Inspirating Info About Nonprofit Financial Audit

What is an independent financial.

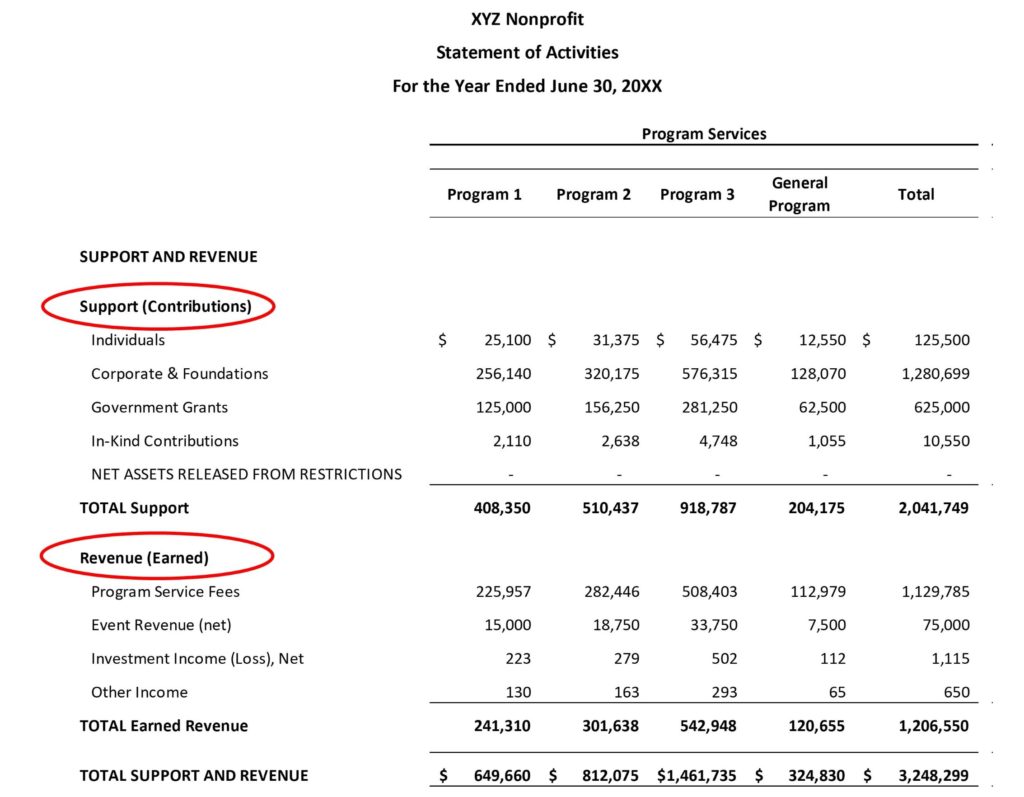

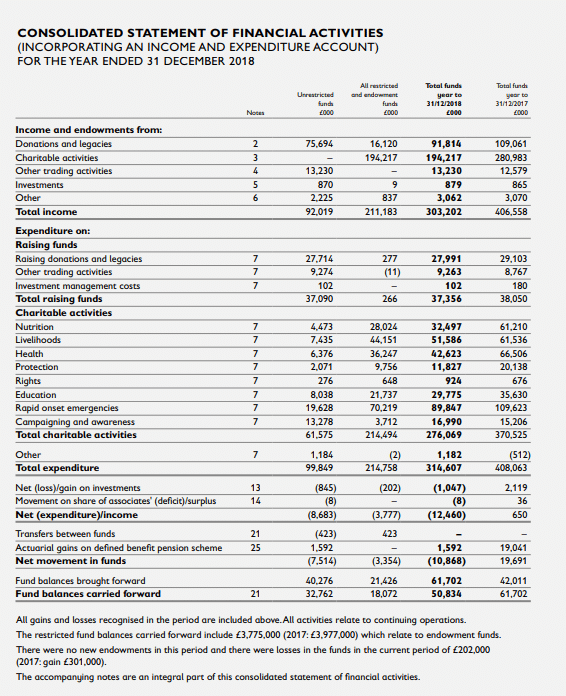

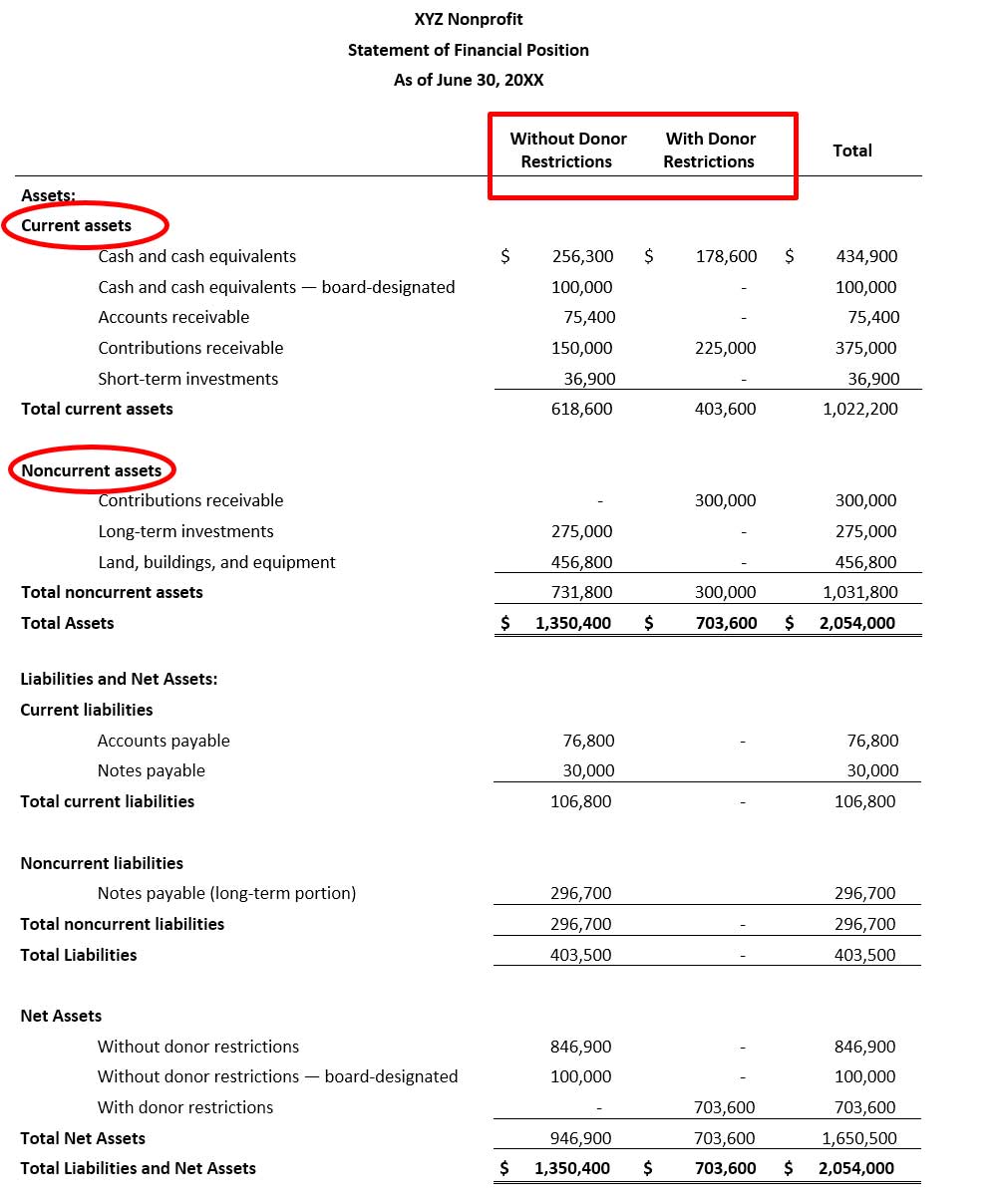

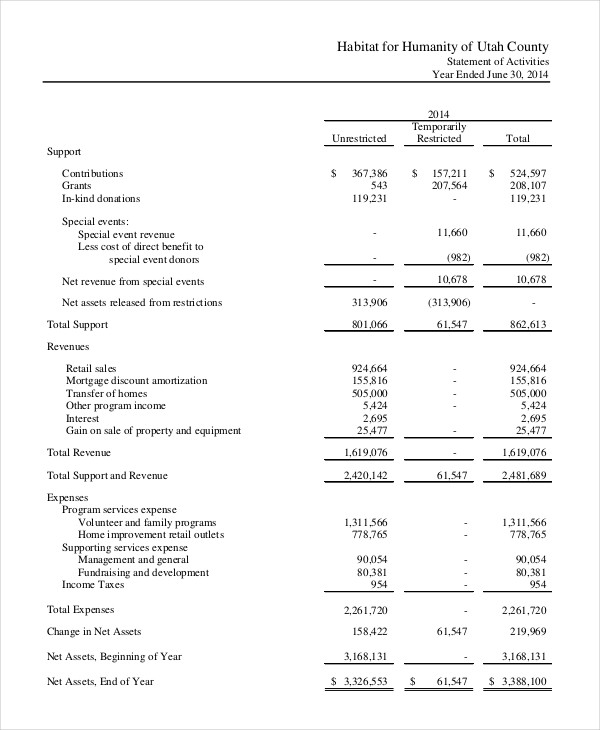

Nonprofit financial audit. A guide to the basics of nonprofit financial audits, including when nonprofits need to conduct audits, the benefits of financial audits, how to. What this is: The association of nonprofit accountants and finance professionals (anafp) is the largest professional association dedicated solely to those working in and/or interested in.

