Great Info About Trial Balance List

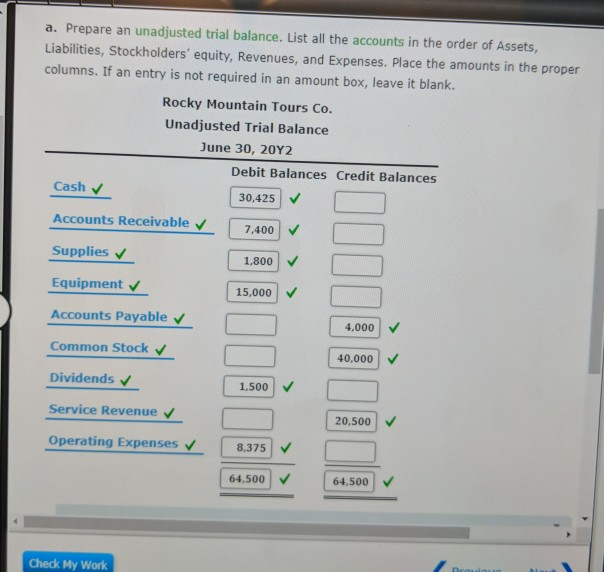

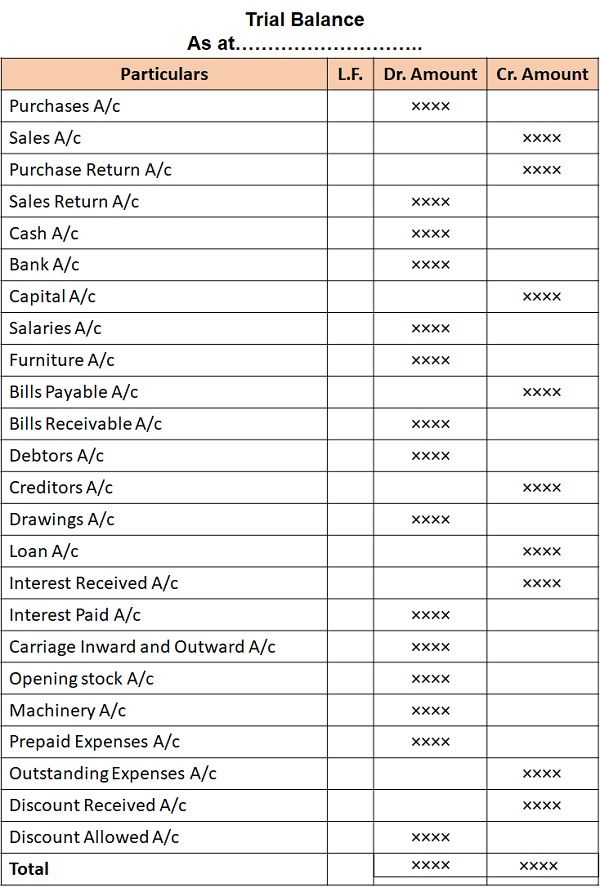

Accounts in a trial balance are listed in the following order:

Trial balance list. Accountants use a trial balance to test the equality of their debits and credits. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. Assets liabilities equity revenue expenses

Trump was penalized $355 million, plus millions more in interest, and banned for three years from serving in any top roles at a new. Liabilities & incomes shall have a credit balance. The accounts included are the bank, stock, debtors, creditors, wages, expense codes and sales.

