One Of The Best Tips About Prepare Income Statement And Balance Sheet

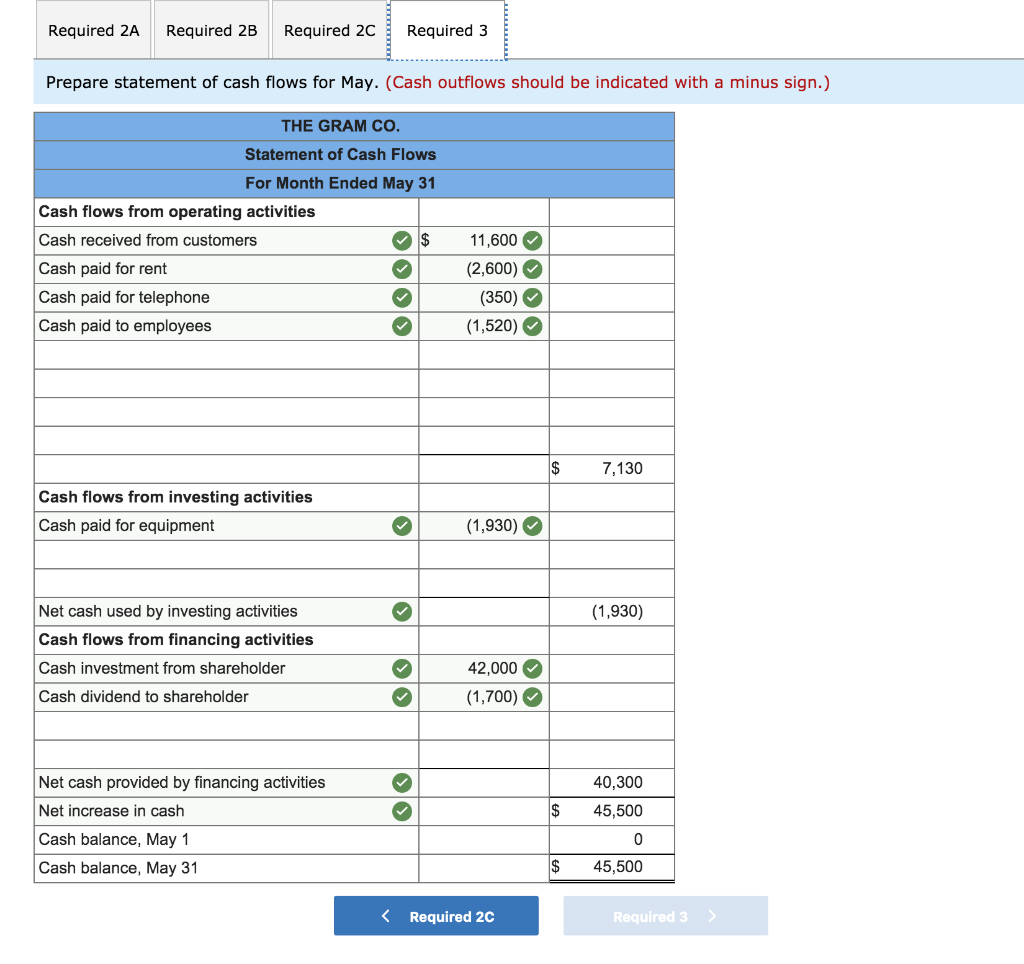

The balance sheet and the income statement are two of the three major financial statements that small businesses prepare to report on their financial performance, along with the cash flow statement.

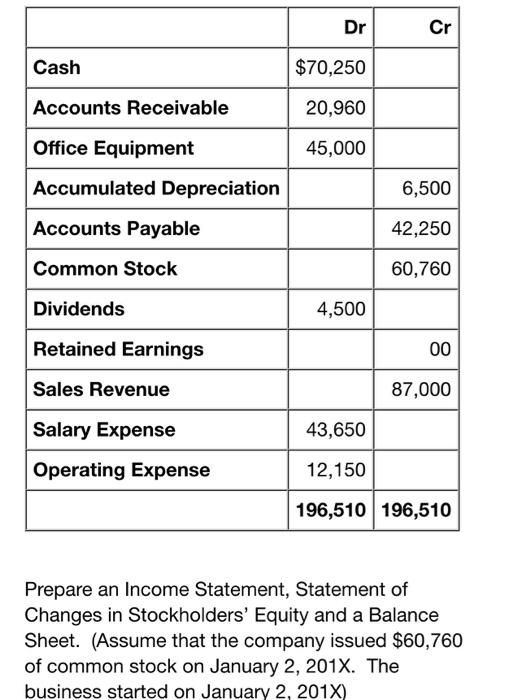

Prepare income statement and balance sheet. I like to think of the income statement as the story that explains the change between two balance sheets, with change in equity just one piece of the story. Your income statement and balance sheet are two of the most important documents you will create as a business owner. When we look at financial statements as a whole, income statements and balance sheets complement one another.

Every other account title has been highlighted to help your eyes focus better while checking your work. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Also known as a “ profit and loss statement ” or “statement of earnings,” it includes items such as:

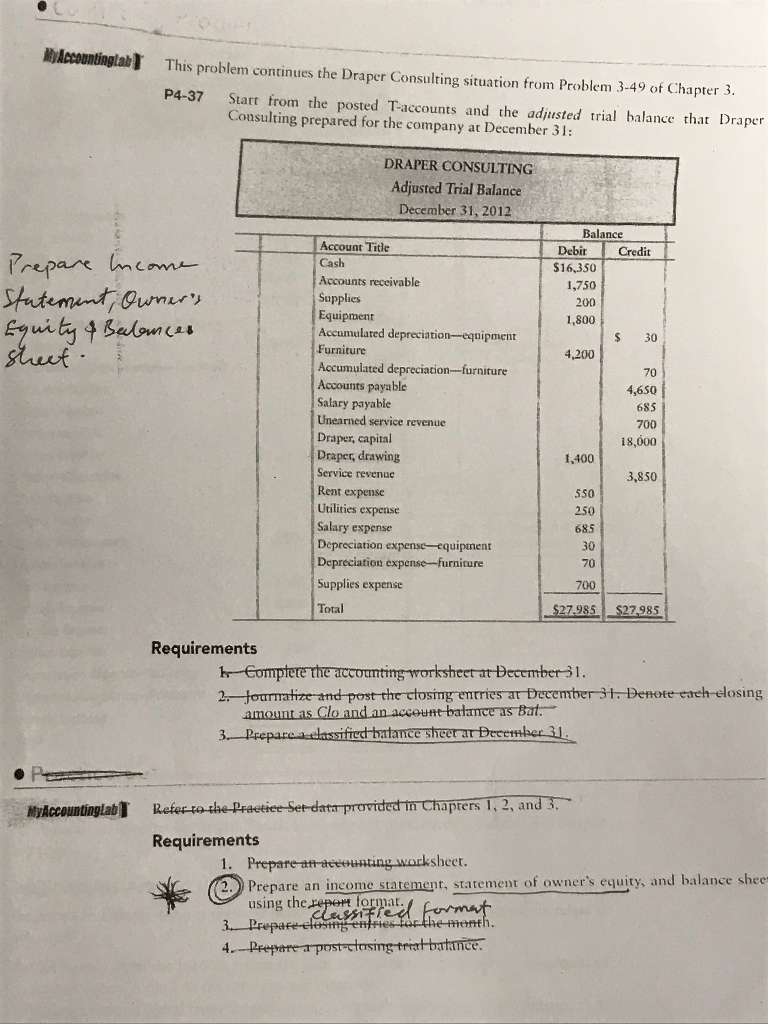

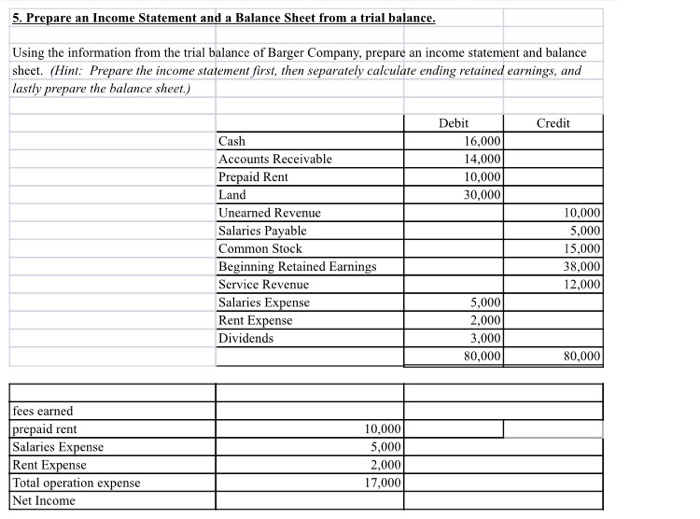

This is the most updated trial balance (i.e. What’s included in an income statement. 2.3 prepare an income statement, statement of owner’s equity, and balance sheet highlights one of the key factors for success for those beginning the study of accounting is to understand how the elements of the financial.

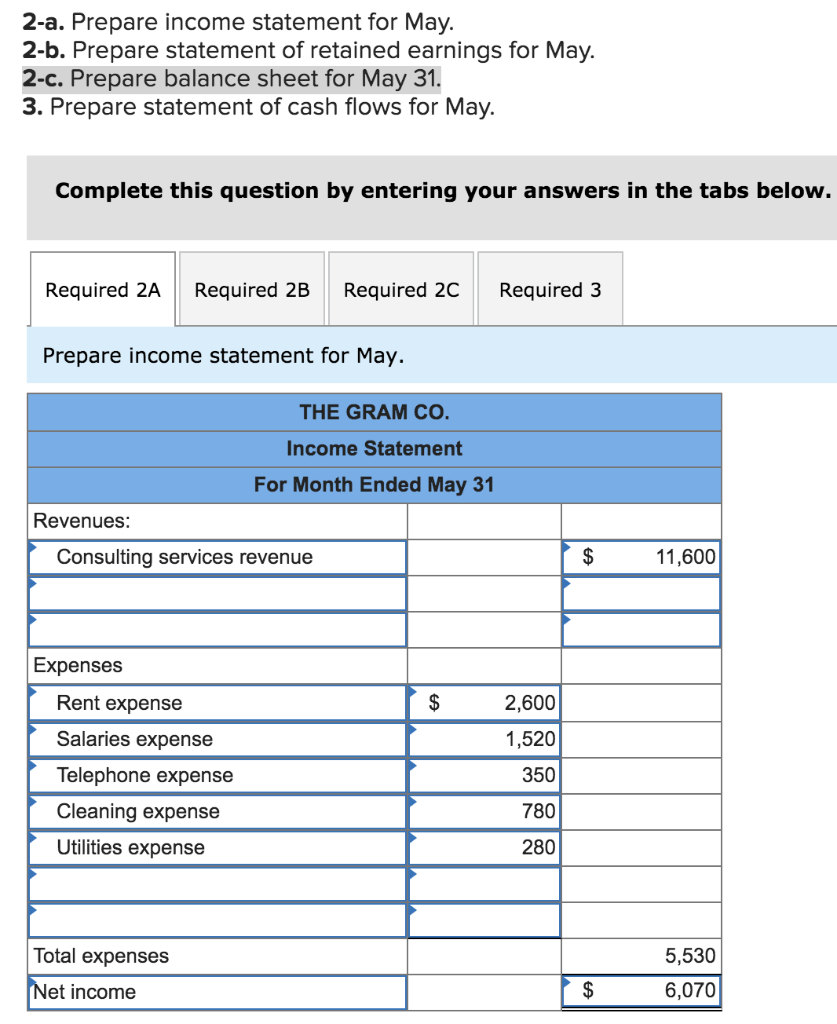

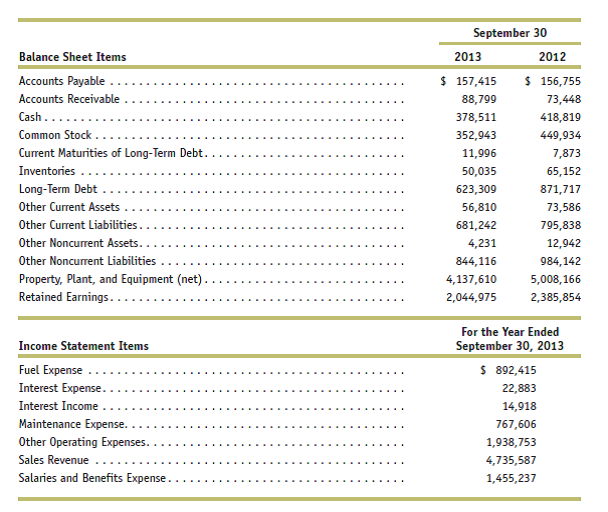

In many cases, ratios are constructed for each balance sheet (and income statement) for a number of years, so that you can make comparisons and spot important trends. To prepare an income statement, small businesses must analyze and report their revenues, operating expenses, and the resulting gross profit or losses for a specific reporting period. The second line shows the title of the report.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it. An income statement is a document showcasing and analyzing the profits and losses of your business. Income statement often, the first place an investor or analyst will look is the income statement.

