Painstaking Lessons Of Info About Bank Interest In Income Statement

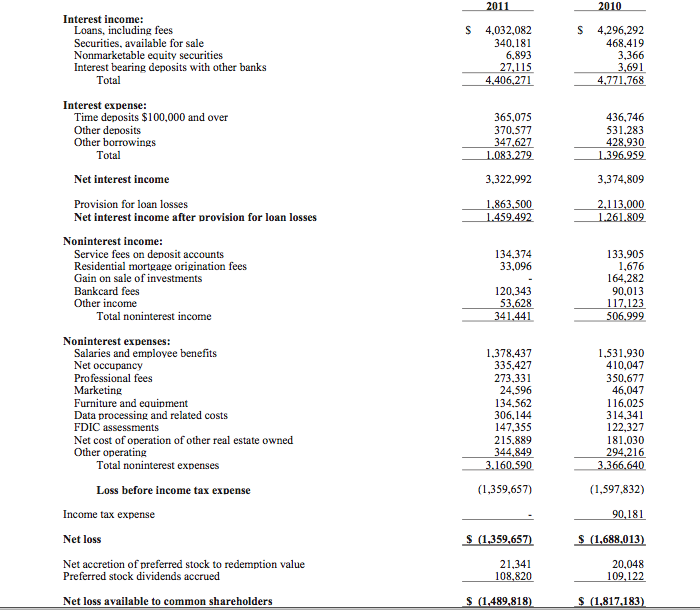

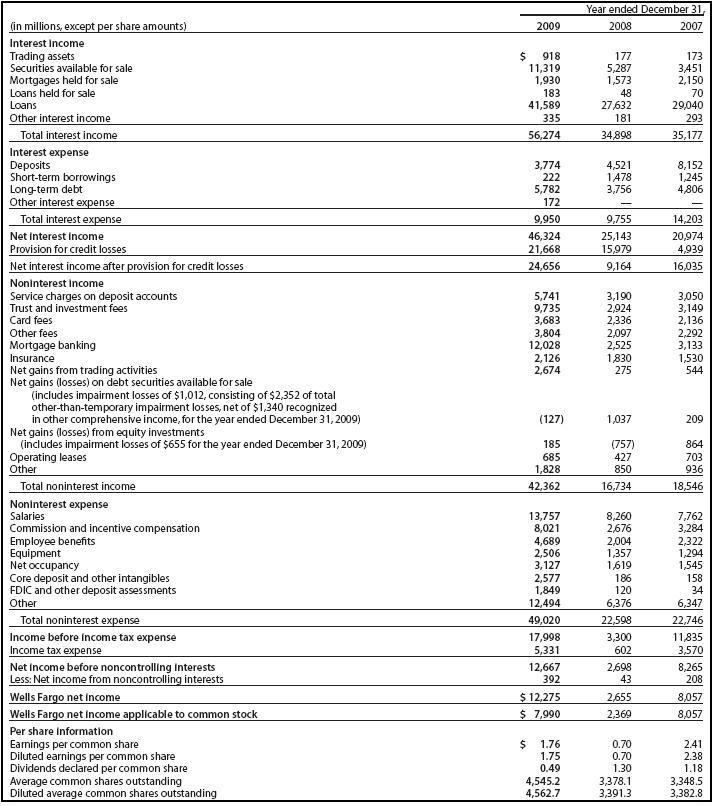

This line item is typically presented separately from interest expense in the income statement.

Bank interest in income statement. As i explained also in the last article, the bank pays customers interest on. Others combine them and report them under either interest. His decision to allow a vote on a labour.

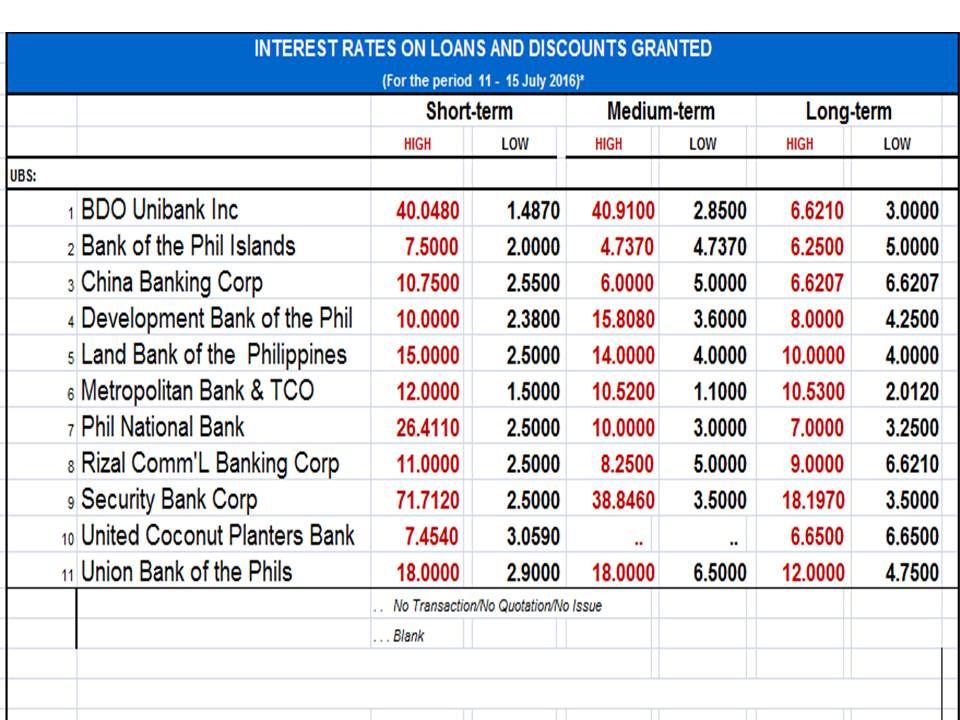

Most banks provide this table in their annual 10k statement. Treasury bills don't offer high interest rates, but because. The two main heads in income are net interest income which is earned from lending activities.

Interest income = average cash and cash equivalents × cash rate (%) where: You might receive this tax form from your bank because it. On a larger scale, interest income is the amount earned by an investor’s money that he places in an investment or project.

