Spectacular Info About Format Of Profit And Loss Account Balance Sheet

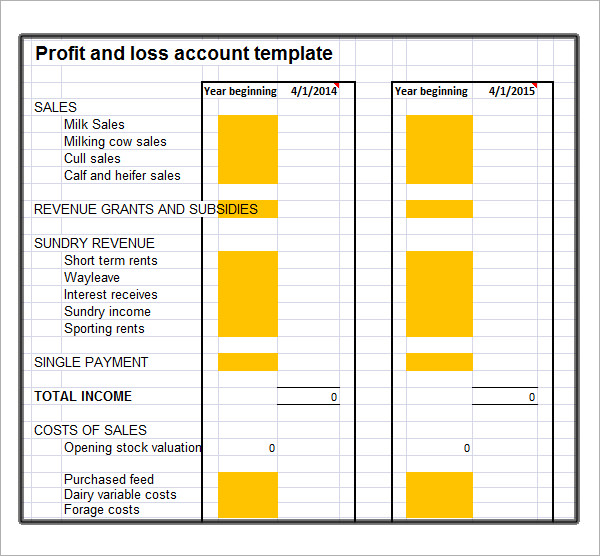

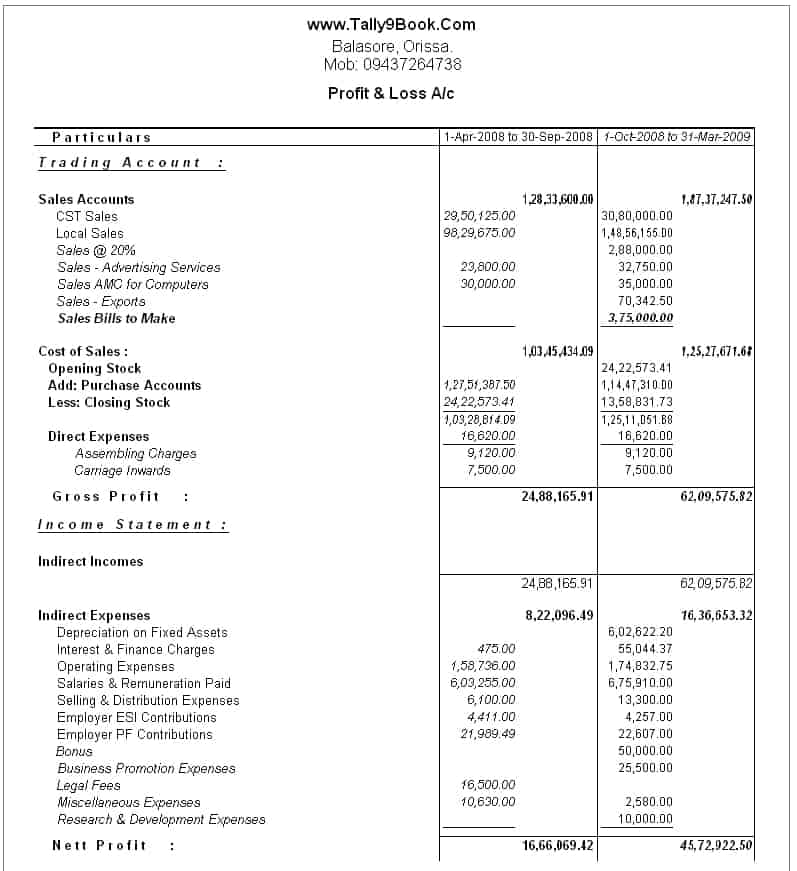

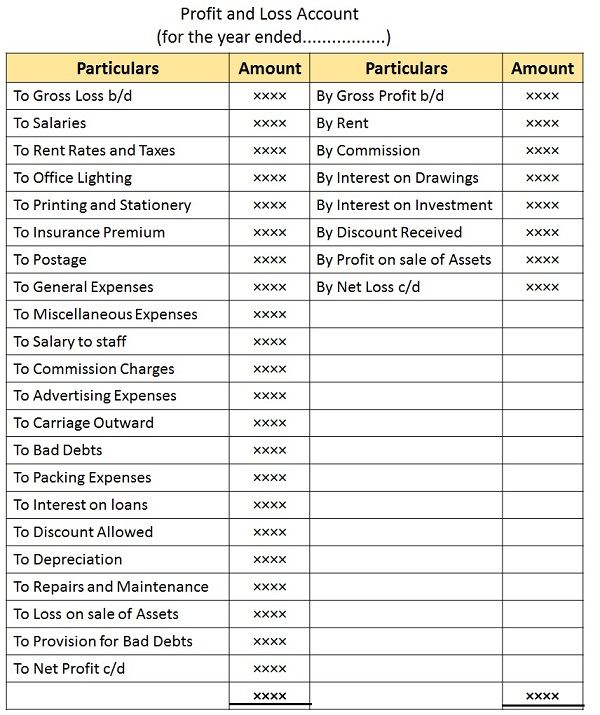

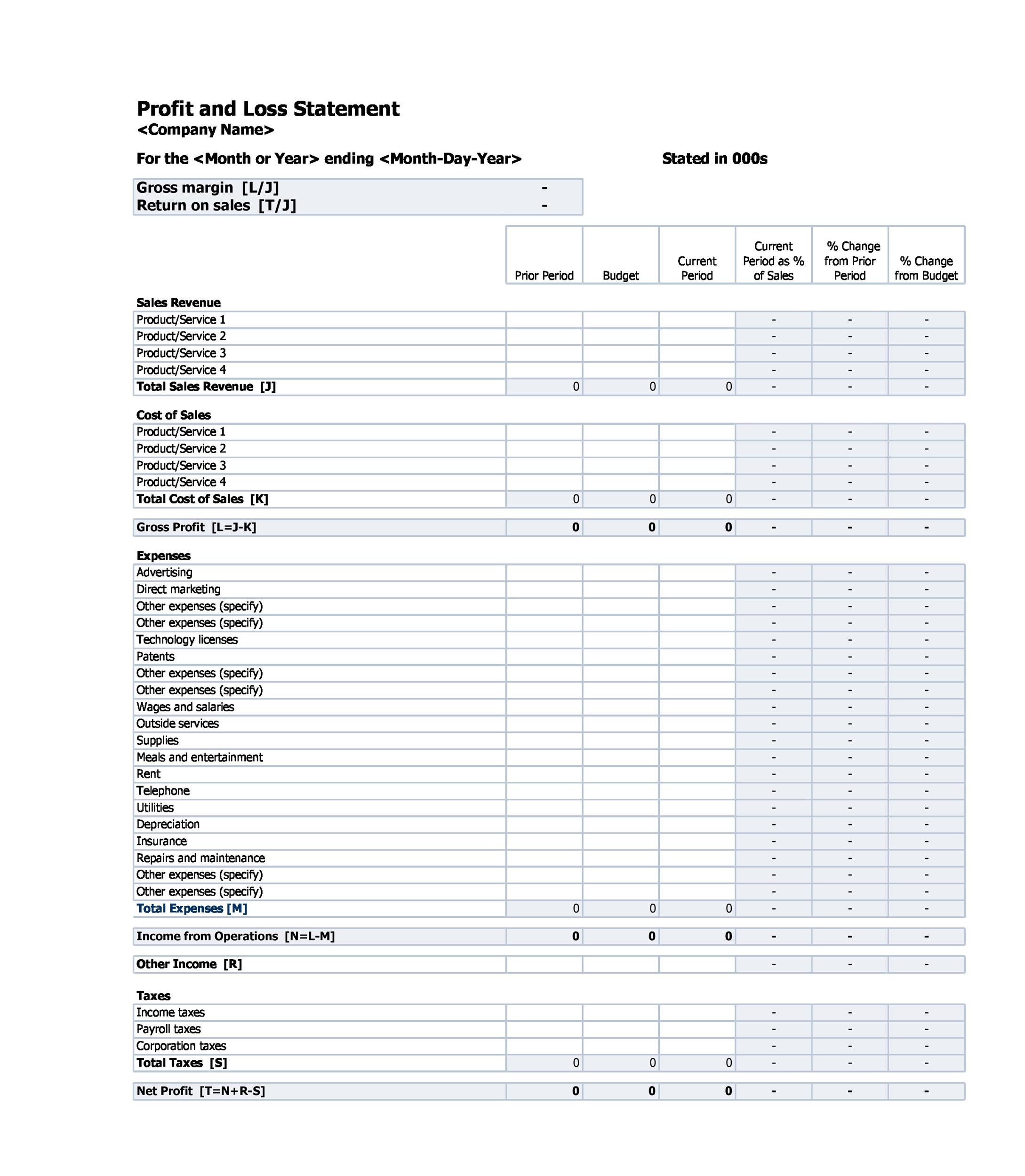

Let us take you through different formats of the profit & loss account:

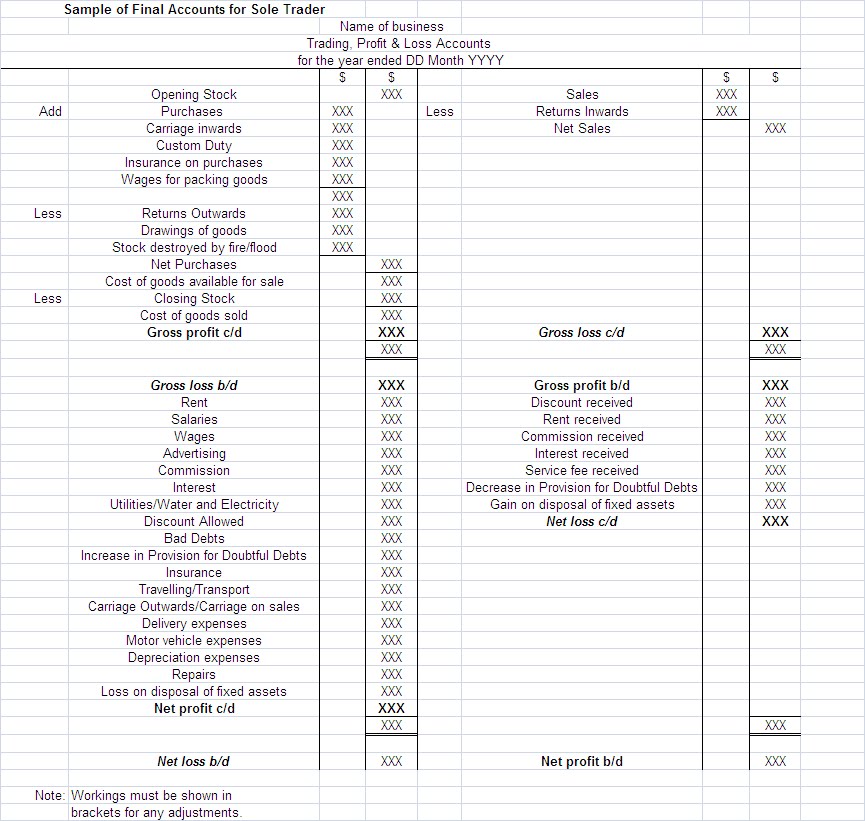

Format of profit and loss account and balance sheet. A balance sheet is prepared on the last day of a financial year while the profit and loss account is maintained for the whole accounting period. Record the above transactions in the respective ledger accounts and extract the balances thereof as at 20th/2/2018. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report.

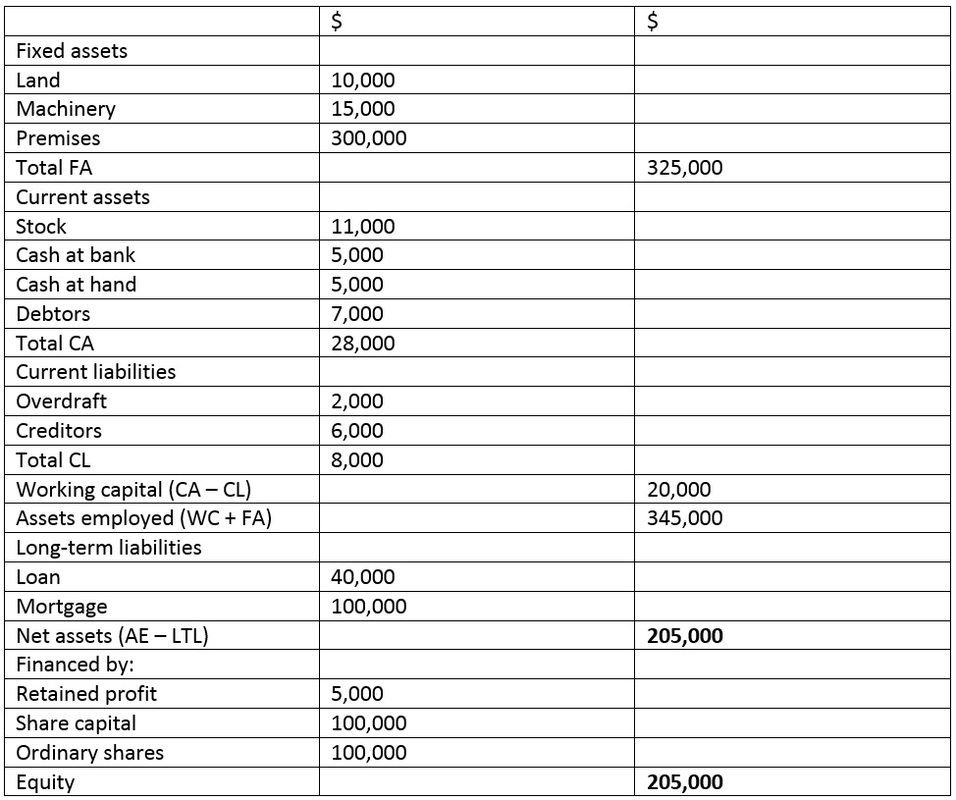

It is a statement which shows the. If the revenues of an organization are more than its expenses, it is known as net profit. Preparing trading and profit and loss and balance sheet preparing a trading account is the first stage in of final accounts of a trading concern.

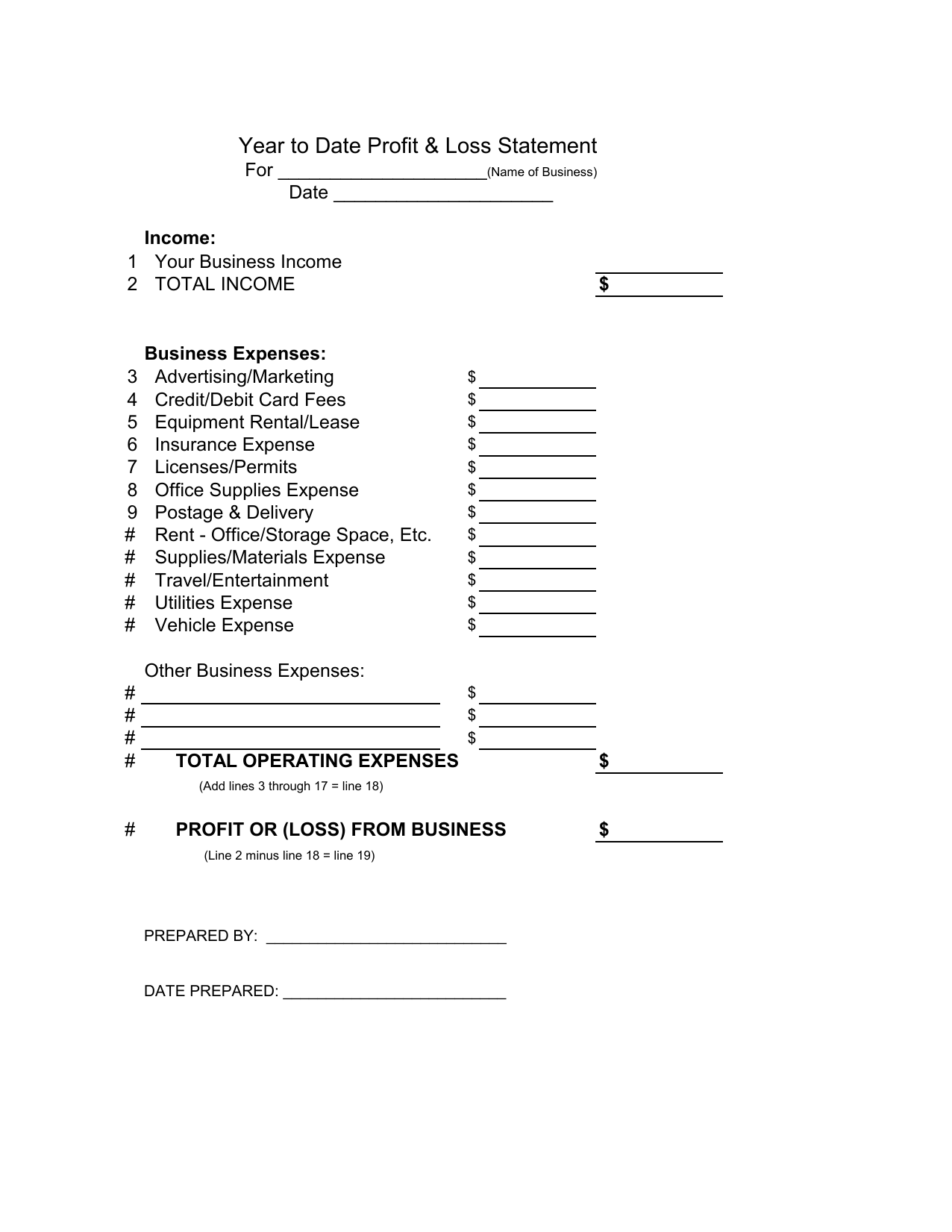

Different formats of the profit & loss account. In this article, we will see types of profit and loss account and profit and loss account format. In order to prepare the profit and loss account and the balance sheet, a business.

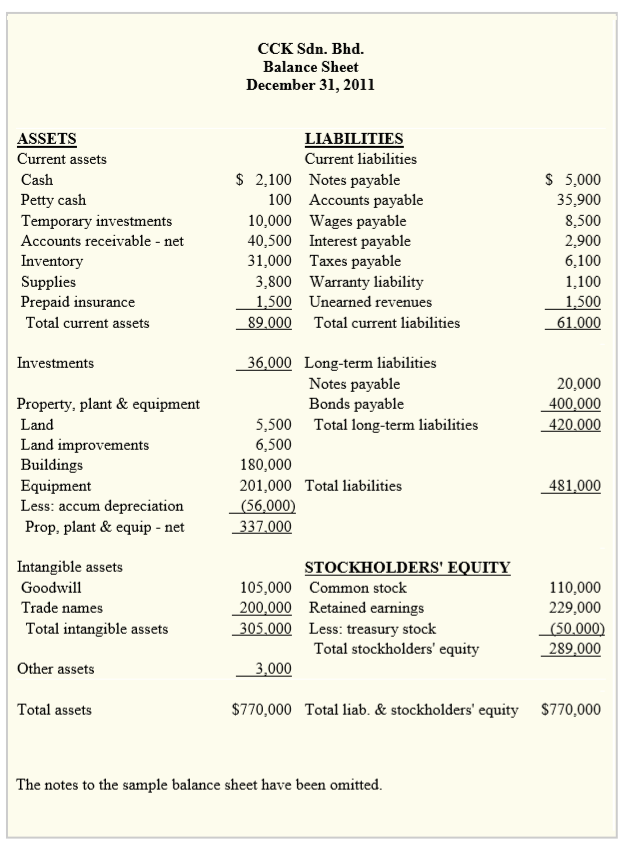

Written by tim vipond what is the profit and loss statement (p&l)? Profit and loss account/statement types of profit and loss. Trading and profit and loss account and balance sheet a balance sheet is the last drawn financial statement which reports a company's assets, liabilities, and the.

James leckie | last updated: A profit and loss (p&l) statement summarizes the revenues, costs and expenses incurred during a specific period of time. The p&l account is a component of final accounts.

Format for sole traders & partnership. Download, open, and save the excel template download and open the free small business profit and loss statement template for excel. Key differences difference between balance sheet and profit & loss account a balance sheet, or otherwise known as a position statement.

June 11, 2021 you may have heard your accountant or bank manager talk about your “balance sheet” and “profit and loss. However, if the revenues of an organization are less than its expenses, it is. A profit and loss account is prepared to determine the net income (performance result) of an enterprise.

The basic formula for a profit and loss statement is: Those making net trading profits, incurred between 15% to 50% of such profits as transaction cost. A p&l statement provides information.

A profit and loss (p&l) account shows the annual net profit or net loss of a business. A profit and loss statemen t is a financial document that details your business’s revenue, expenses, and net income over a month, quarter, or year. It is prepared to determine the net profit or net loss of a trader.

Profit and loss account trading account is the first part of this account, and it is used to determine the gross profit that is earned by the business. Profit and loss statement vs balance sheet there are several formatting differences that you will notice when comparing your balance sheet. It determines the gross profit or.

![Balance Sheet vs. Profit and Loss Account [2024]](https://res.cloudinary.com/goforma/image/upload/v1585669485/small business accounting/profit-and-loss-example_simgmu.jpg)