The balance sheet shows a company’s total value while the income statement shows whether a company is generating a profit or a loss. Click below to download a free sample template of each of these important financial statements. Do not panic when they do not balance.

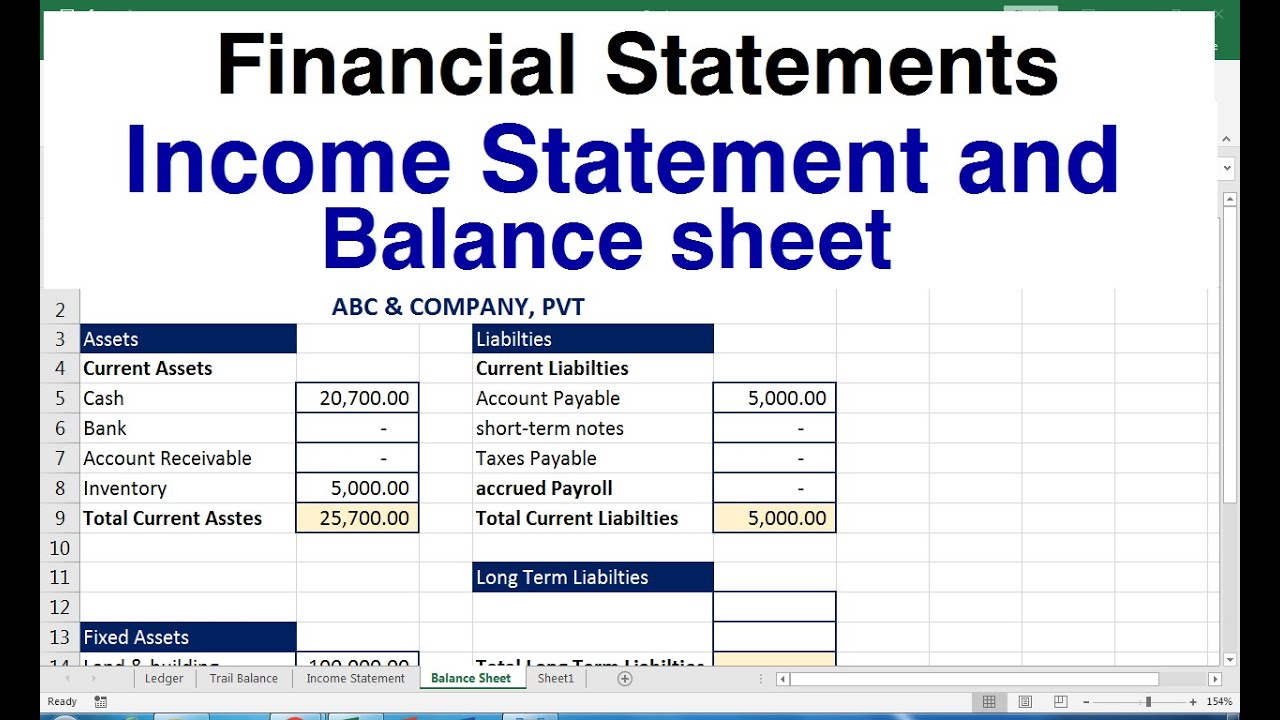

The income statement, statement of changes in equity, and statement of cash flows use. Income statement and balance sheet. Periodically prepared balance sheets are the primary financial tool for assessing the relative wealth or financial condition at a given point in time.

Take the information from maggie's music shop adjusted trial balance and fill out an income statement. With freshbooks, you don’t need to become an accountant overnight to run your business the way it deserves. A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date.

Revenue cost of goods sold expenses taxes The income statement is one of the most important financial statements because it details a company’s income and expenses over a specific period. Income statements and balance sheets are reliable ways to measure the financial health of your business.

Revenue, gains, expenses, and losses. Remember that we have four financial statements to prepare: When you prepare an income statement, there are four main categories to take into account: