Here’s A Quick Way To Solve A Tips About Income Statement Accounting 1

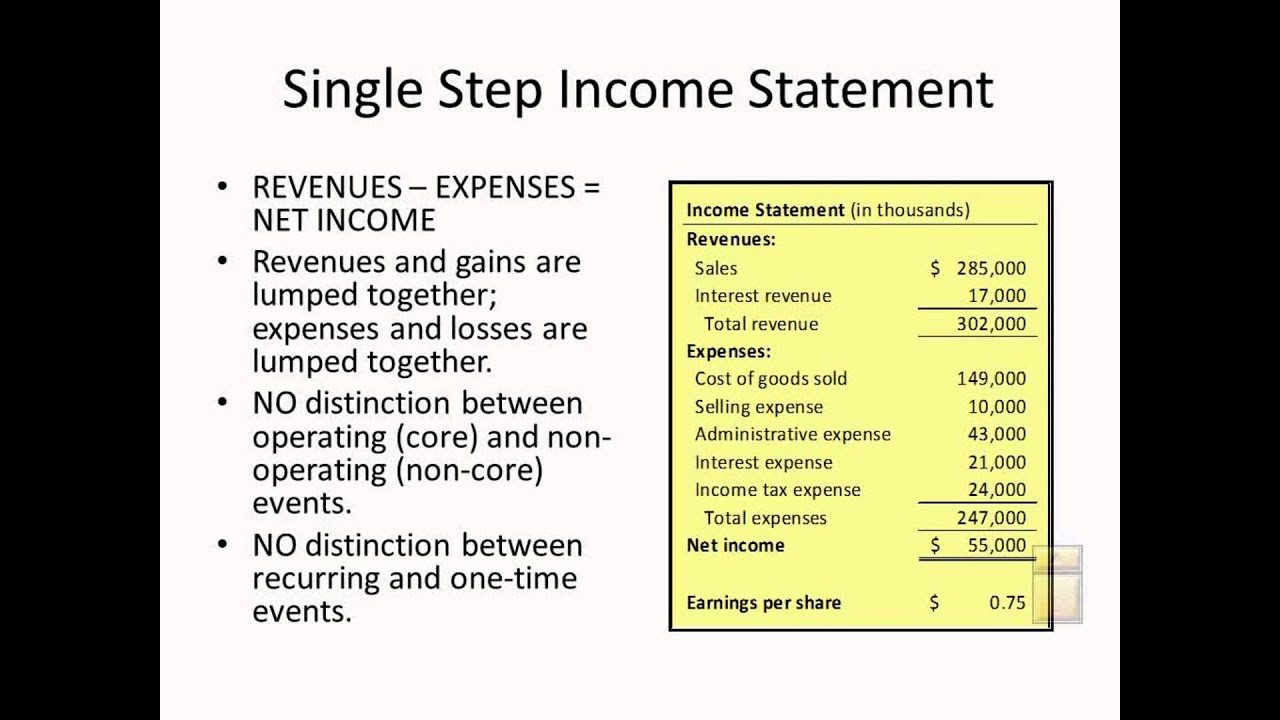

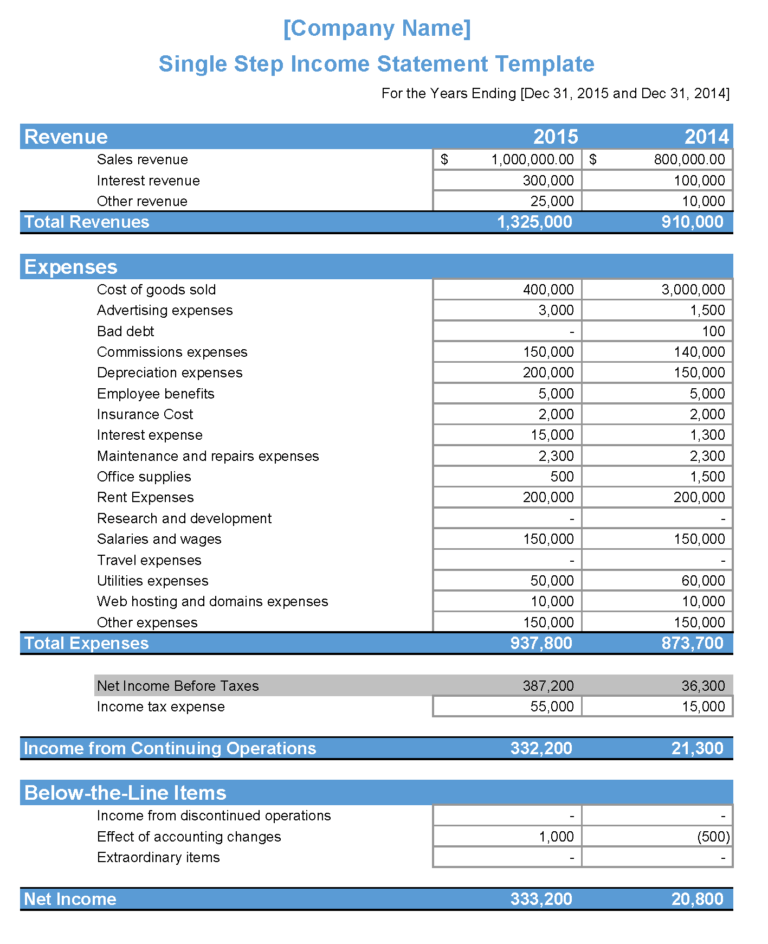

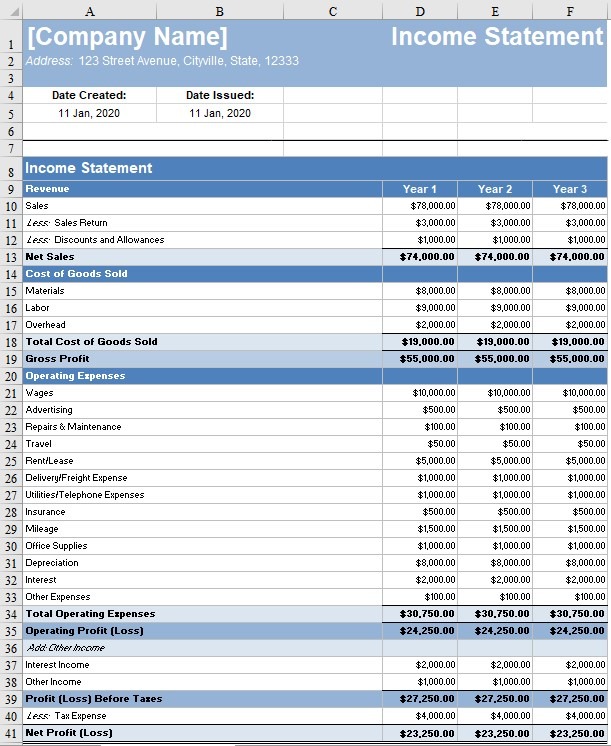

This financial report follows the following formula:

Income statement accounting 1. Income statements have four distinct sections. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable education (save) repayment plan. What is an income statement?

