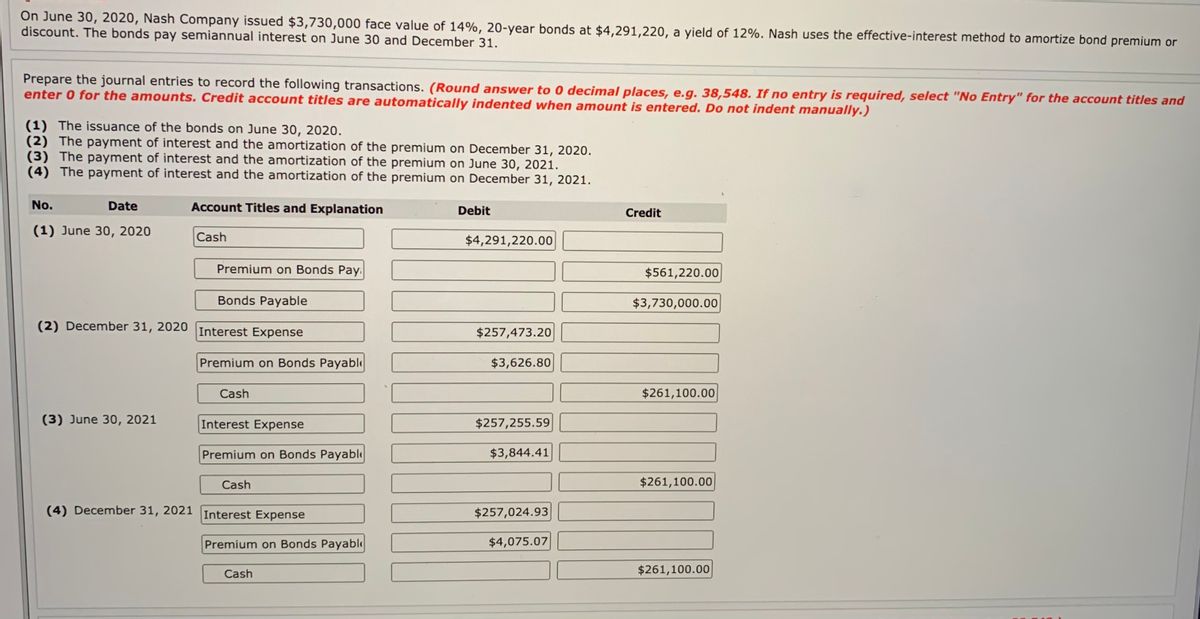

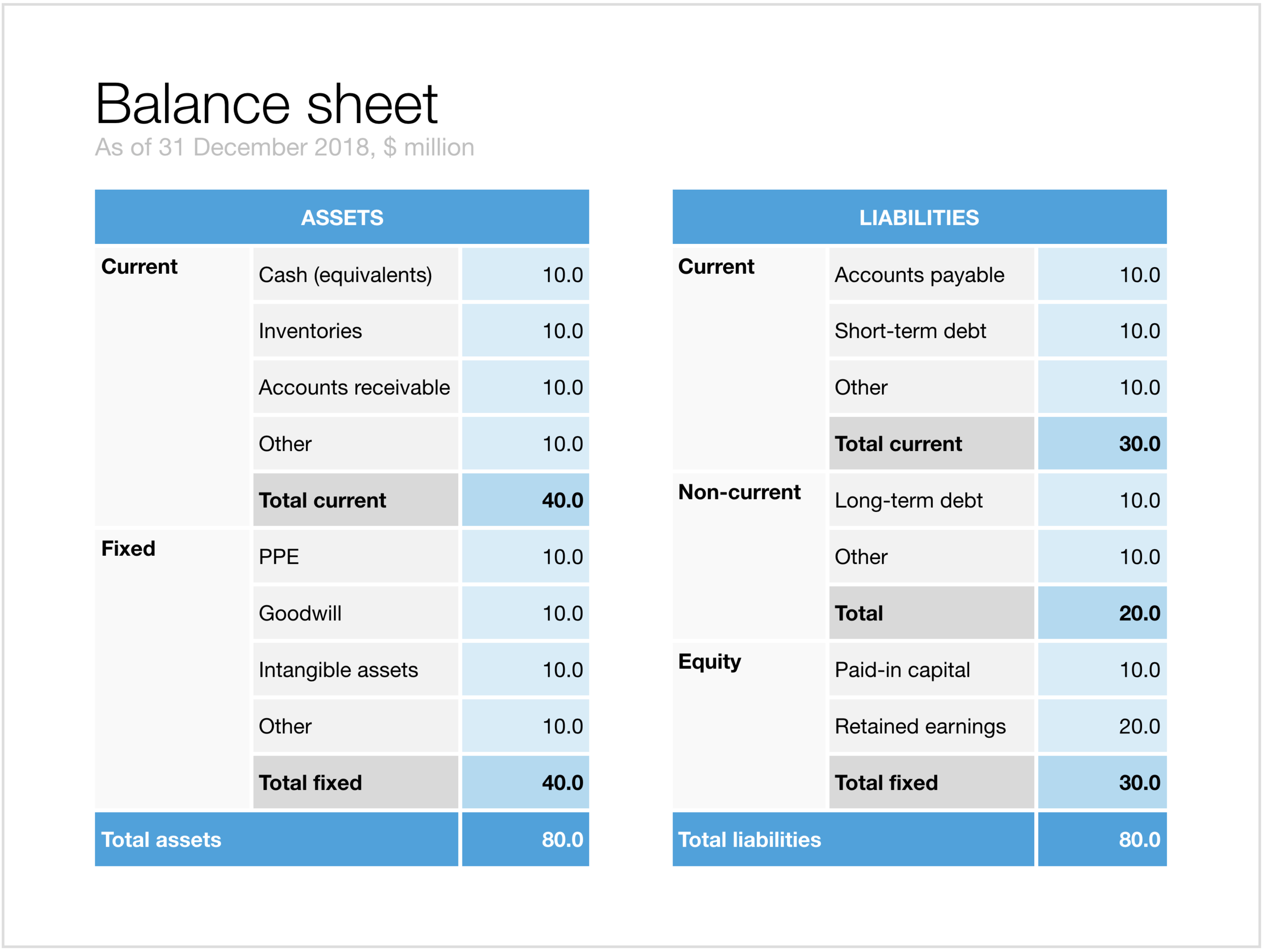

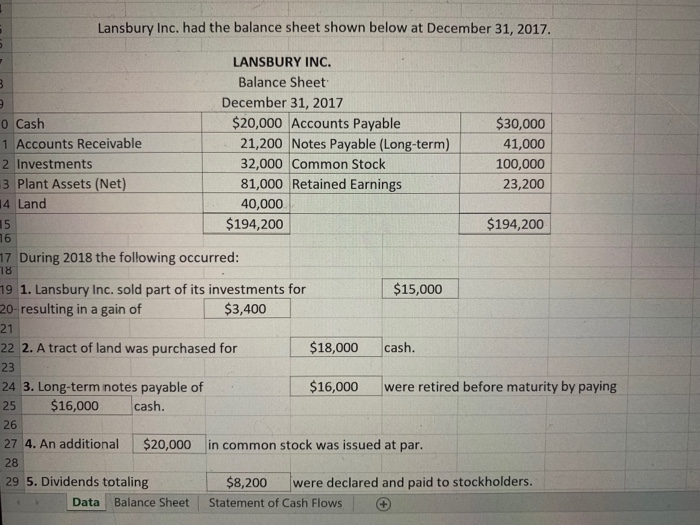

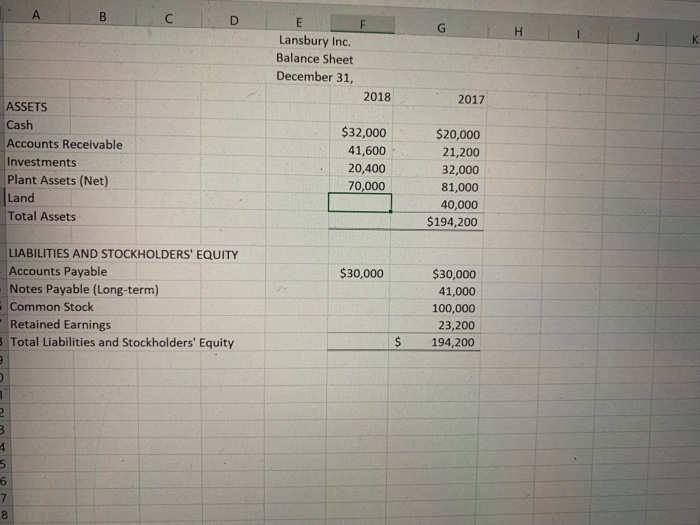

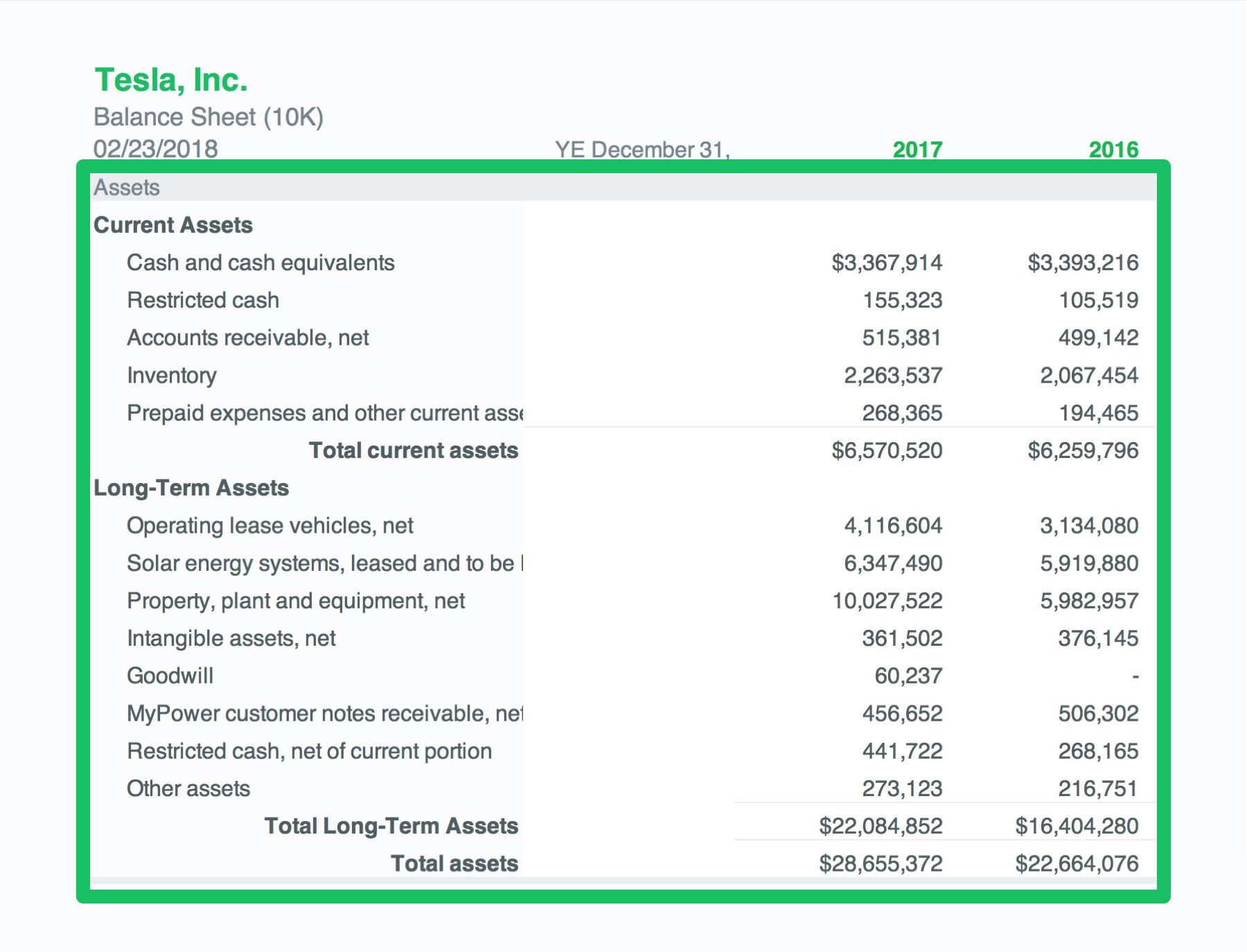

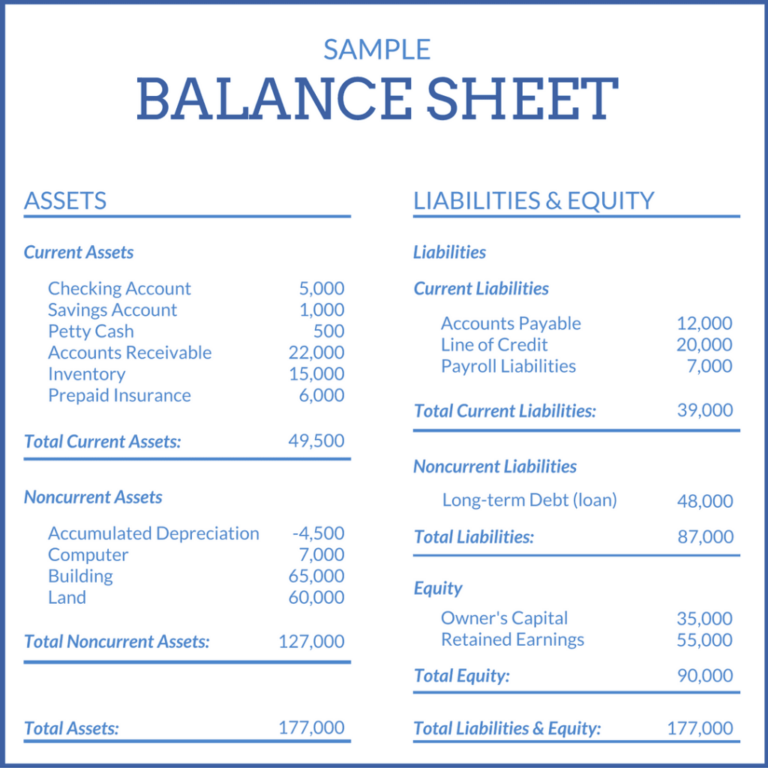

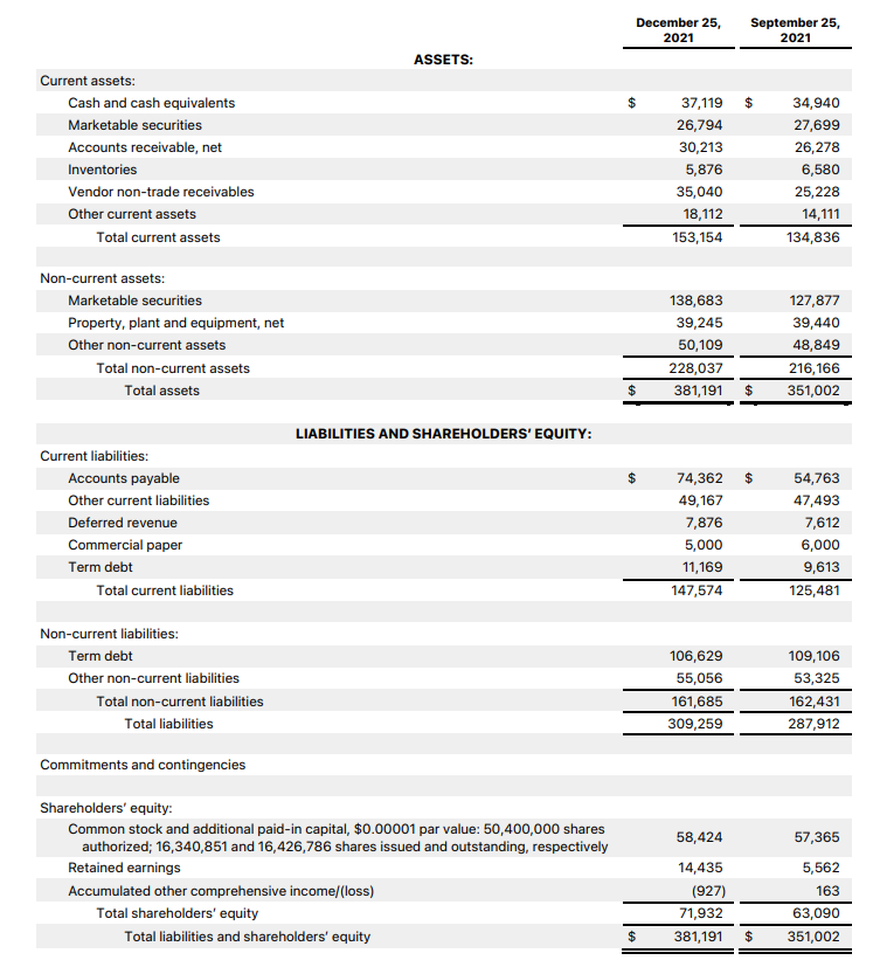

Balance sheet show. In the balance sheet report, double click (quick zoom) the inventory asset amount to open the transaction by account detail report. Liabilities are obligations to creditors, lenders, etc. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

It can also be referred to as a statement of net worth or a statement of financial position. Your balance sheet shows what your business owns (assets), what it owes (liabilities), and what money is left over for the owners (owner’s equity). These three core statements are intricately linked to each other and this guide will explain how they all fit together.