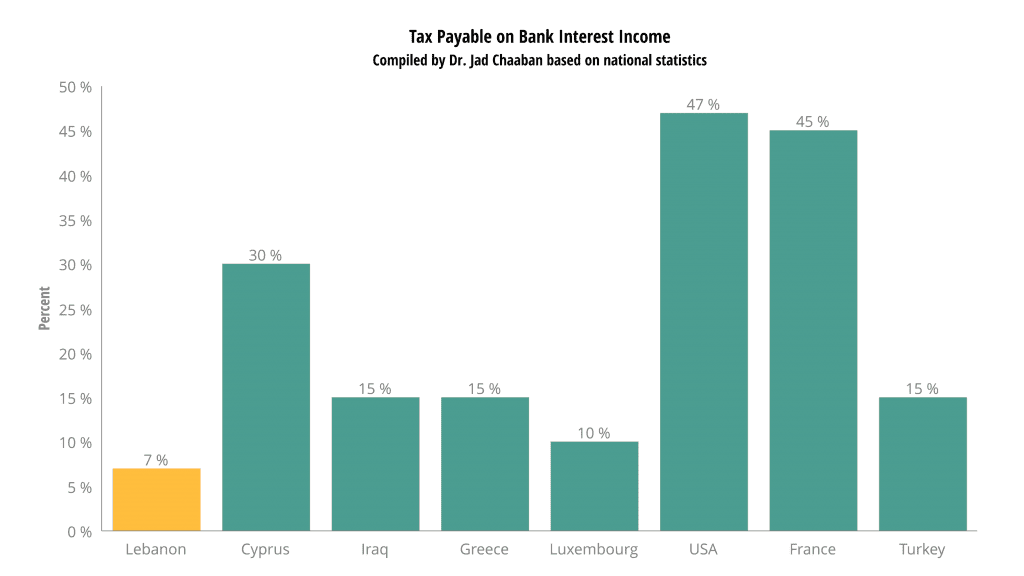

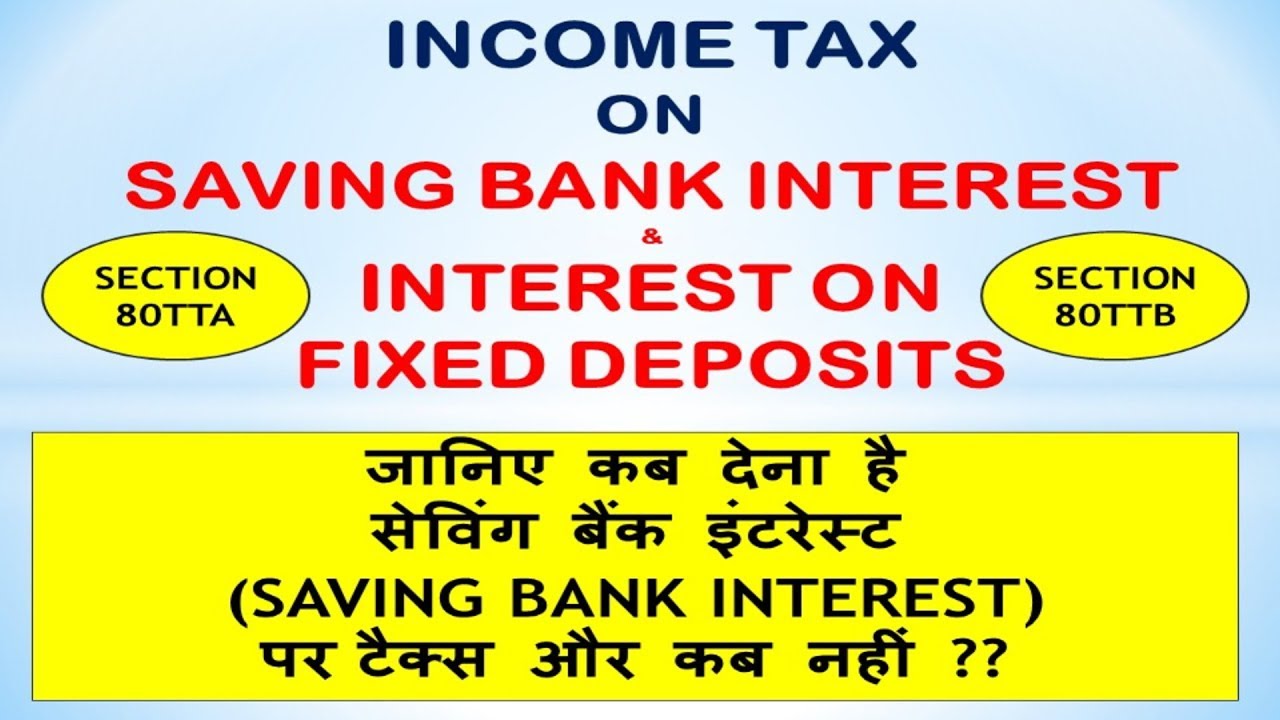

Section 80ttb of the income tax act provides tax benefits for senior citizens on interest income from deposits, allowing a deduction of rs. Tax treatment of interest income. Interest income, as discussed prior, is the money.

Using the formula above, xyz bank's net interest income is: Average cash and cash equivalents → (beginning + ending cash balance) ÷ 2. Interest or yield is shown that.

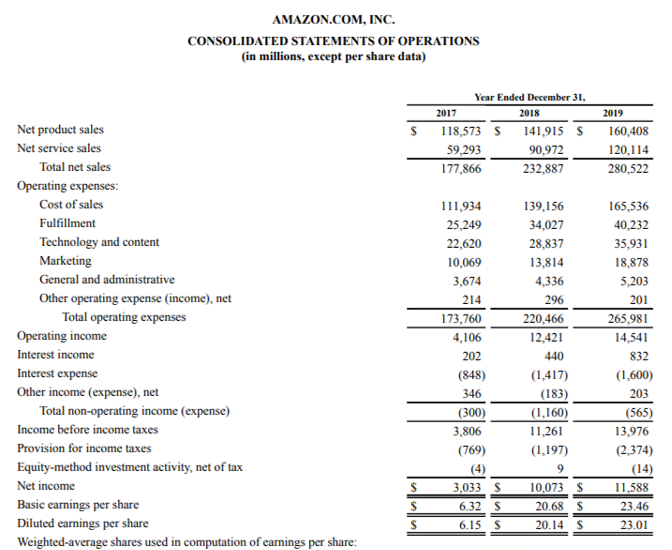

The civil fraud ruling on donald trump, annotated. Why does net interest income (nii). A bank's income statement contains two general categories:

Interest income journal entry is crediting the interest income under the income account in the income statement and debiting the interest receivable account in the balance sheet. Commons speaker sir lindsay hoyle is under pressure this morning over his handling of the snp's motion for a ceasefire in gaza. Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of.

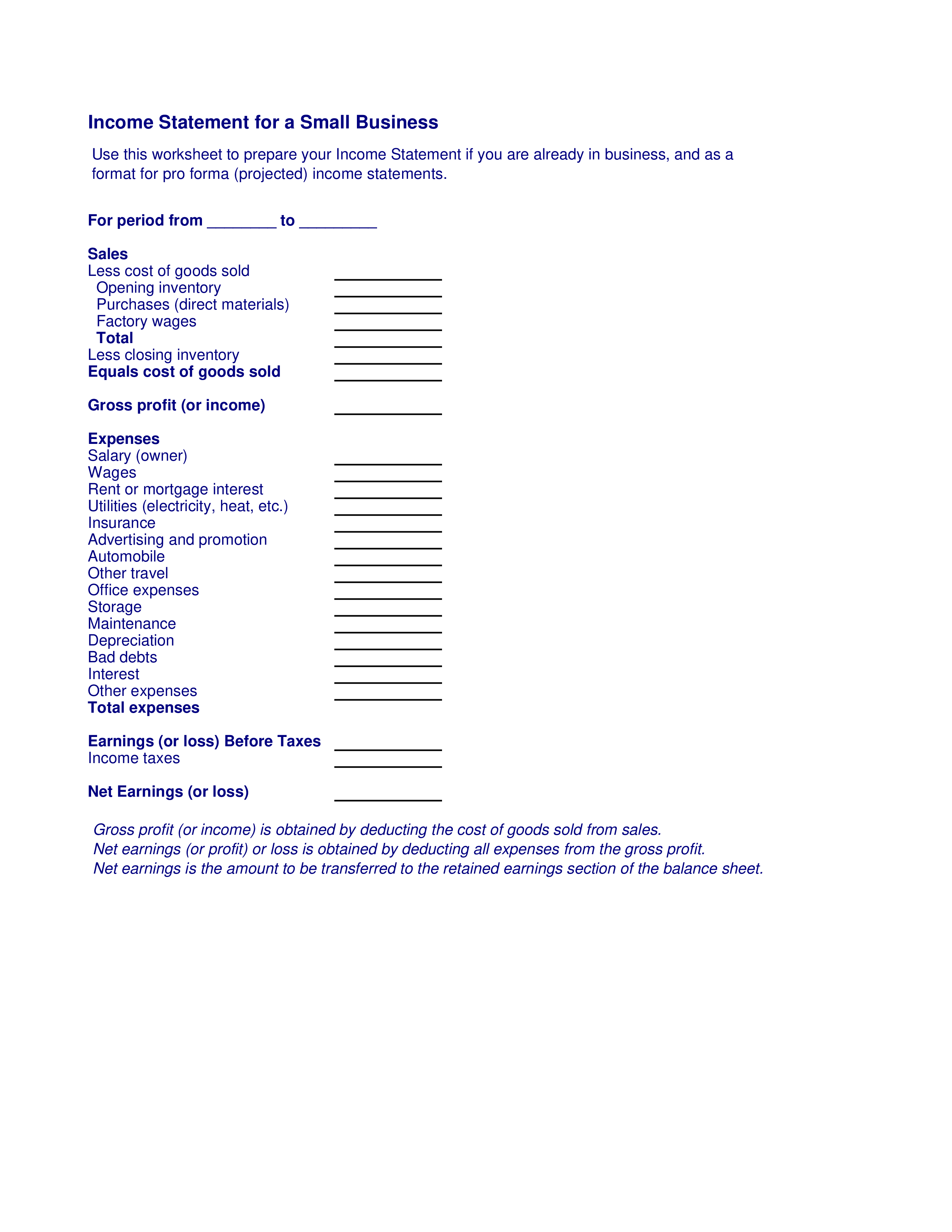

Trump was penalized $355 million plus interest and banned for three years from. It tells the financial story of a business’s operating. Here’s how to do it right complete with a free income statement template.

An interest expense is the cost incurred by an entity for borrowed funds. Some income statements report interest income and interest expense as their own line items. The formula for calculating simple interest is i = p x r x t , where i is the amount of interest, p is the principal balance or the average daily balance, r is the.

The purpose of an income statement is to show a company’s financial performance over a given time period. If the company's income statement presents income from operations and other income. An income statement is crucial for assessing your business performance.