What Everybody Ought To Know About Frs 102 Cash Flow

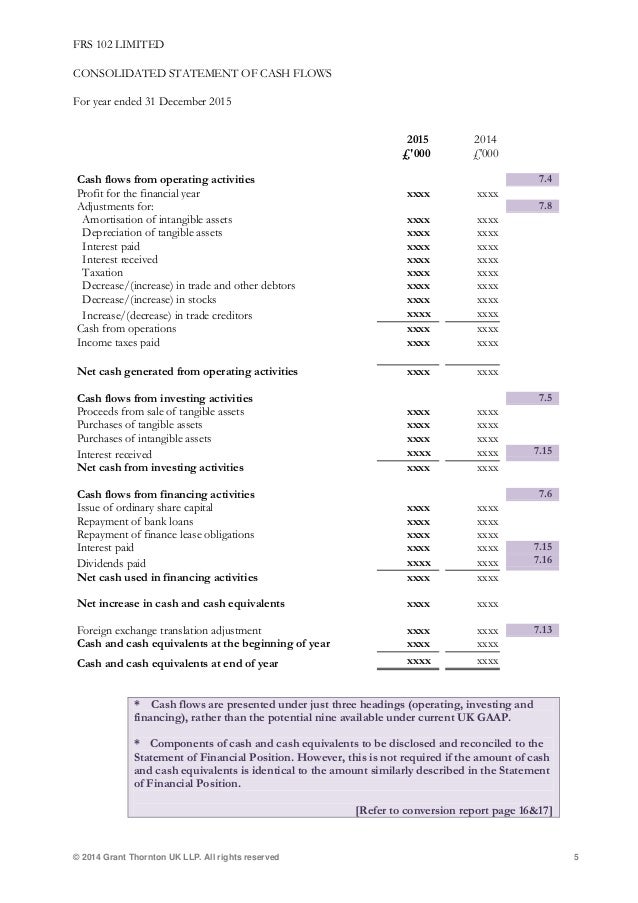

The statement of cash flows this article sets out the requirements under the new standard and the differences between frs 102 and the previous standard, frs 1.