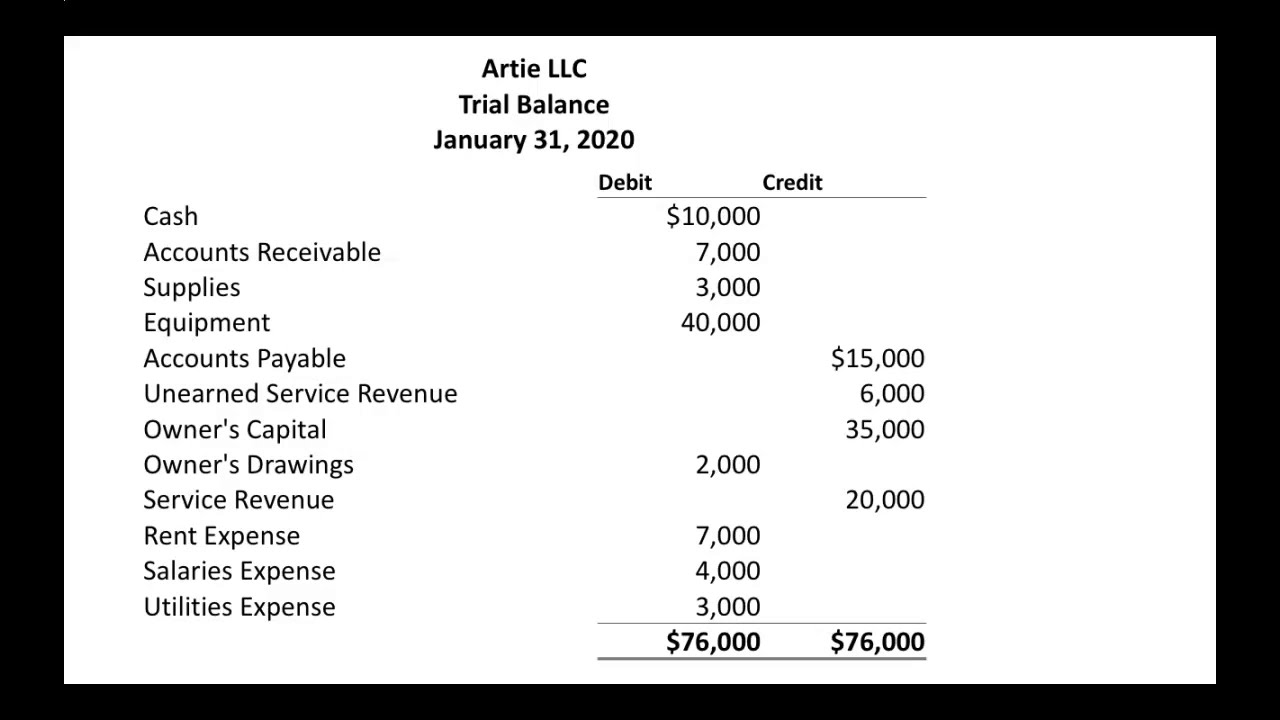

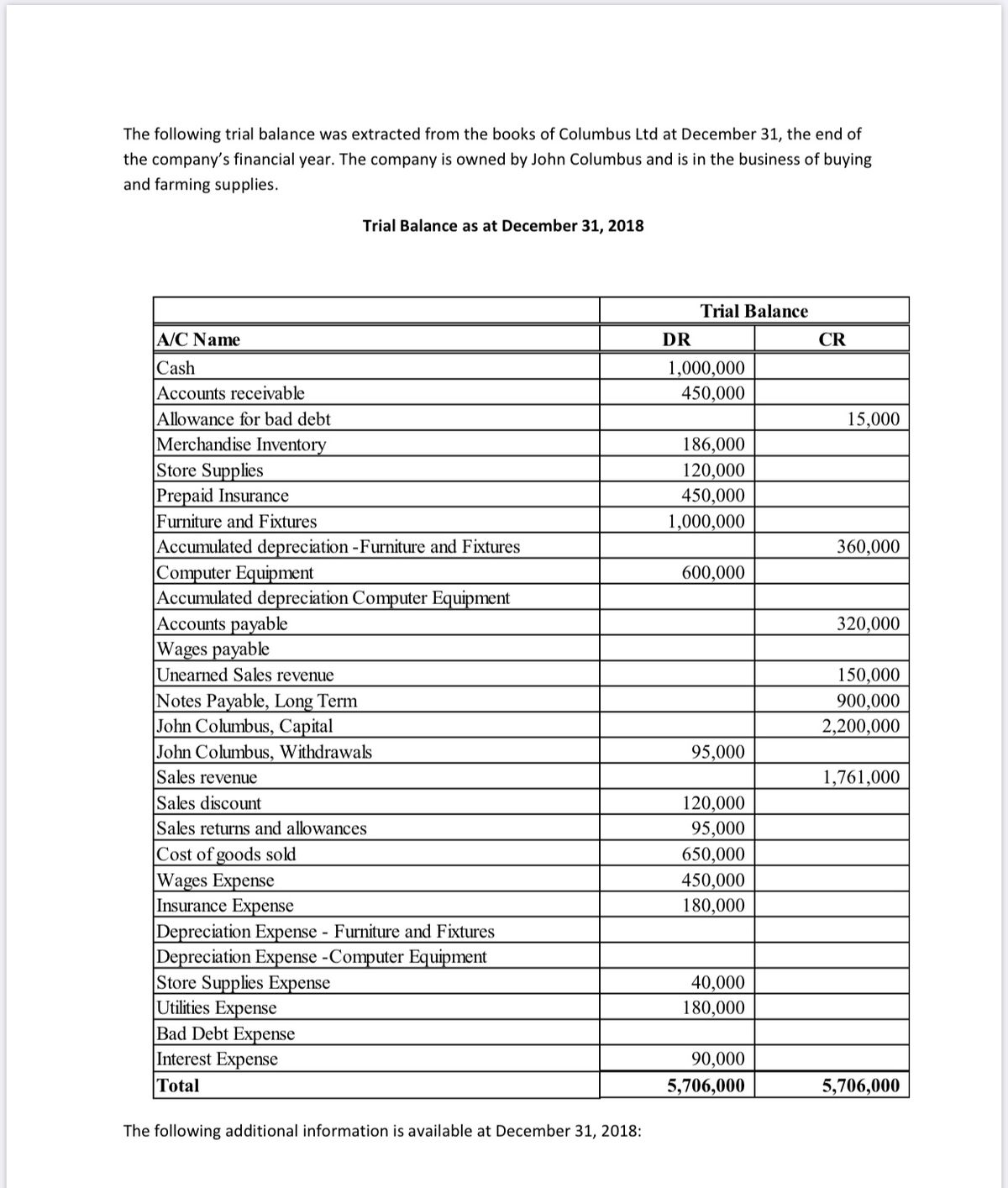

The total debit balances will match the credit balances if the general ledger is accurate. It displays the debits and credits of all business transactions within a specific period, encompassing assets, liabilities, equity, and revenues. Ledger balances are segregated into debit balances and credit balances.

It comprises a list of different accounts of general ledger balances, both debit and credit amounts. For example, utility expenses during a period include the payments of four different bills amounting to $ 1,000, $ 3,000, $ 2,500, and $ 1,500, so in the trial balance, single utility expenses account will be shown wi. The primary purpose of a trial balance is to ensure that the company’s accounting records are in balance.

A trial balance is an internal financial statement that lists the adjusted closing balances of all the general ledger accounts (both revenue and capital) contained in the ledger of a business as at a specific date. The trial balance is a list of all the accounts and so it is easy to compare the trial balance of the current year with that of previous year. Preparing and adjusting trial balances aid in the preparation of accurate financial statements.

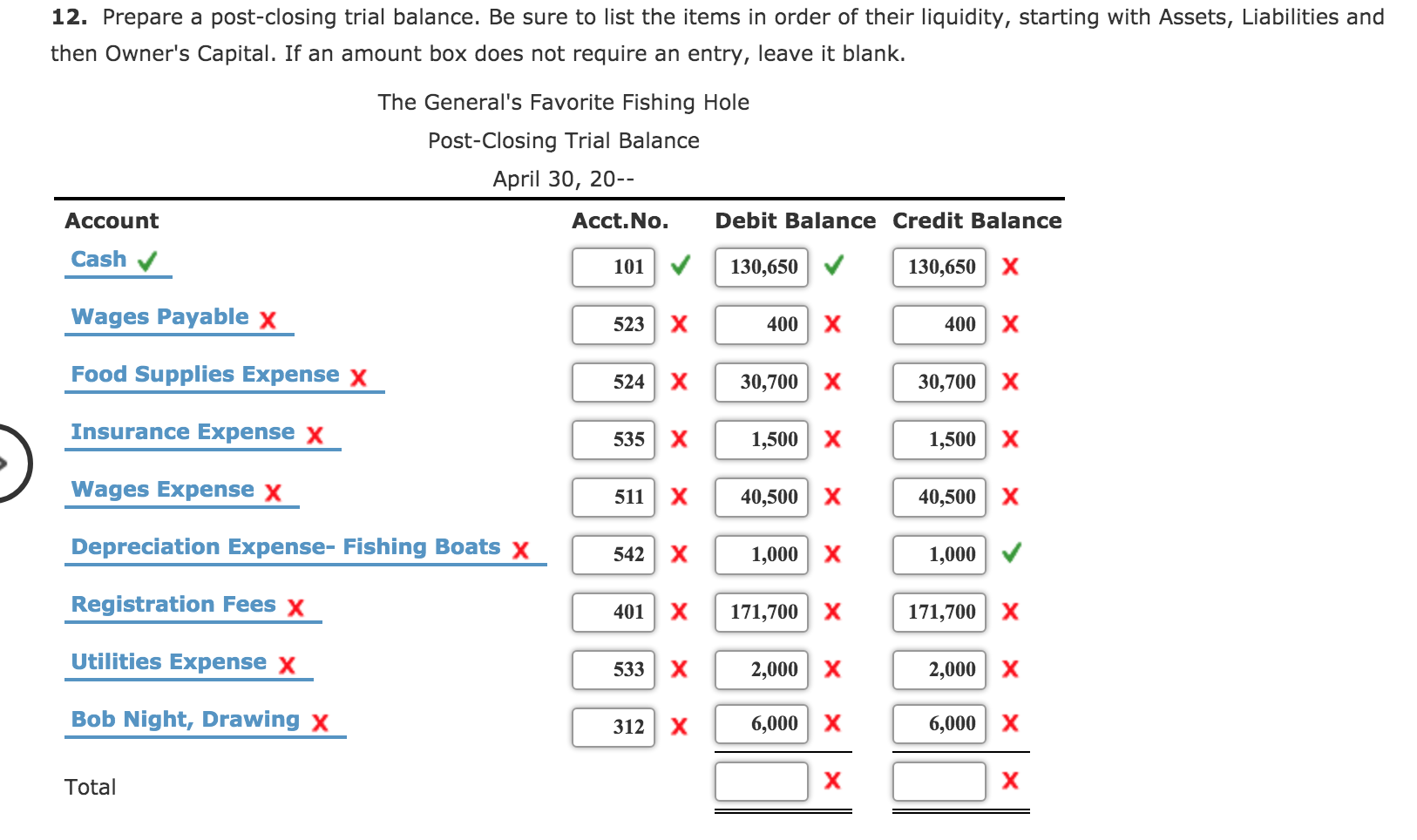

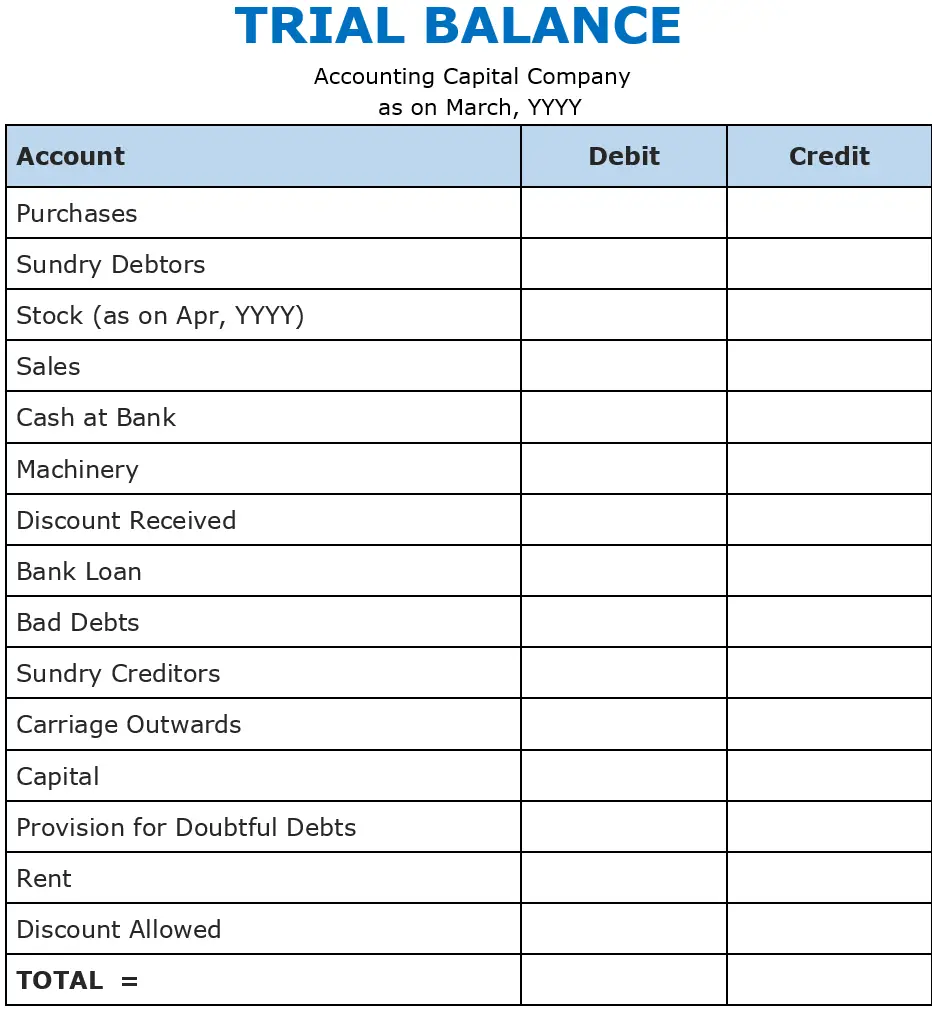

Example of a trial balance document By doing so, a business entity can have a fair idea of how every account has performed and what decisions could be taken to improve the performance level. Trial balance is a list of closing balances of ledger accounts on a certain date and is the first step towards the preparation of financial statements.

For the balance sheet items, assets items are range first and followed by liabilities and equities items. Although a trial balance may equal the debits and credits, it does not mean the figures are correct. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

