Beautiful Work Info About Cash Flow Income

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

It can also reveal whether a company is going through transition or in a state of decline.

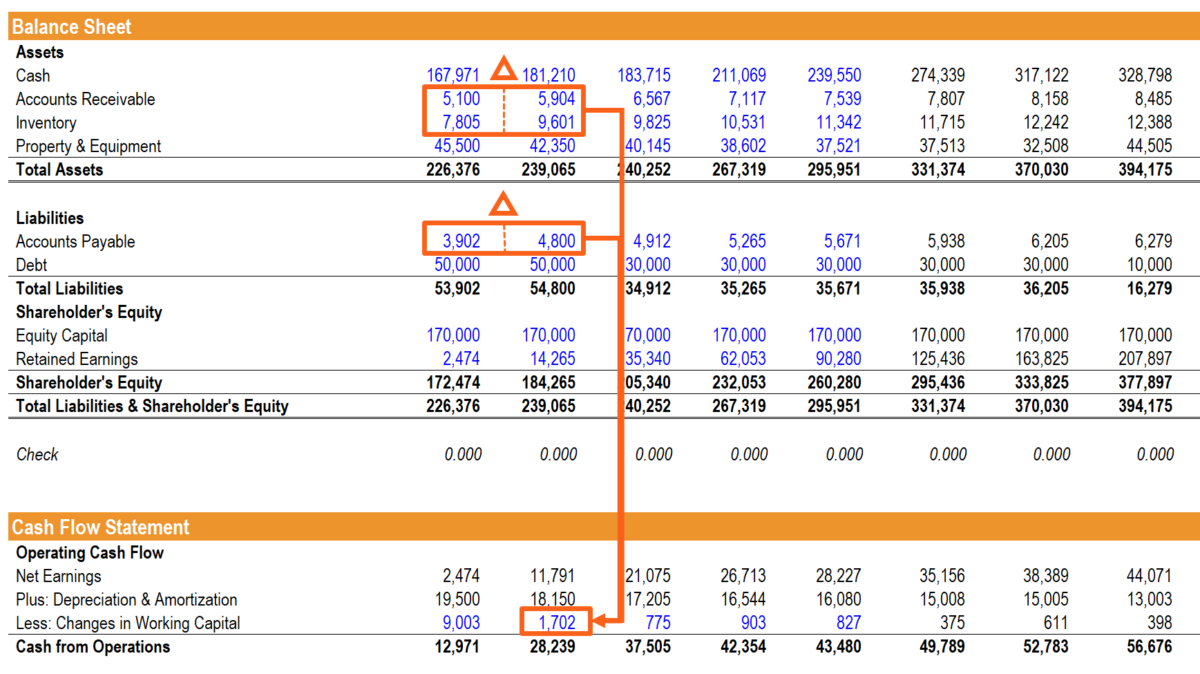

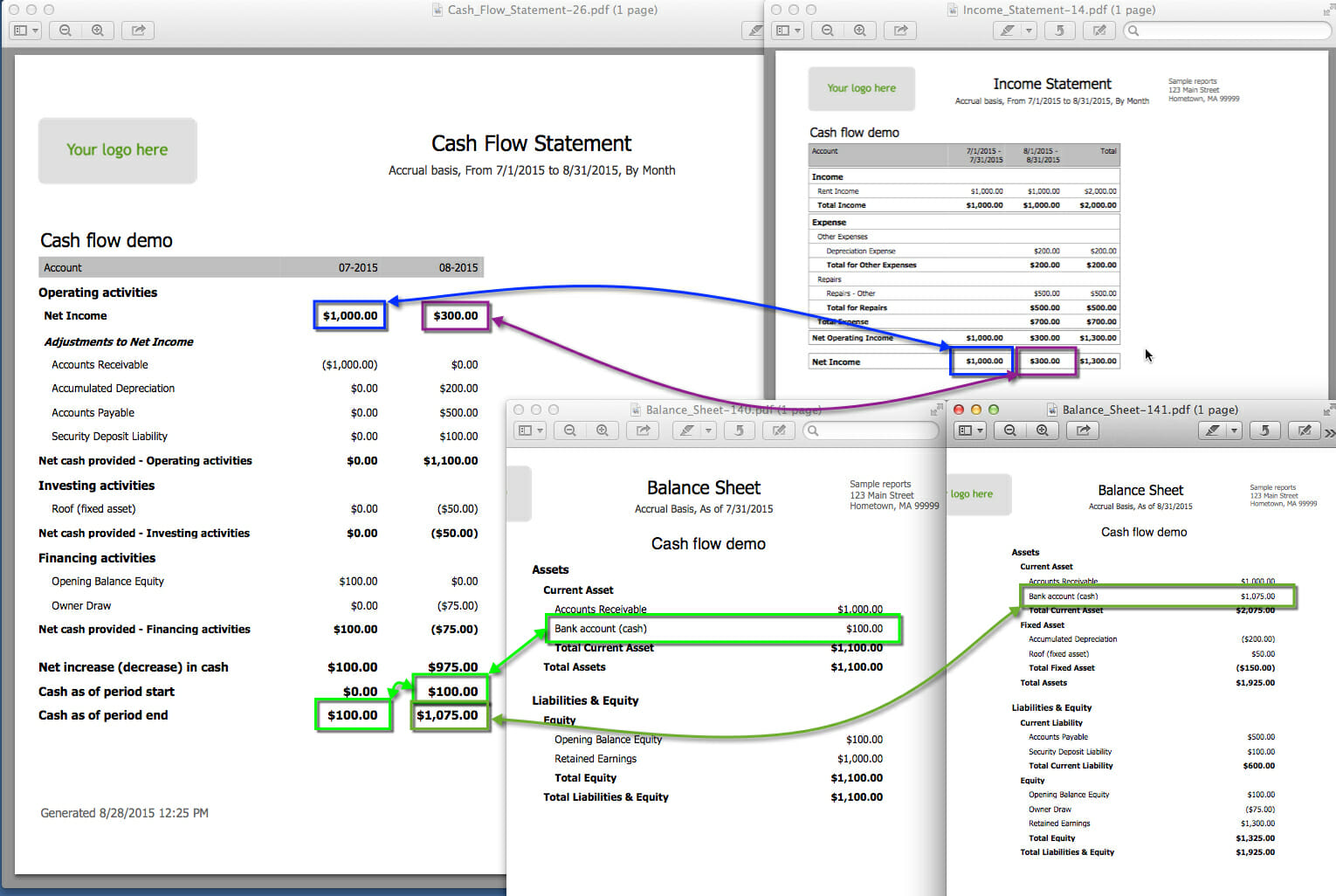

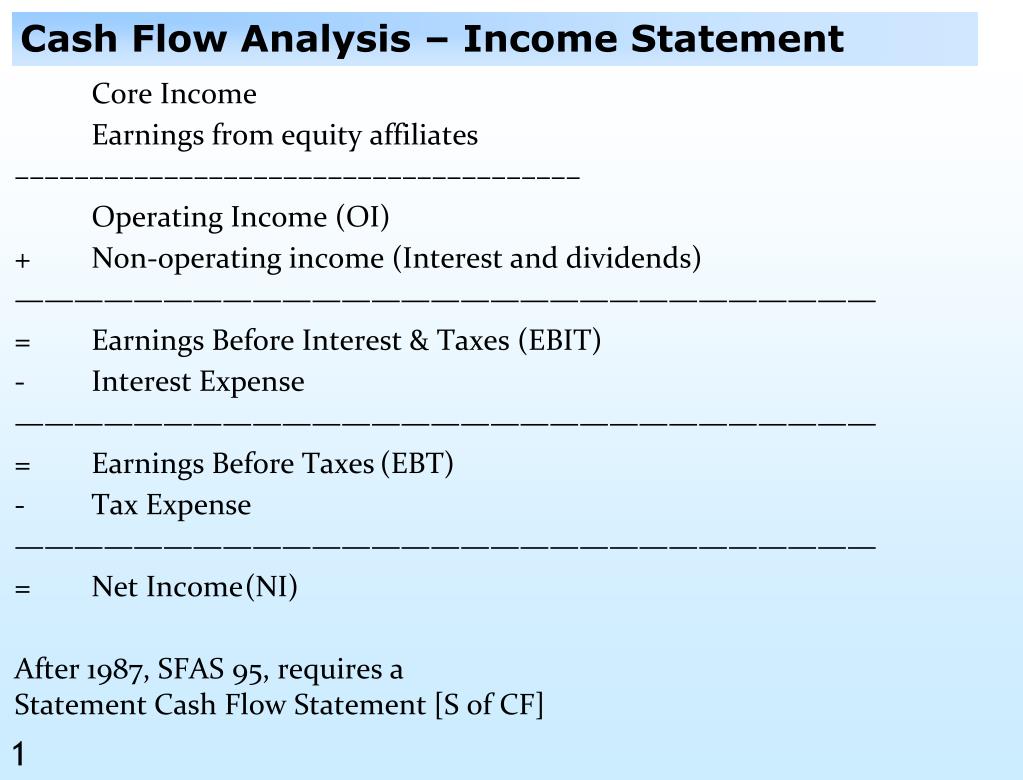

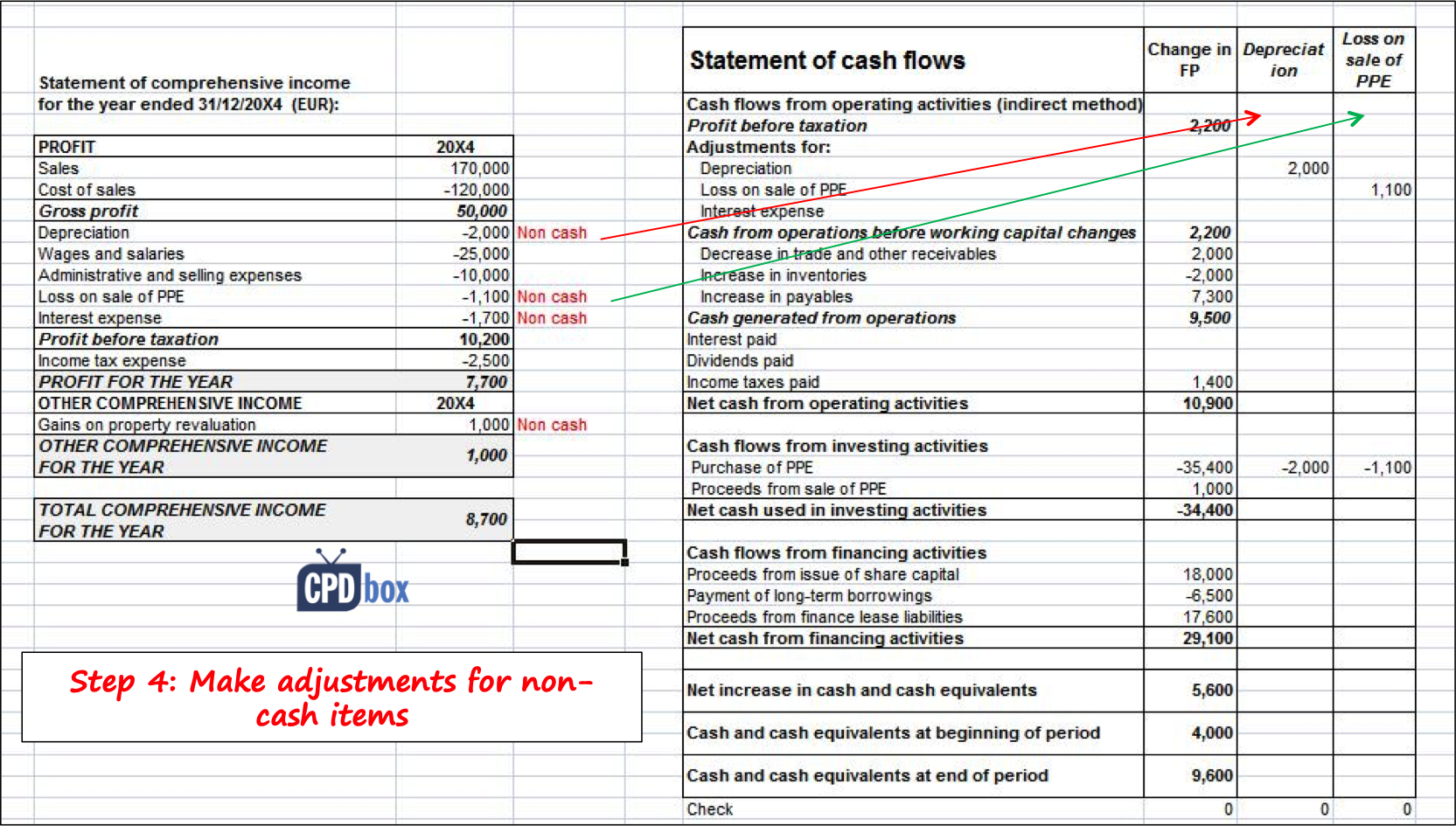

Cash flow income. The income statement, balance sheet, and statement of cash flows are required financial statements. Start calculating operating cash flow by taking net income from the income statement. The cfs measures how well a.

These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a. Benefits of cash flow information definitions cash and cash equivalents presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and.

Yet, it isn’t uncommon for those new to finance and accounting to occasionally confuse the two terms. Contoh cara untuk menghitung cash flow dari aktivitas investasi, anda bisa gunakan formula di bawah ini: Like with the cash flow statement, you can.

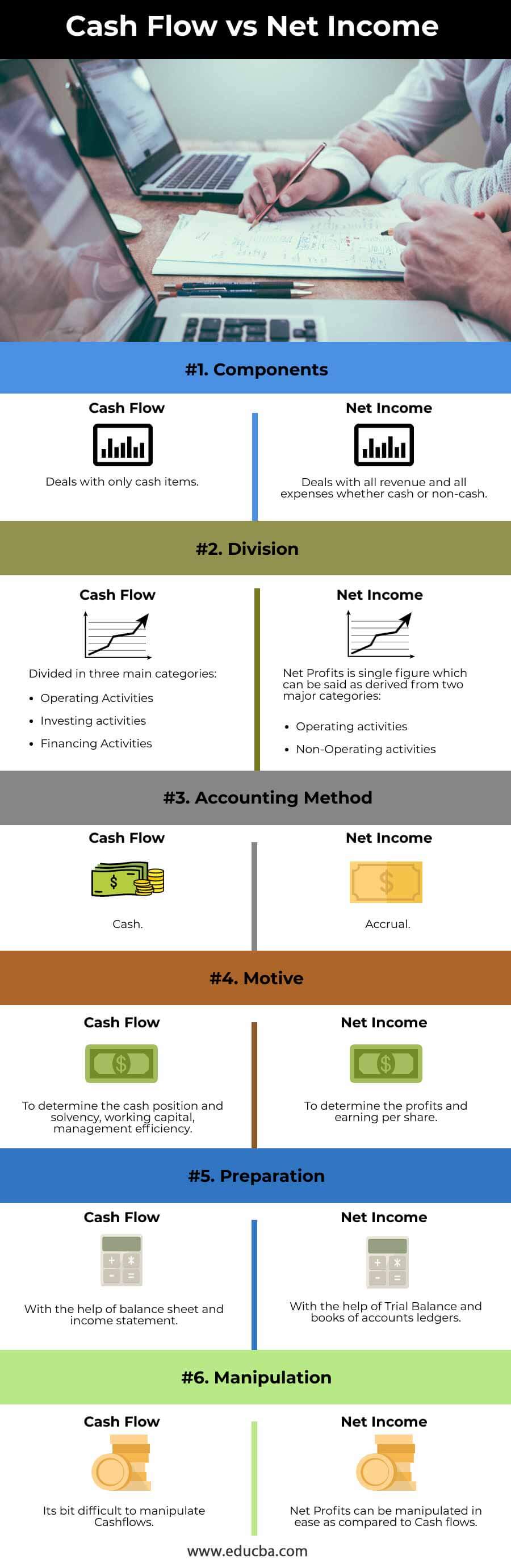

Cash flows from financing (cff), or financing cash flow, shows the net flows of cash used. Differences & similarities business owners often have trouble interpreting how their business is performing. Thus, the income statement to gauge a company’s financial performance and assess their profitability.

Using this information, an investor might decide that a company with uneven cash flow is too risky to. Cash flow and net income are two key factors in judging whether a company has been doing well or. The cash flow statement (cfs) measures how well.

Operating activities analyze a company’s cash flow from net income or losses by reconciling the net income to the actual. This article will provide a quick overview of the. This value can be found on the income statement of the same accounting period.

Unitholders of record on march 1, 2024 wil… The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company. Other cash flows are ignored for this calculation.

Whether it’s a rapidly growing startup or a mature and profitable company. While income statements are excellent for showing you how much money you’ve spent and earned, they don’t necessarily tell you how much cash you have on hand for a specific period of time. The cash flow statement is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company.

Census bureau data, 20 percent of u.s. Finance financial accounting leading with finance cash flow and profit are essential financial metrics in business. Equity income fund and agf systematic global infrastructure etf, which pay monthly distributions.

In this case, depreciation and amortization is the only item. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. Amazon’s net income is $2.37 billion, and its cash flow from operations is $16.44 billion.

:max_bytes(150000):strip_icc()/dotdash_Finla_How_are_Cash_Flow_and_Revenue_Different_Nov_2020-01-abf2a04cb90a43daa9df7cfd7a6ab720.jpg)

:max_bytes(150000):strip_icc()/IncomestatementApple-83dd63870e72405e87749f33fd8e35af.jpg)