Recommendation Info About Financial Accounting Ratios Formulas

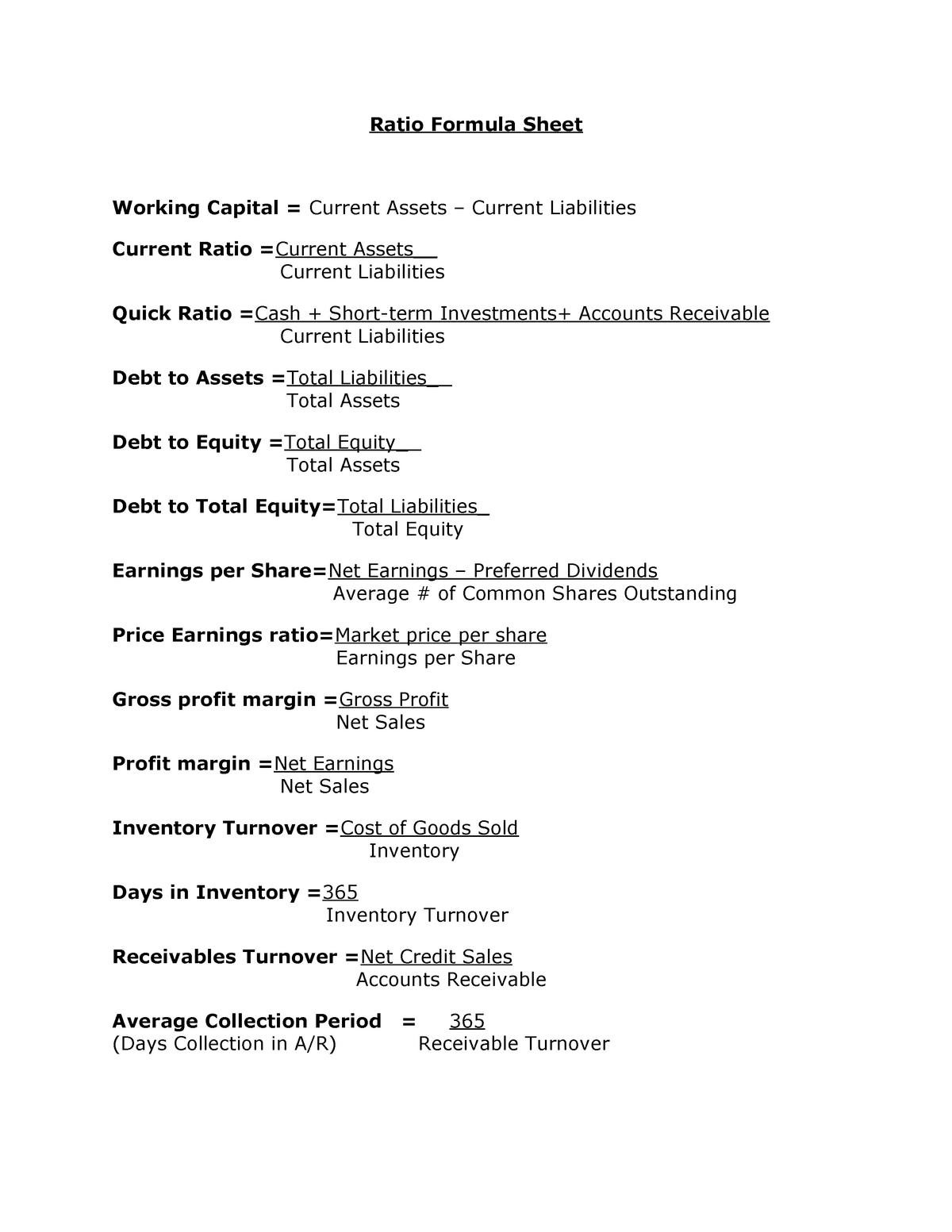

Ratio #5 debt to total assets;

