Underrated Ideas Of Info About Common Size Financials

Under this new scheme, the.

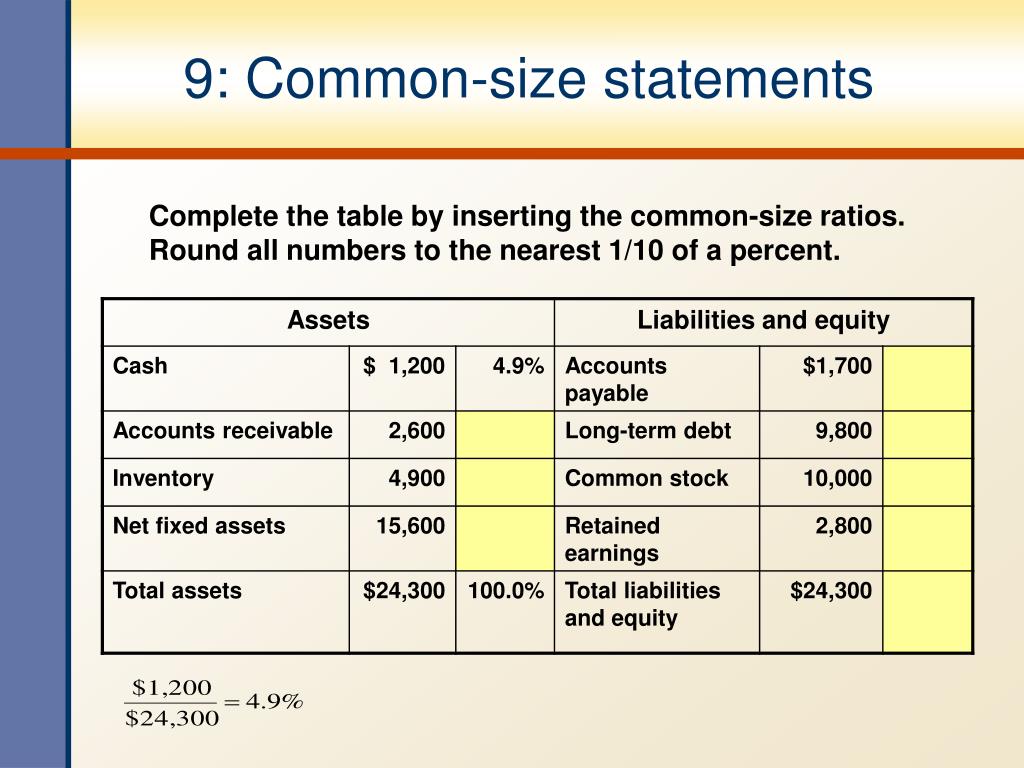

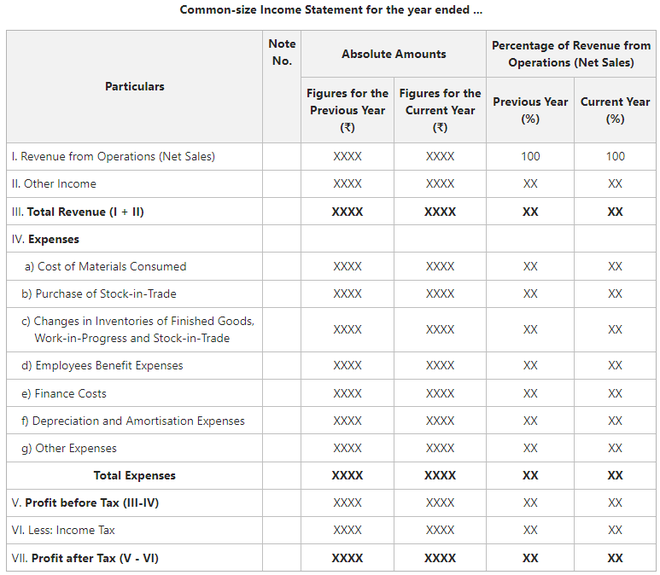

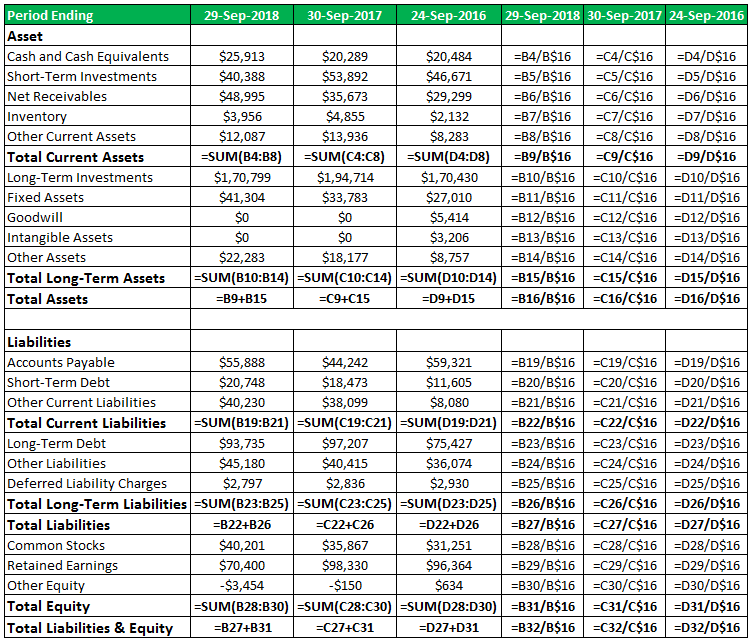

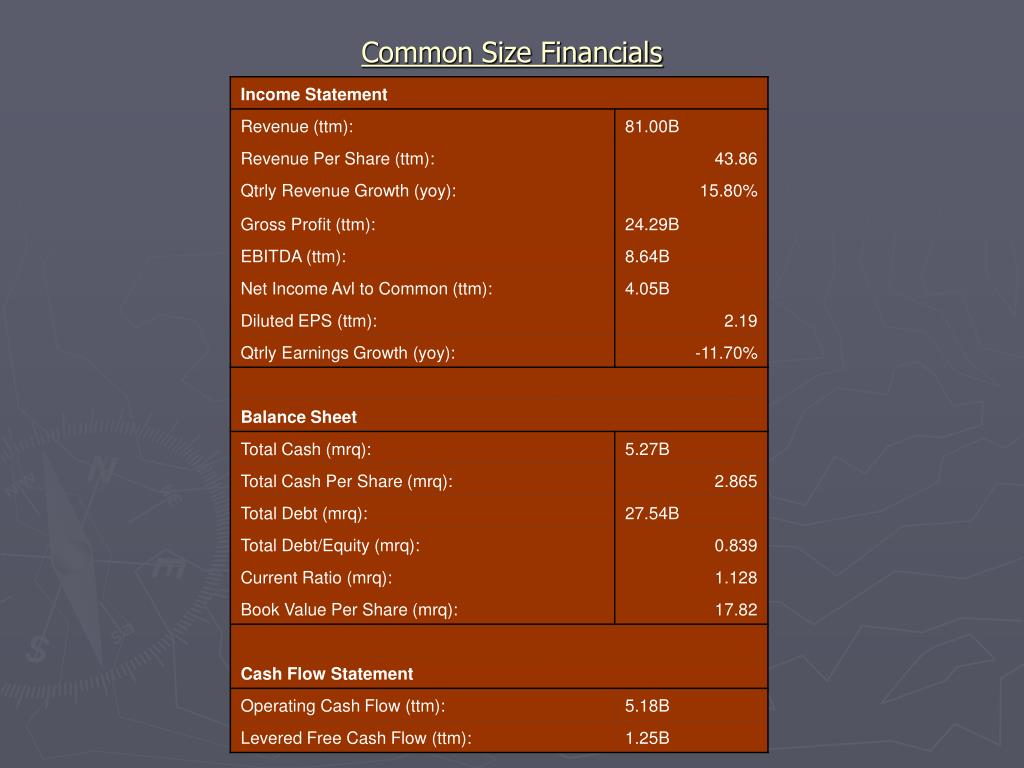

Common size financials. It presents financial information in a standardized format to better understand the relative. A common size financial statement shows each line item on a financial statement as a percentage of a. 4 rows how to common size an income statement.

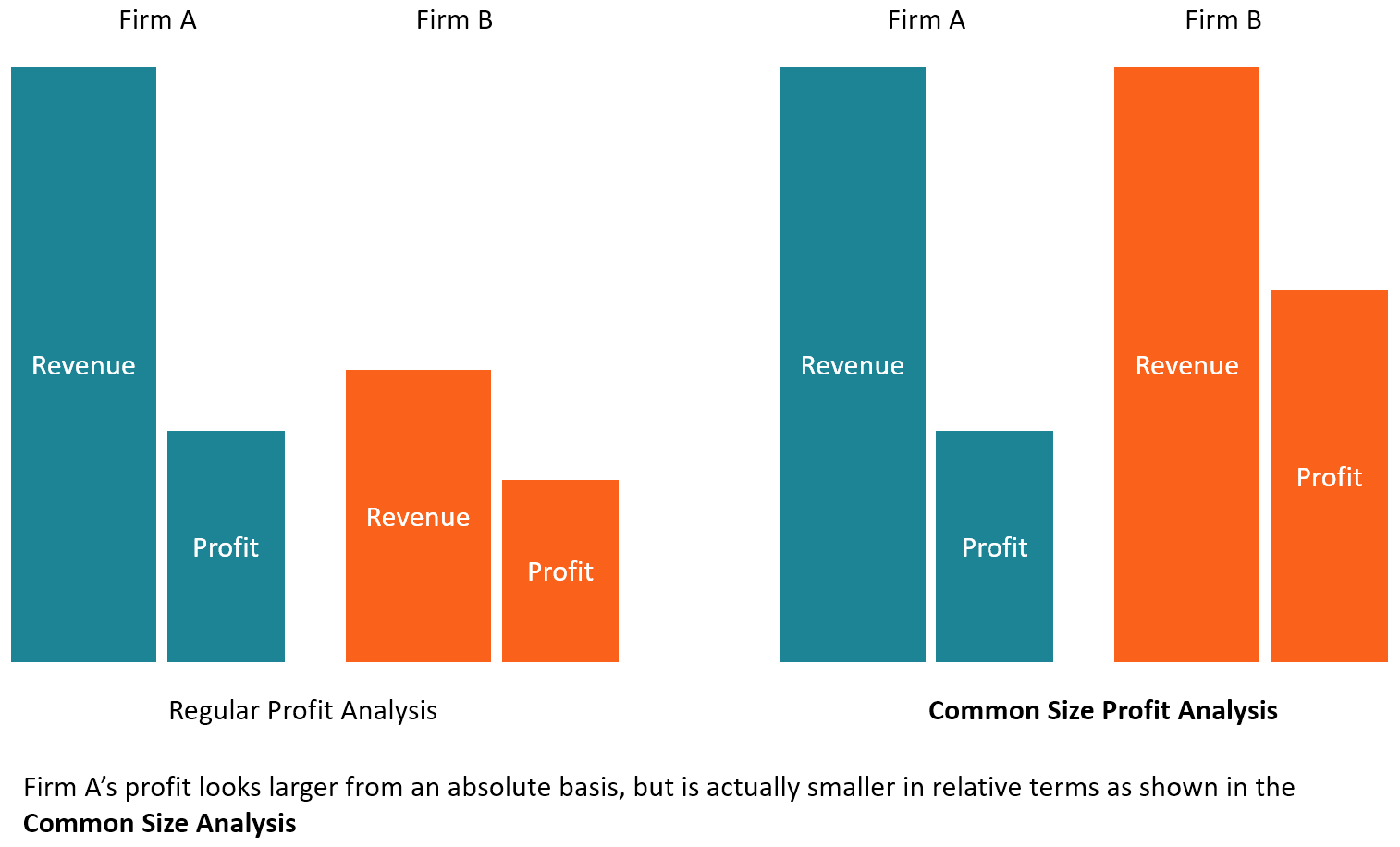

It allows for easy comparison. The common size ratio refers to any number on a business’ financial statements that is expressed as a percentage of a base. It evaluates financial statements by expressing each.

For all of 2023, global m&a value fell 16 percent to $3.1 trillion—a showing even weaker than the pandemic year of 2020. Finance ministerial regulation no. Common size analysis is used to visualize a company's financial performance.

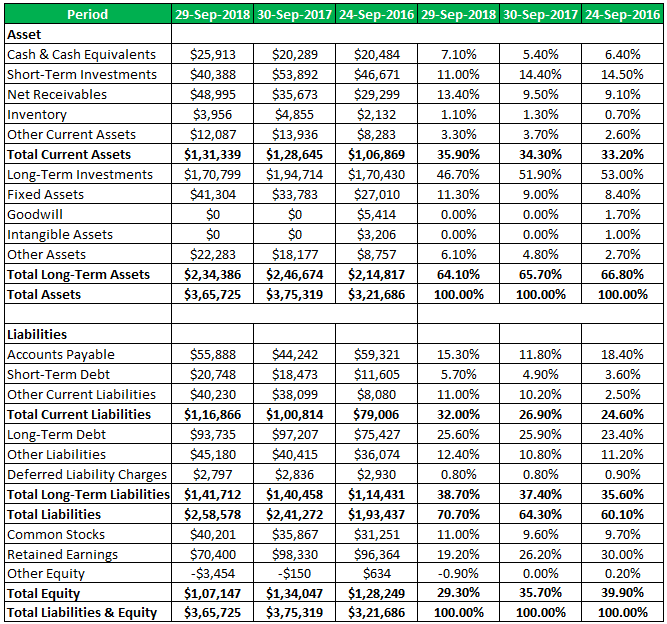

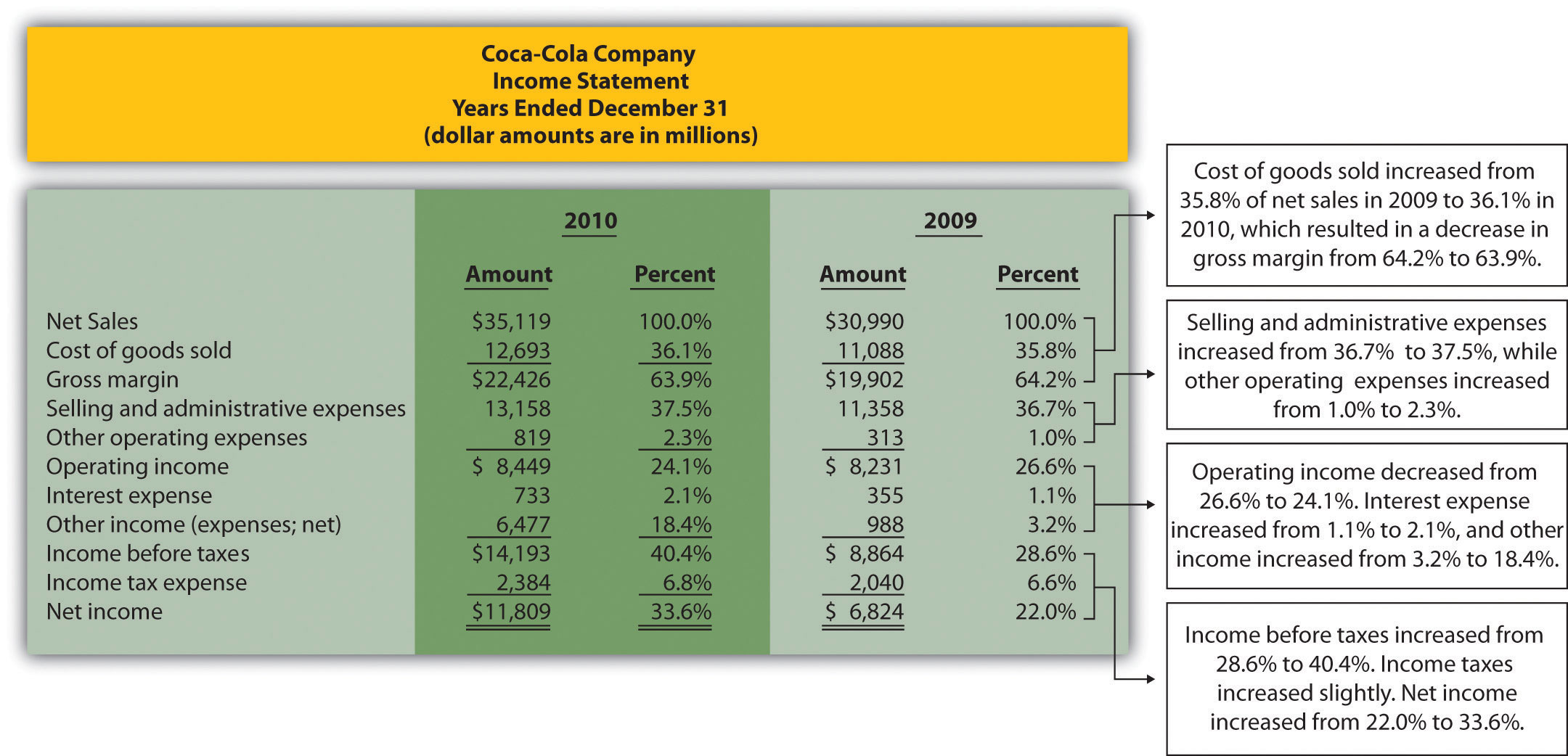

To common size an income statement, analysts divide each. Common size financial statements are a powerful tool that can help you understand and optimize your business. Thus, all the percentages shown can be easily.

Common size financial statement analysis involves converting the numbers in a financial statement into percentages relative to a common base. The most common bases used for common size financial statements are sales and total assets. A common size financial statement is a financial document where each item is expressed as a percentage relative to a reference figure, usually the total revenue.

Use industry comparisons to assess organizational performance. A common size financial statement displays items as a percentage of a common base figure, total sales revenue, for. While the average deal size increased 14.

September 23, 2023 what is a common size financial statement? A common size financial statement lists any entries as a percentage of a base figure. They aid in comparison, trend analysis , and benchmarking,.

Common size analysis displays each line item of your financial statement as a percentage of a base figure to help you determine how your company is performing year. Common size financial statements express line items as percentages of total revenue or total assets. This differs compared to traditional financial statements that would use.

:max_bytes(150000):strip_icc()/dotdash_Final_Common_Size_Income_Statement_Oct_2020-01-f6706faee5644055954e9e5675485a5e.jpg)

:max_bytes(150000):strip_icc()/CommonSizeIncomeStatement_v1-6d2a9c4def2449168cbd16525632bbd1.jpg)