Real Info About Advertising Expense On Income Statement

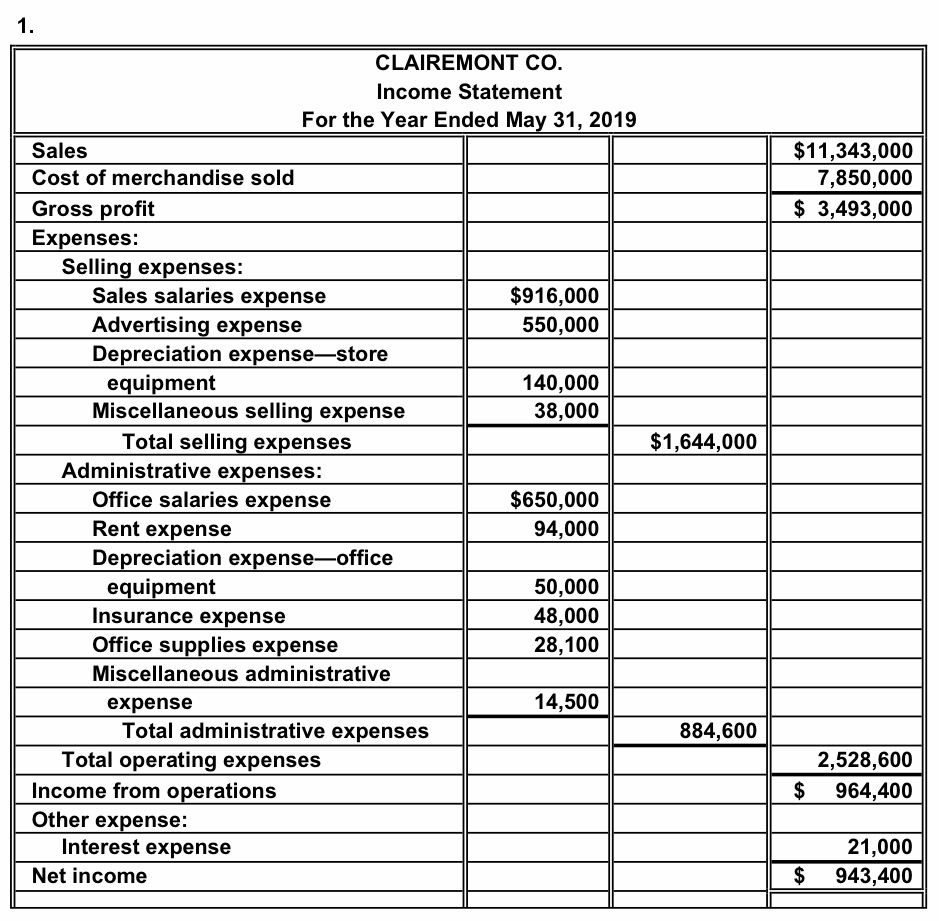

