Exemplary Tips About Benefits Of Preparing Cash Flow Statement

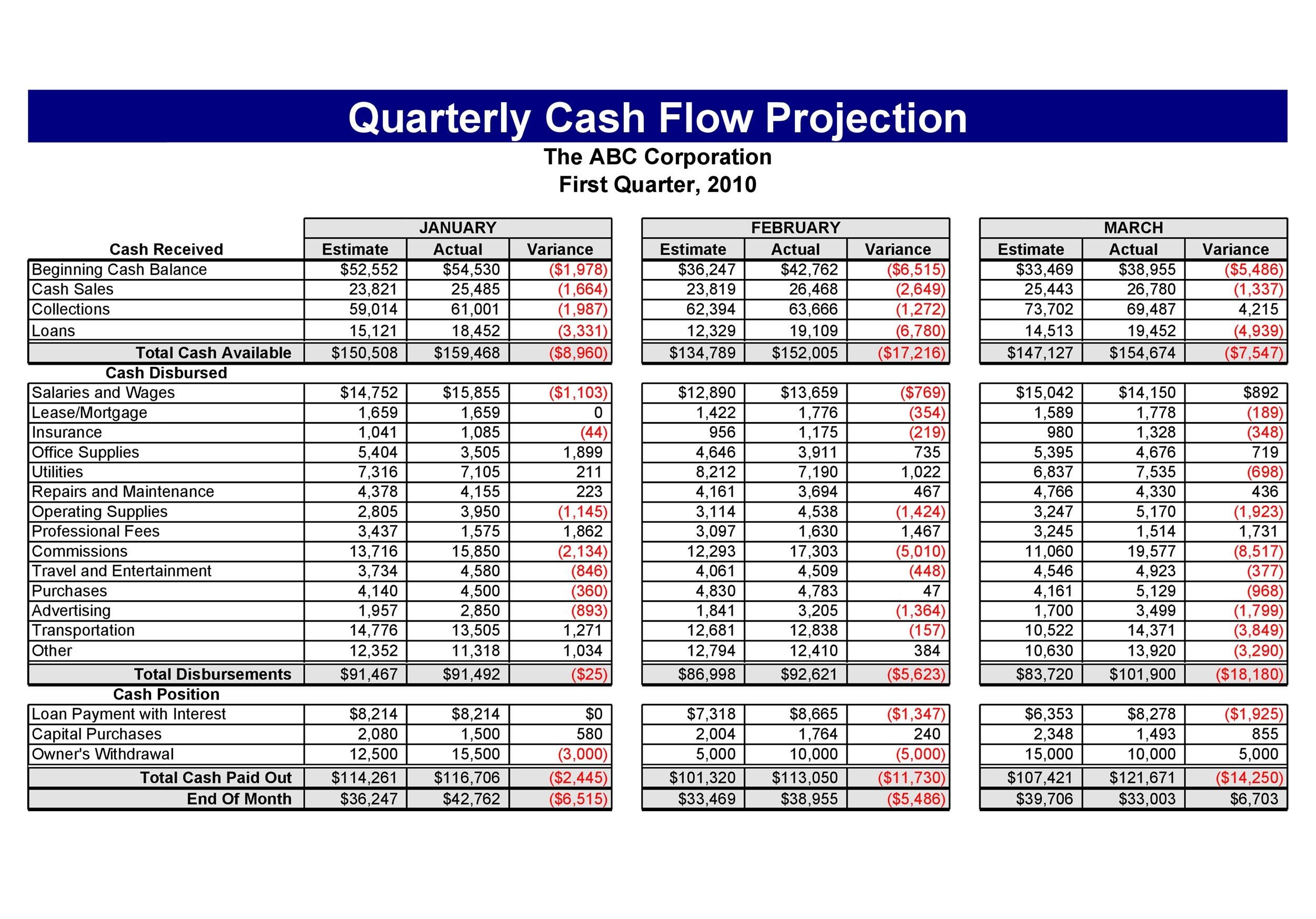

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

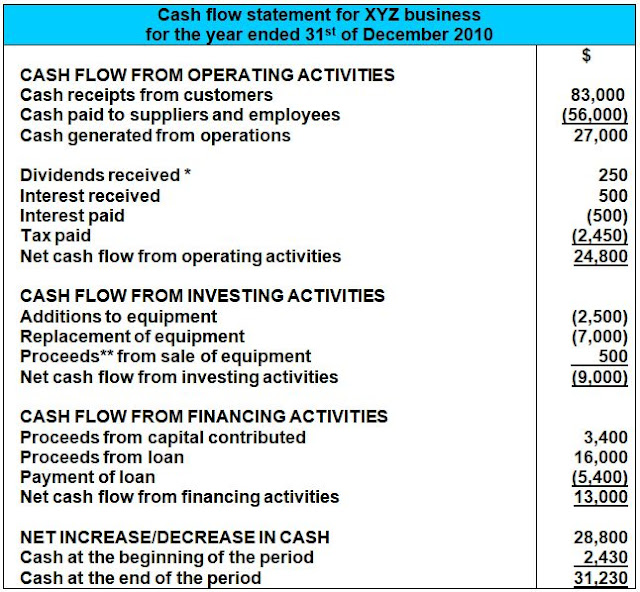

Benefits of preparing cash flow statement. Interest payments, salaries, rent payments, inventory transactions, and tax payments are all included. The advantages of cash flow statement are: Strong cash flow puts the company in a.

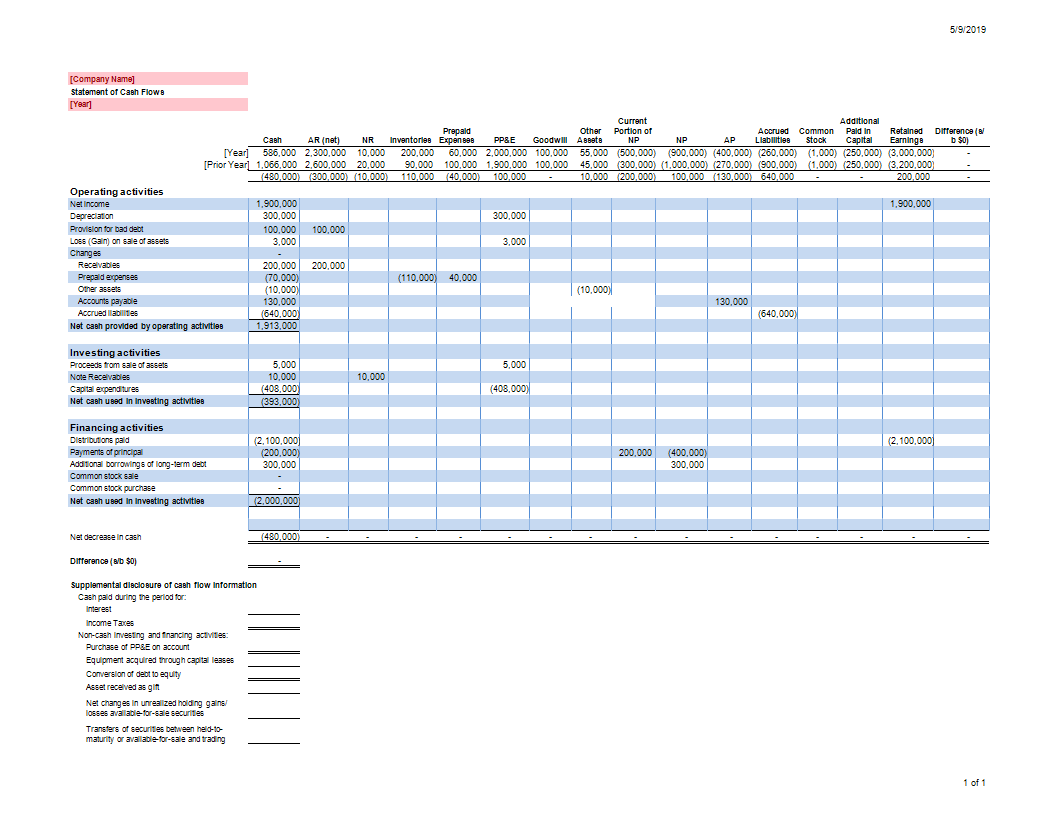

Operating activities this part of the cash flow statement represents how much cash is generated. This helps in critical periods, so they’re prepared when making investments, taking loans, repaying debts and even reducing the workforce if it’s affecting the business. A cash flow statement is the most important part of analyzing cash flows related to financing, operations, investments and profits.

By randy lasnick 20 apr 2022 the cash flow statement’s impact on managing a business is enormous. Tips why are cash flow statements important for business? It helps in looking at the cash budgets of past evaluations with the present to analyze the.

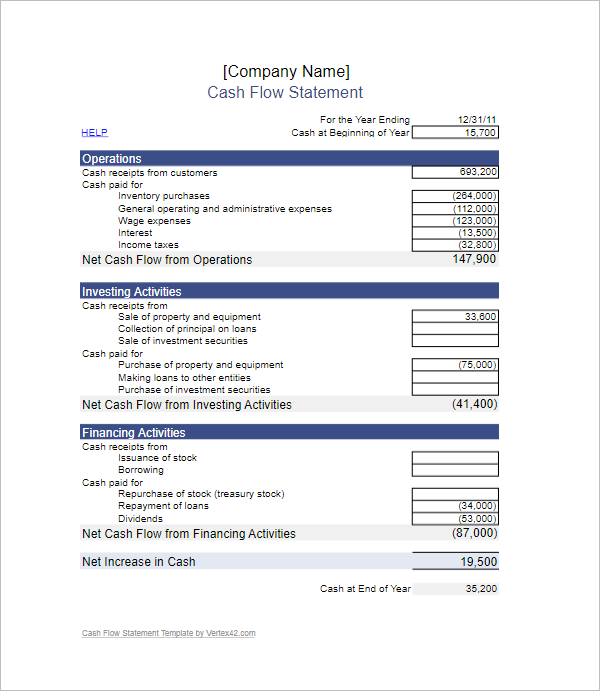

See below why benefits of preparing cash flow statement for an organization or firm and benefits of cash flow analysis. The cash flow statement helps to define the optimum cash position for the firm. The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet.

In other words, the cash flow statement presents the reason for changes in cash passion in two balance sheet dates. It is an essential document for evaluating the sources and uses of cash for an organization. The cash flow statement measures how well the company generates cash to pay its debt obligations and fund its operating expenses.

Cash flow statement helps the management to ascertain the liquidity and profitability position of a firm. The main objectives of preparing a cash flow statement are as follows: Cash flow statement helps in knowing the definite figure of cash inflows and outflows from different tasks of the business.

The statement of cash flows acts as a bridge between the income statement and balance sheet by showing how cash moved in and out of the business. Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. A cash flow statement is a statement of the inflow or outflow of cash or cash equivalent of the company in the specified period.

The statement of cash flows is one of the financial statements investors rely on to gauge a company's financial strength. Cash flow information is harder to manipulate as it just reflects cash in and cash out, it. Also known as the statement of cash flows, the cfs helps its creditors determine how much cash is available (referred to as liquidity) for the company to fund its operating expenses and pay.

What is cash flow statement? Here are eight reasons why a cash flow statement might be useful for your company: Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the beginning of the reporting period.

Providing a better view of the company’s liquidity allowing for the identification of a trend in cash flow providing insights into the company’s financial stability If optimum cash balance can be determined, the firm can ascertain the excess or shortage of cash. (a) ascertaining liquidity and profitability positions: