Peerless Info About Financial Statements Of Sole Proprietorship Balance Sheet Template For Startup Business

Balance sheet below is the balance sheet for ian hodgins at 31 december 20x2.

Financial statements of sole proprietorship balance sheet template for startup business. It includes your assets and liabilities and tells you your business's net worth. Analyzing basic financial statements for your startup. As stated in mindtap “four principles are an integral part of financial.

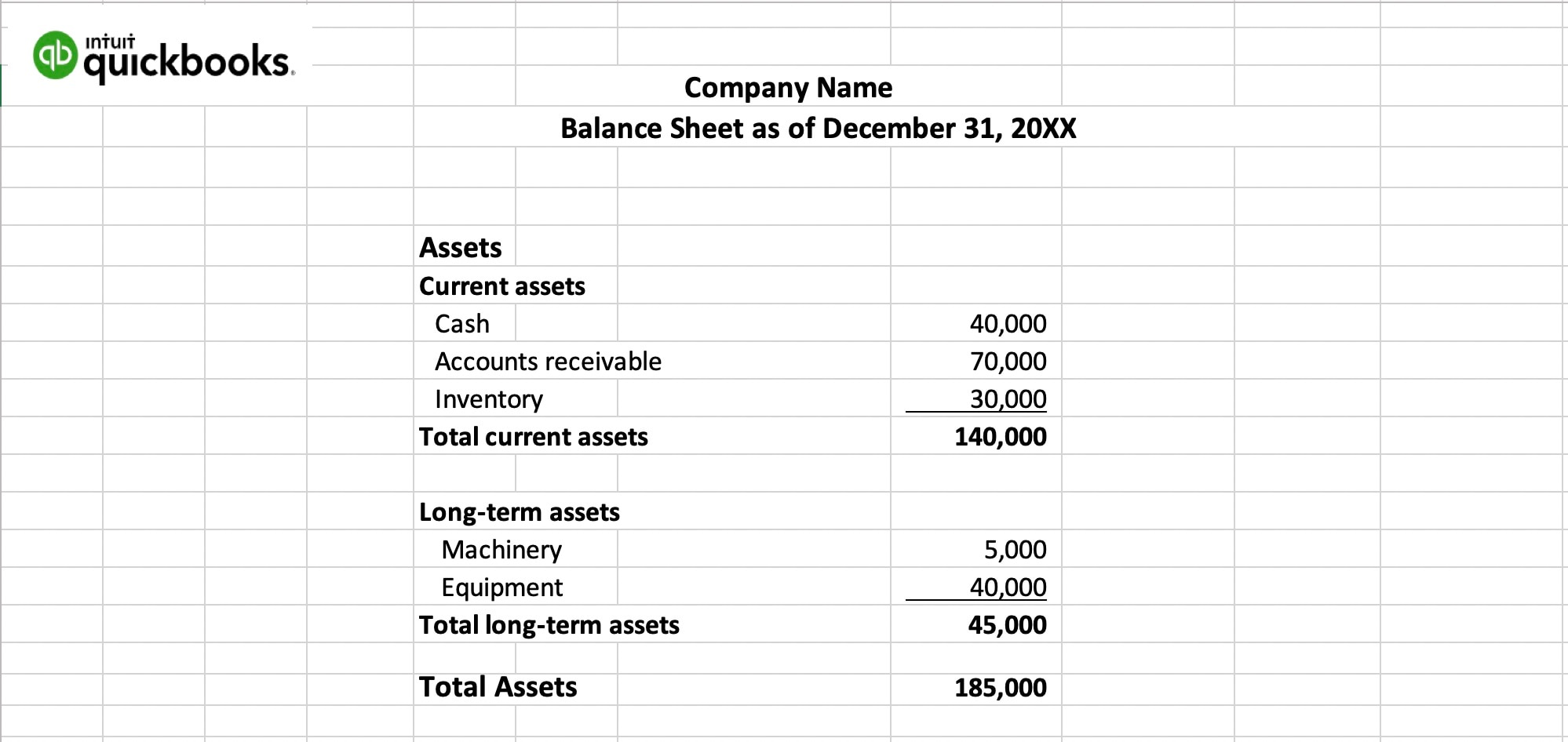

All you need to do is to link your trial balance accounts to our reporting classes. A balance sheet is a summary of your startup’s assets, liabilities, and equity to convey your company’s financial position. A company’s balance sheet is a snapshot in time.

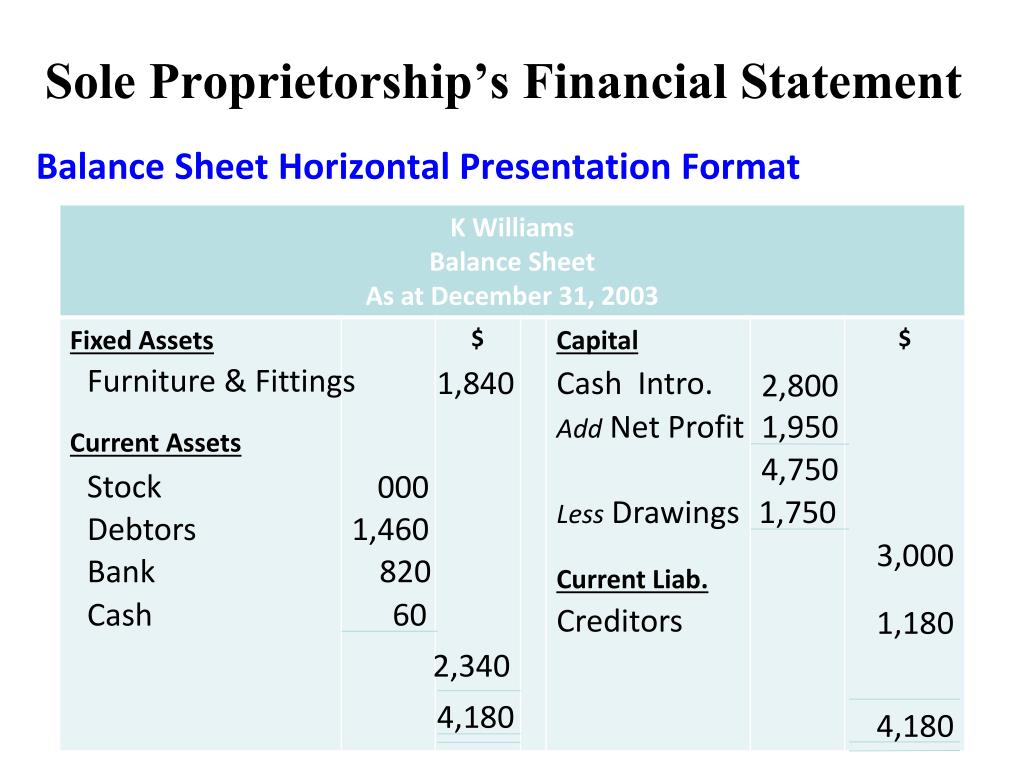

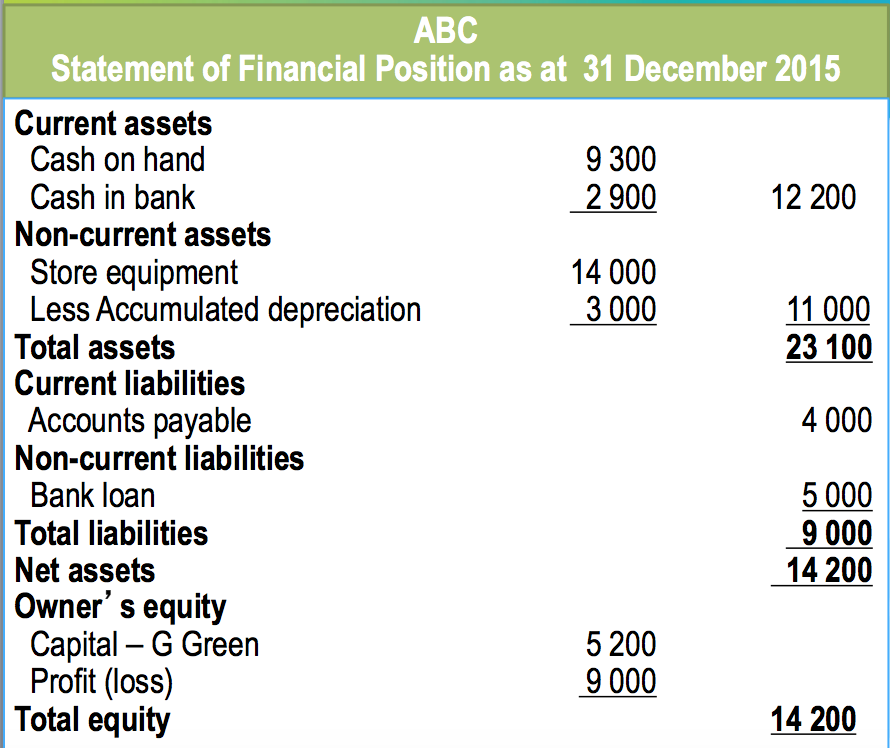

It can be drawn in horizontal or vertical format. Financial statement #1: A balance sheet is a business statement that shows what the business owns, what it owes, and the value of the owner's investment in the business.

It shows a proper balance including assets, liability, and owner’s equity. The financial statements of a sole proprietorship are similarly tied to its owner's personal finances in ways that are not the case for other business ownership structures, such as. Microsoft excel will provide you with a platform where you can easily create a balance sheet format for proprietorship.

The balance sheet of a sole proprietorship indicates the name of the business, the name of the statement and the date of the statement. Our unique financial statement format for sole proprietorships in excel consists of automated reports including an income statement, balance sheet, cash flow statement, statement of changes in equity and the notes to the financial statements. Use this free excel template to generate a beginning balance sheet for your new business startup.

A wide range of businesses operates as sole proprietorships, reflecting the versatility of this business structure. A startup balance sheet or projected balance sheet is a financial statement highlighting a business startup's assets, liabilities, and owners' equity. A sole proprietor must submit their annual financial statements to the fais department within 4 months of their financial year end.

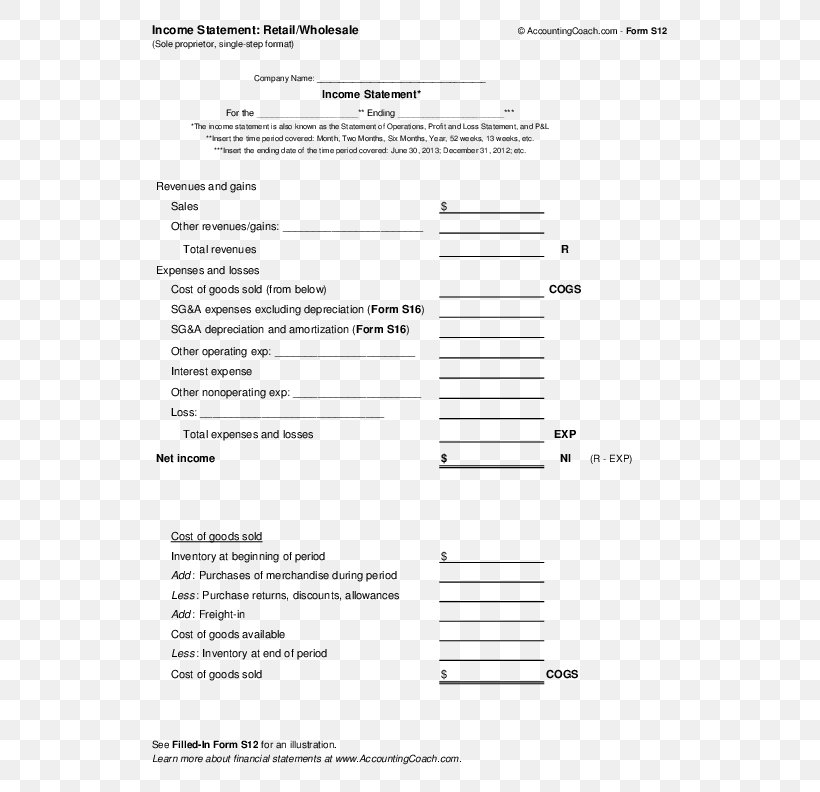

Choosing the right structure is pivotal. Below are the balance sheet and the income statement for a sole trader called ian hodgins. The following are sample balance sheet (statement of financial position), income statement, and statement of changes in owner’s equity for an individual or sole proprietorship business.

This balance sheet form is designed for a sole proprietorship that is in the retail or wholesale business. The balance sheet, profit and loss (p&l) statement, and a cash flow statement. To set up a balance sheet for a sole proprietorship, list assets and liabilities to capture the company's overall financial picture as well as its financial relationship with its owner.

Financial statements 2 introduction accounting is often described as the “language of business”. Freshbooks provides a range of income statement and balance sheet examples to suit a variety of businesses, no matter if you have just started out or if you are looking for a different solution. What does financial year end refers to?

Understanding that financial statements provide an insight into how much a company’s startup turns into revenue and how much of it is lost due to expenses. Freelance writers, photographers, graphic designers, and other independent contractors often operate as sole proprietors. Find the best finance statement templates for.