Simple Tips About Organizational Costs On Balance Sheet Gaap

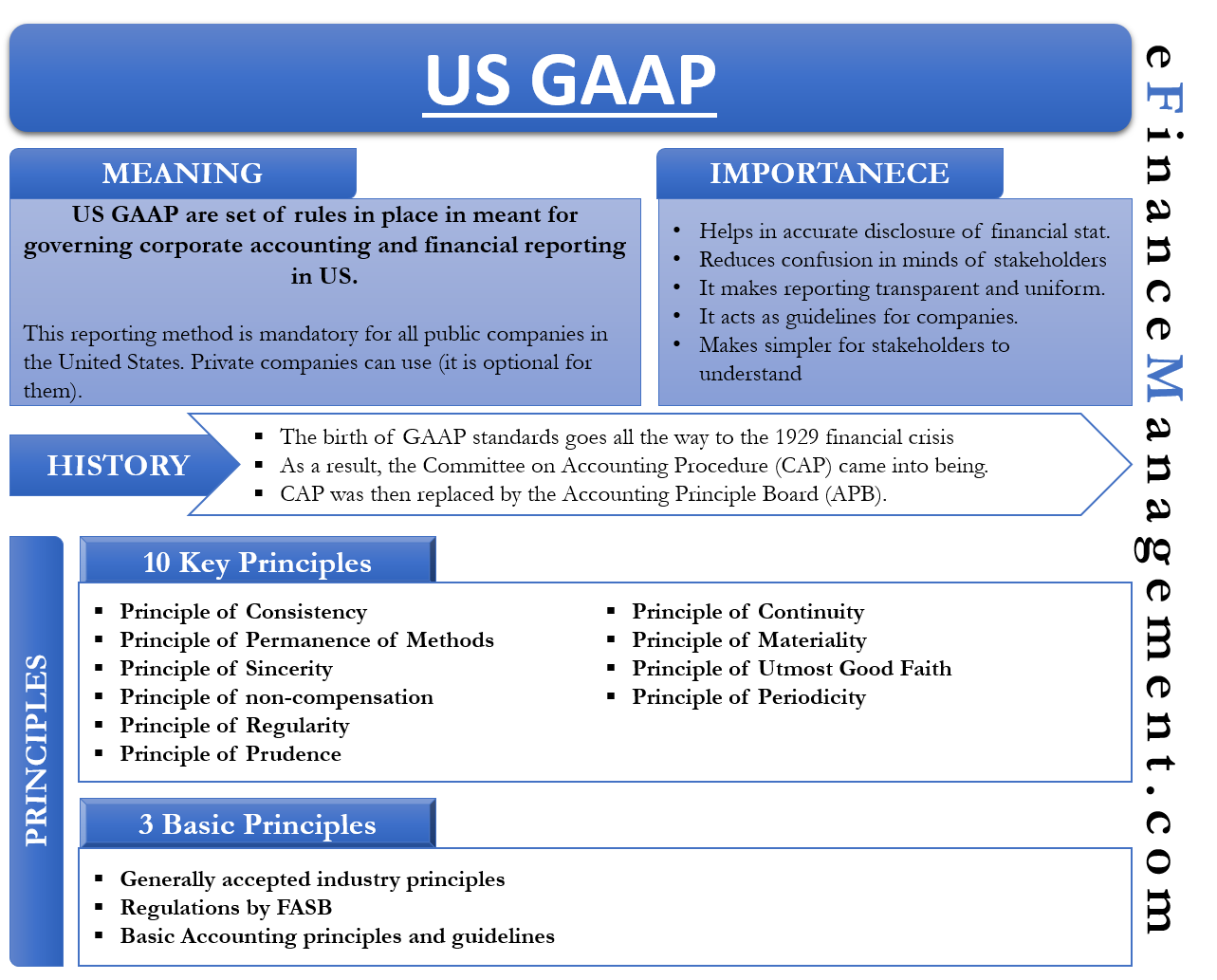

Gaap is the set of accounting rules set forth by the financial accounting standards board (fasb) that u.s.

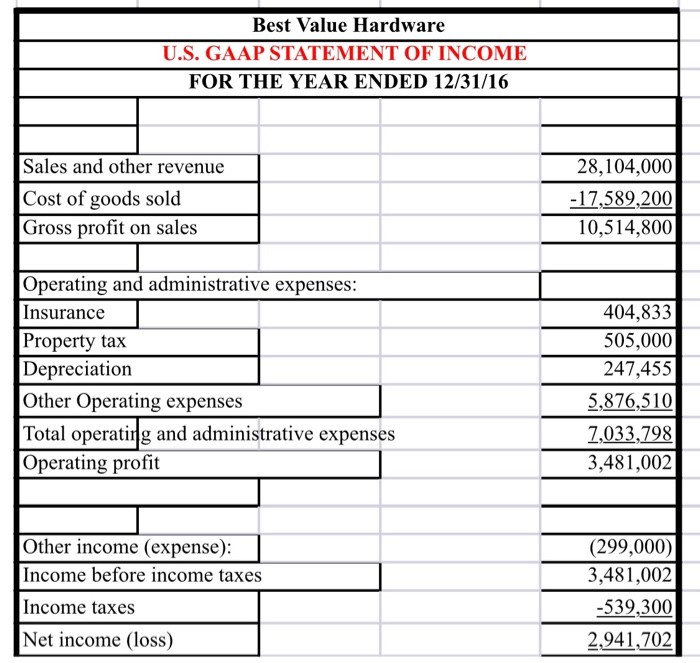

Organizational costs on balance sheet gaap. Gaap is a set of detailed accounting guidelines and standards meant to ensure publicly traded u.s. An organizational cost or expense is the initial cost incurred to create a company. To report these things, the.

