Real Info About Consolidated Statement Of Profit And Loss

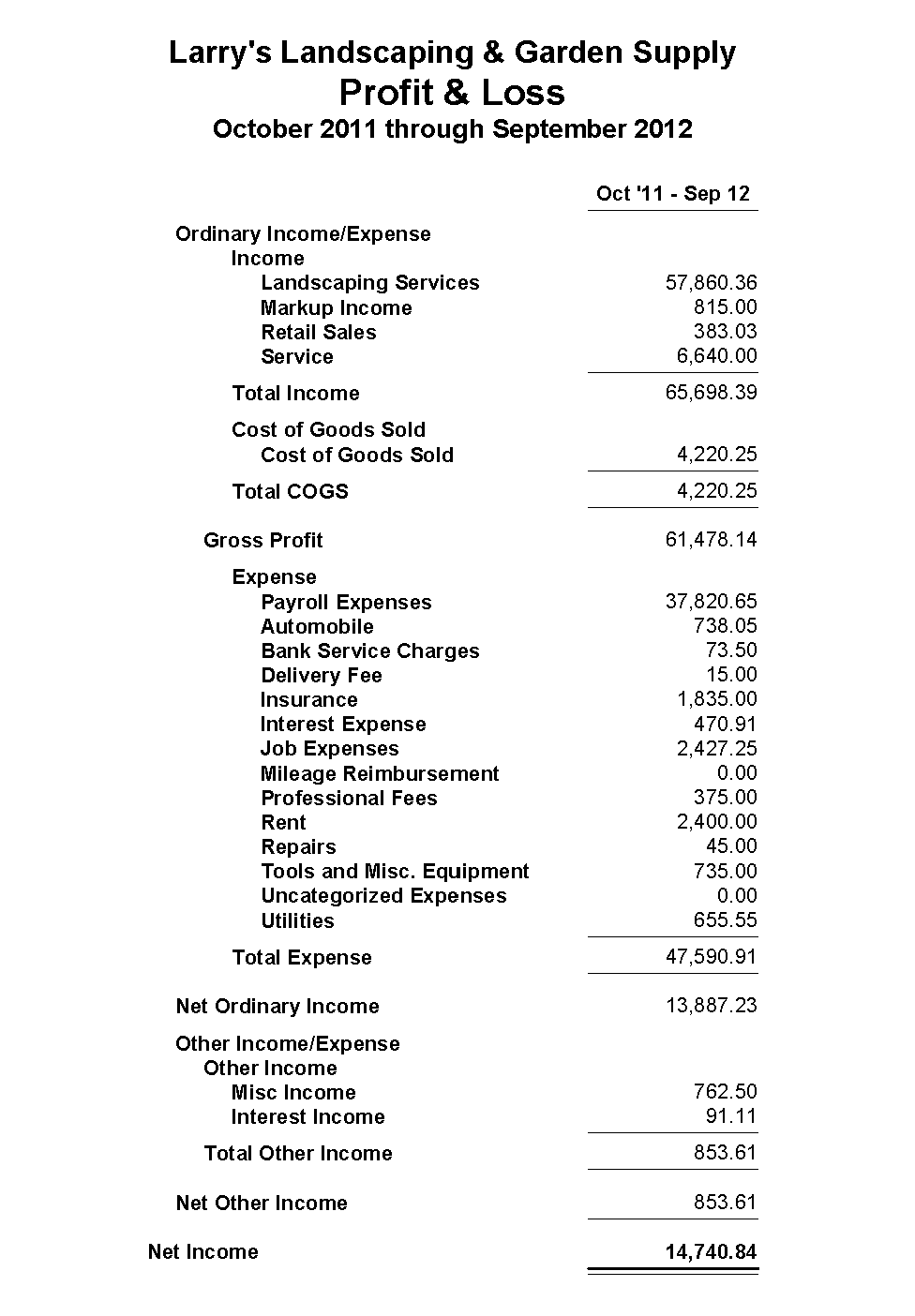

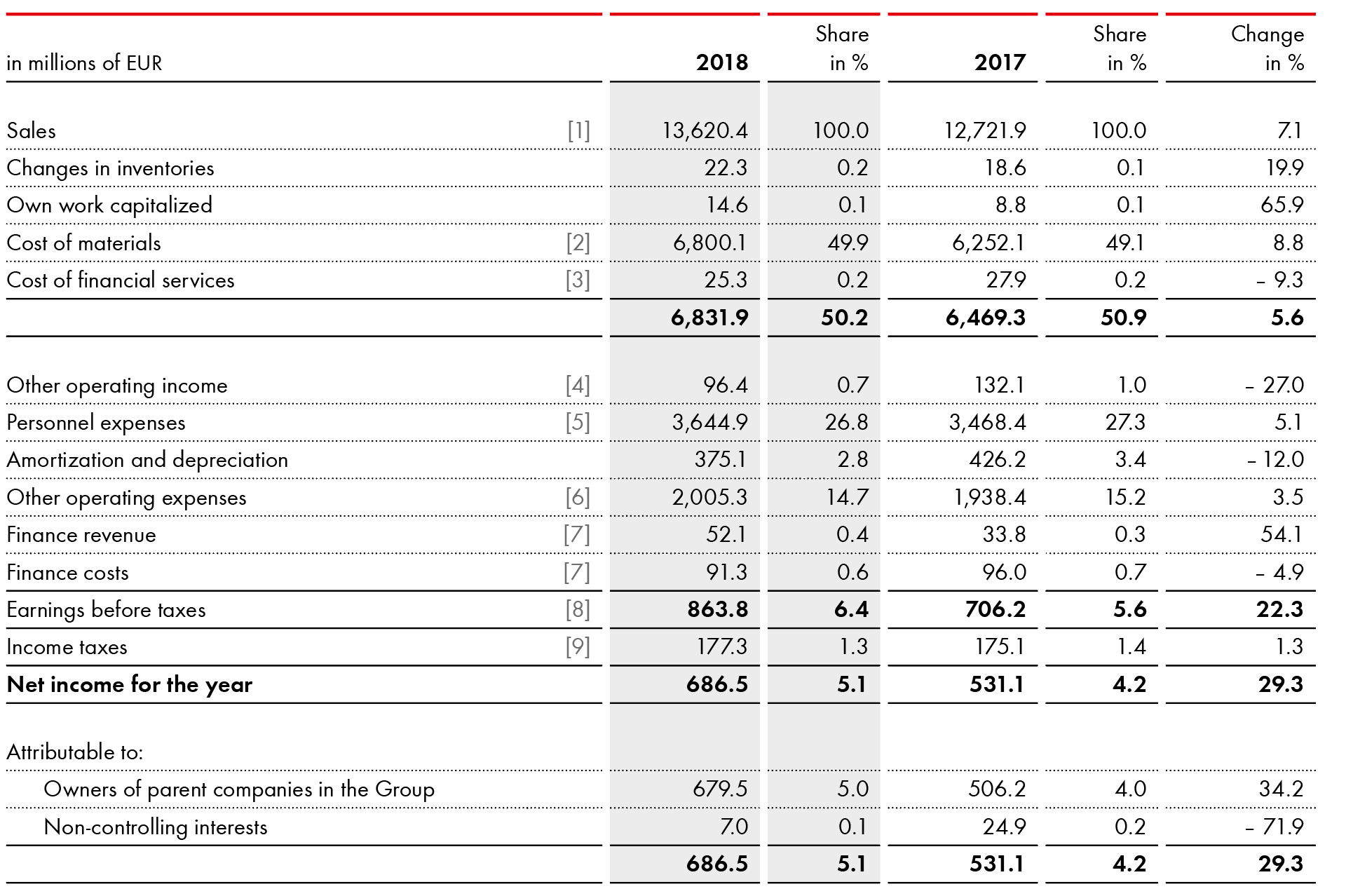

The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

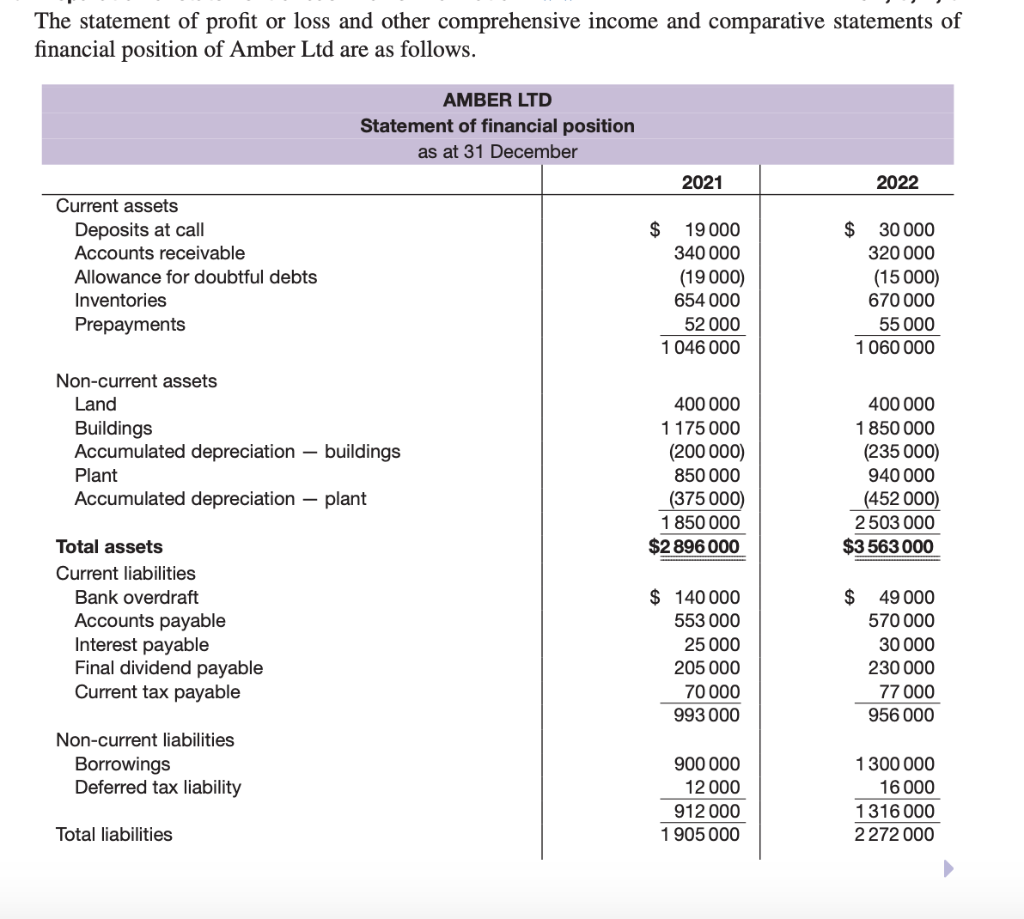

Consolidated statement of profit and loss. The consolidated income statement follows these basic principles: 1/4 of such goods was still in stock at the end of the year. In case there is a loss, the consolidated profit and loss account will be credited and capital reserve or goodwill debited.

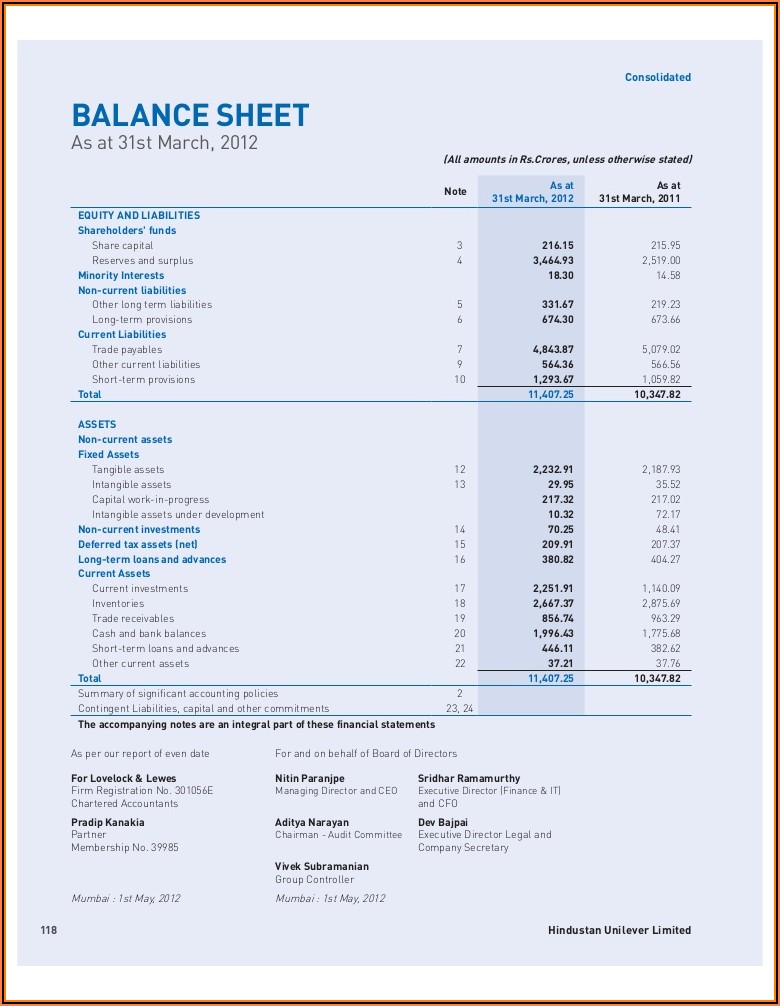

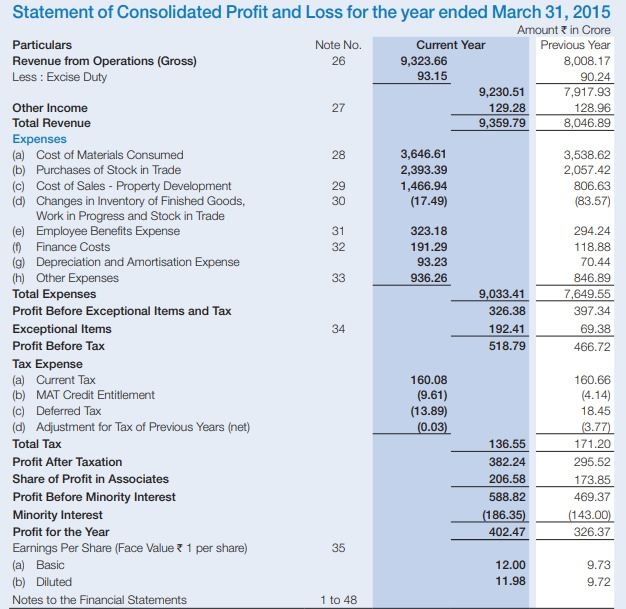

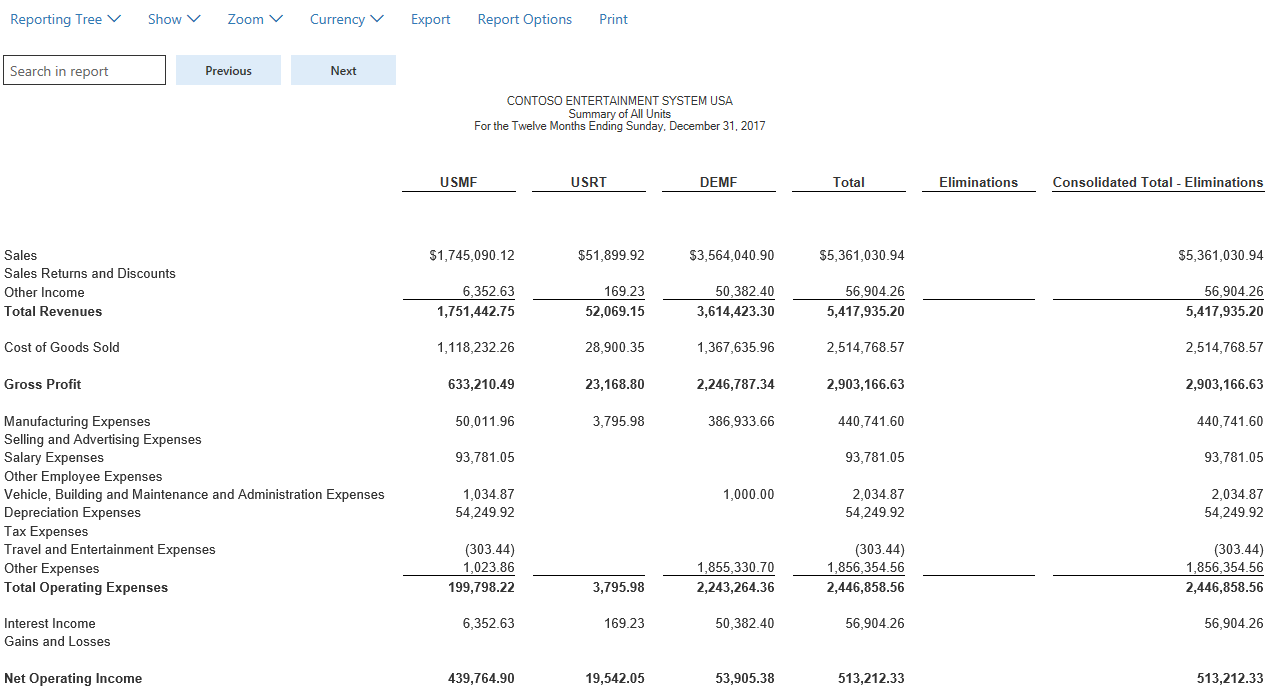

Consolidated statement of profit and loss (` in crores) notes year ended march 31, 2020 year ended march 31, 2019 i. A key functionality in this type of report displays subsidiaries or divisions along with intercompany eliminations in the columns. A profit and loss statement (p&l), or income statement or statement of operations, is a financial report that provides a summary of a company’s revenues, expenses, and profits/losses over a given period of time.

(1) add together the revenues and expenses of the parent and the subsidiary. Companies often use the word consolidated loosely in financial statement. The steps for consolidating the income statements are as follows:

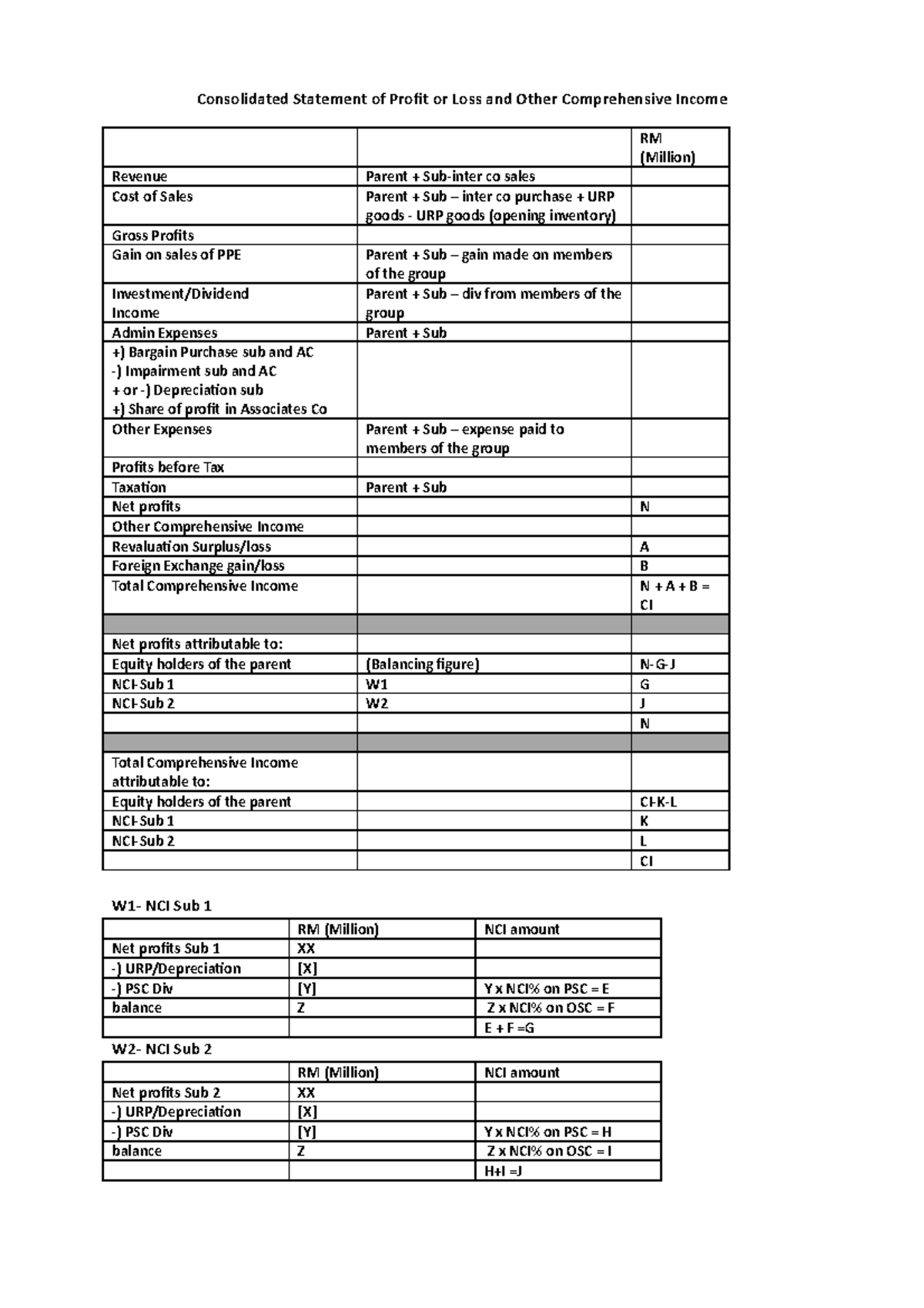

(i) consolidated profit and loss account is prepared in a columnar form. Measured at fair value through profit or loss. Prepare the consolidated profit and loss statement for the year ended on 31st december, 2013.

(ii) revenue incomes and revenue expenditures of holding company and subsidiary companies are recorded. Gross profit determines how well a company can earn a profit while. W4 nci opening balance (w3)

