Painstaking Lessons Of Tips About Cash Debit Or Credit In Trial Balance

Before diving into the debit or credit, we need to assess what kind of financial statements element that cash belongs to.

Cash debit or credit in trial balance. Once we know the exact element, then we can clearly know whether cash is debit or credit. Generally capital, revenue and liabilities have credit balance so they are placed on the credit side of the trial balance. A general rule to follow here is;

The reason or logic behind the above rule is to keep the accounting equation in balance and this is the convention commonly followed. All assets ( cash in hand, cash at bank, inventory, land and building, plant and machinery, etc.) sundry debtors. In addition, it should state the final date of the accounting period for which the report is created.

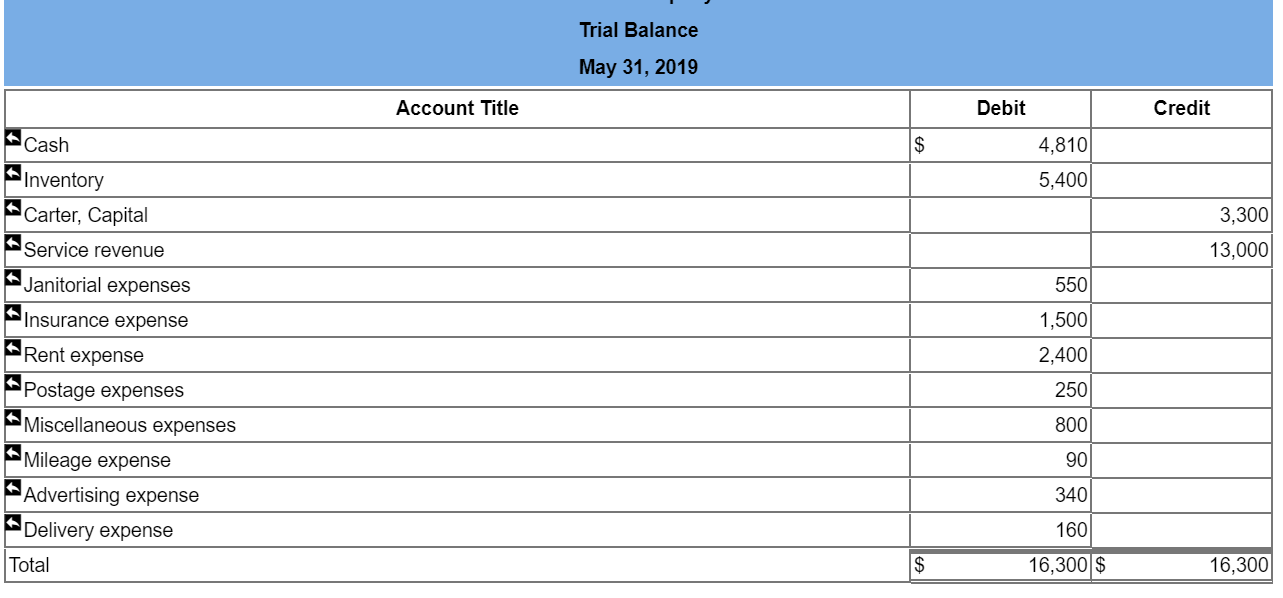

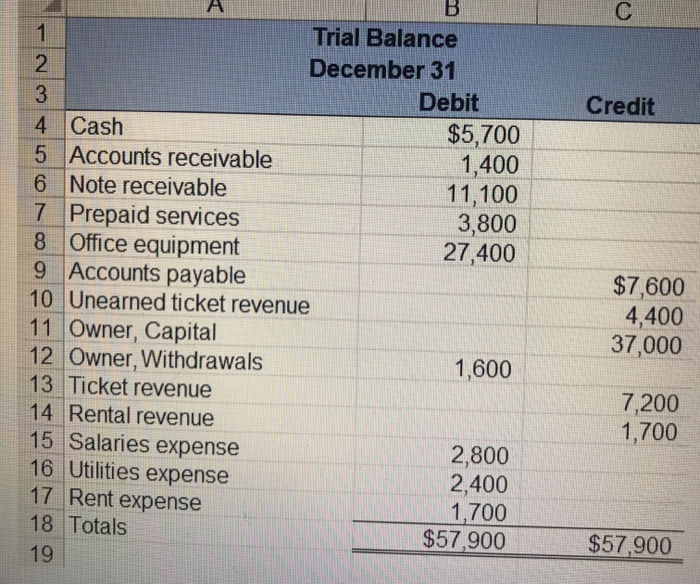

The cardinal rule of the trial balance is that the total of the trial balance debit and credit accounts and ba lances taken from the ledgers should be the same or tallied. The final total in the debit column must be the same dollar. Trial balance only confirms that the total of all debit balances match the total of all credit balances.

>read what are final accounts? If the total of all debit values equals the total of all credit values, then the accounts are correct—at least as far as the trial balance can tell. So, if credit side > debit side, it is a credit balance.

Debits (dr) record all of the money flowing into an account, while credits (cr) record all of the money flowing out of an account. An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate. It’s used at the end of an accounting period to ensure that the entries in a company’s accounting system are mathematically correct.

But at an amount that is $ 100 too high. The rule to prepare trial balance is that the total of the debit balances and credit balances extracted from the ledger must tally. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process.

The trial balance is used to test the equality between total debits and total credits. It shows a list of all accounts and their balances, either under the debit column or credit column. The rule to prepare the trial balance is an equation which is as follows:

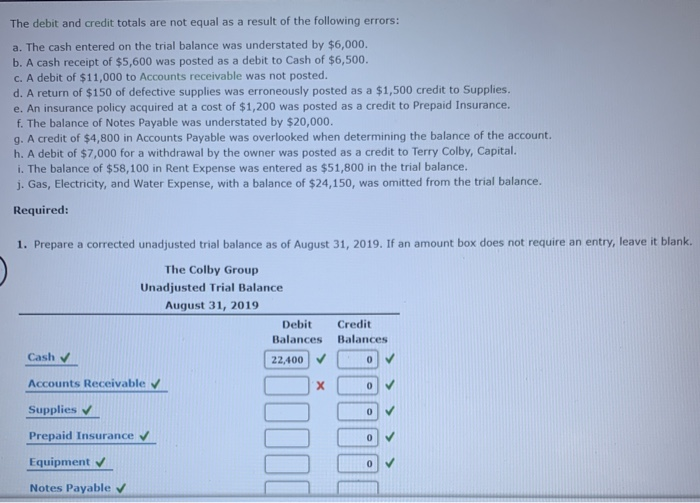

If totals are not equal, it means that an error was made in the recording and/or posting process and should be investigated. This statement comprises two columns: In a trial balance, each general ledger account is listed with the account number, account name description, debit amount in the debit column, and credit amount in the credit column.

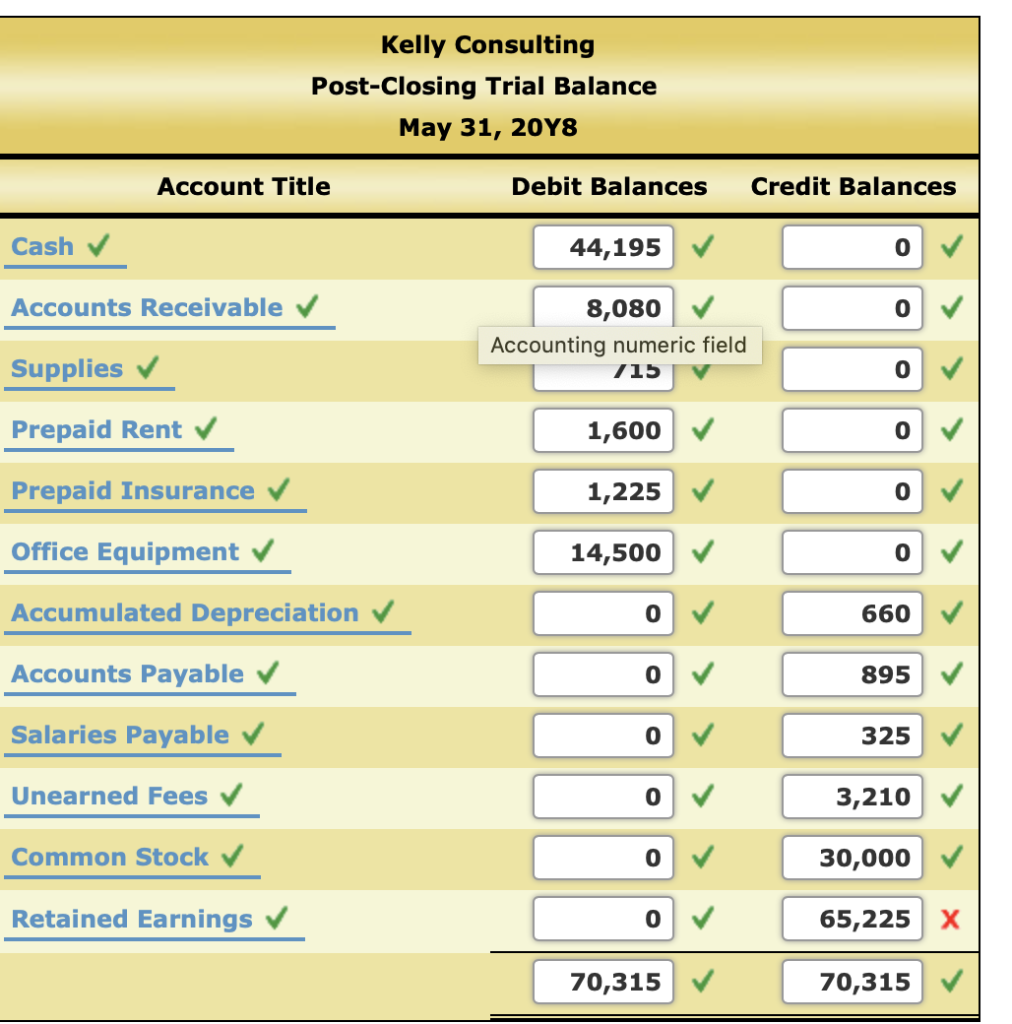

The primary purpose of a trial balance is to identify errors and ensure the equality of debits and credits. Once all ledger accounts and their balances are recorded, the debit and credit columns on the trial balance are totaled to see if the figures in each column match each other. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

Best discover credit cards of 2024. Creditor’s account above example shows credit balance in creditor’s account (to balance c/d) which is shown on the debit side. In addition to the $354.9 million judgment in the civil fraud.