Can’t-Miss Takeaways Of Info About Tds 26as Statement

There are other occurrences where the mismatches are spotted in the tds statement and form 26as.

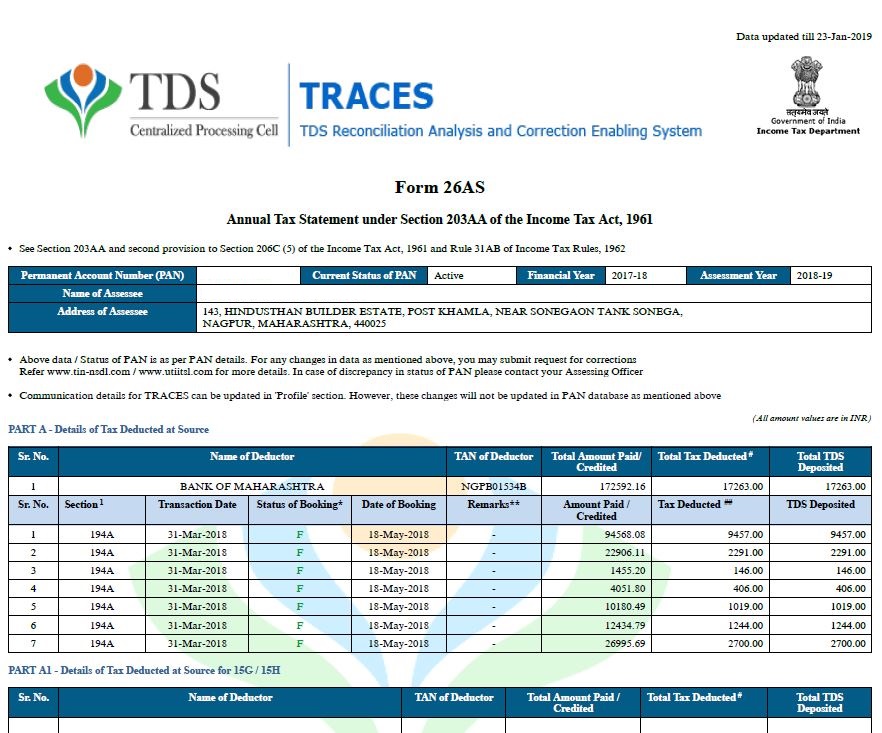

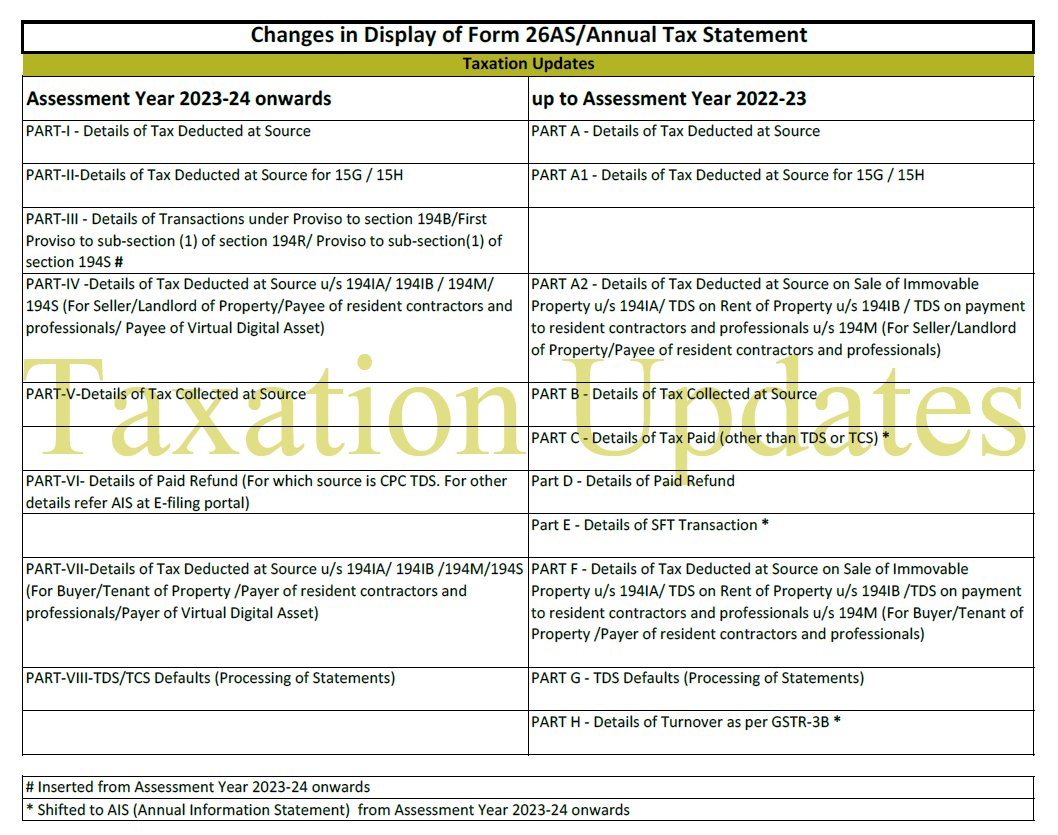

Tds 26as statement. Along with your tds details, you can now find below details in the new form 26as statement; Form 26as is a government. What to do if the tds credit is not reflected in form 26as?

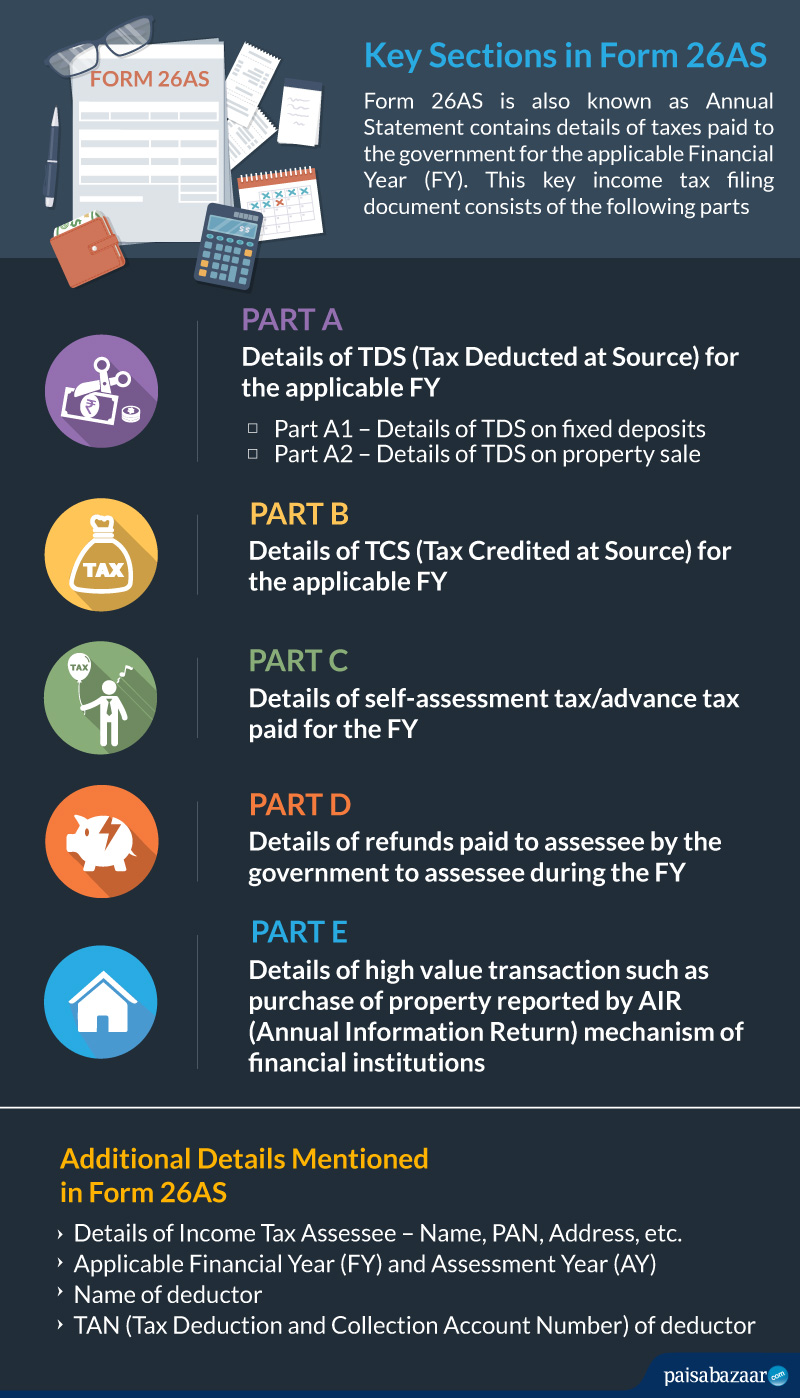

Read more about types of tds deduction. Form 26as is a consolidated statement issued under section 203aa of the income tax act, 1961. Form 26as is a consolidated tax statement that provides tax related information (tds, tcs, refund etc).

Unfortunately, the 26as statements will. Form 26as is like an account statement where all annual tax. Form 16 is issued annually on tds from salary, and form 16a is issued every three months for tds on income from other sources.

Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along. Typically, consolidated views of tds paid confirmations are received through the 26as statement in the income tax portal. This could be due to innumerable fallacies some of which.

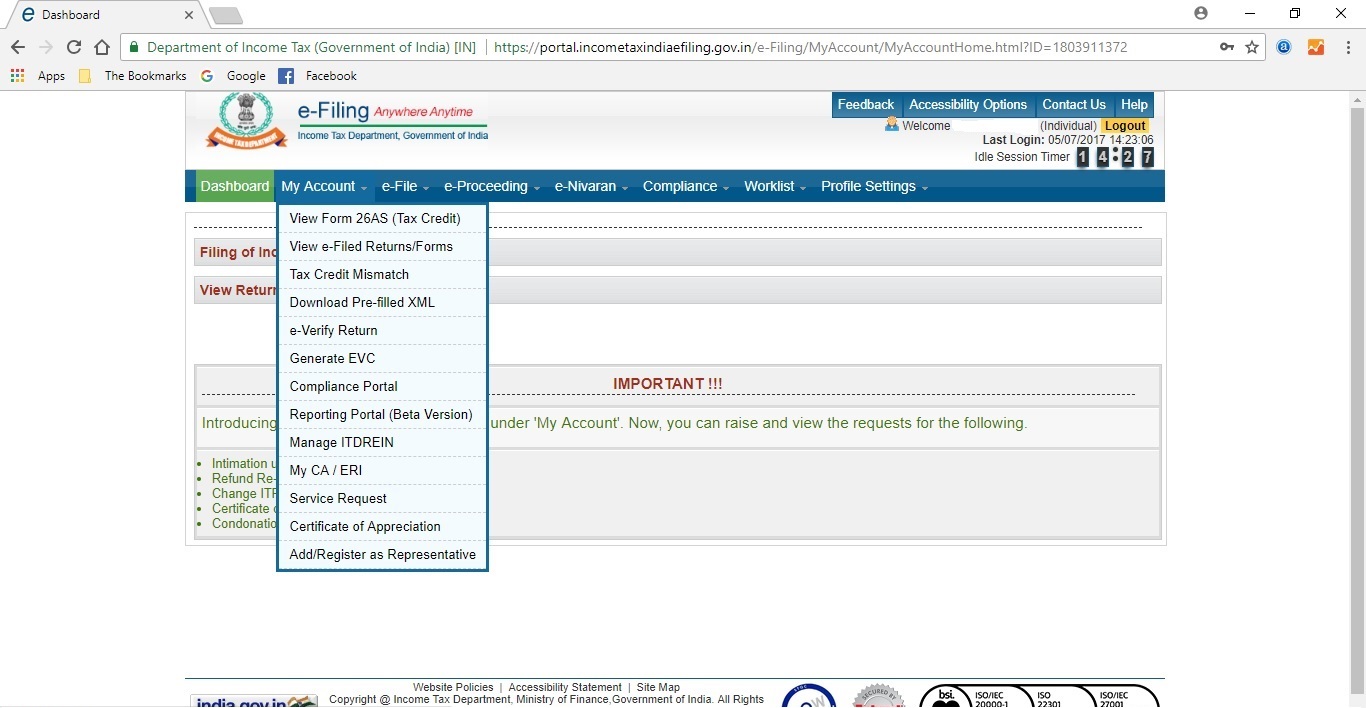

If you are not registered with traces, please refer to our e. Form 26as with respect to tds: It encapsulates various financial transactions linked to your.

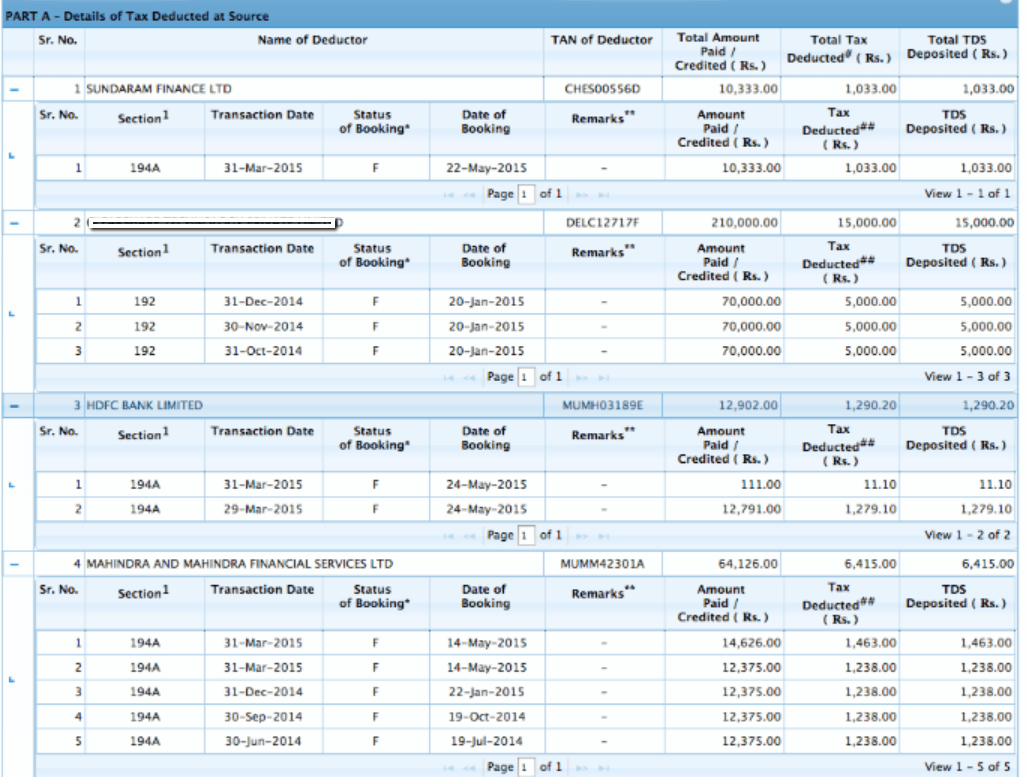

In order to avoid the tds mismatch i.e if your claim of tds is higher than the tax credits available in 26as statement, please contact the deductor for filing of the. Form 26as is a statement that outlines the following details: The website provides access to the pan holders to view the details of tax credits in form 26as.

This certificate would provide the details of the income paid to you and also the tax deducted from that income by the payer and whether the same has been.