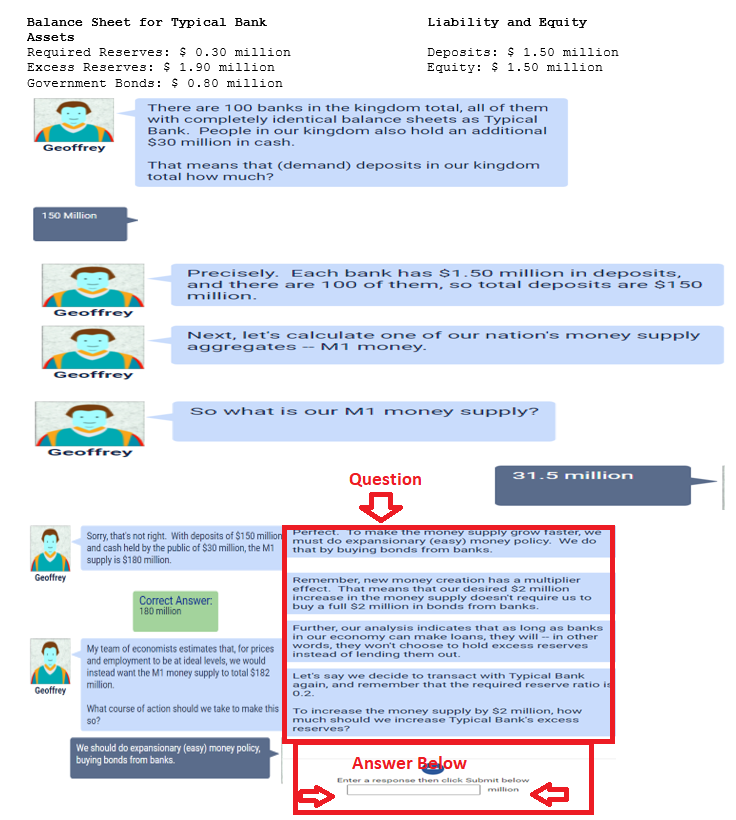

Beautiful Work Info About Typical Bank Balance Sheet

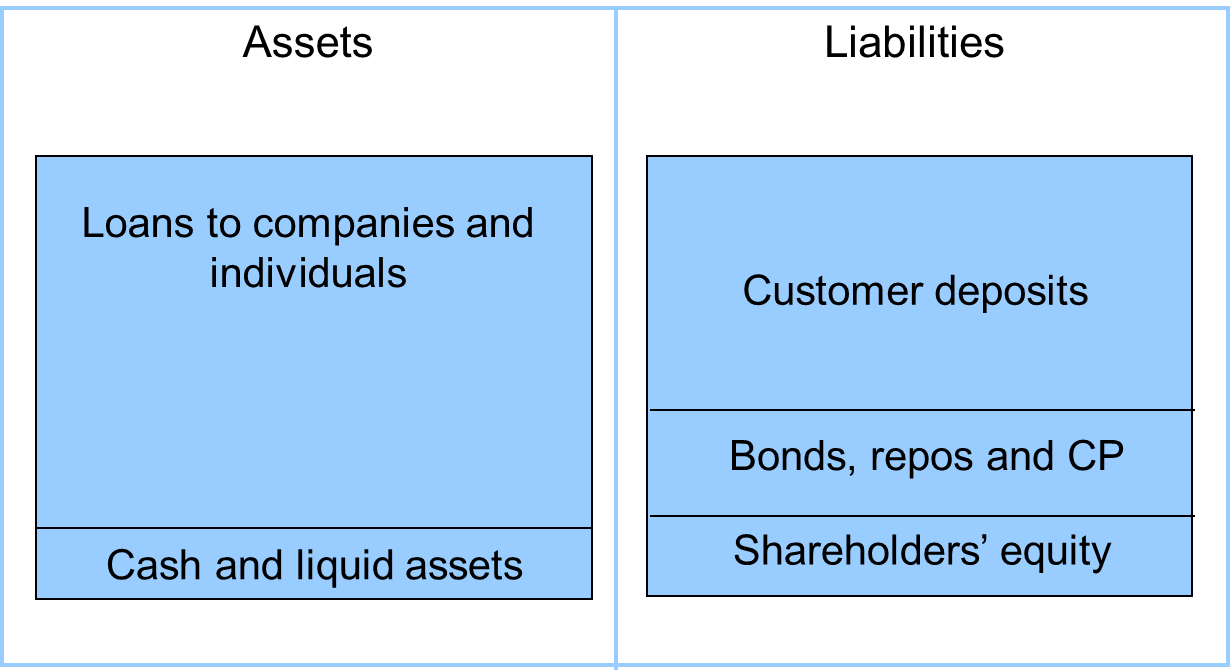

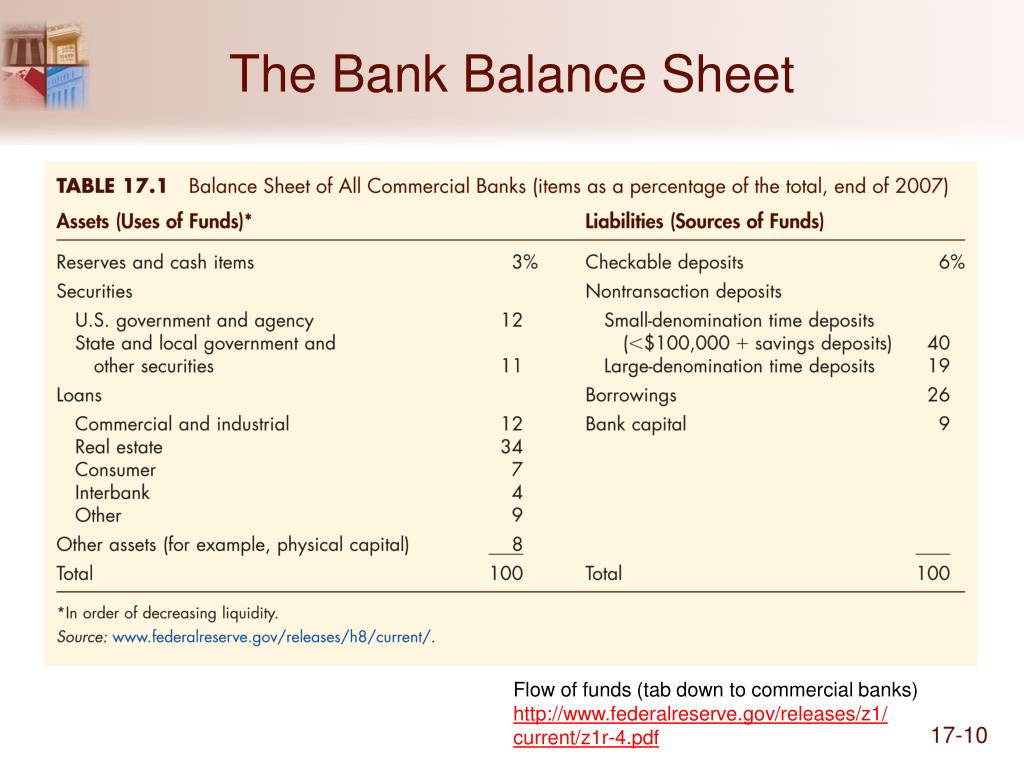

Bank’s balance sheet comprises three parts assets, liability, and equity.

Typical bank balance sheet. Take a look at the balance sheet in any global bank today, and it will probably look different—lighter—than it did ten years ago. Write a custom formula to transform one or more series or combine two or more series. You won't find inventory, accounts receivable, or accounts payable.

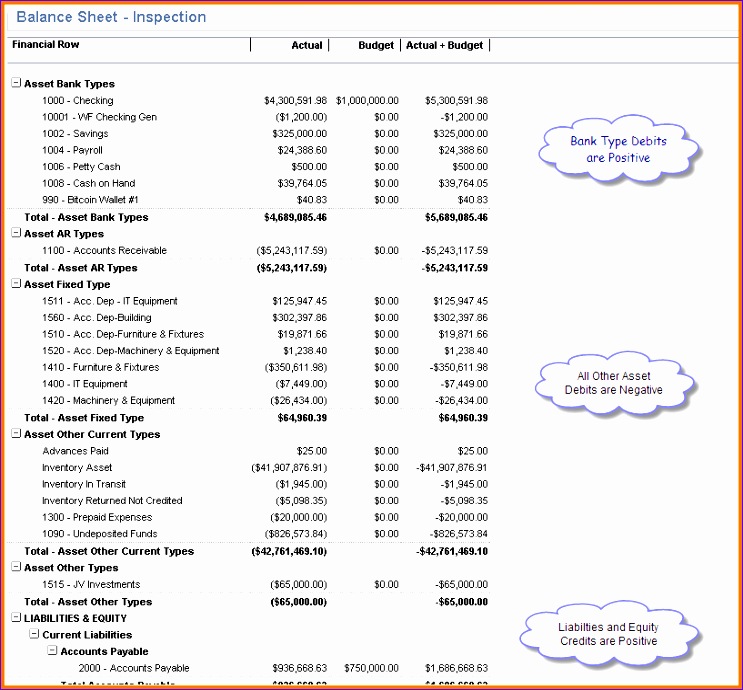

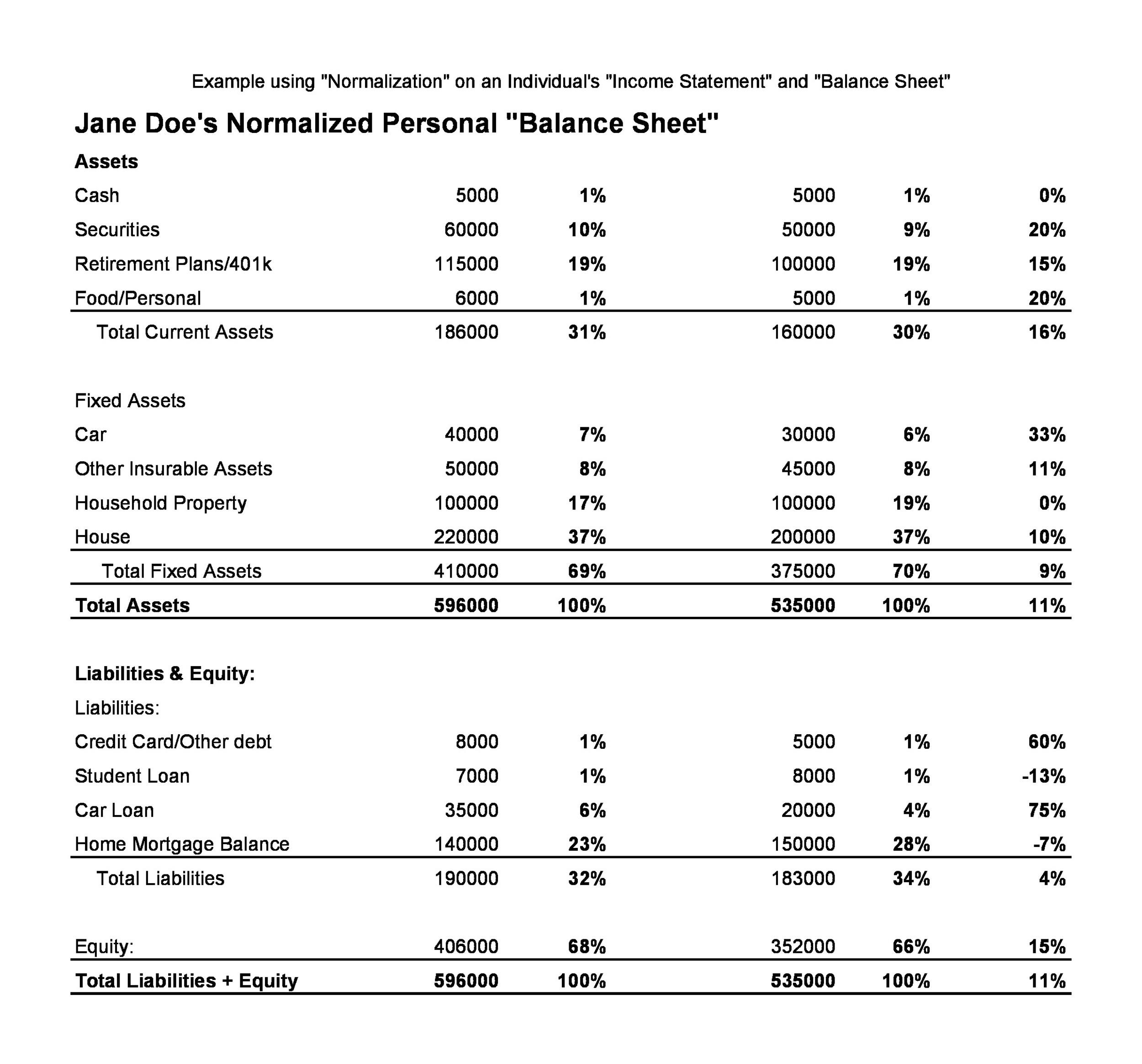

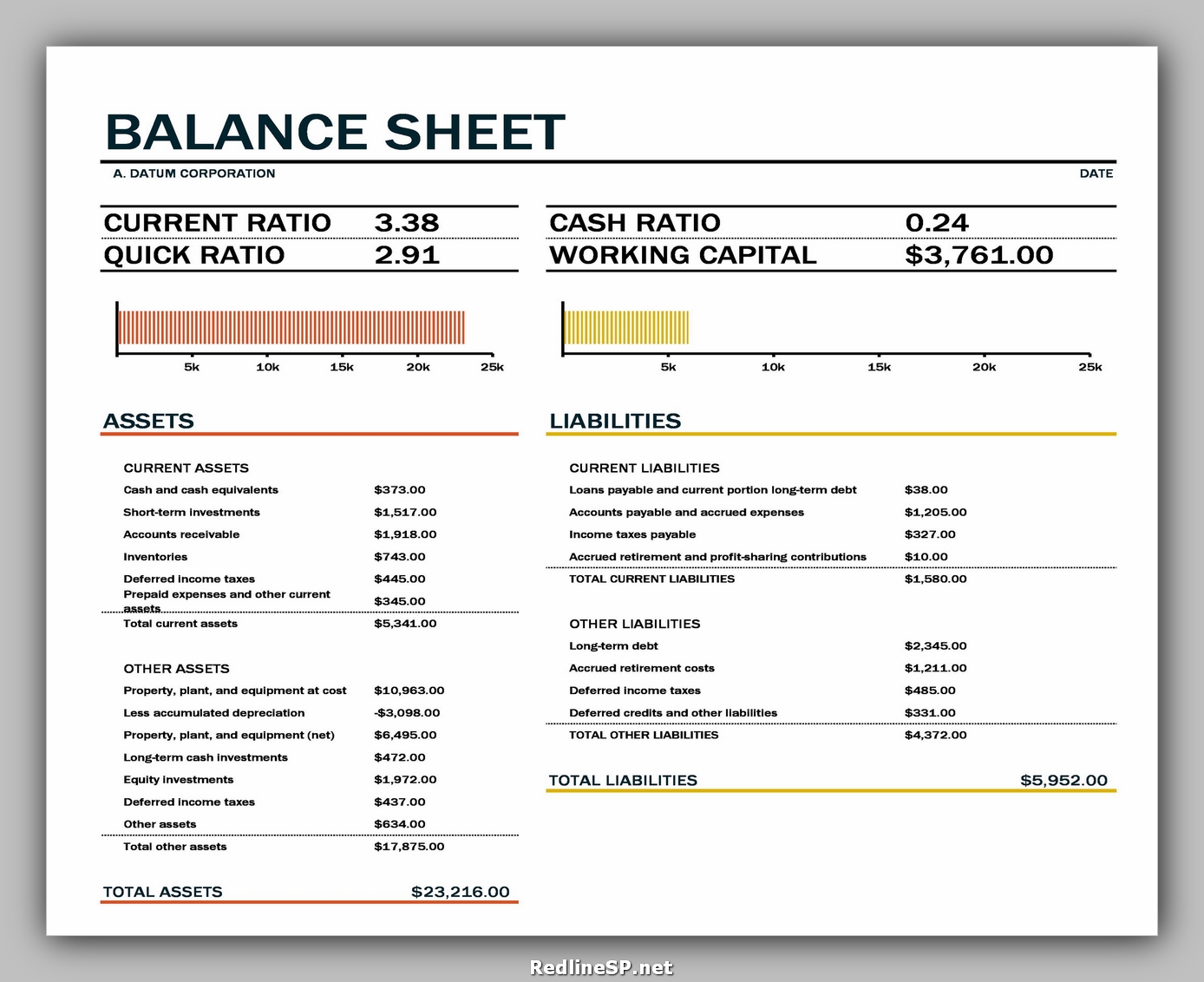

A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. Assets property trading assets loans to customers deposits to the central bank property trading assets loans to customers deposits to the central bank liabilities loans from the central bank deposits from customers trading liabilities misc. A balance sheet (aka statement of condition, statement of financial position) is a financial report that shows the value of a company's assets, liabilities, and owner's equity on a specific date, usually at the end of an accounting period, such as a quarter or a year.

To better understand a business's financial situation and level of solvency, you can do a few quick and easy calculations that use data found within the balance sheet. The balance sheet displays the company’s total assets and how the assets are. What is the balance sheet?

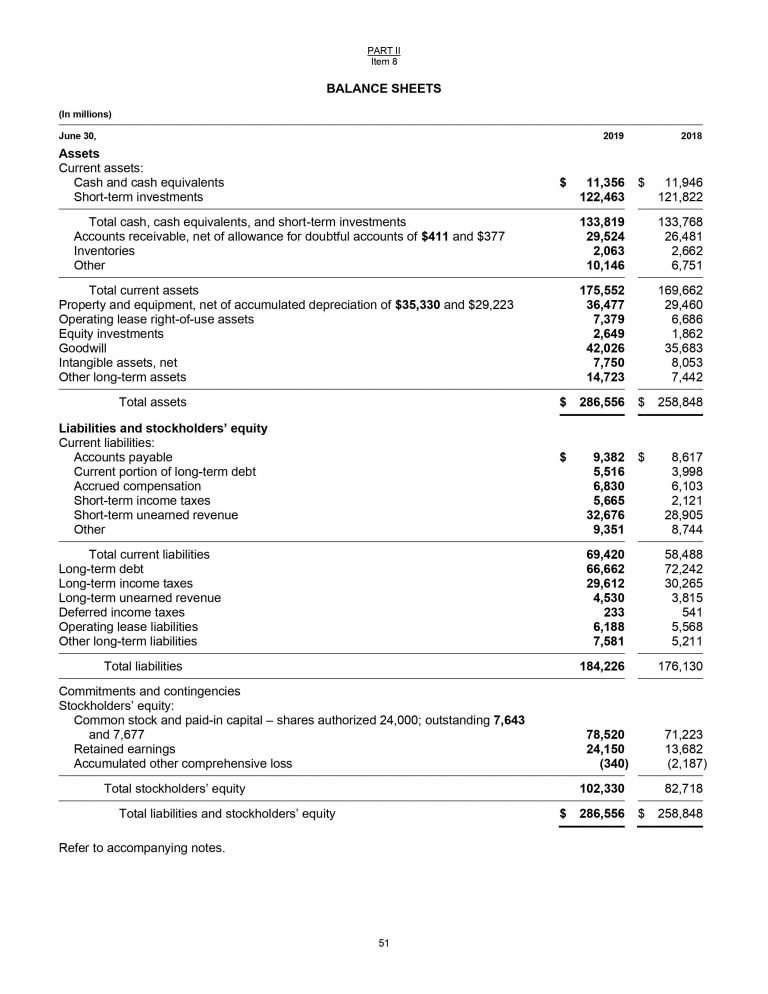

Dollars, not seasonally adjusted (qbpbstas) units: They’re also essential for getting investors, securing a loan, or selling your business. This includes loans, securities, and reserves.

This made the older, lower. The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. Average balances provide a framework for the bank's financial performance.

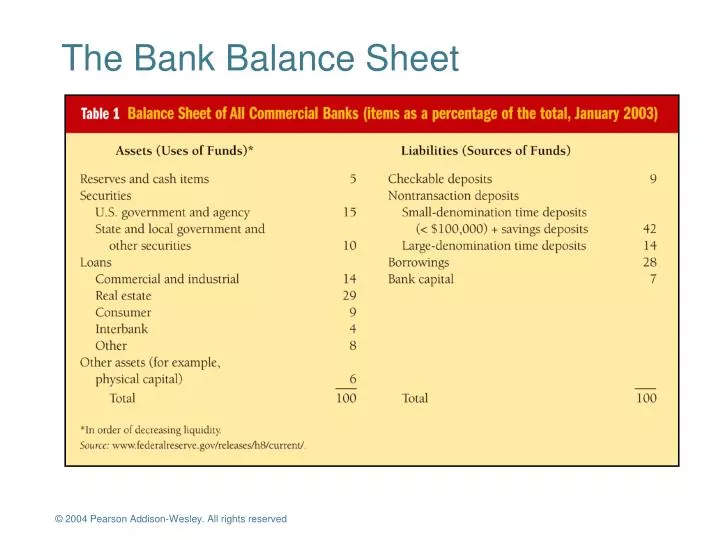

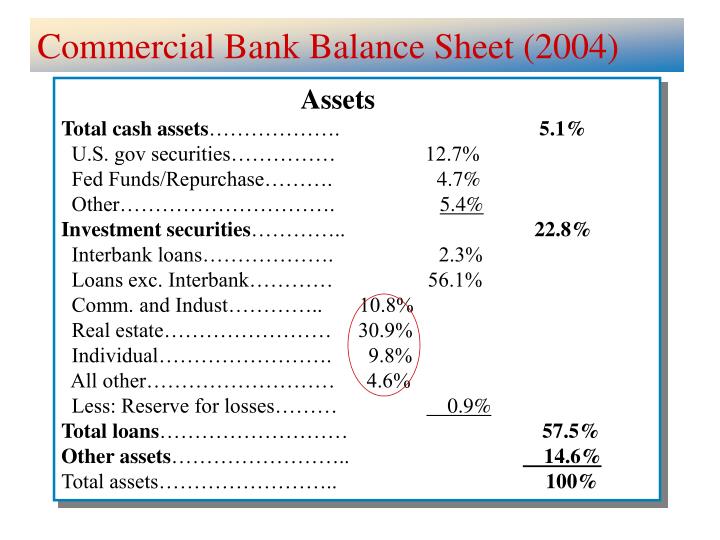

A central bank may have quite low subscribed capital but have built up substantial reserves from retained earnings or put aside large specific At bank of america, deposits make up about 60% of its overall liabilities, with the majority of those deposits in accounts. A bank has assets such as cash held in its vaults and monies that the bank holds at the federal reserve bank (called “reserves”), loans that are made to customers, and bonds.

Cash is considered a source of income and is kept on deposit. The main elements if this balance sheer are assets, liabilities, and the bank capital. Their main function is to attract funds from savers and lend them to those applying for a credit or loan.

Banks may also keep cash for other banks. Liabilities equity but banks do not operate like regular companies do. Bank balance sheets report the assets, liabilities, and bank capital for an individual bank.

Assets = liabilities + capital the assets are items that the bank owns. Explanation banks do not operate as regular companies do; Therefore, part of a bank’s assets is the money it loans, but this is not their money.

The bottom line. Edit line 1. How to read a bank balance sheet?