Brilliant Strategies Of Info About Financial Statements Are Prepared From Bank Balance Sheet Template

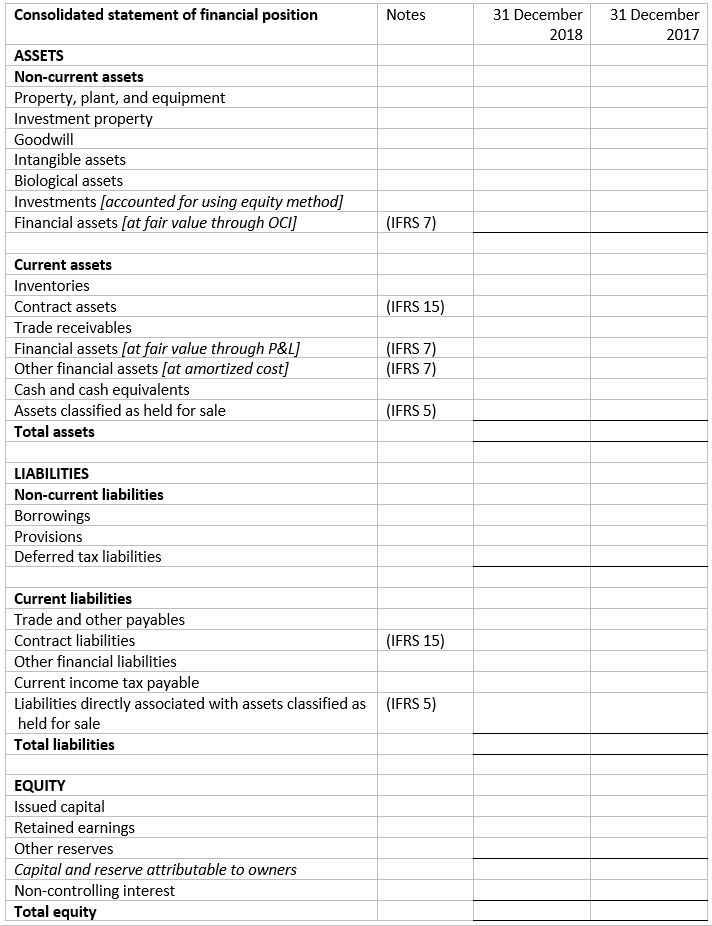

Balance sheet (statement of financial position) profit and loss account (income statement) cash flow statement limited companies are legally required to produce financial statements (both a balance sheet and profit and loss account) when they file their company accounts at the end of the financial year.

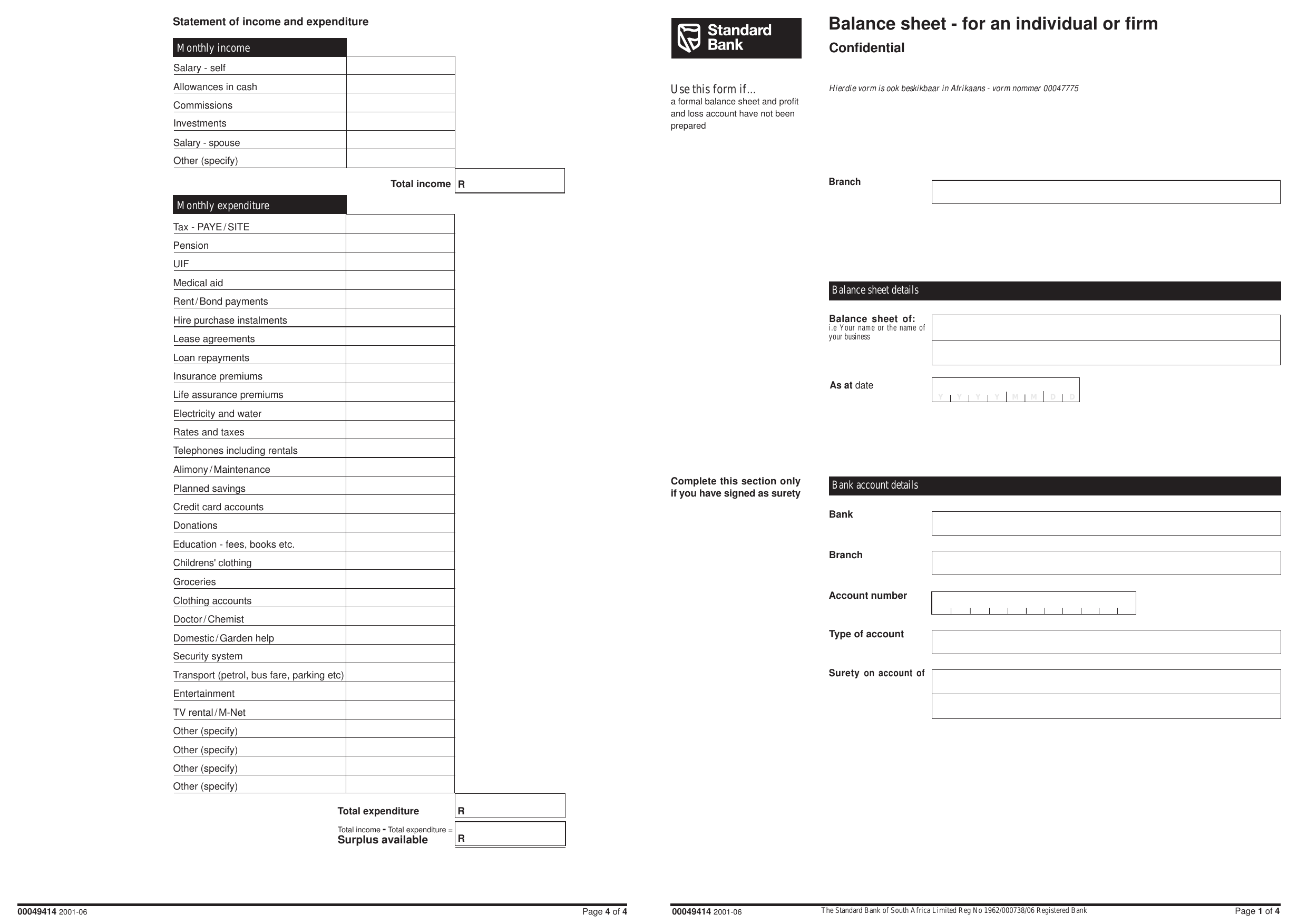

Financial statements are prepared from bank balance sheet template. It consists of assets, representing what the bank owns, and liabilities, describing what it owes to its depositors and other creditors. Many companies use the shareholders’ equity as a separate financial statement. Frequently asked questions (faqs) a bank’s balance sheet provides a snapshot of its financial position at a specific time.

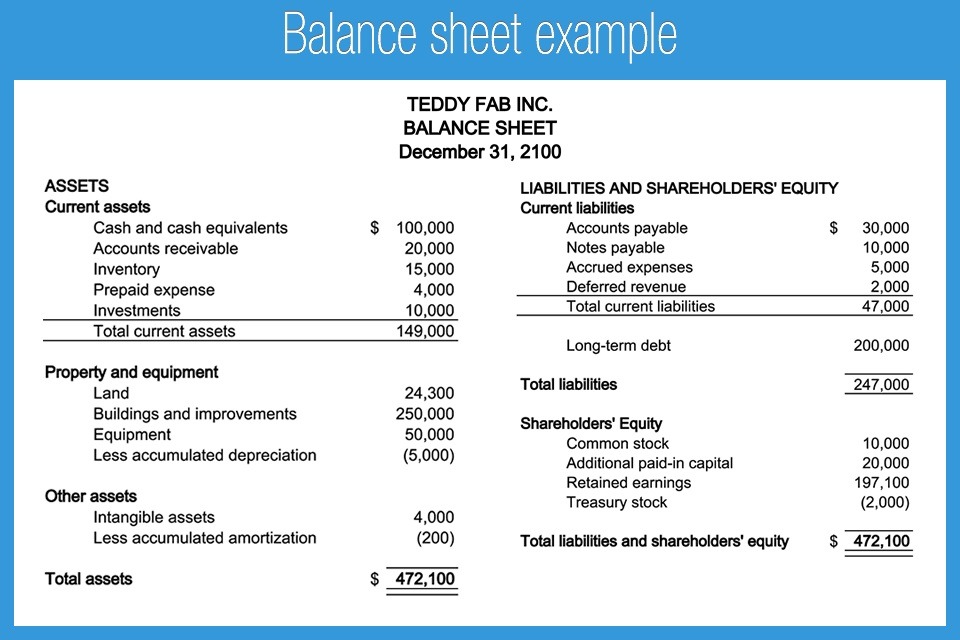

Use these balance sheet templates as financial statements to keep tabs on your assets (what you own) and liabilities (what you owe) to determine your equity. You can think of it like a snapshot of what the business looked like on that day in time. Preparing financial statements is the seventh step in the accounting cycle.

Comparing several years of a company’s balance sheet may highlight trends, for better or worse. To learn more, launch our finance courses online! We visit each unique line item in the subsections below.

Annual financial statements cover the company’s latest fiscal year. Download balance sheet template what is a balance sheet a simple balance sheet is one of the three fundamental financial statements that give a snapshot of the financial position of your business entity at the end of an accounting period. But usually, it comes with the balance sheet.

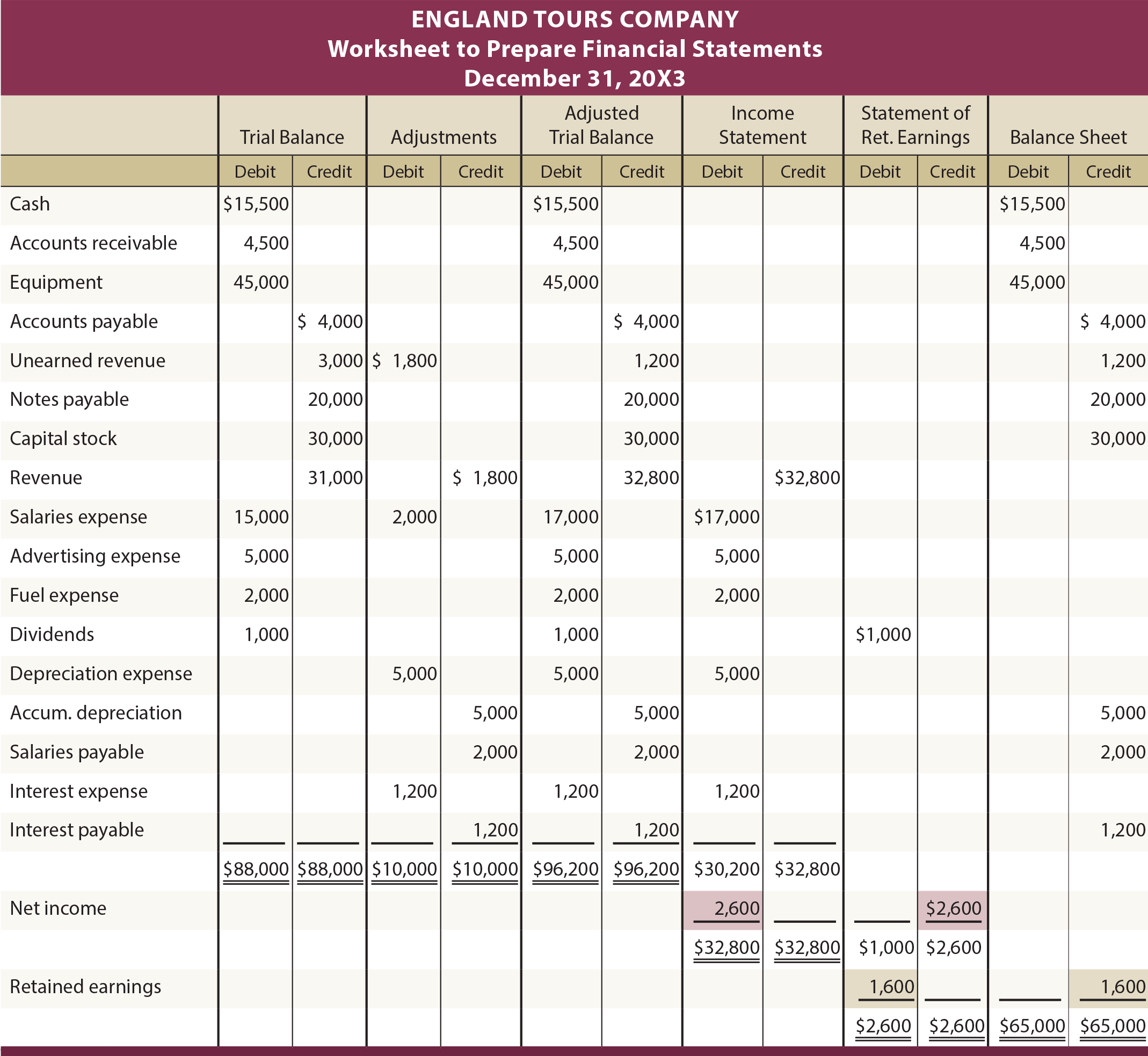

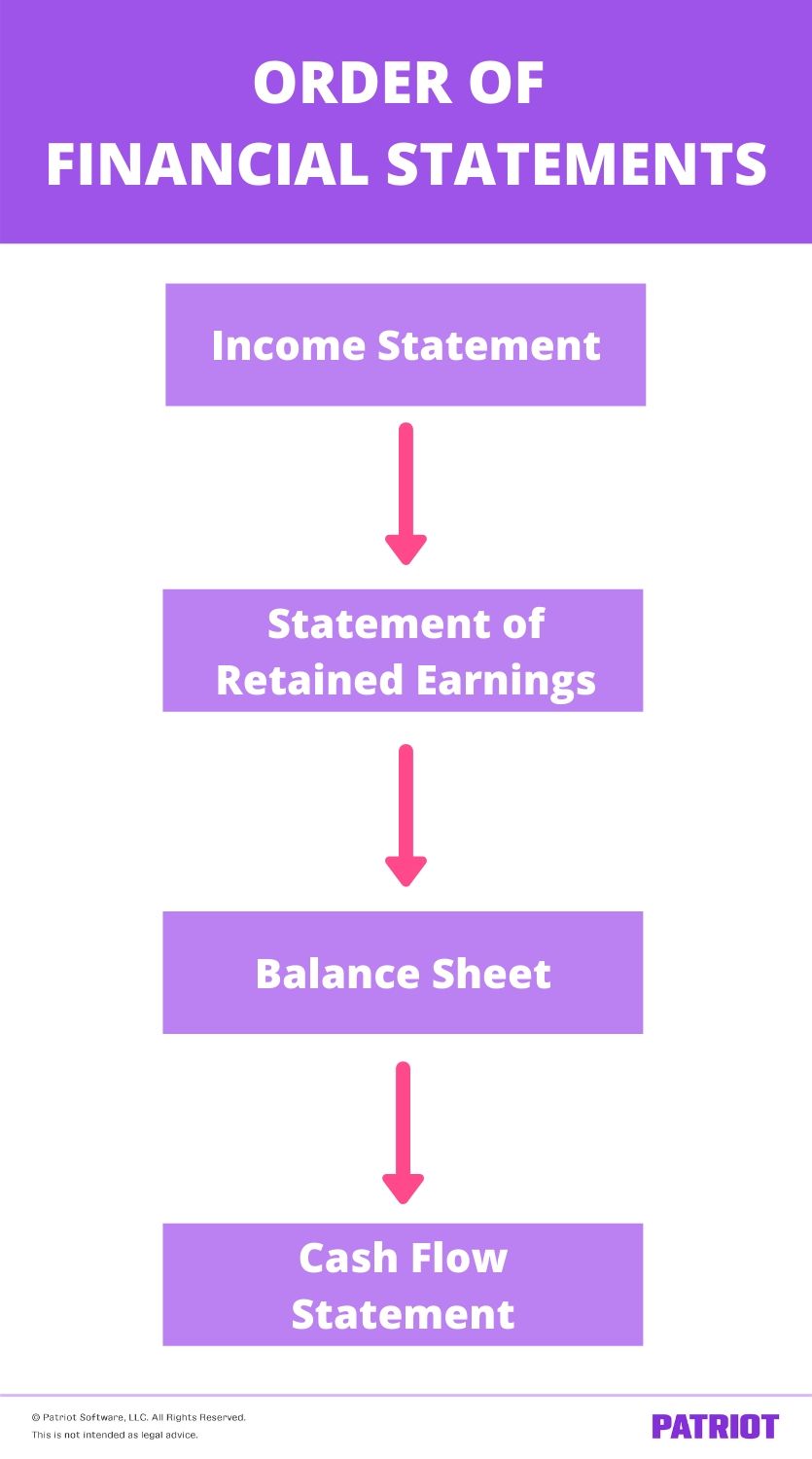

Fill out your cost of sales and its subsections fill out your operating expenses change the business name and dates add rows to add new revenue streams and expenses the total amounts will automatically populate based on the embedded formulas. Remember that we have four financial statements to prepare: Banks balance sheet explained how to read?

Basis of preparation and accounting policies. You can learn a lot about a business’s health by looking at its balance sheet and calculating some ratios. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

Financial statements are prepared using the individual account balances listed in the adjusted trial balance in the preceding step. These financial statements were introduced in introduction to financial statements and statement of. Follow the steps below to fill out our income statement template.

Cash flow statement (statement of cash flows) the. These three statements together show the assets and liabilities of a. Is the most important step in the accounting cycle because it represents the purpose of financial accounting.

It basically showcases your company’s assets, liabilities, and shareholder’s equity as on a specific date. Balance sheets are one of the core financial statements presented in business plans and financial models for analyzing potential m&a transactions and establishing a valuation. The three financial statements are:

Loans to customers and deposits from customers the main operations and source of revenue for banks are their loan and deposit operations. Balance sheet a bank’s balance sheet has certain unique items. They are presented in the currency units (cu) of a land.

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

![Free Bank Statement Template [Excel, Word, PDF] Best Collections](https://www.bestcollections.org/wp-content/uploads/2021/05/bank-balance-sheet-template.jpg)