Best Of The Best Info About Difference Between Direct And Indirect Method

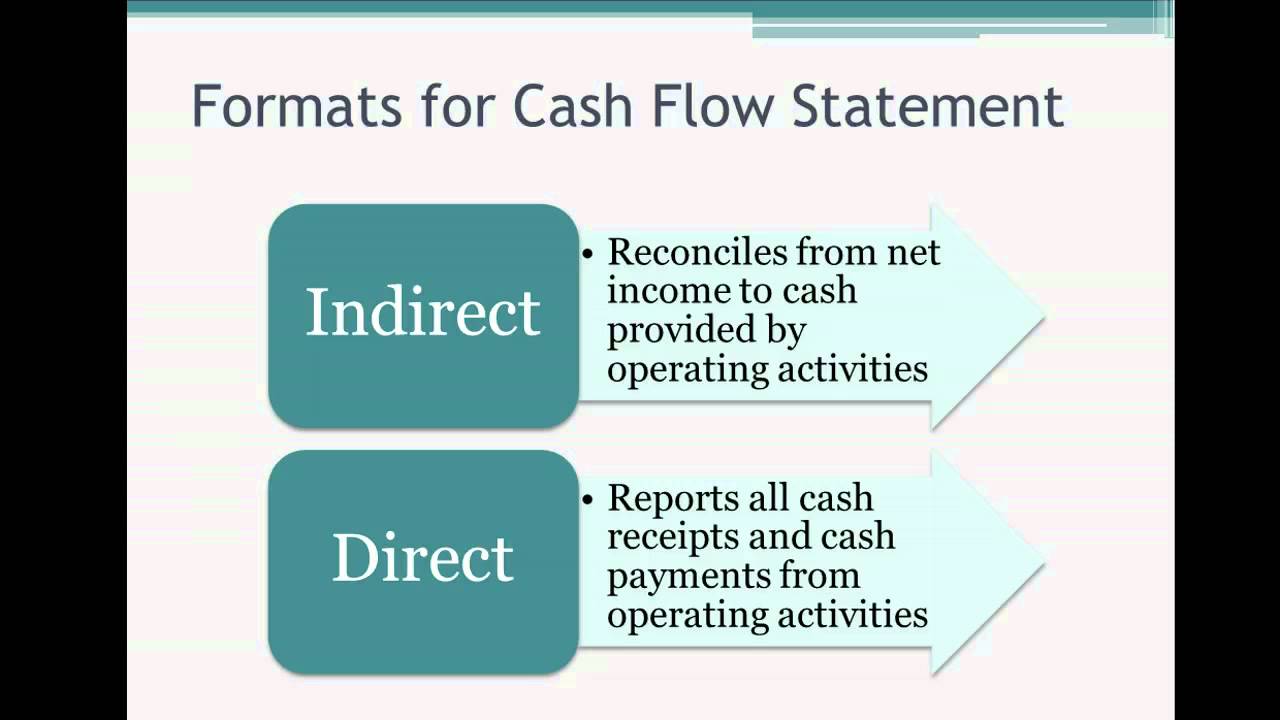

Direct technique presents operating cash flows as a list of incoming and departing cash flows.

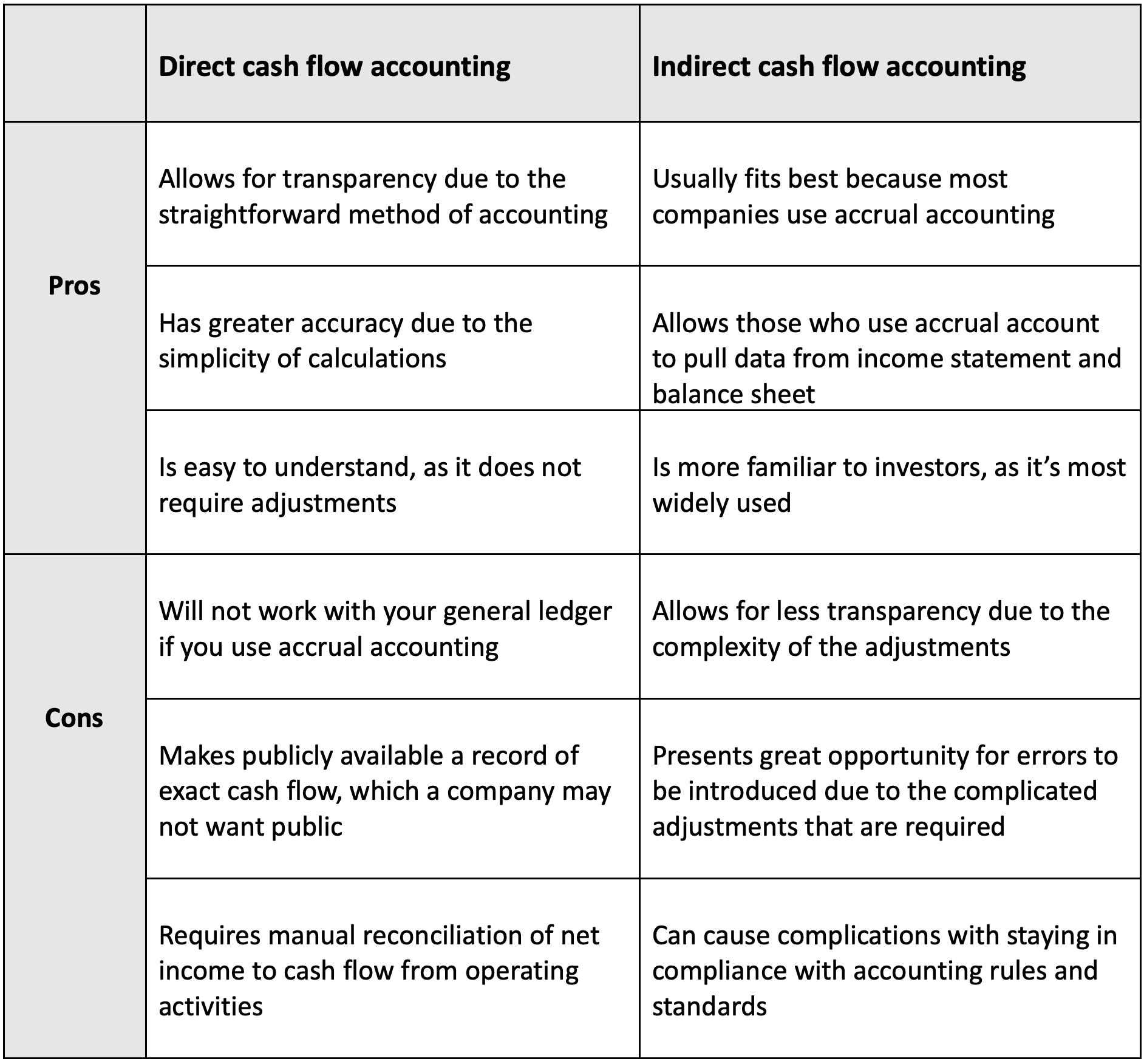

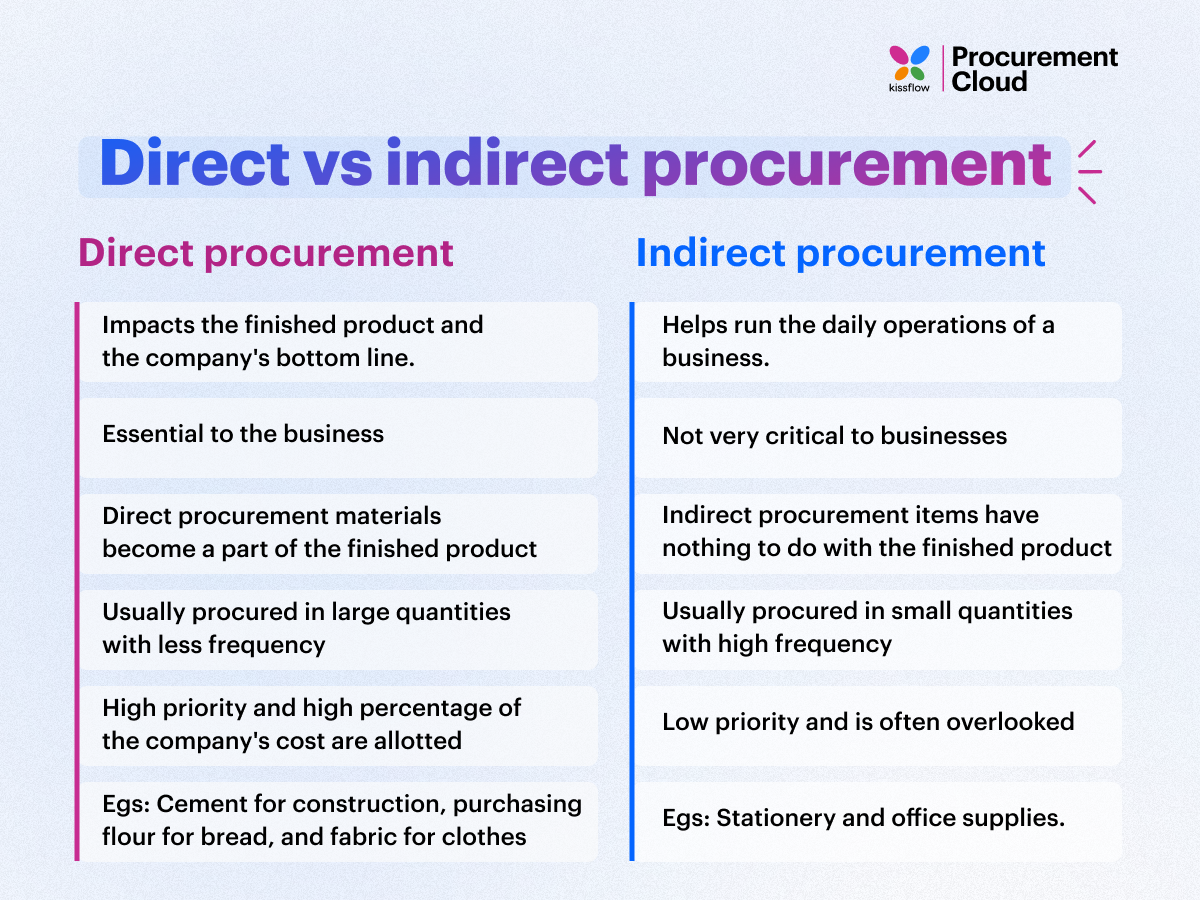

Difference between direct and indirect method. What sets apart direct and indirect methods in calculating net cash flow from operating activities? The direct method, in essence, subtracts. While both are ways of calculating your net cash flow from.

The two methods differ in their approaches, which are. Key differences between direct and indirect forecasting. The difference between these methods lies in the presentation of information within the cash flows from operating.

The indirect method starts with your net profit and adjusts for things that don’t involve actual cash, like depreciation. Direct and indirect cash flow forecasting differ in their methodologies and data sources. This video discusses the differences between the direct method statement of cash flows and indirect method statement of cash flows.

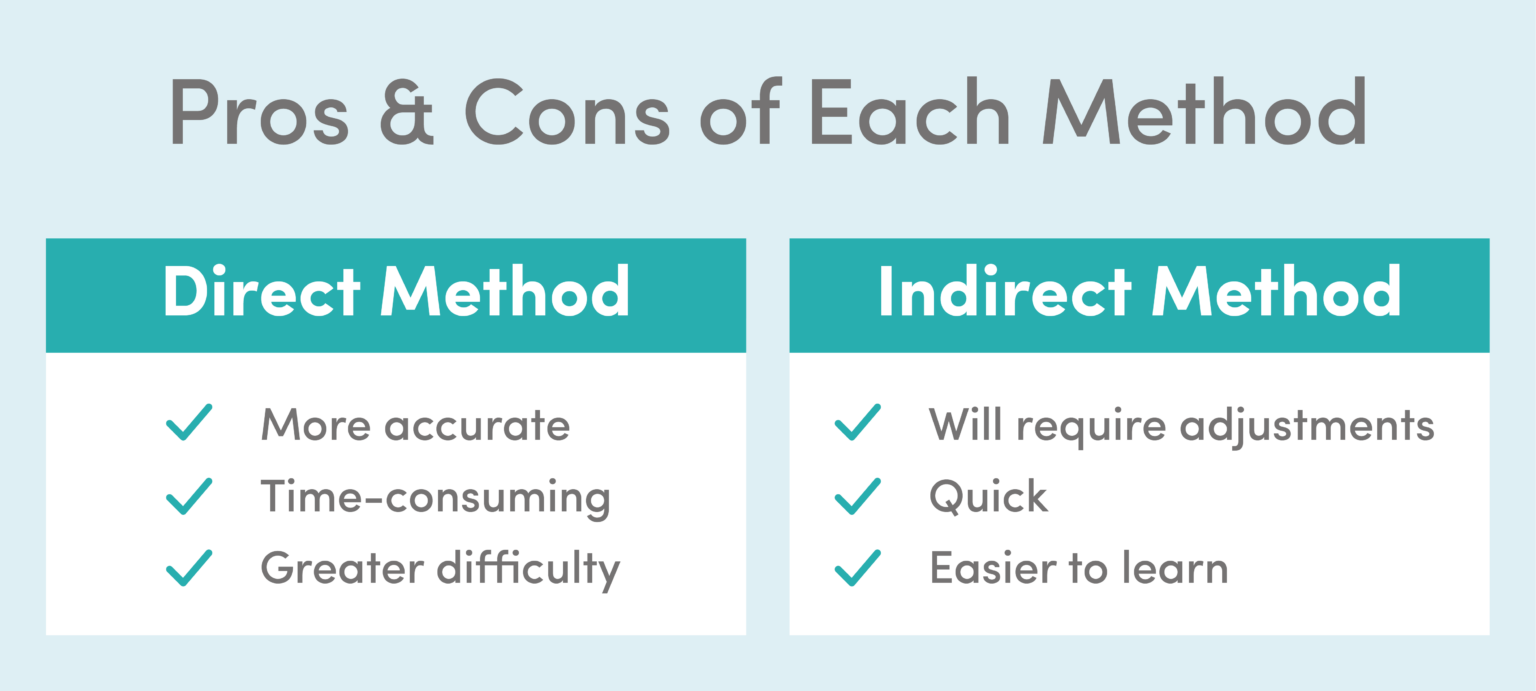

The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the expense. Calculating the cash flows from indirect method is easier. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows.

The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the. The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the expense. Direct cash flow method.

When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look. In this article, we explore direct and indirect cash flow, highlight their most notable differences and provide an example of a cash flow statement using both. The indirect method and direct method are two ways of preparing the statement of cash flows.

Direct method is the preferred approach, but most companies use the indirect method for preparing cash flow statement because it is easier to implement. Direct method examples. So what's the difference between direct and indirect?

There are two commonly used methods of calculating cash flow: