Real Info About Explain A Balance Sheet

The cash flow statement shows cash movements from operating, investing, and financing activities.

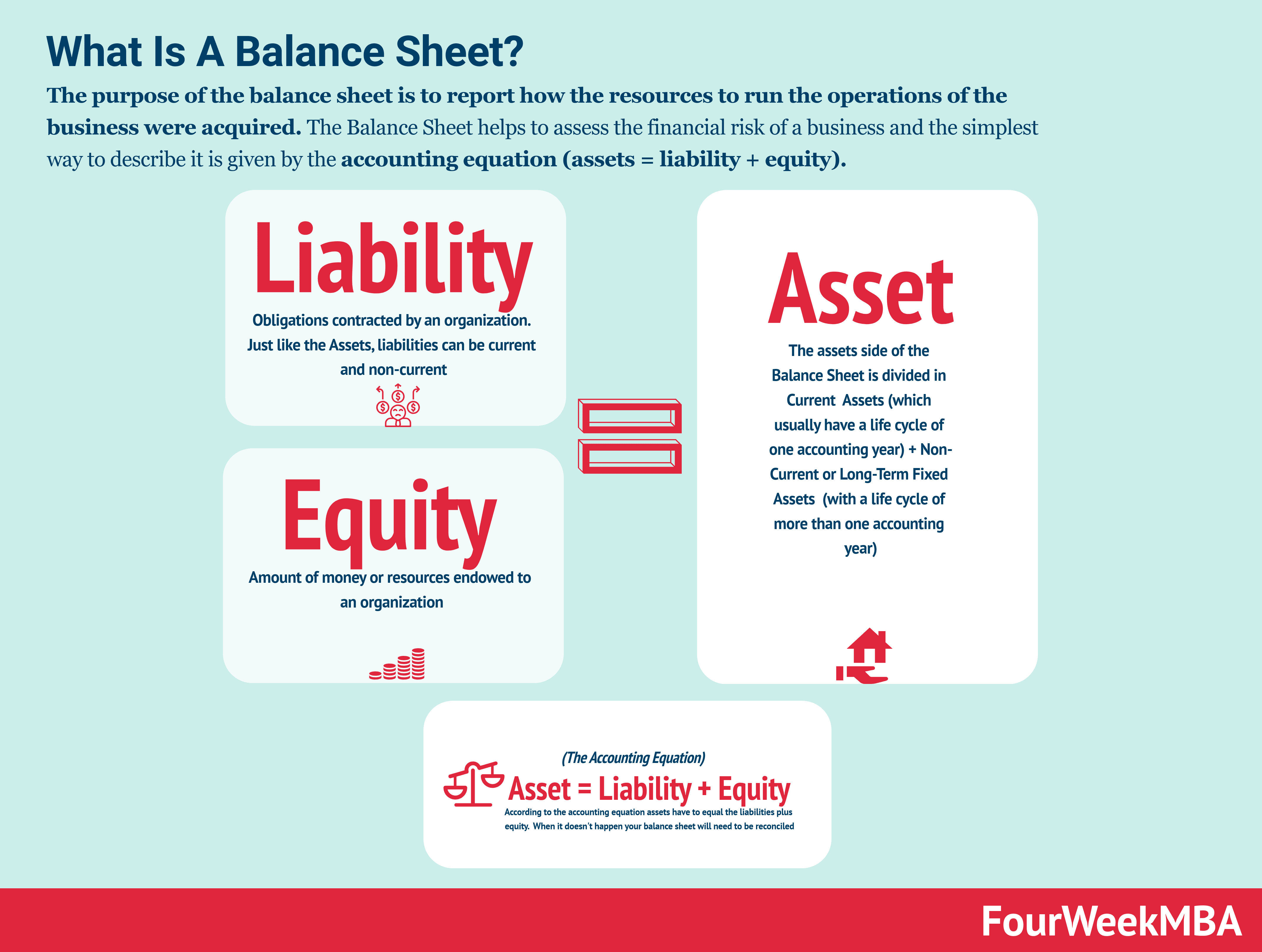

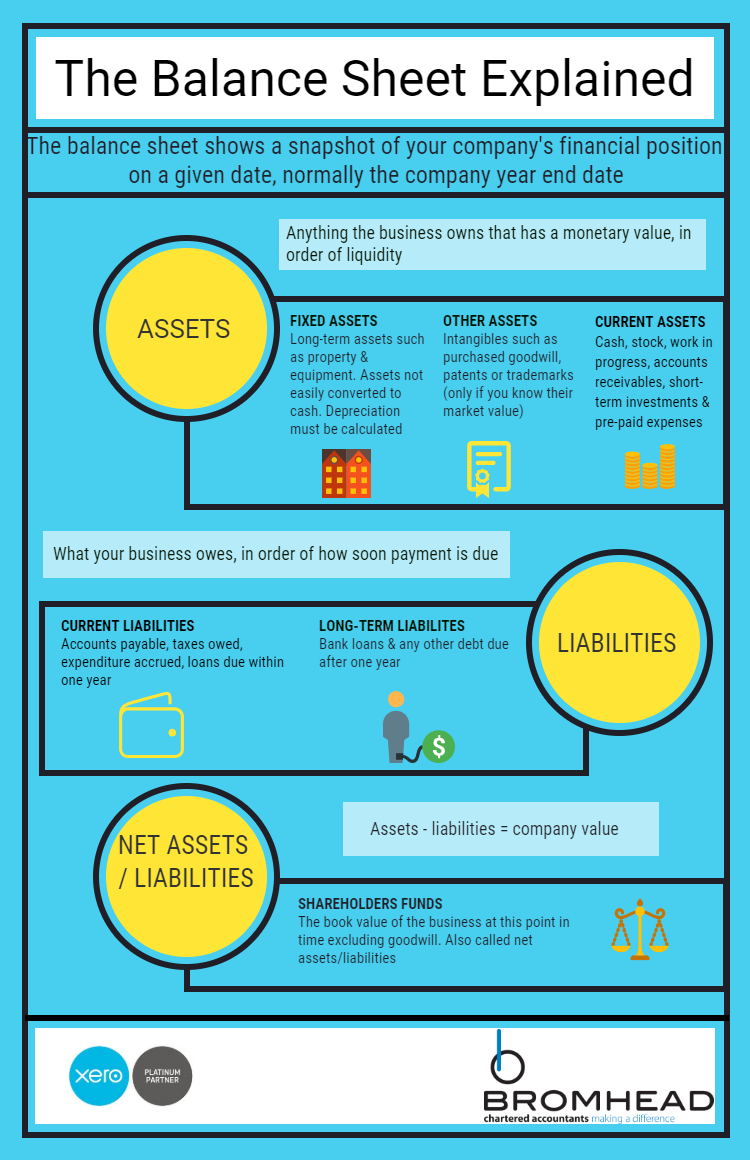

Explain a balance sheet. Determine the reporting date and period. A balance sheet, at its core, shows the liquidity and the theoretical value of the business. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business's calendar year.

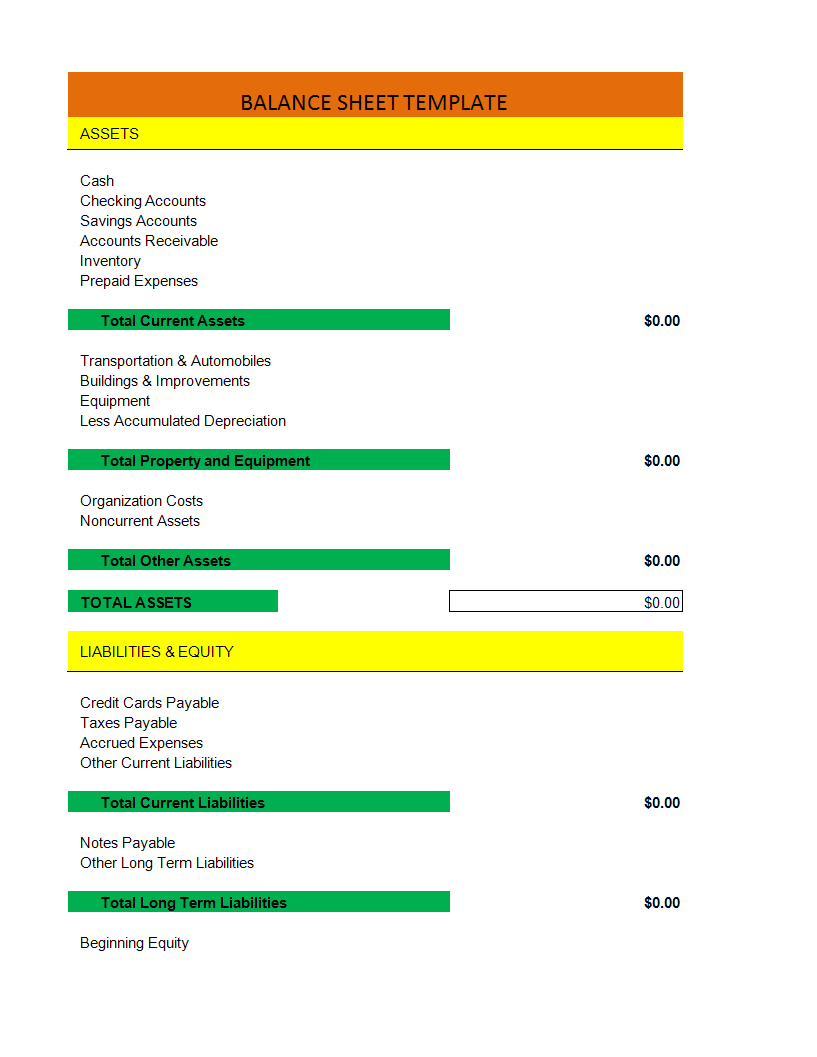

The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a period of time. The balance sheet is split into two columns, with each column balancing out the other to net to. A balance sheet provides a summary of a business at a given point in time.

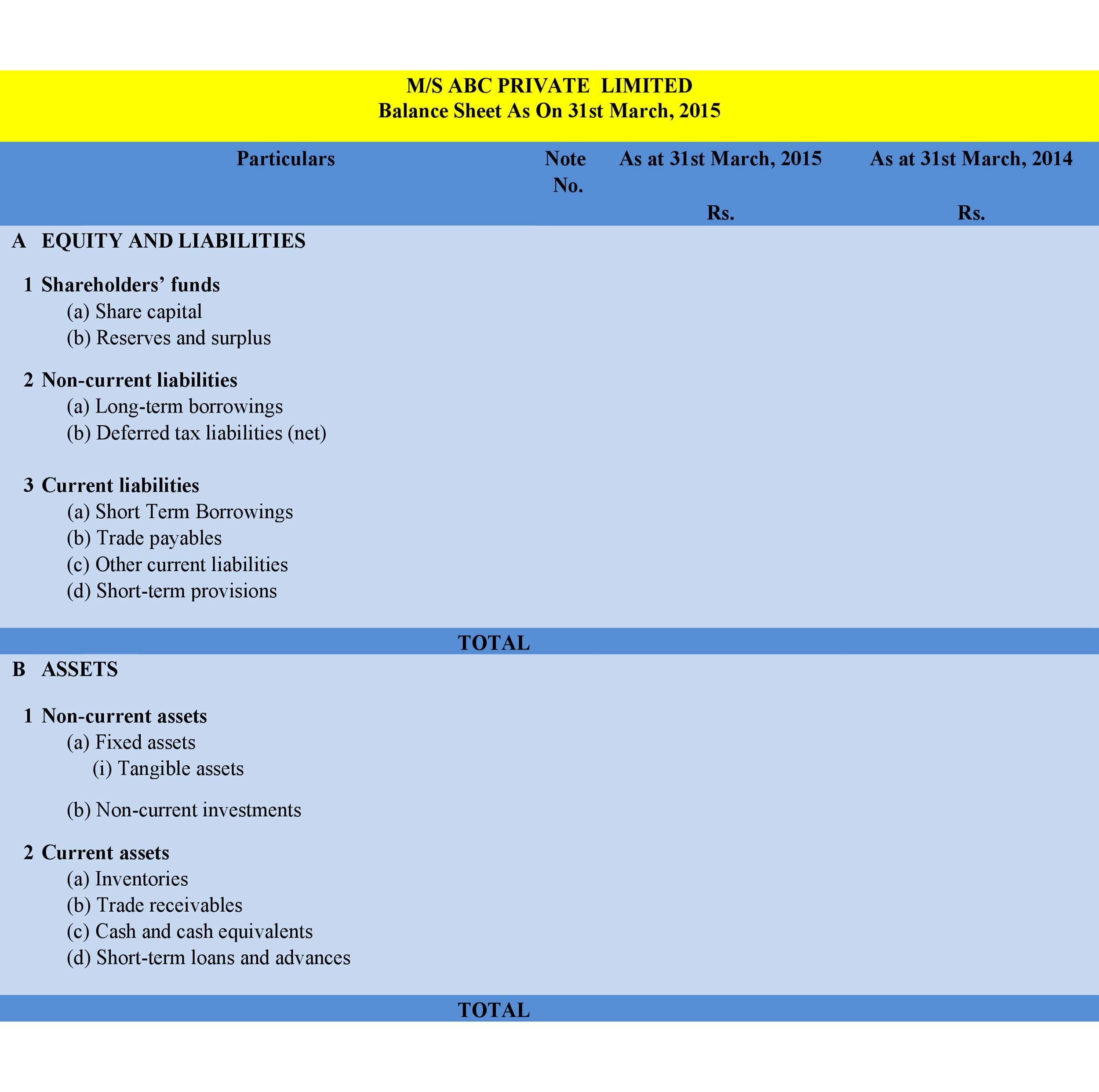

The main purpose of preparing a balance sheet is to disclose the financial position of a business enterprise at a given date. A balance sheet is a financial statement that contains details of a company’s assets or liabilities at a specific point in time. It’s usually thought of as the second most important financial statement.

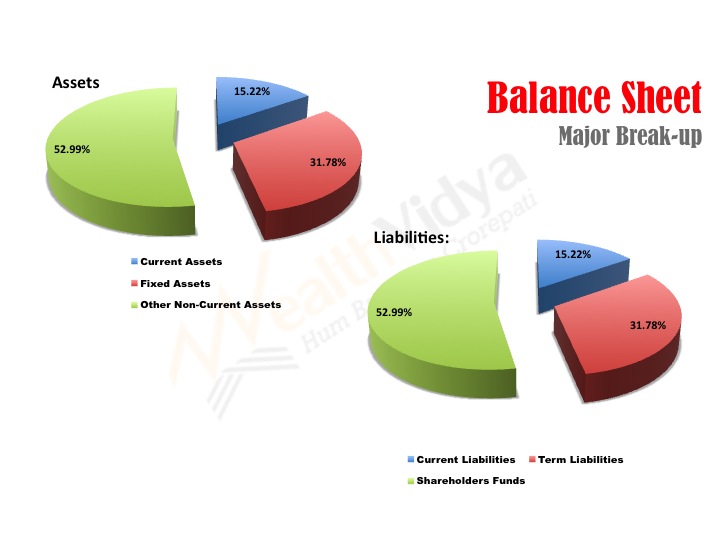

Balance sheet is part of any financial statement which provides a snapshot of entity’s financial condition on a given date. It is one of the three core financial statements ( income statement and cash flow statement being the other two) used for evaluating the performance of a business. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity.

A balance sheet lists a company’s assets, liabilities, and owner’s equity at a specific point in time. The balance sheet, also known as the statement of financial position, is one of the three key financial statements. Read on to know about the balance sheet in simple.

A balance sheet is meant to depict the total assets, liabilities, and shareholders’ equity of a company on a specific date, typically referred to as the reporting date. These three core statements are intricately linked to each other and this guide will explain how they all fit together. Property, plant, and equipment (also known as pp&e) capture the company’s tangible fixed assets.

It records a company's assets, shareholders' and liabilities equity at a particular point of time. It summarizes a company’s financial position at a point in time. What is a balance sheet?

The balance sheet is one of the three core financial statements that are used to evaluate a business. A balance sheet is a statement of the assets, liabilities, and shareholders’ (or owners’) equity of a business at a particular point in time. Measuring a company’s net worth, a balance sheet shows what a company owns and how these assets are financed, either through debt or equity.

Key takeaways a balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity. The balance sheet shows a company’s assets, liabilities, and shareholders’ equity at a particular point in time. Balance sheet (also known as the statement of financial position) is a financial statement that shows the assets, liabilities and owner’s equity of a business at a particular date.

These offer an inside look at a company. [1] it is the summary of each and every financial statement of an organization. What is a balance sheet?

/investing-lesson-3-analyzing-a-balance-sheet-357264_FINAL-ff829eab9bf045c981c883c323bc0ca6.png)