One Of The Best Info About Direct Method And Indirect Of Cash Flow Statement

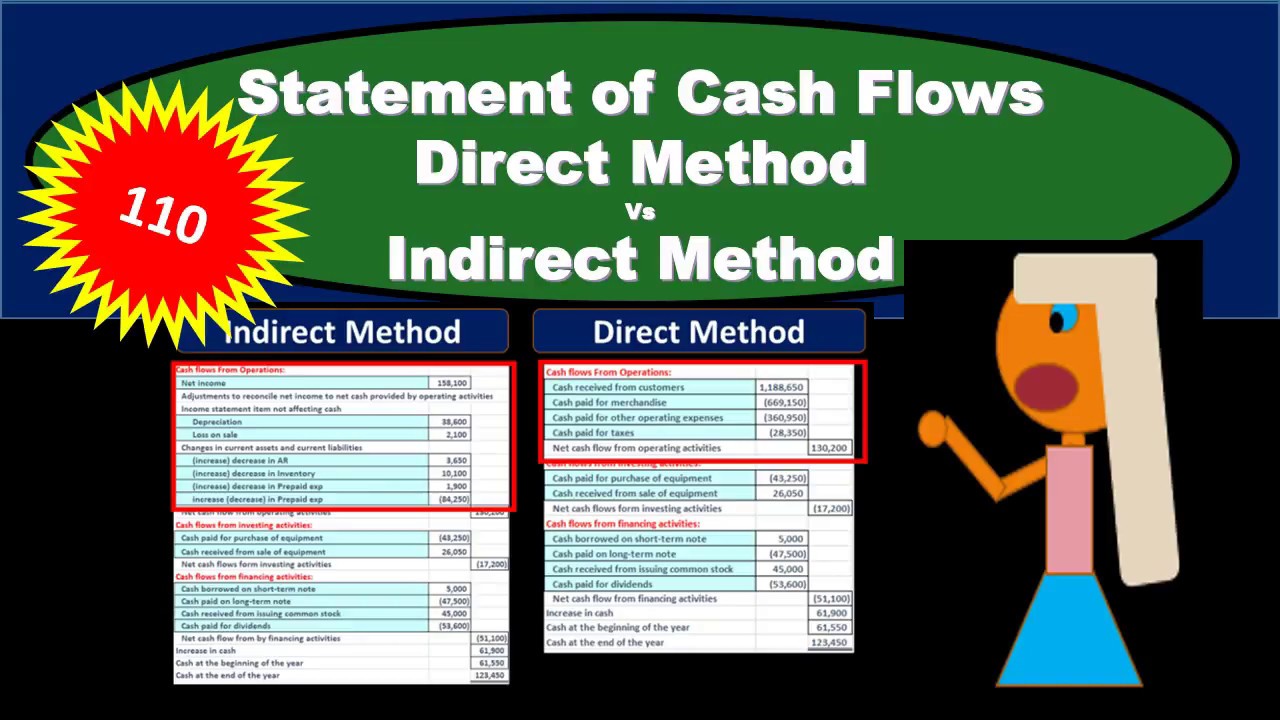

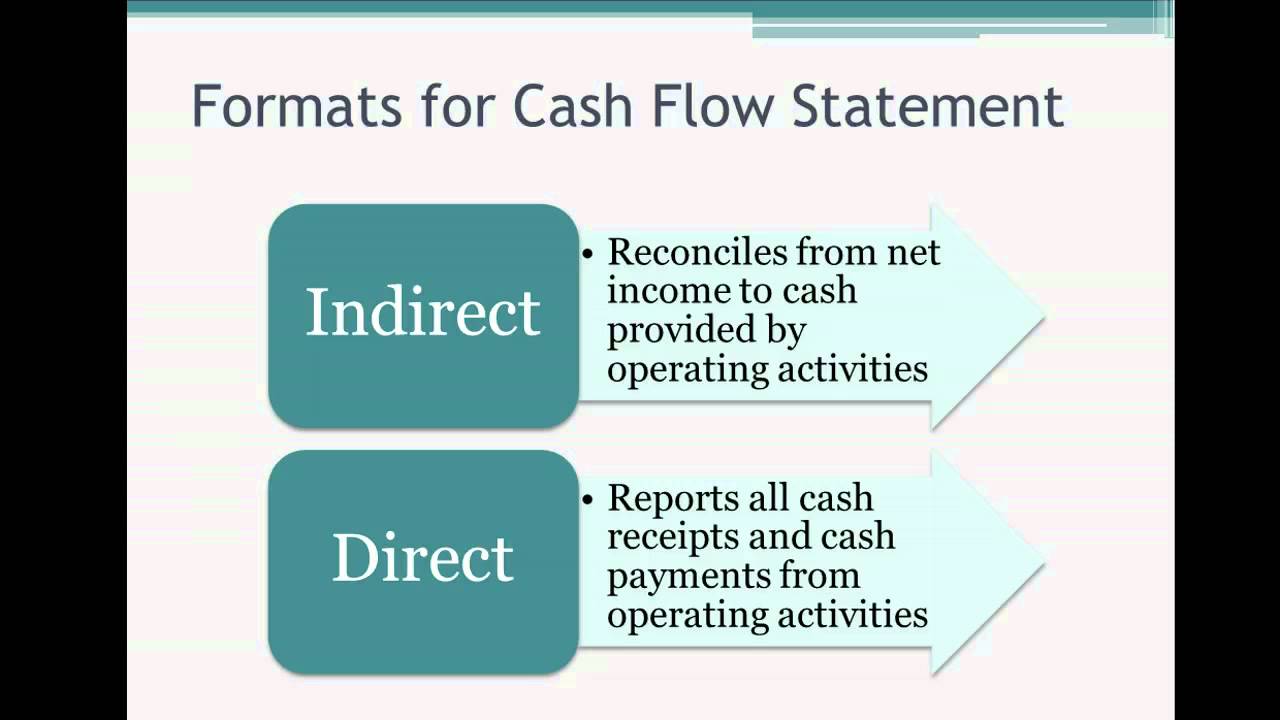

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement.

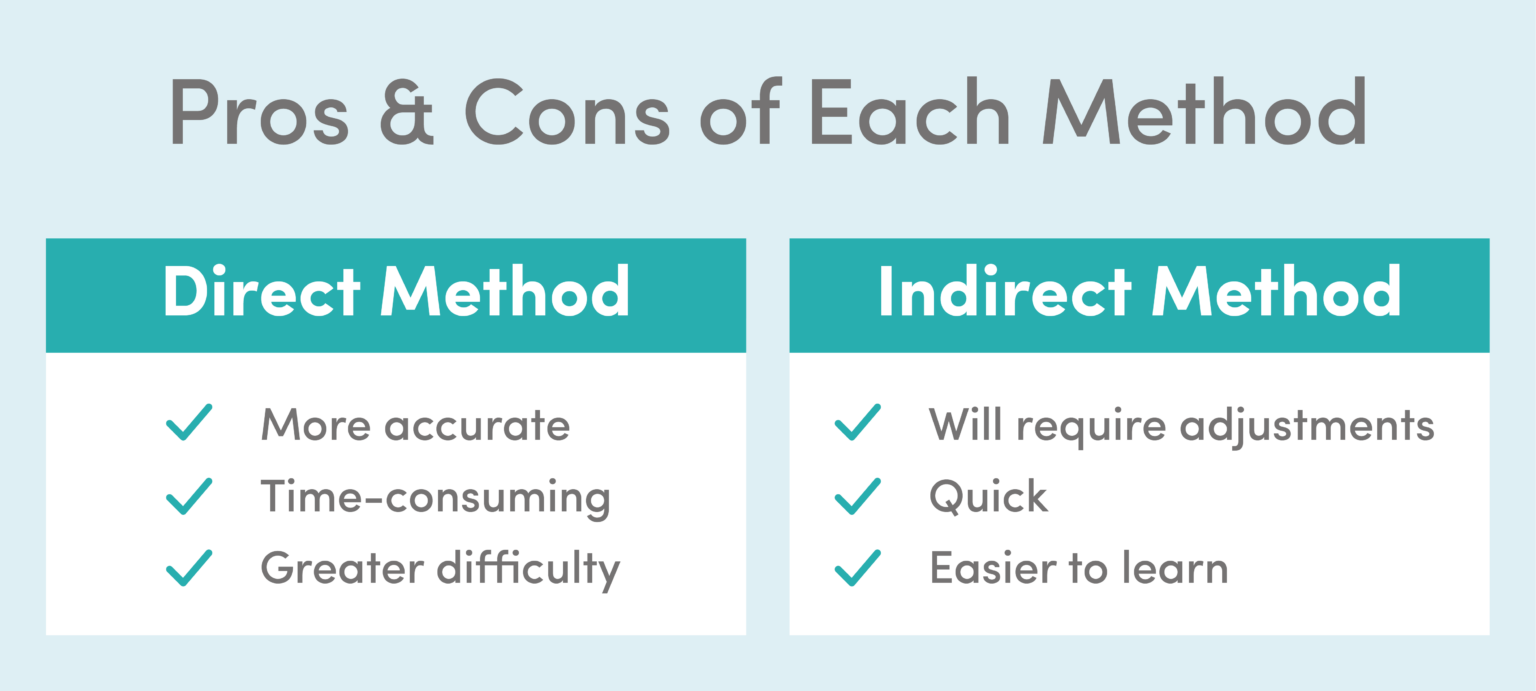

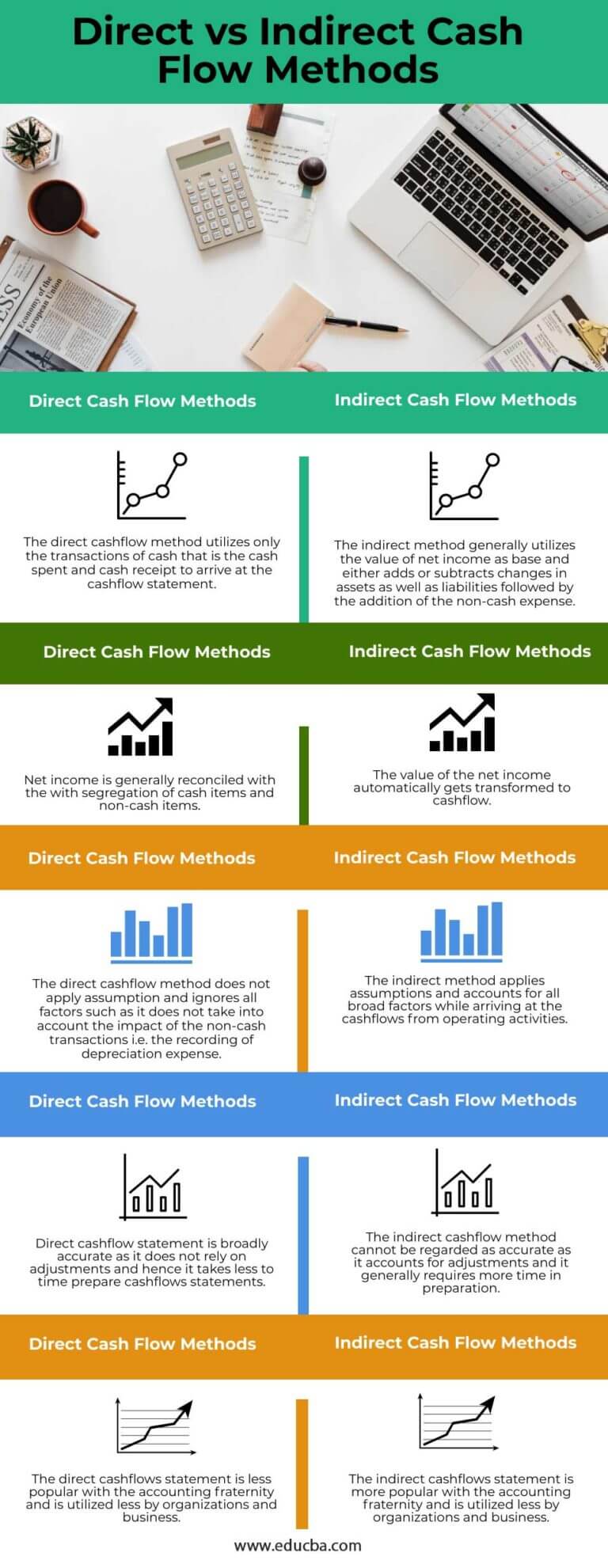

Direct method and indirect method of cash flow statement. The direct method, also known as the income statement method, is one of two methods utilized while crafting the cash flow statement—the other method being the indirect method, which we will examine later. One of the key differences between direct cash flow vs. The direct method converts each item on the income statement to a cash basis.

The direct method is one of two accounting treatments used to generate a cash flow statement. Further, ifrs requires a reconciliation between net income and cash flows from operating activities when direct method cash flow statement is prepared. You can gather this information from the company’s balance sheet and income statement.

A company can choose the direct method or the indirect method. Indirect cash flow the indirect method focuses on net income and may include cash that is not yet in the business. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows.

The cash flow statement using the indirect method would look like the following: Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Cash flows from operating activities:

Provision for bad debts on accounts receivable. It also requires a completely separate reconciliation that looks very similar to the indirect method to prove the operating activities section is accurate. Begin with net income from the income statement.

Highlights the statement of cash flows is prepared by following these steps: Direct method is the preferred approach, but most companies use the indirect method for preparing cash flow statement because it is easier to implement. The direct method lists all receipts and payments of cash from individual sources to compute operating cash flows.

Items that typically do so include: (there are no differences in the cash flows from investing activities and/or the cash flows from financing activities.) The statement of cash flows direct method uses actual cash inflows and outflows from.

Cash collected from customers interest and dividends received cash paid to employees cash paid to suppliers interest paid income taxes paid In this method, you begin with the net income and adjust it to calculate the company’s operating cash flow. Indirect cash flow method is the type of transactions used to produce a cash flow statement.

The cash flow statement indirect method is one way to present a company’s total cash flow. When using the direct method to calculate cash flow from operating, investing and financing activities, your statement may look something like this: Add back noncash expenses, such as depreciation, amortization, and depletion.

Though the financial accounting standards board generally prefers the direct method statement of cash flow, both the direct and indirect methods of cash flow are in line with generally accepted accounting principles (gaap). For instance, assume that sales are stated at $100,000 on an accrual basis. The indirect method is one of two accounting treatments used to generate a cash flow statement.