Perfect Info About Finance Cost On Income Statement

Companies finance their operations either through equity financing or through borrowings and loans.

Finance cost on income statement. It is built using the accrual. Purpose of this paper. We can define expenses as the outflow of economic resources that occurs in the normal course of business activities.

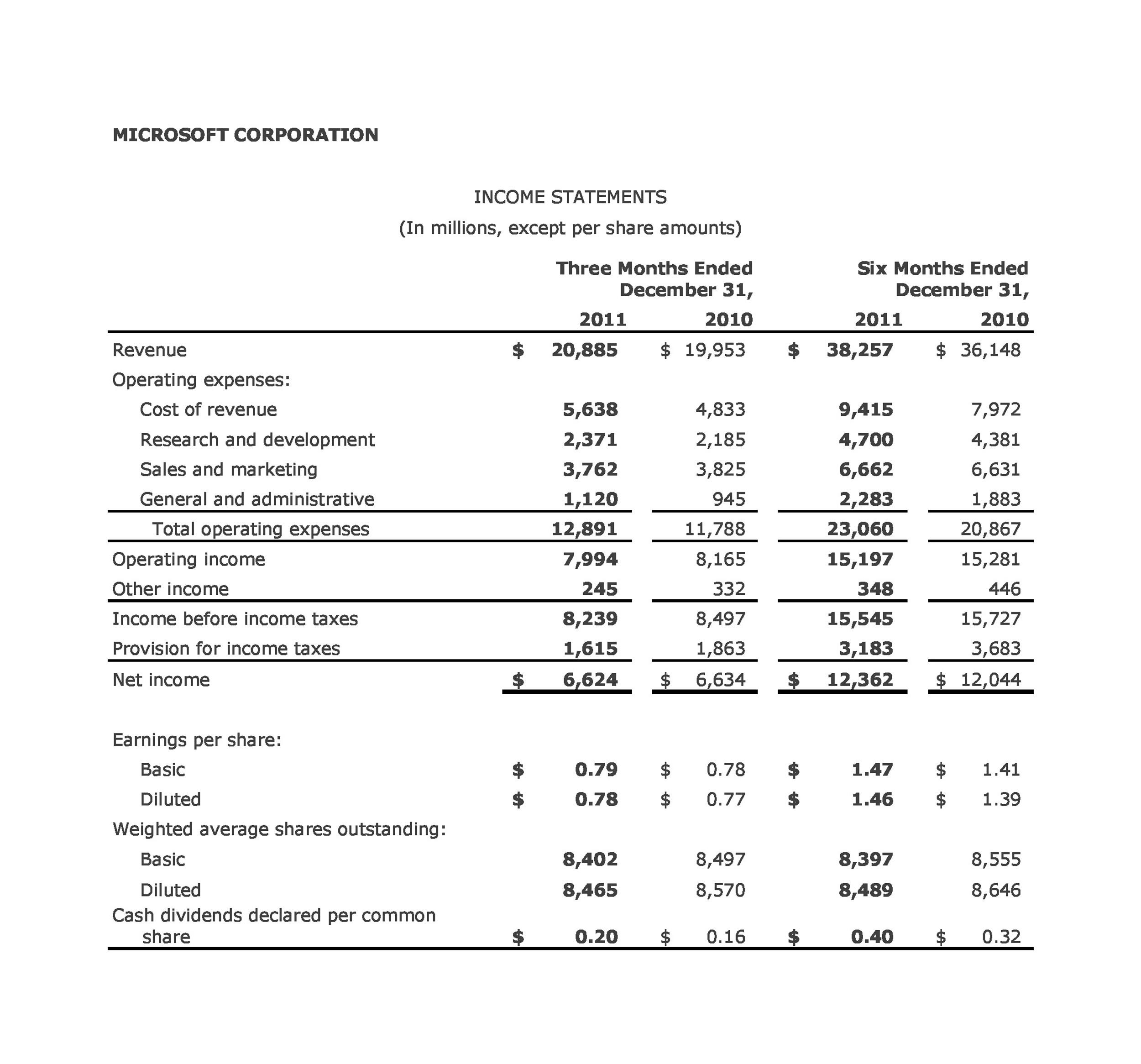

Bajaj finance share price; The income statement is one of three statements used in both corporate finance (including financial modeling) and accounting. The income statement shows a firm’s performance over a specific period of time.

The providers of funds want reward for against there funds. They are also known as “finance costs” or “borrowing costs.” a company funds its operations using two different sources: Over time, these reports have become legal and regulatory requirements.

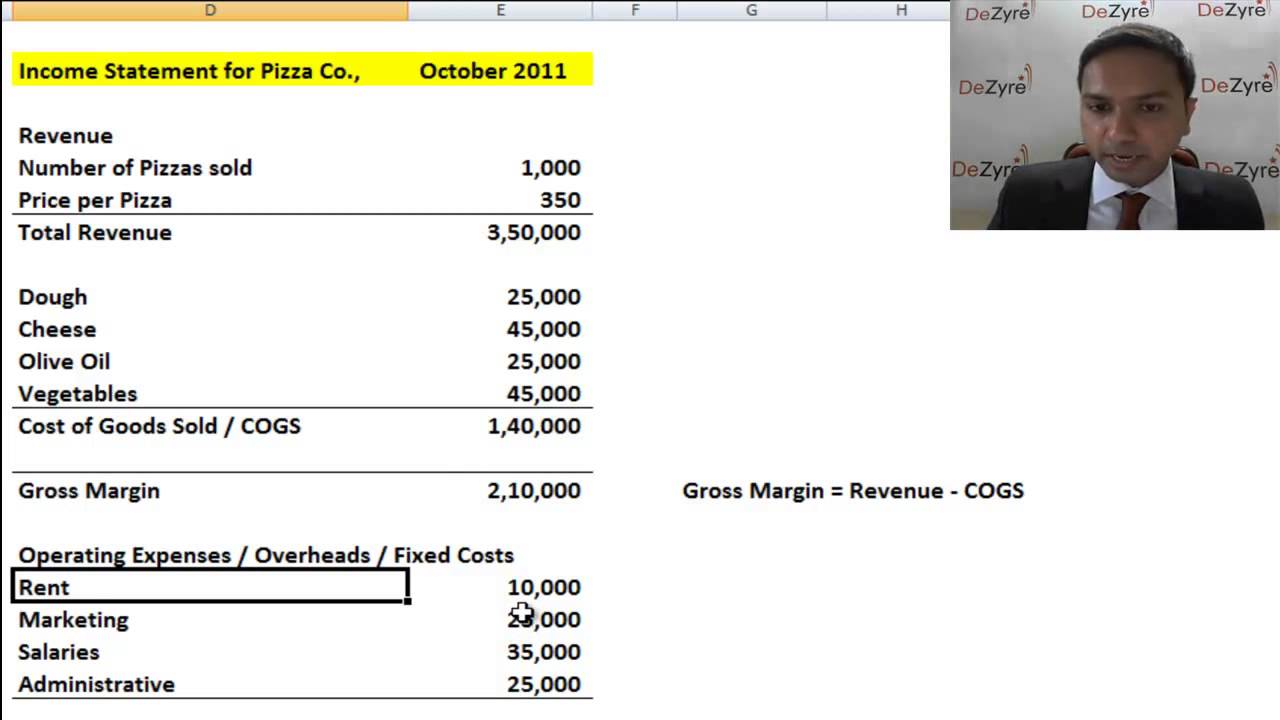

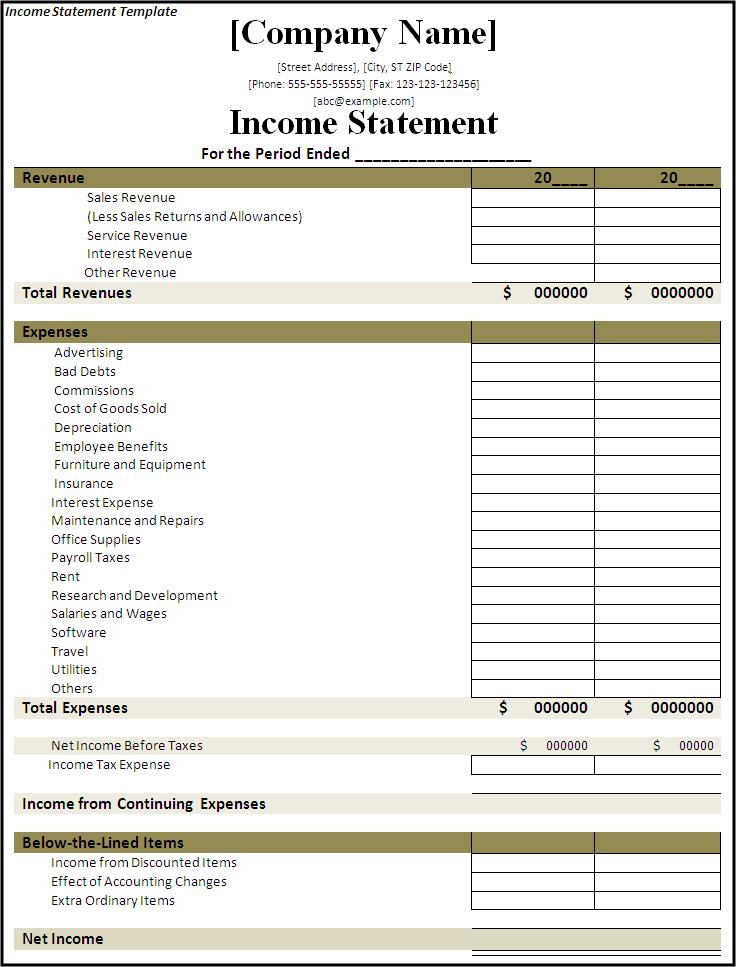

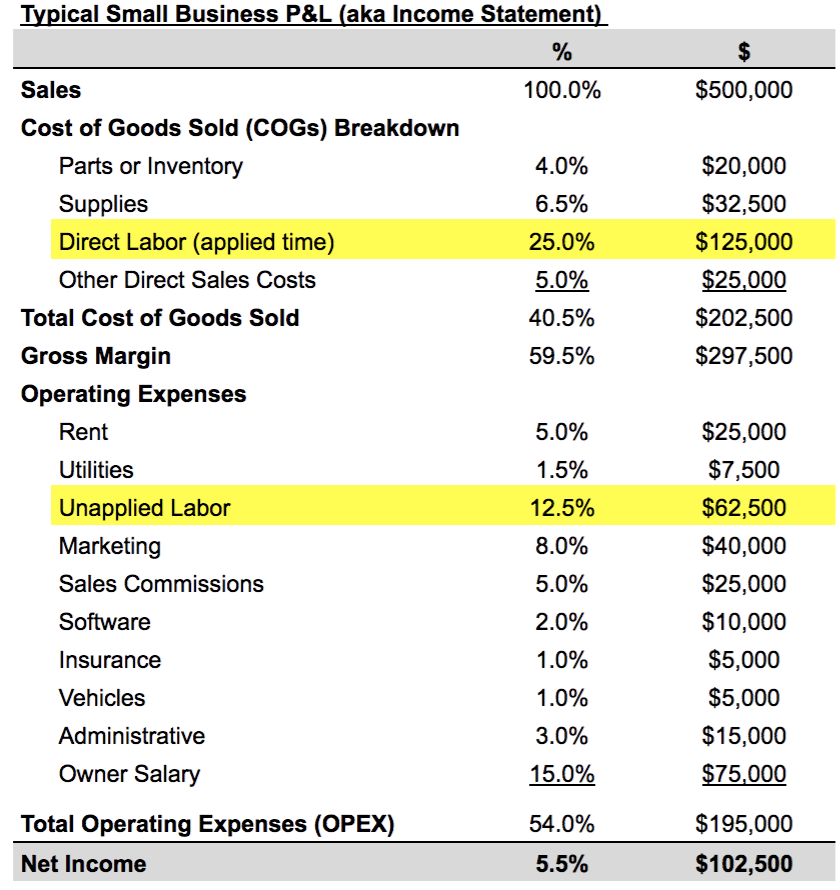

The income statement provides an overview of revenues, expenses, net income, and earnings per share. The income statement, being a detailed record of a company’s financial performance over a specified period, shows the revenues, costs, and profits (or losses) a company makes. Income statements are also carefully reviewed when a business wants to cut spending or determine strategies for growth.

The statement helps financial statement users understand the sales generated during the period and the expenses incurred to generate those sales. These funds do not come for free. Here's what to do.

The typical income statement contains: Record adjusted ebitda margin fourth. These are fees paid by the borrower to the bankers, lawyers and anyone else involved in arranging the financing.

What’s the difference between a cash flow statement and an income statement? The income statement shows a company’s expense, income, gains, and losses, which can be put into a mathematical equation to arrive at the net profit or loss for that time period. Since our public sector finances, uk:

For the quarter, gaap earnings per diluted share was $4.93, up 33% from the previous quarter. The income statement focuses on four key items: An increase in customer interest and demand for sustainable products, reflected as an increase in sales revenue section.

Net is simply the total sum, and it refers to the fact that the people who manage the funds have added interest income to interest expense to come up with one figure. Nvda) today reported revenue for the fourth quarter ended january 28, 2024, of $22.1 billion, up 22% from the previous quarter and up 265% from a year ago. Revenue, expenses, gains, and losses.

What are “expenses”? Expenses are decreases in economic benefits for a company and arise from the depletion of assets or incurrences of liabilities. Financial analysis of an income statement can reveal that the costs of goods sold are falling, or that sales have been improving, while return on equity is rising.

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)