Breathtaking Tips About Cost Of Goods Sold Trial Balance

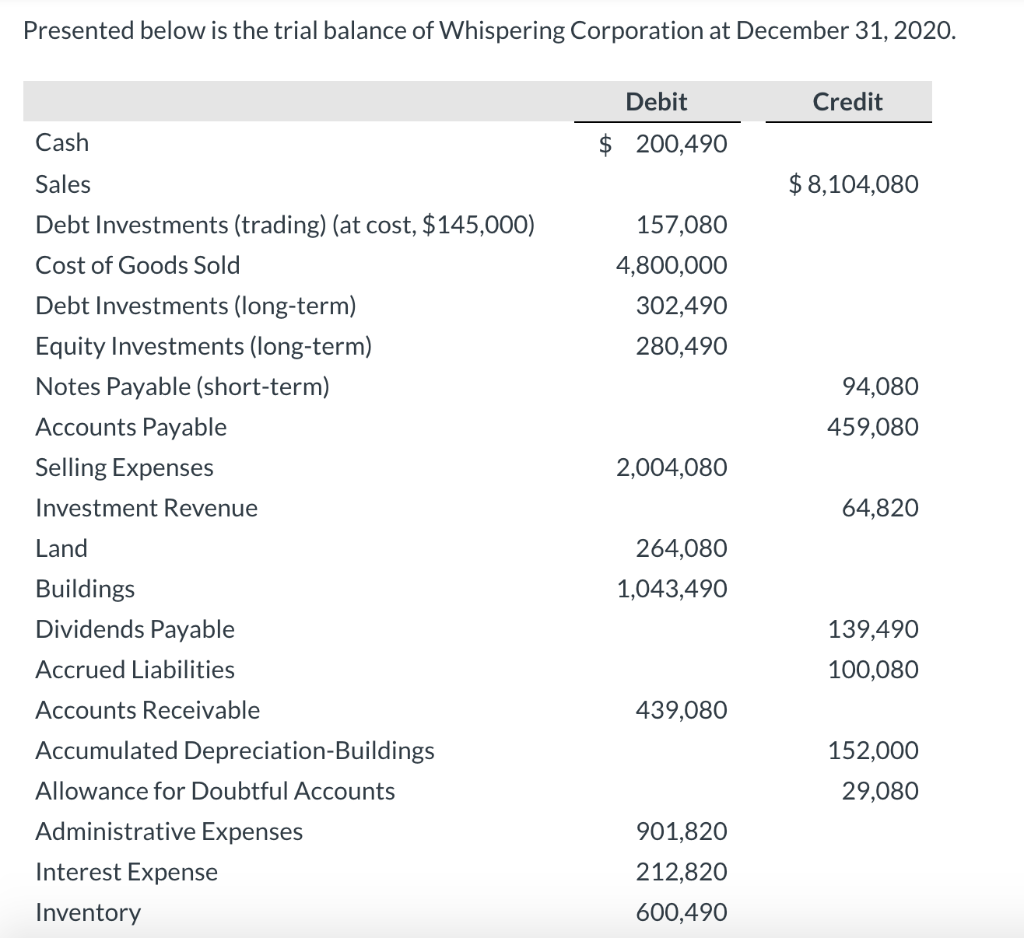

The accounts reflected on a trial balance are related.

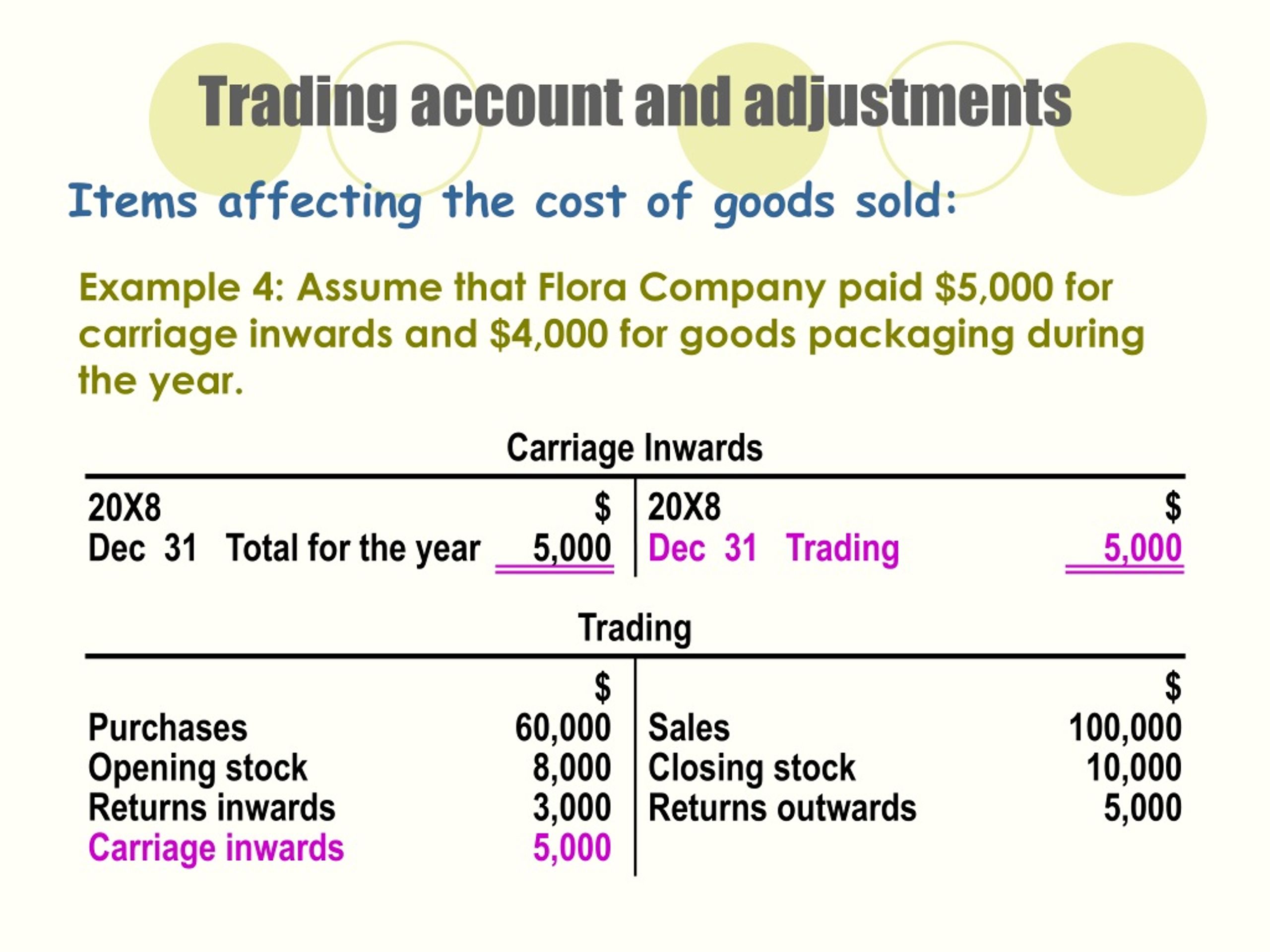

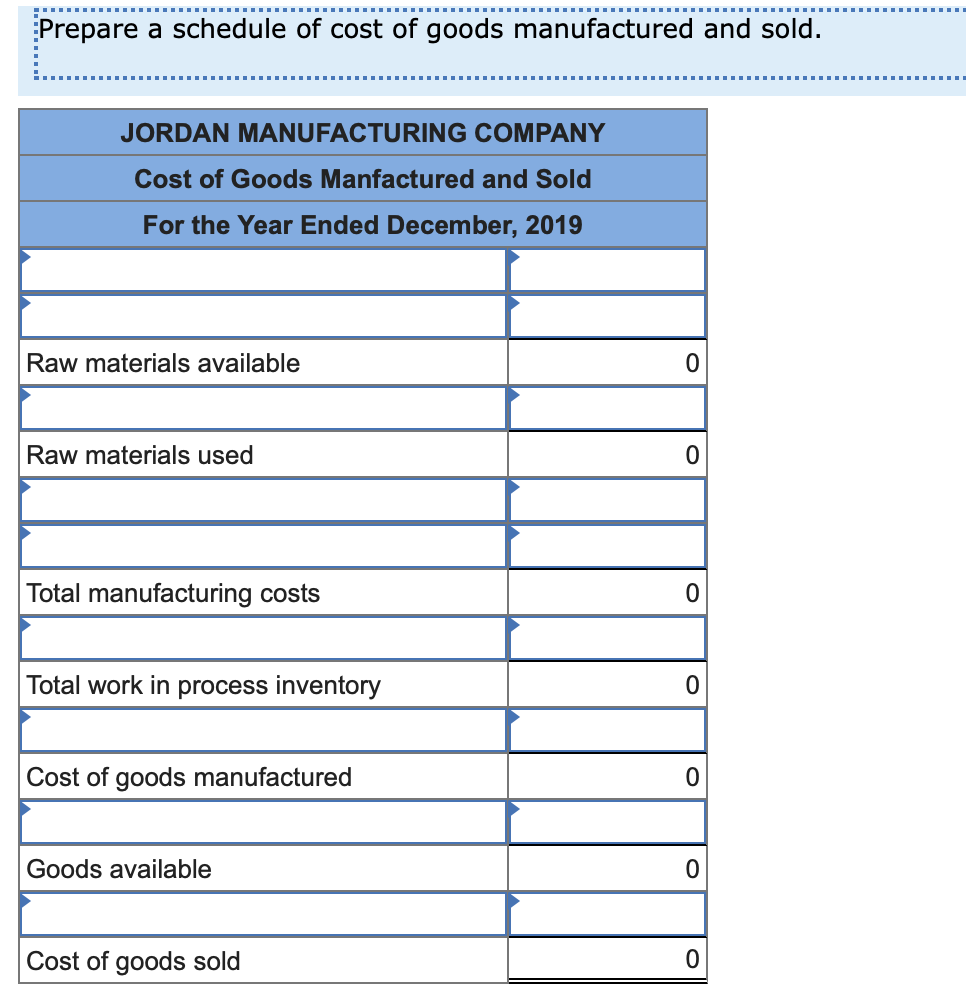

Cost of goods sold trial balance. Enter the merchandise purchase under the name field. The cost of goods sold sometimes abbreviated to cogs or referred to as cost of sales, is the costs associated with producing the goods which have been sold. 10.3 calculate the cost of goods sold and ending inventory using the perpetual method 10.4 explain and demonstrate the impact of inventory valuation errors on the income.

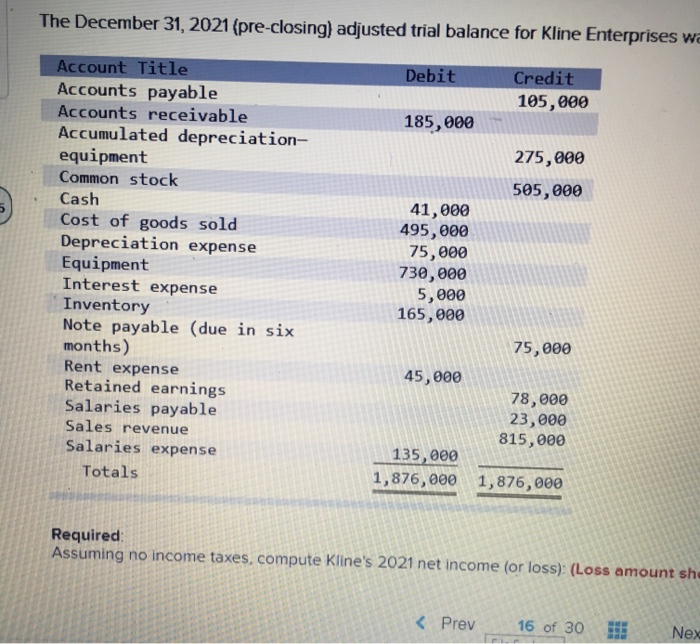

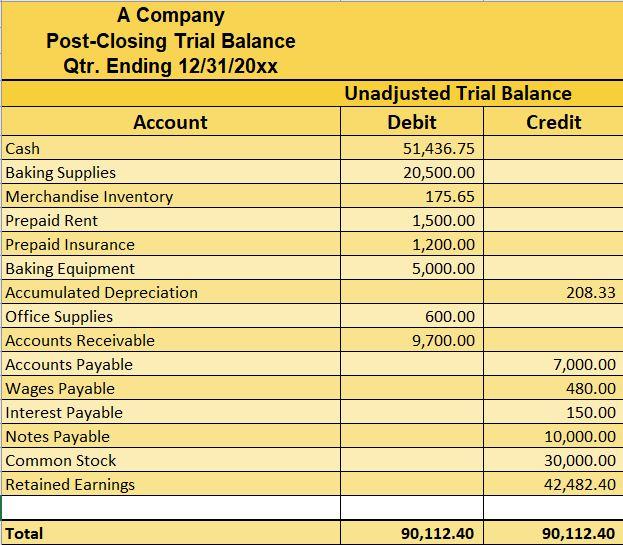

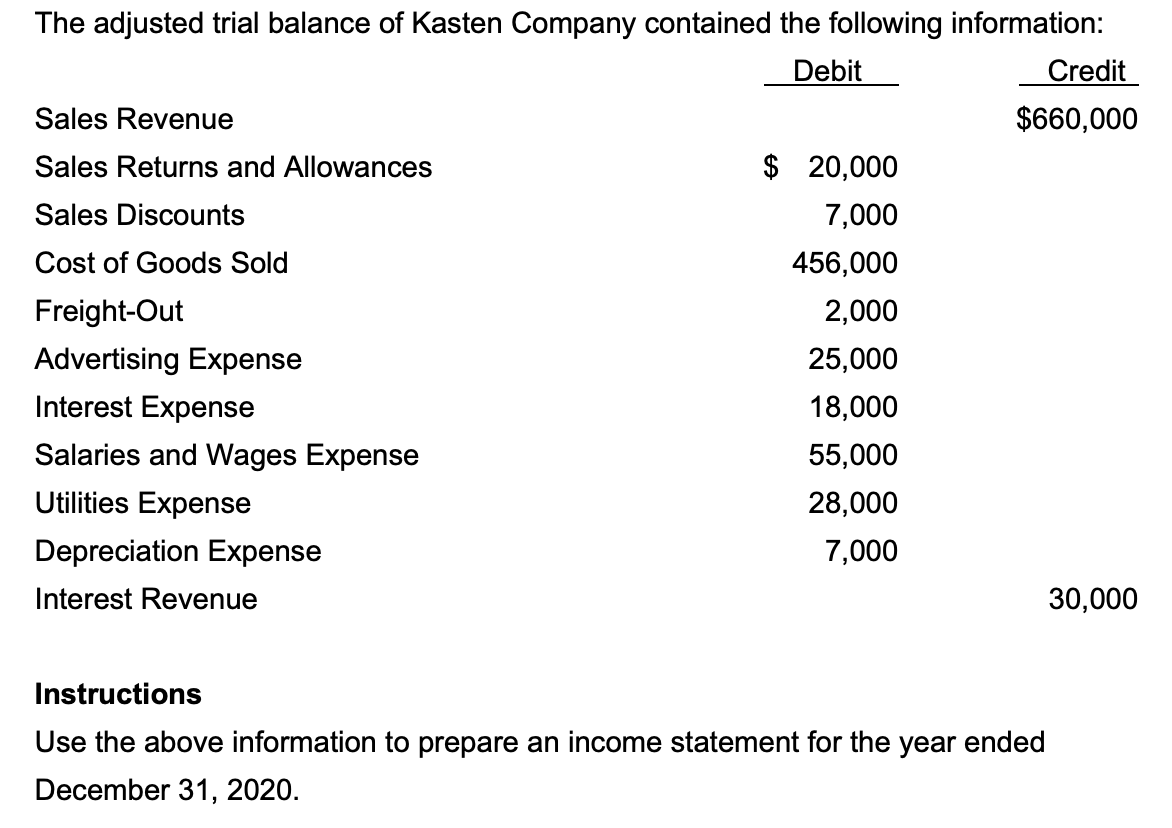

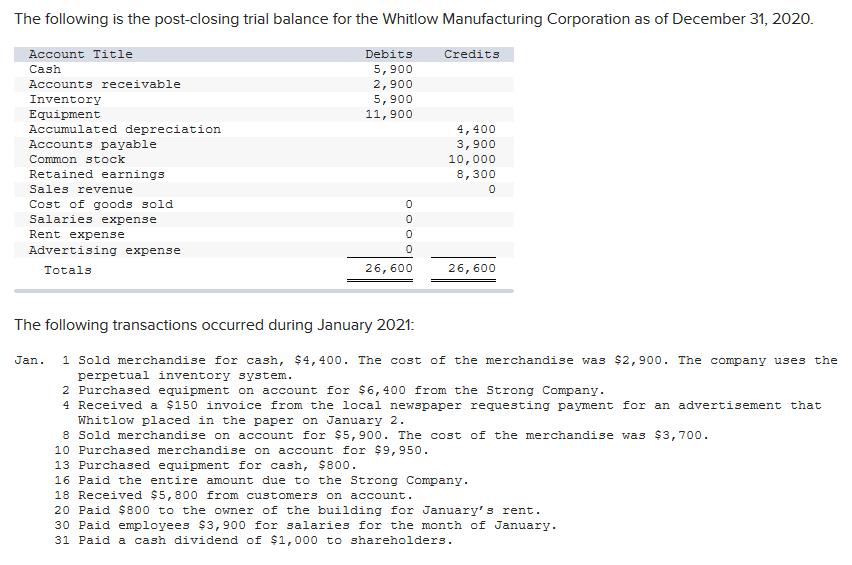

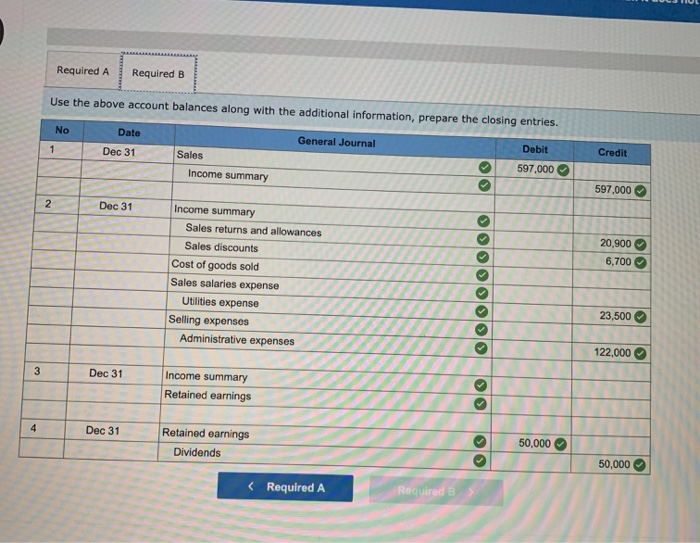

But before you prepare the financial statements, you need to first get the trial balance. Merchandise inventory, before adjustment, had a balance of $3,150, which was the beginning inventory. You should record the cost of goods sold as a business expense on your income statement.

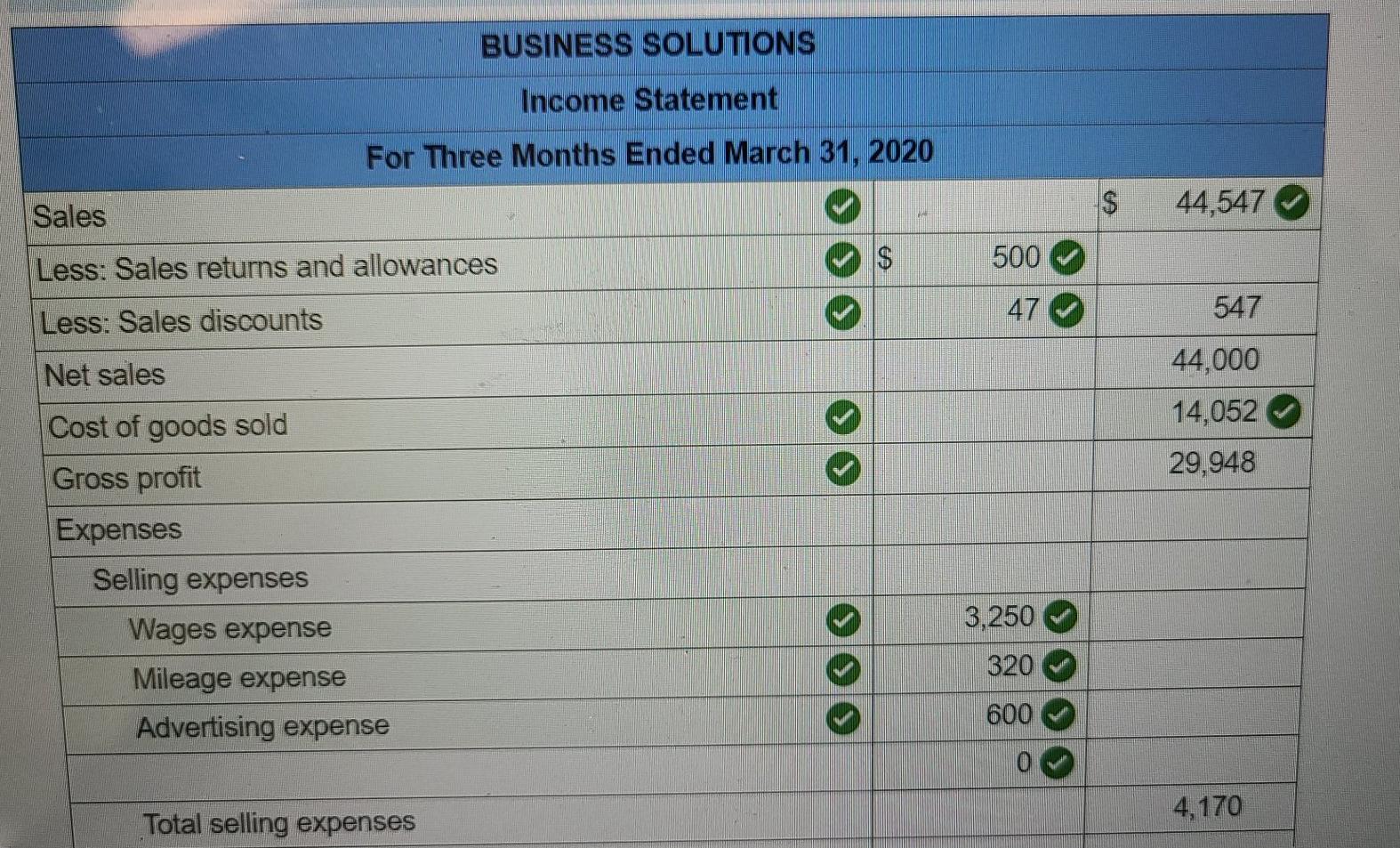

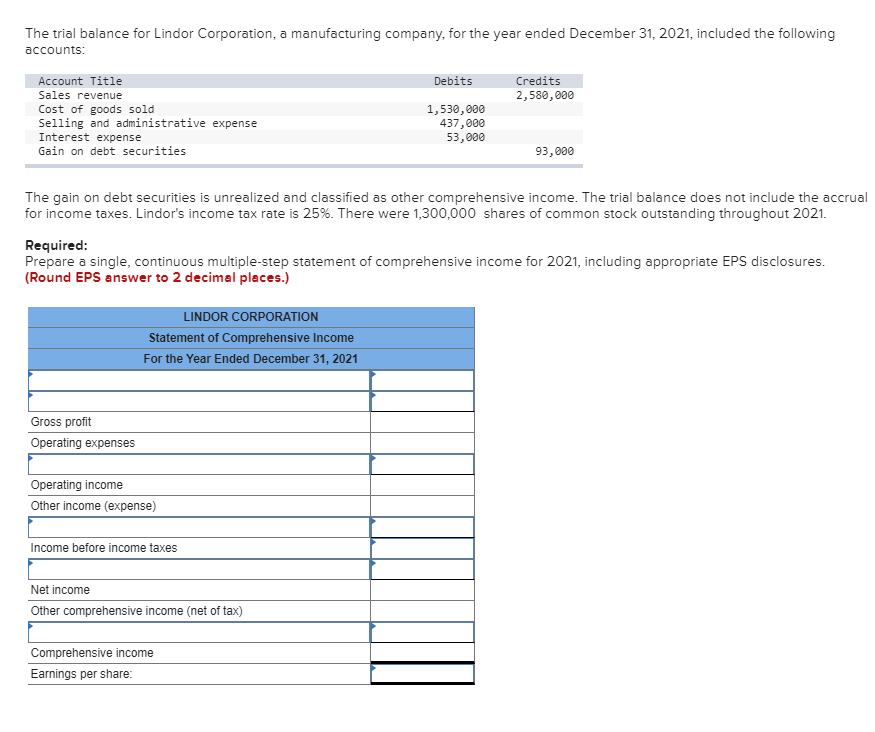

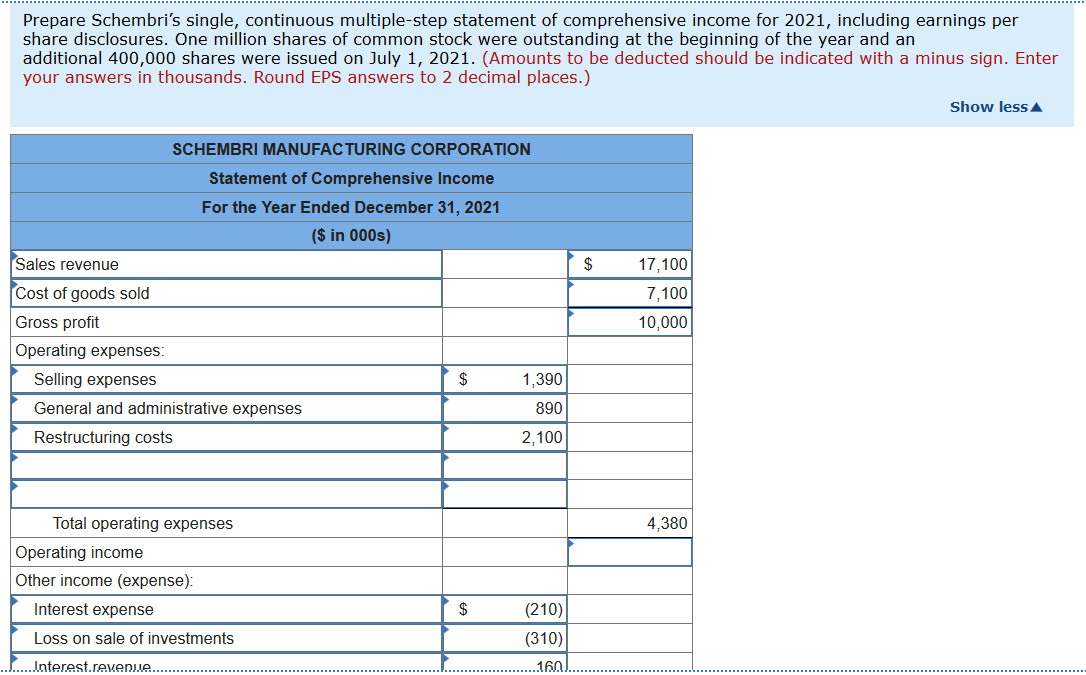

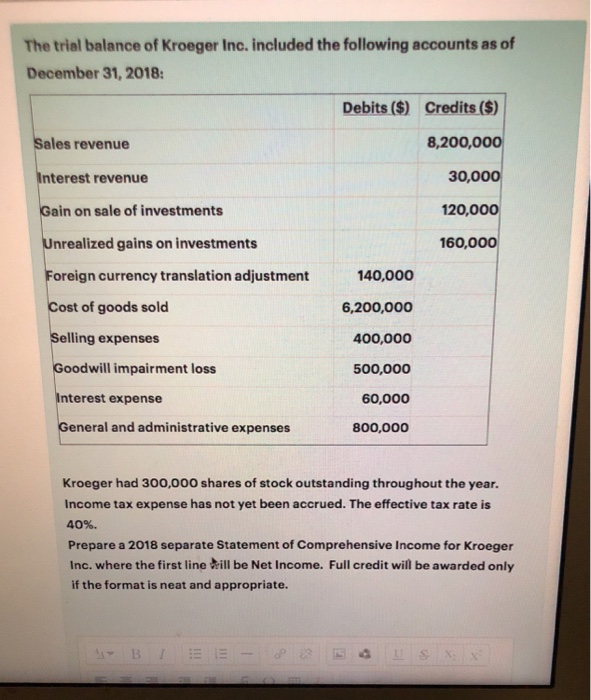

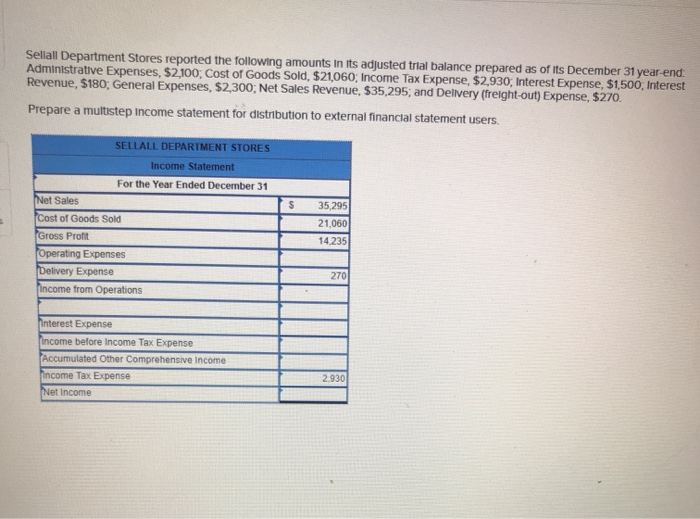

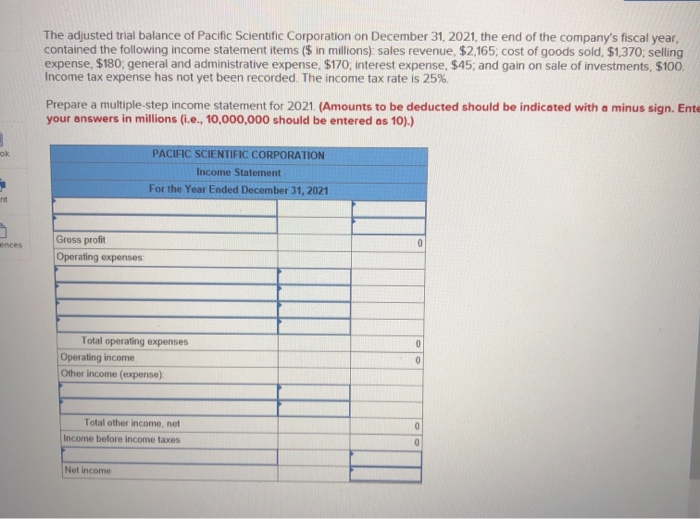

Cost of goods sold on an income statement. If the cogs formula is confusing, think of it. For example, let’s assume the following is the trial balance for printing plus.

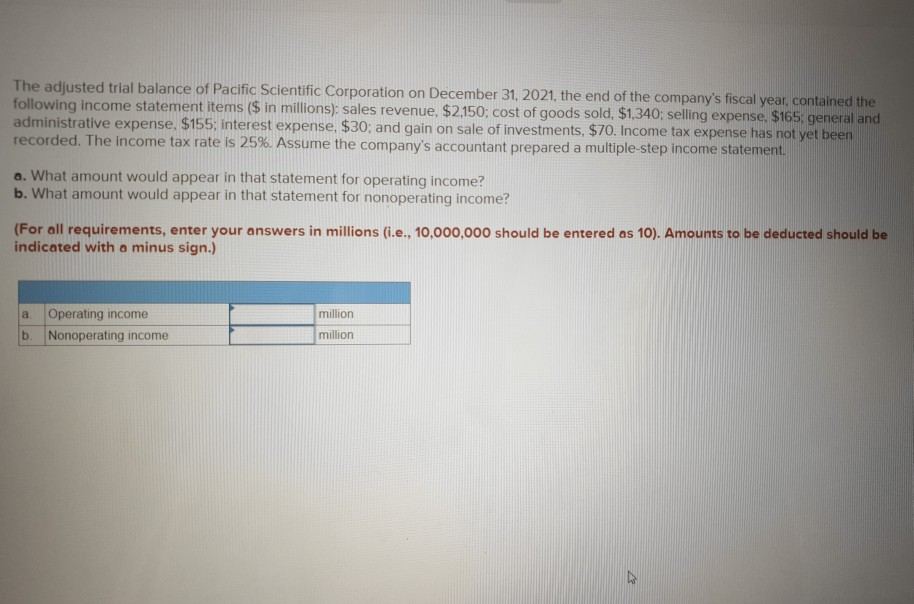

Irs.gov) cost of goods sold formula (cogs) the calculation of cogs is distinct in that each expense. A merchandising company uses the same 4 financial statements we learned before: What is the journal entry to record the cost of goods sold at the end of the accounting period?

A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time. Reporting cost of goods sold; If the outcome of the difference is a whole number, then you may have transposed a figure.

The cost of goods sold for june 2022 is $18,100. Need help setting up your business’s books so you can track cogs, expenses, income, and. To calculate her cost of goods sold for the month, her formula would be:

The basic formula for the cost of goods sold is to start with the inventory at the beginning of the year and add purchases and other costs. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned. This can also be calculated simply by multiplying the number of pieces sold per jewel by its cost per unit and getting.

What is the definition of cost of goods sold? With the information in the example, we can calculate the cost of.