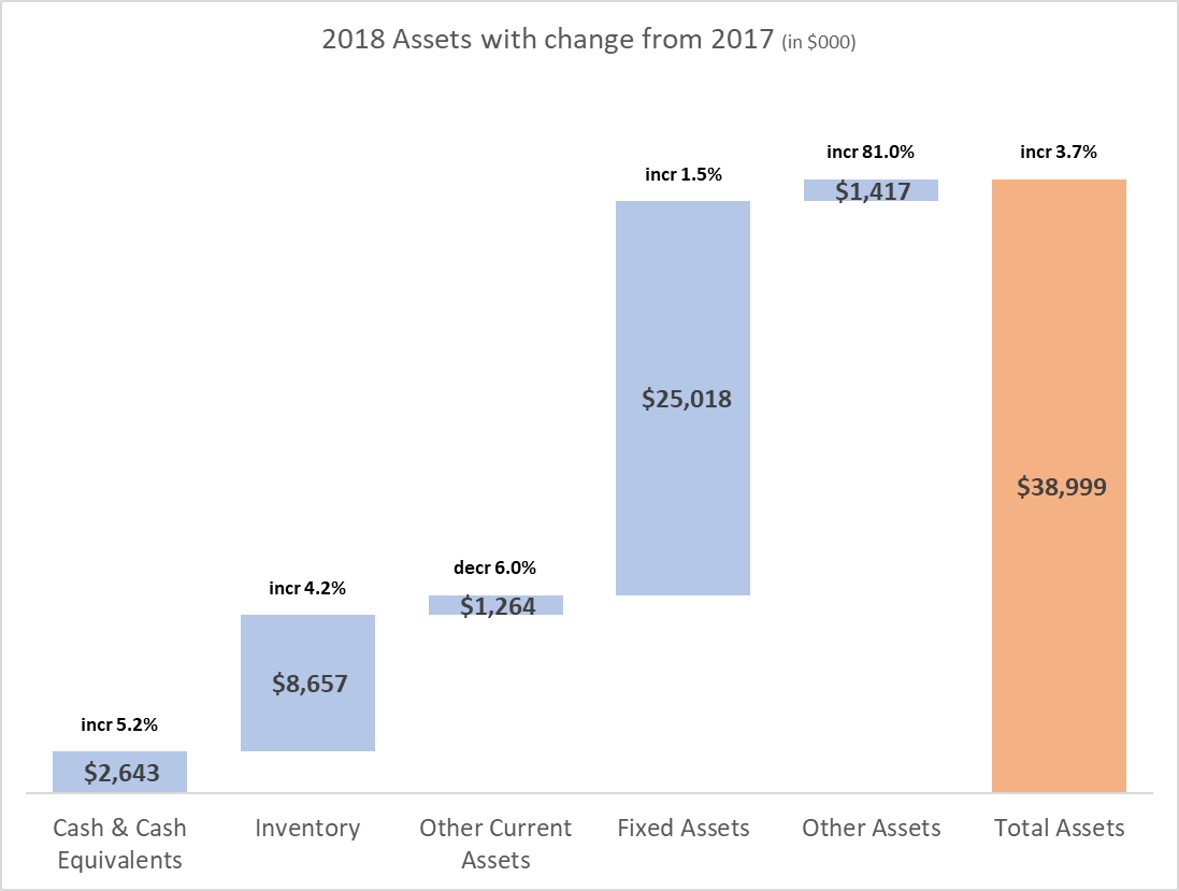

How much the company owes what’s left when you subtract liabilities from assets a balance sheet only shows you a company’s financial status at one point in time. The balance sheet shows how cash flows throughout your finances and points to ways in which you can improve your company’s financial health. It summarizes a company’s financial position at a point in time.

Officials agreed that the deeper. It records the assets and liabilities of the business at the end of the accounting period after the preparation of trading and profit and loss accounts. A balance sheet is a financial statement that shows you three things about a company:

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. The cash flow statement shows cash movements from operating, investing, and financing activities. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

Assets refer to properties owned and controlled by the company. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth). The balance sheet is one of the three core financial statements that are used to.

And capital represents the portion left for the owners of the business after all liabilities are paid. Outweighs the risks of keeping borrowing costs elevated for too long. Assets = liabilities + equity.

The company’s balance sheet is an accounting report that shows a company’s assets, liabilities, and shareholders’ equity. A balance sheet is a comprehensive financial statement that gives a snapshot of a company’s financial standing at a particular moment. A balance sheet summarizes the assets, liabilities, and capital of a company.

Profit and loss statement (income statement) Vertical balance sheets show assets at the top, with the balance sheet’s liabilities and shareholders’ equity sections presented below. Examples, formula, & how to read | britannica money investing the corporate balance sheet:

The balance sheet is a statement that shows the financial position of the business. The fed kept its target rate unchanged between 5.25 and 5.50 per cent when it last met and suggested rates had. A balance sheet covers a company’s assets as defined.