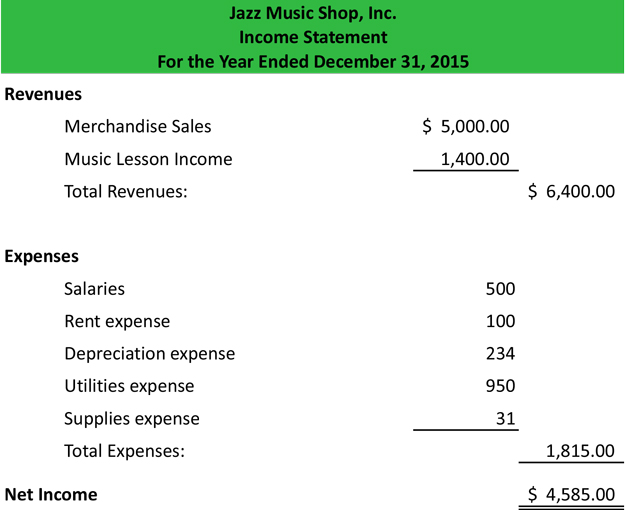

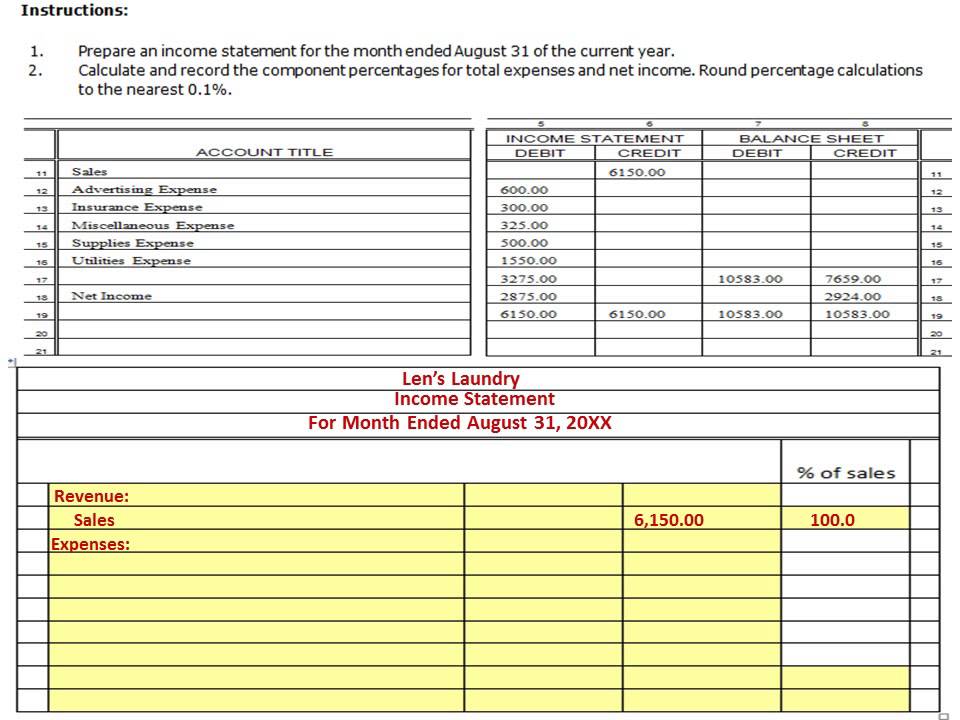

Definition income statement, also known as profit & loss account, is a report of income, expenses and the resulting profit or loss earned during an accounting period. Compute gross profit and the gross profit percentage. Net income is revenues less expenses (see the highlighted accounts on the adjusted trial balance above).

Define “gains” and “losses” and explain how they differ from “revenues” and “expenses”. Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago. Income from operations of $652 million;

The income statement's primary purpose is to show the financial performance of a business. The income statement illustrates the profitability of a company under accrual accounting rules. It records revenues, gains, expenses, and losses to evaluate net income.

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. The income statement reports revenues from sales of goods and services as well as expenses such as rent expense and cost of goods sold. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

This calculation shows investors and creditors the overall profitability of the company as well as how efficiently the company is at generating profits from total revenues. Example following is an illustrative example of an income statement prepared in accordance with the format prescribed by ias 1 presentation of financial statements. The income statement presents an entity's revenues and expenses, and the resulting net income or net loss.

An income statement reports a business’s revenues, expenses, and overall profit or loss for a specific time period. Record adjusted ebitda margin fourth. An income statement is one of the three important financial statements used for reporting a company’s financial performance over a specific accounting period.

It’s one of the 3 major financial statements that small businesses prepare to report on their financial performance, along with the balance sheet and the cash flow statement. Consider business xyz that earned $25,000 from the sale of goods and $3,000 as revenue from training personnel. A typical set of financial statements is made up of an income statement, statement of retained earnings, balance sheet, statement of cash flows, and explanatory notes.

To help accountants prepare and users better understand financial statements, the profession has outlined what is referred to as elements of the financial statements, which are those categories or accounts that accountants use to record transactions and prepare financial statements. An income statement is a financial report detailing a company’s income and expenses over a reporting period. In return, the business spent money on various activities, including wages, rent, transportation, etc., leading to $14,200 in expenses.

The first section of the income statement calculates gross profit, or the total amount of money made, from sales revenue and cost of goods sold. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs. The 'income statement', or 'profit and loss statement' (p&l) is one of the three major financial statements, along with the balance sheet and the statement of cash flows.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)