Lessons I Learned From Tips About Preparation Of Financial Statements From Incomplete Records Pdf

State the meaning and features of incomplete records;.

Preparation of financial statements from incomplete records pdf. To do this, you will start with baseline content in a document, potentially via a form template. 1 incomplete records when you are preparing a set of accounts, it is likely that youmay not have all of the information available to you to complete a setof financial statements. Accrual requires that $100 of insurance expense be reported on december’s income statement.

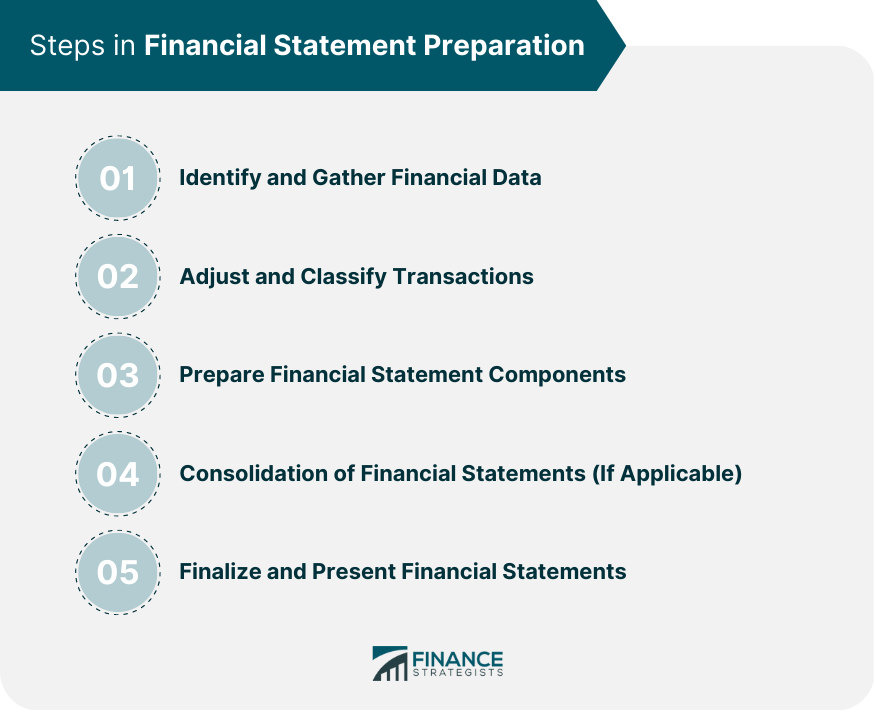

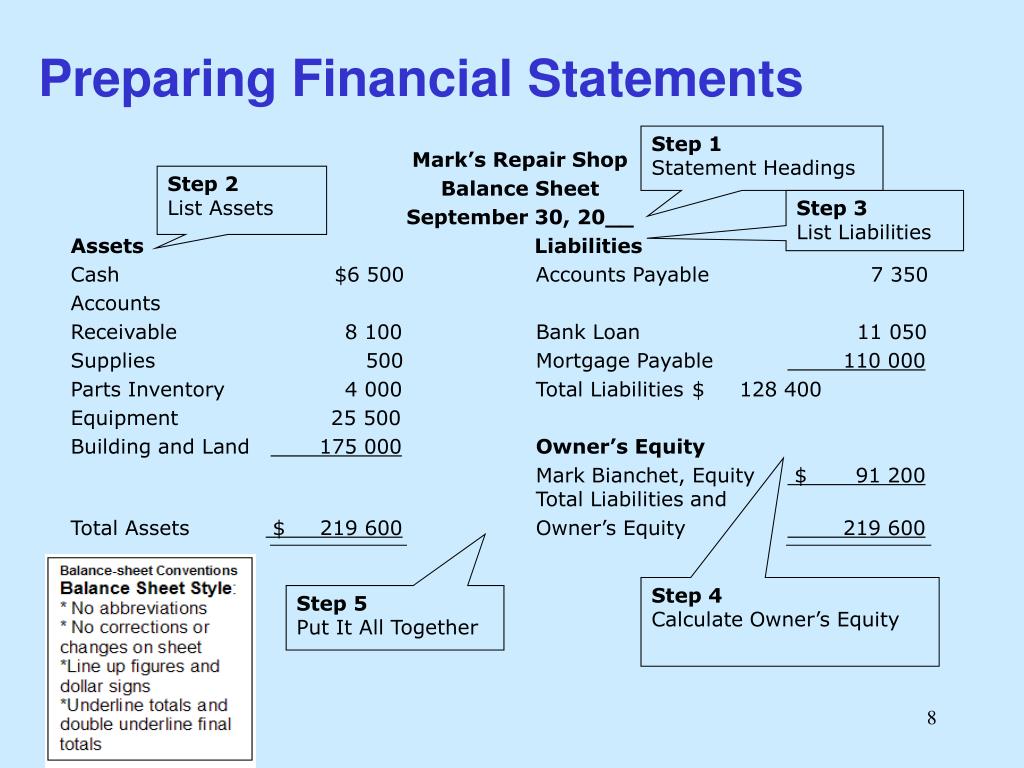

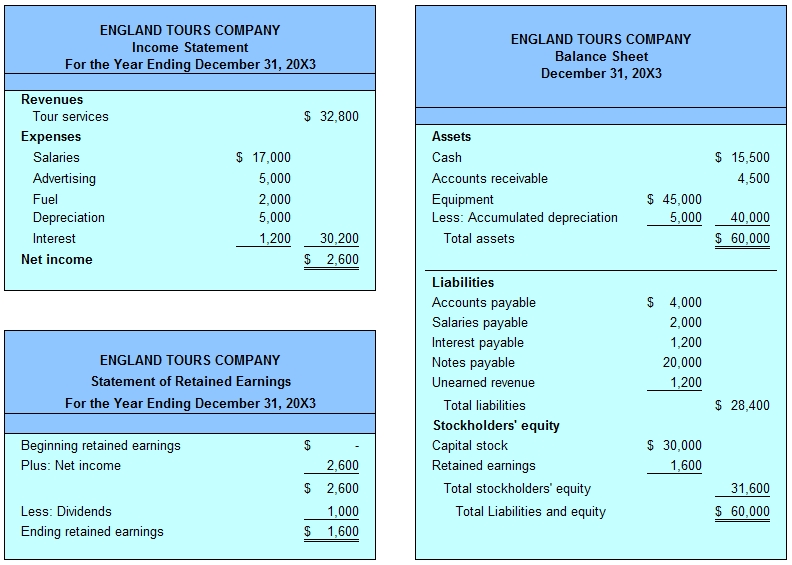

