Nice Tips About Cash Basis Financial Statements

Here’s a look inside donald trump’s $355 million civil fraud verdict.

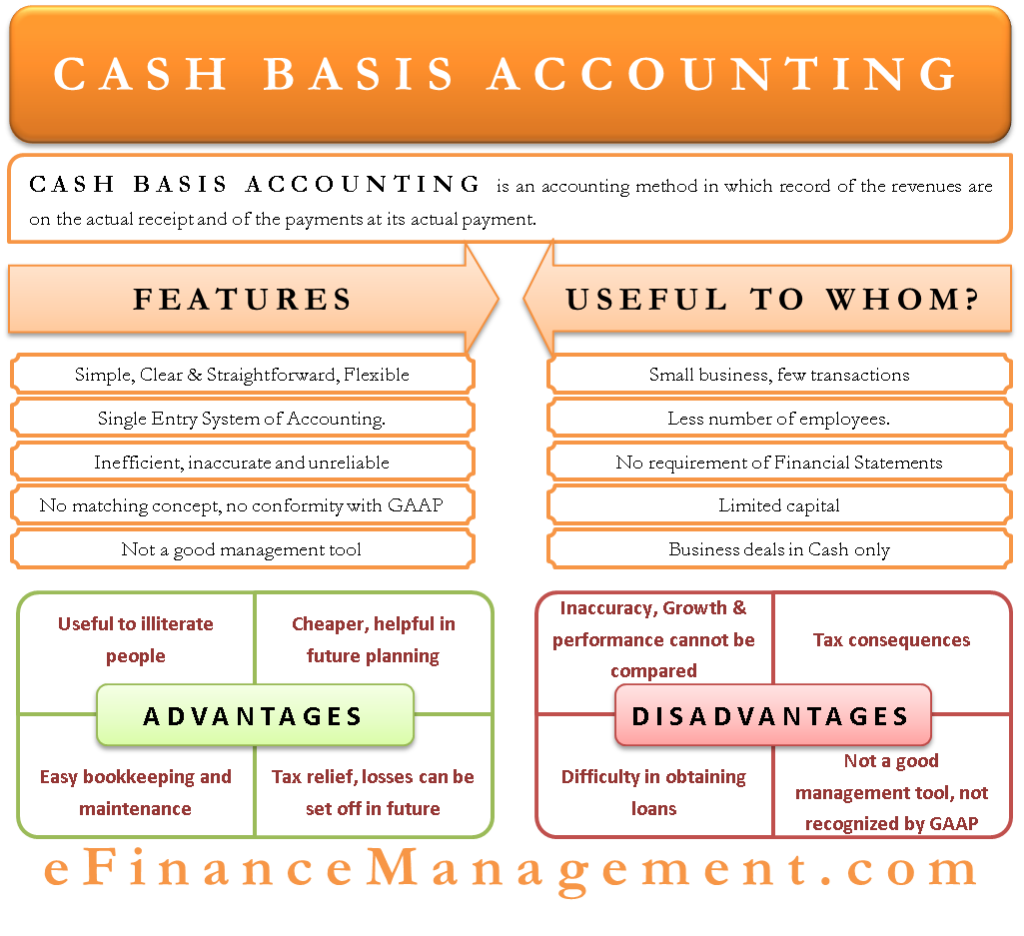

Cash basis financial statements. General purpose financial statements under the cash basis of accounting. Santa clara, calif., february 22, 2024. Cash basis financial statements have both advantages and disadvantages.

A major advantage of ocboa. Financial reporting under the cash basis of accounting. And if you maintain your books on a cash basis, there will be little difference between your.