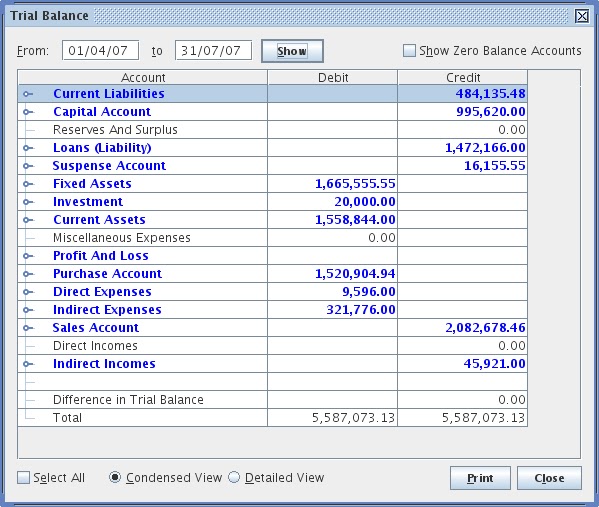

How to prepare a trial balance: By kate christobek. Preparation of trial balance allows a firm to check for mathematical accuracy of the general ledger balances.

A trial balance is a conglomerate of or list of debit and credit balances extracted from various accounts in the ledger including cash and bank balances from cash book. Balancing in a trial balance. Learn what is trial balance, its features, preparation process, purpose and forms.

The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. Generally, the trial balance format has three columns.