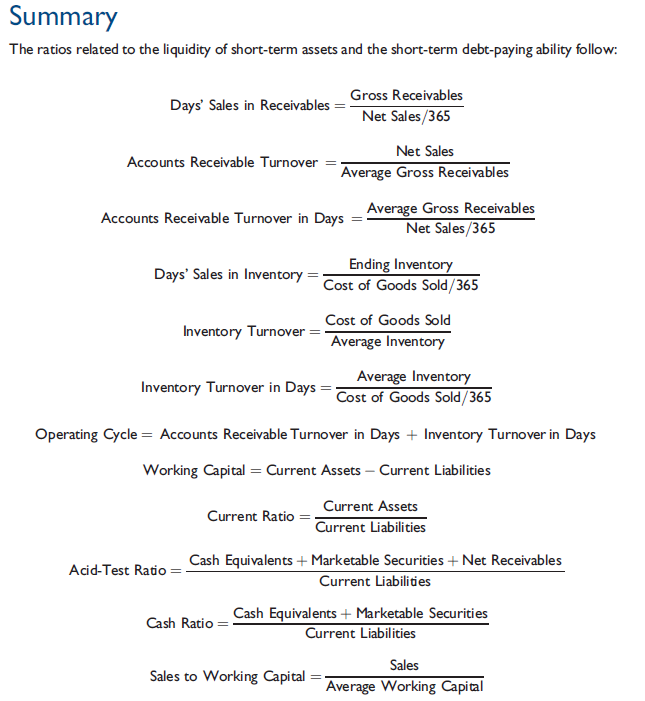

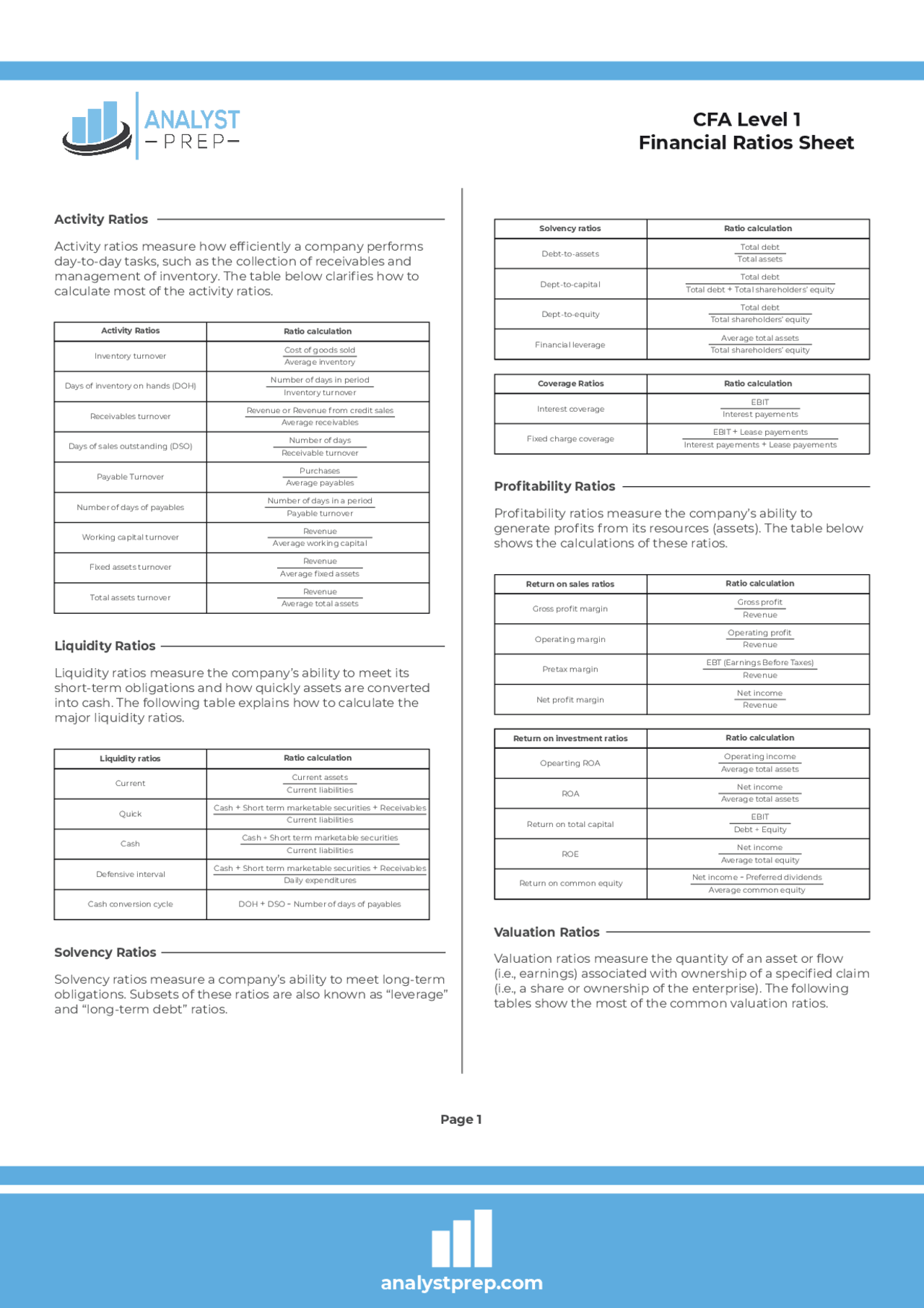

Financial accounting ratios formulas. Commonly used ratios in this classification include: Internal measure = current assets / average daily operating costs. In the realm of accounting, formulas act as guiding lights, illuminating the path to financial clarity.

Ii) long term solvency or financial leverage ratios. These are the most important financial ratios formulas you can use to analyze any business: Or = external equities / internal equities.

Net working capital = net working capital / total assets. Profitability, liquidity, management efficiency, leverage, and valuation & growth. Frequently asked questions (faqs) q:

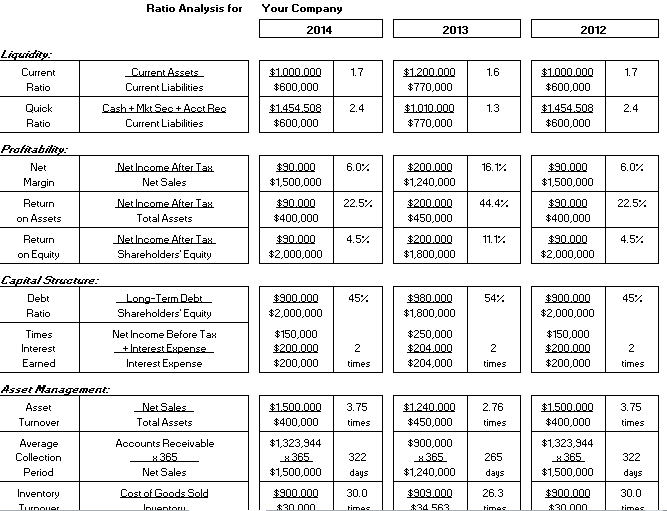

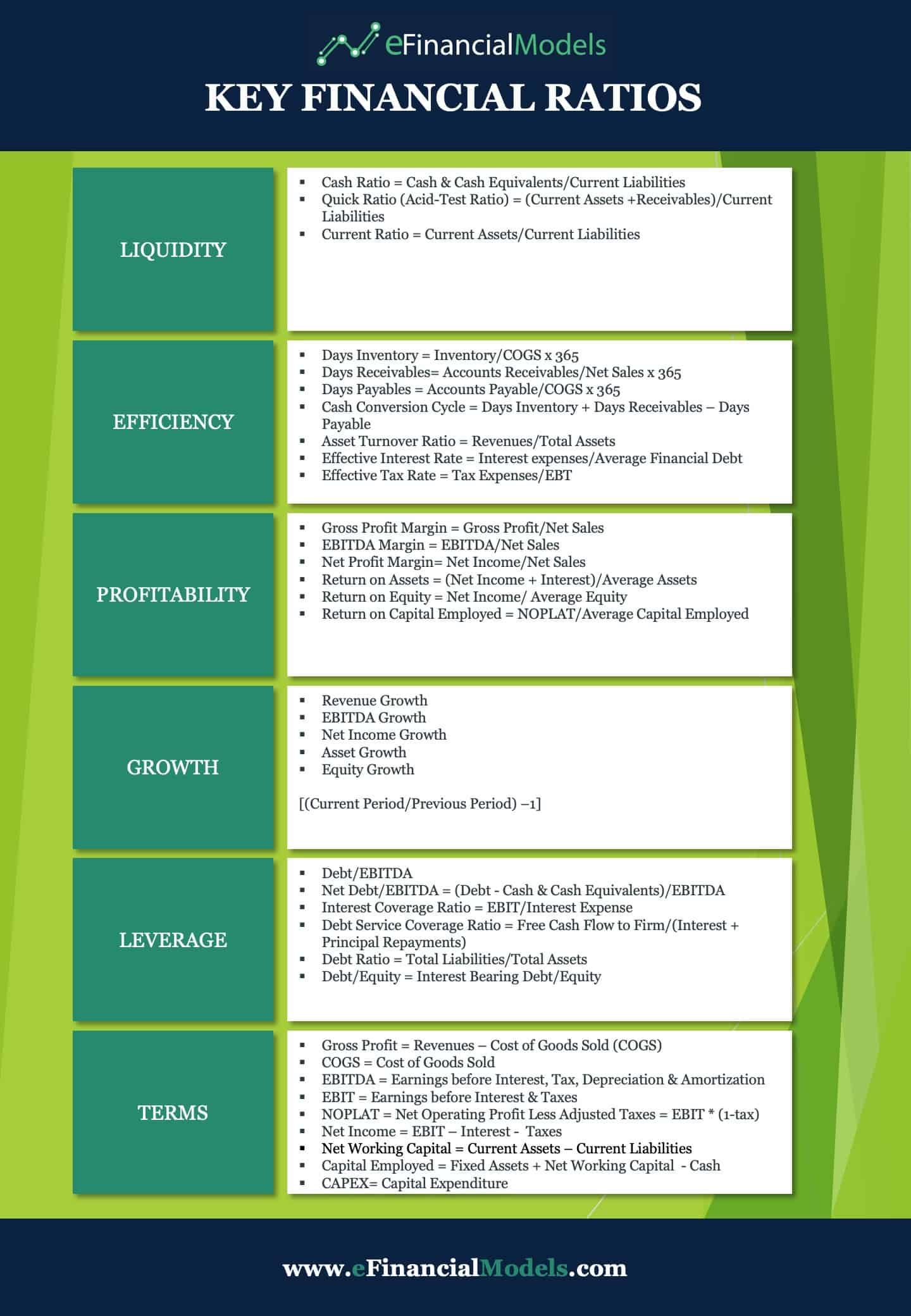

Commonly used profitability ratios and formulas. Andrew bloomenthal updated march 17, 2023 reviewed by amy drury fact checked by michael logan what is ratio analysis? Accounting ratios indicate the company’s performance by comparing various figures from financial statements and the results/performance of the company over the last period, suggesting the relationship between two accounting items where financial statement analysis performs using liquidity, solvency, activity, and profitability ratios.

Analysis of financial ratios serves two. Gross profit ratio = (gross profit / net sales) × 100; Funded debt to total capitalization ratio.

Gross margin = gross profit / net sales. Liquidity, debt levels (leverage), growth, margins, profitability and rates of return (ror), valuation, and much more. Return on assets = net income/total assets.

Financial ratios are grouped into the following categories: List of financial ratios, their formula, and explanation. Financial ratios are often divided up into seven main categories:

Financial ratios using balance sheet amounts. An accounting ratio compares two line items in a company’s financial statements, namely made up of its income statement, balance sheet, and cash flow statement. Gross profit ratio the gross profit ratio or margin ratio measures the revenue and the gross profit and is given as a percentage.

Performance ratios compare information on the income statement, and are designed to judge the ability of an organization to generate a profit. Learn how to compute and interpret financial ratios through this lesson. From basic calculations to intricate financial ratios, these formulas empower businesses to make informed decisions, ensuring a robust financial foundation.

Our discussion of 15 financial ratios. Learn the most useful financial ratios here. This is a collection of financial ratio formulas which can help you calculate financial ratios in a given problem.