Framework for preparation and presentation of financial statements;. Calculations could include the use of statements of affairs. How accounting techniques are applied in the preparation and analysis of financial statements for a.

Bookkeeping due to the matching principle which uses accrual accounting rules to record revenue and expenses. Accounts from incomplete records 11 learning objectives after studying this chapter, you will be able to : The auditor need not include in audit documentation superseded drafts of working papers and financial statements, notes that reflect.

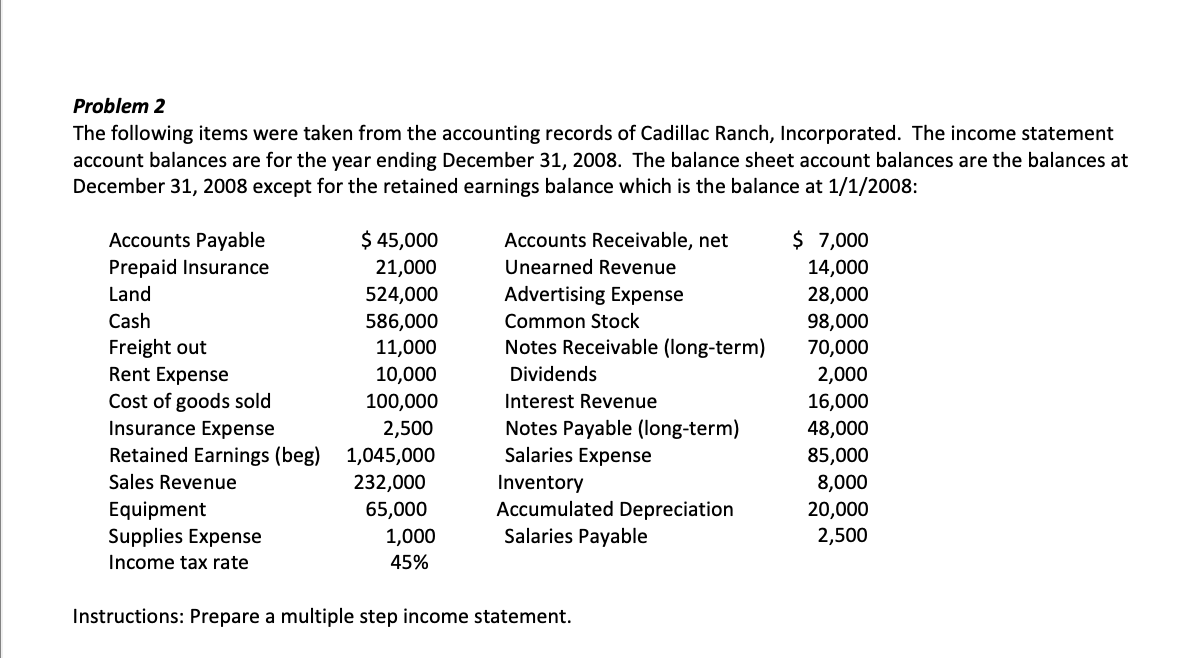

Methods of preparation of accounts (ascertainment of profit or loss from incomplete. Preparation of financial statements 4481 accountant'sprofessionaljudgment,suchfinancialstatementswouldbemis. State the meaning and features of incomplete records;

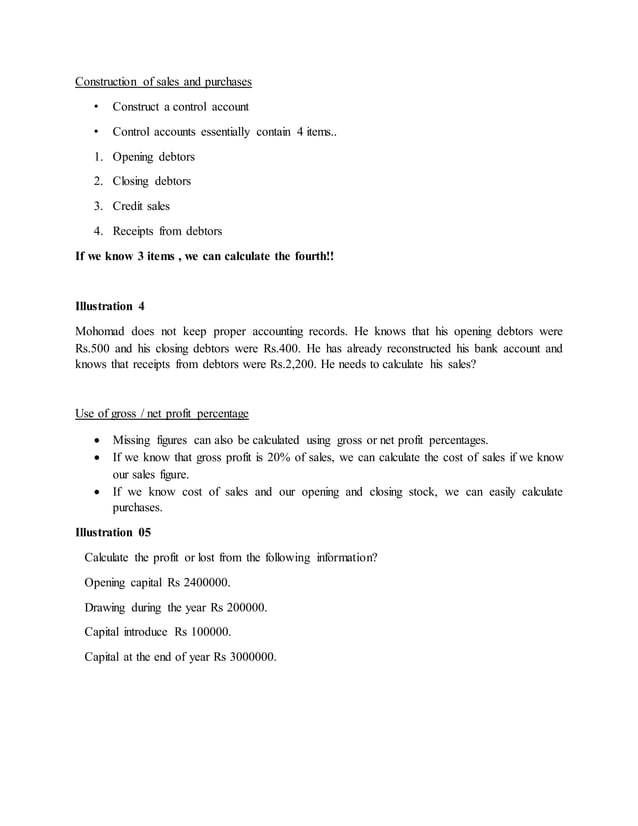

1 preparation of accounts for a sole trader 1 2 partnership accounts 47 3 incomplete records 99 4 financial reporting and ethical principles 165 mock assessment. There are standard techniques for calculating missing figures:

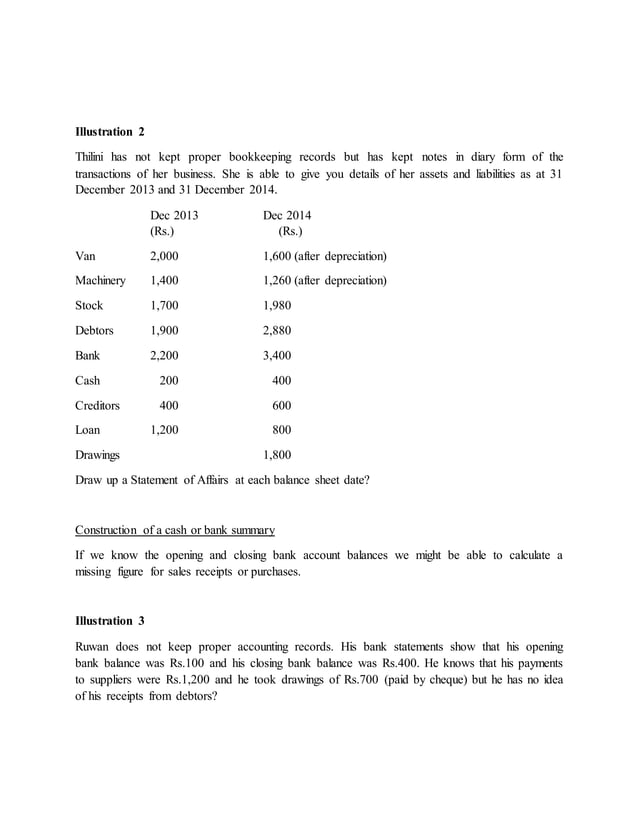

The document discusses incomplete records and accounting. Differences between incomplete records system (single entry) and double entry system. This booklet contains the study guide for acca's certified accounting technician paper 3 (int):

After studying this chapter, you will be able to : In word, you can create a form that others can fill out and save or print. Calculate profit or loss using the statement of affairs method;.

Examiners like questions on incomplete records because they provide the opportunity to test a variety of bookkeeping and accounting techniques. Another $1,200 of expense is reported in year 2010. This document provides an accounting.

Incomplete records this a more common scenario, both in exam questions and in practice. Incomplete records 107 although the trader has maintained a cash book, or had one prepared for him, no ledger accounts will have been written up and the single entry in.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/financialstatements-final-d1268249b5284b3989c979ee82f2869e.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)