Nice Info About Financial Ratios Liquidity Solvency And Profitability

The last category of financial measurement examines.

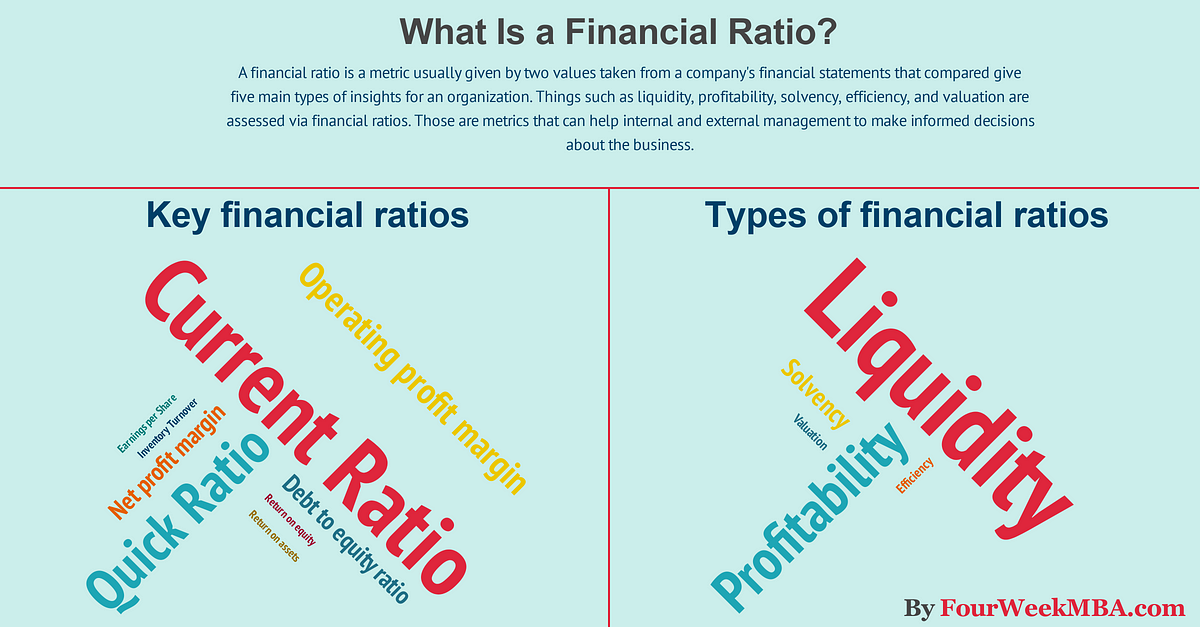

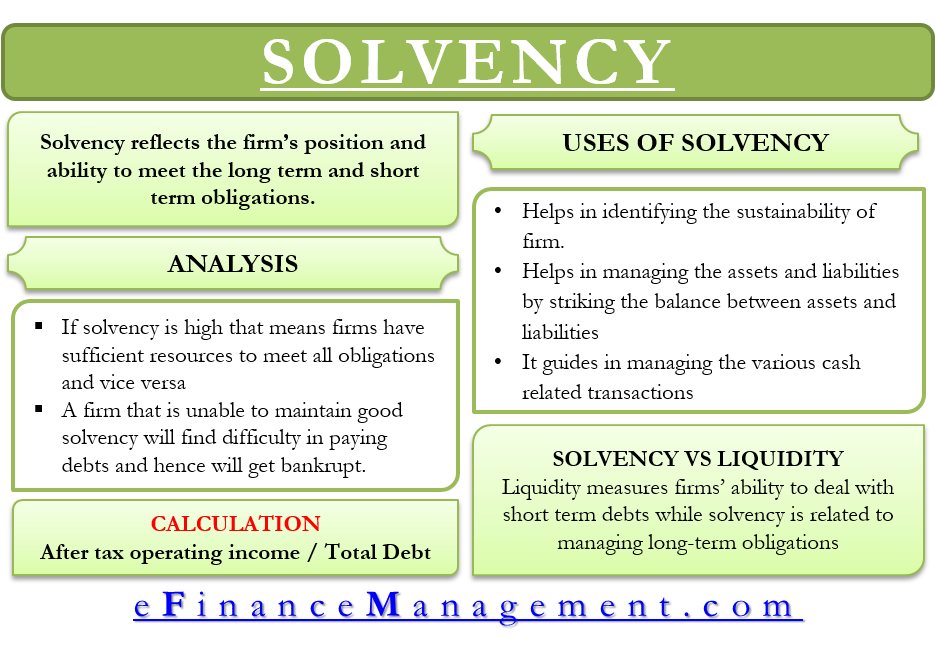

Financial ratios liquidity solvency and profitability. Liquidity is the firm's ability to pay off short term debts, and solvency is the ability to pay off long term debts. Financial ratios are used by businesses and analysts to determine how a company is financed. Liquidity, solvency and profitability ratios have no significant.

This study examines the performance of dialog axiata plc and sri lanka telecom plc by employing both cash flow ratios and traditional financial ratios over the past five years. A variety of categories may be used to classify financial ratios. The correct answer is b.

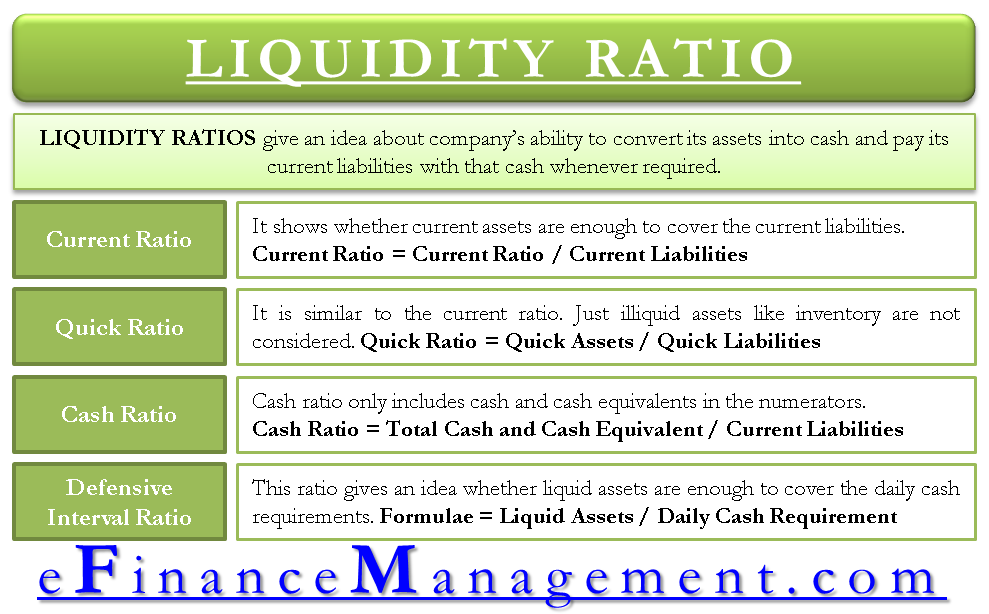

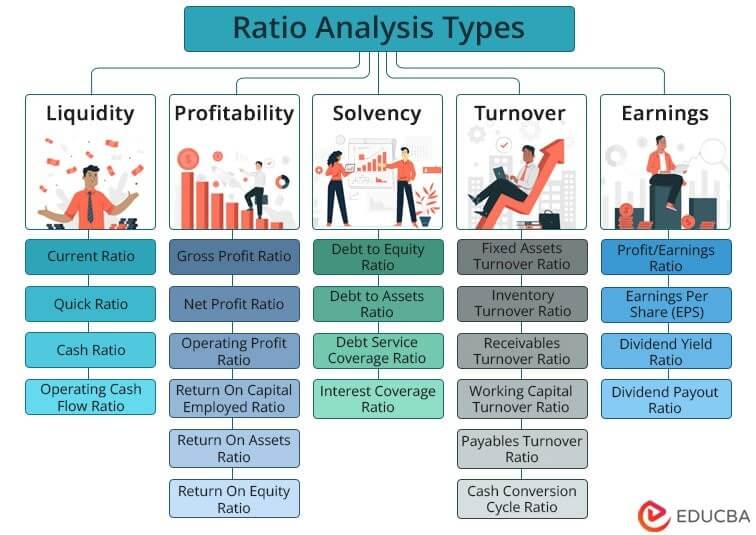

In general, there are four categories of ratio analysis: Common liquidity ratios include the following: Both solvency and liquidity are important for financial health but focus on different time frames.

Financial ratios help to analyse the financial performance of all the activities of an organisation and all its products and services in all markets. Note that while there are more ideal outcomes for some ratios, the industry in which the business operates can change the influence each of these outcomes has over stakeholder decisions. 38 3.8k views 3 years ago financial statement analysis learn how to use financial ratio analysis for financial statement analysis!

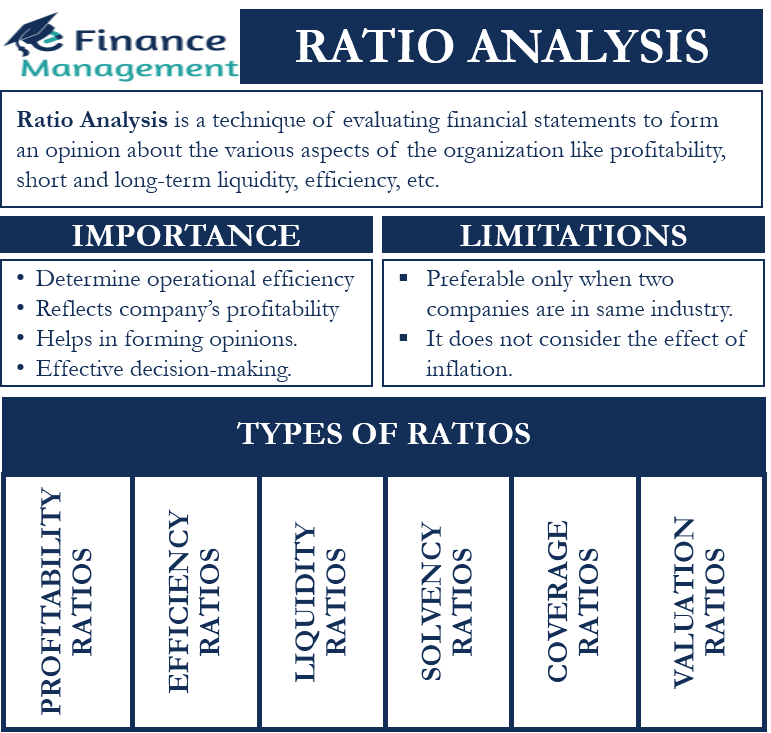

The information resulting from ratio analysis can be used to examine trends in performance, establish benchmarks for success, set budget expectations, and compare industry competitors. Financial ratios are based on the balance sheet and profit and loss account of the organisation. Impact on the dividend policy.

4 ratio analysis ratio analysis is the technique used to understand the liquidity, activity, operational level, turnover and financial position of the business ratio analysis is the process of analyzing the information in a financial report as it relates to another piece of information in the same report. The other results show liquidity ratio measured by current ratio, activity ratio measured by total asset turnover, and solvency ratio measured by debt to equity ratio has an. Liquidity ratios are an important class of financial metrics used to determine a debtor's ability to pay off current debt obligations without raising external capital.

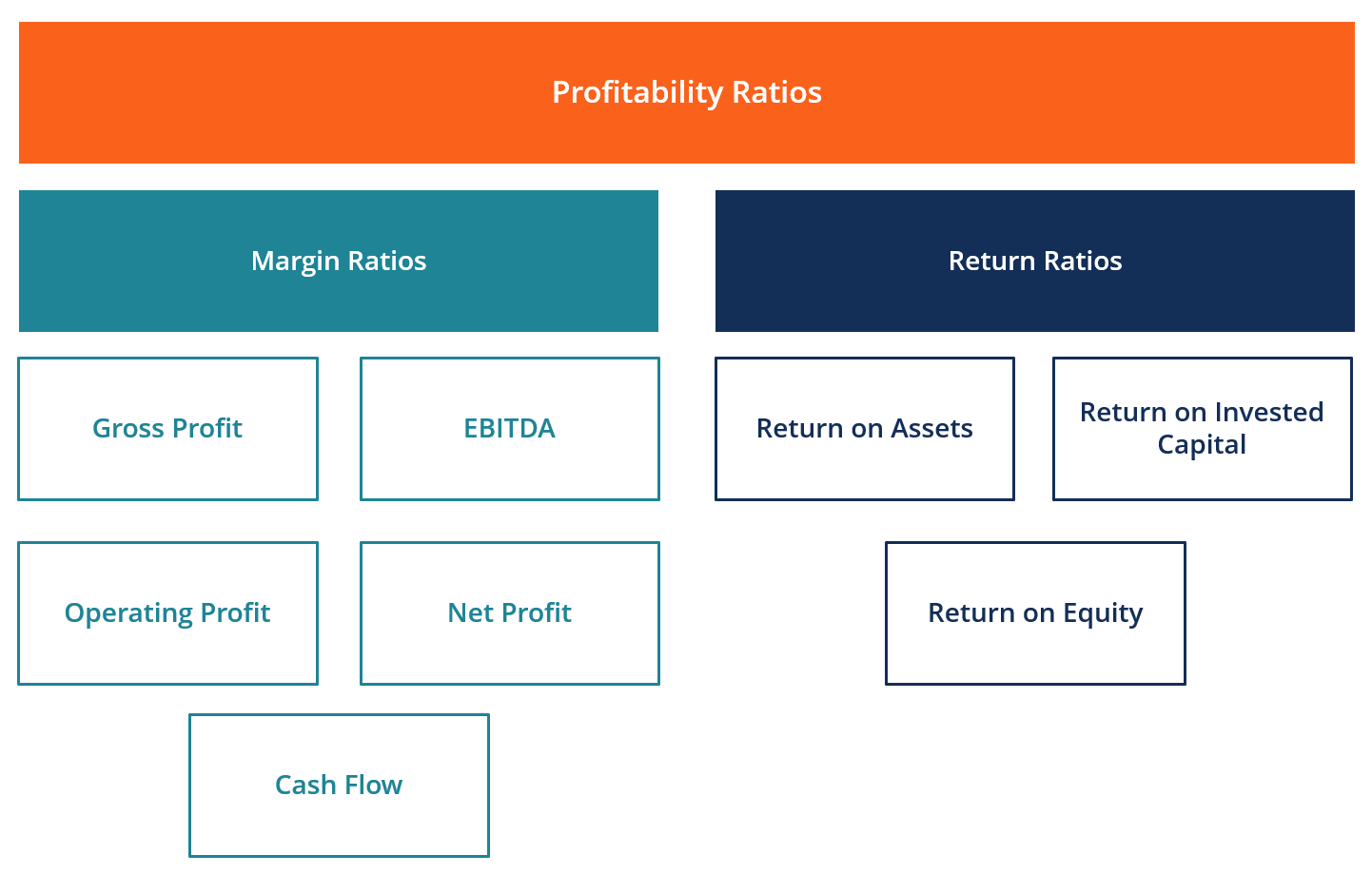

Liquidity, solvency, profitability, and valuation ratios financial ratios are used to express one financial quantity in relation to another and can assist with company and security valuations, as well as with stock selections, and forecasting. There are four main categories of ratios: Profitability, financial ratios, liquidity, financial analysis.

An overview solvency and liquidity are both terms that refer to an. Financial ratio analysis assesses the performance of the firm's financial functions of liquidity, asset management, solvency, and profitability. Profitability, liquidity, solvency, and valuation.

Liquidity, solvency, efficiency, and profitability. Ratios are also used to determine profitability, liquidity, and solvency. A total of 150 datasets.

Financial ratio analysis is often broken into six different types: Solvency looks at the future, while. Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios.