Out Of This World Tips About Depreciation Financial Statement

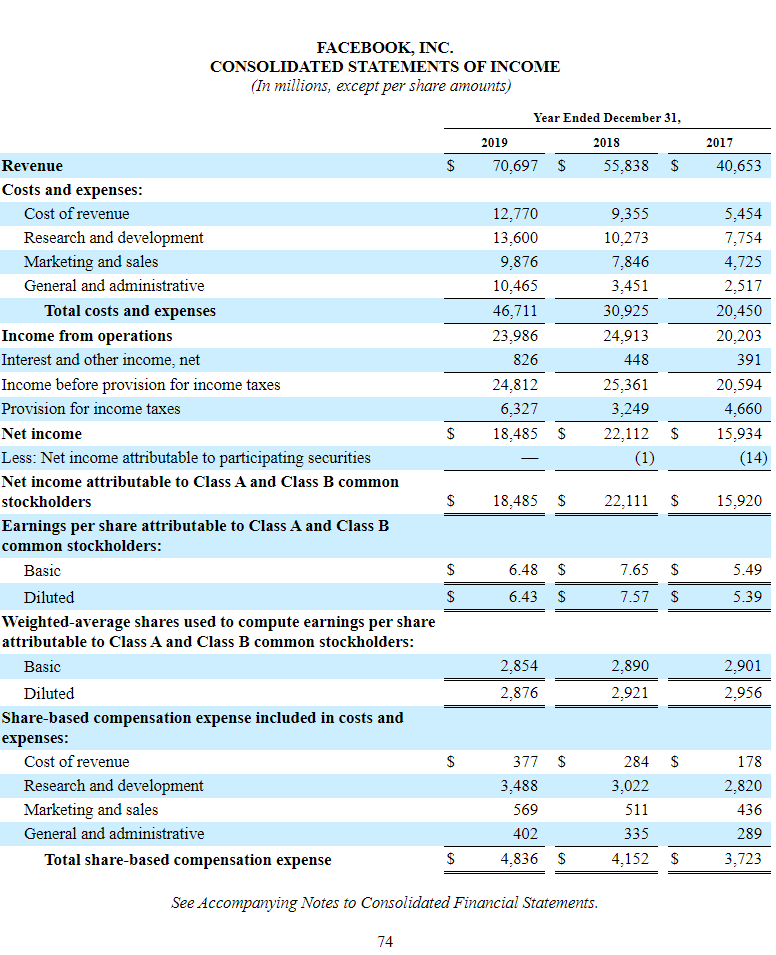

The formula of depreciation expense is used to find how much asset value can be deducted as an expense through the income statement.

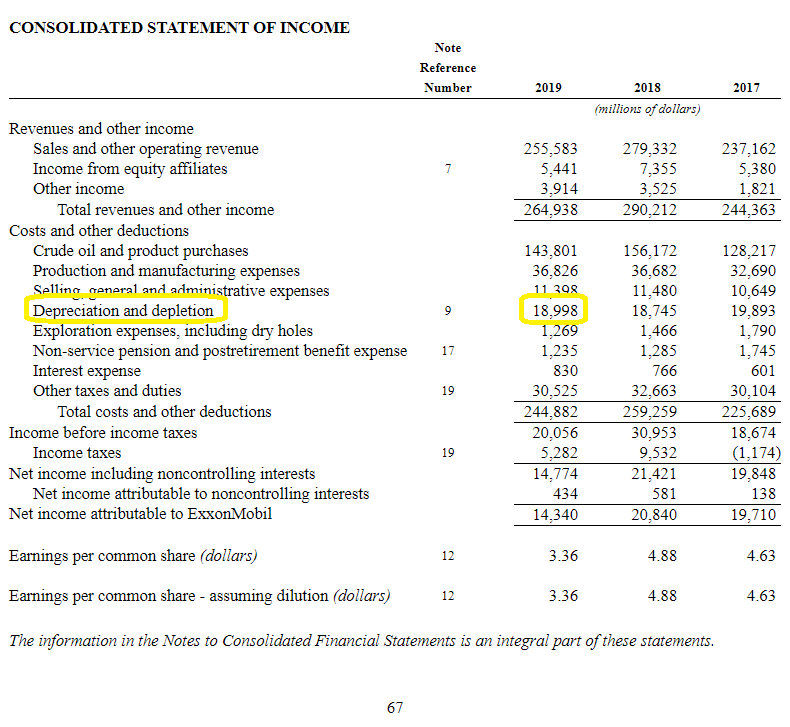

Depreciation financial statement. Depreciation expense is an income statement item. Accumulated depreciation is not recorded separately on. It is accounted for when companies record the loss in value of their fixed assets through depreciation.

