Smart Tips About Tds Not Showing In 26as

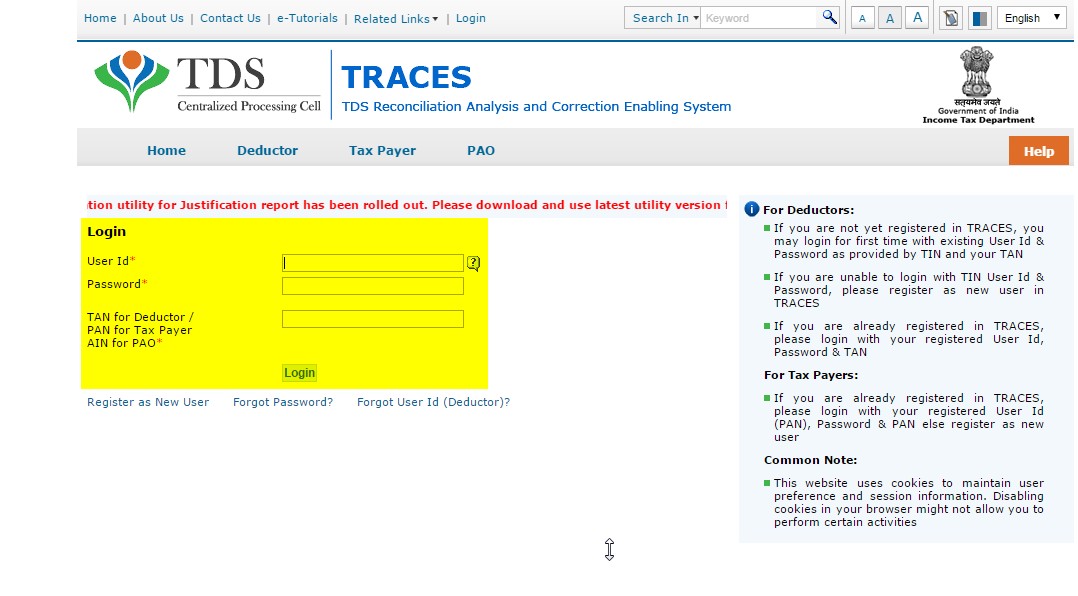

The deductor can rectify the errors by filing a tds/tcs correction statement for mistakes in the tds return filed by the deductor.

Tds not showing in 26as. Form 26as is a statement that provides details of any amount deducted as tds or tcs from various sources of income of a taxpayer. The possible reasons for a tax credit not being displayed in your form 26a are listed below: Consequently, the tds amount may not be reflected in your form 26as, leading to a mismatch.

For this, you need to prior differentiate both the forms and see which entries are not showing in form 26as. Can’t find the tds deducted by employer in your form 26as for fy21? If a taxpayer has evidential proof that tds is already deducted on a particular income, then even if such tds credit is not reflected in 26as, the taxpayer.

Select the “view form 26as” link. Press the “continue” button. If tax is deducted and a tds certificate is issued, credit of tds cannot be denied to the recipient solely on the ground that such credit does not appear in form 26as.

As, at times, it so happens that the amount of tds credit appearing in form 26as is more than the amount in tds certificates and this happens because one or. If you are a taxpayers, you need to check your form 26as to ensure the tax deducted at source (tds) is reflected correctly in the income tax records. If there is a mismatch in the figures of form 26as and tds actually deducted, the.

The last date for issuing form 16 by an employer is 15 th june. If you have income from multiple sources or. On being called upon to explain as to how the benefit of this tds was claimed,.

Once the revised tds return is. Taxpayers must resort to certain steps to avoid mistakes and subsequent penalties while trying to file their itrs in time. Here are the common mistakes that led toward tds.

The tax deductor or collector has not filed a tds or tcs return. Reasons for mismatches between tds statement and form 26as. In some cases, certain tds entries may be missing in both form 26as and the ais, which can happen if the deductor has not reported the tds details to the tax.

It also reflects details of advance tax/self. Tds certificates should be downloaded only from traces you should ensure that tds certificates (form 16/16a/form16b/form16c) issued to you are. Select the “income tax returns” tab.

Verify details in form 26as: There are various occasions where the tds information in the tds statement and. What are the consequences of mismatch in tds figures in form 26as?

If you find that tds has not been deducted by your.

![State Bank Of India [SBI] — tds deducted and not reflected in 26as](https://www.consumercomplaints.in/thumb.php?complaints=2007339&comment=3147104&src=138325216.jpg&wmax=900&hmax=900&quality=85&nocrop=1)