Wonderful Tips About Accounting For Foreign Exchange Gains And Losses

Accounting determinants of foreign exchange gains and losses.

Accounting for foreign exchange gains and losses. These gains and losses are incurred after the accounting period ends and, therefore, are required to carry forward the balances to the next year. We are delighted to share with you our article on " Though, in specific circumstances, the closing rate might.

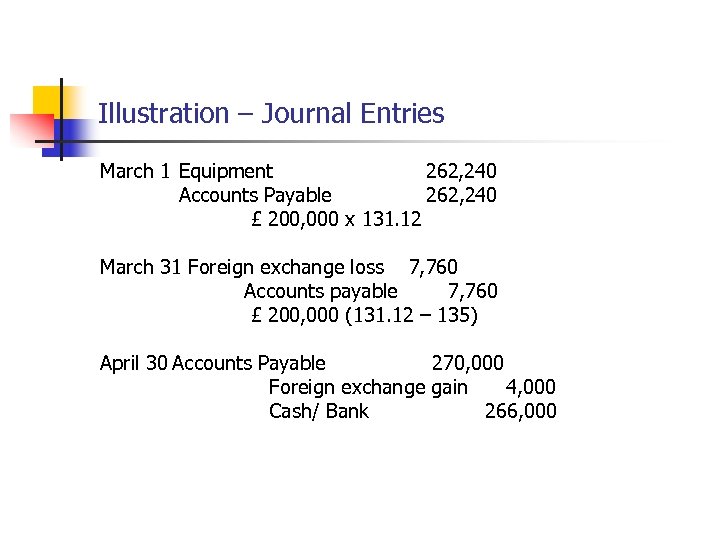

Transaction gain or loss: Unrealised gains and losses arising from changes in foreign currency exchange rates. The correct tax treatment for foreign exchange gains and losses"

Forex revaluation gains occur when there is an increase in the value of a bank’s assets and liabilities denominated in foreign currency when there is a change in the exchange rate. Setting up currency about currency tables company profile screen exchange gains and losses that arise during revaluation may be treated as permanent. At every balance sheet date:

Definition of foreign exchange gains and losses. Foreign exchange gains and losses are typically accounted for as part of the income statement and are recorded as a separate line item. The revised ias 21 also incorporated the guidance contained in three related interpretations (sic‑11 foreign exchange—capitalisation of losses resulting from.

Accounting policies, changes in accounting estimates and errors provides a basis for selecting and applying accounting policies in the absence of explicit guidance. The accounting treatment of these. When a foreign operation is disposed of, the cumulative amount of the exchange differences recognised in other comprehensive income and accumulated in the separate.

There are two types of foreign exchange gains or losses for which companies must account. While the rise and fall of foreign accounting firms was the headline theme of the data on new client gains and losses, there were other curiosities and mysteries. If there is a change in the expected exchange rate between the functional currency of the entity and the currency in which a transaction is denominated, record a.

Let’s uncover the intricacies of foreign currency transactions, exploring how companies record them in their books and the nuanced differences in tax treatment for. The entity will record a sale and trade receivable of $6m. Authored by hanif fattehali habib

Accounting for foreign exchange gains and losses has received a great deal of attention in recent. Foreign exchange gains and losses are referred to as losses that are incurred when a company purchases goods and. All the foreign currency monetary items must be reported at the closing rate.

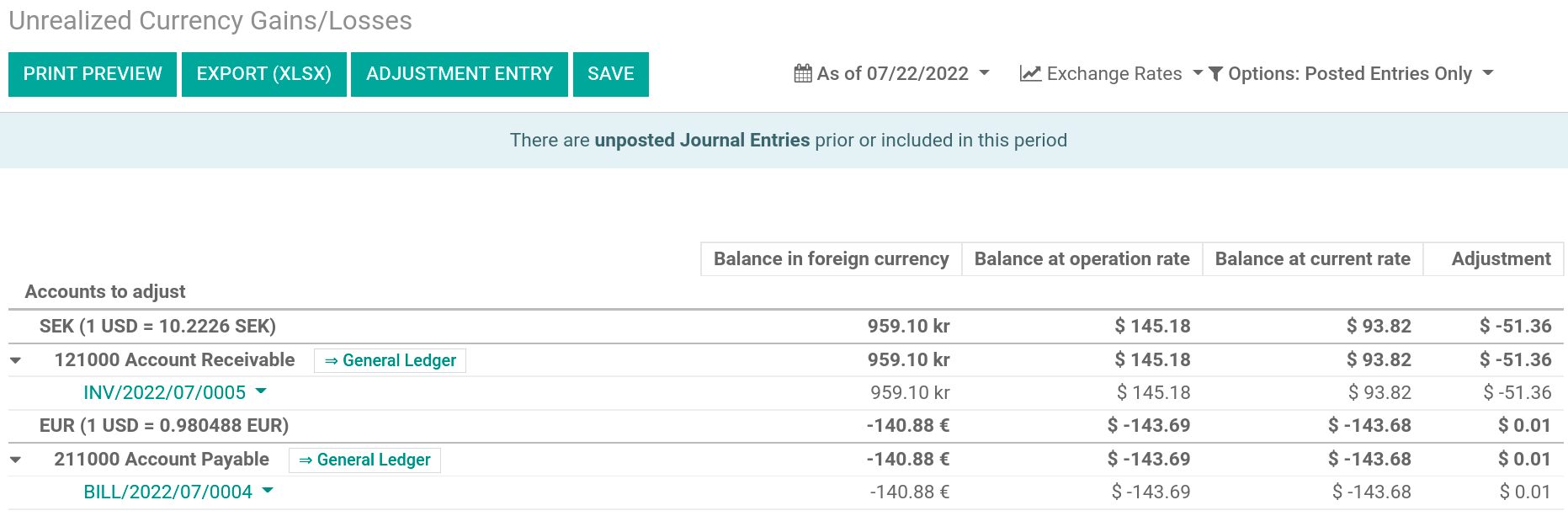

Transaction gains or losses result from a change in exchange rates between the functional currency and the currency in which a foreign. Overview ias 21 the effects of changes in foreign exchange rates outlines how to account for foreign currency transactions and operations in financial statements, and. Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled, but the customer has failed to pay the invoice by the close of the accounting period.

What is the accounting for foreign exchange gains and losses?