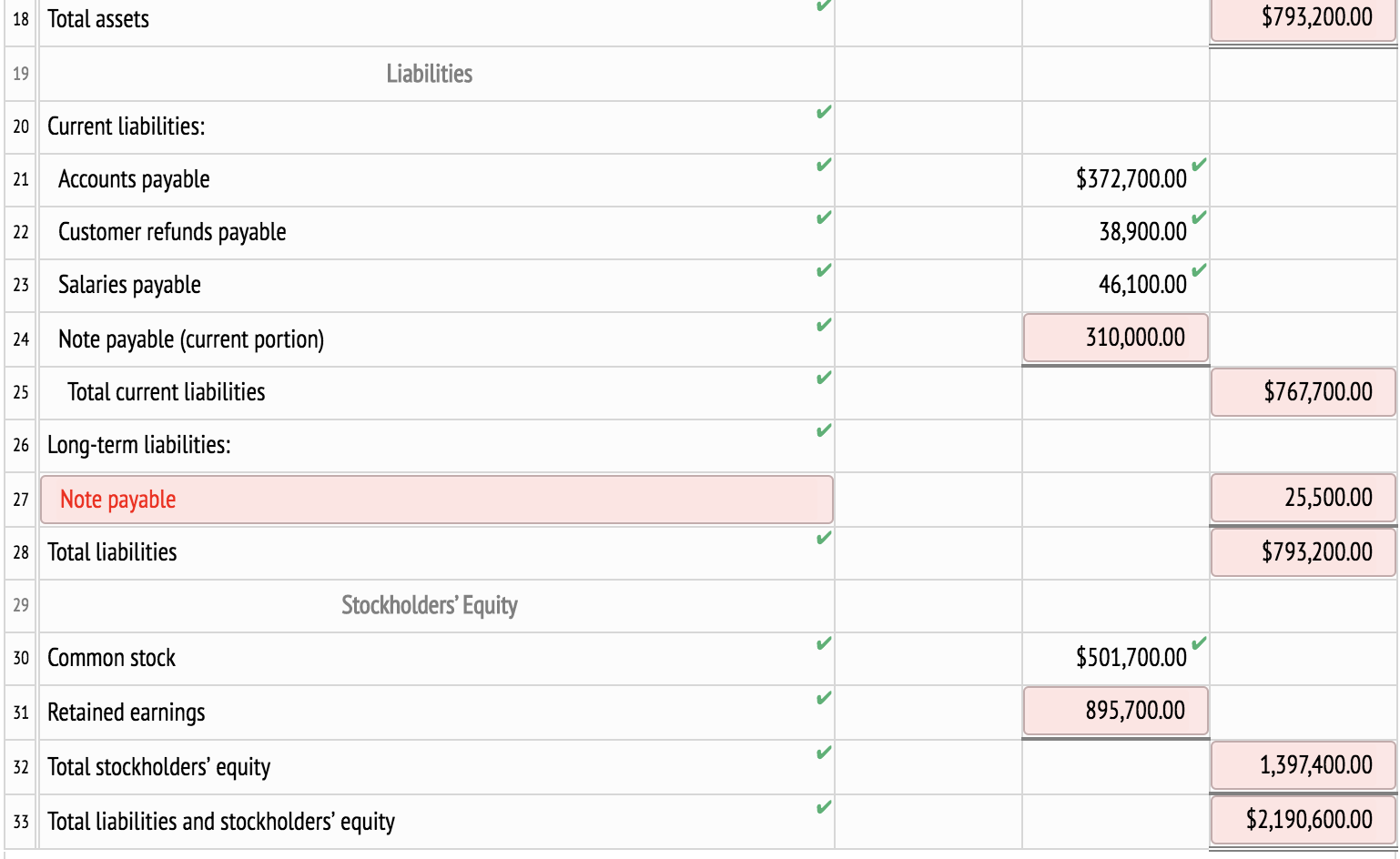

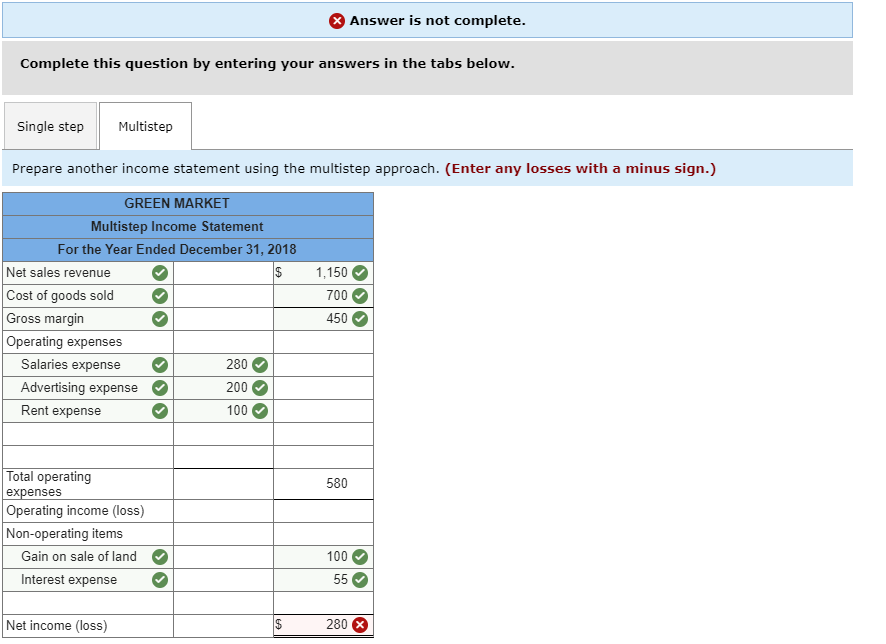

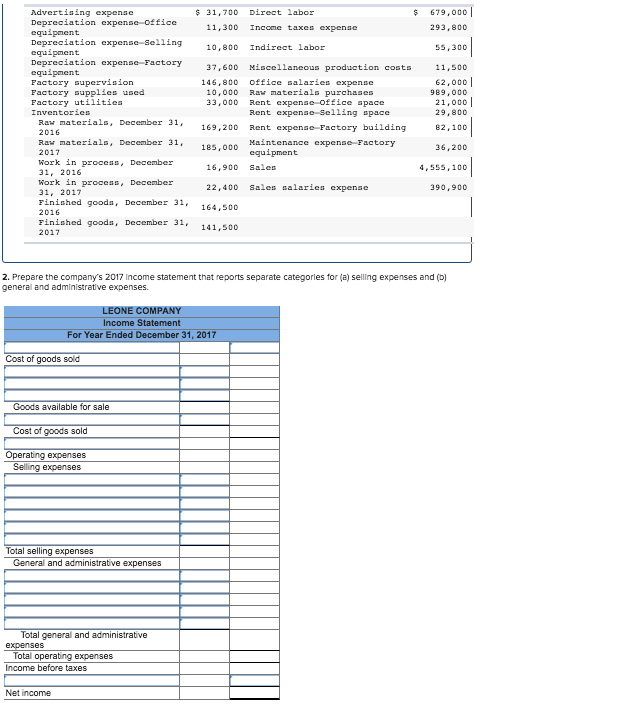

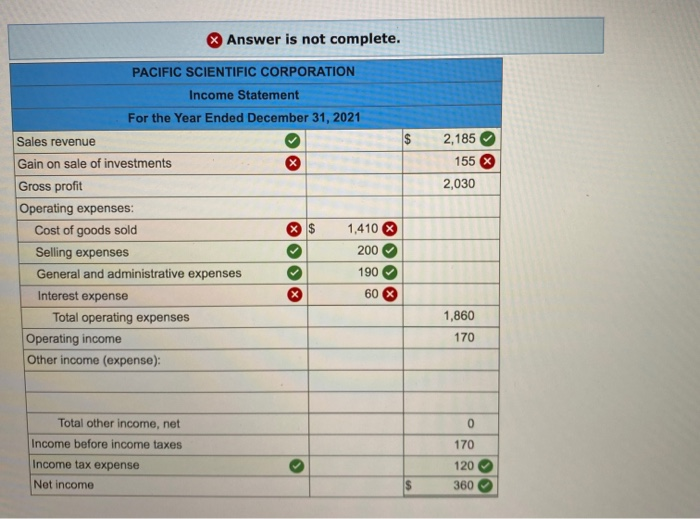

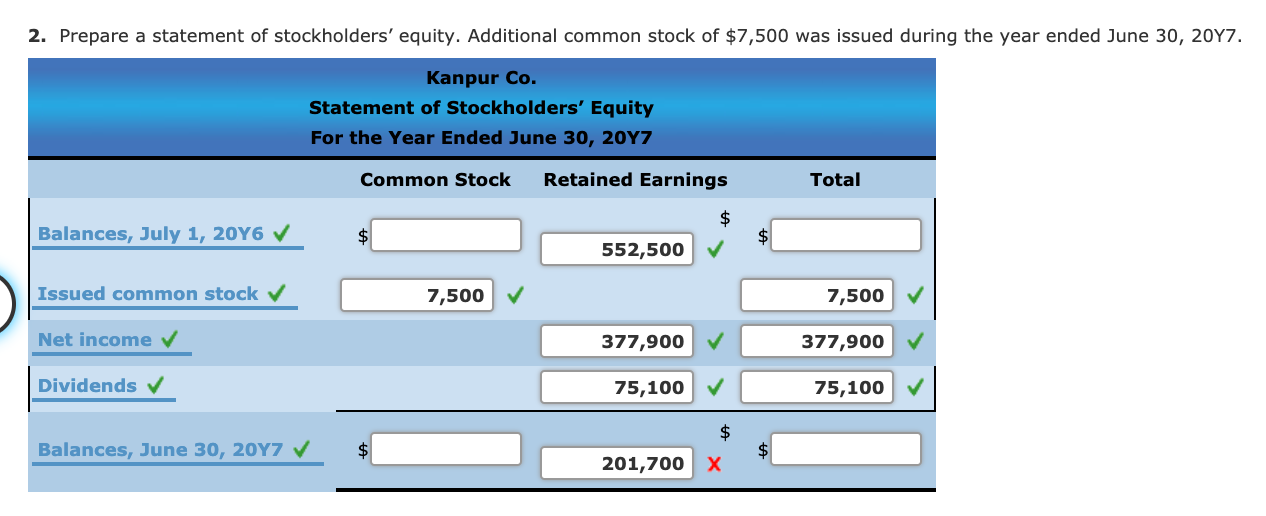

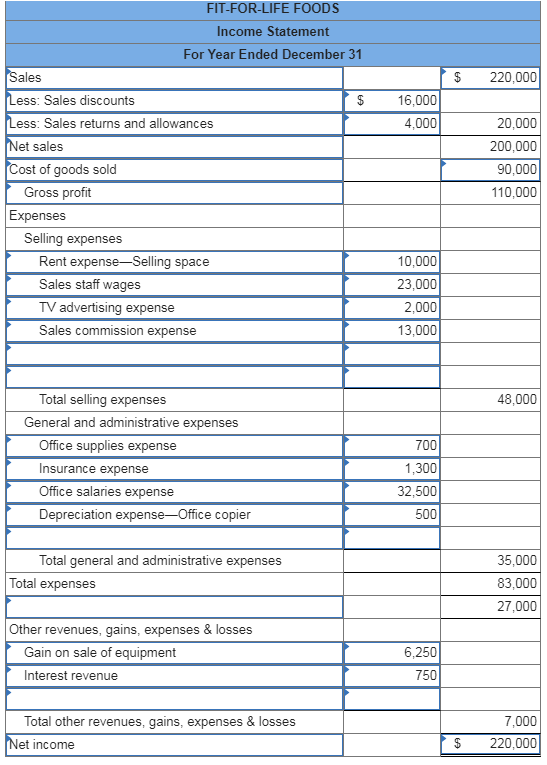

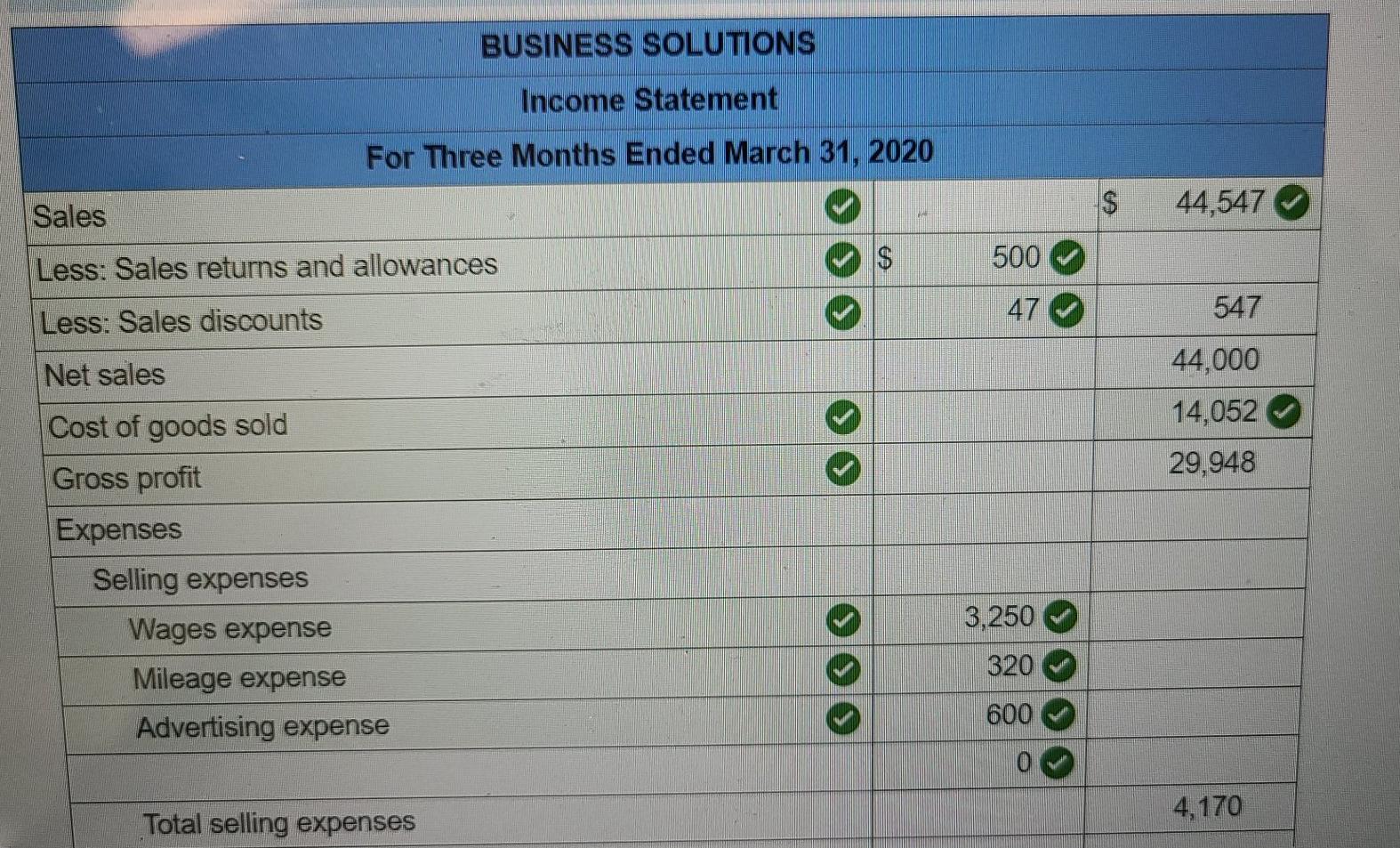

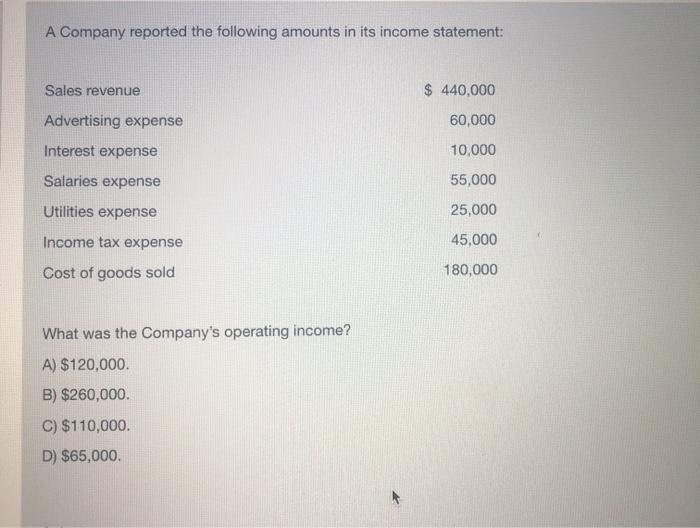

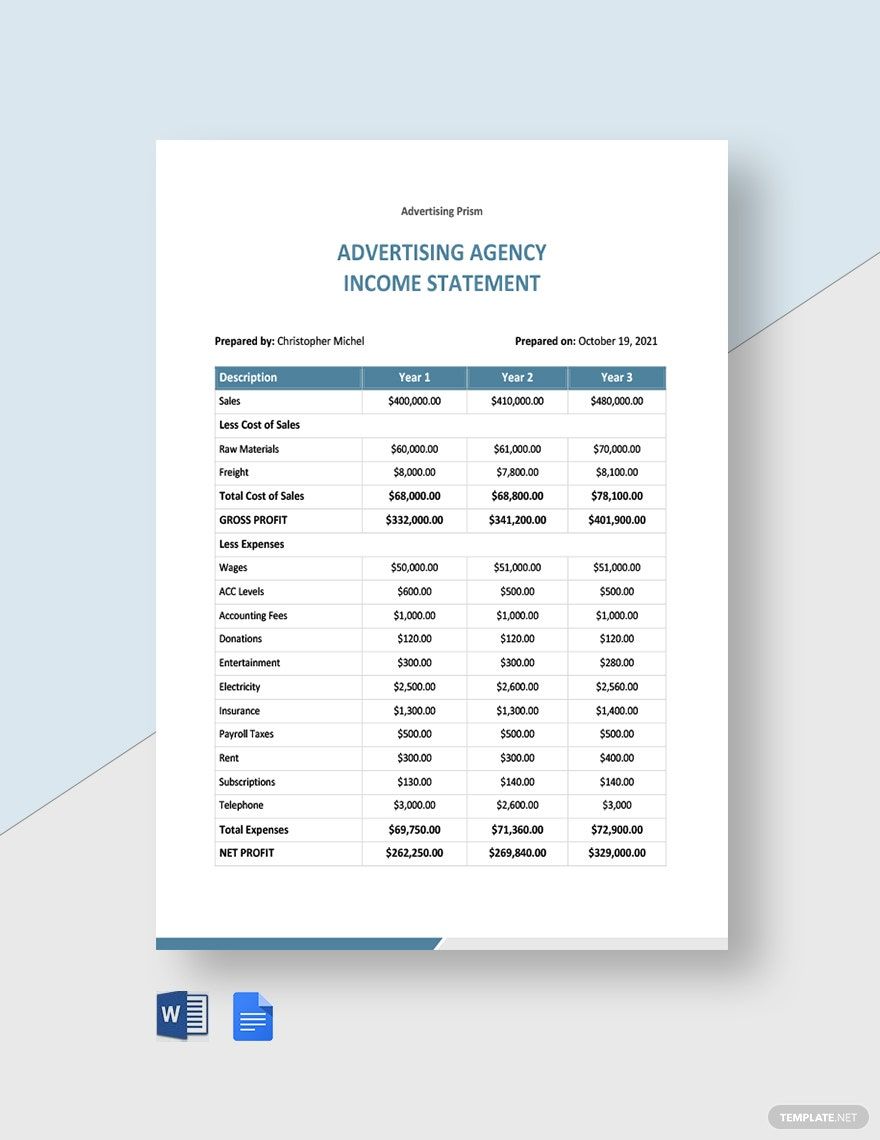

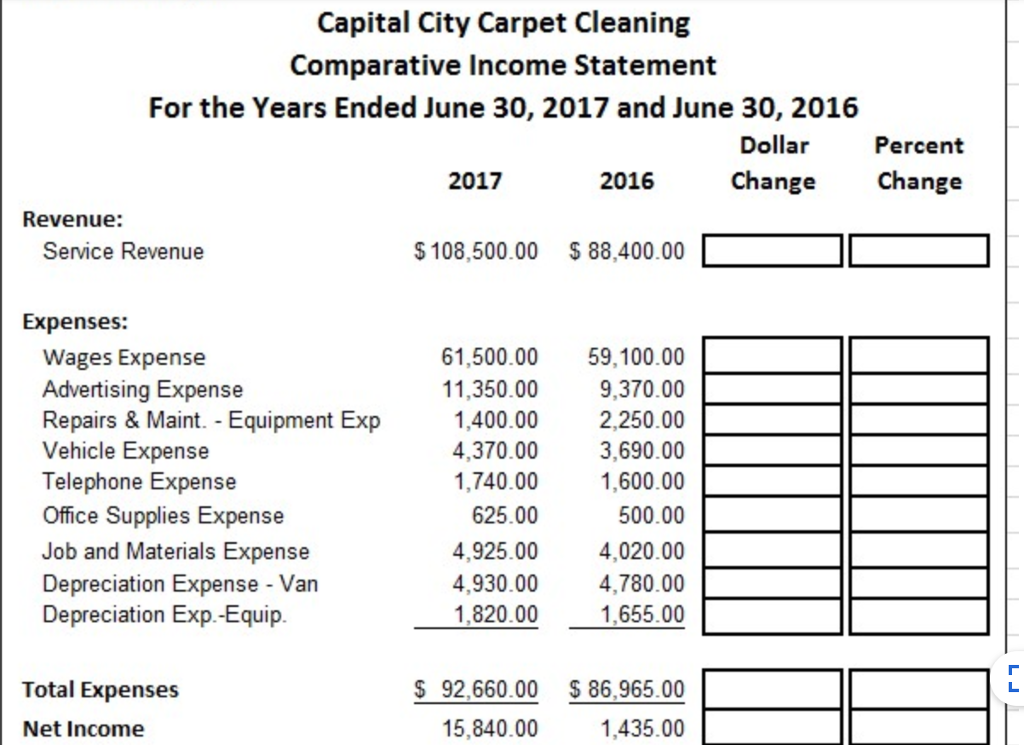

An income statement reports a business’s revenues, expenses, and overall profit or loss for a specific time period.

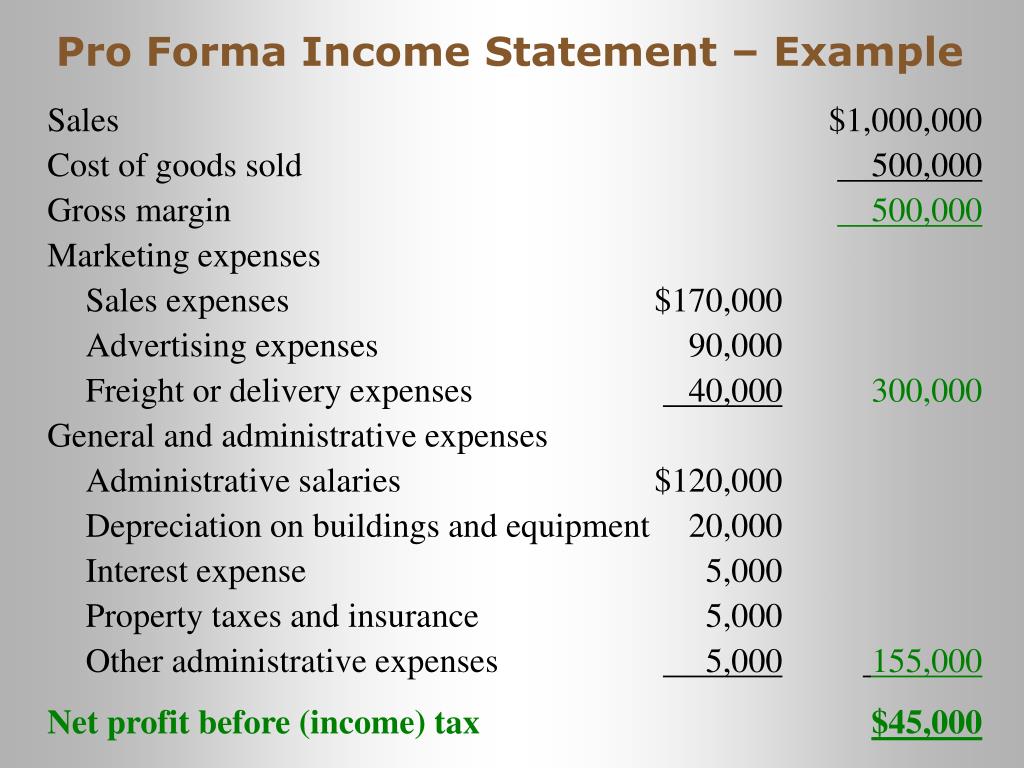

Advertising expense on income statement. By regularly analyzing your income statements, you can. Advertising costs are generally presented as part of selling, general, and administrative (sg&a) expenses in a reporting entity’s income statement. An income statement summarizes a company's financial performance.

Advertising expense is the income statement account which reports the dollar amount of ads run during the period shown in the income statement. An income statement is another name for a profit and loss statement (p&l). Expenses are the costs and expenses incurred to earn the company's revenues during the period of the income statement.

Revenue minus expenses equals profit or loss. It shows your revenue, minus your expenses and. For any given expenditure on advertising, a company should aim to maximize the npv of advertising expenditure.

Advertising expense is a general ledger account in which is stored the consumed amount of advertising costs. An income statement compares revenue to expenses to determine profit or loss. Steps to prepare an income statement.

Division of net income by the total number of outstanding shares. Income before taxes less taxes. Income statement reports show financial performance based on revenues, expenses, and net income.

Lawn mowing revenue, gas expense, advertising expense, depreciation expense (equipment), supplies expense, and salaries expense. It shows all revenues and expenses of the company over a specific period of time. How do i determine my payroll tax liabilities?.

Learn how to record advertising expense on the company income statement and balance sheet when the supplier invoices the company. For example, 5% might seem like a reasonable amount to spend on advertising. It is common for an expense to be reported on the.

An income statement is a financial statement that shows you how profitable your business was over a given reporting period. In the case of prepayments for advertising that will occur on a future date, the cost will be recorded as a current asset in a prepaid expenses account until the. What is the employer's social security tax rate for 2023 and 2024?

Marketing charges are part of a company’s operating expenses, and accountants specifically include them in the “selling, general and administrative. Your reporting period is the specific timeframe the income statement covers. The balance in this account is reset to zero at.