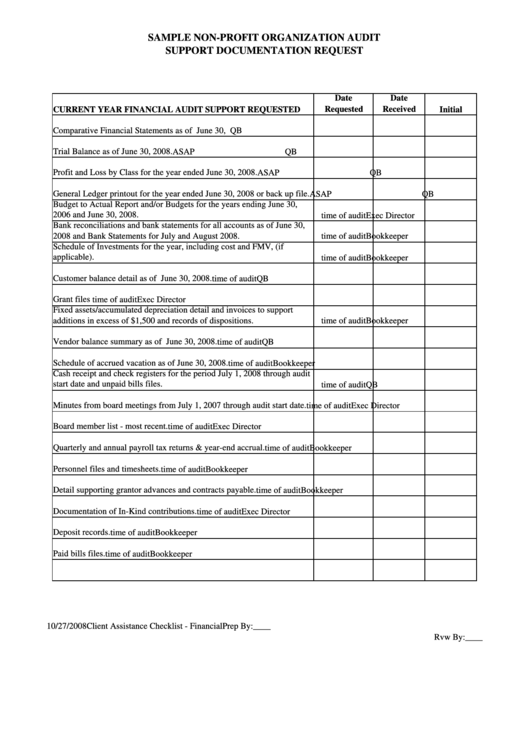

496.407 requires audits for charitable organizations as follows: The tennessee comptroller’s annual audit of lewis county for the fiscal year ending on june 30, 2023. Getting ready for the audit checklist.

When a new york judge delivers a final ruling in donald j. It addresses the choice whether to. After all, you’re not paying taxes!

It said it had not been able to get the information it needed for the company’s 2021 audit. Nonprofits that spend or earn more than a certain amount (usually around $500,000) may be required to complete a financial audit. Nonprofit financial audits may be required by some of the funders that contribute to your organization.

16, 2024 updated 9:59 a.m. These donations are filed in the 501 (c) (3) fiscal sponsor’s form 990. Review all accounts and transactions.

There are three main steps to the nonprofit financial audit for the organization: Choose a cpa and prepare for the audit once the organization has. Journals that detail the organization’s business transactions and affected accounts.

Fiscal sponsors will list their fiscal sponsorships in their 990s and some may even provide. Lewis county audit highlights need for improvement. Best overall nonprofit accounting software.

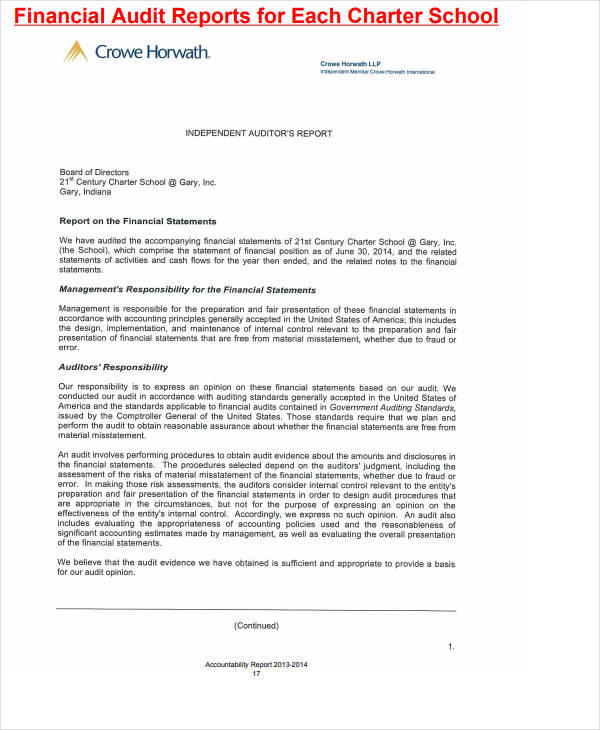

Suing the auditors in the territory would. This is used as an accountability standard to be sure. The guide will also tell you about the role.

Trump’s civil fraud trial as soon as friday, the former president could. Reviewing all of your nonprofit’s accounts and transactions before your audit can help you make sure everything is in. Ledgers for the fiscal year.

Practice pointers look for a cpa or auditing firm that understands accounting for charitable nonprofits and has expressed interest in your mission. To help you better understand nonprofit financial audits, this guide will answer the following five frequently asked questions about them: For those receiving annual contributions of $1 million or more an independent.

![Free Printable Nonprofit Financial Statement Templates [Excel]](https://www.typecalendar.com/wp-content/uploads/2023/08/Nonprofit-Financial-Statement.jpg)