Favorite Tips About Depreciation And Balance Sheet

Explore its impact, how it affects businesses, and.

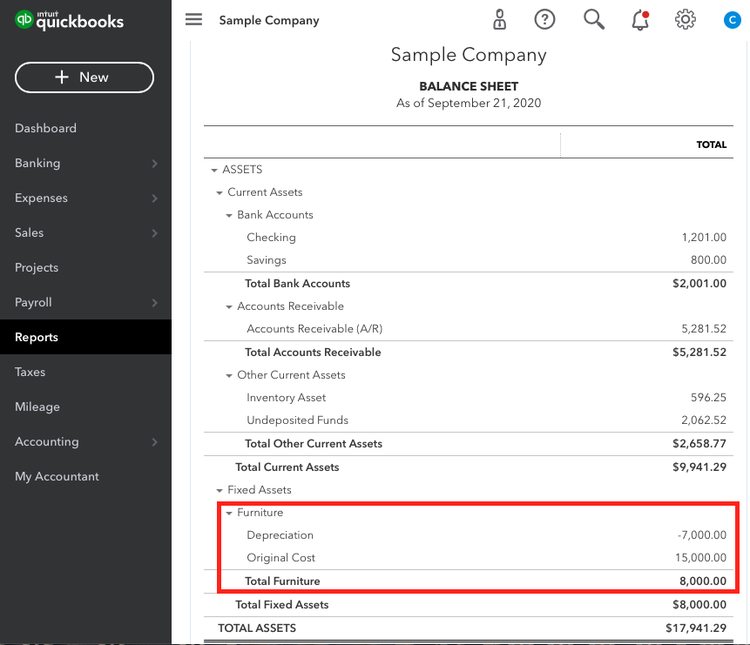

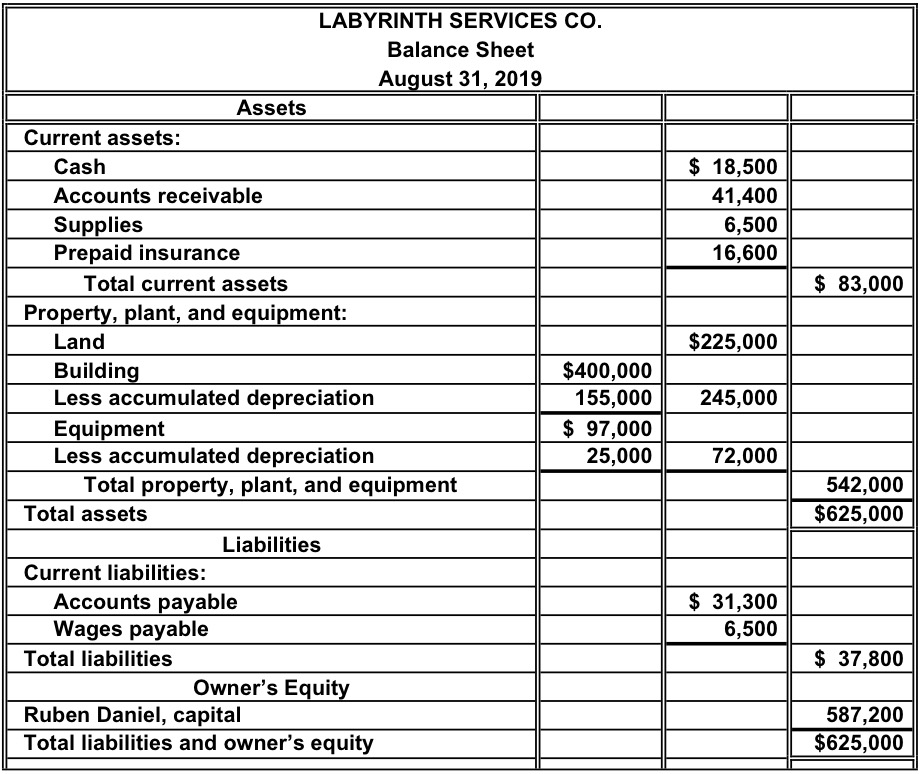

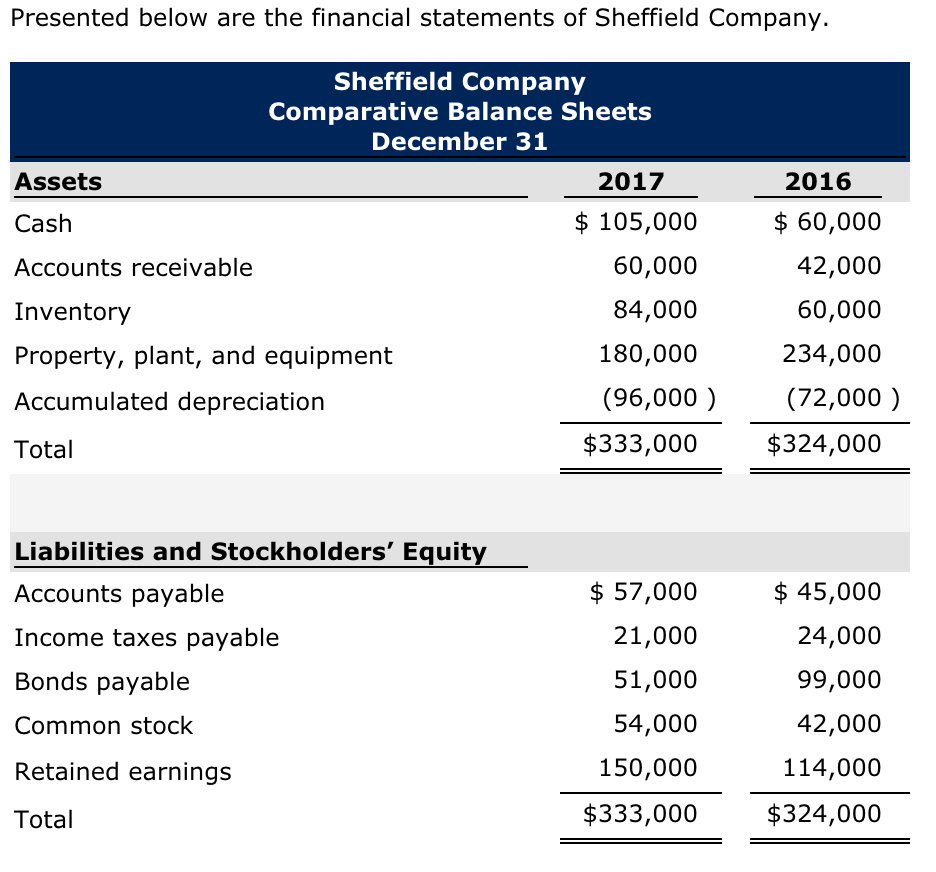

Depreciation and balance sheet. Depreciation is found on the income statement, balance sheet, and cash flow statement. On a balance sheet, depreciation is recorded as a decline in the value of the item, again without any actual cash changing hands. On the income statement, it is listed as depreciation expense, and.

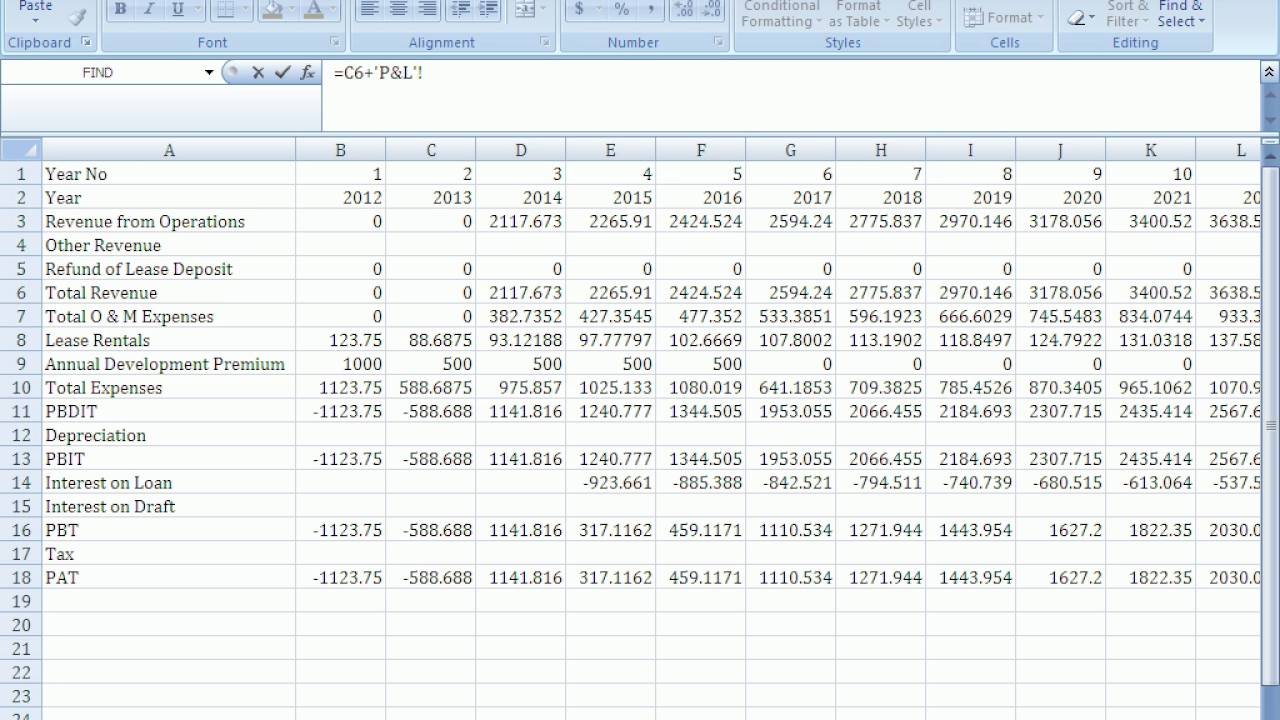

The depreciation expense during a specific period reduces the income recorded on the p&l. December 30, 2023 discover the role of depreciation expense in a balance. After 120 months, the accumulated depreciation reported on the balance.

Depreciation is considered a cost of doing business — as such, it should be accounted for on your profit and loss (p&l) report as an expense. Depreciation is typically tracked one of two places: (an asset is something that has continuing value, like a computer, a car, or a piece of.

The depreciation term is found on both the income statement and the balance sheet. Accumulated depreciation on the balance sheet serves an important role in in reflecting the actual current value of the assets held by a business. For income statements, depreciation is listed as an expense.

Telekom malaysia bhd’s (tm) net debt to earnings before interest, tax, depreciation and amortisation (ebitda) may fall to 0.4 times for the financial. It accounts for depreciation charged to expense for the income reporting period. Accounting accumulated depreciation:

It can thus have a big impact on a company’s financial performance overall. Accumulated depreciation is recorded on the balance sheet. On an income statement or balance sheet.

This item reflects the total depreciation charges taken to date on a specific asset as it drops in. A depreciation schedule is required in financial modeling to forecast the value of a company’s fixed assets ( balance sheet ), depreciation expense ( income statement ),. Finance where does depreciation expense go on a balance sheet modified:

Depreciation impacts both a company’s p&l statement and its balance sheet. The basic difference between depreciation expense and accumulated depreciation lies in the fact that one appears as an expense on the income statement. Everything you need to know by alicia tuovila updated october 26, 2023 reviewed by david kindness fact checked by.

Depreciation flows out of the balance sheet from property plant and equipment (pp&e) onto the income statement as an expense, and then gets added back in the cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)