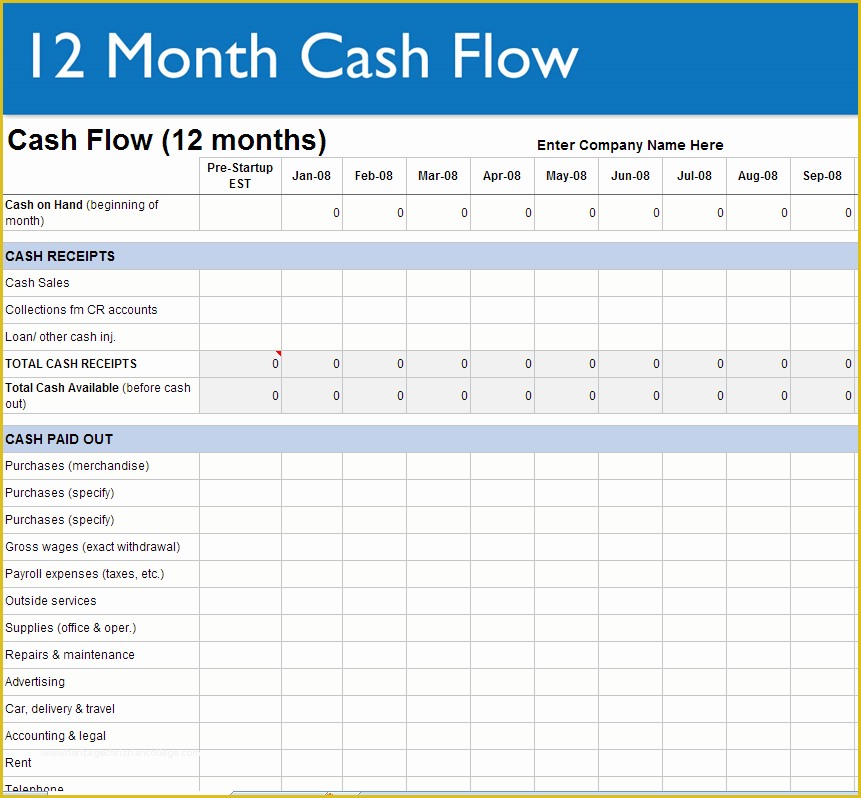

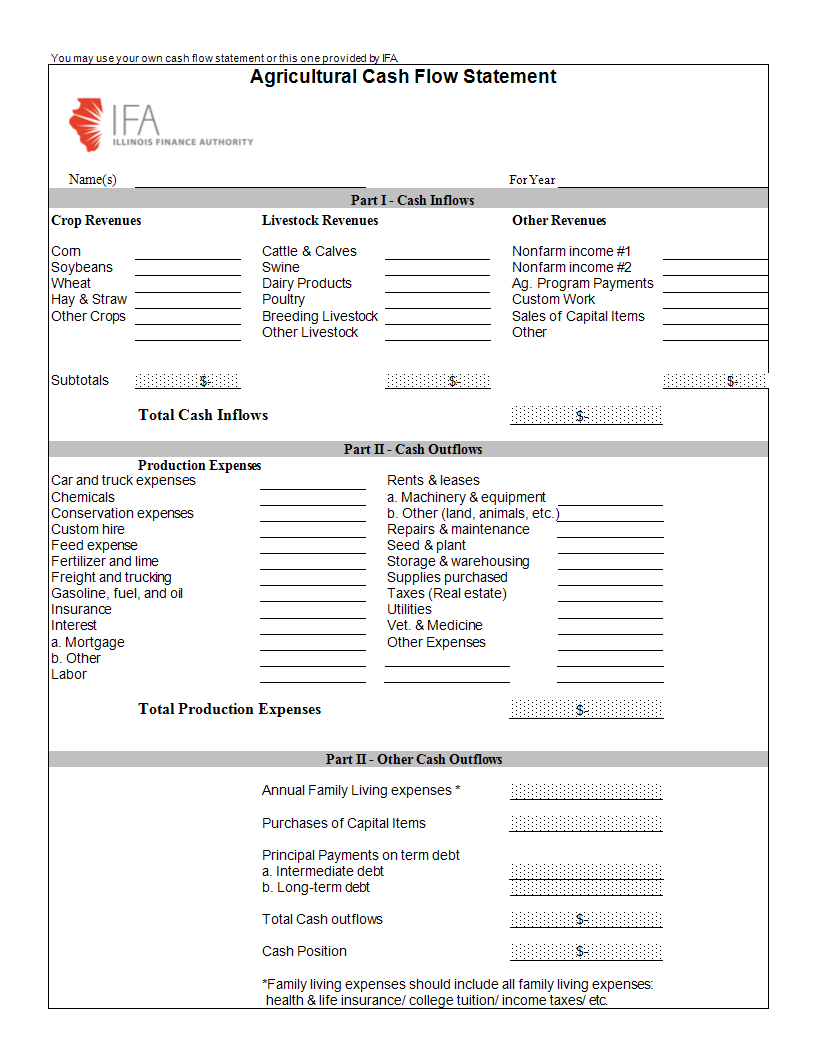

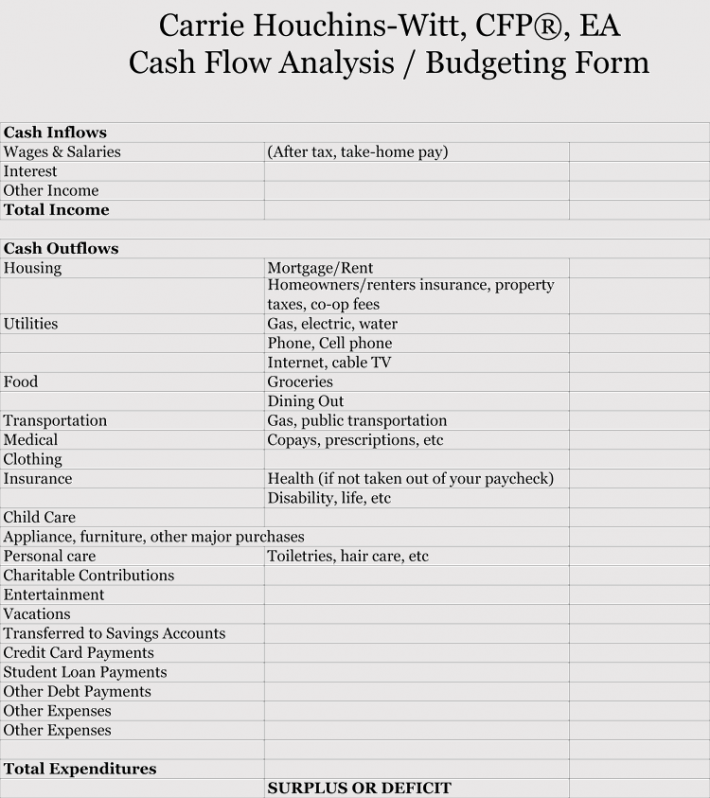

Frs 102 cash flow. Frs 102 factsheet 3: Operating activities investing activities financing activities. Under the small entity provisions within s1a of frs 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement.