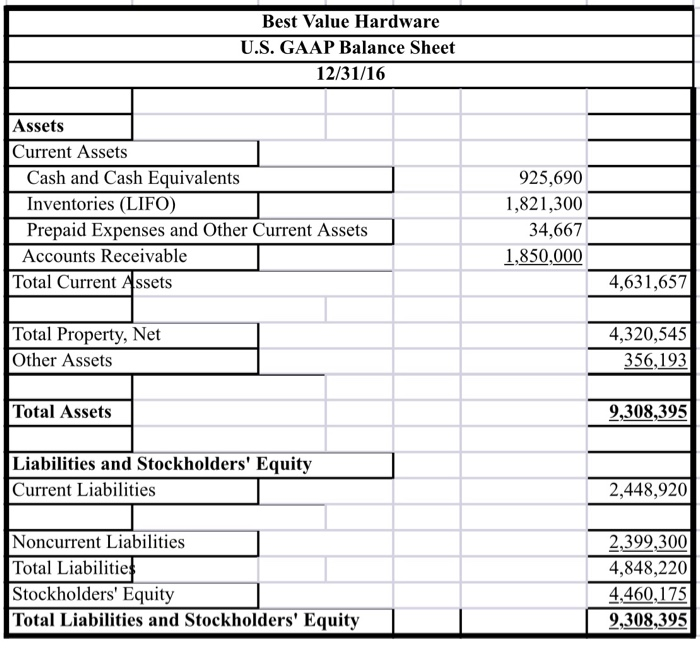

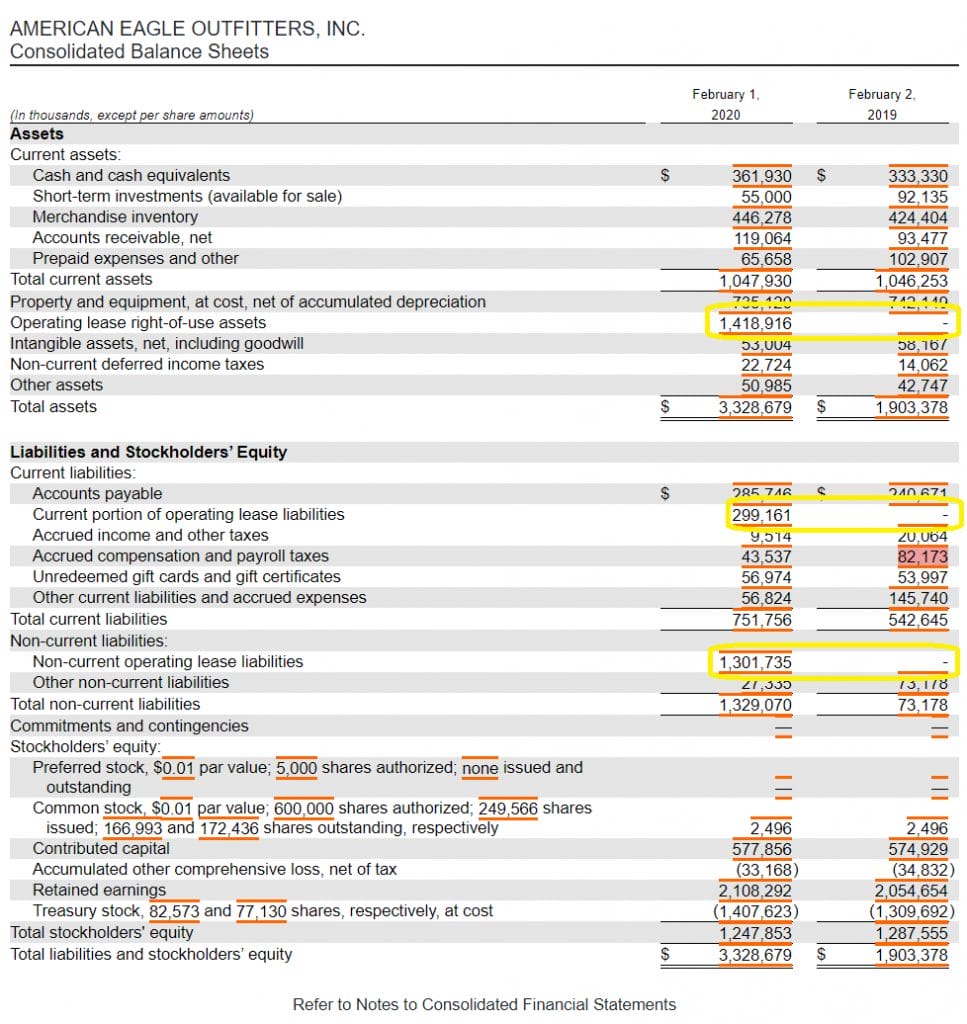

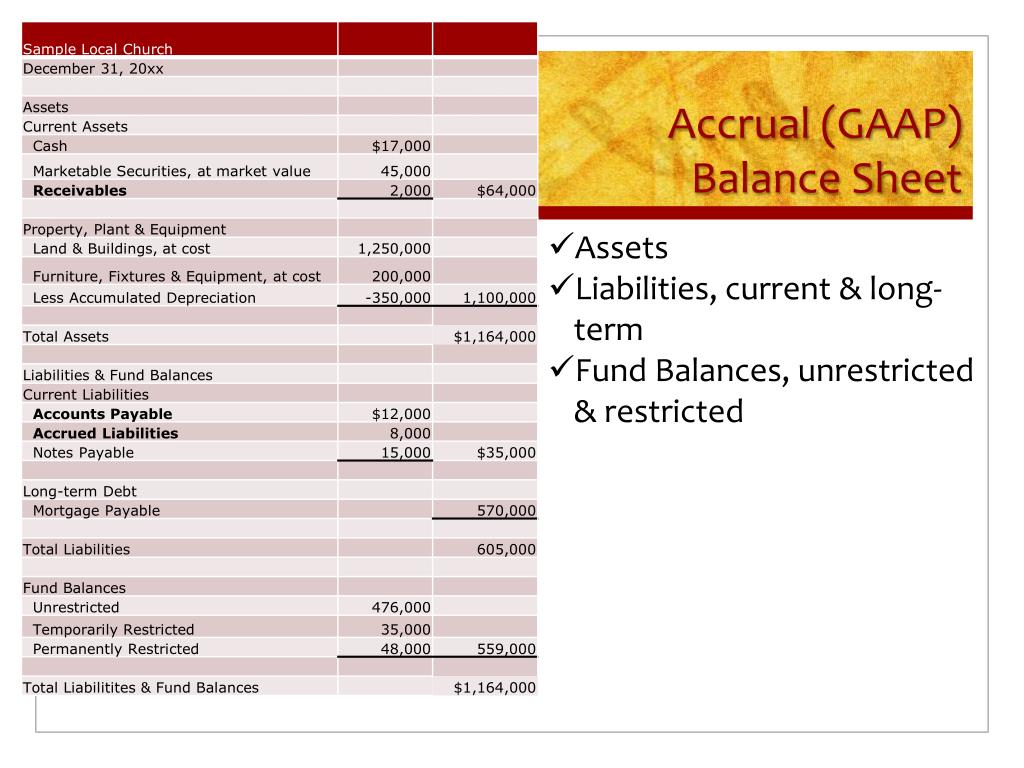

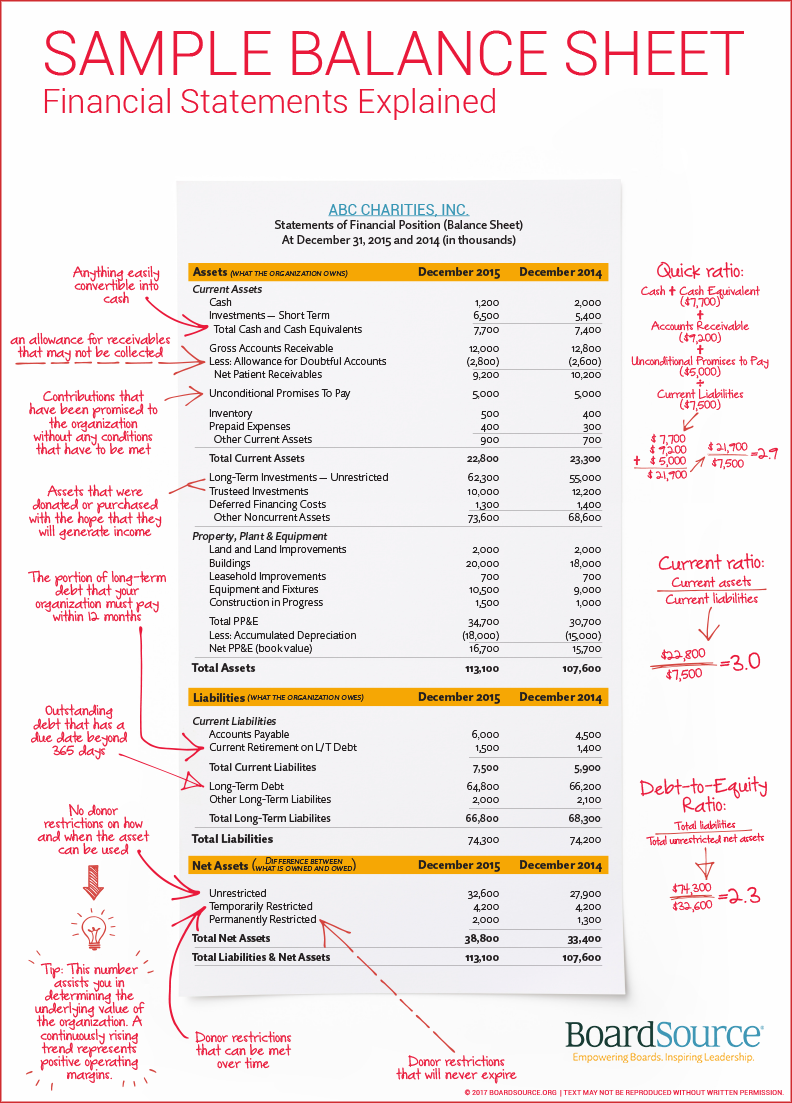

To strengthen balance sheet, reduce debt and improve liquidity. Complex accounting methodologies are mandated covering the smallest detail. A balance sheet is a financial statement that summarizes a company's assets, liabilities and shareholders' equity at a specific point in time.

Organizational costs usually include professional fees incurred to form the fund. This financial statement is used. An organizational cost or expense is the initial cost incurred to create a fund.

Companies are expected to follow when putting. For example, if you've spent $23,000 preparing your new office and $25,000 on market research, you record. Company also announces plans for strategic.

Organization costs can be classified as assets on the company's balance sheet. This involves recording the incorporation costs as an asset on the company’s balance sheet and then recognizing the costs as. What is a balance sheet?

Organizational costs usually include legal and promotional fees to. Cash proceeds from sale enable buzzfeed, inc. Discover how to identify, treat, and report contingent liabilities on a balance sheet and how the u.s.

You record them when you incur them in the expense category called startup costs. Explanation a business may incur a number of costs as it is forming or during. Presentation of a balance sheet for a single.

Organizational costs are those costs incurred that relate to the setup of a business. What are organizational costs? The gaap standards cover financial reporting as a whole.

From the partnership's perspective, it receives cash from its partner as a capital contribution, pays the syndication costs, and capitalizes those costs as an. For example, gaap stipulates how to file income statements, what financial periods to include, and. Assets are recorded on the balance sheet at cost, meaning that all costs to purchase the asset and to prepare the asset for operation should be included.

Accounting for organizational costs under gaap is simple. Capitalization and amortization: A balance sheet provides a snapshot of a company’s financial performance at a given point in time.