Can’t-Miss Takeaways Of Info About Gaap Income Statement Template

Gaap, as well as rules and regulations of the u.s.

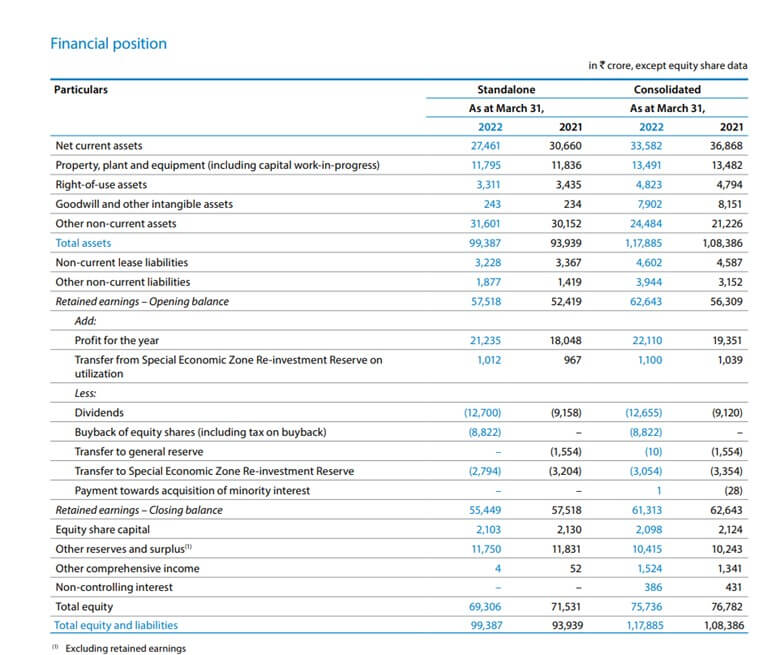

Gaap income statement template. Download the ifrs model financial statements 2021, a practical and illustrative document that shows how to apply the latest standards and interpretations. Gaap is the set of accounting rules set forth by the financial accounting standards board (fasb) that u.s. Companies are expected to follow when putting together their financial statements.

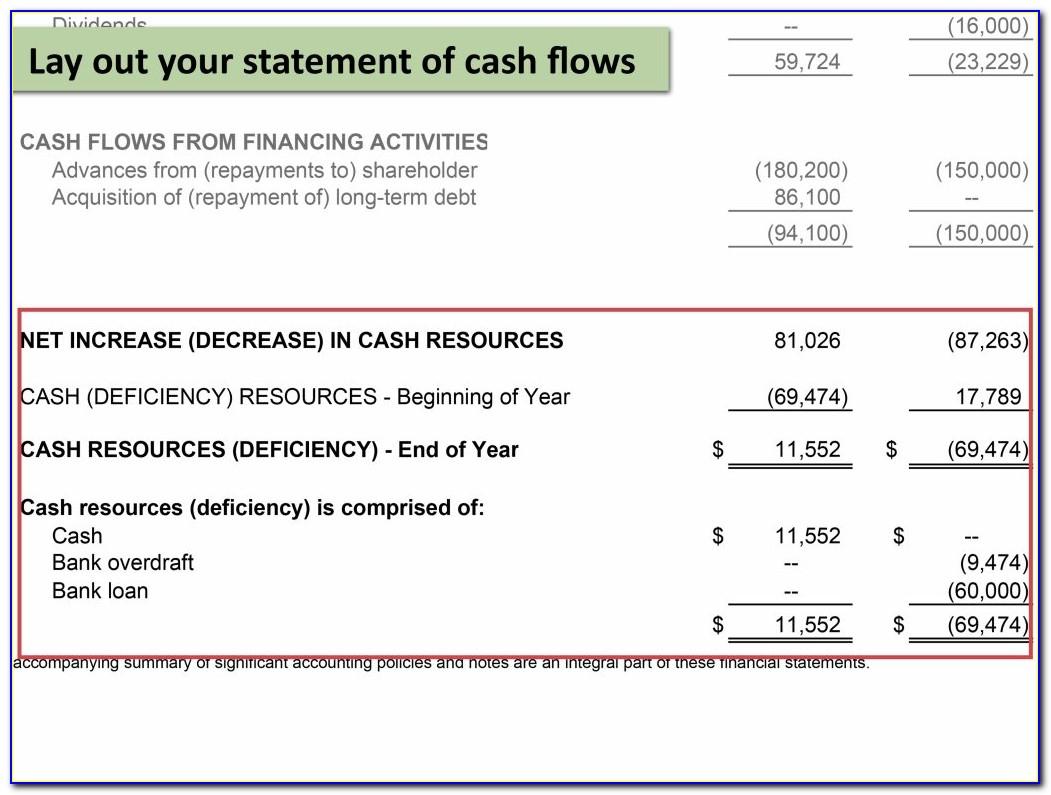

January 28, january 29, january 28, january 29,. Not totally sure i have these calculations/xbrl formulas correct; A single statement:

Companies of various sizes across over 100 different industries. Us gaap income statement format income statement format as per us gaap is: Securities and exchange commission (sec),

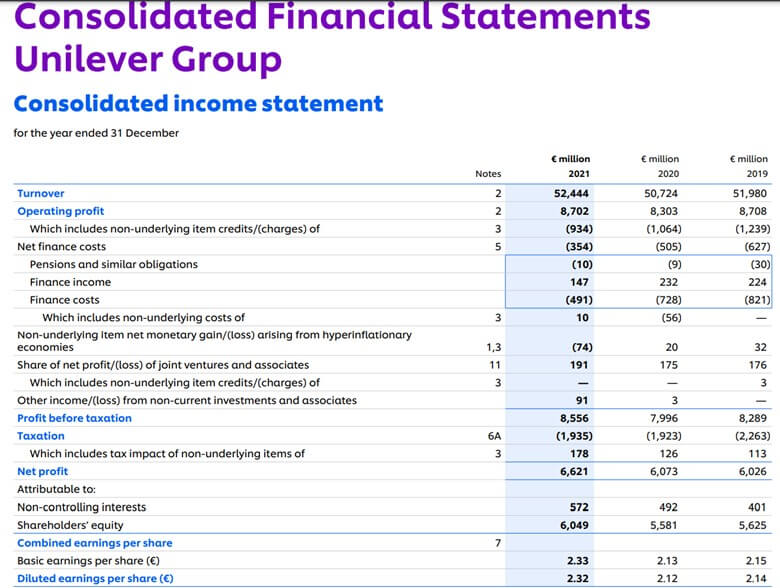

Very basic statement of comprehensive income (warning!!! Gaap net income rose to $449.1 million, or $2.89 per diluted share, from $271.5 million, or $1. Record adjusted ebitda margin fourth.

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. Q1 fy2024 revenue increased to $1.649 billion from $1.361 billion in q1 fy2023. Download the free excel template now to advance your knowledge of financial modeling and accounting.

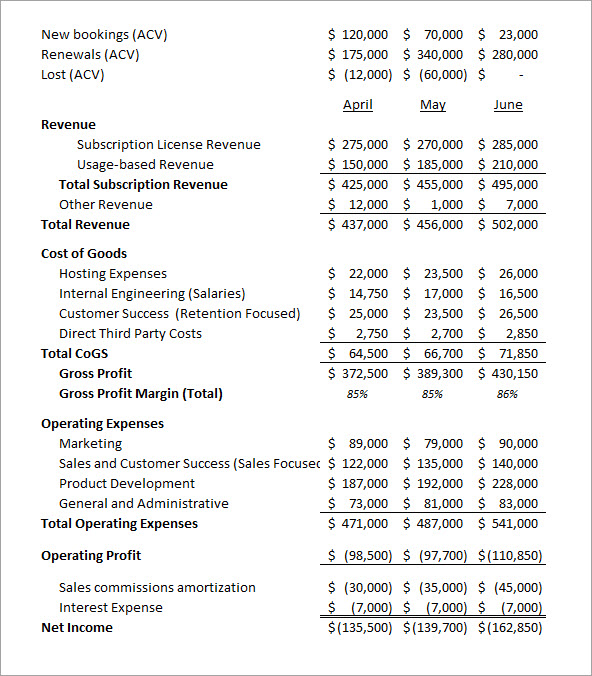

However, many companies following ifrs choose to report three periods. What are common drivers for each income statement item? This article is a guide to what are income statement examples.

Format and content of the income statement Transfers and servicing of financial assets (ts) utilities and power companies (up) equity method investments & joint venture entities. Gaap diluted eps for q4 was $4.93, up 33% from q3 and up 765% from.

Whether you're a preparer or auditor, you'll save time and improve efficiency with this valuable resource that will give you an unparalleled picture of u.s. The above template is from cfi’s financial analysis fundamentals course. 2019, association of international certified professional accountants.

The two major elements of the income statement are as. Asc 205, presentation of financial statements, and asc 225, income statement, provide the baseline authoritative guidance for presentation of the income statement for all us gaap reporting entities. Ance with gaap, preparers of full disclosure financial statements prepared when applying the cash‐ or tax‐basis of accounting are often faced with difficult questions.

Examples include a liability associated with a pending lawsuit or a liability associated with the company’s future cost of fixing a product under warranty. Us gaap requires presenting three periods, compared to two for ifrs. This publication is updated annually and reflects the new and revised pronouncements.