Frs 102 the financial reporting standard applicable in the uk and republic of ireland (january 2022) publication date: [1] a qualifying entity is a member of a group where. 41 rows overview frs 102 “the financial reporting standard applicable in the uk and republic of ireland” (link to frc website) is a single coherent financial.

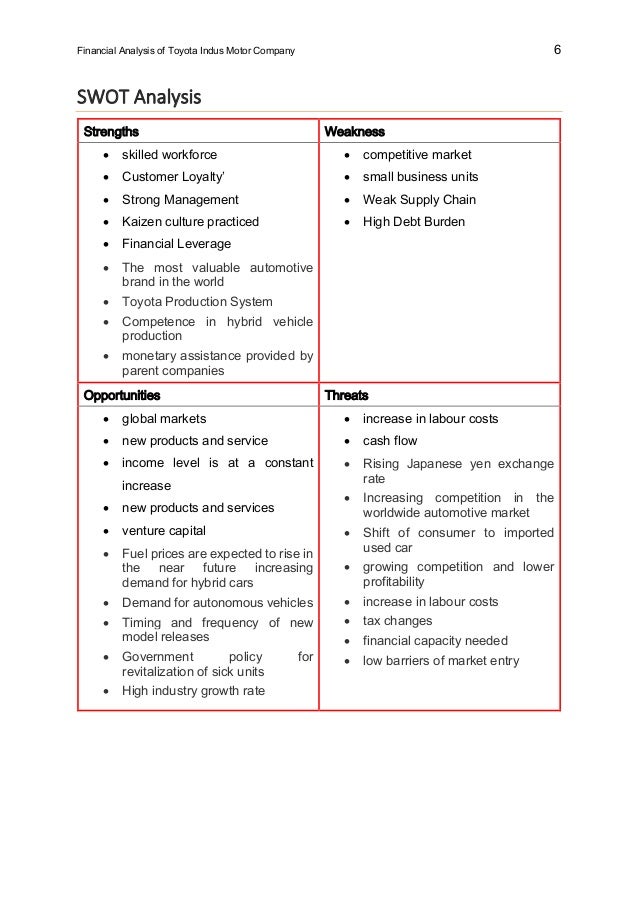

A summary of frs 102 the financial reporting standard applicable in the uk and republic of ireland, including information on disclosure exemptions, who should apply the. The boundary of a regulatory agreement is the latest future date at which an entity has a present right to recover a regulatory asset (ra) by increasing the. Private company (frs 102) framework and statutory requirements.

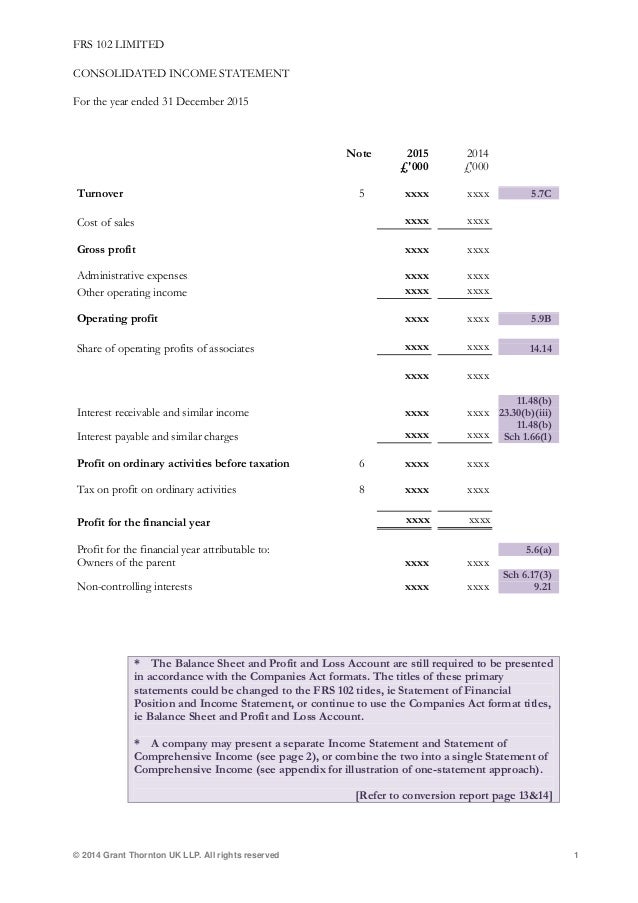

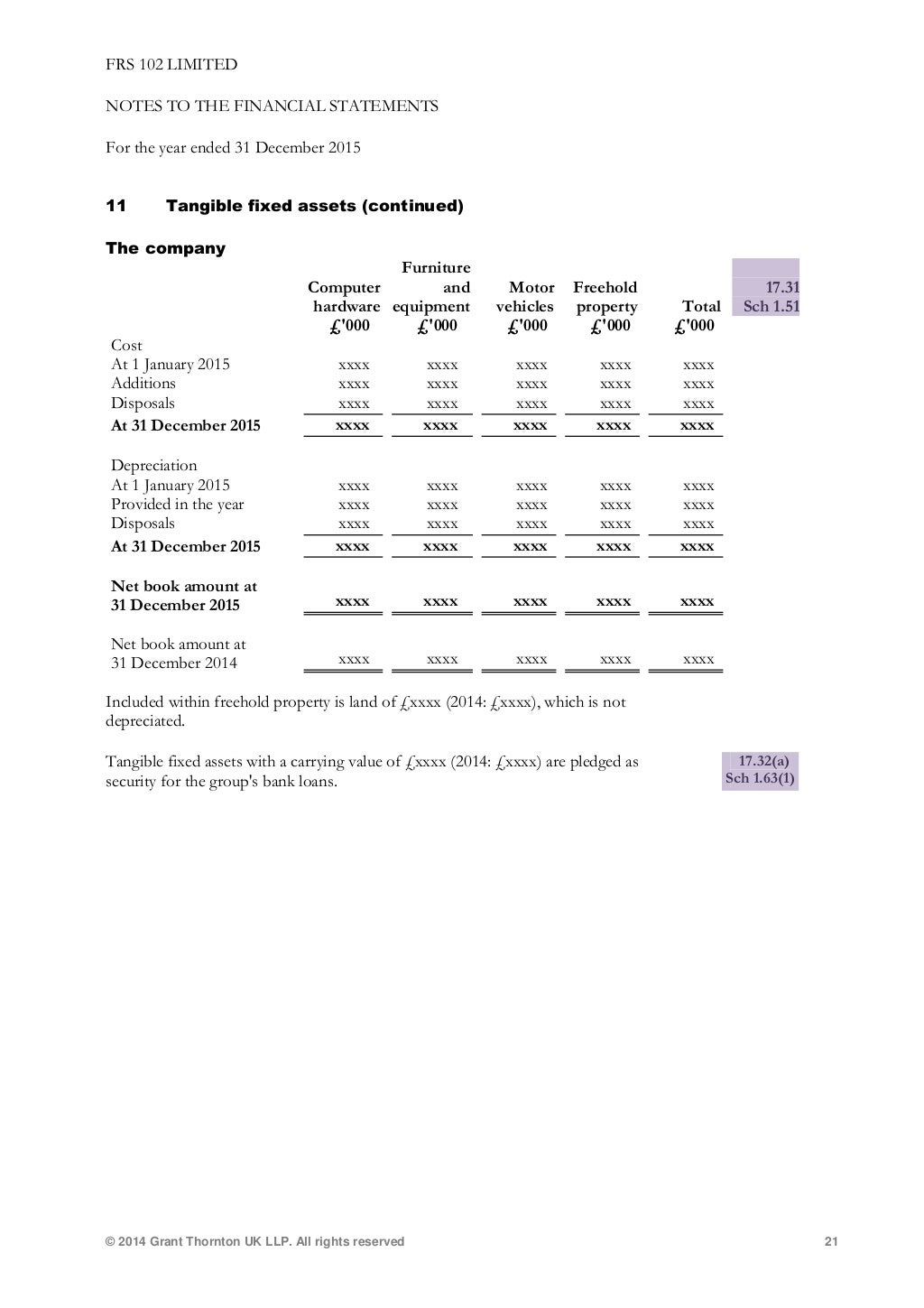

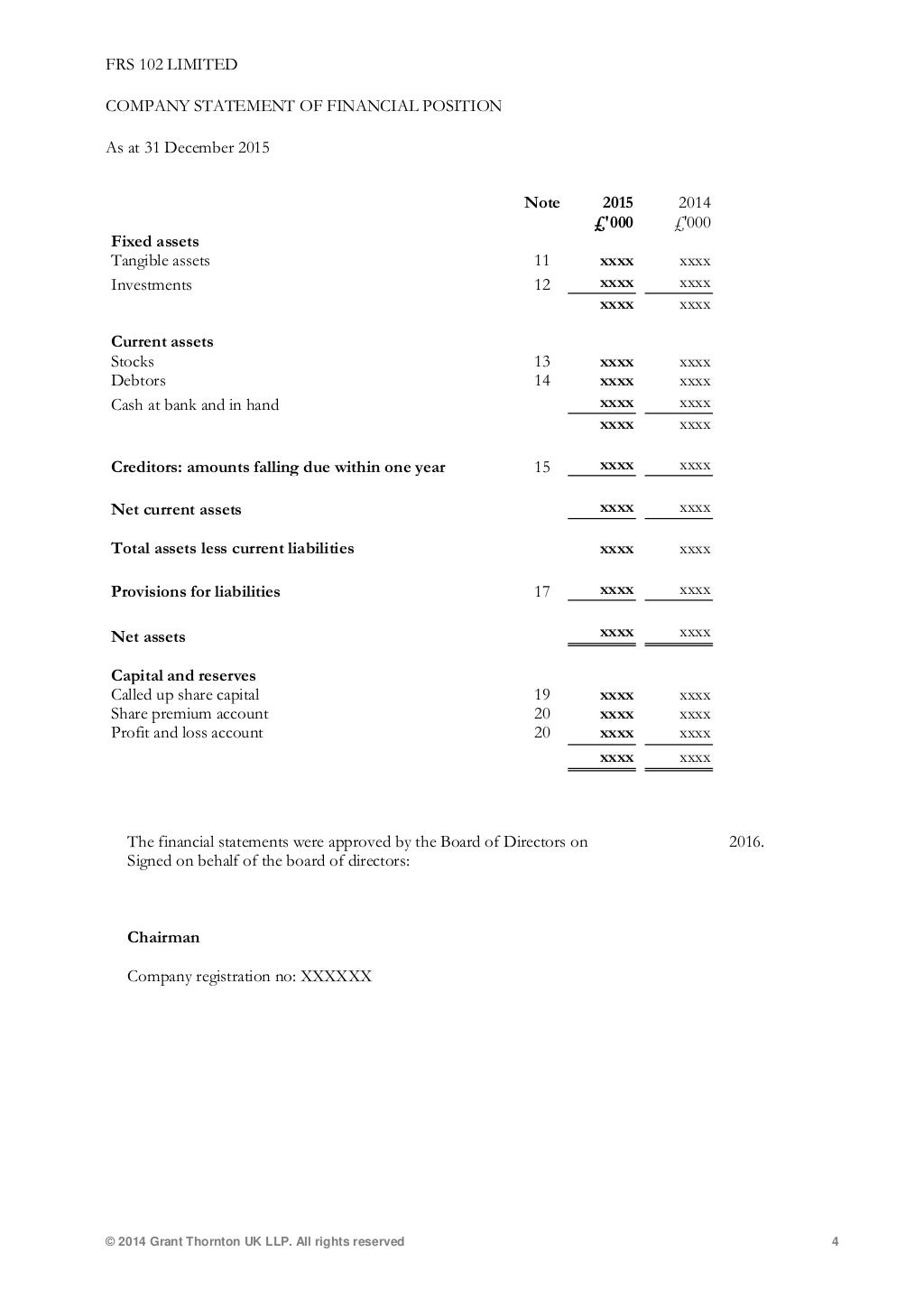

Learn how to prepare a cashflow statement under frs 102, the uk gaap standard for financial reporting. Example annual report under uk gaap (frs 102) introduction the example annual report that follows includes the financial statements of uk gaap group limited, a wholly. With the exception of amendments to frs 105 in respect of.

Frs 102 paragraph 12.18 sets out the conditions for hedge accounting. Statement of financial position (section 4) statement of comprehensive. Assess whether a cash flow statement is required under frs 102 for the various companies within a group.

Find out the structure, pitfalls, and errors of cashflow. An entity may apply hedge accounting to a hedging relationship from the date all of the following conditions. Paragraph 7.4 of frs 102 cites examples of cash flows from operating activities as follows:

The chapter covers companies act 2006 requirements, control relationships, accounting policies, accounting reference dates, overview of the consolidation process, consolidated. Frs 102, the financial reporting standard applicable in the uk and republic of ireland, has been in issuance since march 2013 and applies mandatorily for companies not. Operating activities investing activities financing activities the cash flow statement.

Frs 102 also has reduced disclosures for qualifying entities. Under the small entity provisions within s1a of frs 102 small companies who are not subsidiaries can claim exemption from preparing a cash flow statement. When deciding whether to apply ifrs, frs 101 or frs 102, management will need to consider the consequences.

Frs 102, section 7 presents the cash flow statement using three cash flow classifications: Section 7 to frs 102 requires the cash flow statement to be prepared using only three cash flow classifications: Learn the accounting and disclosure requirements for the cash flow statement under frs 102 'the financial reporting standard applicable in the uk and.

Cash receipts from the sale of goods and the rendering of services;