Depreciation is the accounting process of allocating the cost of tangible, fixed assets over the time frame a company expects to benefit from their use. Companies depreciate assets for both tax and accounting purposes and have several different. Depreciation can be somewhat arbitrary which causes the value of assets to.

Written by masterclass last updated: Depreciation represents how much of the asset's value has been used up in any given time period. Depreciation expense is a fundamental concept in finance and accounting that represents the systematic allocation of the cost of a tangible asset over its estimated.

Analysts offer strategies for volatility mitigation. Depreciation expense is reported on the income statement as any other normal business expense, while accumulated depreciation is a running total of. Depreciation is a financial accounting method used to allocate the cost of tangible assets over t. clearias on.

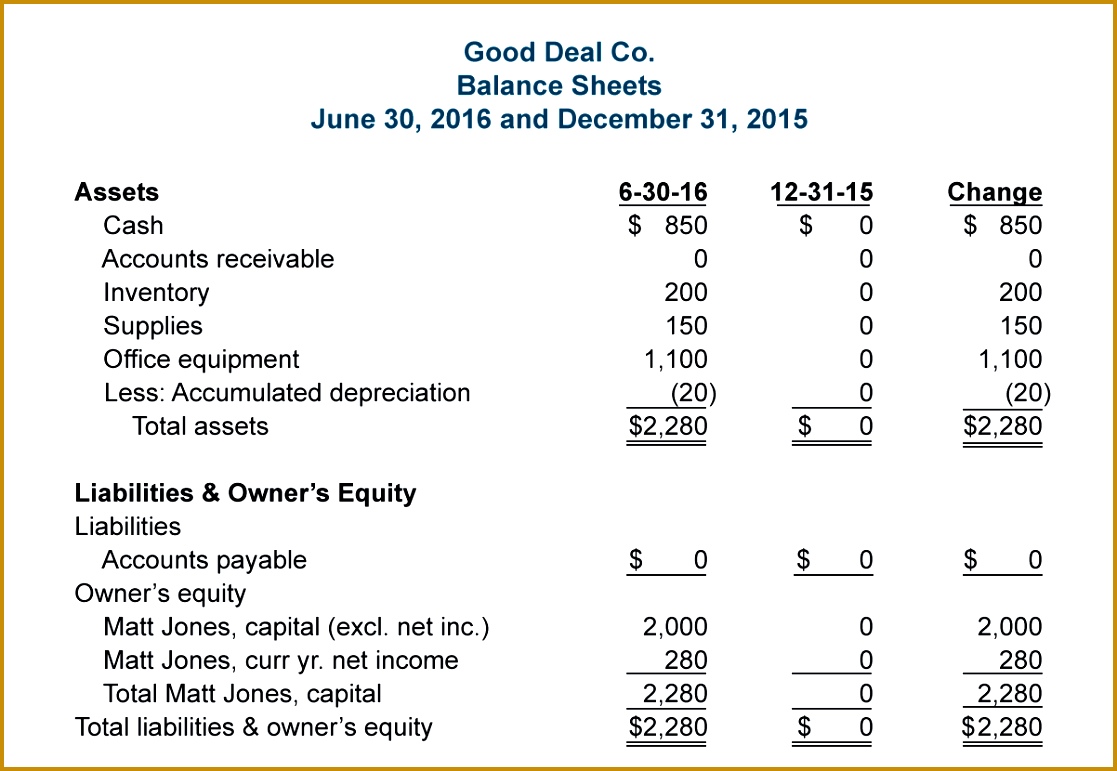

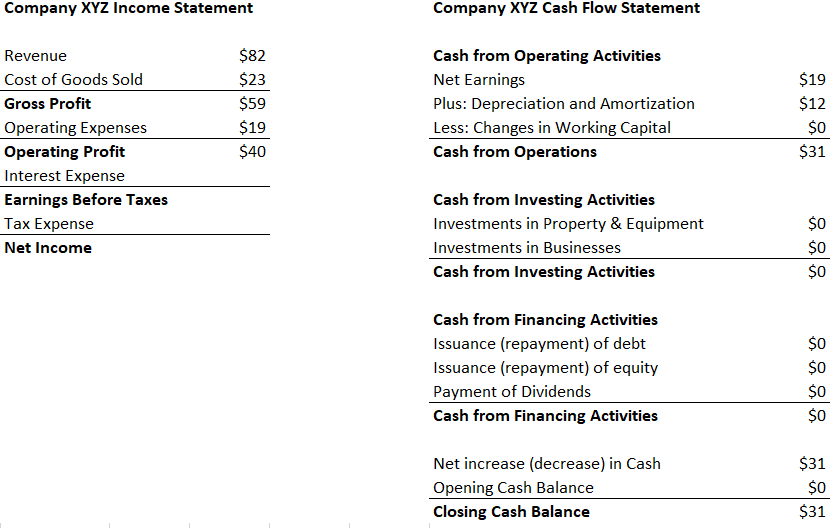

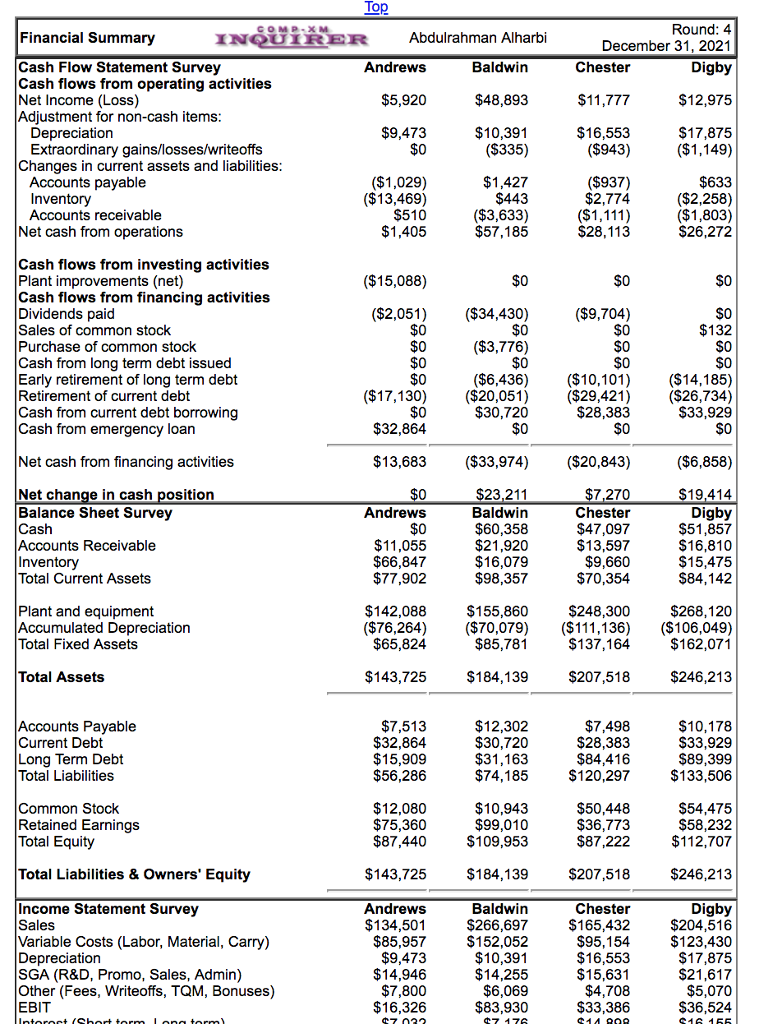

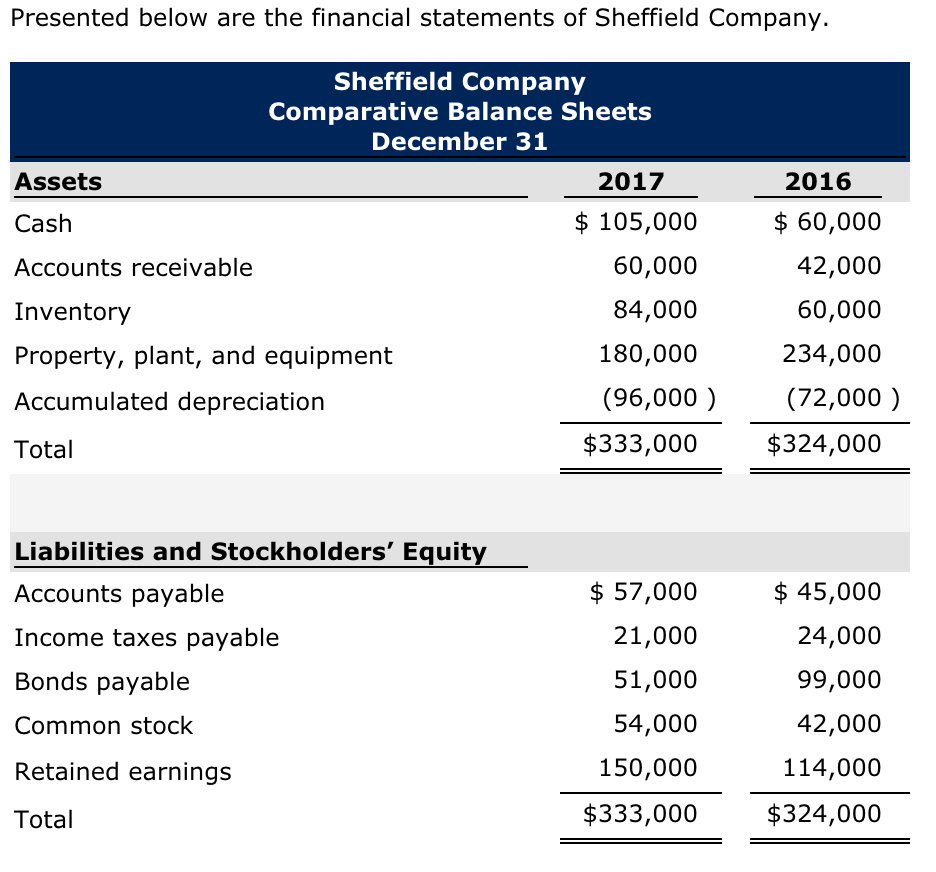

Key learning points. Depreciation is found on the income statement, balance sheet, and cash flow statement. Investopedia / mira norian formula and calculation of accumulated depreciation there are several acceptable methods for calculating depreciation.

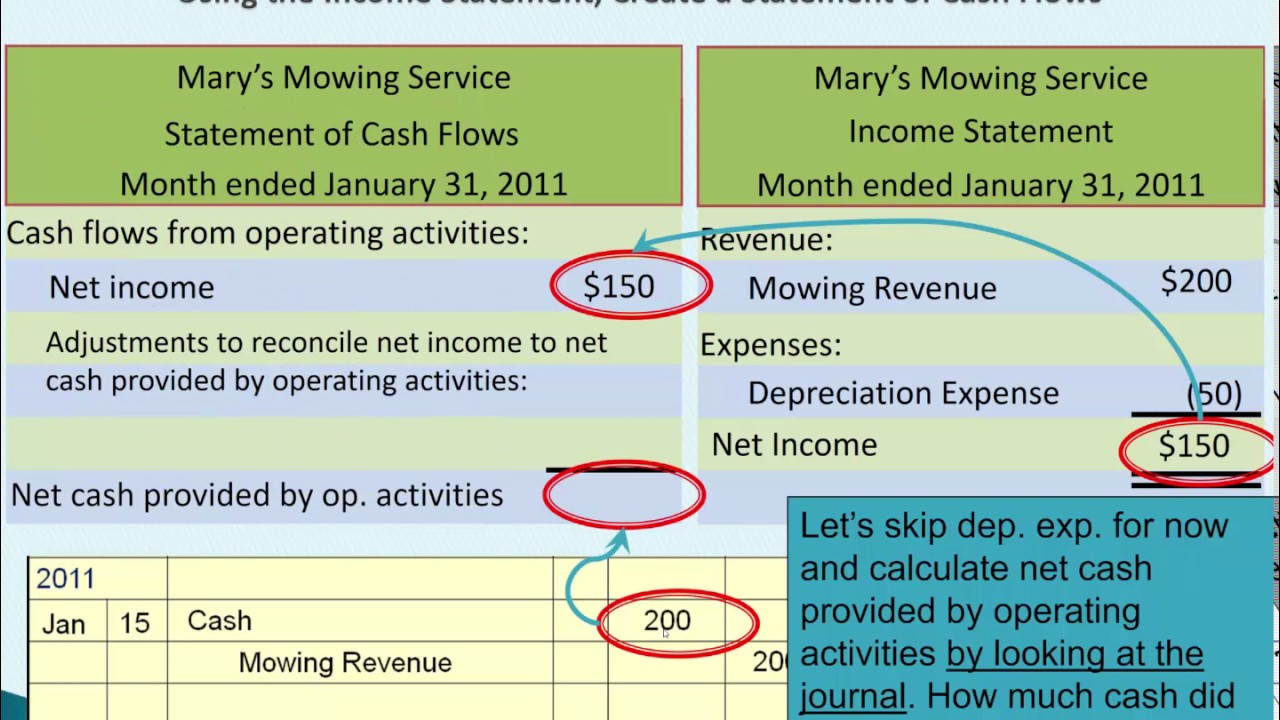

Depreciation is an accounting practice used to spread the cost of a tangible or physical assetover its useful life. Recording depreciation on an income statement consists of gradually charging the asset's cost to expense over the asset's estimated useful life. The most important point, which must be understood at the outset, is that all these adjustments have an.

On walmart’s balance sheet, each year, it will add. This is known as depreciation, and it is the source of. Depreciation on the 3 financial statements (7:53) in this video, we walk you through how an increase in depreciation affects the 3 financial statements and highlight the specific.

Depreciation's impact on financial statements. Accumulated depreciation is the total amount of depreciation expense allocated to a specific asset since the asset was put into use. Depreciation expense is recorded on the income statement as an expense or debit, reducing net income.

Sep 14, 2021 • 4 min read fixed assets lose value over time.