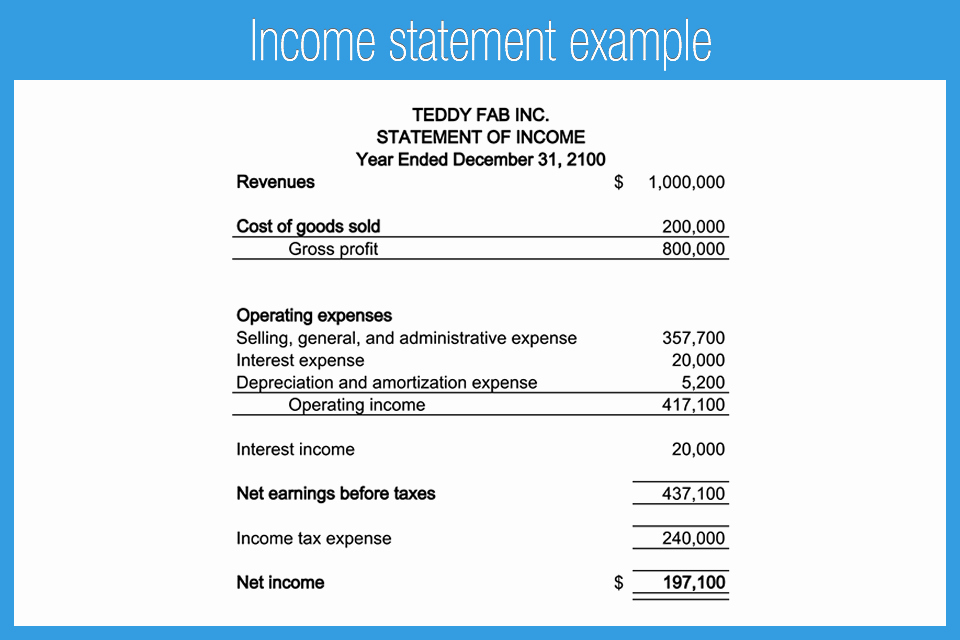

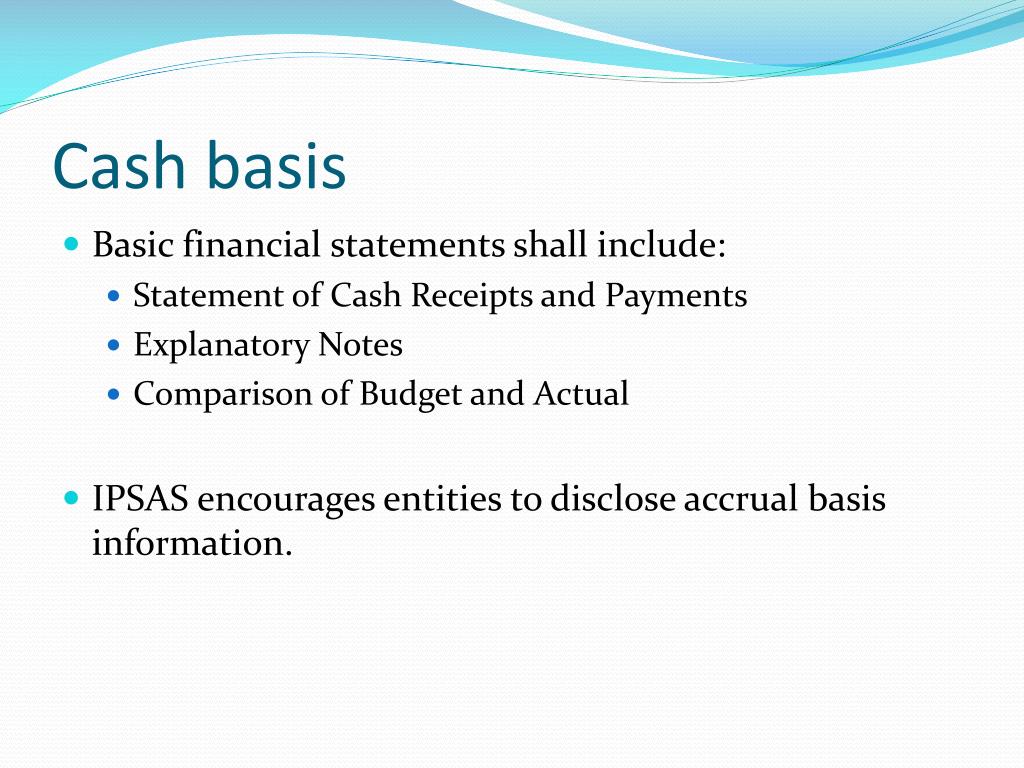

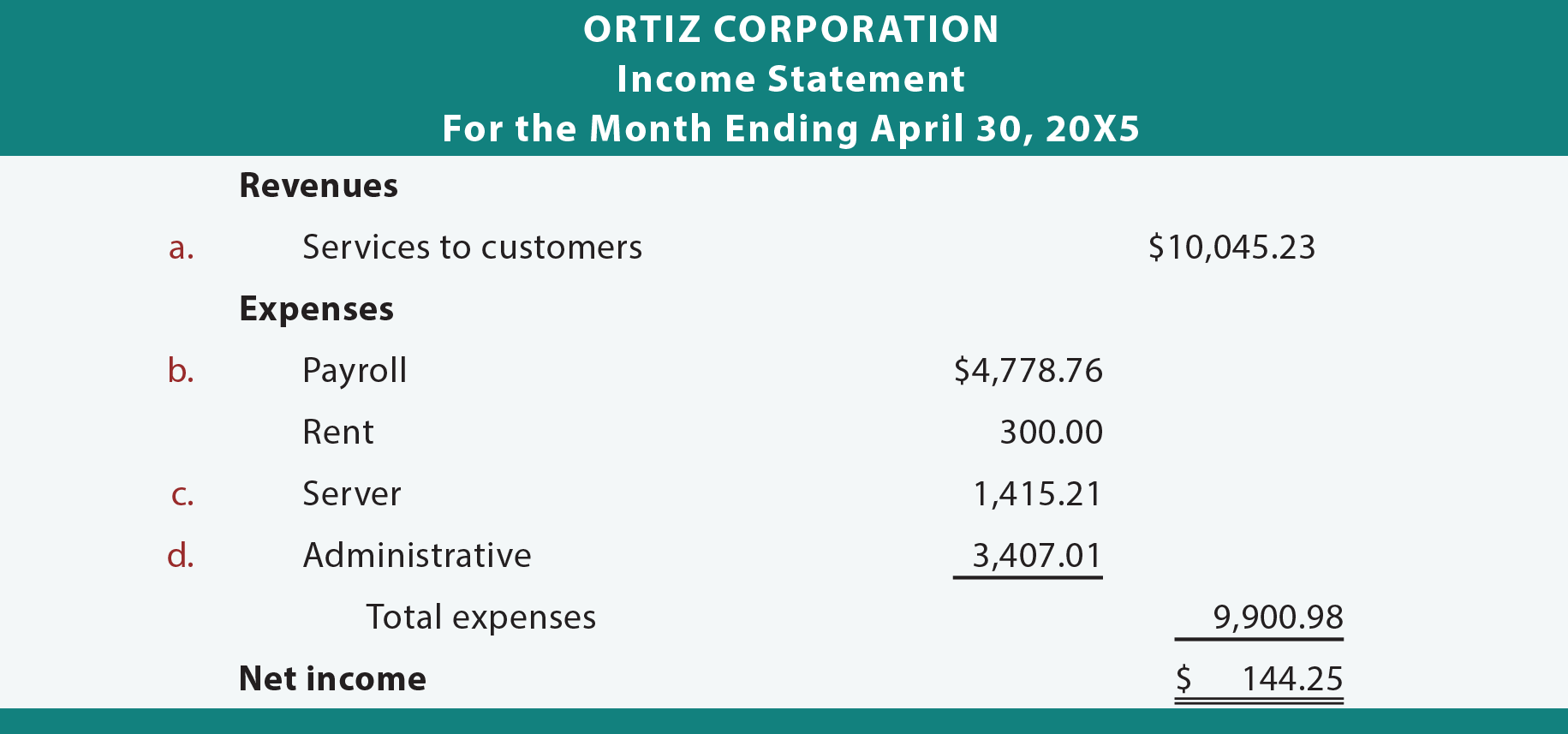

(the cash basis ipsas) which was a limited scope project to remove obstacles to adoption of the standard which included the requirement to prepare consolidated. A new york judge has ordered donald trump and his companies to pay $355 million. You have just learned about the income statement—the accounts it displays and its format.

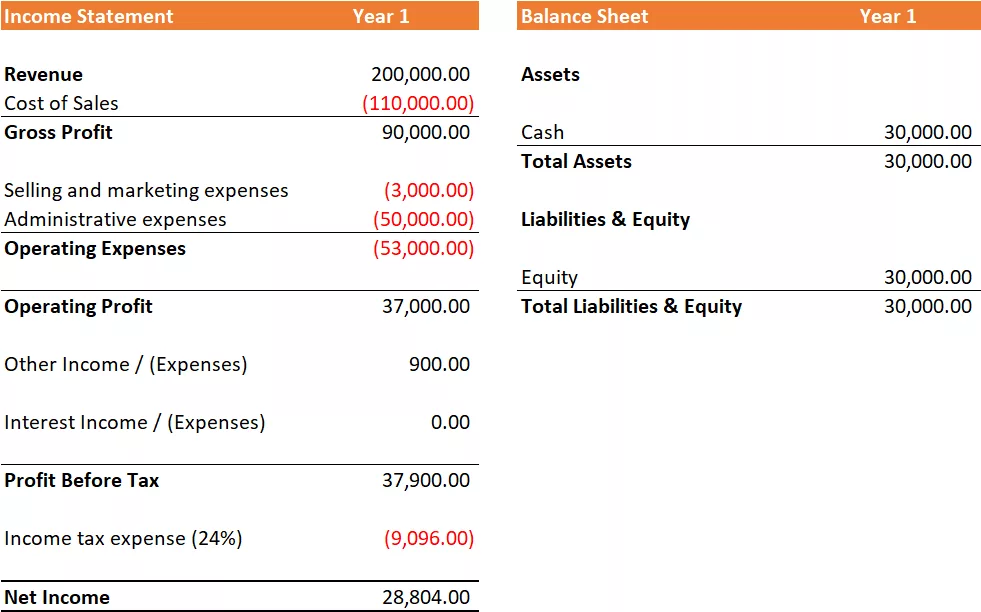

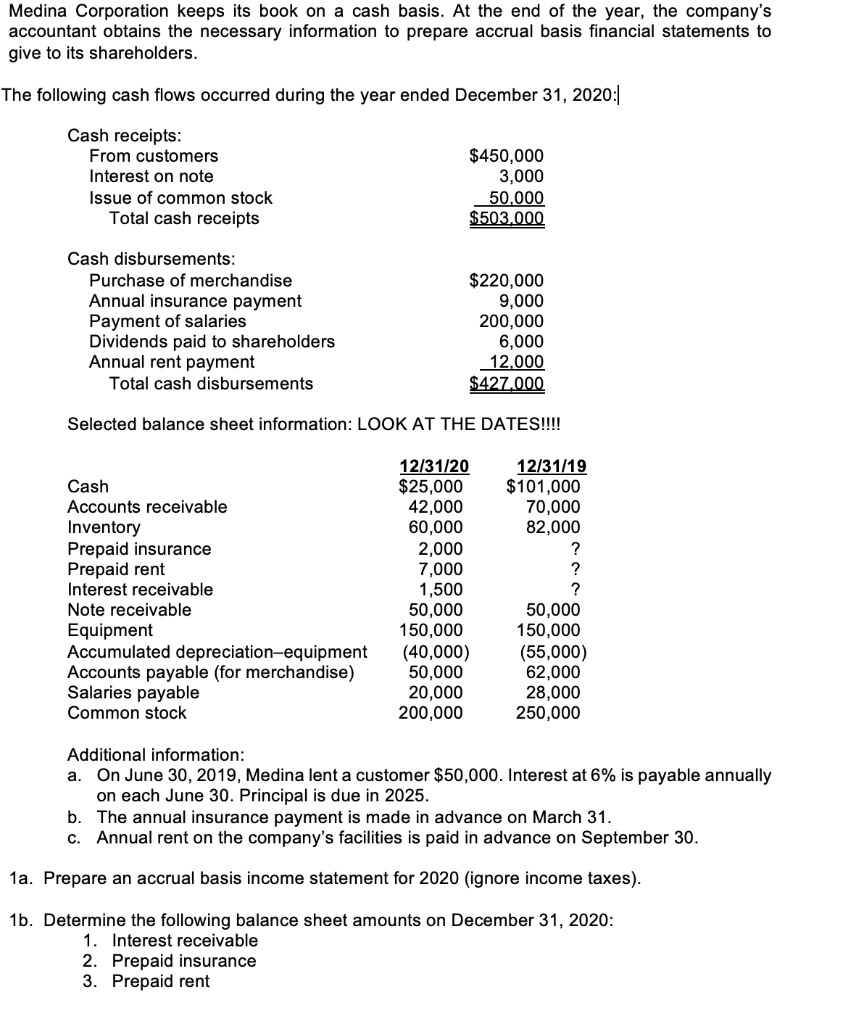

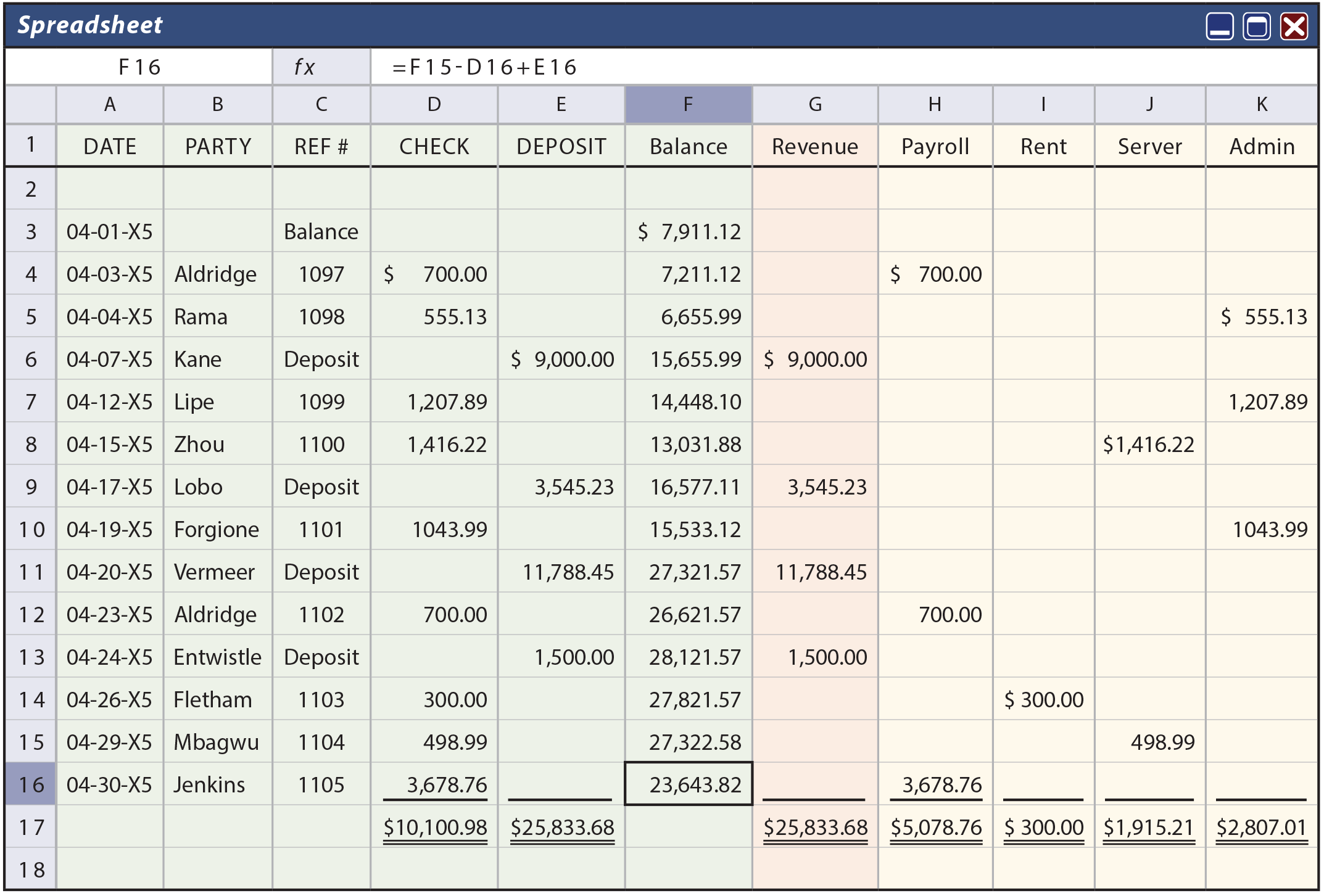

A statement of cash flow on any balance sheet should be. Financial statement presentation financing transactions foreign currency health care entities ifrs and us gaap: In this lesson, we will explain how to prepare financial statements using the cash basis of accounting.

A cash basis income statement is an income statement that only contains revenues for which cash has been received from customers, and expenses. This practice aid is intended to provide preparers of cash‐ and tax‐basis financial statements with guidelines and best practices to promote consistency and for. We will hold off for now on the other three financial statements— the.

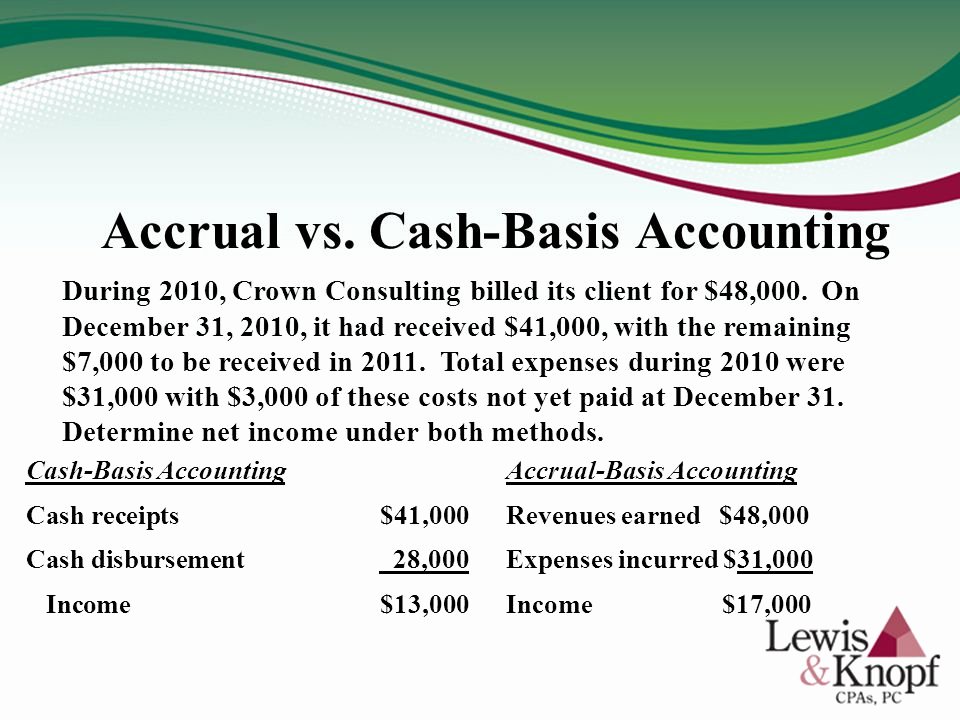

This contrasts accrual accounting, which recognizes income at the time the revenue is earned and records expenses when liabilities are incurred regardless of when cash is. Under the cash basis of accounting, transactions are only recorded when there is a related change in cash. One of the main benefits is that they are.

Similarities and differences income taxes insurance. Cash basis accounting is easy to implement, maintain and understand. Additionally, financial statements prepared using cash basis accounting may not be as detailed or informative as those prepared using accrual basis accounting.

It defines the cash basis of accounting, establishes requirements for the disclosure of information in. The cash basis of accounting is the practice of recording revenue when cash has been received, and recording expenses when cash has been paid out. Businesses using cash basis accounting record revenue when it’s actually received—say, when a check is deposited, clears and.

This means that there are no accounts receivable or. We will also illustrate the difference between cash and. Cash basis refers to a major accounting method that recognizes revenues and expenses at the time cash is received or paid out.

A) today announced a quarterly dividend of 23.6 cents per share of common stock will be. What is cash basis accounting?

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

![[Webinar] Which accounting method is best for your business?](https://www.a2xaccounting.com/img/blog/modified-cash-basis-min.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)