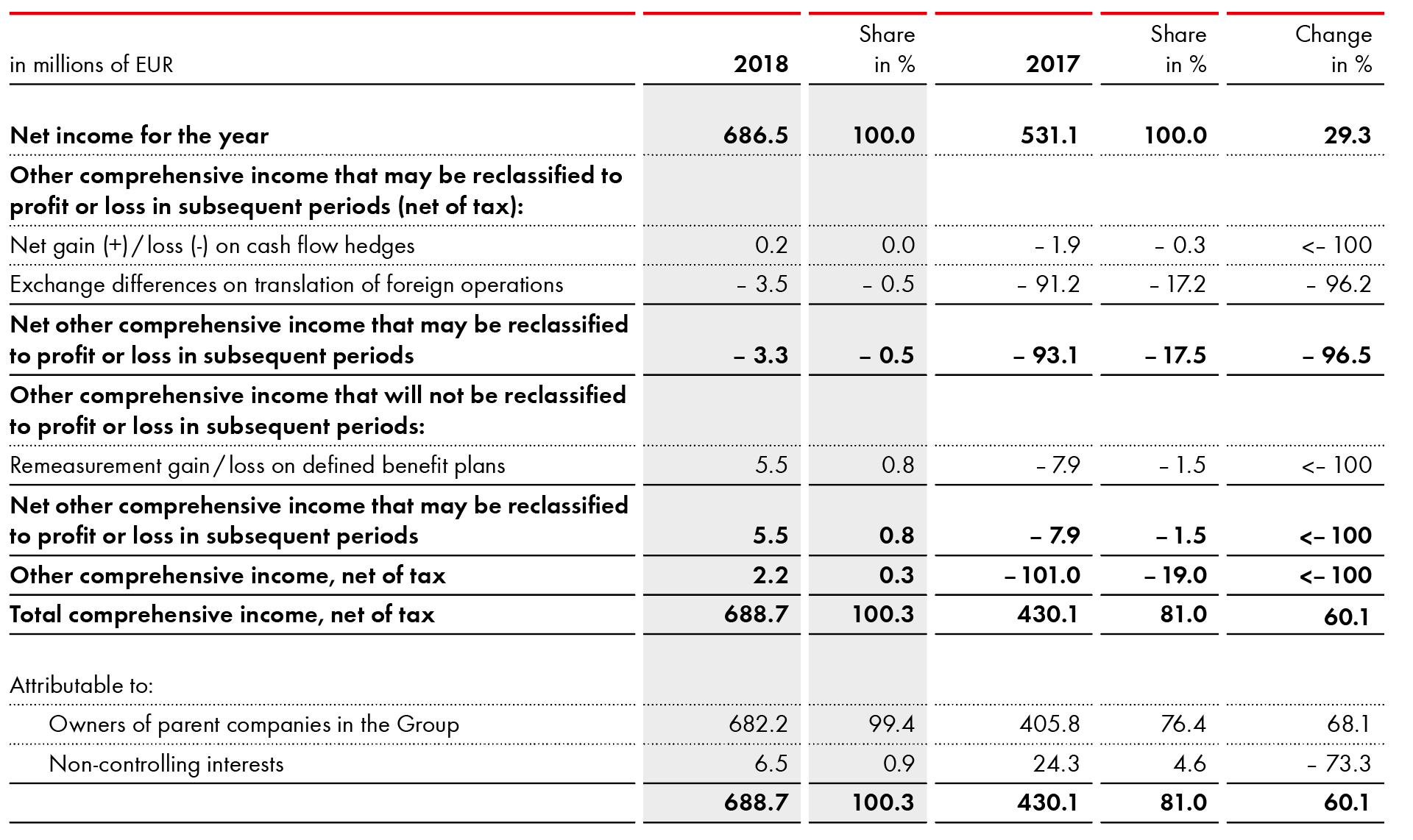

In terms of our report attached for s r b c & co llp chartered accountants firm registration number: Consolidated statement of profit or loss and other comprehensive income for the year ended 31 december 20xx continued illustrating the presentation in one statement by function continued Financial statements, including consolidated financial statements, must report the substance of transactions and arrangements.

We also go through a thorough example where we complete a. Sales rose 19.53% to rs 14.87 crore in the quarter ended december 2023 as against rs 12.44 crore during the previous quarter ended december. Revenue from operations 33 (a) revenue 2,58,594.36 2,99,190.59 (b) other operating revenues 2,473.61 2,747.81 total revenue from operations 2,61,067.97 3,01,938.40 ii.

After acquiring control over s ltd., h ltd. Supplied to it goods at cost plus 20%, the total invoice value of such goods being ` 60,000; Nci is part of equity (the ownership) of the group and so the opening balance at the date of acquisition will increase with its share of any profits and decrease with any share of losses.

On each side there is one column for each company, one column for adjustments and one for total. This is so even if that subsidiary is measured at fair value through profit or loss by the higher level In this lesson, we explain what consolidations are and the steps to follow in completing a consolidated statement of profit or loss.

If the subsidiary is acquired part way through the year all the revenues and expenses of the subsidiary must be time apportioned during the consolidation process. In the consolidated statement of profit or loss, any dividend income received from the associate is replaced by bringing in one line that shows the parent’s share of the associate’s profit. This is presented as ‘share of profits of associate’ as a new heading immediately before the consolidated profit before tax.

:max_bytes(150000):strip_icc()/Consolidatedfinancialstatement_final-1a46c53d5f0d4eca864b30adfe22b048.png)